Key Insights

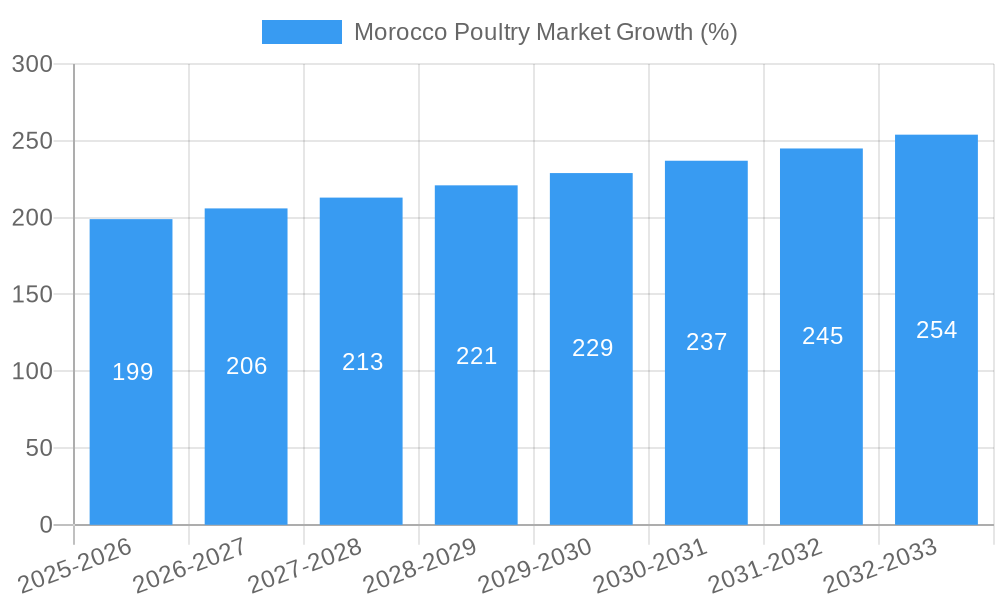

The Morocco poultry market, valued at $4.88 billion in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 4.03% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer demand for protein-rich, affordable poultry products, coupled with rising disposable incomes and a growing population, are significant drivers. Furthermore, government initiatives promoting agricultural development and supporting the poultry sector, including improvements in infrastructure and access to financing, contribute to market expansion. The increasing adoption of modern poultry farming techniques, focusing on efficiency and disease control, further enhances production capacity. However, challenges exist, including feed price fluctuations, which can impact production costs, and potential disease outbreaks that can disrupt supply chains. Competition within the market is moderately high, with key players such as Koutoubia Holding, ALF Sahel, and King Generation SA actively vying for market share. The market's segmentation likely reflects variations in product types (broilers, layers, eggs), processing methods, and distribution channels. The forecast period of 2025-2033 suggests continued growth, driven by sustained consumer preference for poultry and ongoing efforts to enhance the industry's efficiency and sustainability.

The Moroccan poultry market presents significant opportunities for investment and growth, particularly for businesses focusing on innovation, efficiency, and sustainability. Opportunities exist in value-added products, such as processed poultry and ready-to-eat meals, catering to changing consumer preferences. Furthermore, advancements in poultry farming technologies, such as precision feeding and automated systems, can improve productivity and reduce operational costs. Addressing challenges such as feed price volatility through strategic sourcing and diversification is crucial for long-term success. Strategic partnerships between producers, processors, and distributors can further strengthen the market's resilience and competitiveness. Overall, the Moroccan poultry market offers a compelling investment proposition for both domestic and international players, provided they carefully navigate the existing market dynamics and embrace innovative strategies.

Morocco Poultry Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Morocco poultry market, encompassing market dynamics, leading players, and future growth projections from 2019 to 2033. The study covers key segments, examines industry developments, and identifies crucial factors influencing market growth and challenges. With a base year of 2025 and an estimated year of 2025, this report offers invaluable data for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The forecast period spans from 2025 to 2033, building upon historical data from 2019 to 2024.

Morocco Poultry Market Composition & Trends

This section delves into the intricate structure of the Moroccan poultry market, evaluating market concentration, innovative drivers, regulatory frameworks, substitute products, end-user profiles, and mergers & acquisitions (M&A) activity. We analyze market share distribution amongst key players, providing a clear picture of the competitive landscape. Furthermore, the report quantifies M&A deal values to illustrate investment trends and strategic shifts within the sector.

- Market Concentration: The Moroccan poultry market exhibits a [xx]% concentration ratio, with the top five players controlling an estimated [xx]% of the market. This indicates a [Describe Market Concentration - e.g., moderately concentrated, highly fragmented] market structure.

- Innovation Catalysts: Technological advancements in feed efficiency, disease control, and automated processing are driving productivity improvements. Furthermore, consumer demand for higher quality and value-added poultry products is stimulating innovation.

- Regulatory Landscape: Government regulations regarding animal welfare, food safety, and environmental protection significantly impact market operations. Importantly, recent government initiatives, such as the USD 495 million livestock protection program, are shaping industry dynamics.

- Substitute Products: Red meat and other protein sources represent key substitute products, influencing consumer choices and impacting market demand for poultry.

- End-User Profiles: The Moroccan poultry market caters primarily to household consumers, followed by the food service industry (restaurants, hotels). Further segmentation includes industrial users (processed food manufacturers).

- M&A Activities: While precise M&A deal values are unavailable for all transactions, the expansion of Zalar Holdings in 2020 exemplifies the strategic consolidation efforts within the sector. The report further estimates the total value of M&A activity in the sector at USD [xx] Million during the historical period.

Morocco Poultry Market Industry Evolution

This section examines the historical and projected growth trajectories of the Moroccan poultry market, exploring technological advancements and evolving consumer preferences. Detailed analysis of market growth rates and adoption metrics for innovative technologies will be presented. For example, the adoption rate of automated poultry farming systems is projected to increase from [xx]% in 2024 to [xx]% by 2033. Further examination of shifting consumer demands from conventional poultry to organic and free-range options will show how this affects market shares and pricing strategies. The impact of government programs like the USD 198 million investment in poultry sector development until 2030 will be discussed. We expect a Compound Annual Growth Rate (CAGR) of [xx]% for poultry meat production and [xx]% for egg production during the forecast period.

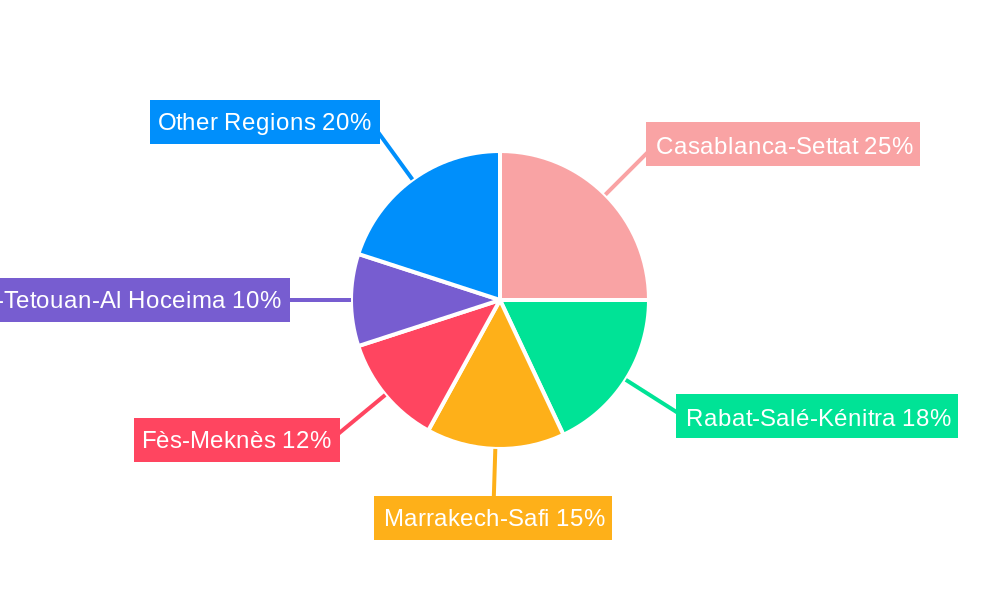

Leading Regions, Countries, or Segments in Morocco Poultry Market

The report identifies the leading region in the Moroccan poultry market and analyzes the factors driving its dominance.

- Key Drivers of Dominance:

- Favorable climatic conditions for poultry farming.

- Proximity to major consumption centers.

- Well-developed infrastructure facilitating efficient distribution.

- Higher concentration of processing facilities and export capabilities.

- Government incentives and investment in the region.

The [Dominant region] region benefits from a higher concentration of poultry farms, processing plants, and access to skilled labor, making it the dominant segment. Further, government support and investment initiatives in this region, bolster its position within the Moroccan poultry market.

Morocco Poultry Market Product Innovations

Recent innovations include the introduction of value-added poultry products (e.g., ready-to-cook meals), focusing on convenience and premium qualities. Technological advancements in breeding techniques have resulted in improved feed conversion ratios and enhanced disease resistance. These advancements are crucial in enhancing the productivity and profitability of poultry farming businesses. This report further details the successful implementation of improved poultry housing systems, leading to enhanced animal welfare and increased efficiency.

Propelling Factors for Morocco Poultry Market Growth

Several factors contribute to the growth of the Moroccan poultry market. Firstly, the growing population and rising disposable incomes are boosting demand for protein-rich foods, including poultry. Secondly, government initiatives such as the USD 198 million investment program and the USD 495 million livestock protection program are creating favorable conditions for market expansion. Thirdly, technological advancements in breeding, feeding, and disease management lead to higher yields and improved efficiency.

Obstacles in the Morocco Poultry Market

Challenges include the volatility of feed prices (especially barley and imported feed), susceptibility to avian influenza outbreaks, and competitive pressures from imported poultry products. These factors can lead to supply chain disruptions and fluctuations in poultry prices, impacting overall market stability. Furthermore, regulatory compliance costs can pose a challenge to smaller players. The impact of these factors on profitability is quantified in the full report.

Future Opportunities in Morocco Poultry Market

Emerging opportunities lie in expanding the market for processed poultry products, catering to a growing demand for convenience foods. Investments in sustainable and eco-friendly poultry farming practices are expected to attract environmentally-conscious consumers. The development of specialized poultry breeds adapted to the Moroccan climate presents a further opportunity for growth.

Major Players in the Morocco Poultry Market Ecosystem

- Koutoubia Holding

- ALF Sahel

- King Generation SA

- Dar EL Fellous

- Matinales

- Maroc Dawajine

- Rabat Poultry - Dawajine Johara

- Zalar Holdings

- La Fonda

- Zaime Eggs (Oeufs ZAIME) *List Not Exhaustive

Key Developments in Morocco Poultry Market Industry

- June 2023: Morocco's government allocated USD 495 million to protect livestock capital, including subsidizing barley and imported feed. This significantly reduced production costs for poultry producers.

- May 2023: A new program contract (USD 198 million investment) with FISA aims to increase poultry meat production to 92,000 tonnes and egg production to 7.6 billion units by 2030. This spurred significant investments and expansion plans within the industry.

- February 2020: Zalar Holdings expanded its presence in Morocco, consolidating its position in grain storage and trade, providing improved access to feed for poultry producers.

Strategic Morocco Poultry Market Forecast

The Moroccan poultry market is poised for sustained growth, driven by supportive government policies, rising consumer demand, and technological innovations. Opportunities exist in value-added products, sustainable farming, and export markets. The continued expansion of existing players and potential entry of new players will shape the competitive landscape over the forecast period, leading to continued market growth and consolidation. The overall market outlook is positive, with significant potential for further development and expansion throughout the forecast period.

Morocco Poultry Market Segmentation

-

1. Product Type

- 1.1. Table Eggs

- 1.2. Broiler Meat

-

1.3. Processed Meat

- 1.3.1. Nuggets and Popcorns

- 1.3.2. Sausages

- 1.3.3. Burgers

- 1.3.4. Marinated Poultry Products

- 1.3.5. Other Processed Meat Products

-

2. Distribution Channel

- 2.1. Hotels

- 2.2. Restaurants

- 2.3. Catering

- 2.4. Modern Trade (Supermarkets/Hypermarkets)

- 2.5. Other Distribution Channels

Morocco Poultry Market Segmentation By Geography

- 1. Morocco

Morocco Poultry Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.03% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Growth of Quick-service Restaurants Propel Market Growth; Favorable Government Initiatives Supporting Market Growth

- 3.3. Market Restrains

- 3.3.1. Rapid Growth of Quick-service Restaurants Propel Market Growth; Favorable Government Initiatives Supporting Market Growth

- 3.4. Market Trends

- 3.4.1. Innovations in Table Egg Processing Technology Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Morocco Poultry Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Table Eggs

- 5.1.2. Broiler Meat

- 5.1.3. Processed Meat

- 5.1.3.1. Nuggets and Popcorns

- 5.1.3.2. Sausages

- 5.1.3.3. Burgers

- 5.1.3.4. Marinated Poultry Products

- 5.1.3.5. Other Processed Meat Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hotels

- 5.2.2. Restaurants

- 5.2.3. Catering

- 5.2.4. Modern Trade (Supermarkets/Hypermarkets)

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Morocco

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Koutoubia Holding

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALF Sahel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 King Generation SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dar EL Fellous

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Matinales

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Maroc Dawajine

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rabat Poultry - Dawajine Johara

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zalar Holdings

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 La Fonda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zaime Eggs (Oeufs ZAIME)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Koutoubia Holding

List of Figures

- Figure 1: Morocco Poultry Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Morocco Poultry Market Share (%) by Company 2024

List of Tables

- Table 1: Morocco Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Morocco Poultry Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Morocco Poultry Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Morocco Poultry Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 5: Morocco Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Morocco Poultry Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 7: Morocco Poultry Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Morocco Poultry Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Morocco Poultry Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Morocco Poultry Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Morocco Poultry Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Morocco Poultry Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 13: Morocco Poultry Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Morocco Poultry Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Morocco Poultry Market?

The projected CAGR is approximately 4.03%.

2. Which companies are prominent players in the Morocco Poultry Market?

Key companies in the market include Koutoubia Holding, ALF Sahel, King Generation SA, Dar EL Fellous, Matinales, Maroc Dawajine, Rabat Poultry - Dawajine Johara, Zalar Holdings, La Fonda, Zaime Eggs (Oeufs ZAIME)*List Not Exhaustive.

3. What are the main segments of the Morocco Poultry Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Growth of Quick-service Restaurants Propel Market Growth; Favorable Government Initiatives Supporting Market Growth.

6. What are the notable trends driving market growth?

Innovations in Table Egg Processing Technology Driving the Market.

7. Are there any restraints impacting market growth?

Rapid Growth of Quick-service Restaurants Propel Market Growth; Favorable Government Initiatives Supporting Market Growth.

8. Can you provide examples of recent developments in the market?

June 2023: Under the terms of the agreement, Morocco’s government announced the allocation of USD 495 million toward protecting livestock capital. This included the subsidization of barley and imported feed for livestock and poultry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Morocco Poultry Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Morocco Poultry Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Morocco Poultry Market?

To stay informed about further developments, trends, and reports in the Morocco Poultry Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence