Key Insights

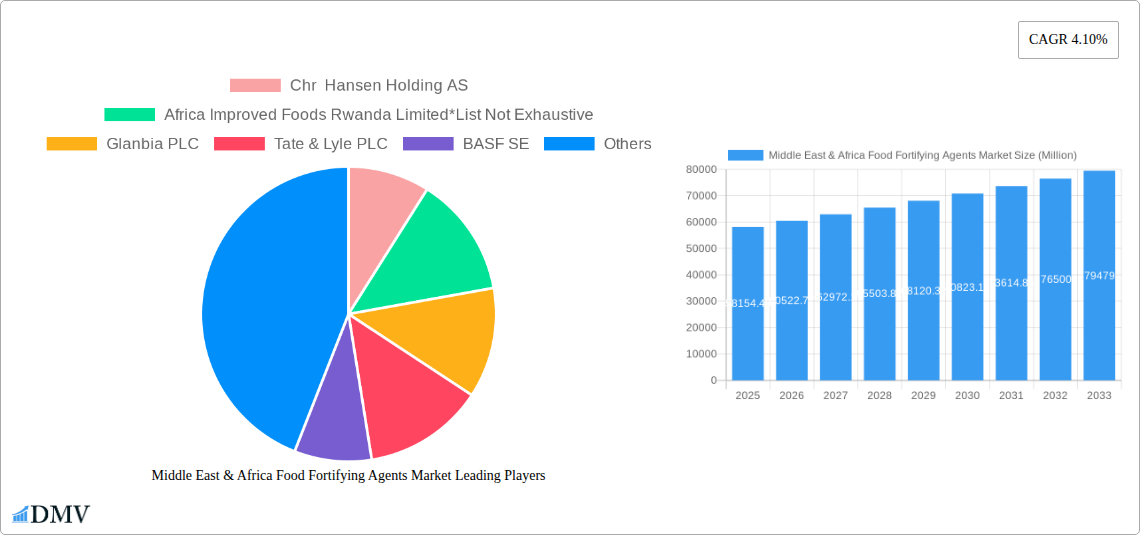

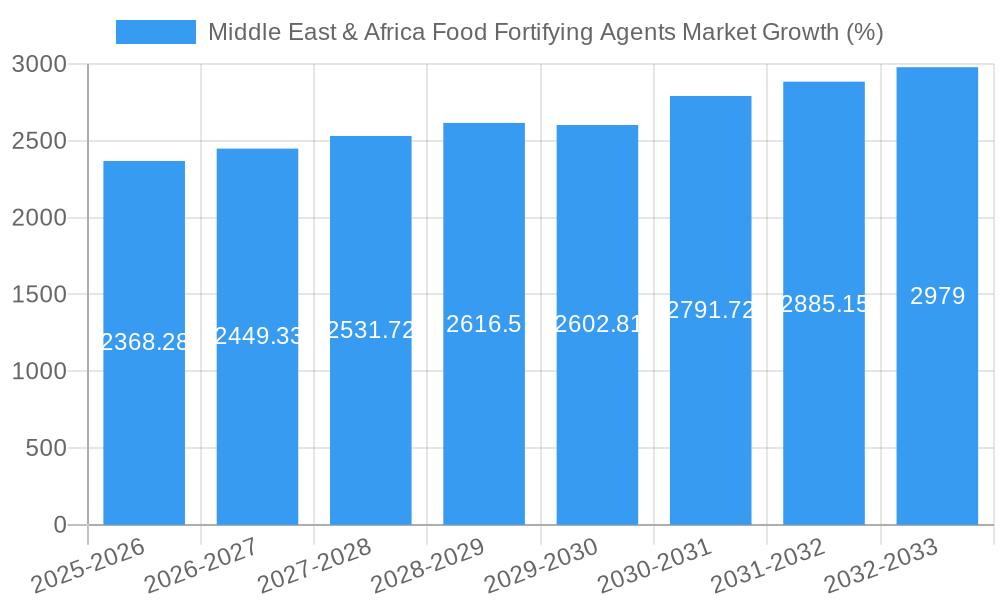

The Middle East & Africa (MEA) Food Fortifying Agents market, valued at $58,154.49 million in 2025, is projected to experience robust growth, driven by increasing awareness of nutritional deficiencies and rising consumer demand for fortified foods. The region's burgeoning population, coupled with a growing prevalence of malnutrition, particularly among infants and children, fuels significant demand for fortified products. Key drivers include government initiatives promoting food fortification, rising disposable incomes enabling increased spending on nutritious food, and the expanding presence of multinational food and beverage companies actively investing in the region. The market is segmented by type (Proteins & Amino Acids, Vitamins & Minerals, Lipids, Prebiotics & Probiotics, Others) and application (Infant Formula, Dairy & Dairy-Based Products, Cereals & Cereal-based Products, Fats & Oils, Beverages, Dietary Supplements, Others). Vitamins & Minerals are likely the largest segment, given their widespread use in various food applications to address micronutrient deficiencies. Infant formula and dairy products represent significant application segments due to their crucial role in infant nutrition and overall dietary health. While challenges exist, such as regulatory hurdles and varying levels of infrastructure development across the region, the long-term outlook for the MEA food fortifying agents market remains positive, driven by sustained economic growth and a focus on public health.

The market's Compound Annual Growth Rate (CAGR) of 4.10% from 2025 to 2033 indicates a steady expansion. Growth is expected to be particularly strong in countries experiencing rapid urbanization and economic development, such as the UAE and Saudi Arabia. Companies like Chr. Hansen Holding AS, Glanbia PLC, and BASF SE are key players, leveraging their expertise in developing and supplying high-quality food fortifying agents. The competitive landscape is expected to become more intense as new players enter the market, driven by increasing demand and lucrative market opportunities. Future growth will be influenced by factors such as technological advancements in fortification techniques, consumer preference shifts towards healthier foods, and evolving regulatory frameworks governing food fortification. Further research into specific regional needs and consumer behavior within the MEA region will be vital for targeted market penetration and effective product development.

Middle East & Africa Food Fortifying Agents Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Middle East & Africa Food Fortifying Agents Market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this study is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is estimated to be valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Middle East & Africa Food Fortifying Agents Market Composition & Trends

This section delves into the competitive landscape of the Middle East & Africa Food Fortifying Agents Market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We examine the impact of mergers and acquisitions (M&A) activity, providing insights into deal values and their influence on market share distribution. Key aspects analyzed include:

- Market Concentration: A detailed examination of market share held by major players, revealing the degree of competition and potential for disruption. The top five players currently hold an estimated xx% market share.

- Innovation Catalysts: Analysis of technological advancements driving innovation in food fortification, including novel delivery systems and fortification strategies.

- Regulatory Landscape: A thorough assessment of existing regulations and their impact on market growth, including variations across different countries within the Middle East and Africa.

- Substitute Products: Identification and evaluation of potential substitute products and their competitive impact on the market.

- End-User Profiles: A detailed segmentation of end-users, including their specific needs and preferences for fortified foods.

- M&A Activities: Review of significant M&A activities within the industry during the study period (2019-2024), including deal values and their strategic implications. Examples include the acquisition of X company by Y company for xx Million in 2022, which significantly strengthened Y company's presence in the vitamins and minerals segment.

Middle East & Africa Food Fortifying Agents Market Industry Evolution

This section provides a comprehensive analysis of the Middle East & Africa Food Fortifying Agents Market's growth trajectory, technological advancements, and evolving consumer preferences. We examine historical trends (2019-2024) and project future growth (2025-2033), considering factors such as increasing consumer awareness of nutrition, government initiatives promoting food fortification, and the rise of functional foods. The report will showcase data points like the increasing adoption of prebiotics and probiotics in fortified foods, and the growth rate of the infant formula segment fueled by rising birth rates in certain regions. Specific technological advancements like microencapsulation and targeted delivery systems will also be detailed, alongside analysis of their impact on market growth.

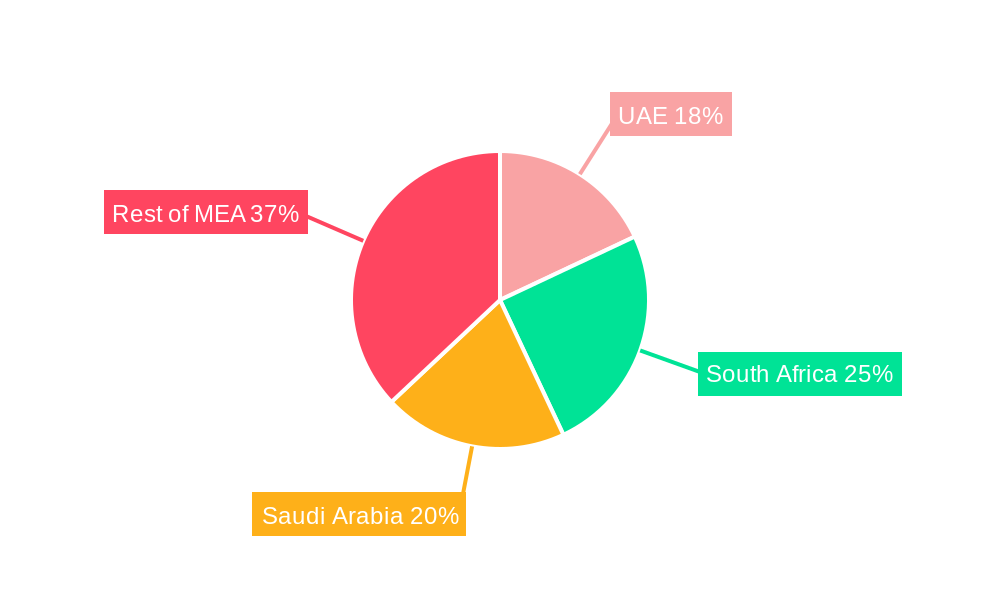

Leading Regions, Countries, or Segments in Middle East & Africa Food Fortifying Agents Market

This section identifies the leading regions, countries, and segments within the Middle East & Africa Food Fortifying Agents Market. We analyze dominance factors and key drivers for each, providing detailed insights into market performance and future prospects.

By Type:

- Vitamins & Minerals: This segment is expected to dominate the market, driven by increasing awareness of micronutrient deficiencies and government regulations mandating fortification. Key drivers include increasing government initiatives to combat malnutrition and rising disposable incomes driving demand for premium fortified products.

- Proteins & Amino Acids: This segment is experiencing significant growth due to the increasing demand for protein-rich foods. Factors driving growth include rising health consciousness and the popularity of plant-based protein sources.

- Others: This segment comprises lipids, prebiotics & probiotics, etc., with each demonstrating unique growth trajectories based on evolving consumer preferences.

By Application:

- Infant Formula: This segment exhibits strong growth due to increasing birth rates and the importance of providing infants with adequate nutrition. Governments' emphasis on food safety regulations for this product category creates further impetus for market growth.

- Dairy & Dairy-Based Products: This segment demonstrates consistent growth as consumers increasingly seek fortified dairy options for enhanced nutritional value.

- Cereals & Cereal-based Products: This segment is a significant consumer of fortifying agents, driven by consumer demand for convenient and nutritious breakfast options.

(Detailed analysis of each segment’s dominance factors and growth drivers will be provided in the full report)

Middle East & Africa Food Fortifying Agents Market Product Innovations

The Middle East & Africa Food Fortifying Agents Market is witnessing significant product innovation, with manufacturers introducing novel delivery systems, such as microencapsulation, to enhance the stability and bioavailability of fortifying agents. Furthermore, the development of customized fortification solutions targeted at specific nutritional needs is gaining traction. Unique selling propositions include improved taste and texture profiles, increased shelf life, and enhanced nutrient absorption.

Propelling Factors for Middle East & Africa Food Fortifying Agents Market Growth

Several key factors propel the growth of the Middle East & Africa Food Fortifying Agents Market. These include increasing awareness of micronutrient deficiencies among consumers, stringent government regulations mandating food fortification, and the rising popularity of functional foods. Economic growth and rising disposable incomes also play a pivotal role, allowing consumers to afford premium fortified products. Furthermore, technological advancements in fortification technologies and the development of novel delivery systems are accelerating market expansion.

Obstacles in the Middle East & Africa Food Fortifying Agents Market

Despite the significant growth potential, the Middle East & Africa Food Fortifying Agents Market faces several obstacles. These include inconsistent regulatory frameworks across different countries, supply chain disruptions impacting raw material availability and cost, and intense competition among established and emerging players. Furthermore, variations in consumer preferences and affordability challenges in certain regions present considerable hurdles.

Future Opportunities in Middle East & Africa Food Fortifying Agents Market

Future opportunities lie in the untapped potential of several markets within the Middle East and Africa. Expansion into underserved rural communities, developing tailored fortification solutions for specific populations, and leveraging digital marketing strategies to reach consumers present significant growth avenues. Emerging technologies, such as nanotechnology for enhanced nutrient delivery, and innovative product formats will also shape the market's future.

Major Players in the Middle East & Africa Food Fortifying Agents Market Ecosystem

- Chr. Hansen Holding AS

- Africa Improved Foods Rwanda Limited

- Glanbia PLC

- Tate & Lyle PLC

- BASF SE

- Koninklijke DSM NV

- Ingredion Incorporated

Key Developments in Middle East & Africa Food Fortifying Agents Market Industry

- January 2023: X company launched a new line of microencapsulated vitamin supplements for the infant formula market.

- June 2022: Y company acquired Z company, expanding its product portfolio and market reach in the prebiotics and probiotics segment.

- (Further key developments with dates will be included in the full report)

Strategic Middle East & Africa Food Fortifying Agents Market Forecast

The Middle East & Africa Food Fortifying Agents Market is poised for sustained growth driven by a multitude of factors including increased consumer awareness of health and nutrition, governmental support for food fortification programs, and advancements in fortification technologies. The market's future potential is considerable, with opportunities for innovation and expansion across various product segments and geographic regions. Further growth is expected as consumers embrace healthier lifestyles and prioritize nutrient-rich foods.

Middle East & Africa Food Fortifying Agents Market Segmentation

-

1. Type

- 1.1. Proteins & Amino Acids

- 1.2. Vitamins & Minerals

- 1.3. Lipids

- 1.4. Prebiotics & Probiotics

- 1.5. Others

-

2. Application

- 2.1. Infant Formula

- 2.2. Dairy & Dairy-Based Products

- 2.3. Cereals & Cereal-based Products

- 2.4. Fats & Oils

- 2.5. Beverages

- 2.6. Dietary Supplements

- 2.7. Others

-

3. Geography

- 3.1. South Africa

- 3.2. United Arab Emirates

- 3.3. Rest of Middle East & Africa

Middle East & Africa Food Fortifying Agents Market Segmentation By Geography

- 1. South Africa

- 2. United Arab Emirates

- 3. Rest of Middle East

Middle East & Africa Food Fortifying Agents Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Rising Demand for Prebiotics & Probiotics Fortified Food in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proteins & Amino Acids

- 5.1.2. Vitamins & Minerals

- 5.1.3. Lipids

- 5.1.4. Prebiotics & Probiotics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Infant Formula

- 5.2.2. Dairy & Dairy-Based Products

- 5.2.3. Cereals & Cereal-based Products

- 5.2.4. Fats & Oils

- 5.2.5. Beverages

- 5.2.6. Dietary Supplements

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South Africa

- 5.3.2. United Arab Emirates

- 5.3.3. Rest of Middle East & Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.4.2. United Arab Emirates

- 5.4.3. Rest of Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Proteins & Amino Acids

- 6.1.2. Vitamins & Minerals

- 6.1.3. Lipids

- 6.1.4. Prebiotics & Probiotics

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Infant Formula

- 6.2.2. Dairy & Dairy-Based Products

- 6.2.3. Cereals & Cereal-based Products

- 6.2.4. Fats & Oils

- 6.2.5. Beverages

- 6.2.6. Dietary Supplements

- 6.2.7. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. South Africa

- 6.3.2. United Arab Emirates

- 6.3.3. Rest of Middle East & Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Arab Emirates Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Proteins & Amino Acids

- 7.1.2. Vitamins & Minerals

- 7.1.3. Lipids

- 7.1.4. Prebiotics & Probiotics

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Infant Formula

- 7.2.2. Dairy & Dairy-Based Products

- 7.2.3. Cereals & Cereal-based Products

- 7.2.4. Fats & Oils

- 7.2.5. Beverages

- 7.2.6. Dietary Supplements

- 7.2.7. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. South Africa

- 7.3.2. United Arab Emirates

- 7.3.3. Rest of Middle East & Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Rest of Middle East Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Proteins & Amino Acids

- 8.1.2. Vitamins & Minerals

- 8.1.3. Lipids

- 8.1.4. Prebiotics & Probiotics

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Infant Formula

- 8.2.2. Dairy & Dairy-Based Products

- 8.2.3. Cereals & Cereal-based Products

- 8.2.4. Fats & Oils

- 8.2.5. Beverages

- 8.2.6. Dietary Supplements

- 8.2.7. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. South Africa

- 8.3.2. United Arab Emirates

- 8.3.3. Rest of Middle East & Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. UAE Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 10. South Africa Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 11. Saudi Arabia Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of MEA Middle East & Africa Food Fortifying Agents Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Chr Hansen Holding AS

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Africa Improved Foods Rwanda Limited*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Glanbia PLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tate & Lyle PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 BASF SE

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Koninklijke DSM NV

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Ingredion Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.1 Chr Hansen Holding AS

List of Figures

- Figure 1: Middle East & Africa Food Fortifying Agents Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Food Fortifying Agents Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: UAE Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: South Africa Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Saudi Arabia Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of MEA Middle East & Africa Food Fortifying Agents Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: Middle East & Africa Food Fortifying Agents Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Food Fortifying Agents Market?

The projected CAGR is approximately 4.10%.

2. Which companies are prominent players in the Middle East & Africa Food Fortifying Agents Market?

Key companies in the market include Chr Hansen Holding AS, Africa Improved Foods Rwanda Limited*List Not Exhaustive, Glanbia PLC, Tate & Lyle PLC, BASF SE, Koninklijke DSM NV, Ingredion Incorporated.

3. What are the main segments of the Middle East & Africa Food Fortifying Agents Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 58154.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Rising Demand for Prebiotics & Probiotics Fortified Food in the Region.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Food Fortifying Agents Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Food Fortifying Agents Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Food Fortifying Agents Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Food Fortifying Agents Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence