Key Insights

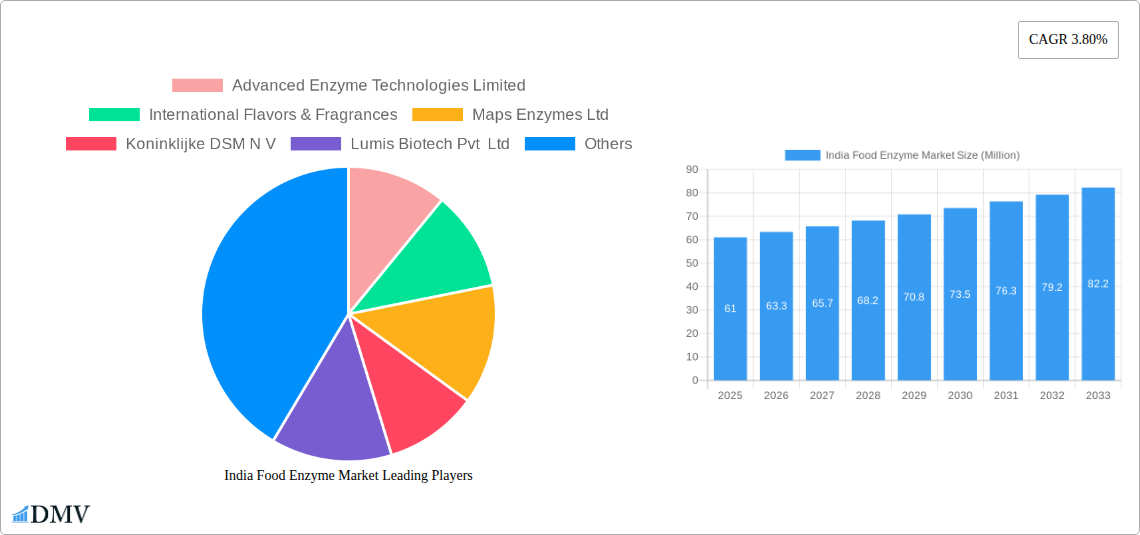

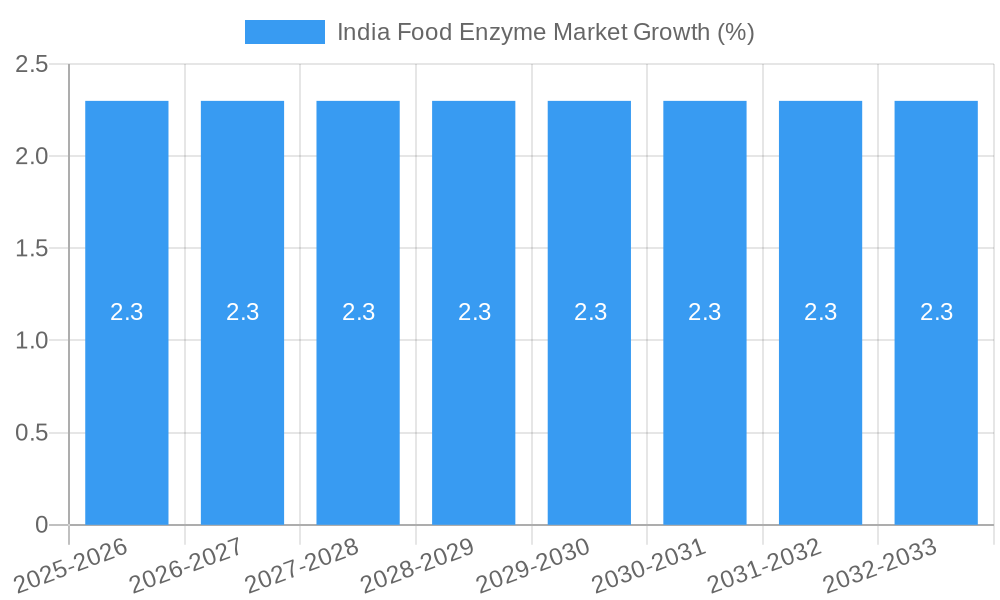

The India food enzyme market, valued at approximately ₹500 million (USD 61 million) in 2025, exhibits robust growth potential, projected to expand at a compound annual growth rate (CAGR) of 3.80% from 2025 to 2033. This expansion is fueled by several key drivers. The rising demand for processed and convenience foods in India's burgeoning middle class is a primary catalyst. Consumers increasingly seek products with extended shelf life, improved texture, and enhanced flavor profiles, all of which are facilitated by the use of food enzymes. Furthermore, the government's initiatives to promote food processing and the growth of organized retail are creating a favorable environment for enzyme adoption. Specific application segments like bakery, confectionery, and dairy products are experiencing particularly strong growth, driven by increasing consumption and evolving consumer preferences. The market is segmented by enzyme type (carbohydrases, proteases, lipases, and others) and application, reflecting the diverse functionalities of enzymes across the food processing value chain. While regulatory hurdles and fluctuations in raw material prices pose some challenges, the overall market outlook remains optimistic, particularly given the expanding adoption of advanced enzyme technologies that offer enhanced performance and efficiency.

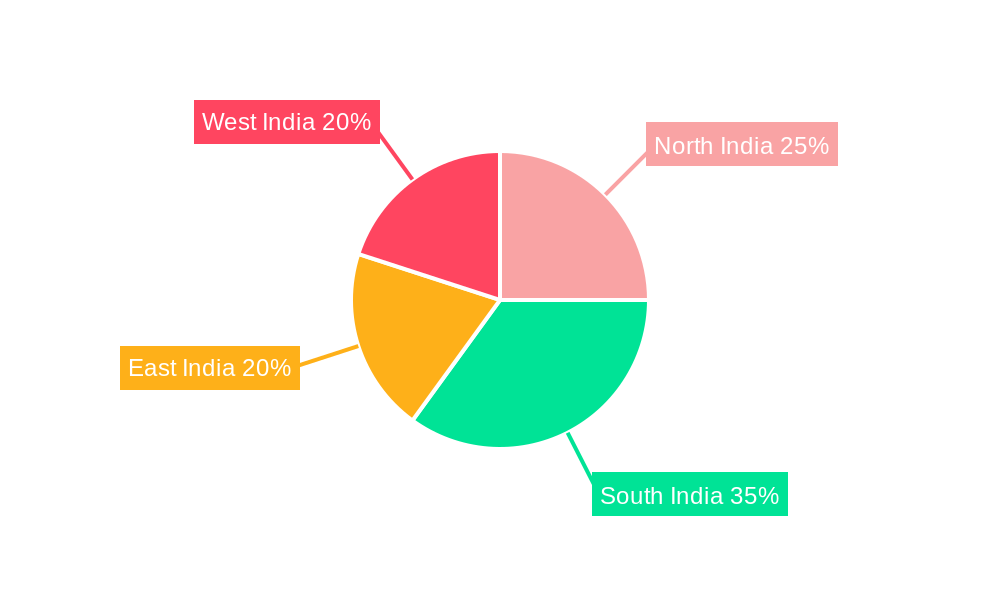

The competitive landscape is dynamic, with both domestic and international players vying for market share. Established global players like Novozymes and DSM compete alongside domestic companies like Advanced Enzyme Technologies and Lumis Biotech. This competition is driving innovation and affordability, making food enzymes more accessible to a wider range of food manufacturers. Regional variations exist, with the South and West India regions currently demonstrating stronger growth compared to other regions. This is attributable to higher industrial concentration and greater consumer demand in these areas. However, future growth is anticipated across all regions as awareness and adoption of food enzymes increase. The forecast period (2025-2033) suggests a significant expansion in market size, indicating that India's food enzyme market is poised to become a key segment within the global food processing industry.

India Food Enzyme Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the India Food Enzyme Market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the market's growth potential. The forecast period covers 2025-2033, while the historical period analyzed is 2019-2024. The market is segmented by type (Carbohydrases, Proteases, Lipases, Other Types) and application (Bakery, Confectionery, Dairy and Frozen Desserts, Meat Poultry and Sea Food Products, Beverages, Other Applications). The total market size is estimated at xx Million in 2025.

India Food Enzyme Market Composition & Trends

The India Food Enzyme Market is characterized by a moderately concentrated landscape, with several multinational and domestic players vying for market share. Key drivers include increasing demand for processed foods, rising health consciousness (driving demand for healthier food processing), and government initiatives promoting the food processing industry. The regulatory landscape, while generally supportive, is constantly evolving, requiring manufacturers to ensure compliance. Substitute products, such as chemical-based alternatives, pose a challenge, but the inherent benefits of enzyme-based solutions (natural, efficient) drive market demand. Mergers and acquisitions (M&A) activities have significantly shaped the market landscape. Recent deals have included:

- February 2021: International Flavors & Fragrances (IFF) merged with DuPont's Nutrition and Biosciences Business, strengthening IFF's position. The deal value was xx Million.

- December 2022: Novozymes and Chr. Hansen's merger agreement represents a significant consolidation in the enzyme industry. The deal value is predicted to be xx Million.

Market share distribution is currently estimated to be as follows: Major players hold approximately 60% of the market share, while smaller players and emerging firms comprise the remaining 40%. Innovation is crucial for companies to remain competitive, with new enzyme applications and enhanced performance characteristics driving growth.

India Food Enzyme Market Industry Evolution

The India Food Enzyme Market has witnessed significant growth over the past few years, driven by factors such as rising disposable incomes, changing consumer preferences towards convenience foods, and increased investment in the food processing sector. The market experienced a CAGR of xx% during the historical period (2019-2024). This growth is projected to continue, with an estimated CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in enzyme engineering and production processes, have led to the development of more efficient and cost-effective enzymes. Consumers are increasingly demanding healthier, more natural food products, further fueling demand for food enzymes. The adoption of enzymes in various food applications continues to grow, with significant penetration observed in the bakery and dairy segments. Specific growth rates vary across segments, with the proteases segment demonstrating the highest growth due to its wide range of applications in meat tenderization, cheese production, and other food processes.

Leading Regions, Countries, or Segments in India Food Enzyme Market

- Dominant Segment: The proteases segment currently holds the largest market share, driven by its extensive use in dairy processing, meat tenderization, and baking.

- Key Drivers:

- Significant Investment: Increased investments from both domestic and international players are fueling expansion.

- Government Support: Government initiatives to modernize the food processing industry and promote exports are aiding growth.

- High Demand: The demand for dairy products and meat is consistently increasing, leading to higher demand for proteases.

- Regional Dominance: The northern and western regions of India lead in consumption due to higher per capita income, a high density of food processing industries, and a growing demand for processed and convenience foods.

The bakery segment showcases substantial growth, propelled by increasing consumption of baked goods and evolving consumer preferences for improved texture and shelf life. The dairy and frozen desserts segment also registers strong growth, fueled by the expanding dairy industry and preference for convenient dessert options.

India Food Enzyme Market Product Innovations

Recent product innovations include the launch of enzymes with improved performance characteristics, such as increased stability, broader pH range, and higher activity levels. Novozymes' launch of "Formea Prime" in January 2021, an enzyme specifically designed for high-protein beverages, exemplifies this trend. This addresses industry challenges associated with whey protein hydrolysates, offering manufacturers improved formulation efficiency and enhancing product quality. The unique selling propositions of these innovative enzymes include improved cost-effectiveness, enhanced product quality, and simplified processing methods. These advancements are driving market growth and enhancing the competitiveness of the Indian food enzyme industry.

Propelling Factors for India Food Enzyme Market Growth

The India Food Enzyme Market is propelled by several factors, including:

- Technological advancements: Continuous improvements in enzyme production and application technologies are creating more efficient and cost-effective solutions.

- Economic growth: The rising disposable incomes of Indian consumers are leading to higher demand for processed foods.

- Favorable regulatory environment: Government policies promoting the food processing industry provide a positive outlook for market growth.

- Changing consumer preferences: Consumers are demanding healthier and more convenient food options, thereby driving the adoption of enzymes in food processing.

Obstacles in the India Food Enzyme Market

Despite the positive growth outlook, several challenges hinder the market's development:

- Regulatory hurdles: Complex regulatory processes and compliance requirements can create barriers to entry for new players.

- Supply chain disruptions: Global supply chain uncertainties can impact the availability and cost of raw materials needed for enzyme production.

- Intense competition: The market is experiencing increasing competition from both domestic and international players, putting downward pressure on profit margins.

Future Opportunities in India Food Enzyme Market

Significant opportunities exist for growth in the India Food Enzyme Market:

- Expansion into new markets: Untapped markets in rural areas and emerging segments (e.g., plant-based foods) offer significant growth potential.

- Technological innovations: The development of novel enzymes with specific functionalities will unlock new applications and enhance market penetration.

- Focus on sustainability: The growing focus on sustainable food production will drive the adoption of environmentally friendly enzymes.

Major Players in the India Food Enzyme Market Ecosystem

- Advanced Enzyme Technologies Limited

- International Flavors & Fragrances

- Maps Enzymes Ltd

- Koninklijke DSM N V

- Lumis Biotech Pvt Ltd

- Nature BioScience Pvt Ltd

- Kerry Group PLC

- Noor Enzymes

- Novozymes A/S

- Infinita Biotech Private Limited

- List Not Exhaustive

Key Developments in India Food Enzyme Market Industry

- January 2021: Novozymes launched "Formea Prime," a new enzyme for high-protein beverages.

- February 2021: International Flavors & Fragrances merged with DuPont's Nutrition and Biosciences Business.

- December 2022: Novozymes and Chr. Hansen agreed to merge, creating a larger player in the food enzyme market.

Strategic India Food Enzyme Market Forecast

The India Food Enzyme Market is poised for sustained growth in the coming years, driven by factors such as increasing demand for processed foods, technological innovations, and supportive government policies. The market's expansion into new applications and geographical regions will further fuel this growth. The projected CAGR of xx% indicates a significant market opportunity for companies operating in this sector. The increasing focus on sustainability and the development of novel enzyme technologies are expected to create even greater opportunities in the years to come.

India Food Enzyme Market Segmentation

-

1. Type

- 1.1. Carbohydrases

- 1.2. Proteases

- 1.3. Lipases

- 1.4. Other Types

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Other Applications

India Food Enzyme Market Segmentation By Geography

- 1. India

India Food Enzyme Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients

- 3.3. Market Restrains

- 3.3.1. Risk of Allergies

- 3.4. Market Trends

- 3.4.1. Rising Demand for Processed Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrases

- 5.1.2. Proteases

- 5.1.3. Lipases

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Food Enzyme Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Advanced Enzyme Technologies Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 International Flavors & Fragrances

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maps Enzymes Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke DSM N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Lumis Biotech Pvt Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nature BioScience Pvt Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Kerry Group PLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Noor Enzymes

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Novozymes A/S

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Infinita Biotech Private Limited*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Advanced Enzyme Technologies Limited

List of Figures

- Figure 1: India Food Enzyme Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Food Enzyme Market Share (%) by Company 2024

List of Tables

- Table 1: India Food Enzyme Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Food Enzyme Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Food Enzyme Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: India Food Enzyme Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Food Enzyme Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Food Enzyme Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Food Enzyme Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Food Enzyme Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: India Food Enzyme Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Food Enzyme Market?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the India Food Enzyme Market?

Key companies in the market include Advanced Enzyme Technologies Limited, International Flavors & Fragrances, Maps Enzymes Ltd, Koninklijke DSM N V, Lumis Biotech Pvt Ltd, Nature BioScience Pvt Ltd, Kerry Group PLC, Noor Enzymes, Novozymes A/S, Infinita Biotech Private Limited*List Not Exhaustive.

3. What are the main segments of the India Food Enzyme Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Clean Label Bakery Products; Increasing Popularity of Specialty Ingredients.

6. What are the notable trends driving market growth?

Rising Demand for Processed Food.

7. Are there any restraints impacting market growth?

Risk of Allergies.

8. Can you provide examples of recent developments in the market?

December 2022: Danish food ingredient and enzyme makers Novozymes and Chr. Hansen agreed to merge. In comparison, both firms produce enzymes, Chr. Hansen focuses on enzymes and microbials for the food industry, and Novozymes' major business areas include enzymes for household products, food and beverages, and biofuels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Food Enzyme Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Food Enzyme Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Food Enzyme Market?

To stay informed about further developments, trends, and reports in the India Food Enzyme Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence