Key Insights

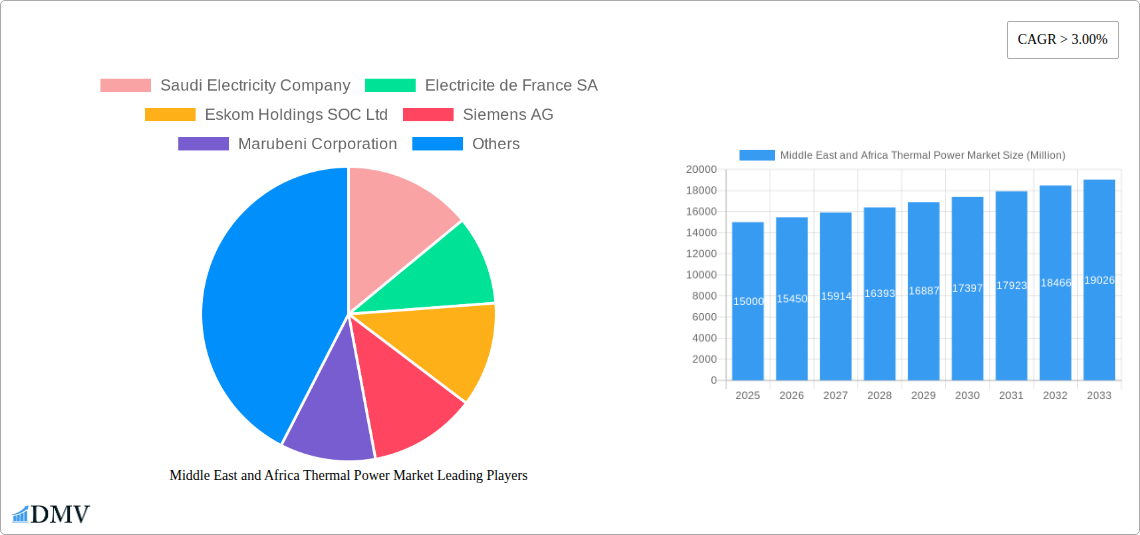

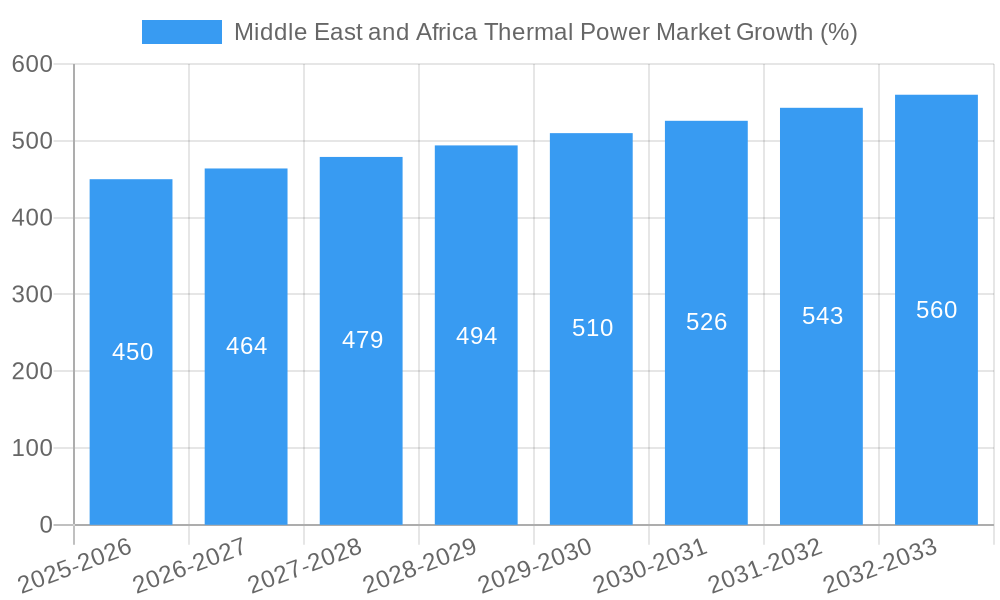

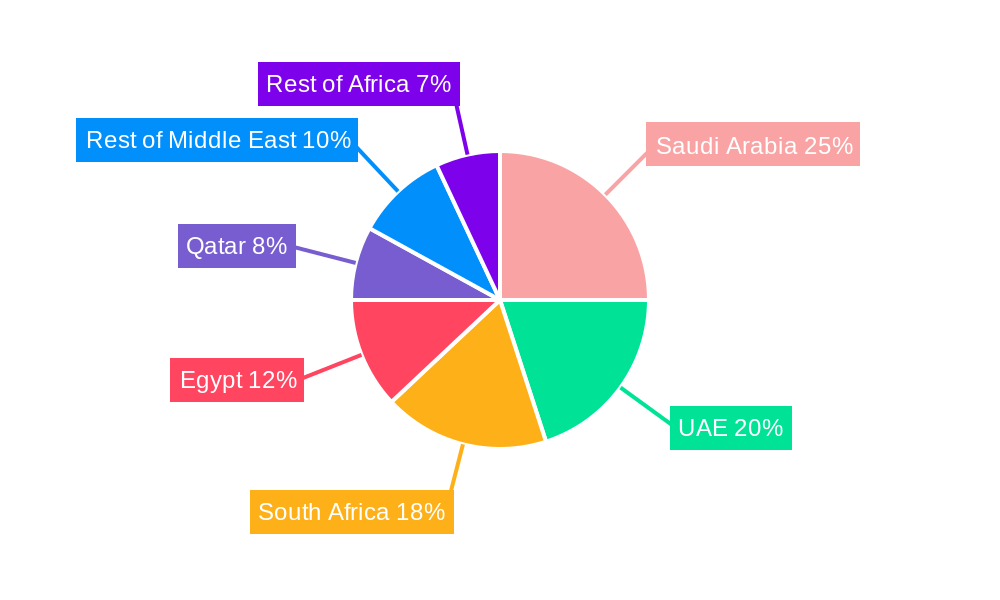

The Middle East and Africa Thermal Power Market, valued at approximately $XX million in 2025 (estimated based on provided CAGR and market trends), is projected to experience robust growth, exceeding a 3% CAGR through 2033. Several factors drive this expansion. The increasing energy demand fueled by rapid population growth and industrialization across the region necessitates substantial power generation capacity additions. Furthermore, the relatively abundant reserves of fossil fuels, such as natural gas and coal, in certain areas within the Middle East and Africa make thermal power generation a cost-effective and readily available option in the near to medium term. However, the market faces significant constraints, primarily environmental concerns surrounding greenhouse gas emissions and air pollution. The transition towards renewable energy sources, while gaining momentum, is still gradual, leaving thermal power as a dominant player in the foreseeable future. Market segmentation reveals a diverse energy mix, with significant contributions from oil, natural gas, nuclear, and coal power plants. Key players like Saudi Electricity Company, Electricite de France SA, and Eskom Holdings SOC Ltd. are strategically positioned to capitalize on this growth, though they face pressures to adapt to evolving regulatory landscapes and sustainability targets. Regional variations are notable, with South Africa, the UAE, and Saudi Arabia representing significant market segments due to their substantial energy needs and existing infrastructure.

The competitive landscape is marked by both established players and emerging companies striving for market share. Strategies include expansion of existing plants, technological advancements improving efficiency and reducing emissions, and strategic partnerships to secure fuel supplies and navigate regulatory complexities. The forecast period will see ongoing investments in thermal power infrastructure, particularly in regions with high energy demand growth. However, the long-term outlook is influenced by global efforts to mitigate climate change and the increasing competitiveness of renewable energy technologies. The market's trajectory will depend on the balance between the immediate need for reliable power, the ongoing transition towards cleaner energy sources, and the overall economic development of the region. A thorough understanding of these dynamics is critical for investors, policymakers, and industry participants navigating this dynamic market.

Middle East & Africa Thermal Power Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East & Africa thermal power market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market size is estimated at XXX Million in 2025 and is projected to reach XXX Million by 2033.

Middle East and Africa Thermal Power Market Market Composition & Trends

This section delves into the intricate composition of the Middle East & Africa thermal power market, analyzing market concentration, innovation drivers, regulatory landscapes, substitute products, end-user profiles, and mergers & acquisitions (M&A) activities. We examine the market share distribution amongst key players, revealing the competitive dynamics at play. The report details significant M&A deals, quantifying their values and impact on the market landscape. For example, we assess the impact of acquisitions by major players like Siemens AG and Marubeni Corporation on market consolidation. The report also analyzes the influence of regulatory frameworks in countries like Saudi Arabia and South Africa on investment decisions and market growth. Finally, we explore the adoption of alternative energy sources and their influence on the thermal power market's future.

- Market Concentration: High concentration in key countries like Saudi Arabia and South Africa, with a few dominant players.

- Innovation Catalysts: Focus on efficiency improvements, emission reduction technologies, and digitalization.

- Regulatory Landscape: Analysis of policies influencing investments in thermal power across different countries.

- Substitute Products: Assessment of renewable energy sources and their growing competition.

- End-User Profiles: Detailed examination of utility companies, industrial consumers, and other end-users.

- M&A Activities: Analysis of significant deals, including deal values and their impact on market dynamics. xx Million in M&A activity observed between 2019 and 2024.

Middle East and Africa Thermal Power Market Industry Evolution

This section provides a deep dive into the evolutionary path of the Middle East & Africa thermal power market. We analyze historical market growth (2019-2024), projecting future trajectories (2025-2033) based on various factors including technological advancements, evolving consumer demands, and the influence of governmental policies across different regions and countries. The report examines the shift in energy sources from coal to natural gas and the increasing adoption of cleaner technologies in thermal power generation. Specific growth rates for different segments (oil, natural gas, coal, nuclear) are provided, detailing the adoption rates of new technologies, and analyzing the impact of fluctuating energy prices on market demand.

Leading Regions, Countries, or Segments in Middle East and Africa Thermal Power Market

This section identifies the leading regions and countries within the Middle East & Africa thermal power market. It offers a comprehensive analysis of the factors driving the dominance of specific regions, focusing on investment trends, regulatory support, and infrastructure development. The report segments the market based on energy sources (Oil, Natural Gas, Nuclear, Coal) and geography (United Arab Emirates, Saudi Arabia, South Africa, Egypt, Qatar, Rest of the Middle East and Africa). Saudi Arabia and South Africa are identified as leading markets based on capacity, investment, and consumption.

- Saudi Arabia: High domestic demand, significant investments in new power plants, and government support for energy diversification.

- South Africa: Large installed capacity, substantial investments in infrastructure upgrades, and reliance on coal.

- UAE: High investments in diversification of energy sources and development of robust power grids.

- Egypt: Growing energy demands driven by population increase and industrialization.

- Natural Gas: Dominating the fuel mix due to its relative abundance and lower emissions compared to oil and coal.

Middle East and Africa Thermal Power Market Product Innovations

This section highlights the latest product innovations and advancements transforming the Middle East & Africa thermal power sector. We detail new technologies improving efficiency, reducing emissions, and enhancing reliability. This includes advancements in supercritical and ultra-supercritical power plants, combined cycle gas turbines, and waste heat recovery systems. The emphasis is on the unique selling propositions and performance metrics of these innovative products.

Propelling Factors for Middle East and Africa Thermal Power Market Growth

Several factors contribute to the growth of the Middle East & Africa thermal power market. These include increasing energy demands driven by population growth and industrialization, significant investments in infrastructure development, and the abundance of fossil fuel resources in certain regions. Government initiatives promoting energy security and access also play a significant role. The cost-effectiveness of thermal power plants, particularly in regions with ample fuel resources, is a key driver.

Obstacles in the Middle East and Africa Thermal Power Market Market

Despite its growth potential, the Middle East & Africa thermal power market faces significant challenges. These include stringent environmental regulations aimed at reducing greenhouse gas emissions, increasing concerns about air pollution, and fluctuations in global fossil fuel prices, influencing project economics. Competition from renewable energy sources, supply chain disruptions, and the geopolitical landscape also affect market dynamics.

Future Opportunities in Middle East and Africa Thermal Power Market

Future growth opportunities exist in improving the efficiency of existing plants, adopting cleaner technologies like carbon capture and storage, investing in combined cycle power plants, and exploring the potential of smaller-scale distributed generation solutions. The focus on regional integration and cooperation to enhance energy security and reduce reliance on single fuel sources is also crucial.

Major Players in the Middle East and Africa Thermal Power Market Ecosystem

- Saudi Electricity Company

- Electricite de France SA (https://www.edf.fr/en)

- Eskom Holdings SOC Ltd (https://www.eskom.co.za/)

- Siemens AG (https://www.siemens.com/)

- Marubeni Corporation (https://www.marubeni.com/en/)

- Egyptian Electricity Holding company

- Dubai Electricity and Water Authority (https://www.dewa.gov.ae/en)

- Acwa Power Barka SAOG

Key Developments in Middle East and Africa Thermal Power Market Industry

- 2022 Q4: Saudi Arabia announces a major investment in new gas-fired power plants.

- 2023 Q1: Eskom Holdings implements new efficiency measures in existing coal plants.

- 2023 Q2: A significant merger occurs between two regional thermal power companies. (Details of merger would be included in the full report)

Strategic Middle East and Africa Thermal Power Market Market Forecast

The Middle East & Africa thermal power market is poised for continued growth, albeit at a moderated pace compared to previous years, driven by a combination of factors, such as growing energy demand and ongoing investments in infrastructure. While the transition towards cleaner energy sources is inevitable, thermal power will remain a significant part of the energy mix for the foreseeable future, particularly in regions with abundant fossil fuel resources. The focus on efficiency improvements, emissions reduction, and technological advancements will shape the market’s future trajectory.

Middle East and Africa Thermal Power Market Segmentation

-

1. Source

- 1.1. Oil

- 1.2. Natural Gas

- 1.3. Nuclear

- 1.4. Coal

-

2. Geogrpahy

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Egypt

- 2.5. Qatar

- 2.6. Rest of the Middle-East and Africa

Middle East and Africa Thermal Power Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Thermal Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Natural Gas-based Thermal Plants to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.1.3. Nuclear

- 5.1.4. Coal

- 5.2. Market Analysis, Insights and Forecast - by Geogrpahy

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Egypt

- 5.2.5. Qatar

- 5.2.6. Rest of the Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. South Africa Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East and Africa Thermal Power Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Saudi Electricity Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Electricite de France SA

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Eskom Holdings SOC Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Siemens AG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Marubeni Corporation

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Egyptian Electricity Holding company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dubai Electricity and Water Authority

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Acwa Power Barka SAOG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Saudi Electricity Company

List of Figures

- Figure 1: Middle East and Africa Thermal Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Thermal Power Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 3: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 4: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Source 2019 & 2032

- Table 13: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Geogrpahy 2019 & 2032

- Table 14: Middle East and Africa Thermal Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Saudi Arabia Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Israel Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Qatar Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Kuwait Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Oman Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Bahrain Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Jordan Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Lebanon Middle East and Africa Thermal Power Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Thermal Power Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Middle East and Africa Thermal Power Market?

Key companies in the market include Saudi Electricity Company, Electricite de France SA, Eskom Holdings SOC Ltd, Siemens AG, Marubeni Corporation, Egyptian Electricity Holding company, Dubai Electricity and Water Authority, Acwa Power Barka SAOG.

3. What are the main segments of the Middle East and Africa Thermal Power Market?

The market segments include Source, Geogrpahy.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Natural Gas-based Thermal Plants to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Thermal Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Thermal Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Thermal Power Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Thermal Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence