Key Insights

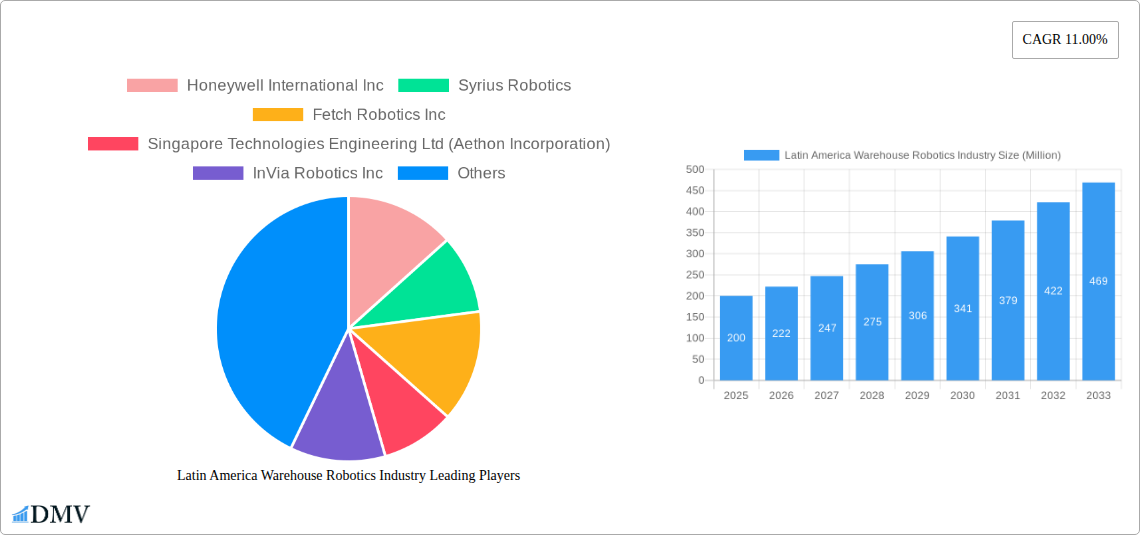

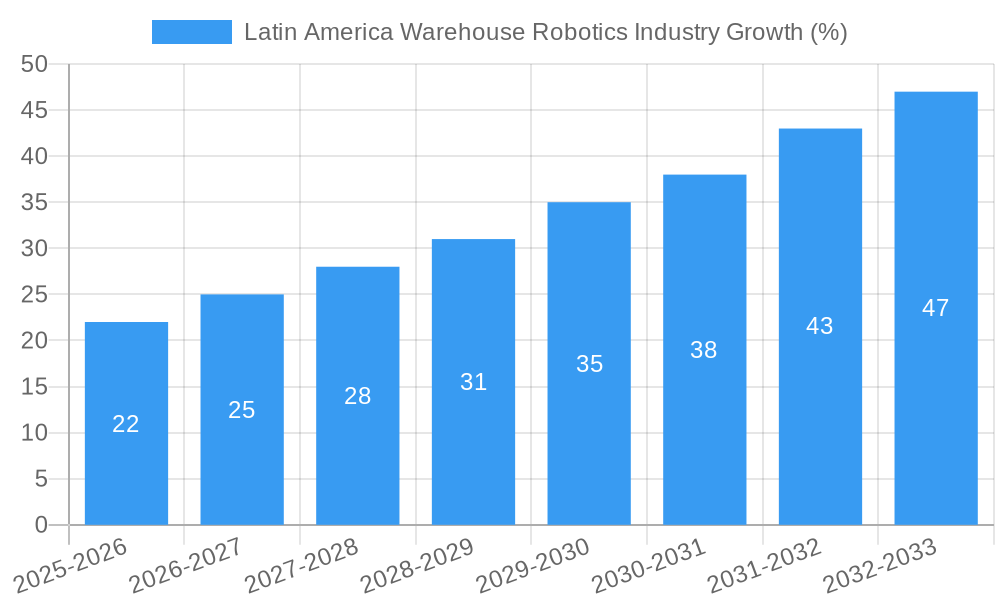

The Latin American warehouse robotics market is experiencing robust growth, driven by the expanding e-commerce sector, increasing labor costs, and the need for enhanced supply chain efficiency across key industries like food and beverage, automotive, and retail. The market, currently estimated at approximately $XX million in 2025 (assuming a reasonable starting point based on global market trends and regional economic activity), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 11% from 2025 to 2033. This growth is fueled by rising adoption of automated storage and retrieval systems (ASRS), mobile robots (AGVs and AMRs), and sortation systems, particularly in Brazil, Argentina, and Colombia, which represent the largest market segments within the region. While initial investment costs represent a significant restraint, the long-term return on investment (ROI) through increased productivity, reduced operational expenses, and improved order fulfillment accuracy is driving adoption. Further growth will hinge on the continued development of robust technological infrastructure, skilled labor pools capable of operating and maintaining these systems, and favorable government policies that encourage automation within the logistics sector.

The segmentation reveals valuable insights. Industrial robots and ASRS are likely leading the market share currently, reflecting a focus on improving warehouse throughput and storage optimization. The food and beverage sector, with its demanding requirements for speed and accuracy, is an early adopter, followed by the automotive and retail sectors due to their high-volume operations. However, the growth of e-commerce is expected to increase demand across all sectors and segments, particularly for mobile robots (AGVs and AMRs) which offer flexibility in navigating increasingly complex warehouse layouts. Furthermore, the market presents opportunities for companies offering integrated solutions, combining different robotic systems to create more efficient end-to-end warehouse operations. Competition is likely intensifying with both established global players and innovative regional companies vying for market share. The continued focus on improving technology, reducing implementation costs, and tailored solutions for specific industry needs will be crucial for success.

Latin America Warehouse Robotics Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Latin America warehouse robotics industry, offering valuable insights for stakeholders seeking to understand market dynamics, future trends, and investment opportunities. The study covers the period 2019-2033, with 2025 as the base and estimated year. The report projects a robust market expansion driven by increasing e-commerce adoption, automation needs across various sectors, and technological advancements. The total market value is projected to reach xx Million by 2033.

Latin America Warehouse Robotics Industry Market Composition & Trends

This section delves into the competitive landscape, analyzing market concentration, innovation drivers, regulatory frameworks, and substitution threats within the Latin American warehouse robotics market. We examine the impact of mergers and acquisitions (M&A) on market share distribution, providing insights into deal values and their influence on industry dynamics. The report assesses the roles of key players like Honeywell International Inc, Syrius Robotics, Fetch Robotics Inc, Singapore Technologies Engineering Ltd (Aethon Incorporation), InVia Robotics Inc, Omron Adept Technologies, Toshiba Corporation, Kiva Systems (Amazon Robotics LLC), Fanuc Corporation, Geek+ Inc, Grey Orange Pte Ltd, Locus Robotic, and ABB Limited.

- Market Concentration: The Latin American warehouse robotics market exhibits a moderately concentrated structure, with a few major players holding significant market share. The report details the market share distribution among these players.

- Innovation Catalysts: Technological advancements in AI, machine learning, and computer vision are driving innovation, leading to more sophisticated and efficient robotic systems.

- Regulatory Landscape: An analysis of regional regulatory frameworks impacting the adoption and deployment of warehouse robotics is included.

- Substitute Products: The report identifies potential substitute products and their impact on market growth.

- End-User Profiles: Detailed profiles of end-users across various sectors (Food and Beverage, Automotive, Retail, Electrical and Electronics, Pharmaceutical, and Others) are provided, highlighting their specific automation needs.

- M&A Activities: The report analyzes recent M&A activities, including deal values and their impact on market consolidation. Estimated total M&A deal value during the historical period (2019-2024) is xx Million.

Latin America Warehouse Robotics Industry Evolution

This section provides a detailed historical and future analysis of the Latin American warehouse robotics market, examining growth trajectories, technological advancements, and evolving consumer demands. It presents data points such as compound annual growth rates (CAGRs) and adoption rates for various robotic systems. The analysis spans from the historical period (2019-2024) to the forecast period (2025-2033). Growth in the market is expected to be driven by factors such as increasing e-commerce penetration, the need for improved supply chain efficiency, and labor shortages. Technological advancements, such as the development of more advanced AI-powered robots and collaborative robots (cobots), will further fuel market expansion. Shifting consumer demands for faster delivery times and increased product variety are also contributing to the growth of the warehouse robotics market. The projected CAGR from 2025 to 2033 is estimated at xx%.

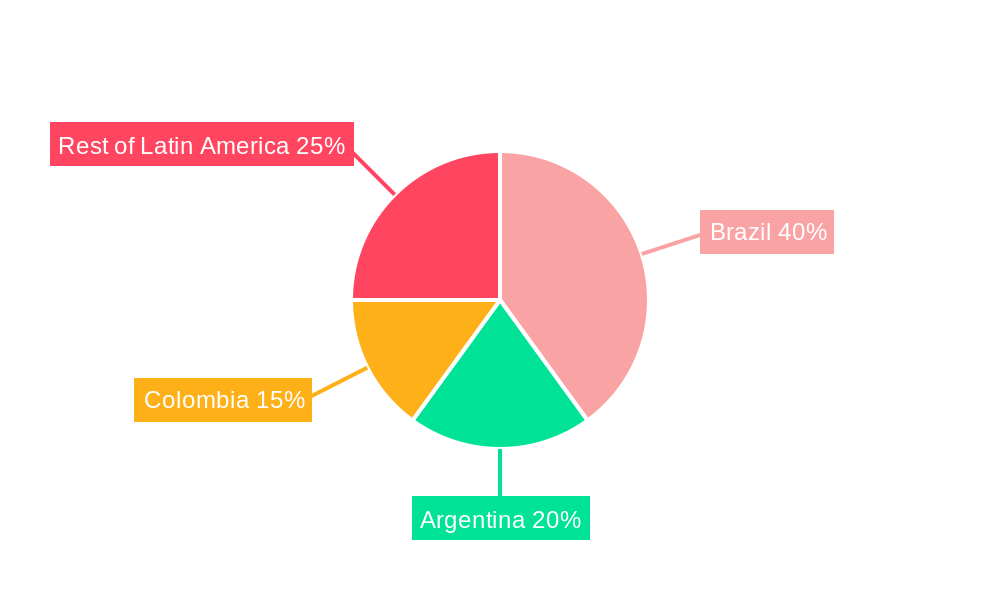

Leading Regions, Countries, or Segments in Latin America Warehouse Robotics Industry

This section identifies the dominant regions, countries, and segments within the Latin American warehouse robotics market. The analysis considers various segments including:

Type: Industrial Robots, Sortation Systems, Conveyors, Palletizers, Automated Storage and Retrieval System (ASRS), Mobile Robots (AGVs and AMRs) Function: Storage, Packaging, Trans-shipments, Other Functions End User: Food and Beverage, Automotive, Retail, Electrical and Electronics, Pharmaceutical, Other End Users Country: Brazil, Argentina, Columbia, Rest of Latin America

- Dominant Region/Country: Brazil is projected to be the leading market, driven by factors such as [insert detailed explanation with data]. Argentina and Columbia also exhibit significant growth potential due to [reasons with data and explanation].

- Key Drivers (Bullet Points):

- Increasing investments in automation technologies.

- Government initiatives promoting technological advancements.

- Favorable economic conditions in specific regions.

- Growing e-commerce penetration rates.

- Demand for improved logistics efficiency.

The dominance of specific segments is analyzed based on factors like adoption rates, market size, and growth potential. For example, the ASRS segment is expected to show significant growth due to its capacity for high-density storage, contributing to space optimization within warehouses.

Latin America Warehouse Robotics Industry Product Innovations

This section highlights recent product innovations, encompassing new features, improved performance metrics, and unique selling propositions within the Latin American warehouse robotics market. Advances in areas such as navigation technology, payload capacity, and ease of integration are driving adoption. The focus is on showcasing advancements and the resulting efficiency improvements that benefit various warehouse operations. The emergence of collaborative robots (cobots) allowing seamless human-robot interaction is a significant technological advancement within the market.

Propelling Factors for Latin America Warehouse Robotics Industry Growth

The growth of the Latin American warehouse robotics market is propelled by a confluence of technological, economic, and regulatory factors. Technological advancements in robotics and AI lead to increased efficiency and accuracy. The rising e-commerce sector demands faster and more efficient order fulfillment, further stimulating adoption. Supportive government policies and initiatives promote automation and technological modernization within the logistics industry.

Obstacles in the Latin America Warehouse Robotics Industry Market

Despite significant growth potential, challenges such as high initial investment costs, integration complexities, and the need for skilled labor can hinder market expansion. Supply chain disruptions and regional economic fluctuations can also impact market growth. Furthermore, competition from established players and emerging entrants creates dynamic market pressures. The estimated total negative impact of these obstacles on the market value in 2025 is xx Million.

Future Opportunities in Latin America Warehouse Robotics Industry

The future of the Latin American warehouse robotics market presents several promising opportunities. The increasing adoption of advanced technologies like AI and machine learning will lead to further automation and optimization of warehouse operations. Expansion into underserved regions and the emergence of new industry verticals provide new avenues for growth. The integration of robotics into diverse sectors, especially in e-commerce and food and beverage distribution, presents substantial market expansion potential.

Major Players in the Latin America Warehouse Robotics Industry Ecosystem

- Honeywell International Inc

- Syrius Robotics

- Fetch Robotics Inc

- Singapore Technologies Engineering Ltd (Aethon Incorporation)

- InVia Robotics Inc

- Omron Adept Technologies

- Toshiba Corporation

- Kiva Systems (Amazon Robotics LLC)

- Fanuc Corporation

- Geek+ Inc

- Grey Orange Pte Ltd

- Locus Robotic

- ABB Limited

Key Developments in Latin America Warehouse Robotics Industry Industry

- [Month, Year]: Launch of a new autonomous mobile robot (AMR) by [Company Name], enhancing warehouse efficiency.

- [Month, Year]: Acquisition of [Company A] by [Company B], resulting in expanded market reach and product portfolio.

- [Month, Year]: Government initiative in [Country] to promote automation in the logistics sector.

- [Month, Year]: Successful implementation of a large-scale ASRS system in a major warehouse. (Additional bullet points as needed)

Strategic Latin America Warehouse Robotics Industry Market Forecast

The Latin American warehouse robotics market is poised for sustained growth, driven by technological advancements, increased e-commerce adoption, and favorable regulatory frameworks. The forecast period (2025-2033) indicates a significant expansion in market size, particularly in key sectors such as food and beverage, e-commerce fulfillment, and automotive logistics. Opportunities abound for companies to capitalize on the region's expanding demand for automation solutions and optimized warehouse operations. Continued innovation and strategic partnerships will be critical to success within this dynamic market.

Latin America Warehouse Robotics Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

- 1.7. Others

-

2. Function

- 2.1. Storage

- 2.2. Packaging

- 2.3. Trans-shipments

- 2.4. Other Functions

-

3. End User

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End Users

Latin America Warehouse Robotics Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Warehouse Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of SKUs; Increasing Investments in Technology and Robotics

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Requirements; Hight Cost

- 3.4. Market Trends

- 3.4.1. The Adoption of Industrial Robotics Expected to Act as a Significant Driving Factor

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Packaging

- 5.2.3. Trans-shipments

- 5.2.4. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Honeywell International Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Syrius Robotics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Fetch Robotics Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 InVia Robotics Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Omron Adept Technologies

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toshiba Corporation

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kiva Systems (Amazon Robotics LLC)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fanuc Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Geek+ Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Grey Orange Pte Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Locus Robotic

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 ABB Limited

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 Honeywell International Inc

List of Figures

- Figure 1: Latin America Warehouse Robotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Warehouse Robotics Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 4: Latin America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 15: Latin America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Latin America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Warehouse Robotics Industry?

The projected CAGR is approximately 11.00%.

2. Which companies are prominent players in the Latin America Warehouse Robotics Industry?

Key companies in the market include Honeywell International Inc, Syrius Robotics, Fetch Robotics Inc, Singapore Technologies Engineering Ltd (Aethon Incorporation), InVia Robotics Inc, Omron Adept Technologies, Toshiba Corporation, Kiva Systems (Amazon Robotics LLC), Fanuc Corporation, Geek+ Inc, Grey Orange Pte Ltd, Locus Robotic, ABB Limited.

3. What are the main segments of the Latin America Warehouse Robotics Industry?

The market segments include Type, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of SKUs; Increasing Investments in Technology and Robotics.

6. What are the notable trends driving market growth?

The Adoption of Industrial Robotics Expected to Act as a Significant Driving Factor.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Requirements; Hight Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Warehouse Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Warehouse Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Warehouse Robotics Industry?

To stay informed about further developments, trends, and reports in the Latin America Warehouse Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence