Key Insights

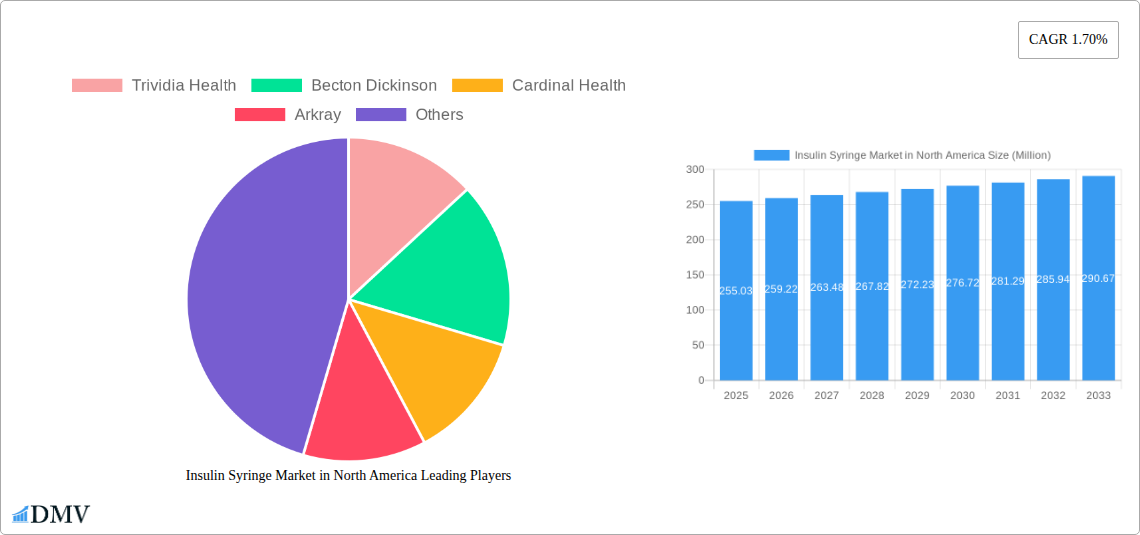

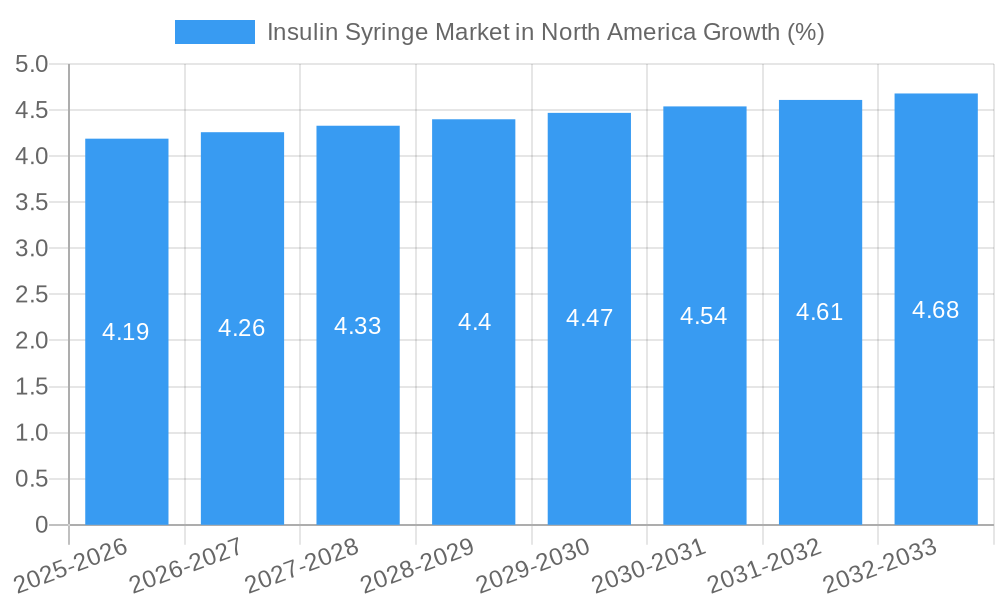

The North American insulin syringe market, valued at $255.03 million in 2025, is projected to experience steady growth, driven primarily by the increasing prevalence of diabetes and the rising geriatric population. This segment is characterized by two primary product types: disposable and reusable insulin syringes. Disposable syringes dominate the market due to their convenience and hygiene benefits, reducing the risk of infection. The application segment is bifurcated between insulin delivery and blood sampling, with insulin delivery holding a significantly larger market share. Growth is further fueled by advancements in syringe design, such as improved needle technology and ergonomic features enhancing patient comfort and reducing injection pain. However, factors like the increasing cost of healthcare and the preference for alternative insulin delivery methods (e.g., insulin pens) could act as restraints on market expansion. While precise market segmentation data isn't provided, a reasonable estimation, based on industry trends, suggests that disposable syringes account for approximately 70% of the market, with the remaining 30% comprised of reusable syringes. Similarly, insulin delivery constitutes approximately 90% of the application market, with blood sampling accounting for the remaining 10%. Major players like Becton Dickinson, Cardinal Health, and Trividia Health are actively engaged in research and development to enhance their product offerings and maintain their market positions. The forecast period (2025-2033) anticipates continued, albeit modest, growth, primarily fueled by the ongoing demand for efficient and safe insulin delivery systems.

The continued growth in the North American insulin syringe market is expected to be influenced by several key factors. Government initiatives promoting diabetes management and preventative healthcare will contribute to market expansion. Technological advancements, including the development of smart syringes with integrated monitoring capabilities, offer significant growth opportunities. However, potential challenges include increasing competition from alternative insulin delivery systems and stringent regulatory requirements for medical devices. Furthermore, economic factors, such as fluctuations in healthcare spending, can influence market growth trajectories. Companies operating in this market must adapt to evolving consumer needs and regulatory landscapes to maintain competitiveness and capture market share in the coming years. Given the projected CAGR of 1.70%, we can expect a gradual but consistent increase in market value throughout the forecast period. This moderate growth reflects the market's maturity and the presence of established players.

Insulin Syringe Market in North America: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the North American insulin syringe market, offering a comprehensive overview of market trends, leading players, and future growth prospects. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The study encompasses both disposable and reusable insulin syringes across insulin delivery and blood sampling applications.

Insulin Syringe Market in North America Market Composition & Trends

The North American insulin syringe market exhibits a moderately consolidated structure, with key players like Trividia Health, Becton Dickinson, Cardinal Health, and Arkray holding significant market share. The market share distribution across these companies is estimated at xx% in 2025, driven by factors such as brand reputation, established distribution networks, and continuous innovation. Innovation in the sector is primarily focused on enhancing safety features, improving usability, and integrating smart technologies for better patient monitoring and adherence. The regulatory landscape is crucial, influenced by FDA guidelines regarding product safety and efficacy. Substitute products, while limited, include insulin pens and pumps. The end-user profile primarily comprises diabetic patients, healthcare providers, and hospitals. M&A activity in this space has been relatively modest in recent years, with deal values averaging around xx Million USD annually (2019-2024). A notable event was the October 2022 agreement between Becton, Dickinson, and Company and Biocorp, aiming to enhance medication adherence via connected technology.

- Market Concentration: Moderately consolidated, with top players commanding xx% of the market in 2025.

- Innovation Catalysts: Enhanced safety, improved usability, integration of smart technologies.

- Regulatory Landscape: Stringent FDA regulations governing product safety and efficacy.

- Substitute Products: Insulin pens and pumps.

- End-User Profiles: Diabetic patients, healthcare providers, hospitals.

- M&A Activity: Moderate, with average annual deal values of xx Million USD (2019-2024).

Insulin Syringe Market in North America Industry Evolution

The North American insulin syringe market has experienced steady growth throughout the historical period (2019-2024), driven by the increasing prevalence of diabetes. The market is projected to maintain a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market value of xx Million USD by 2033. Technological advancements, such as the integration of smart features and improved needle safety mechanisms, have significantly influenced market growth. Consumer demand is shifting towards more user-friendly and technologically advanced products. Furthermore, increasing awareness of diabetes management and rising healthcare expenditure are also key contributors to market expansion. The adoption of connected insulin delivery systems is growing at a rate of xx% annually, reflecting a growing preference for remote patient monitoring.

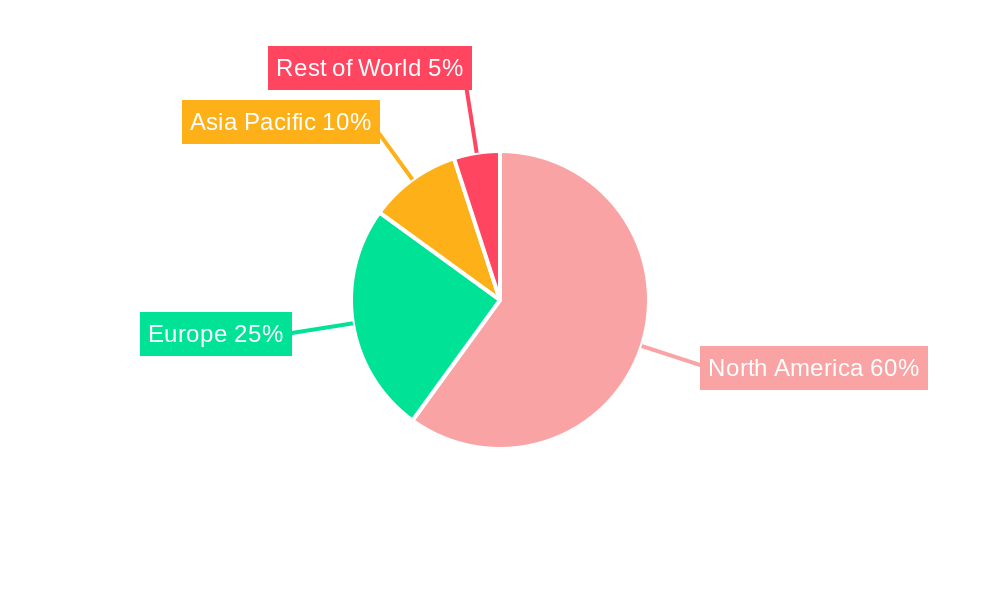

Leading Regions, Countries, or Segments in Insulin Syringe Market in North America

The United States dominates the North American insulin syringe market, driven by several factors.

- Key Drivers (US):

- High prevalence of diabetes.

- Extensive healthcare infrastructure.

- Significant investment in diabetes management technologies.

- Stringent regulatory oversight ensuring product quality.

Within product types, disposable syringes hold a dominant share of over xx%, attributed to their convenience and affordability. In terms of application, insulin delivery accounts for the larger market share compared to blood sampling, due to the significantly higher number of individuals requiring insulin injections. This is further fueled by the increasing prevalence of type 1 and type 2 diabetes in the US.

Insulin Syringe Market in North America Product Innovations

Recent innovations center on improving safety and ease of use. Features such as improved needle guards, ergonomic designs, and pre-filled syringes are becoming increasingly common. The integration of smart technologies, such as NFC chips for data tracking, is another area of significant focus. These innovations aim to improve patient adherence and provide real-time data for healthcare providers, ultimately leading to better diabetes management outcomes.

Propelling Factors for Insulin Syringe Market in North America Growth

The market's growth is propelled by the rising prevalence of diabetes, particularly type 2 diabetes, across North America. Technological advancements leading to safer and more user-friendly designs further stimulate market expansion. Government initiatives promoting diabetes awareness and improved healthcare access also contribute significantly.

Obstacles in the Insulin Syringe Market in North America Market

Major obstacles include the risk of supply chain disruptions, especially evident following the December 2023 FDA advisory against certain Chinese-manufactured syringes. Competitive pressures from established players and the emergence of new technologies also present challenges. Regulatory hurdles and stringent quality control measures can impact market entry and growth.

Future Opportunities in Insulin Syringe Market in North America

Emerging opportunities lie in the development of advanced insulin delivery systems, such as smart insulin pens with integrated sensors and data connectivity. Further growth is anticipated in the integration of artificial intelligence and machine learning for personalized diabetes management. Expanding into underserved populations and focusing on patient education and support are additional avenues for growth.

Major Players in the Insulin Syringe Market in North America Ecosystem

Key Developments in Insulin Syringe Market in North America Industry

- December 2023: FDA advises against using plastic syringes made in China due to quality concerns, potentially disrupting supply chains and impacting market dynamics.

- October 2022: Becton, Dickinson, and Company and Biocorp collaborate on connected technology for improved medication adherence, representing a significant advancement in insulin delivery systems.

Strategic Insulin Syringe Market in North America Market Forecast

The North American insulin syringe market is poised for continued growth driven by technological advancements, rising diabetes prevalence, and increasing focus on improved patient outcomes. Opportunities for innovation and expansion into related markets such as smart insulin delivery systems will be key drivers of future market success. The market is expected to witness sustained growth throughout the forecast period, reaching xx Million USD by 2033.

Insulin Syringe Market in North America Segmentation

- 1. Insulin Syringe

-

2. Geography

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

Insulin Syringe Market in North America Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest of North America

Insulin Syringe Market in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide

- 3.3. Market Restrains

- 3.3.1. Blood Contaminations and Other Complications; Injury Caused During Blood Collection

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Canada

- 5.2.3. Rest of North America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 6. United States Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Canada

- 6.2.3. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 7. Canada Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Canada

- 7.2.3. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 8. Rest of North America Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Canada

- 8.2.3. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Insulin Syringe

- 9. United States Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 10. Canada Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 11. Mexico Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America Insulin Syringe Market in North America Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Trividia Health

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Becton Dickinson

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Cardinal Health

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Arkray

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.1 Trividia Health

List of Figures

- Figure 1: Insulin Syringe Market in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Insulin Syringe Market in North America Share (%) by Company 2024

List of Tables

- Table 1: Insulin Syringe Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Insulin Syringe Market in North America Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 3: Insulin Syringe Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Insulin Syringe Market in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Insulin Syringe Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Insulin Syringe Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Insulin Syringe Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Insulin Syringe Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Insulin Syringe Market in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Insulin Syringe Market in North America Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 11: Insulin Syringe Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 12: Insulin Syringe Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Insulin Syringe Market in North America Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 14: Insulin Syringe Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Insulin Syringe Market in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Insulin Syringe Market in North America Revenue Million Forecast, by Insulin Syringe 2019 & 2032

- Table 17: Insulin Syringe Market in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Insulin Syringe Market in North America Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Insulin Syringe Market in North America?

The projected CAGR is approximately 1.70%.

2. Which companies are prominent players in the Insulin Syringe Market in North America?

Key companies in the market include Trividia Health, Becton Dickinson, Cardinal Health, Arkray.

3. What are the main segments of the Insulin Syringe Market in North America?

The market segments include Insulin Syringe, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 255.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Early Diagnosis of Chronic Conditions; Increasing Incidence of Trauma and Accidents; Surge in the Number of Surgical Procedures Carried Out Worldwide.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Blood Contaminations and Other Complications; Injury Caused During Blood Collection.

8. Can you provide examples of recent developments in the market?

Decmber 2023: FDA advises against using plastic syringes made in China amid reports of quality failures. Officials began the investigation after receiving information about quality issues associated with “several Chinese manufacturers of syringes.”

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Insulin Syringe Market in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Insulin Syringe Market in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Insulin Syringe Market in North America?

To stay informed about further developments, trends, and reports in the Insulin Syringe Market in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence