Key Insights

The Malaysian food service market, a vibrant and diverse sector, is experiencing robust growth, projected to reach a significant size within the next decade. The market's expansion is fueled by several key drivers. A rising young population with increasing disposable incomes is driving demand for diverse dining experiences, particularly within the quick-service restaurant (QSR) segment and cafes. The burgeoning tourism sector also contributes significantly, with a large influx of both domestic and international travelers seeking a range of culinary options, from traditional Malaysian cuisine to international fare like Western and Asian fusion. Furthermore, the expansion of organized retail and the rise of online food delivery platforms are significantly impacting market dynamics. The preference for convenient and readily available dining solutions is accelerating growth within the chained outlet segment. However, challenges remain, including fluctuations in raw material prices and intense competition amongst the numerous established players and emerging food businesses in the market.

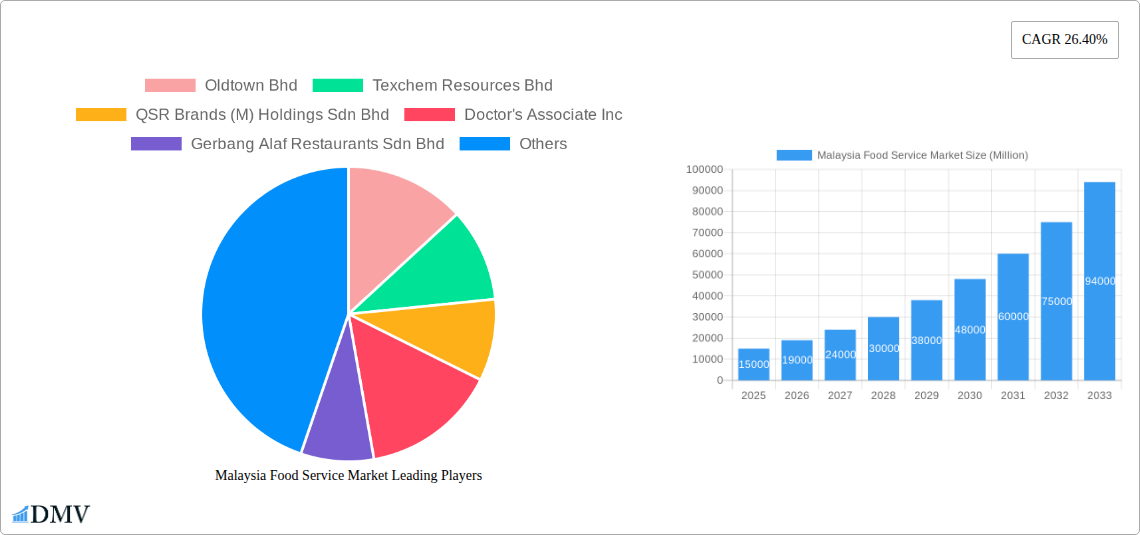

Despite these challenges, the Malaysian food service market presents considerable opportunities. The increasing adoption of innovative technologies, such as automated ordering systems and advanced kitchen management tools, allows for operational efficiencies. Furthermore, a rising focus on healthy eating and customized dining options will continue to shape menu offerings and consumer preferences. Market segmentation reveals significant growth potential in diverse segments, including cafes & bars, QSRs catering to Western, Asian, and Malaysian cuisine across varied outlets and locations (leisure, lodging, retail, standalone, and travel). The strong presence of both international and local food chains like Oldtown White Coffee, QSR Brands (M) Holdings, and Secret Recipe reflects the market's dynamism and competition. Successful players will be those adapting to changing consumer demands and leveraging technology to improve efficiency and customer experience. The forecast period of 2025-2033 promises significant expansion, suggesting substantial investment opportunities for businesses operating within this dynamic sector.

Malaysia Food Service Market: A Comprehensive Report (2019-2033)

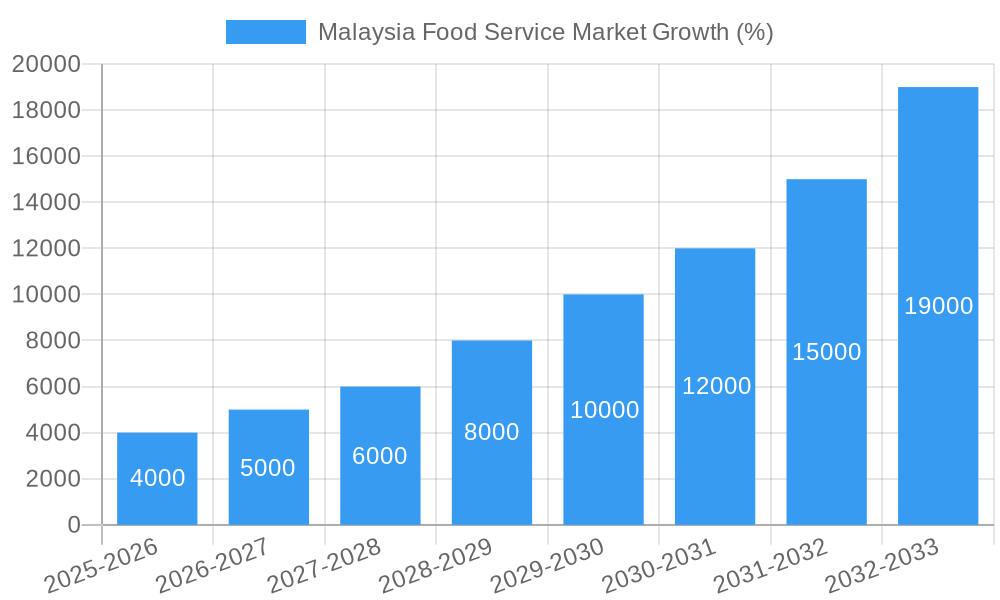

This insightful report provides a comprehensive analysis of the dynamic Malaysian food service market, encompassing its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this lucrative sector. The report meticulously examines market trends, leading segments, key players, and future growth potential, offering actionable insights for informed decision-making. The total market value is estimated to reach xx Million by 2033.

Malaysia Food Service Market Composition & Trends

This section delves into the intricate composition of the Malaysian food service market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, and end-user profiles. We analyze the competitive landscape, identifying market share distribution among key players like Oldtown Bhd, QSR Brands, and Domino's Pizza Enterprises Ltd. The report also examines the impact of mergers and acquisitions (M&A) activities, providing insights into deal values and their implications for market dynamics. The Malaysian food service industry exhibits a diverse landscape with significant competition, particularly within the QSR segment. The market share distribution is currently uneven, with a few dominant players and numerous smaller independent operators. M&A activity is considerable, with recent deals like Domino’s acquisition of the Malaysia, Singapore, and Cambodia operations for USD 214 Million significantly impacting the market landscape. Innovation is driven by evolving consumer preferences and technological advancements, with an emphasis on digital ordering, delivery, and personalized experiences. Regulatory changes, particularly those related to food safety and hygiene, significantly impact market dynamics. Substitute products, such as home-cooked meals and meal delivery kits, present competitive pressure.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller players.

- Innovation Catalysts: Evolving consumer preferences (healthier options, convenience), technological advancements (online ordering, delivery platforms).

- Regulatory Landscape: Stringent food safety and hygiene regulations, impacting operational costs and compliance.

- Substitute Products: Home-cooked meals, meal delivery kits, impacting market share of traditional food service outlets.

- End-User Profiles: Diverse demographics with varied needs and preferences, influencing the range of offerings within the market.

- M&A Activity: Significant M&A activity observed, impacting market consolidation and competitive dynamics; recent deals valued at xx Million.

Malaysia Food Service Market Industry Evolution

This section analyzes the evolution of the Malaysian food service market, focusing on growth trajectories, technological advancements, and shifting consumer demands. The Malaysian food service industry has experienced robust growth over the past five years, driven by increasing urbanization, rising disposable incomes, and a burgeoning young population. Technological innovations, including online ordering platforms and food delivery services, are transforming the consumer experience. Consumer demands are evolving towards healthier and more convenient options, prompting businesses to adapt their offerings and operational strategies. The market demonstrates a high growth rate, averaging xx% annually during the historical period, with projected growth continuing into the forecast period. Technological advancements such as mobile ordering and payment systems, cloud-based POS, and kitchen automation contribute to improved efficiency and customer satisfaction. The shift towards healthier eating habits necessitates the market's adaptation through the introduction of more nutritious menus and ingredients.

Leading Regions, Countries, or Segments in Malaysia Food Service Market

This section identifies the dominant regions, countries, or segments within the Malaysian food service market, considering various factors such as foodservice type (Cafes & Bars, Quick Service Restaurants (QSRs)), cuisine (Western, Asian, Malaysian), outlet type (Chained Outlets, Independent Outlets), and location (Leisure, Lodging, Retail, Standalone, Travel).

- Key Drivers: High population density in urban areas, strong tourism sector, and rising disposable incomes significantly influence the market's growth in major cities. Government support for the food service industry provides additional impetus.

- Dominance Factors: The QSR segment, particularly in urban areas, dominates due to convenience and affordability. Malaysian cuisine remains popular domestically, whereas Western options are influential in tourist-centric locations. Chained outlets often enjoy economies of scale and brand recognition.

The Kuala Lumpur and Selangor regions demonstrate the highest concentration of food service establishments due to their high population densities, significant tourist inflow, and robust economic activity. The QSR segment holds a significant market share, driven by factors such as affordability, convenience, and widespread accessibility. The Malaysian cuisine segment exhibits strong domestic demand, while Western cuisine caters to a broader customer base and tourist market. Chained outlets dominate the market due to brand recognition, consistent quality, and established supply chains.

Malaysia Food Service Market Product Innovations

The Malaysian food service market is witnessing significant product innovations, focusing on improved customer experience, optimized operational efficiency, and enhanced food quality. These advancements span from the introduction of personalized meal options tailored to individual dietary needs to the implementation of technologically advanced kitchen equipment and inventory management systems. Unique selling propositions include customized meal plans, loyalty programs, and seamless digital ordering platforms. The integration of technology enhances operational efficiency, streamlining workflows and reducing labor costs.

Propelling Factors for Malaysia Food Service Market Growth

Several factors contribute to the growth of the Malaysian food service market. Technological advancements, such as online ordering and delivery platforms, enhance convenience and accessibility, driving market expansion. Economic growth and rising disposable incomes among consumers fuel demand for food service offerings. Government initiatives promoting tourism and the hospitality industry stimulate market growth. The expansion of the middle class, with increased spending capacity and changing lifestyle patterns, further contributes to the market’s growth.

Obstacles in the Malaysia Food Service Market Market

Several challenges hinder growth in the Malaysian food service market. Stringent food safety regulations increase operational costs and compliance burdens. Supply chain disruptions and rising input costs, particularly for raw materials, directly impact profitability. Intense competition among food service establishments places pressure on margins and prices. The volatility in raw material prices significantly impacts profitability; for example, fluctuations in the prices of rice and imported meat affect menu costs.

Future Opportunities in Malaysia Food Service Market

The Malaysian food service market presents several future opportunities. Expansion into underserved markets, such as rural areas, presents significant untapped potential. The adoption of advanced technologies, such as AI-powered recommendation systems and robotic process automation, can enhance efficiency and customer experience. Meeting the growing demand for healthy and sustainable food options presents opportunities for businesses to develop innovative product offerings. Focusing on enhancing the customer experience through technological advancements, such as personalized recommendations and improved online ordering interfaces, will drive growth.

Major Players in the Malaysia Food Service Market Ecosystem

- Oldtown Bhd

- Texchem Resources Bhd

- QSR Brands (M) Holdings Sdn Bhd

- Doctor's Associate Inc

- Gerbang Alaf Restaurants Sdn Bhd

- A&W (Malaysia) Sdn Bhd

- Revenue Valley Sdn Bhd

- Secret Recipe Cakes & Café Sdn Bhd

- Domino's Pizza Enterprises Ltd

- Craveat International Sdn Bhd

- Berjaya Corporation Bhd

- San Francisco Coffee Sdn Bhd

- Marrybrown Sdn Bhd

- Nando's Chickenland Malaysia Sdn Bhd

Key Developments in Malaysia Food Service Market Industry

- August 2022: Domino’s Pizza Enterprises acquired Domino’s Pizza businesses in Malaysia, Singapore, and Cambodia for USD 214 Million.

- September 2022: TGI Fridays announced plans to open 75 restaurants in Southeast Asia over the next 10 years.

- January 2023: OldTown White Coffee planned to open 50 new outlets across Malaysia in 2023.

Strategic Malaysia Food Service Market Market Forecast

The Malaysian food service market is poised for continued growth driven by several factors. Technological advancements, particularly in online ordering and delivery, will continue to reshape the industry. The rising middle class and increasing disposable incomes will fuel consumer demand. Opportunities lie in innovation, customization, and catering to evolving consumer preferences for healthier and more sustainable options. The market's future hinges on adaptation, innovation, and a focus on customer experience, promising substantial growth over the forecast period.

Malaysia Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Malaysia Food Service Market Segmentation By Geography

- 1. Malaysia

Malaysia Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 26.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. Full service restaurants held the major share in the market owing to the higher preference for authentic cuisines

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. China Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. India Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Malaysia Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Oldtown Bhd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Texchem Resources Bhd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 QSR Brands (M) Holdings Sdn Bhd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Doctor's Associate Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Gerbang Alaf Restaurants Sdn Bhd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 A&W (Malaysia) Sdn Bhd

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Revenue Valley Sdn Bhd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Secret Recipe Cakes & Café Sdn Bhd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Domino's Pizza Enterprises Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Craveat International Sdn Bhd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Berjaya Corporation Bhd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 San Francisco Coffee Sdn Bhd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Marrybrown Sdn Bhd

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Nando's Chickenland Malaysia Sdn Bhd

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 Oldtown Bhd

List of Figures

- Figure 1: Malaysia Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Malaysia Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Malaysia Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Malaysia Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Malaysia Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Malaysia Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Malaysia Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Malaysia Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Malaysia Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Malaysia Food Service Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Food Service Market?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Malaysia Food Service Market?

Key companies in the market include Oldtown Bhd, Texchem Resources Bhd, QSR Brands (M) Holdings Sdn Bhd, Doctor's Associate Inc, Gerbang Alaf Restaurants Sdn Bhd, A&W (Malaysia) Sdn Bhd, Revenue Valley Sdn Bhd, Secret Recipe Cakes & Café Sdn Bhd, Domino's Pizza Enterprises Ltd, Craveat International Sdn Bhd, Berjaya Corporation Bhd, San Francisco Coffee Sdn Bhd, Marrybrown Sdn Bhd, Nando's Chickenland Malaysia Sdn Bhd.

3. What are the main segments of the Malaysia Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

Full service restaurants held the major share in the market owing to the higher preference for authentic cuisines.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

January 2023: OldTown White Coffee café chain announced its plans to open 50 new outlets across Malaysia in 2023. The company is targeting growth in Malaysia’s northern and eastern suburban regions as it seeks to provide new customers with a choice of Asian-style products they can rely on.September 2022: TGI Fridays made a big franchising push in Asia, with plans to open 75 restaurants in Southeast Asia over the next 10 years. The deal with master franchisor Universal Success Enterprises is TGI Fridays’ biggest development agreement to date. TGI Fridays have more international locations (385) than domestic stores (315). It opened 22 international restaurants in 2022.August 2022: Domino’s Pizza Enterprises announced its plans to sign the biggest acquisition in the company’s history by acquiring the existing Domino’s Pizza businesses in Malaysia, Singapore, and Cambodia for USD 214 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Food Service Market?

To stay informed about further developments, trends, and reports in the Malaysia Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence