Key Insights

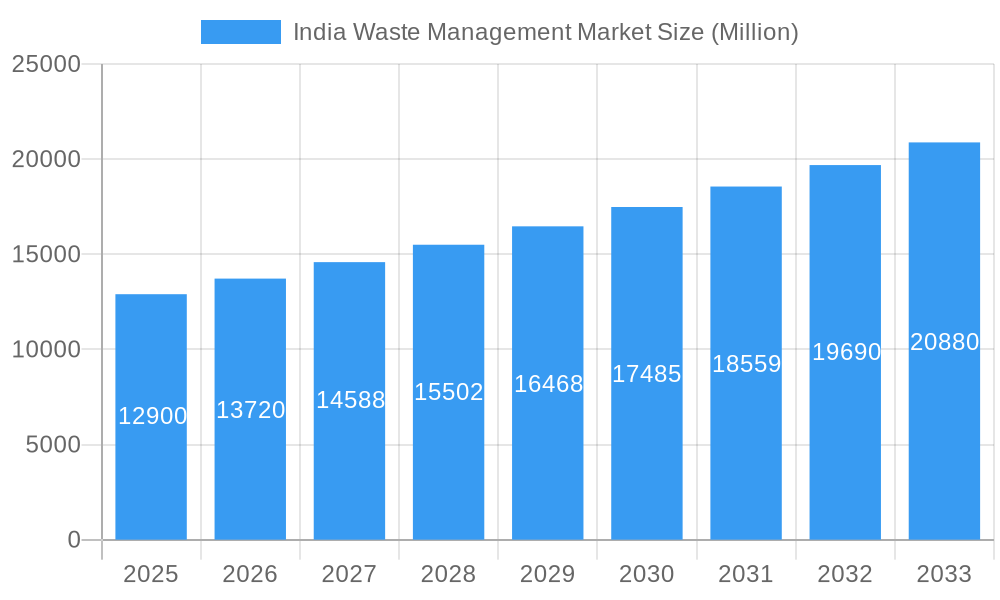

The India Waste Management Market, valued at $12.90 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental concerns, and stringent government regulations. A Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant expansion of the market, reaching an estimated $22.3 billion by 2033. Key drivers include the government's emphasis on Swachh Bharat Abhiyan (Clean India Mission), growing industrial waste generation, and increasing awareness among citizens regarding waste segregation and recycling. Furthermore, technological advancements in waste-to-energy conversion and improved waste management infrastructure are contributing to this growth. Challenges remain, including inefficient waste collection systems in certain areas, lack of public participation in waste segregation, and the need for further investment in advanced waste processing technologies. The market is segmented by waste type (municipal solid waste, industrial waste, hazardous waste, e-waste), treatment method (landfilling, incineration, composting, recycling), and region (North, South, East, West). Leading players like A2Z Green Waste Management Ltd, BVG India Ltd, and Ramky Enviro Engineers Ltd are actively shaping the market landscape through technological innovation and strategic partnerships.

India Waste Management Market Market Size (In Billion)

The market's future hinges on effective policy implementation, public-private partnerships to improve infrastructure, and the adoption of sustainable waste management practices. Continued technological advancements, especially in areas like waste-to-energy and plastic recycling, will play a crucial role in accelerating growth. The increasing focus on circular economy models and the development of smart waste management solutions are expected to further boost market expansion. Addressing challenges related to informal waste pickers' integration into the formal sector and enhancing public awareness campaigns are vital for ensuring the responsible and sustainable growth of the India Waste Management Market. The market's consistent growth trajectory suggests significant investment opportunities and the potential for significant environmental and economic benefits in the coming years.

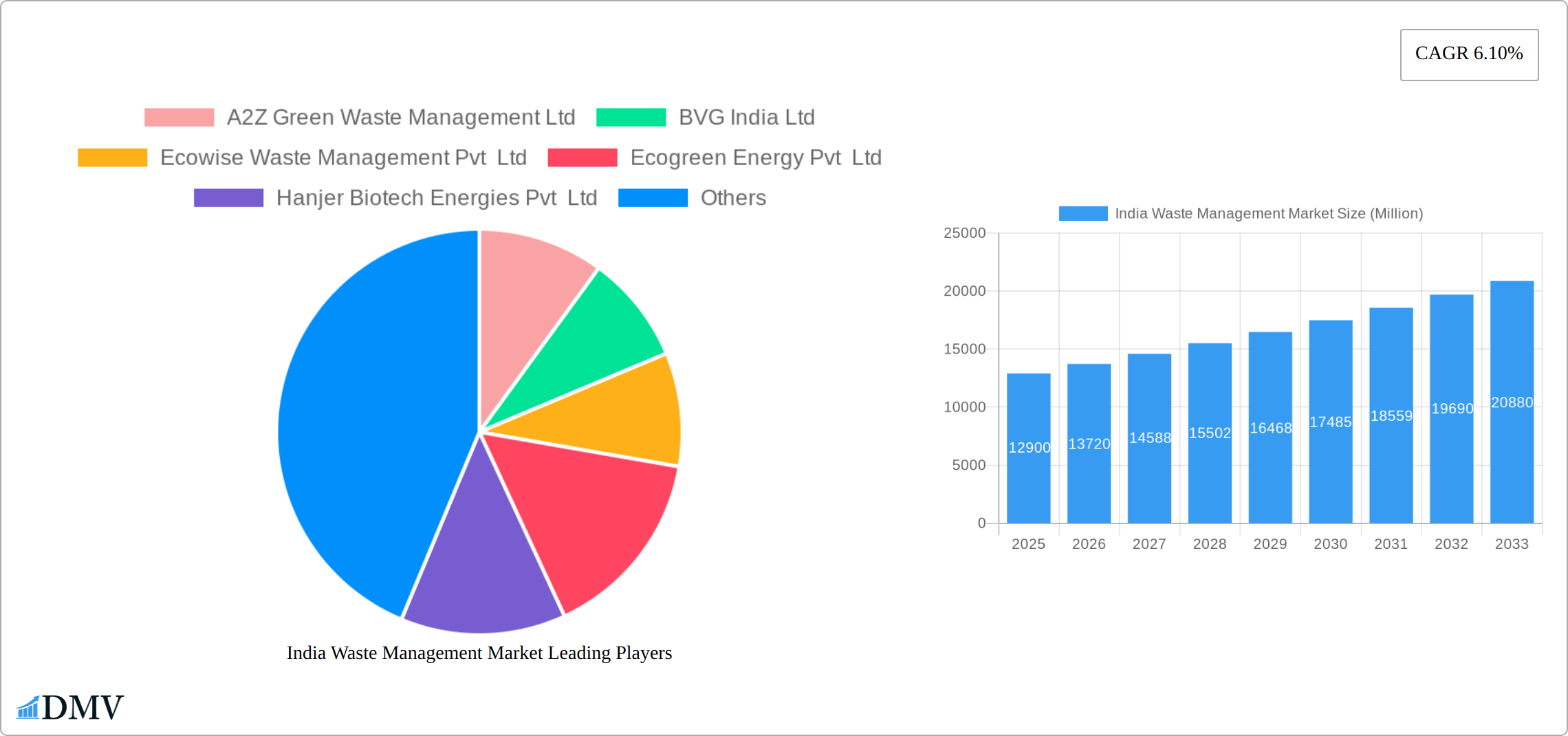

India Waste Management Market Company Market Share

India Waste Management Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning India Waste Management Market, offering invaluable data and projections for stakeholders from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this study unveils the market's composition, evolution, and future potential, providing critical insights for informed decision-making. The market is poised for significant growth, driven by increasing environmental awareness, stringent government regulations, and technological advancements. The total market value is predicted to reach XX Million by 2033.

India Waste Management Market Composition & Trends

This section dissects the competitive landscape, innovative drivers, regulatory framework, and market dynamics of the Indian waste management sector. We analyze market concentration, revealing the market share distribution among key players. The report also explores the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible. Furthermore, we examine the influence of substitute products and evolving end-user profiles.

- Market Concentration: The Indian waste management market exhibits a moderately concentrated structure, with a few large players holding significant market share. The top 5 players account for approximately XX% of the market.

- Innovation Catalysts: Technological advancements, such as AI-powered waste sorting systems and advanced recycling technologies, are driving innovation. Government initiatives promoting sustainable waste management practices further fuel innovation.

- Regulatory Landscape: Stringent government regulations regarding waste disposal and recycling are shaping market dynamics. The implementation of Extended Producer Responsibility (EPR) policies significantly influences industry players.

- Substitute Products: The availability of substitute products and their cost-effectiveness is analyzed, including their impact on market growth.

- End-User Profiles: The report profiles various end-users, including municipalities, industrial sectors, and residential areas, highlighting their specific waste management needs and preferences.

- M&A Activities: The report identifies recent M&A activities in the sector, analyzing their impact on market consolidation and competitive dynamics. Deal values are estimated at XX Million for the period 2019-2024.

India Waste Management Market Industry Evolution

This section charts the evolution of the Indian waste management market, detailing market growth trajectories, technological progress, and changing consumer behavior. We delve into the adoption rates of new technologies and their impact on market expansion. Specific growth rates and adoption metrics are provided, highlighting key market shifts and transformative trends.

(This section would include a detailed paragraph-based analysis of market growth trajectories, technological advancements such as AI-powered sorting, automation in waste collection, and the shift towards circular economy principles, detailing adoption rates and growth figures with specific data points. Example: "The market experienced a CAGR of XX% during the historical period (2019-2024), primarily driven by increasing urbanization and government initiatives. The adoption of advanced recycling technologies is projected to increase by XX% by 2033.")

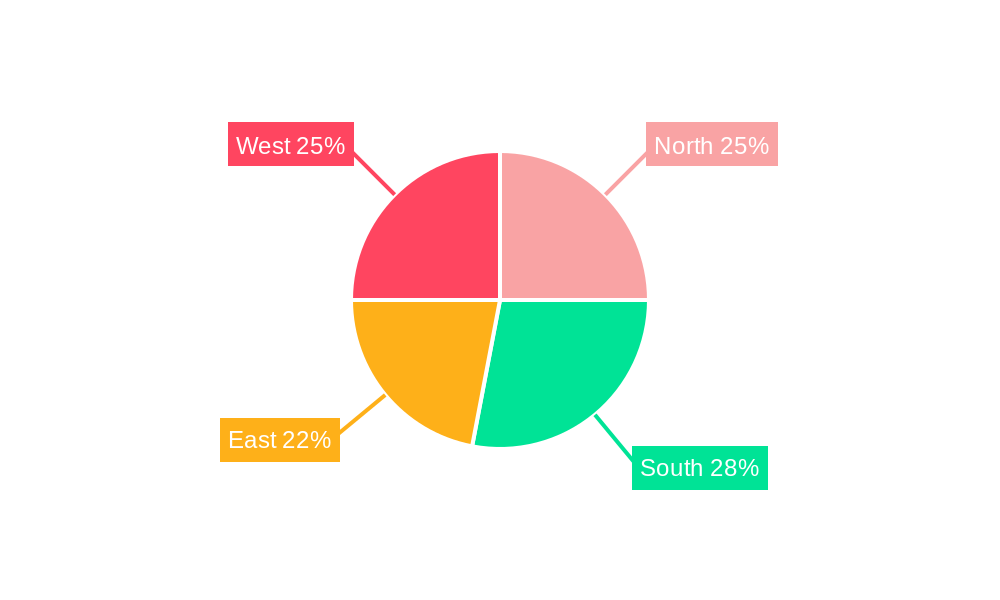

Leading Regions, Countries, or Segments in India Waste Management Market

This section pinpoints the leading regions, countries, or segments within the Indian waste management market, examining the factors contributing to their dominance. The analysis encompasses investment trends, government support, and other key determinants.

- Key Drivers:

- Significant investments in waste management infrastructure in urban centers.

- Favorable government policies and regulations promoting sustainable waste management.

- Growing awareness among consumers about environmental protection and recycling.

- Technological advancements enhancing efficiency and cost-effectiveness of waste management operations.

(This section would include in-depth paragraph-based analysis for each of the leading regions or segments, detailing reasons for dominance with specific examples and data points. For example, a specific region's dominance might be explained by higher per capita waste generation, the presence of large industrial clusters requiring advanced waste management solutions, or robust government initiatives.)

India Waste Management Market Product Innovations

This section showcases recent product innovations, highlighting unique selling propositions and technological advancements that have reshaped the waste management landscape. The analysis encompasses applications and performance metrics of these new products.

(This section would describe innovative products like smart bins, advanced waste sorting systems, and new recycling technologies, detailing their unique selling points and performance metrics such as increased efficiency, reduced costs, and improved waste diversion rates. Example: “The introduction of AI-powered waste sorting systems has significantly increased the efficiency of recycling processes, leading to a XX% increase in recyclable material recovery.”)

Propelling Factors for India Waste Management Market Growth

This section delves into the pivotal drivers orchestrating the expansion of the Indian waste management sector. Our comprehensive analysis integrates technological advancements, robust economic stimuli, and evolving regulatory frameworks, all substantiated by illustrative real-world examples that underscore their tangible impact.

- Rapid Urbanization & Growing Waste Generation: The relentless pace of urbanization across India, coupled with an escalating population and changing consumption patterns, is leading to a substantial increase in the volume and complexity of waste generated. This necessitates more sophisticated and efficient waste management solutions. For instance, metropolitan cities are grappling with managing mixed municipal solid waste (MSW) that includes plastics, organic waste, and construction debris.

- Government Initiatives & Policy Support: The Indian government, through ambitious policies like the Swachh Bharat Mission (SBM), Smart Cities Mission, and the Solid Waste Management Rules, 2016, is actively promoting sustainable waste management practices. These policies mandate segregation at source, encourage recycling and composting, and provide financial incentives for waste-to-energy projects, thereby creating a conducive environment for market growth.

- Technological Innovations & Efficiency Improvements: The adoption of advanced technologies is revolutionizing waste management. Automated collection systems, sensor-based waste bin monitoring, GPS-enabled tracking for collection vehicles, and advanced sorting technologies are significantly enhancing operational efficiency, reducing costs, and improving the overall service delivery. The implementation of GIS mapping for waste collection routes in several urban local bodies exemplifies this trend.

- Growing Environmental Awareness & Corporate Social Responsibility (CSR): A rising consciousness among citizens and corporations regarding environmental sustainability is driving demand for responsible waste disposal and recycling services. Many companies are now investing in waste management solutions as part of their CSR initiatives, further bolstering market expansion.

- Circular Economy Principles: The increasing focus on adopting circular economy principles, which emphasize reducing, reusing, and recycling materials, is a significant growth catalyst. This shift is encouraging the development of value-added products from waste materials and fostering innovation in resource recovery.

Obstacles in the India Waste Management Market

This section meticulously identifies the significant obstacles and restraints that are currently impeding the unhindered growth of the Indian waste management market. Our examination encompasses regulatory complexities, supply chain vulnerabilities, and intense competitive landscapes, with a focus on quantifiable implications where possible.

- Inadequate Infrastructure, Especially in Rural Areas: A substantial gap exists in the availability of modern waste collection, transportation, and processing infrastructure, particularly in Tier-2, Tier-3 cities, and rural regions. This deficiency leads to unscientific dumping, environmental pollution, and health hazards. The lack of organized waste management systems in many peri-urban and rural areas poses a critical challenge.

- Challenges in Waste Segregation at Source: Despite policy mandates, achieving effective waste segregation at the household and commercial levels remains a significant hurdle. Lack of public awareness, inadequate training, and inconsistent enforcement contribute to mixed waste streams, complicating processing and recycling efforts.

- Fluctuations in Raw Material Prices & Market Demand for Recyclables: The profitability of recycling operations is often susceptible to volatility in the prices of recovered raw materials (e.g., plastics, metals). Unpredictable market demand for recyclables can impact the financial viability of waste management enterprises.

- Intense Competition & Pricing Pressures: The presence of numerous small and unorganized players alongside larger, formal entities leads to fierce competition. This can result in price wars, particularly for municipal contracts, potentially squeezing profit margins for established players and hindering investment in advanced technologies.

- Complex Regulatory Landscape & Enforcement Issues: While policies are evolving, navigating the complex and sometimes inconsistent regulatory framework can be challenging for businesses. Issues related to land acquisition for waste processing facilities, obtaining permits, and ensuring consistent enforcement of environmental norms also present obstacles.

- Lack of Skilled Manpower and Technical Expertise: The sector often faces a shortage of skilled labor and technical professionals capable of operating and maintaining advanced waste management technologies, impacting efficiency and scalability.

Future Opportunities in India Waste Management Market

This section illuminates the promising emerging opportunities within the Indian waste management market, with a strategic focus on untapped markets, pioneering technologies, and evolving consumer preferences and corporate mandates.

- Expansion of Waste-to-Energy (WTE) Projects: With increasing waste volumes and a growing need for sustainable energy solutions, the development and scaling up of waste-to-energy plants present a significant opportunity. Government incentives and the potential to reduce landfill dependence are driving this segment.

- E-waste Management and Recycling: The exponential growth of the electronics sector has led to a surge in e-waste. Dedicated e-waste collection, dismantling, and recycling facilities, adhering to global standards, offer substantial growth potential. Companies are increasingly looking for responsible e-waste disposal solutions.

- Rural Waste Management Solutions: The vast, underserved rural market represents a largely untapped opportunity. Developing cost-effective and localized waste management solutions for rural communities, including composting and small-scale recycling initiatives, can unlock significant market potential.

- Specialized Waste Management (Industrial, Hazardous, Biomedical): The increasing stringency of regulations for managing industrial, hazardous, and biomedical waste is creating demand for specialized expertise and infrastructure. Companies offering comprehensive solutions for these niche segments are well-positioned for growth.

- Circular Economy Business Models & Resource Recovery: The shift towards a circular economy fosters opportunities for businesses that can effectively recover valuable resources from waste streams. This includes developing innovative recycling processes, upcycling waste materials into new products, and establishing robust take-back programs.

- Digital Transformation and Smart Waste Management: Leveraging IoT, AI, and data analytics for smart waste collection, route optimization, real-time monitoring, and predictive maintenance will become increasingly crucial, offering opportunities for technology providers and solution developers.

- Extended Producer Responsibility (EPR) Implementation: As EPR regulations become more widespread and stringent across various product categories (e.g., plastics, packaging, electronics), it will drive demand for compliant waste management and recycling services from producers.

Major Players in the India Waste Management Market Ecosystem

This section identifies and profiles the key entities and organizations that are instrumental in shaping and driving the Indian waste management market landscape. The list, while comprehensive, is not exhaustive and aims to represent a cross-section of influential market participants.

- A2Z Green Waste Management Ltd

- BVG India Ltd

- Ecowise Waste Management Pvt Ltd

- Ecogreen Energy Pvt Ltd

- Hanjer Biotech Energies Pvt Ltd

- Tatva Global Environment Ltd

- Waste Ventures India Pvt Ltd

- Hydroair Tectonics (PCD) Ltd

- IL&FS Environmental Infrastructure and Services Ltd

- Jindal ITF Urban Infrastructure Ltd

- Ramky Enviro Engineers Ltd

- SPML Infra Ltd

- List Not Exhaustive

Key Developments in India Waste Management Market Industry

This section meticulously highlights significant recent developments and strategic initiatives within the Indian waste management sector, emphasizing their profound impact on market dynamics, operational efficiencies, and policy evolution.

- August 2023: The Brihanmumbai Municipal Corporation (BMC) has formally adopted the highly successful 'Indore model' of waste management for implementation across Mumbai. This strategic decision signifies a commitment to improving solid waste management (SWM) practices in India's financial capital. The move is anticipated to significantly enhance Mumbai’s waste management efficiency, drawing lessons from Indore's established success in source segregation, collection, and processing.

- March 2023: Bharat Petroleum Corporation Limited (BPCL) has launched the 'Sound Management of Waste Disposal (SMWD)' initiative, underscoring its commitment to environmental sustainability with a specific focus on e-waste reduction and enhanced recycling processes. This proactive initiative not only positions BPCL as a corporate leader in environmental stewardship but also sets a precedent that could inspire other major corporations to adopt similar responsible waste management practices.

- Ongoing Focus on Plastic Waste Management Rules: The continuous enforcement and evolving amendments to the Plastic Waste Management Rules, 2016, including the ban on single-use plastics, are driving innovation in plastic recycling technologies and the development of alternative materials, creating new market opportunities.

- Growth in Public-Private Partnerships (PPPs): There is a noticeable trend towards increasing collaborations between government bodies and private sector players through PPP models. These partnerships are crucial for financing, developing, and operating large-scale waste management infrastructure, including scientific landfills and waste processing plants.

- Increased Investment in Technology for Waste Segregation and Processing: Significant investments are being channeled into advanced technologies for automated waste segregation, composting facilities, and waste-to-energy conversion, aiming to improve the efficiency and economic viability of waste management operations.

Strategic India Waste Management Market Forecast

This section summarizes growth catalysts and future opportunities, highlighting the significant market potential.

(This section would summarize growth catalysts and future opportunities. Example: “The Indian waste management market is poised for significant growth, fueled by supportive government policies, technological advancements, and rising environmental awareness. The focus on sustainable practices and the expansion into new markets promise substantial opportunities for market players.”)

India Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic Waste

- 1.6. Bio-medical Waste

-

2. Disposal Methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of Ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public-private Partnership

India Waste Management Market Segmentation By Geography

- 1. India

India Waste Management Market Regional Market Share

Geographic Coverage of India Waste Management Market

India Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.3. Market Restrains

- 3.3.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.4. Market Trends

- 3.4.1. Increase in amount of waste generated

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of Ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public-private Partnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A2Z Green Waste Management Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BVG India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ecowise Waste Management Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecogreen Energy Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanjer Biotech Energies Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tatva Global Environment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Ventures India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hydroair Tectonics (PCD) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IL&FS Environmental Infrastructure and Services Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jindal ITF Urban Infrastructure Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ramky Enviro Engineers Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SPML Infra Ltd**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 A2Z Green Waste Management Ltd

List of Figures

- Figure 1: India Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 4: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 5: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 6: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 7: India Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 10: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 11: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 12: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 13: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 14: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 15: India Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste Management Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the India Waste Management Market?

Key companies in the market include A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt Ltd, Ecogreen Energy Pvt Ltd, Hanjer Biotech Energies Pvt Ltd, Tatva Global Environment Ltd, Waste Ventures India Pvt Ltd, Hydroair Tectonics (PCD) Ltd, IL&FS Environmental Infrastructure and Services Ltd, Jindal ITF Urban Infrastructure Ltd, Ramky Enviro Engineers Ltd, SPML Infra Ltd**List Not Exhaustive.

3. What are the main segments of the India Waste Management Market?

The market segments include Waste Type, Disposal Methods, Type of Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

6. What are the notable trends driving market growth?

Increase in amount of waste generated.

7. Are there any restraints impacting market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

8. Can you provide examples of recent developments in the market?

August 2023: The Brihanmumbai Municipal Corporation (BMC) analyzed the highly successful 'Indore model' of waste management to enhance solid waste management (SWM) in Mumbai. This approach has contributed to Indore, known as the 'Mini Mumbai' of Madhya Pradesh, maintaining its position as the cleanest city in India for six consecutive years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste Management Market?

To stay informed about further developments, trends, and reports in the India Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence