Key Insights

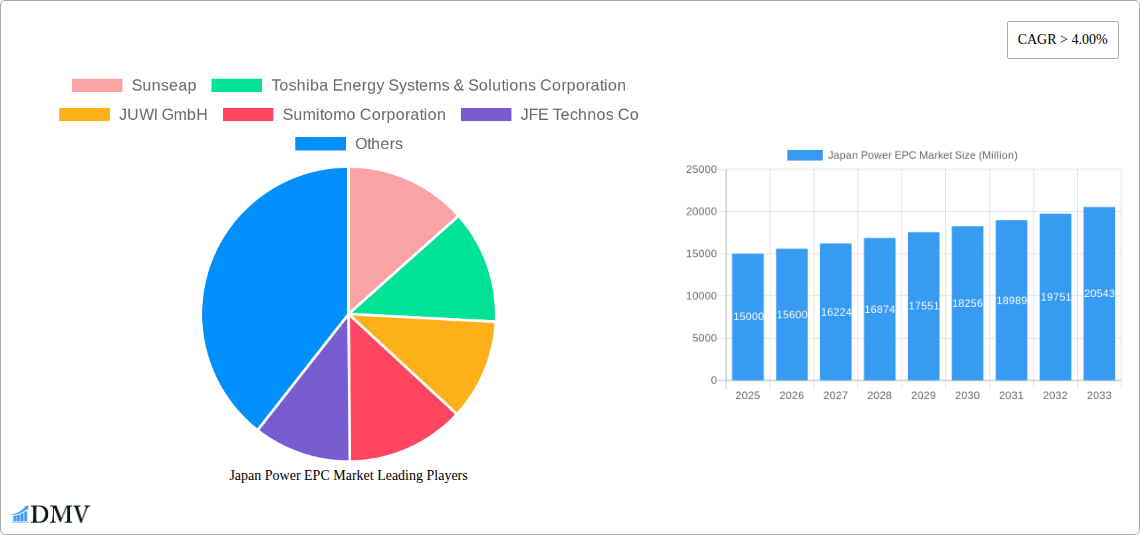

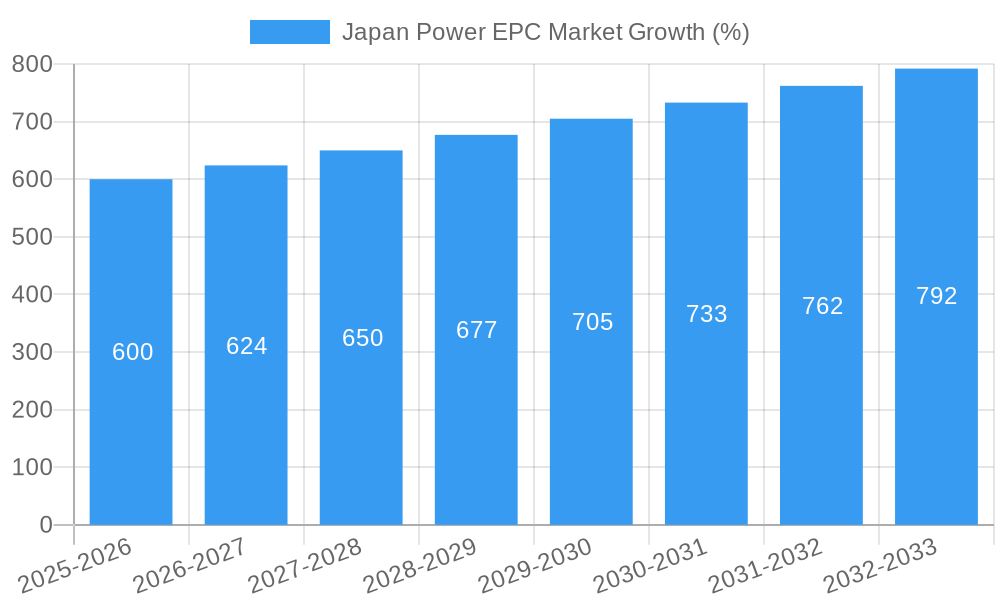

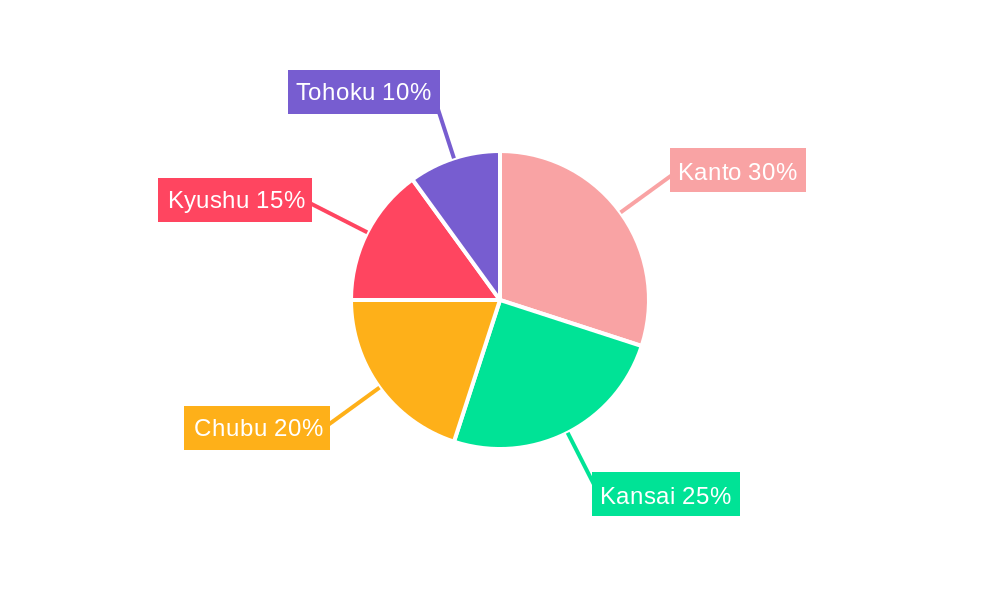

The Japan Power Engineering, Procurement, and Construction (EPC) market is experiencing robust growth, driven by increasing electricity demand, government initiatives promoting renewable energy sources, and aging infrastructure requiring upgrades. The market's Compound Annual Growth Rate (CAGR) exceeding 4.00% reflects a positive outlook, with significant opportunities across various power generation segments. While thermal power remains a substantial part of the market, the strong push towards decarbonization is significantly boosting the renewable energy segment, particularly solar and wind power projects. This trend is further fueled by Japan's commitment to achieving carbon neutrality targets. The market is segmented geographically, with regions like Kanto, Kansai, and Chubu representing significant shares, reflecting higher population density and industrial activity. Key players, including Sunseap, Toshiba Energy Systems & Solutions Corporation, and JUWI GmbH, are actively involved, competing in a market characterized by both large-scale projects and smaller, localized initiatives. The estimated market size for 2025 is based on an extrapolation of historical data and market projections that consider these aforementioned factors.

Significant challenges remain, however. High initial investment costs for renewable energy projects, coupled with potential regulatory hurdles and land availability constraints, could act as restraints on the market's growth. Nevertheless, the government's supportive policies and growing investor interest in sustainable energy solutions are expected to mitigate these challenges. The forecast period (2025-2033) promises considerable expansion, with continued technological advancements likely to increase efficiency and reduce costs in renewable energy sectors. The competitive landscape is expected to intensify, with existing players expanding their portfolios and new entrants exploring opportunities in this growing market. Ongoing modernization efforts within the thermal and hydroelectric sectors also contribute to the overall market growth, ensuring a dynamic and multifaceted investment landscape.

Japan Power EPC Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Japan Power Engineering, Procurement, and Construction (EPC) market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report leverages extensive market research and data analysis to present a clear and actionable picture of this multi-billion-dollar industry.

Japan Power EPC Market Market Composition & Trends

The Japan Power EPC market exhibits a moderately concentrated structure, with several major players vying for market share. The market's composition is shaped by intense competition, driving innovation and operational efficiency. Regulatory landscapes, particularly those concerning renewable energy integration and nuclear power, significantly influence market dynamics. Substitute products, such as distributed generation systems, exert pressure on traditional EPC models. End-user profiles are diverse, ranging from large utilities like Kansai Electric Power CO INC to independent power producers (IPPs) like Pacifico Energy K K. M&A activity has been relatively active, with deal values in the range of xx Million in recent years, contributing to market consolidation and shifting competitive dynamics.

- Market Share Distribution: Toshiba Energy Systems & Solutions Corporation and Sumitomo Corporation hold significant market shares, estimated at xx% and xx%, respectively, as of 2024. Other key players, including Marubeni Corporation and JFE Technos Co, each account for approximately xx% of the market. Smaller players collectively contribute xx%.

- M&A Activity: The past five years have witnessed an average of xx M&A deals annually, with total deal values exceeding xx Million. These transactions reflect strategic consolidation within the market.

- Innovation Catalysts: Government incentives for renewable energy projects and stricter environmental regulations are driving innovation in areas such as energy storage and smart grid technologies.

Japan Power EPC Market Industry Evolution

The Japan Power EPC market has experienced fluctuating growth during the historical period (2019-2024), influenced by factors such as economic fluctuations and policy shifts. From 2019 to 2024, the market experienced an average annual growth rate (AAGR) of approximately xx%. This growth is projected to accelerate in the forecast period (2025-2033), with an estimated AAGR of xx%, driven by increasing investments in renewable energy infrastructure and ongoing efforts to modernize the nation's aging power grid. Technological advancements, such as the adoption of digital twins and advanced construction techniques, are enhancing efficiency and reducing project timelines. Shifting consumer preferences towards sustainable energy sources further propel this transformation. The growing adoption of renewable energy technologies, specifically solar and wind power, is significantly impacting market growth. Adoption metrics indicate a xx% increase in renewable energy EPC projects between 2019 and 2024.

Leading Regions, Countries, or Segments in Japan Power EPC Market

While the entire Japanese market is relevant, the Renewables segment within Power Generation is currently exhibiting the strongest growth within the Japan Power EPC market. This is primarily due to the government's ambitious renewable energy targets and increasing private sector investment.

- Key Drivers for Renewables Dominance:

- Government Policies and Incentives: Substantial government subsidies and feed-in tariffs are making renewable energy projects financially viable.

- Technological Advancements: Decreasing costs of solar PV and wind turbine technologies are making them increasingly competitive with conventional power sources.

- Environmental Concerns: Growing public awareness of climate change and the need for sustainable energy solutions is driving demand for renewable energy projects.

- Investment Trends: Significant investments from both domestic and international companies are fueling the expansion of the renewable energy sector.

The dominance of the Renewables segment is expected to continue throughout the forecast period, as Japan strives to meet its ambitious renewable energy targets and reduce its carbon footprint.

Japan Power EPC Market Product Innovations

Recent product innovations in the Japan Power EPC market include advanced digital solutions for project management, predictive maintenance systems for power plants, and the integration of energy storage solutions into renewable energy projects. These innovations aim to enhance efficiency, reduce operational costs, and improve the reliability of power generation assets. The unique selling propositions (USPs) of these innovations often center on enhanced project delivery timelines, lower lifecycle costs, and improved grid integration capabilities.

Propelling Factors for Japan Power EPC Market Growth

The Japan Power EPC market's growth is fueled by several key factors: government policies promoting renewable energy adoption (e.g., ambitious renewable energy targets), increasing investments in upgrading aging infrastructure, and the growing demand for reliable and sustainable power sources. Furthermore, technological advancements in renewable energy technologies and the decreasing cost of these technologies are making renewable energy projects more economically viable.

Obstacles in the Japan Power EPC Market Market

Challenges include stringent regulatory approvals, which can delay project timelines, and potential supply chain disruptions impacting project costs and delivery schedules. The highly competitive landscape also adds pressure on profit margins. The impact of these constraints on market growth is estimated at xx% annually.

Future Opportunities in Japan Power EPC Market

Future opportunities lie in the expansion of offshore wind power, further integration of smart grid technologies, and the development of innovative energy storage solutions. The growing emphasis on decarbonization and energy efficiency presents significant potential for market expansion. The integration of hydrogen power generation within the energy mix also offers promising avenues for growth.

Major Players in the Japan Power EPC Market Ecosystem

- Sunseap

- Toshiba Energy Systems & Solutions Corporation

- JUWI GmbH

- Sumitomo Corporation

- JFE Technos Co

- Electric Power Development Co Ltd

- SHIZEN ENERGY Inc

- Marubeni Corporation

- Kansai Electric Power CO INC

- Pacifico Energy K K

Key Developments in Japan Power EPC Market Industry

- February 2022: Juwi Shizen Energy Inc. completed construction of the Sonnedix Sano solar plant (41.6 MW), showcasing the growing renewable energy sector.

- April 2022: Toyo Engineering Corporation secured a contract to build a 50,000-kW biomass power plant, highlighting continued investment in diverse energy sources.

Strategic Japan Power EPC Market Market Forecast

The Japan Power EPC market is poised for significant growth over the forecast period (2025-2033), driven by continued investments in renewable energy, modernization of existing infrastructure, and the government's commitment to achieving carbon neutrality. The market's potential is substantial, with projections indicating a market value exceeding xx Million by 2033. The increasing focus on energy efficiency and the adoption of innovative technologies will further shape the market's trajectory.

Japan Power EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Nuclear

- 1.4. Renewables

- 2. Power Tr

Japan Power EPC Market Segmentation By Geography

- 1. Japan

Japan Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 4.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies

- 3.3. Market Restrains

- 3.3.1. 4.; High Initial Investment Cost and Long Investment Return Period on Projects

- 3.4. Market Trends

- 3.4.1. Renewables Segment to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Nuclear

- 5.1.4. Renewables

- 5.2. Market Analysis, Insights and Forecast - by Power Tr

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Kanto Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sunseap

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Toshiba Energy Systems & Solutions Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JUWI GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sumitomo Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 JFE Technos Co

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Electric Power Development Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SHIZEN ENERGY Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Marubeni Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kansai Electric Power CO INC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pacifico Energy K K

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Sunseap

List of Figures

- Figure 1: Japan Power EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Power EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Japan Power EPC Market Revenue Million Forecast, by Power Tr 2019 & 2032

- Table 4: Japan Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Kanto Japan Power EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Kansai Japan Power EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Chubu Japan Power EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kyushu Japan Power EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tohoku Japan Power EPC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Japan Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 12: Japan Power EPC Market Revenue Million Forecast, by Power Tr 2019 & 2032

- Table 13: Japan Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Power EPC Market?

The projected CAGR is approximately > 4.00%.

2. Which companies are prominent players in the Japan Power EPC Market?

Key companies in the market include Sunseap, Toshiba Energy Systems & Solutions Corporation, JUWI GmbH, Sumitomo Corporation, JFE Technos Co, Electric Power Development Co Ltd, SHIZEN ENERGY Inc, Marubeni Corporation, Kansai Electric Power CO INC, Pacifico Energy K K.

3. What are the main segments of the Japan Power EPC Market?

The market segments include Power Generation, Power Tr.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Demand for Renewable Energy4.; Upcoming Investments in the Energy Sector and Supportive Renewable Energy Policies.

6. What are the notable trends driving market growth?

Renewables Segment to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; High Initial Investment Cost and Long Investment Return Period on Projects.

8. Can you provide examples of recent developments in the market?

April 2022: Toyo Engineering Corporation was awarded a contract to build a 50,000-kW biomass power plant. Tomatoh Biomass Power GK would construct this facility in Tomakomai-shi, Hokkaido, Japan. The company was expected to complete the EPC contract on a turn-key basis, which covers engineering, procurement, building, and commissioning services for a power production unit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Power EPC Market?

To stay informed about further developments, trends, and reports in the Japan Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence