Key Insights

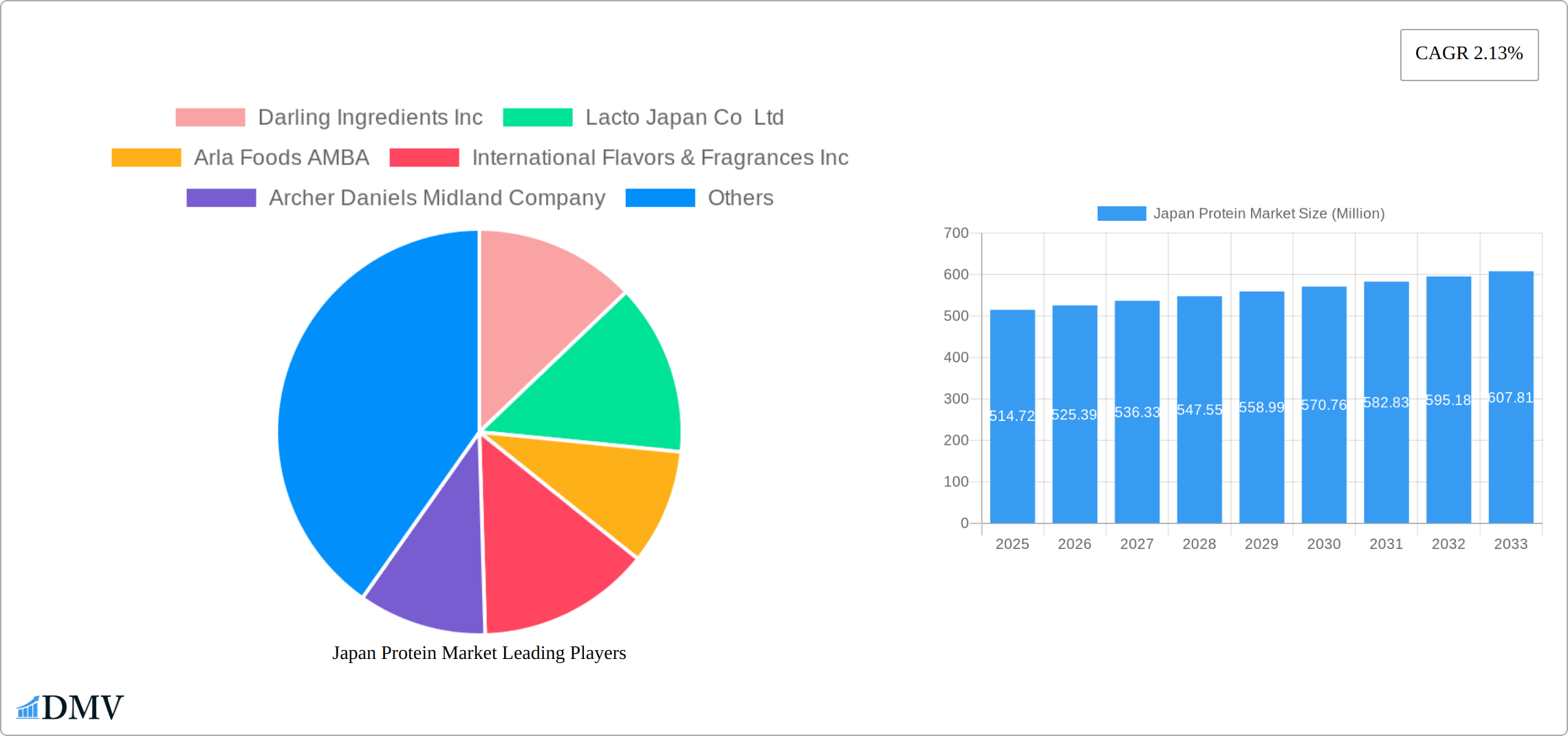

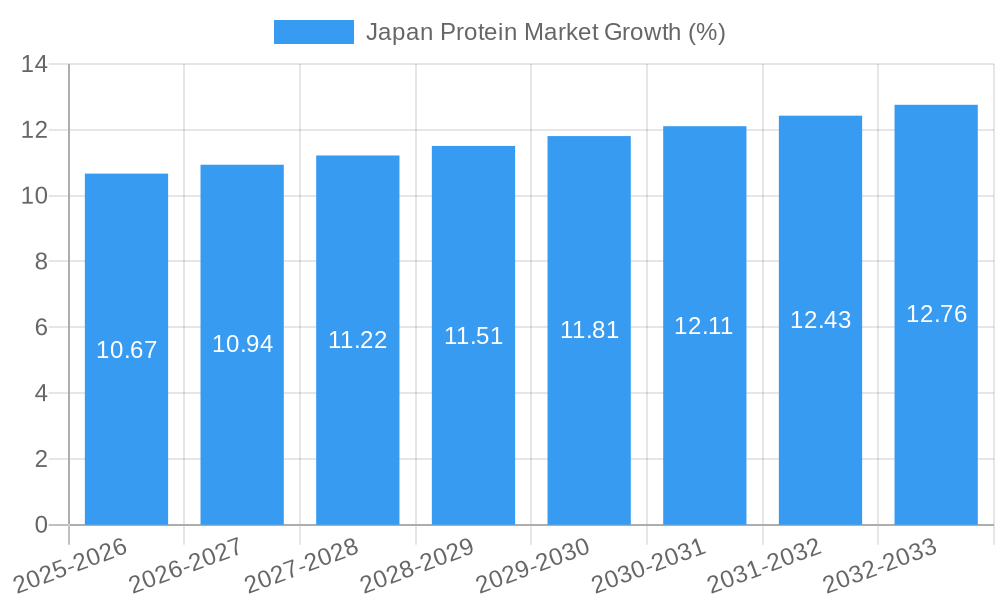

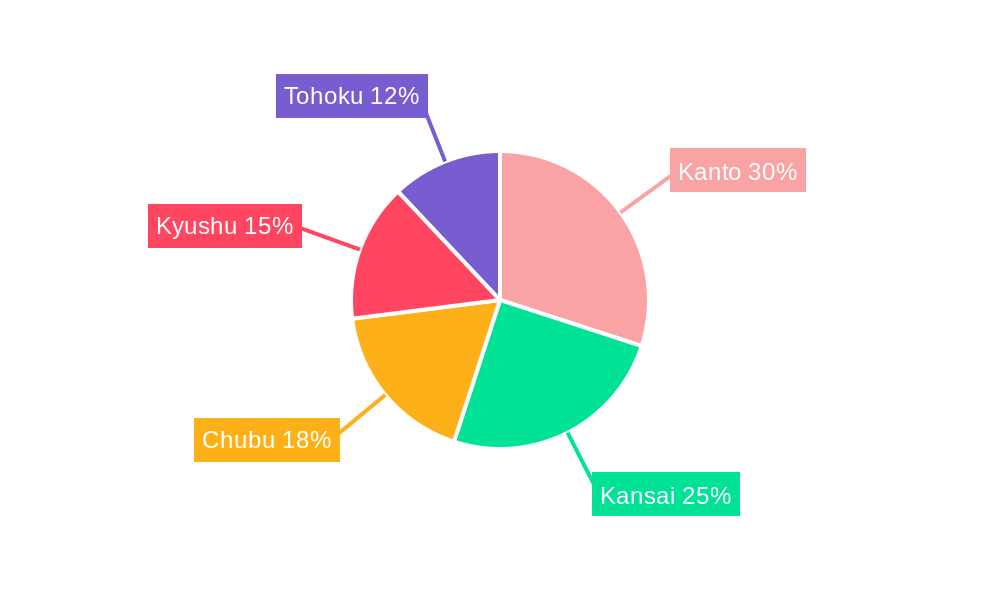

The Japan protein market, valued at $514.72 million in 2025, is projected to experience steady growth, driven primarily by increasing consumer demand for protein-rich foods and supplements, fueled by health and wellness trends. The rising popularity of functional foods and beverages incorporating protein sources like whey, soy, and plant-based alternatives is a key factor contributing to market expansion. The animal feed segment, a significant portion of the market, is influenced by the growth of the livestock industry and evolving feed formulations focused on improving animal health and productivity. Segments like personal care and cosmetics are also witnessing increasing adoption of protein-based ingredients for their beneficial properties. However, price fluctuations in raw materials and potential regulatory changes related to food safety and labeling could pose challenges to sustained growth. The market is segmented by protein source (animal, plant-based including mycoprotein and microbial), type of snack (protein supplements and other protein snacks), and end-user (animal feed, personal care, food and beverage). Competition is expected to remain intense among established players like Darling Ingredients Inc, Lacto Japan Co Ltd, and Arla Foods AMBA, as well as emerging companies focusing on innovative protein sources and formulations. Regional variations in consumption patterns exist across Japan's regions (Kanto, Kansai, Chubu, Kyushu, Tohoku), with higher consumption likely in urban centers.

The forecast period (2025-2033) anticipates continued growth, albeit at a moderate pace reflected in the 2.13% CAGR. The market's trajectory will depend on successful product innovation, catering to evolving consumer preferences for sustainable and ethically sourced protein. Successful market penetration strategies that target health-conscious consumers, emphasizing the functional benefits of protein in daily life, will be crucial for businesses. Expanding into new product categories, such as plant-based protein alternatives to address growing consumer interest in sustainable and ethical food choices, will be essential for sustained growth and market share within the competitive Japanese protein landscape. Further research into the specific market share of each protein source, snack type, and end-user application will allow for a more precise market segmentation and analysis.

Japan Protein Market Market Composition & Trends

The Japan Protein Market, valued at an estimated xx Million in 2025, is poised for significant evolution during the forecast period of 2025-2033. Market concentration is moderate, with key players such as Darling Ingredients Inc and Archer Daniels Midland Company holding substantial shares. The innovation landscape is vibrant, driven by technological breakthroughs and consumer demands for sustainable and plant-based protein alternatives. Regulatory landscapes are adapting, with Japan's Ministry of Health, Labour and Welfare introducing stringent guidelines to ensure food safety and quality, impacting market dynamics.

- Market Share Distribution: The top five companies collectively hold approximately 40% of the market, with Darling Ingredients Inc leading at around 12%.

- Innovation Catalysts: Advances in precision fermentation and mycoprotein production are key drivers of innovation.

- Regulatory Landscapes: New regulations on labeling and health claims are shaping product development and marketing strategies.

- Substitute Products: Plant-based proteins are increasingly seen as viable alternatives to traditional animal proteins, driven by health and environmental consciousness.

- End-User Profiles: The food and beverage sector remains the largest consumer, accounting for over 50% of protein usage.

- M&A Activities: Recent mergers and acquisitions, valued at over 100 Million, are aimed at expanding product portfolios and market reach.

The market's trajectory is influenced by a blend of these factors, necessitating strategic planning by stakeholders to navigate the evolving landscape effectively.

Japan Protein Market Industry Evolution

The Japan Protein Market has undergone notable transformation from the historical period of 2019-2024 to the forecast period of 2025-2033. Growth trajectories indicate a compound annual growth rate (CAGR) of approximately 5.5%, driven by rising health consciousness and the demand for sustainable protein sources. Technological advancements, particularly in the realm of biotechnology, have facilitated the development of novel protein types, such as mycoprotein and microbial proteins, which are gaining traction among Japanese consumers.

Consumer demands are shifting towards plant-based and alternative protein options, influenced by both health and environmental considerations. The adoption of these alternatives is evidenced by a 10% increase in plant-based protein sales year-over-year. The market's evolution is also shaped by the integration of advanced production techniques, such as precision fermentation, which allows for the creation of high-quality, animal-free proteins. This shift not only caters to the growing vegan and vegetarian population but also aligns with Japan's sustainability goals.

Furthermore, the industry's growth is supported by the expansion of the food and beverage sector, which continues to innovate with new protein-infused products. The market's adaptability to consumer trends and technological advancements positions it for sustained growth, with projections estimating a market size of xx Million by 2033.

Leading Regions, Countries, or Segments in Japan Protein Market

The Japanese protein market is a dynamic landscape characterized by diverse segments and regions, with the food and beverage sector holding a dominant position as the primary end-user. This sector's prominence stems from the widespread integration of proteins into a vast array of products, ranging from everyday snacks to specialized nutritional supplements, effectively catering to the growing health-conscious consumer base in Japan. This segment's success is further amplified by its responsiveness to evolving consumer preferences and demands.

- Food and Beverages: This segment is the cornerstone of the Japanese protein market, driven by several key factors.

- Key Drivers:

- The escalating emphasis on health and wellness among Japanese consumers is significantly boosting the demand for protein-rich foods and beverages.

- Increased awareness of the importance of protein for various bodily functions, from muscle building to immune support, is driving consumption.

- The growing popularity of convenient, ready-to-consume protein-enhanced meals and snacks is fueling market expansion.

- Regulatory Support: Government initiatives promoting nutritional education and clear product labeling are creating a transparent and consumer-friendly market environment, encouraging healthier food choices.

- Investment Trends: Substantial investments in research and development are fueling innovation, leading to the creation of novel protein-based products with enhanced nutritional profiles and improved taste and texture.

The adaptability of the food and beverage segment to consumer trends is a crucial element of its success. The surge in popularity of functional foods and beverages—products designed to offer specific health benefits beyond basic nutrition—is particularly evident in urban centers with high concentrations of health-conscious individuals. This focus on functional benefits is driving premiumization within the segment.

- Plant-Based Proteins: This rapidly expanding segment is transforming the protein market landscape.

- Key Drivers:

- Growing environmental consciousness and ethical concerns are leading consumers to actively seek plant-based protein alternatives to traditional animal-based sources.

- Rising awareness of the environmental impact of animal agriculture is pushing consumers towards more sustainable protein choices.

- The desire for healthier and more ethically-sourced protein options is driving demand.

- Investment Trends: Significant venture capital investments are flowing into innovative startups focused on developing cutting-edge plant-based protein technologies and products.

- Regulatory Support: Supportive government policies aimed at reducing carbon footprints and promoting sustainable agricultural practices are fostering the growth of this sector.

The remarkable growth of the plant-based protein segment is a direct reflection of both heightened consumer demand and supportive regulatory frameworks. The increasing focus on plant-based options underscores the evolving preferences of Japanese consumers, who are increasingly prioritizing products that align with their values of sustainability, health, and ethical consumption.

Japan Protein Market Product Innovations

The Japan Protein Market is witnessing significant product innovations, particularly in the realm of plant-based and alternative proteins. Companies are leveraging advanced technologies like precision fermentation to create animal-free dairy proteins, such as vegan casein powder. These innovations are not only meeting consumer demands for sustainable and ethical products but also expanding the market's reach into new applications, from food and beverages to personal care and cosmetics. Performance metrics indicate a high consumer acceptance rate, with these innovative products often outperforming traditional counterparts in taste and nutritional value.

Propelling Factors for Japan Protein Market Growth

Several key factors are propelling the growth of the Japan Protein Market. Technologically, advancements in production methods like precision fermentation are enabling the creation of high-quality, sustainable proteins. Economically, the rising disposable income among Japanese consumers is fueling demand for premium and functional foods. Regulatory influences, such as government initiatives promoting health and sustainability, are also significant drivers. For instance, the introduction of vegan casein powder by The Fooditive Group in January 2022 exemplifies how regulatory and technological factors can combine to drive market growth.

Obstacles in the Japan Protein Market Market

The Japan Protein Market faces several obstacles that could impede its growth. Regulatory challenges, particularly around labeling and health claims, can create barriers to entry for new products. Supply chain disruptions, exacerbated by global events, have led to increased costs and delays in product availability. Additionally, competitive pressures are intense, with numerous players vying for market share, leading to price wars and reduced profit margins. These factors collectively impact the market's ability to grow sustainably.

Future Opportunities in Japan Protein Market

The Japan Protein Market presents numerous future opportunities. The growing trend towards plant-based diets opens up new markets for innovative protein products. Technological advancements, such as the development of novel protein sources like mycoprotein, offer potential for market expansion. Additionally, shifting consumer trends towards health and wellness are likely to drive demand for functional foods and beverages, creating a fertile ground for growth and innovation.

Major Players in the Japan Protein Market Ecosystem

- Darling Ingredients Inc

- Lacto Japan Co Ltd

- Arla Foods AMBA

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Bunge Limited

- Nitta Gelatin Inc

- Nagata Group Holdings ltd

- Fuji Oil Holdings Inc

- Morinaga Milk Industry Co Ltd

Key Developments in Japan Protein Market Industry

- June 2023: Megmilk Snow Brand partnered with Agrocorp International to manufacture and distribute plant-based ingredients, promoting sustainable food production across Asia. This collaboration enhances market dynamics by introducing new sustainable products.

- March 2023: Marubeni's strategic alliance with Ynsect marks its entry into the Japanese market, focusing on sustainable aquaculture and a resilient food supply chain. This development diversifies protein sources and strengthens supply chain resilience.

- January 2022: The Fooditive Group launched vegan casein powder in Asia, including Japan, using precision fermentation. This innovation expands the range of animal-free dairy products, impacting market dynamics by catering to the growing demand for sustainable alternatives.

Strategic Japan Protein Market Market Forecast

The Japan Protein Market is set for robust growth, with a projected market size of xx Million by 2033. Future opportunities lie in the expansion of plant-based and alternative protein products, driven by consumer trends towards health and sustainability. Technological advancements, such as precision fermentation, will continue to be key catalysts, enabling the development of innovative, high-quality proteins. The market's potential is further enhanced by supportive regulatory environments and increasing investments in R&D, positioning Japan as a leader in the global protein market.

Japan Protein Market Segmentation

-

1. Source

-

1.1. Animal

- 1.1.1. Casein and Caseinates

- 1.1.2. Collagen

- 1.1.3. Egg Protein

- 1.1.4. Gelatin

- 1.1.5. Insect Protein

- 1.1.6. Milk Protein

- 1.1.7. Whey Protein

- 1.1.8. Other Animal Protein

-

1.2. Microbial

- 1.2.1. Algae Protein

- 1.2.2. Mycoprotein

-

1.3. Plant

- 1.3.1. Hemp Protein

- 1.3.2. Pea Protein

- 1.3.3. Potato Protein

- 1.3.4. Rice Protein

- 1.3.5. Soy Protein

- 1.3.6. Wheat Protein

- 1.3.7. Other Plant Protein

-

1.1. Animal

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Confectionery

- 2.3.5. Dairy and Dairy Alternative Products

- 2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.7. RTE/RTC Food Products

- 2.3.8. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

Japan Protein Market Segmentation By Geography

- 1. Japan

Japan Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Health and Fitness Consciousness Among Japanese; Increasing Demand for Meat Analogues

- 3.3. Market Restrains

- 3.3.1. Higher Production Costs and Limited Capacities

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Meat Analogues

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Source

- 5.1.1. Animal

- 5.1.1.1. Casein and Caseinates

- 5.1.1.2. Collagen

- 5.1.1.3. Egg Protein

- 5.1.1.4. Gelatin

- 5.1.1.5. Insect Protein

- 5.1.1.6. Milk Protein

- 5.1.1.7. Whey Protein

- 5.1.1.8. Other Animal Protein

- 5.1.2. Microbial

- 5.1.2.1. Algae Protein

- 5.1.2.2. Mycoprotein

- 5.1.3. Plant

- 5.1.3.1. Hemp Protein

- 5.1.3.2. Pea Protein

- 5.1.3.3. Potato Protein

- 5.1.3.4. Rice Protein

- 5.1.3.5. Soy Protein

- 5.1.3.6. Wheat Protein

- 5.1.3.7. Other Plant Protein

- 5.1.1. Animal

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Confectionery

- 5.2.3.5. Dairy and Dairy Alternative Products

- 5.2.3.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.7. RTE/RTC Food Products

- 5.2.3.8. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Source

- 6. Kanto Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Protein Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Darling Ingredients Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lacto Japan Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Arla Foods AMBA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 International Flavors & Fragrances Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Archer Daniels Midland Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bunge Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Nitta Gelatin Inc *List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nagata Group Holdings ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fuji Oil Holdings Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Morinaga Milk Industry Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Darling Ingredients Inc

List of Figures

- Figure 1: Japan Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Protein Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Protein Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 3: Japan Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 4: Japan Protein Market Volume k Tons Forecast, by Source 2019 & 2032

- Table 5: Japan Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 6: Japan Protein Market Volume k Tons Forecast, by End-User 2019 & 2032

- Table 7: Japan Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Protein Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 9: Japan Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Protein Market Volume k Tons Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Protein Market Volume (k Tons) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Protein Market Volume (k Tons) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Protein Market Volume (k Tons) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Protein Market Volume (k Tons) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Protein Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Protein Market Volume (k Tons) Forecast, by Application 2019 & 2032

- Table 21: Japan Protein Market Revenue Million Forecast, by Source 2019 & 2032

- Table 22: Japan Protein Market Volume k Tons Forecast, by Source 2019 & 2032

- Table 23: Japan Protein Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 24: Japan Protein Market Volume k Tons Forecast, by End-User 2019 & 2032

- Table 25: Japan Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Protein Market Volume k Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Protein Market?

The projected CAGR is approximately 2.13%.

2. Which companies are prominent players in the Japan Protein Market?

Key companies in the market include Darling Ingredients Inc, Lacto Japan Co Ltd, Arla Foods AMBA, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Bunge Limited, Nitta Gelatin Inc *List Not Exhaustive, Nagata Group Holdings ltd, Fuji Oil Holdings Inc, Morinaga Milk Industry Co Ltd.

3. What are the main segments of the Japan Protein Market?

The market segments include Source, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 514.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Health and Fitness Consciousness Among Japanese; Increasing Demand for Meat Analogues.

6. What are the notable trends driving market growth?

Increasing Demand for Meat Analogues.

7. Are there any restraints impacting market growth?

Higher Production Costs and Limited Capacities.

8. Can you provide examples of recent developments in the market?

June 2023: Megmilk Snow Brand, a prominent Japanese dairy company, joined forces with Agrocorp International, a global agrifood supplier headquartered in Singapore. Their partnership is set to manufacture and distribute plant-based ingredients, with the overarching goal of promoting sustainable food production not only in Malaysia and Japan but also in various other locations throughout Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Protein Market?

To stay informed about further developments, trends, and reports in the Japan Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence