Key Insights

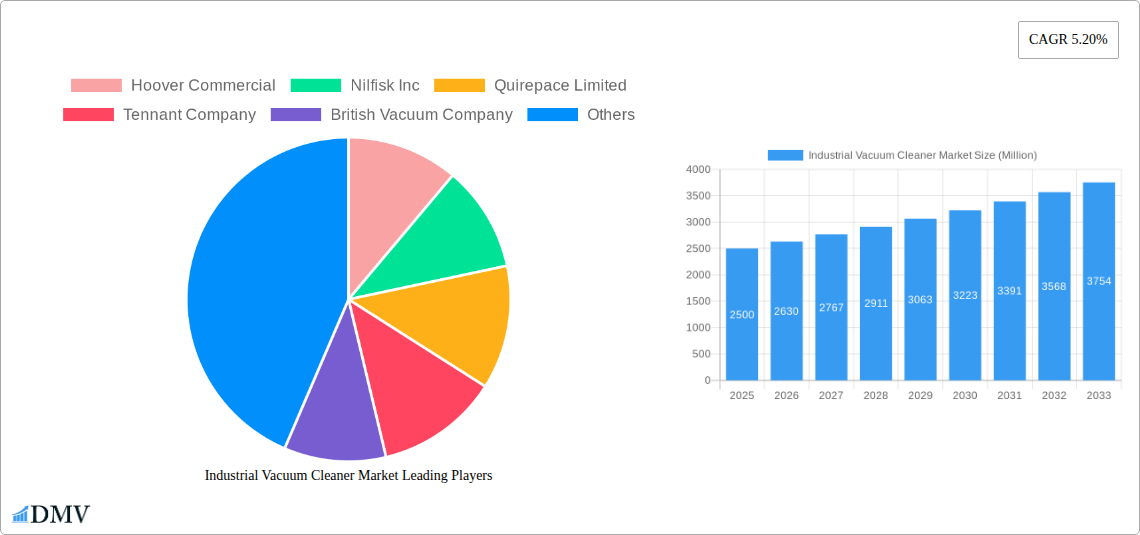

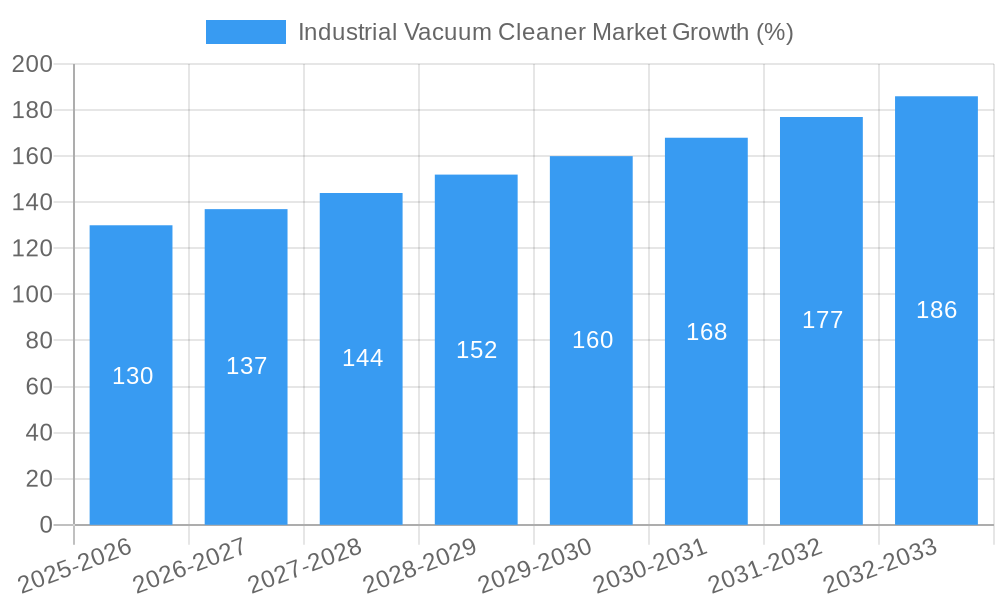

The industrial vacuum cleaner market, valued at approximately $2.5 billion in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.20% from 2025 to 2033. This expansion is driven by several key factors. Increasing automation across manufacturing and industrial sectors fuels demand for efficient and powerful cleaning solutions. The rise of stringent safety and hygiene regulations, particularly within the food and beverage and pharmaceutical industries, necessitates the use of industrial-grade vacuum cleaners. Furthermore, the growing awareness of occupational health and safety risks associated with dust and debris exposure is prompting businesses to invest in advanced vacuum cleaning technologies. The market is witnessing a shift towards more sustainable and energy-efficient options, with electric-powered vacuum cleaners gaining traction. The segment is further diversified by product type (upright, canister, backpack) and end-user industry (food and beverage, metal working, pharmaceuticals, manufacturing, building and construction, and others). Competition is fierce, with established players like Hoover Commercial, Nilfisk Inc., and Tennant Company alongside specialized manufacturers vying for market share. Geographic growth will likely be strongest in rapidly industrializing regions of Asia Pacific, driven by significant infrastructure development and manufacturing expansion.

While the market presents significant opportunities, certain restraints exist. The high initial investment cost of industrial vacuum cleaners can be a barrier to entry for smaller businesses. Fluctuations in raw material prices and economic downturns could impact market growth. However, the long-term benefits in terms of increased productivity, improved safety, and reduced maintenance costs are likely to outweigh these challenges. Innovative features such as advanced filtration systems, improved maneuverability, and smart connectivity are expected to further drive market growth in the coming years. The increasing adoption of Industry 4.0 principles and smart factories will also create opportunities for integrating industrial vacuum cleaners into automated cleaning systems, boosting market demand further.

Industrial Vacuum Cleaner Market: A Comprehensive Report (2019-2033)

This insightful report provides a deep dive into the global industrial vacuum cleaner market, offering a comprehensive analysis of market trends, competitive landscape, and future growth prospects. From market size and segmentation to key players and technological advancements, this report equips stakeholders with the knowledge necessary to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033. The total market value in 2025 is estimated at xx Million.

Industrial Vacuum Cleaner Market Market Composition & Trends

This section analyzes the current state of the industrial vacuum cleaner market, examining factors influencing its evolution. Market concentration is relatively fragmented, with several key players vying for market share. However, significant M&A activity, as evidenced by xx Million in deals in the past five years (2019-2024), suggests a trend toward consolidation. The market share distribution amongst the leading companies such as Hoover Commercial, Nilfisk Inc, and Tennant Company varies dynamically, with some players exhibiting higher growth than others. The introduction of innovative technologies such as improved filtration systems and automated cleaning mechanisms act as significant catalysts for innovation, while stringent environmental regulations drive the adoption of more efficient and sustainable vacuum cleaner solutions. Substitute products, such as compressed air systems, pose a level of competition, but the versatility and efficiency of industrial vacuum cleaners remain their key advantage. The end-user profile is diverse, spanning various sectors, including food and beverage, metalworking, pharmaceuticals, manufacturing, and construction.

- Market Concentration: Moderately fragmented

- Innovation Catalysts: Advanced filtration, automated cleaning

- Regulatory Landscape: Stringent environmental regulations driving efficiency

- Substitute Products: Compressed air systems

- End-User Profiles: Diverse across various industries

- M&A Activity: xx Million in deals (2019-2024)

Industrial Vacuum Cleaner Market Industry Evolution

The industrial vacuum cleaner market has witnessed significant growth over the past few years, driven by increasing industrialization and the growing need for efficient cleaning and dust extraction solutions. From 2019 to 2024, the market exhibited a Compound Annual Growth Rate (CAGR) of xx%, reaching xx Million in 2024. Technological advancements, such as the development of more powerful and energy-efficient motors, improved filtration technologies (HEPA and ULPA filters), and the integration of smart features, have been pivotal in shaping this growth. Shifting consumer demands toward improved ergonomics, ease of use, and reduced maintenance costs have also influenced market trends. This trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, driven by sustained demand from end-user industries and ongoing technological innovation. Adoption of electric models is also increasing, which should continue to boost market growth.

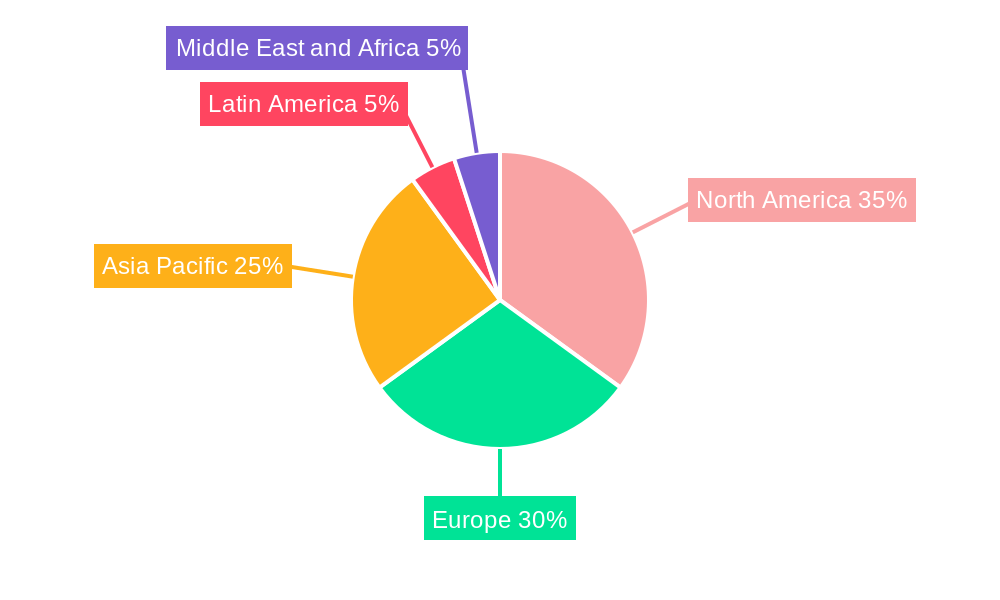

Leading Regions, Countries, or Segments in Industrial Vacuum Cleaner Market

The industrial vacuum cleaner market displays regional variations in growth and adoption. Currently, North America and Europe hold the largest market share, driven by high industrial activity and stringent environmental regulations. However, regions like Asia-Pacific are witnessing rapid expansion due to increasing industrialization and economic growth.

By End-user Industry:

- Manufacturing: High demand for efficient dust and debris removal in various manufacturing processes.

- Building and Construction: Significant need for powerful vacuum cleaners to manage large volumes of dust and debris.

- Food and Beverages: Stringent hygiene requirements driving the adoption of specialized industrial vacuum cleaners.

By Product Type:

- Upright: Dominates the market due to its ease of use and adaptability to various applications.

- Canister: Suitable for specific cleaning tasks and smaller workspaces.

By Power Source:

- Electric: Growing popularity due to its affordability, convenience, and environmentally friendly nature.

The continued growth across various segments indicates a diverse and evolving market, with specific industrial segments showing greater demand than others.

Industrial Vacuum Cleaner Market Product Innovations

Recent years have witnessed significant advancements in industrial vacuum cleaner technology. Innovations include the introduction of more efficient motor designs, improved filtration systems (such as HEPA and ULPA filters for capturing finer particles), and the incorporation of smart features for remote monitoring and control. Several manufacturers are focusing on creating lighter and more ergonomically designed vacuums to enhance user experience and reduce workplace injuries. The integration of innovative filter-cleaning systems, such as Guardair Corporation’s PulseAir technology, reduces downtime and maintenance costs, representing a key selling point for this specific product.

Propelling Factors for Industrial Vacuum Cleaner Market Growth

Several factors are fueling the growth of the industrial vacuum cleaner market. Technological advancements, including improved filtration systems and quieter operation, are making these vacuums more efficient and user-friendly. Economic factors, such as increasing industrial output in developing countries, are boosting demand. Furthermore, stringent environmental regulations are encouraging the adoption of vacuums with better dust collection capabilities, driving growth in this sector.

Obstacles in the Industrial Vacuum Cleaner Market Market

Despite positive growth trends, challenges remain. Supply chain disruptions, particularly affecting components sourcing, can hamper production and increase costs. Fluctuations in raw material prices also impact manufacturing costs and overall profitability. Furthermore, intense competition amongst numerous manufacturers requires continuous innovation and cost optimization to maintain a competitive edge.

Future Opportunities in Industrial Vacuum Cleaner Market

The industrial vacuum cleaner market presents exciting growth opportunities. Expanding into emerging economies with rapidly developing industrial sectors offers considerable potential. The development of specialized industrial vacuum cleaners for niche applications (e.g., hazardous material handling) presents new avenues. Additionally, the increasing focus on sustainability is driving demand for eco-friendly vacuum cleaners, offering another significant opportunity for growth.

Major Players in the Industrial Vacuum Cleaner Market Ecosystem

- Hoover Commercial

- Nilfisk Inc

- Quirepace Limited

- Tennant Company

- British Vacuum Company

- Delfin Industrial Vacuums

- Numatic International Ltd

- American Vacuum Company

- Kerstar UK Ltd

- VAC-U-MAX

- Alfred Karcher GmbH and Co KG

- Robert Bosch GmbH

- Oreck Corporation

- RGS Vacuum Systems

- Pullman Ermator Inc

- Polivac International Pty Ltd

Key Developments in Industrial Vacuum Cleaner Market Industry

- April 2022: Numatic announced plans for a new Henry Vacuum factory in Somerset, signifying investment in production expansion.

- September 2022: Guardair Corporation launched the PulseAir Vacuum/Dust Extractor Line, featuring a unique filter-cleaning system.

Strategic Industrial Vacuum Cleaner Market Market Forecast

The future of the industrial vacuum cleaner market looks promising. Continued technological innovation, coupled with increasing demand from various industrial sectors and a growing focus on sustainability, will drive market expansion. The market is projected to experience robust growth, driven by the factors mentioned above, creating significant opportunities for established players and new entrants. Strategic partnerships and acquisitions will further shape the industry’s landscape, leading to a more consolidated and technologically advanced market in the years to come.

Industrial Vacuum Cleaner Market Segmentation

-

1. Product Type

- 1.1. Upright

- 1.2. Canister

- 1.3. Backpack

-

2. Power Source

- 2.1. Electric

- 2.2. Pneumatic

-

3. End-user Industry

- 3.1. Food and Beverages

- 3.2. Metal Working

- 3.3. Pharmaceuticals

- 3.4. Manufacturing

- 3.5. Building and Construction

- 3.6. Other End-user Industries

Industrial Vacuum Cleaner Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Vacuum Cleaner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Industrial Automation; Stringent Safety and Hygiene Standards

- 3.3. Market Restrains

- 3.3.1. High Implementation and Installation Costs; Absence of Skilled Expertise and Technological Challenges

- 3.4. Market Trends

- 3.4.1. Food and Beverages Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Upright

- 5.1.2. Canister

- 5.1.3. Backpack

- 5.2. Market Analysis, Insights and Forecast - by Power Source

- 5.2.1. Electric

- 5.2.2. Pneumatic

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverages

- 5.3.2. Metal Working

- 5.3.3. Pharmaceuticals

- 5.3.4. Manufacturing

- 5.3.5. Building and Construction

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Upright

- 6.1.2. Canister

- 6.1.3. Backpack

- 6.2. Market Analysis, Insights and Forecast - by Power Source

- 6.2.1. Electric

- 6.2.2. Pneumatic

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverages

- 6.3.2. Metal Working

- 6.3.3. Pharmaceuticals

- 6.3.4. Manufacturing

- 6.3.5. Building and Construction

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Upright

- 7.1.2. Canister

- 7.1.3. Backpack

- 7.2. Market Analysis, Insights and Forecast - by Power Source

- 7.2.1. Electric

- 7.2.2. Pneumatic

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverages

- 7.3.2. Metal Working

- 7.3.3. Pharmaceuticals

- 7.3.4. Manufacturing

- 7.3.5. Building and Construction

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Upright

- 8.1.2. Canister

- 8.1.3. Backpack

- 8.2. Market Analysis, Insights and Forecast - by Power Source

- 8.2.1. Electric

- 8.2.2. Pneumatic

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverages

- 8.3.2. Metal Working

- 8.3.3. Pharmaceuticals

- 8.3.4. Manufacturing

- 8.3.5. Building and Construction

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Upright

- 9.1.2. Canister

- 9.1.3. Backpack

- 9.2. Market Analysis, Insights and Forecast - by Power Source

- 9.2.1. Electric

- 9.2.2. Pneumatic

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverages

- 9.3.2. Metal Working

- 9.3.3. Pharmaceuticals

- 9.3.4. Manufacturing

- 9.3.5. Building and Construction

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Upright

- 10.1.2. Canister

- 10.1.3. Backpack

- 10.2. Market Analysis, Insights and Forecast - by Power Source

- 10.2.1. Electric

- 10.2.2. Pneumatic

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Food and Beverages

- 10.3.2. Metal Working

- 10.3.3. Pharmaceuticals

- 10.3.4. Manufacturing

- 10.3.5. Building and Construction

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Industrial Vacuum Cleaner Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Hoover Commercial

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nilfisk Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Quirepace Limited

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Tennant Company

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 British Vacuum Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Delfin Industrial Vacuums

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Numatic International Ltd

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 American Vacuum Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kerstar UK Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 VAC-U-MAX

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Alfred Karcher GmbH and Co KG

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Robert Bosch GmbH

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Oreck Corporation

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 RGS Vacuum Systems*List Not Exhaustive

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Pullman Ermator Inc

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 Polivac International Pty Ltd

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.1 Hoover Commercial

List of Figures

- Figure 1: Global Industrial Vacuum Cleaner Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Industrial Vacuum Cleaner Market Revenue (Million), by Product Type 2024 & 2032

- Figure 13: North America Industrial Vacuum Cleaner Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Industrial Vacuum Cleaner Market Revenue (Million), by Power Source 2024 & 2032

- Figure 15: North America Industrial Vacuum Cleaner Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 16: North America Industrial Vacuum Cleaner Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 17: North America Industrial Vacuum Cleaner Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 18: North America Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Industrial Vacuum Cleaner Market Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe Industrial Vacuum Cleaner Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe Industrial Vacuum Cleaner Market Revenue (Million), by Power Source 2024 & 2032

- Figure 23: Europe Industrial Vacuum Cleaner Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 24: Europe Industrial Vacuum Cleaner Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 25: Europe Industrial Vacuum Cleaner Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 26: Europe Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Industrial Vacuum Cleaner Market Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Asia Pacific Industrial Vacuum Cleaner Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Asia Pacific Industrial Vacuum Cleaner Market Revenue (Million), by Power Source 2024 & 2032

- Figure 31: Asia Pacific Industrial Vacuum Cleaner Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 32: Asia Pacific Industrial Vacuum Cleaner Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Asia Pacific Industrial Vacuum Cleaner Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Asia Pacific Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Industrial Vacuum Cleaner Market Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Latin America Industrial Vacuum Cleaner Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Latin America Industrial Vacuum Cleaner Market Revenue (Million), by Power Source 2024 & 2032

- Figure 39: Latin America Industrial Vacuum Cleaner Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 40: Latin America Industrial Vacuum Cleaner Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 41: Latin America Industrial Vacuum Cleaner Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 42: Latin America Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Industrial Vacuum Cleaner Market Revenue (Million), by Product Type 2024 & 2032

- Figure 45: Middle East and Africa Industrial Vacuum Cleaner Market Revenue Share (%), by Product Type 2024 & 2032

- Figure 46: Middle East and Africa Industrial Vacuum Cleaner Market Revenue (Million), by Power Source 2024 & 2032

- Figure 47: Middle East and Africa Industrial Vacuum Cleaner Market Revenue Share (%), by Power Source 2024 & 2032

- Figure 48: Middle East and Africa Industrial Vacuum Cleaner Market Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Middle East and Africa Industrial Vacuum Cleaner Market Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Middle East and Africa Industrial Vacuum Cleaner Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Industrial Vacuum Cleaner Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 4: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Industrial Vacuum Cleaner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Industrial Vacuum Cleaner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Industrial Vacuum Cleaner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Industrial Vacuum Cleaner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Industrial Vacuum Cleaner Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 17: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 18: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 19: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 21: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 22: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 25: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 26: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 27: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 29: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 30: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 33: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Power Source 2019 & 2032

- Table 34: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 35: Global Industrial Vacuum Cleaner Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Vacuum Cleaner Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the Industrial Vacuum Cleaner Market?

Key companies in the market include Hoover Commercial, Nilfisk Inc, Quirepace Limited, Tennant Company, British Vacuum Company, Delfin Industrial Vacuums, Numatic International Ltd, American Vacuum Company, Kerstar UK Ltd, VAC-U-MAX, Alfred Karcher GmbH and Co KG, Robert Bosch GmbH, Oreck Corporation, RGS Vacuum Systems*List Not Exhaustive, Pullman Ermator Inc, Polivac International Pty Ltd.

3. What are the main segments of the Industrial Vacuum Cleaner Market?

The market segments include Product Type, Power Source, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Industrial Automation; Stringent Safety and Hygiene Standards.

6. What are the notable trends driving market growth?

Food and Beverages Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Implementation and Installation Costs; Absence of Skilled Expertise and Technological Challenges.

8. Can you provide examples of recent developments in the market?

September 2022 - Guardair Corporation launched the PulseAir Vacuum/Dust Extractor Line. It is powered by compressed air and powerful industrial vacuums with a proprietary, button-activated system that is engineered to clean the vacuum filter without opening the unit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Vacuum Cleaner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Vacuum Cleaner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Vacuum Cleaner Market?

To stay informed about further developments, trends, and reports in the Industrial Vacuum Cleaner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence