Key Insights

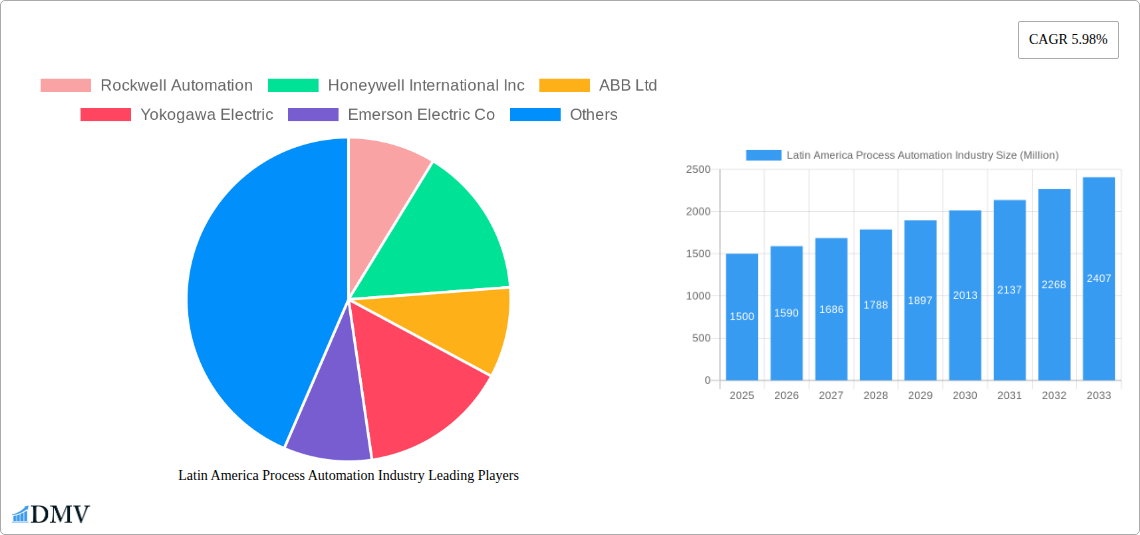

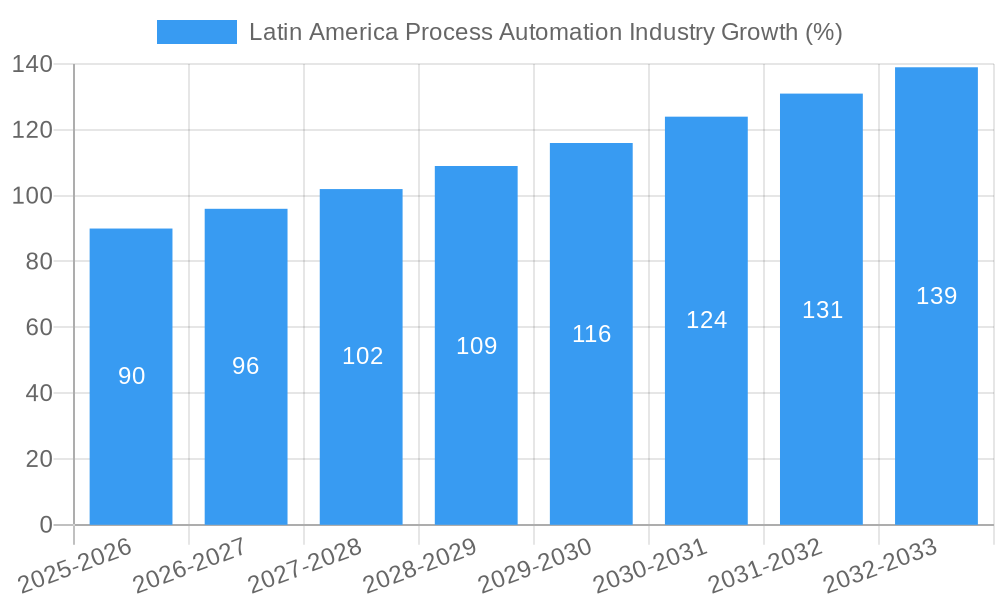

The Latin American process automation market, valued at approximately $X million in 2025, is projected to experience robust growth, driven by the increasing adoption of advanced process control (APC) systems across key industries. A Compound Annual Growth Rate (CAGR) of 5.98% from 2025 to 2033 indicates a significant expansion, reaching an estimated $Y million by 2033. This growth is fueled by several factors: the burgeoning oil and gas sector, particularly in Brazil and Mexico, demanding enhanced efficiency and safety; the expanding chemical and petrochemical industries striving for optimized production and reduced operational costs; and a growing emphasis on automation in the power and utilities sector to improve grid management and reliability. Furthermore, the rising adoption of Industry 4.0 principles and the increasing availability of sophisticated wireless communication protocols are catalyzing market expansion. While the initial investment in advanced automation technologies can be a restraint, the long-term benefits of increased productivity, improved safety, and reduced operational expenses are compelling many companies to overcome these initial barriers. Segmentation analysis reveals strong growth potential in advanced process control software, driven by the need for greater optimization and real-time data analysis. Within this segment, multivariable model-based APC solutions are experiencing particularly high demand due to their capability to handle complex, interconnected processes. The region's diverse industrial landscape, coupled with supportive government initiatives focused on industrial modernization, further bolsters the growth trajectory of the Latin American process automation market.

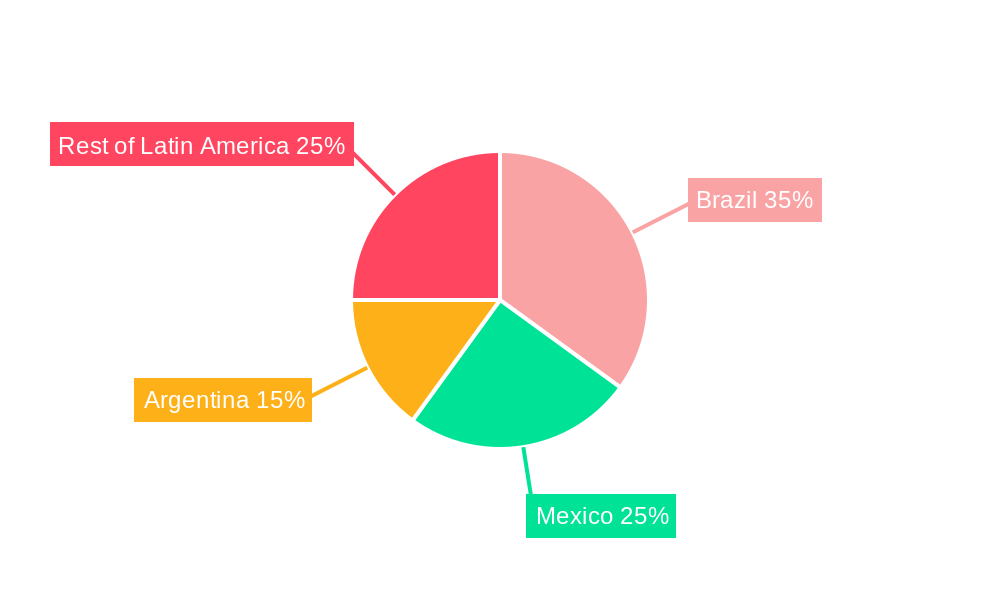

The market's growth is expected to be particularly pronounced in Brazil, Mexico, and Argentina, owing to their robust industrial bases and substantial investments in infrastructure development. However, economic volatility in certain Latin American countries, coupled with potential supply chain disruptions, pose challenges to consistent market expansion. Despite these challenges, the continued focus on improving operational efficiency, enhancing safety standards, and increasing production output across various industries will ensure the sustained growth of the process automation market in Latin America. The increasing integration of artificial intelligence (AI) and machine learning (ML) within APC solutions promises to further augment the market's future potential, driving a higher degree of automation and optimization across multiple industrial processes. Competition among established global players and emerging regional vendors is fierce, leading to innovation in product offerings and service delivery models.

Latin America Process Automation Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Latin America process automation market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic market. The market is projected to reach xx Million by 2033.

Latin America Process Automation Industry Market Composition & Trends

This section delves into the competitive landscape of the Latin American process automation market, analyzing market concentration, key innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger and acquisition (M&A) activities. The report provides a granular understanding of market share distribution among key players like Rockwell Automation, Honeywell International Inc, ABB Ltd, and others. We analyze the impact of M&A activities, estimating a total M&A deal value of xx Million during the historical period (2019-2024). The increasing adoption of Industry 4.0 technologies and the growing demand for enhanced operational efficiency are key factors driving market growth. Specific examples of M&A activities and their impact on market dynamics will be highlighted. The report also examines the influence of regulatory changes and the availability of substitute products on market competition. End-user profiles are detailed, showcasing industry-specific needs and adoption patterns across sectors.

- Market Concentration: Analysis of market share distribution among top players (Rockwell Automation, Honeywell, ABB, etc.).

- Innovation Catalysts: Detailed examination of technological advancements driving market innovation.

- Regulatory Landscape: Assessment of the impact of regulatory frameworks on market dynamics.

- Substitute Products: Analysis of the competitive threat from substitute products and technologies.

- End-User Profiles: Segmentation of end-users across various industries (Oil & Gas, Chemical, etc.) with detailed analysis of their needs and preferences.

- M&A Activities: Detailed analysis of major M&A deals, including deal values and their impact on market consolidation.

Latin America Process Automation Industry Industry Evolution

This section provides a detailed analysis of the evolution of the Latin American process automation industry, encompassing market growth trajectories, technological advancements, and evolving consumer demands from 2019 to 2033. We present a comprehensive overview of market growth rates across different segments and the factors driving this growth, including the increasing adoption of advanced process control (APC) systems and the growing demand for digital transformation initiatives. The influence of technological advancements, such as the Internet of Things (IoT) and artificial intelligence (AI), on market growth is also explored. The changing preferences of consumers and end-users, and their influence on market trends and technological advancements are also considered.

Leading Regions, Countries, or Segments in Latin America Process Automation Industry

This section identifies the dominant regions, countries, and segments within the Latin American process automation market. Detailed analysis is provided, focusing on key drivers—investment trends, regulatory support, and technological advancements—for each prominent segment and region. The report will highlight leading segments based on Communication Protocol (Wired, Wireless), System Type (System Hardware, Sensors & Transmitters), Software Type (Basic Process Control, Advanced Process Control), APC solutions (Advanced Regulatory Control, Multivariable Model, Inferential & Sequential), and End-user Industry (Oil & Gas, Chemical & Petrochemical, Power & Utilities, etc.).

- Key Drivers: Investment trends, regulatory support, technological advancements, and market size in each region and segment.

- Dominance Factors: In-depth analysis of the factors contributing to the dominance of specific regions and segments within the Latin American market.

Latin America Process Automation Industry Product Innovations

This section showcases the latest product innovations in the Latin American process automation industry. It provides details about innovative applications, performance metrics, and unique selling propositions, while highlighting the technological advancements driving product innovation. Examples include the introduction of next-generation sensors, improved control systems, and advanced analytics platforms.

Propelling Factors for Latin America Process Automation Industry Growth

This section identifies the key growth drivers for the Latin American process automation industry, examining technological advancements, economic factors, and regulatory influences. Examples include government initiatives promoting industrial automation, increased investments in infrastructure projects, and the growing adoption of digital technologies across various industries.

Obstacles in the Latin America Process Automation Industry Market

This section analyzes the key challenges and obstacles hindering the growth of the Latin American process automation market. It focuses on the impacts of regulatory hurdles, supply chain disruptions, and intense competitive pressures, using quantifiable data to illustrate their effects on market expansion.

Future Opportunities in Latin America Process Automation Industry

This section outlines the emerging opportunities in the Latin American process automation market. The focus is on new markets, technologies, and consumer trends that could stimulate market expansion. This includes potential for growth in emerging sectors, development of specialized automation solutions, and adoption of innovative technologies.

Major Players in the Latin America Process Automation Industry Ecosystem

- Rockwell Automation

- Honeywell International Inc

- ABB Ltd

- Yokogawa Electric

- Emerson Electric Co

- Siemens AG

- General Electric Co

- Fuji Electric

- Schneider Electric

- Delta Electronics Limited

- Mitsubishi Electric

- Eaton Corporation

Key Developments in Latin America Process Automation Industry Industry

- January 2020: Emerson Electronics Co. launched a new portfolio of RXi industrial display and panel PC products to minimize lifecycle costs and improve production processes across various industries.

- May 2020: RoviSys collaborated with VANTIQ to develop applications for detecting and containing COVID-19 in the food and beverage and life science sectors.

Strategic Latin America Process Automation Industry Market Forecast

This section summarizes the key growth catalysts for the Latin American process automation market, focusing on future opportunities and the market's overall potential. The continued adoption of automation technologies across various industries, coupled with supportive government policies and economic growth, is expected to drive significant market expansion in the coming years. The report provides projections for market size, growth rates, and key trends that will shape the industry’s future.

Latin America Process Automation Industry Segmentation

-

1. Communication Protocol

- 1.1. Wired

- 1.2. Wireless

-

2. System Type

-

2.1. By System Hardware

- 2.1.1. Supervis

- 2.1.2. Distributed Control System (DCS)

- 2.1.3. Programmable Logic Controller (PLC)

- 2.1.4. Manufacturing Execution System (MES)

- 2.1.5. Valves & Actuators

- 2.1.6. Electric Motors

- 2.1.7. Human Machine Interface (HMI)

- 2.1.8. Process Safety Systems

- 2.1.9. Sensors and Transmitters

-

2.2. By Software Type

-

2.2.1. APC (Standalone & Customized Solutions)

- 2.2.1.1. Advanced Regulatory Control

- 2.2.1.2. Multivariable Model

- 2.2.1.3. Inferential & Sequential

- 2.2.2. Data Analytics and Reporting-based Software

- 2.2.3. Other Software and Services

-

2.2.1. APC (Standalone & Customized Solutions)

-

2.1. By System Hardware

-

3. End-user Industry

- 3.1. Oil and Gas

- 3.2. Chemical and Petrochemical

- 3.3. Power and Utilities

- 3.4. Water and Wastewater

- 3.5. Food and Beverage

- 3.6. Paper and Pulp

- 3.7. Pharmaceutical

- 3.8. Other End-user Industries

Latin America Process Automation Industry Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Process Automation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector

- 3.3. Market Restrains

- 3.3.1. Relatively High Deployment Costs; Complex Design compared to Traditional Sensors

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by System Type

- 5.2.1. By System Hardware

- 5.2.1.1. Supervis

- 5.2.1.2. Distributed Control System (DCS)

- 5.2.1.3. Programmable Logic Controller (PLC)

- 5.2.1.4. Manufacturing Execution System (MES)

- 5.2.1.5. Valves & Actuators

- 5.2.1.6. Electric Motors

- 5.2.1.7. Human Machine Interface (HMI)

- 5.2.1.8. Process Safety Systems

- 5.2.1.9. Sensors and Transmitters

- 5.2.2. By Software Type

- 5.2.2.1. APC (Standalone & Customized Solutions)

- 5.2.2.1.1. Advanced Regulatory Control

- 5.2.2.1.2. Multivariable Model

- 5.2.2.1.3. Inferential & Sequential

- 5.2.2.2. Data Analytics and Reporting-based Software

- 5.2.2.3. Other Software and Services

- 5.2.2.1. APC (Standalone & Customized Solutions)

- 5.2.1. By System Hardware

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil and Gas

- 5.3.2. Chemical and Petrochemical

- 5.3.3. Power and Utilities

- 5.3.4. Water and Wastewater

- 5.3.5. Food and Beverage

- 5.3.6. Paper and Pulp

- 5.3.7. Pharmaceutical

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Communication Protocol

- 6. Brazil Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 7. Argentina Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 9. Peru Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 10. Chile Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Latin America Latin America Process Automation Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Rockwell Automation

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ABB Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Yokogawa Electric

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Emerson Electric Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Siemens AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 General Electric Co

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Fuji Electric

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Schneider Electric

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Delta Electronics Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Mitsubishi Electric

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Eaton Corporation

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Rockwell Automation

List of Figures

- Figure 1: Latin America Process Automation Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Process Automation Industry Share (%) by Company 2024

List of Tables

- Table 1: Latin America Process Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Process Automation Industry Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 3: Latin America Process Automation Industry Revenue Million Forecast, by System Type 2019 & 2032

- Table 4: Latin America Process Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Latin America Process Automation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Process Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Latin America Process Automation Industry Revenue Million Forecast, by Communication Protocol 2019 & 2032

- Table 14: Latin America Process Automation Industry Revenue Million Forecast, by System Type 2019 & 2032

- Table 15: Latin America Process Automation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Latin America Process Automation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Chile Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Colombia Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Ecuador Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Bolivia Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Paraguay Latin America Process Automation Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Process Automation Industry?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the Latin America Process Automation Industry?

Key companies in the market include Rockwell Automation, Honeywell International Inc, ABB Ltd, Yokogawa Electric, Emerson Electric Co, Siemens AG, General Electric Co, Fuji Electric, Schneider Electric, Delta Electronics Limited, Mitsubishi Electric, Eaton Corporation.

3. What are the main segments of the Latin America Process Automation Industry?

The market segments include Communication Protocol, System Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Diversification Strategies being Adopted by the Manufacturing Companies; Initiatives Undertaken by the Government to Increase Growth in Manufacturing Sector.

6. What are the notable trends driving market growth?

Pharmaceutical Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Relatively High Deployment Costs; Complex Design compared to Traditional Sensors.

8. Can you provide examples of recent developments in the market?

May 2020 - RoviSys announced its collaboration with VANTIQ, a developer of next-generation applications, to develop applications that can detect and contain COVID-19 in the food and beverage industry, apart from the critical life science sector.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Process Automation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Process Automation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Process Automation Industry?

To stay informed about further developments, trends, and reports in the Latin America Process Automation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence