Key Insights

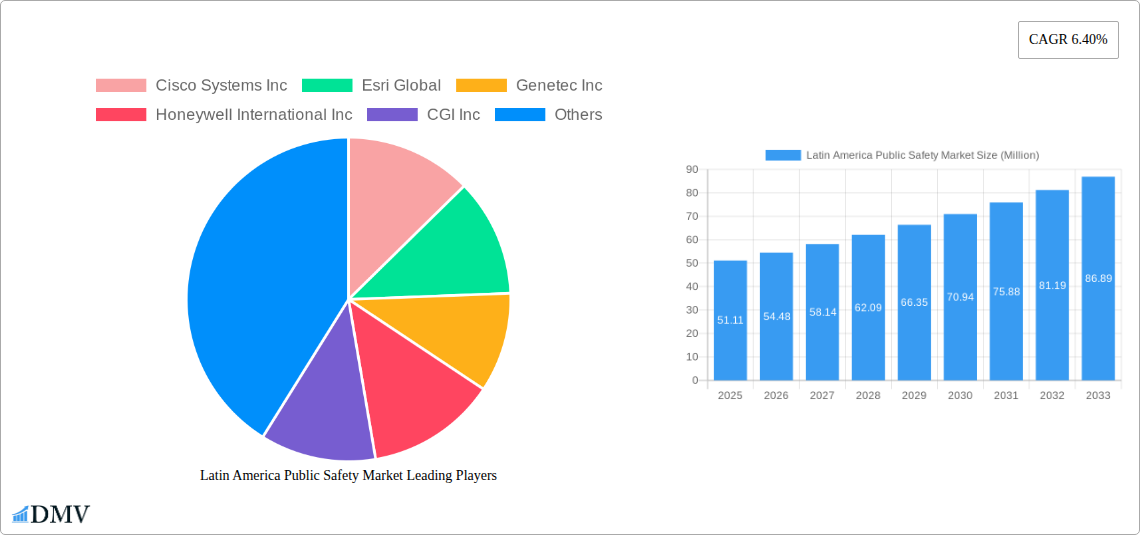

The Latin American Public Safety Market is experiencing robust growth, projected to reach \$51.11 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.40% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing crime rates across major Latin American cities are prompting governments to invest heavily in advanced security technologies. Furthermore, the rising adoption of smart city initiatives, emphasizing integrated surveillance systems and data analytics for improved public safety management, is a significant catalyst. Technological advancements, such as the deployment of AI-powered video analytics, predictive policing tools, and improved communication networks, are enhancing situational awareness and response capabilities, thereby driving market growth. Finally, growing awareness of cybersecurity threats and the need for robust infrastructure protection is contributing to increased demand for public safety solutions.

However, market growth is not without its challenges. Budgetary constraints in some Latin American countries may limit large-scale technology deployments. Furthermore, the digital divide and infrastructure gaps in certain regions can hinder the effective implementation of advanced public safety systems. Concerns regarding data privacy and ethical implications of using advanced surveillance technologies also pose a potential restraint. Despite these challenges, the market is expected to continue its upward trajectory, driven by the increasing prioritization of public safety and the continuous advancements in relevant technologies. Key players like Cisco Systems, Esri, and Genetec are strategically positioning themselves to capitalize on these opportunities by offering comprehensive solutions tailored to the specific needs of the Latin American region. The market segmentation within this region is likely diverse, encompassing solutions for law enforcement, border security, emergency response, and cybersecurity, with varying degrees of adoption across different countries and municipalities.

Latin America Public Safety Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America Public Safety Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period extending to 2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Latin America Public Safety Market Composition & Trends

This section delves into the intricacies of the Latin America Public Safety Market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market is characterized by a moderately fragmented landscape with several major players vying for market share. While exact market share figures are proprietary to the full report, we can confirm that the top 5 players account for approximately xx% of the market in 2025. M&A activity has been relatively robust in recent years, with deal values totaling approximately xx Million in 2024 alone. Innovation is primarily driven by technological advancements in areas like AI-powered video analytics and citizen reporting portals. The regulatory landscape varies across Latin American countries, posing both opportunities and challenges. Substitute products, such as private security firms, exert some competitive pressure. End-users primarily comprise government agencies, law enforcement, and emergency services.

- Market Concentration: Moderately fragmented, with top 5 players holding xx% market share in 2025.

- Innovation Catalysts: AI-powered video analytics, citizen reporting portals.

- Regulatory Landscape: Varies significantly across countries.

- Substitute Products: Private security firms.

- End-User Profiles: Government agencies, law enforcement, emergency services.

- M&A Activity: Total deal value approximately xx Million in 2024.

Latin America Public Safety Market Industry Evolution

The Latin America Public Safety Market has experienced significant growth over the historical period (2019-2024), driven by increasing crime rates, rising government investments in security infrastructure, and technological advancements. The market is projected to maintain a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by the adoption of advanced technologies such as AI, IoT, and cloud computing, leading to enhanced surveillance, improved emergency response times, and increased public safety. Consumer demand is shifting towards integrated solutions that offer enhanced interoperability and data analytics capabilities. The market has witnessed a growing preference for cloud-based solutions over on-premise deployments, owing to cost efficiency and scalability. We project the adoption of cloud-based solutions to reach xx% by 2033.

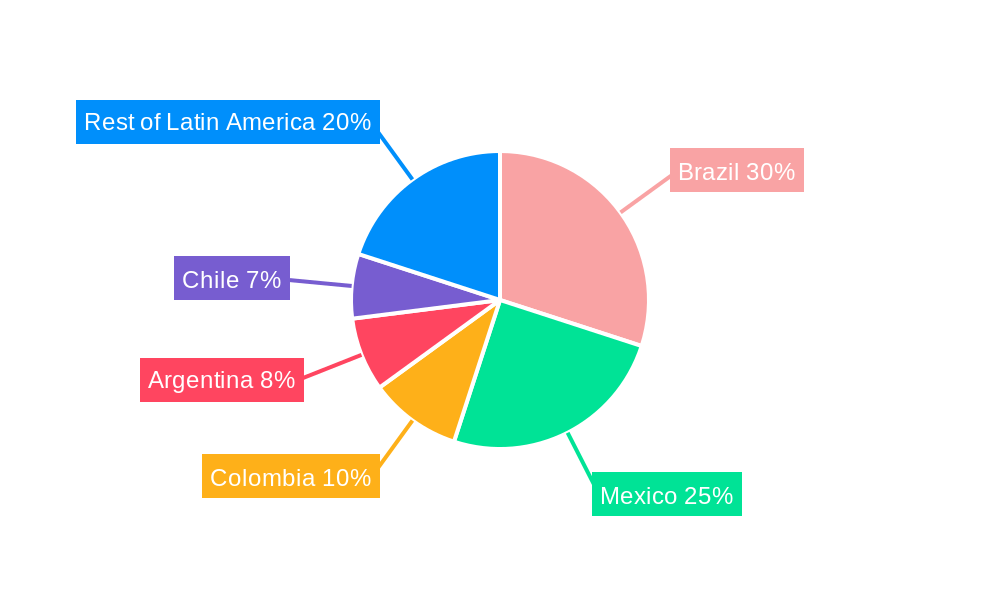

Leading Regions, Countries, or Segments in Latin America Public Safety Market

While the full report provides a detailed breakdown, Brazil and Mexico represent the largest segments of the Latin American Public Safety Market. This dominance is attributed to several factors:

- Brazil: High crime rates, significant government investment in security infrastructure, and a large and rapidly expanding urban population.

- Mexico: Similar factors to Brazil, with a focus on border security and combating drug cartels.

- Other Key Countries: Argentina, Colombia, Chile, and Peru are also exhibiting strong growth potential.

The key drivers for these regions include increased government spending, rising crime rates, and the adoption of advanced technologies. The market is further segmented by product type (e.g., surveillance systems, command and control centers, communication systems), which are analyzed in detail within the full report.

Latin America Public Safety Market Product Innovations

Recent innovations include the integration of AI and machine learning for enhanced video analytics, improving threat detection and response. Citizen reporting portals streamline interaction between citizens and law enforcement. The integration of IoT devices allows for real-time monitoring and data collection, leading to improved situational awareness and response capabilities. These innovations offer unique selling propositions focused on improved efficiency, enhanced security, and increased transparency.

Propelling Factors for Latin America Public Safety Market Growth

Several factors contribute to the market's growth. Increased government spending on public safety initiatives, driven by escalating crime rates and security concerns, is a primary driver. Technological advancements such as AI-powered video analytics and improved communication systems further enhance market expansion. Favorable regulatory environments in certain countries encourage the adoption of innovative technologies. For instance, the implementation of smart city initiatives in various Latin American cities has spurred demand for integrated public safety solutions.

Obstacles in the Latin America Public Safety Market

Despite the growth potential, challenges exist. Budgetary constraints faced by government agencies in several countries can limit investments in advanced technologies. Supply chain disruptions can lead to delays in project implementation. The competitive landscape, with both international and local players, necessitates strategic positioning for success.

Future Opportunities in Latin America Public Safety Market

Future opportunities lie in expanding into underserved markets within the region and leveraging emerging technologies such as blockchain for secure data management. The increasing adoption of smart city initiatives presents significant growth prospects. Focus on developing cost-effective and scalable solutions will be crucial in catering to the diverse needs of various Latin American countries.

Major Players in the Latin America Public Safety Market Ecosystem

- Cisco Systems Inc

- Esri Global

- Genetec Inc

- Honeywell International Inc

- CGI Inc

- Thales Group

- ALE International

- Motorola Solutions Inc

- NEC Corporation

- Atos SE

- Idemia

- Kroll LLC

- Hexagon AB

- SAAB

- Central Squar

Key Developments in Latin America Public Safety Market Industry

- February 2024: Irisity increases investments in Latin America, focusing on public security, transportation, and mission-critical infrastructure. This signifies growing market interest in AI-driven video analytics solutions.

- June 2023: Hexagon AB launches a citizen reporting portal, streamlining interactions between citizens and law enforcement, improving transparency and efficiency. This reflects a growing trend towards citizen engagement in public safety initiatives.

Strategic Latin America Public Safety Market Forecast

The Latin America Public Safety Market is poised for significant growth, driven by continuous technological advancements, increasing government investment, and a rising demand for improved security measures. The adoption of AI, IoT, and cloud-based solutions will further enhance market expansion. Opportunities abound for companies that can provide integrated, cost-effective, and scalable solutions to meet the unique needs of various countries in the region.

Latin America Public Safety Market Segmentation

-

1. Component

-

1.1. Software

- 1.1.1. Location Management

- 1.1.2. Record Management

- 1.1.3. Investigation Management

- 1.1.4. Crime Analysis

- 1.1.5. Criminal Intelligence

- 1.1.6. Other Software

- 1.2. Services

-

1.1. Software

-

2. Mode of Deployment

- 2.1. On-premise

- 2.2. Cloud

-

3. End-user Industry

- 3.1. Medical

- 3.2. Transportation

- 3.3. Law Enforcement

- 3.4. Firefighting

- 3.5. Other End-user Industries

Latin America Public Safety Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Public Safety Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.2.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.3. Market Restrains

- 3.3.1 Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data

- 3.3.2 Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety

- 3.4. Market Trends

- 3.4.1. Software Component to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Public Safety Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Software

- 5.1.1.1. Location Management

- 5.1.1.2. Record Management

- 5.1.1.3. Investigation Management

- 5.1.1.4. Crime Analysis

- 5.1.1.5. Criminal Intelligence

- 5.1.1.6. Other Software

- 5.1.2. Services

- 5.1.1. Software

- 5.2. Market Analysis, Insights and Forecast - by Mode of Deployment

- 5.2.1. On-premise

- 5.2.2. Cloud

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Medical

- 5.3.2. Transportation

- 5.3.3. Law Enforcement

- 5.3.4. Firefighting

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Cisco Systems Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esri Global

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Genetec Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CGI Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALE International

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Motorola Solutions Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 NEC Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Atos SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Idemia

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kroll LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Hexagon AB

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SAAB

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Central Squar

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Cisco Systems Inc

List of Figures

- Figure 1: Latin America Public Safety Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Public Safety Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 5: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 6: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 7: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: Latin America Public Safety Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Latin America Public Safety Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Latin America Public Safety Market Revenue Million Forecast, by Component 2019 & 2032

- Table 12: Latin America Public Safety Market Volume Billion Forecast, by Component 2019 & 2032

- Table 13: Latin America Public Safety Market Revenue Million Forecast, by Mode of Deployment 2019 & 2032

- Table 14: Latin America Public Safety Market Volume Billion Forecast, by Mode of Deployment 2019 & 2032

- Table 15: Latin America Public Safety Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Latin America Public Safety Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: Latin America Public Safety Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Latin America Public Safety Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Brazil Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Argentina Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Argentina Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Chile Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Chile Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Colombia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Colombia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Mexico Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Mexico Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Peru Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Peru Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 31: Venezuela Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Venezuela Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 33: Ecuador Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Ecuador Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 35: Bolivia Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Bolivia Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 37: Paraguay Latin America Public Safety Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Paraguay Latin America Public Safety Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Public Safety Market?

The projected CAGR is approximately 6.40%.

2. Which companies are prominent players in the Latin America Public Safety Market?

Key companies in the market include Cisco Systems Inc, Esri Global, Genetec Inc, Honeywell International Inc, CGI Inc, Thales Group, ALE International, Motorola Solutions Inc, NEC Corporation, Atos SE, Idemia, Kroll LLC, Hexagon AB, SAAB, Central Squar.

3. What are the main segments of the Latin America Public Safety Market?

The market segments include Component, Mode of Deployment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

6. What are the notable trends driving market growth?

Software Component to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Investments in Advanced Cybersecurity Technologies to Protect Sensitive Data. Critical Infrastructure; Stringent Government Regulations to Invest in Safety Measures to Enhance Safety.

8. Can you provide examples of recent developments in the market?

February 2024: Irisity, a Swedish AI and video analytics software provider, increased investments in Latin America, focusing on public security, transportation, and mission-critical infrastructure. The company supplies technology in countries like Mexico and Argentina and supports emergency services in Ecuador and the Dominican Republic. Additionally, Irisity collaborates with the Uruguayan security firm Grupo Securitas. The regional strategy includes bolstering brand recognition, expanding the team, and fostering partnerships with integrators, resellers, and camera manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Public Safety Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Public Safety Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Public Safety Market?

To stay informed about further developments, trends, and reports in the Latin America Public Safety Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence