Key Insights

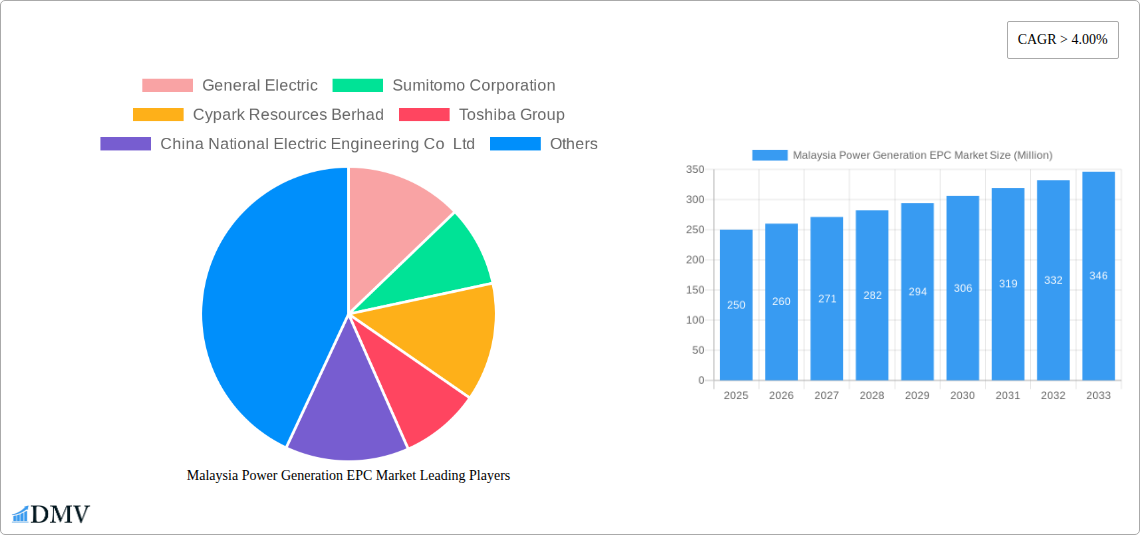

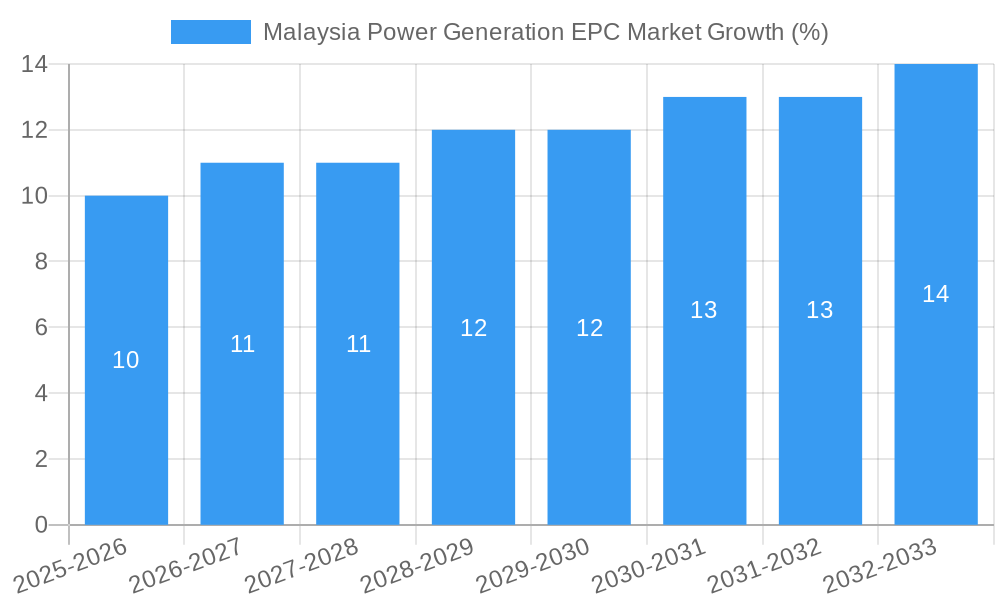

The Malaysia Power Generation Engineering, Procurement, and Construction (EPC) market is experiencing robust growth, driven by increasing energy demand and the government's commitment to renewable energy sources. With a Compound Annual Growth Rate (CAGR) exceeding 4.00% and a 2025 market size in the millions (the exact figure requires further research, but industry reports suggest a figure within the range of 100-500 million USD, depending on the specific segment definitions), the sector presents significant opportunities for investors and EPC contractors. Key drivers include the expansion of renewable energy projects, particularly solar and wind power, aimed at diversifying the energy mix and reducing reliance on fossil fuels. Furthermore, government initiatives promoting sustainable energy development, coupled with rising industrialization and urbanization, are fueling demand for enhanced power generation capacity. While challenges exist, such as potential regulatory hurdles and fluctuating energy prices, the long-term outlook remains positive. The market is segmented by energy source (solar, wind, hydro, coal, natural gas), end-user (utilities, independent power producers (IPPs), industrial), and project size (small, medium, large scale). Leading players, including General Electric, Sumitomo Corporation, and Cypark Resources Berhad, are strategically positioning themselves to capitalize on this growth trajectory. Growth is particularly strong in the renewable energy segments, which are expected to gain market share in the forecast period.

The Asia-Pacific region, specifically Malaysia, plays a crucial role in the global power generation EPC market. Strong economic growth in this region, coupled with infrastructural development, fuels the demand for robust and reliable power infrastructure. The market's maturity is apparent in the presence of both international and domestic EPC contractors, engaging in intense competition, which results in efficient project execution and competitive pricing. The ongoing focus on technological innovation within the sector, such as the adoption of smart grid technologies, further enhances the long-term prospects. The forecast period (2025-2033) projects continued expansion, driven by consistent government support for renewable energy adoption, and technological advancements in power generation. However, careful consideration of environmental impacts and resource management will be crucial for sustainable growth within the market.

Malaysia Power Generation EPC Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Malaysia Power Generation Engineering, Procurement, and Construction (EPC) market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a focus on 2025, this report is essential for stakeholders seeking to understand market dynamics, investment opportunities, and competitive landscapes within this rapidly evolving sector. The Malaysian power generation EPC market is experiencing significant growth driven by increasing energy demands, government initiatives promoting renewable energy, and technological advancements. This report meticulously analyzes these factors, providing actionable insights for strategic decision-making.

Malaysia Power Generation EPC Market Composition & Trends

This section delves into the intricate composition of the Malaysian power generation EPC market, examining key trends shaping its evolution. We analyze market concentration, identifying the leading players and their respective market shares. Innovation catalysts, such as government incentives for renewable energy and technological advancements in solar and wind power, are explored in detail. The regulatory landscape, including licensing procedures and environmental regulations, is critically assessed, along with the impact of substitute products and the competitive dynamics they introduce. The report also provides a detailed profile of end-users, including utilities, IPPs (Independent Power Producers), and industrial consumers, and offers in-depth analysis of recent mergers and acquisitions (M&A) activities, including deal values and their impact on market consolidation. The estimated market size in 2025 is xx Million.

- Market Share Distribution: Analysis of market share held by key players like General Electric, Sumitomo Corporation, and Cypark Resources Berhad.

- M&A Activity: Detailed analysis of recent M&A transactions with deal values expressed in Millions, focusing on their implications for market consolidation.

- Regulatory Landscape: In-depth review of Malaysian regulations impacting the EPC market.

- Substitute Products: Assessment of the influence of alternative energy sources and technologies on market dynamics.

Malaysia Power Generation EPC Market Industry Evolution

This section provides a comprehensive analysis of the evolutionary trajectory of the Malaysian power generation EPC market. We examine historical growth trends (2019-2024), projecting future growth rates (2025-2033). The report assesses the influence of technological advancements, such as improved solar panel efficiency and advancements in wind turbine technology, and how these innovations are shaping market dynamics. The analysis includes a detailed study of shifting consumer demands, reflecting the increasing preference for renewable energy sources and the impact of this shift on the market. The report also explores the impact of government policies, such as feed-in tariffs and renewable energy targets, on market expansion.

Leading Regions, Countries, or Segments in Malaysia Power Generation EPC Market

This section pinpoints the leading segments and regions within the Malaysian power generation EPC market. We identify the dominant segments based on power generation type (Solar, Wind, Hydro, Coal, Natural Gas), end-user (Utilities, IPPs, Industrial), and project size (Small, Medium, Large Scale). The analysis focuses on the factors driving the dominance of specific segments.

- Key Drivers (Bullet Points):

- Investment trends in specific technologies.

- Government support and incentives for renewable energy (e.g., solar).

- Geographical factors impacting project feasibility and development.

- Availability of resources and infrastructure.

- In-depth analysis of dominance factors: Explores the underlying reasons for the identified leading segments. For example, the strong growth in solar power could be attributed to government support and declining solar panel costs.

Malaysia Power Generation EPC Market Product Innovations

This section showcases recent product innovations and technological advancements within the Malaysian power generation EPC market. We analyze the performance metrics of new products, highlighting their unique selling propositions and competitive advantages. This includes advancements in energy storage solutions, smart grid technologies, and improved efficiency in renewable energy systems.

Propelling Factors for Malaysia Power Generation EPC Market Growth

This section identifies and analyzes the key growth drivers for the Malaysian power generation EPC market. Factors such as increasing energy demand, government support for renewable energy, and technological advancements are explored, with specific examples illustrating their impact on market expansion.

Obstacles in the Malaysia Power Generation EPC Market

This section identifies and analyzes the major obstacles hindering growth in the Malaysian power generation EPC market. These may include regulatory hurdles, supply chain disruptions, and intense competition from established and emerging players. Quantifiable impacts of these obstacles are assessed.

Future Opportunities in Malaysia Power Generation EPC Market

This section highlights emerging opportunities in the Malaysian power generation EPC market, focusing on new technologies, market segments, and consumer trends that promise significant growth potential in the coming years. This might include the integration of renewable energy sources, energy storage technologies, and smart grid initiatives.

Major Players in the Malaysia Power Generation EPC Market Ecosystem

- General Electric

- Sumitomo Corporation

- Cypark Resources Berhad

- Toshiba Group

- China National Electric Engineering Co Ltd

- AFRY AB

- Scatec ASA

- Kpower Berhad

- Solarvest Holdings

- Sunway Construction Group Bhd

Key Developments in Malaysia Power Generation EPC Market Industry

- October 2021: Solarvest Holdings Bhd secured a USD 11.2 Million EPC contract for a 50 MW AC capacity solar farm in Bukit Selambau, Kedah, scheduled for commercial operation by 2023. This highlights the growing demand for large-scale solar projects in Malaysia.

- August 2021: Solarvest Holdings won a MYR 66 Million EPC contract for a 17.76 MW solar project in Mukim Bota, Perak, awarded by Grooveland Sdn Bhd. This demonstrates the continued investment in solar energy projects across different regions of Malaysia.

Strategic Malaysia Power Generation EPC Market Forecast

This report concludes by summarizing the key growth catalysts for the Malaysian power generation EPC market, outlining the future opportunities and market potential for the forecast period (2025-2033). The substantial growth potential is driven by a combination of factors, including supportive government policies, technological advancements, and the increasing demand for sustainable energy solutions. The market is poised for significant expansion, presenting considerable opportunities for investors and industry players.

Malaysia Power Generation EPC Market Segmentation

- 1. Thermal

- 2. Hydroelectric

- 3. Renewables

Malaysia Power Generation EPC Market Segmentation By Geography

- 1. Malaysia

Malaysia Power Generation EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives

- 3.3. Market Restrains

- 3.3.1. 4.; Rising Emphasis on Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Renewable Energy Sector Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 5.2. Market Analysis, Insights and Forecast - by Hydroelectric

- 5.3. Market Analysis, Insights and Forecast - by Renewables

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Thermal

- 6. China Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 8. India Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Malaysia Power Generation EPC Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 General Electric

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Sumitomo Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cypark Resources Berhad

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Toshiba Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 China National Electric Engineering Co Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 AFRY AB

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Scatec ASA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kpower Berhad

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Solarvest Holdings

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sunway Construction Group Bhd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 General Electric

List of Figures

- Figure 1: Malaysia Power Generation EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Power Generation EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Power Generation EPC Market Revenue Million Forecast, by Thermal 2019 & 2032

- Table 3: Malaysia Power Generation EPC Market Revenue Million Forecast, by Hydroelectric 2019 & 2032

- Table 4: Malaysia Power Generation EPC Market Revenue Million Forecast, by Renewables 2019 & 2032

- Table 5: Malaysia Power Generation EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Malaysia Power Generation EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Malaysia Power Generation EPC Market Revenue Million Forecast, by Thermal 2019 & 2032

- Table 15: Malaysia Power Generation EPC Market Revenue Million Forecast, by Hydroelectric 2019 & 2032

- Table 16: Malaysia Power Generation EPC Market Revenue Million Forecast, by Renewables 2019 & 2032

- Table 17: Malaysia Power Generation EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Power Generation EPC Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Malaysia Power Generation EPC Market?

Key companies in the market include General Electric, Sumitomo Corporation, Cypark Resources Berhad, Toshiba Group, China National Electric Engineering Co Ltd, AFRY AB, Scatec ASA, Kpower Berhad, Solarvest Holdings, Sunway Construction Group Bhd.

3. What are the main segments of the Malaysia Power Generation EPC Market?

The market segments include Thermal, Hydroelectric, Renewables.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Automotive Sales in Saudi Arabia4.; Rising Demand from Heavy Automotives.

6. What are the notable trends driving market growth?

Renewable Energy Sector Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Rising Emphasis on Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In October 2021, Solarvest Holdings Bhd won an EPC contract worth USD 11.2 million under round four of a large-scale solar program. The solar farm is set to have 50 MW of AC capacity and will be located in the town of Bukit Selambau, Kedah, Malaysia. The solar farm is scheduled to reach commercial operations by 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Power Generation EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Power Generation EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Power Generation EPC Market?

To stay informed about further developments, trends, and reports in the Malaysia Power Generation EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence