Key Insights

The Middle East and Africa (MEA) online grocery delivery market is experiencing robust growth, driven by increasing internet and smartphone penetration, a burgeoning young population accustomed to e-commerce, and a rising preference for convenience among urban consumers. The market's 26.40% Compound Annual Growth Rate (CAGR) from 2019 to 2024 indicates significant expansion. This surge is fueled by factors such as time-constrained lifestyles, the desire for contactless delivery amidst health concerns (particularly post-pandemic), and the expanding availability of diverse grocery options through online platforms. The market segmentation reveals a strong emphasis on retail delivery, quick commerce, and meal kit delivery services, catering to diverse consumer preferences. Key players like Instacart, Wee!, Shipt, Amazon Fresh, and regional players are fiercely competing to capture market share, leading to innovations in logistics and delivery models. The UAE, South Africa, and Saudi Arabia are leading the market growth within the MEA region, reflecting their higher levels of disposable income and technological infrastructure.

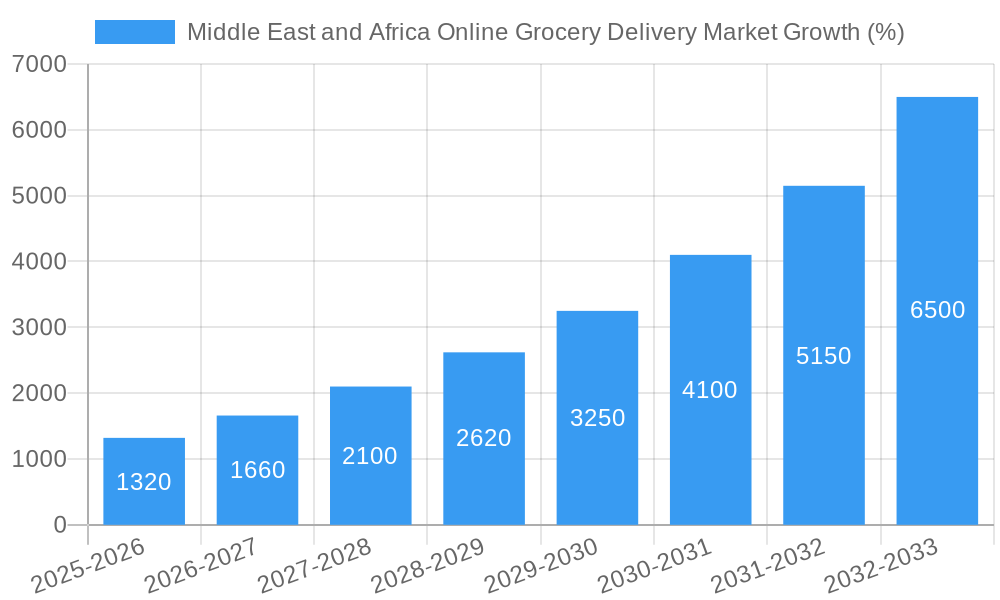

The forecast period (2025-2033) projects continued expansion, albeit potentially at a slightly moderated CAGR, as the market matures. However, factors like fluctuating fuel prices, infrastructural limitations in some regions, and potential regulatory changes pose challenges. The market will likely witness increased competition, further technological advancements, including AI-powered personalization and delivery optimization, and potentially a shift towards sustainable practices in packaging and delivery methods. Growth will be influenced by the success of companies in adapting to evolving consumer demands, enhancing their supply chains, and providing a consistently reliable and cost-effective service. The development of robust payment infrastructure and overcoming logistical challenges in less developed regions will be crucial for sustained market growth throughout the forecast period.

Middle East & Africa Online Grocery Delivery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Middle East and Africa online grocery delivery market, offering crucial insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a comprehensive understanding of past performance, current trends, and future projections. The market's size is expected to reach xx Million by 2033, showcasing substantial growth potential.

Middle East and Africa Online Grocery Delivery Market Composition & Trends

This section dives deep into the market's competitive dynamics, innovation drivers, and regulatory landscape. We analyze market concentration, revealing the market share distribution among key players. The report also examines the influence of M&A activities, quantifying deal values in Millions. Furthermore, we explore the impact of substitute products, end-user profiles, and the evolving regulatory environment on market growth. Innovation catalysts, such as technological advancements and changing consumer preferences, are meticulously examined.

- Market Concentration: Analysis of market share distribution among key players (xx% for top 3 players in 2024 estimated).

- M&A Activity: Review of significant mergers and acquisitions (total deal value in Millions for 2019-2024 estimated at xx Million).

- Regulatory Landscape: Assessment of regulations impacting online grocery delivery across different MEA countries.

- Substitute Products: Examination of alternative options impacting online grocery delivery market share.

- End-User Profiles: Detailed segmentation of online grocery shoppers by demographics and purchasing behavior.

Middle East and Africa Online Grocery Delivery Market Industry Evolution

The Middle East and Africa (MEA) online grocery delivery market has experienced remarkable growth, transforming how consumers access essential goods. This section meticulously charts the market's evolution from 2019 to 2024, providing a comprehensive analysis of historical trajectories and projecting robust future growth rates from 2025 to 2033. We delve into the key technological advancements fueling this expansion, including sophisticated logistics networks, user-friendly mobile applications, and data-driven personalization features. The evolving preferences of MEA consumers, their increasing demand for convenience and speed, and the market's dynamic response are thoroughly examined. Our analysis presents concrete data points, including projected Compound Annual Growth Rates (CAGR) of xx% from 2025-2033 and predicted market penetration rates exceeding xx% by 2033. Furthermore, we analyze adoption metrics for various service types, such as quick-commerce (Q-commerce) and traditional online grocery delivery, highlighting the market's shift towards speed and on-demand services. We also discuss the impact of hyperlocal delivery models and their influence on market segmentation.

Leading Regions, Countries, or Segments in Middle East and Africa Online Grocery Delivery Market

This section identifies the dominant regions, countries, and service types (Retail Delivery, Quick Commerce, Meal Kit Delivery) within the MEA online grocery delivery market. A detailed analysis examines the factors contributing to their dominance. Key drivers like investment trends, regulatory support, and consumer behavior are presented through bullet points for each segment.

- Dominant Region/Country: [Specific Region/Country] will be identified with justification.

- Retail Delivery: Key drivers include [specific reasons].

- Quick Commerce: Key drivers include [specific reasons].

- Meal Kit Delivery: Key drivers include [specific reasons].

Middle East and Africa Online Grocery Delivery Market Product Innovations

This section explores the innovative products and services reshaping the MEA online grocery delivery landscape. We examine the unique selling propositions (USPs) that differentiate market players, focusing on factors such as personalized recommendations, curated product selections, loyalty programs, subscription services, and seamless integration with existing retail ecosystems. The analysis highlights the crucial role of technological advancements in enhancing customer experience, improving operational efficiency, reducing delivery times, and increasing overall satisfaction. Specific examples of innovative solutions, including AI-powered inventory management, predictive analytics for demand forecasting, and advanced route optimization algorithms, will be presented to illustrate the impact of technology on the market's growth and sustainability.

Propelling Factors for Middle East and Africa Online Grocery Delivery Market Growth

The explosive growth of the MEA online grocery delivery market is driven by a confluence of factors. This section identifies and analyzes the key drivers, including: rapid urbanization and the increasing concentration of populations in urban centers; the rising disposable incomes across various socioeconomic groups; the widespread adoption of smartphones and internet penetration; the increasing comfort level with online transactions and digital payment methods; supportive government regulations and initiatives promoting e-commerce; the expanding presence of venture capital and investment in the sector; and the strategic partnerships between established retailers and technology companies. Specific examples of these influences will be provided, supported by case studies and market data, demonstrating the interconnectedness of these factors in shaping the market's trajectory.

Obstacles in the Middle East and Africa Online Grocery Delivery Market

This section identifies and analyzes the challenges hindering market growth. We delve into regulatory hurdles, supply chain disruptions (e.g., logistical challenges impacting delivery times, costs), and intense competitive pressures (quantified impact on market share or profitability will be provided).

Future Opportunities in Middle East and Africa Online Grocery Delivery Market

This section explores promising future opportunities for growth. We discuss emerging markets, innovative technologies (e.g., AI-powered personalization), and evolving consumer trends (e.g., increased demand for sustainable and healthy food options).

Major Players in the Middle East and Africa Online Grocery Delivery Market Ecosystem

- Instacart

- Weee!

- Shipt

- Amazon Fresh

- FreshDirect

- Boxed

- DoorDash

- Peapod

- Uber Eats

- Grubhub

Key Developments in Middle East and Africa Online Grocery Delivery Market Industry

- July 2022: Launch of Veppy.com in the UAE, focusing on personalized recommendations and strategic partnerships with established retailers, showcasing a successful integration of technology and traditional retail infrastructure.

- July 2022: Deliveroo UAE's introduction of "Hop," a 15-minute grocery delivery service in partnership with Choithrams, highlighting the rise of Q-commerce and the collaboration between established players to capture market share in the fast-growing segment.

- [Add more recent key developments with dates and descriptions, focusing on significant market events, partnerships, and technological innovations.]

Strategic Middle East and Africa Online Grocery Delivery Market Forecast

This concluding section summarizes the key growth catalysts and assesses the market's future potential. We highlight the opportunities for expansion and the expected trajectory of market growth based on the identified trends and drivers, providing a concise outlook on the future of the MEA online grocery delivery market.

Middle East and Africa Online Grocery Delivery Market Segmentation

-

1. Service Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

-

2. Geography

- 2.1. UAE

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. UAE

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Rest of Middle East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Retail Delivery

- 6.1.2. Quick Commerce

- 6.1.3. Meal Kit Delivery

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. UAE

- 6.2.2. Saudi Arabia

- 6.2.3. South Africa

- 6.2.4. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Retail Delivery

- 7.1.2. Quick Commerce

- 7.1.3. Meal Kit Delivery

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. UAE

- 7.2.2. Saudi Arabia

- 7.2.3. South Africa

- 7.2.4. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Retail Delivery

- 8.1.2. Quick Commerce

- 8.1.3. Meal Kit Delivery

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. UAE

- 8.2.2. Saudi Arabia

- 8.2.3. South Africa

- 8.2.4. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Rest of Middle East and Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Retail Delivery

- 9.1.2. Quick Commerce

- 9.1.3. Meal Kit Delivery

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. UAE

- 9.2.2. Saudi Arabia

- 9.2.3. South Africa

- 9.2.4. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. UAE Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 11. South Africa Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 12. Saudi Arabia Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 13. Rest of MEA Middle East and Africa Online Grocery Delivery Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Instacart

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Weee!

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Shipt

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Amazon Fresh

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 FreshDirect

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Boxed

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 DoorDash

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Peapod

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Uber Eats

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Grubhub

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Instacart

List of Figures

- Figure 1: Middle East and Africa Online Grocery Delivery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Online Grocery Delivery Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Middle East and Africa Online Grocery Delivery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 17: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 20: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Middle East and Africa Online Grocery Delivery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Online Grocery Delivery Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Middle East and Africa Online Grocery Delivery Market?

Key companies in the market include Instacart , Weee! , Shipt , Amazon Fresh , FreshDirect , Boxed, DoorDash , Peapod, Uber Eats , Grubhub .

3. What are the main segments of the Middle East and Africa Online Grocery Delivery Market?

The market segments include Service Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Mobile apps segment is anticipated to grow at a noticeable pace during the forecast period..

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

July 2022: Considering the high level of competition in the market, the UAE's grocery delivery and quick commerce application 'Veppy.com' is allowing retailers to register their products on its website before its commercial launch at the end of August 2022. This was done in anticipation that the site could be in business right after its launch. Veppy.com makes shopping very personalized by recommending products based on what customers have bought on the site before and what the app has learned from that.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence