Key Insights

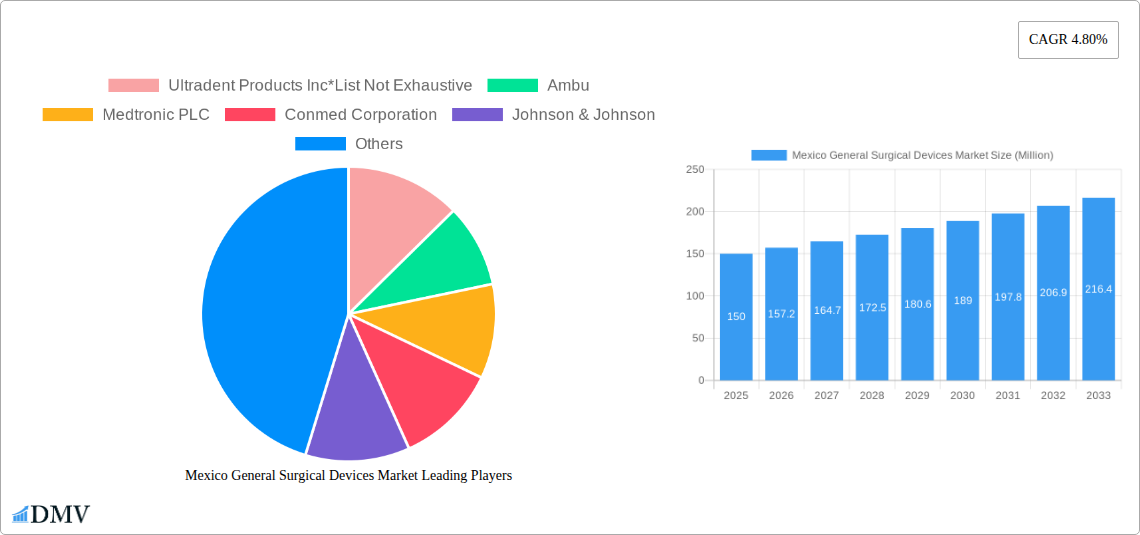

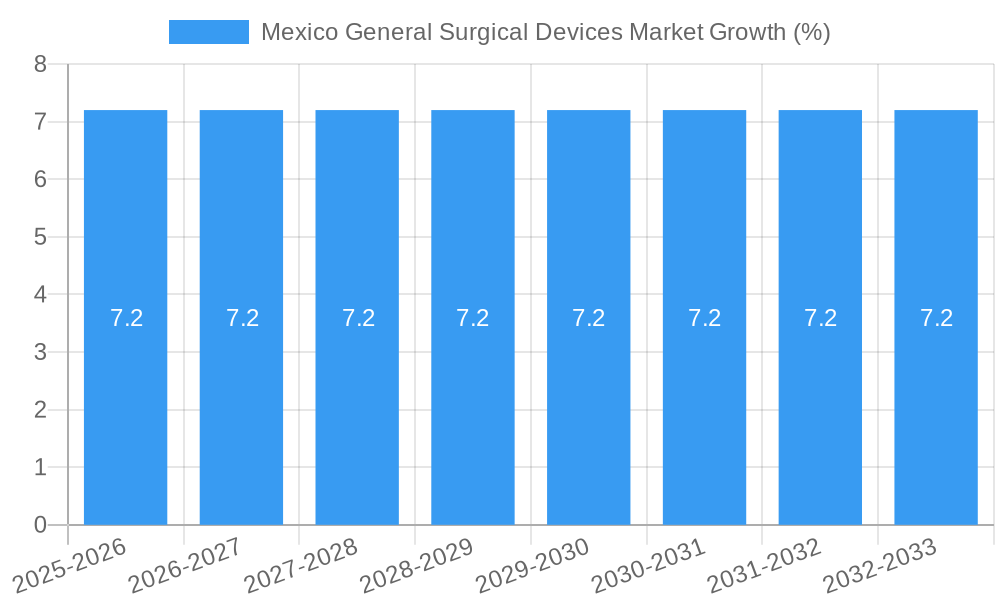

The Mexico general surgical devices market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by factors such as increasing prevalence of chronic diseases requiring surgical intervention, rising healthcare expenditure, and a growing geriatric population. The market's 4.80% CAGR from 2019-2033 indicates a steady expansion, with significant potential for further growth. Key segments driving this expansion include laparoscopic devices, fueled by minimally invasive surgery's rising popularity, and electro surgical devices, owing to their enhanced precision and efficiency. The increasing adoption of advanced surgical techniques and technological advancements within the healthcare infrastructure are also contributing to this market expansion. While challenges such as regulatory hurdles and healthcare infrastructure limitations in certain regions might act as restraints, the overall market outlook remains positive due to ongoing investments in healthcare infrastructure and the government's emphasis on improving healthcare access. The market is segmented by product type (handheld devices, laparoscopic devices, etc.) and application (gynecology, cardiology, etc.), offering diverse growth opportunities for market players.

The presence of established international players like Medtronic, Johnson & Johnson, and Boston Scientific, alongside local distributors, indicates a competitive landscape. However, opportunities exist for companies focusing on innovative product development, particularly in areas like robotic surgery and advanced imaging technologies. Growth will likely be concentrated in urban areas with better healthcare infrastructure. Analyzing specific regional variations within Mexico is crucial for companies targeting this market. Understanding the regulatory environment and adapting strategies to local preferences are essential for successful market penetration and sustained growth. Future market development will likely be influenced by government policies promoting healthcare infrastructure improvements, further driving demand for general surgical devices.

Mexico General Surgical Devices Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Mexico General Surgical Devices Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market size is estimated at XXX Million in 2025 and is projected to reach XXX Million by 2033.

Mexico General Surgical Devices Market Composition & Trends

This section delves into the intricate composition of the Mexican general surgical devices market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activity. The market exhibits a moderately concentrated landscape, with key players holding significant market share. Innovation is driven by the increasing demand for minimally invasive procedures and the adoption of advanced technologies. Stringent regulatory requirements, aligned with international standards, govern the market. Competition from substitute products, such as alternative therapies, presents a challenge. End-users comprise a diverse range of hospitals, clinics, and ambulatory surgical centers.

- Market Share Distribution (2024): Medtronic PLC (xx%), Johnson & Johnson (xx%), Stryker Corporation (xx%), Others (xx%). The precise figures are under further investigation.

- M&A Activity (2019-2024): A total of xx M&A deals were recorded, with a combined value of approximately XXX Million. Further analysis is needed to specify deal sizes.

- Key Trends: Growing adoption of laparoscopic surgery, increasing demand for advanced wound closure devices, and a rising geriatric population.

Mexico General Surgical Devices Market Industry Evolution

The Mexican general surgical devices market has experienced significant growth over the historical period (2019-2024), driven primarily by technological advancements, rising healthcare expenditure, and growing awareness of minimally invasive surgical techniques. The market is witnessing a shift towards technologically advanced devices like robotic-assisted surgery systems and smart surgical instruments. Consumer demand is increasingly focused on safety, efficacy, and improved patient outcomes. This has led to the development of more sophisticated and user-friendly devices that ensure improved surgical precision. The compound annual growth rate (CAGR) during the historical period is estimated at xx%, and a projected CAGR of xx% is expected during the forecast period (2025-2033). The adoption rate of advanced surgical technologies remains a key performance indicator of market progression.

Leading Regions, Countries, or Segments in Mexico General Surgical Devices Market

The Mexican general surgical devices market exhibits strong regional variations. While precise regional breakdown data is unavailable, major metropolitan areas with well-established healthcare infrastructure are likely to dominate. Within product segments, laparoscopic devices are projected to exhibit robust growth, followed by electro-surgical devices and wound closure devices. Similarly, within application segments, gynecology and urology, cardiology, and orthopedics lead the market.

- Key Drivers (Laparoscopic Devices): Increased preference for minimally invasive procedures, rising number of specialized surgical centers, supportive government policies promoting advanced medical technology.

- Key Drivers (Gynecology and Urology): High prevalence of related diseases, rising awareness of minimally invasive procedures, increased investment in healthcare infrastructure.

The dominance of these segments stems from factors such as increased prevalence of related diseases, government support for healthcare infrastructure development, and growing adoption of minimally invasive surgical techniques.

Mexico General Surgical Devices Market Product Innovations

Recent innovations include the development of smaller, more ergonomic handheld devices, advanced laparoscopic instruments with enhanced visualization capabilities, and improved electro-surgical devices with reduced tissue damage. These innovations prioritize enhanced precision, reduced invasiveness, and improved patient outcomes, directly impacting market competitiveness and driving growth. The focus is on integrating smart technologies to enhance surgical efficiency and data analysis.

Propelling Factors for Mexico General Surgical Devices Market Growth

Several factors are driving the growth of the Mexican general surgical devices market. These include:

- Technological Advancements: The continuous development of minimally invasive surgical techniques and advanced medical devices.

- Economic Growth: Rising disposable incomes and increased healthcare expenditure.

- Government Initiatives: Supportive government policies focused on improving healthcare infrastructure and access to advanced medical technologies.

Obstacles in the Mexico General Surgical Devices Market

Challenges facing the market include:

- Regulatory Hurdles: Stringent regulatory approvals and compliance requirements can delay product launches.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of devices.

- Pricing Pressures: Competition from both domestic and international players can lead to pricing pressures, impacting profit margins.

Future Opportunities in Mexico General Surgical Devices Market

Future opportunities lie in:

- Expansion into Underserved Regions: Reaching patients in remote areas with improved access to advanced surgical care.

- Technological Advancements: Investing in emerging technologies such as AI-powered surgical tools and robotic-assisted surgery.

- Focus on Value-Based Care: Developing innovative business models that align with value-based care principles.

Major Players in the Mexico General Surgical Devices Market Ecosystem

- Ultradent Products Inc

- Ambu

- Medtronic PLC

- Conmed Corporation

- Johnson & Johnson

- B Braun Melsungen AG

- Stryker Corporation

- Boston Scientific Corporation

- Integer Holdings Corporation

Key Developments in Mexico General Surgical Devices Market Industry

- September 2022: Nordson MEDICAL opens a Medical Device Manufacturing Center of Excellence in Tecate, Mexico, signifying increased investment in the region's manufacturing capacity.

- October 2022: Ambu establishes its largest manufacturing plant in Ciudad Juárez, Mexico, strengthening its North American supply chain and market presence. This significantly impacts production capacity and market access.

Strategic Mexico General Surgical Devices Market Forecast

The Mexican general surgical devices market is poised for continued growth, driven by favorable demographic trends, technological advancements, and supportive government policies. The increasing adoption of minimally invasive surgical techniques and the expansion of healthcare infrastructure will continue to fuel market expansion, presenting significant opportunities for existing and new market entrants. Further investment in research and development of innovative medical devices will be critical in sustaining this growth.

Mexico General Surgical Devices Market Segmentation

-

1. Product

- 1.1. Handheld Devices

- 1.2. Laproscopic Devices

- 1.3. Electro Surgical Devices

- 1.4. Wound Closure Devices

- 1.5. Trocars and Access Devices

- 1.6. Other Products

-

2. Application

- 2.1. Gynecology and Urology

- 2.2. Cardiology

- 2.3. Orthopaedic

- 2.4. Neurology

- 2.5. Other Applications

Mexico General Surgical Devices Market Segmentation By Geography

- 1. Mexico

Mexico General Surgical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs

- 3.3. Market Restrains

- 3.3.1. High Capital Expenses Needed to Produce Surgical Equipment

- 3.4. Market Trends

- 3.4.1. Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico General Surgical Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Handheld Devices

- 5.1.2. Laproscopic Devices

- 5.1.3. Electro Surgical Devices

- 5.1.4. Wound Closure Devices

- 5.1.5. Trocars and Access Devices

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Gynecology and Urology

- 5.2.2. Cardiology

- 5.2.3. Orthopaedic

- 5.2.4. Neurology

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ambu

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Medtronic PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conmed Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson & Johnson

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 B Braun Melsungen AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stryker Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Boston Scientific Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Integer Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Ultradent Products Inc*List Not Exhaustive

List of Figures

- Figure 1: Mexico General Surgical Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico General Surgical Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Mexico General Surgical Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Mexico General Surgical Devices Market Revenue Million Forecast, by Product 2019 & 2032

- Table 7: Mexico General Surgical Devices Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Mexico General Surgical Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico General Surgical Devices Market?

The projected CAGR is approximately 4.80%.

2. Which companies are prominent players in the Mexico General Surgical Devices Market?

Key companies in the market include Ultradent Products Inc*List Not Exhaustive, Ambu, Medtronic PLC, Conmed Corporation, Johnson & Johnson, B Braun Melsungen AG, Stryker Corporation, Boston Scientific Corporation, Integer Holdings Corporation.

3. What are the main segments of the Mexico General Surgical Devices Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Minimally Invasive Devices; Technological Advancements in General Surgical Devices; Rising Unmet Healthcare Needs.

6. What are the notable trends driving market growth?

Handheld Devices Segment is Expected to Hold a Significant Share in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Capital Expenses Needed to Produce Surgical Equipment.

8. Can you provide examples of recent developments in the market?

September 2022: Nordson MEDICAL, a global integrated solutions partner for the design, engineering and manufacturing of complex medical devices and components announced the official opening of its Tecate, Mexico, Medical Device Manufacturing Center of Excellence. The event was marked with a ribbon cutting ceremony with representatives from the local government and Nordson leadership in attendance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico General Surgical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico General Surgical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico General Surgical Devices Market?

To stay informed about further developments, trends, and reports in the Mexico General Surgical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence