Key Insights

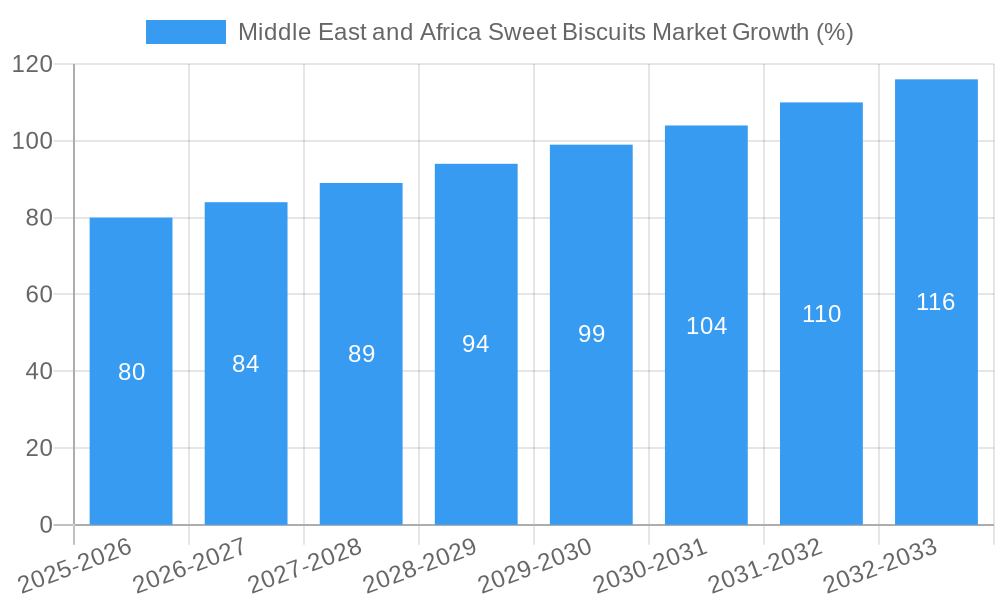

The Middle East and Africa sweet biscuits market presents a compelling growth opportunity, exhibiting a Compound Annual Growth Rate (CAGR) of 5.30% from 2019 to 2033. Driven by increasing disposable incomes, urbanization, and changing consumer preferences towards convenient and readily available snacks, the market is experiencing robust expansion. Key segments like chocolate-coated biscuits and filled biscuits are witnessing particularly strong growth, fueled by innovation in flavors and textures appealing to diverse palates. The market is also witnessing a shift towards healthier options, with manufacturers increasingly focusing on reduced sugar and fat content, catering to health-conscious consumers. Supermarket/hypermarkets remain the dominant distribution channel, although online retail is rapidly gaining traction, offering convenience and expanding market reach, especially in urban centers. Major players like Kellogg's, Mondelez International, and Britannia Industries are actively competing, leveraging their brand recognition and extensive distribution networks. Regional variations exist, with South Africa and other key African nations showing significant potential, driven by population growth and rising demand for processed foods. The market faces challenges such as fluctuating raw material prices and intense competition, but the overall outlook remains positive, reflecting a significant growth trajectory across the forecast period.

The competitive landscape is characterized by a mix of international and regional players. International giants leverage their established brands and marketing expertise to maintain a strong presence. However, local companies are increasingly challenging the incumbents with cost-competitive products tailored to local tastes and preferences. Future growth will be influenced by factors including economic stability across the region, evolving consumer preferences, and the successful adaptation of manufacturers to changing market demands. Strategic partnerships, product diversification, and targeted marketing campaigns are expected to play a critical role in shaping the competitive dynamics and driving further growth in the Middle East and Africa sweet biscuits market. The market segmentation based on types like plain biscuits, cookies, and sandwich biscuits provides a granular understanding of consumer preferences, allowing manufacturers to optimize their product offerings and enhance their market penetration strategies.

Middle East and Africa Sweet Biscuits Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Middle East and Africa sweet biscuits market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report unveils market trends, competitive dynamics, and future growth potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, showcasing significant growth opportunities.

Middle East and Africa Sweet Biscuits Market Composition & Trends

This section delves into the intricate composition of the Middle East and Africa sweet biscuits market, examining key aspects influencing its trajectory. We analyze market concentration, revealing the market share distribution amongst key players like The Kellogg Company, Mondelez International Inc, and Yildiz Holding Inc, alongside regional players such as Gandour and Deemah United Food Industries Corp Ltd. The report also explores innovation drivers, including the introduction of novel flavors, healthier options, and convenient packaging formats. Regulatory landscapes and their impact on market dynamics are meticulously assessed, along with an examination of substitute products and their competitive influence. Finally, the report meticulously analyzes end-user preferences and the impact of mergers and acquisitions (M&A) activities, including deal values and their consequences on market consolidation.

- Market Share Distribution: The Kellogg Company holds an estimated xx% market share in 2025, while Mondelez International Inc. commands approximately xx%. Regional players collectively account for xx% of the market.

- M&A Activities: The report details significant M&A activities within the period, including deal values exceeding xx Million in some instances, highlighting their effect on market structure and competition. Further analysis assesses the strategic rationale behind these deals and their implications for future market growth.

- Innovation Catalysts: The increasing demand for healthier biscuits and innovative flavors is driving product diversification.

- Regulatory Landscape: Varied regulatory standards across different countries within the region impact product formulation and labeling.

- Substitute Products: The presence of alternative snacks and confectionery items poses a competitive challenge to sweet biscuit consumption.

Middle East and Africa Sweet Biscuits Market Industry Evolution

This section provides a detailed chronological analysis of the Middle East and Africa sweet biscuits market's evolution, encompassing historical data from 2019 to 2024, and projecting future trends until 2033. It examines market growth trajectories, pinpointing annual growth rates (AGR) from xx% during the historical period to a projected xx% during the forecast period. We delve into technological advancements impacting production efficiency, product innovation, and distribution channels. Furthermore, the analysis explores the shifting consumer preferences, detailing the growing demand for specific biscuit types (e.g., healthier options, functional biscuits) and their impact on market segmentation.

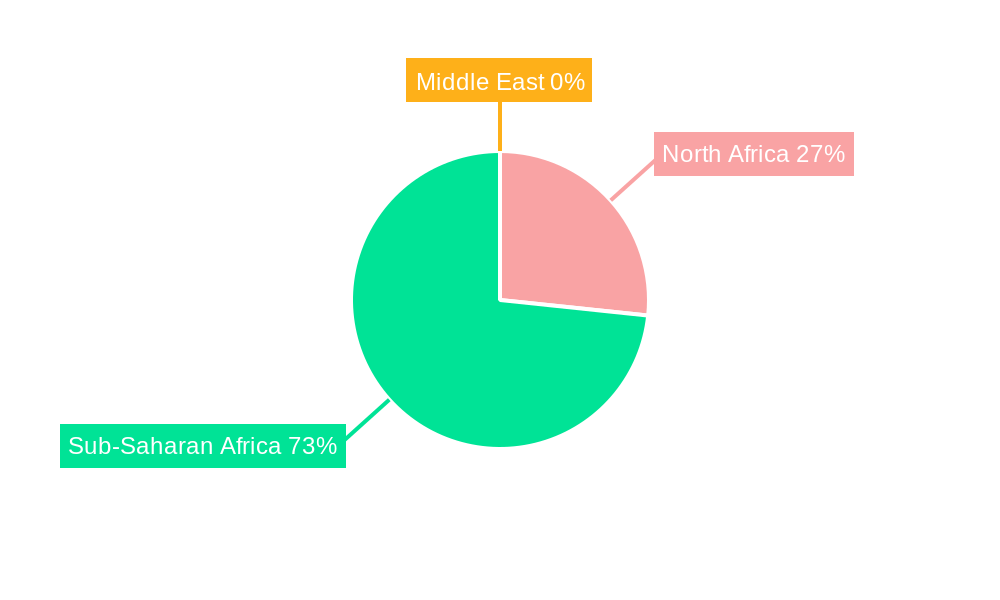

Leading Regions, Countries, or Segments in Middle East and Africa Sweet Biscuits Market

This section identifies the dominant regions, countries, and segments within the Middle East and Africa sweet biscuits market. Through in-depth analysis, we pinpoint leading segments by type (e.g., Plain Biscuits, Cookies, Sandwich Biscuits) and distribution channel (e.g., Supermarket/Hypermarket, Online Retail Stores), highlighting the factors driving their dominance.

- By Type: The filled biscuits segment is projected to experience the highest growth rate, driven by increasing consumer preference for convenience and indulgence. Plain biscuits continue to hold a significant market share due to their affordability and broad appeal.

- By Distribution Channel: Supermarket/Hypermarkets are currently the dominant distribution channel, but online retail stores are experiencing a notable surge in growth, particularly in urban areas with increasing internet penetration.

Key Drivers:

- Investment Trends: Significant investments in new production facilities and brand expansion are propelling market growth.

- Regulatory Support: Favorable government policies related to food processing and distribution are creating a conducive business environment.

Middle East and Africa Sweet Biscuits Market Product Innovations

This section highlights recent product innovations within the Middle East and Africa sweet biscuits market. Manufacturers are focusing on developing healthier options with reduced sugar and fat content, along with the introduction of unique flavors catered to local tastes. Technological advancements in production processes allow for improved efficiency and consistency. Unique selling propositions (USPs) include organic ingredients, gluten-free formulations, and functional benefits (e.g., added vitamins or fiber).

Propelling Factors for Middle East and Africa Sweet Biscuits Market Growth

Several factors are driving the growth of the Middle East and Africa sweet biscuits market. Rising disposable incomes, coupled with a growing young population, fuel increased spending on snacks and confectionery items. Rapid urbanization and changing lifestyles contribute to greater demand for convenient and readily available food options. Technological advancements in production and distribution further enhance market growth.

Obstacles in the Middle East and Africa Sweet Biscuits Market

The Middle East and Africa sweet biscuits market faces certain challenges. Fluctuations in raw material prices, particularly sugar and wheat, affect production costs and profitability. Supply chain disruptions due to geopolitical events or logistical issues can impact product availability. Intense competition from both local and international players creates pressure on pricing and market share. Finally, stringent food safety regulations increase compliance costs.

Future Opportunities in Middle East and Africa Sweet Biscuits Market

The Middle East and Africa sweet biscuits market presents significant future opportunities. Expanding into untapped rural markets holds considerable potential for growth. Increased adoption of e-commerce platforms provides avenues for reaching a wider customer base. The development of innovative products tailored to specific health and dietary needs caters to evolving consumer demands.

Major Players in the Middle East and Africa Sweet Biscuits Market Ecosystem

- The Kellogg Company (The Kellogg Company)

- Gandour

- Deemah United Food Industries Corp Ltd

- Gulf Confectionery & Biscuit Co LLC

- Tiffany Foods Ltd

- Mondelez International Inc (Mondelez International Inc)

- Yildiz Holding Inc (Yildiz Holding Inc)

- Al Yanbou

- ITC Limited (ITC Limited)

- Britannia Industries Limited (Britannia Industries Limited)

Key Developments in Middle East and Africa Sweet Biscuits Market Industry

- April 2022: Lotus invests US$11 Million in a new factory in South Africa, expanding production capacity.

- March 2022: Yıldız Holding launches Ülker biscuits in the UAE.

- February 2022: Edita launches Onrio Mini LAVA filled biscuits.

Strategic Middle East and Africa Sweet Biscuits Market Forecast

The Middle East and Africa sweet biscuits market is poised for sustained growth driven by rising disposable incomes, changing consumer preferences, and technological advancements. The increasing penetration of e-commerce and the development of innovative product offerings further amplify the market's future potential. This report presents a valuable resource for businesses seeking to capitalize on the significant growth opportunities within this dynamic market.

Middle East and Africa Sweet Biscuits Market Segmentation

-

1. Type

- 1.1. Plain Biscuits

- 1.2. Cookies

- 1.3. Sandwich Biscuits

- 1.4. Filled Biscuits

- 1.5. Chocolate-coated Biscuits

- 1.6. Other Sweet Biscuits

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarket

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. United Arab Emirates

- 3.3. South Africa

- 3.4. Rest of Middle-East and Africa

Middle East and Africa Sweet Biscuits Market Segmentation By Geography

- 1. Saudi Arabia

- 2. United Arab Emirates

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Sweet Biscuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products

- 3.3. Market Restrains

- 3.3.1. Competition from Vegan/Plant-based Protein Powders

- 3.4. Market Trends

- 3.4.1. Increasing Inclination towards On-The-Go Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plain Biscuits

- 5.1.2. Cookies

- 5.1.3. Sandwich Biscuits

- 5.1.4. Filled Biscuits

- 5.1.5. Chocolate-coated Biscuits

- 5.1.6. Other Sweet Biscuits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. United Arab Emirates

- 5.3.3. South Africa

- 5.3.4. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. United Arab Emirates

- 5.4.3. South Africa

- 5.4.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plain Biscuits

- 6.1.2. Cookies

- 6.1.3. Sandwich Biscuits

- 6.1.4. Filled Biscuits

- 6.1.5. Chocolate-coated Biscuits

- 6.1.6. Other Sweet Biscuits

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarket/Hypermarket

- 6.2.2. Convenience Stores

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. United Arab Emirates

- 6.3.3. South Africa

- 6.3.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plain Biscuits

- 7.1.2. Cookies

- 7.1.3. Sandwich Biscuits

- 7.1.4. Filled Biscuits

- 7.1.5. Chocolate-coated Biscuits

- 7.1.6. Other Sweet Biscuits

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarket/Hypermarket

- 7.2.2. Convenience Stores

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. United Arab Emirates

- 7.3.3. South Africa

- 7.3.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plain Biscuits

- 8.1.2. Cookies

- 8.1.3. Sandwich Biscuits

- 8.1.4. Filled Biscuits

- 8.1.5. Chocolate-coated Biscuits

- 8.1.6. Other Sweet Biscuits

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarket/Hypermarket

- 8.2.2. Convenience Stores

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. United Arab Emirates

- 8.3.3. South Africa

- 8.3.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of Middle East and Africa Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plain Biscuits

- 9.1.2. Cookies

- 9.1.3. Sandwich Biscuits

- 9.1.4. Filled Biscuits

- 9.1.5. Chocolate-coated Biscuits

- 9.1.6. Other Sweet Biscuits

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarket/Hypermarket

- 9.2.2. Convenience Stores

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. United Arab Emirates

- 9.3.3. South Africa

- 9.3.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South Africa Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East and Africa Sweet Biscuits Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 The Kellogg Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Gandour

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Deemah United Food Industries Corp Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Gulf Confectionery & Biscuit Co LLC*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Tiffany Foods Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Mondelez International Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Yildiz Holding Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Al Yanbou

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ITC Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Britannia Industries Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 The Kellogg Company

List of Figures

- Figure 1: Middle East and Africa Sweet Biscuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Sweet Biscuits Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Sweet Biscuits Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 19: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 27: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East and Africa Sweet Biscuits Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Sweet Biscuits Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Middle East and Africa Sweet Biscuits Market?

Key companies in the market include The Kellogg Company, Gandour, Deemah United Food Industries Corp Ltd, Gulf Confectionery & Biscuit Co LLC*List Not Exhaustive, Tiffany Foods Ltd, Mondelez International Inc, Yildiz Holding Inc, Al Yanbou, ITC Limited, Britannia Industries Limited.

3. What are the main segments of the Middle East and Africa Sweet Biscuits Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Supplement Nutrition; Growing Casein Application in Processed Food Products.

6. What are the notable trends driving market growth?

Increasing Inclination towards On-The-Go Snacking.

7. Are there any restraints impacting market growth?

Competition from Vegan/Plant-based Protein Powders.

8. Can you provide examples of recent developments in the market?

In April 2022, Flemish biscuit maker Lotus invested US$11m and commenced construction of its third factory in South Africa. Lotus has expanded its production capacity from 1,800 tonnes to about 3,100 tonnes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Sweet Biscuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Sweet Biscuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Sweet Biscuits Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Sweet Biscuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence