Key Insights

The India baby food market, valued at $1.08 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, increasing awareness of nutritional needs among urban and increasingly rural parents, and a growing preference for convenient and healthy food options contribute significantly to market expansion. The market's growth is further fueled by the rising number of working mothers, who rely on convenient baby food alternatives, and the increasing prevalence of nuclear families. The market is segmented by product type (infant formula, baby cereals, jarred foods, etc.), distribution channel (online, offline), and region. While established players like Nestle, Abbott, and Danone dominate the market, smaller, specialized brands focusing on organic and premium products are gaining traction, catering to the increasing demand for healthier and more natural alternatives. Competitive pricing strategies, product innovation, and effective marketing campaigns play crucial roles in influencing consumer preferences. The government's initiatives promoting maternal and child health further contribute to market expansion by raising awareness and improving access to nutritious baby food.

However, certain factors may pose challenges to the market's growth trajectory. These include fluctuating raw material prices, stringent regulatory requirements, and the potential impact of economic downturns on consumer spending. Furthermore, the penetration of baby food in rural areas remains relatively low compared to urban areas; this presents a significant opportunity for market expansion but also requires targeted strategies to address regional disparities in affordability and access. Nevertheless, the long-term outlook for the India baby food market remains positive, supported by demographic trends and the continued rise in consumer awareness of the importance of early childhood nutrition. The market is expected to maintain a steady growth trajectory in the coming years, making it an attractive space for both established players and new entrants.

India Baby Food Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic India baby food market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on this rapidly evolving sector. The market size in 2025 is estimated at XX Million.

India Baby Food Market Composition & Trends

This section delves into the intricate makeup of the India baby food market, examining key aspects that influence its growth and development. We analyze market concentration, revealing the market share distribution among key players like Nestle SA, Abbott Laboratories, and Danone SA. Innovation catalysts, such as the rising demand for organic and specialized baby foods, are explored, alongside the impact of the regulatory landscape and the presence of substitute products. End-user profiles are examined to understand the diverse needs and preferences of Indian parents. The report also includes an overview of recent mergers and acquisitions (M&A) activities, quantifying deal values where possible. For example, the impact of smaller players like Slurrp Farms and Early Foods on the market share is considered.

- Market Concentration: Nestle SA and Abbott Laboratories hold a significant market share, with a combined XX% in 2025. However, smaller players are increasingly gaining traction through niche offerings.

- Innovation Catalysts: The growing preference for organic, vegetarian, and customized baby foods drives innovation.

- Regulatory Landscape: Stringent food safety regulations and labeling requirements shape market practices.

- Substitute Products: Homemade baby food remains a significant competitor, especially in rural areas.

- End-User Profiles: The report segments consumers based on income, location, and preferences for different baby food types.

- M&A Activities: While specific deal values remain unavailable for some transactions, the report notes a growing number of smaller acquisitions in the sector, reflecting increased consolidation in recent years with an estimated total M&A value of XX Million between 2019 and 2024.

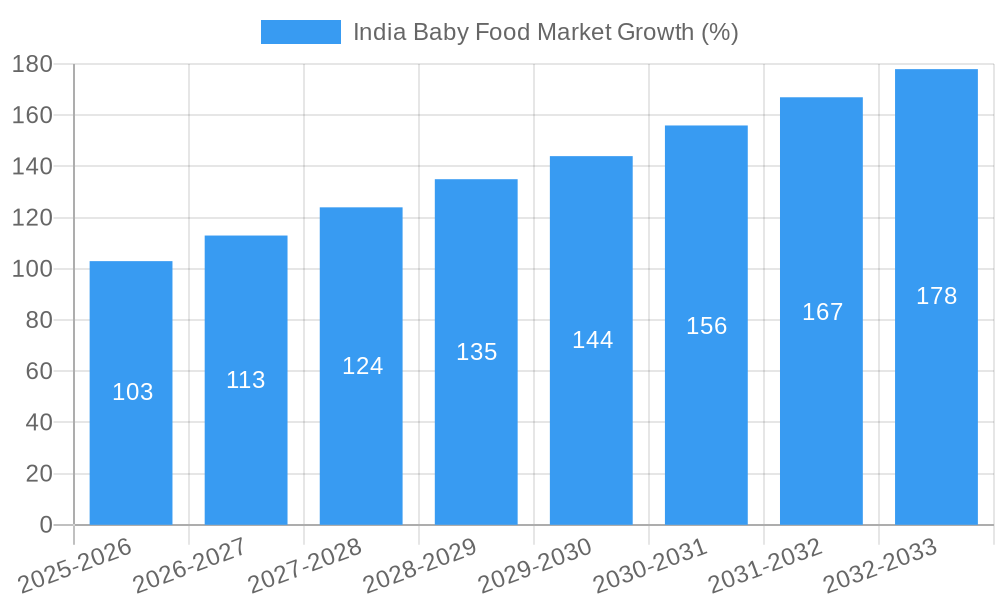

India Baby Food Market Industry Evolution

This section provides a detailed historical analysis (2019-2024) and future projections (2025-2033) of the Indian baby food market. It examines the market's growth trajectories, identifying periods of rapid expansion and any potential slowdowns. Technological advancements, such as improved processing techniques and enhanced packaging solutions, are explored, alongside their impact on market dynamics. Further, we analyze the evolving consumer demands, reflecting the growing preference for healthier, more convenient, and diverse baby food options. The report quantifies these shifts with specific data points, including year-on-year growth rates and adoption metrics for various product categories. The market is anticipated to grow at a CAGR of XX% during the forecast period, reaching an estimated value of XX Million by 2033.

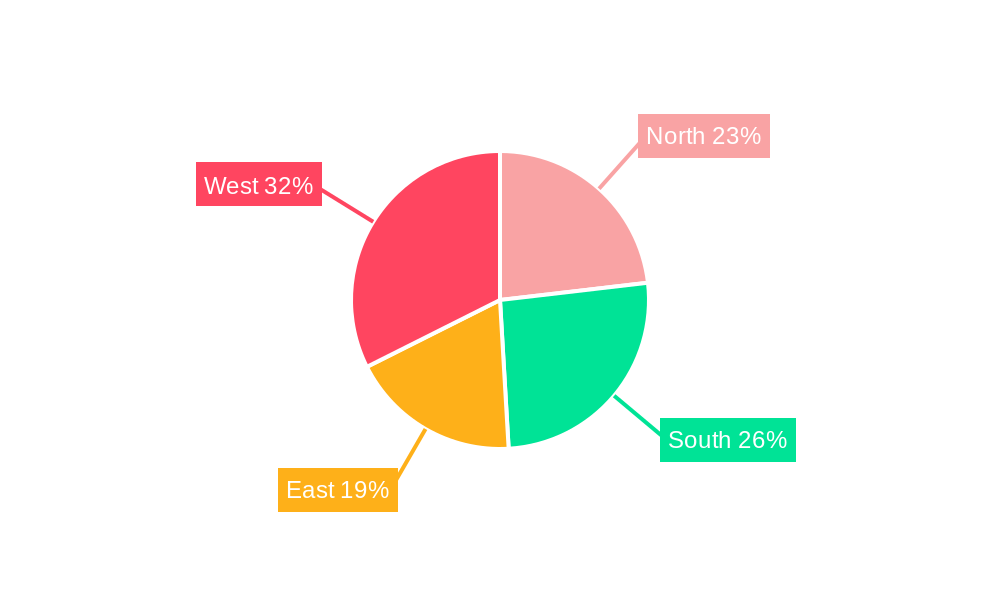

Leading Regions, Countries, or Segments in India Baby Food Market

This section identifies the dominant regions and segments within the India baby food market. We delve into the factors driving their leadership, including investment patterns, government support, and consumer preferences. The report provides an in-depth analysis of the factors contributing to the dominance of specific regions or segments, examining their unique characteristics and growth potential.

- Key Drivers for Dominant Segment/Region:

- Increasing disposable incomes in urban areas.

- Rising awareness of nutrition among parents.

- Government initiatives promoting better infant nutrition.

- Expanding retail infrastructure.

- In-depth Analysis: The report reveals that the urban areas of major metropolitan centers are the fastest-growing segments, driven by increased awareness and higher purchasing power. Rural markets are showing promising growth, indicating the penetration of various baby food products.

India Baby Food Market Product Innovations

This section highlights recent product innovations in the India baby food market. It discusses new product types, improved formulations, and packaging enhancements, alongside the unique selling propositions and technological advancements that drive market appeal. Companies are continually innovating, introducing new formulations, packaging options, and formats to cater to the changing needs and preferences of consumers. These innovations are helping to expand market penetration and drive higher sales.

Propelling Factors for India Baby Food Market Growth

Several key factors contribute to the growth of the India baby food market. These include:

- Technological Advancements: Improved processing and packaging technologies increase shelf life and improve product quality.

- Economic Growth: Rising disposable incomes, particularly in urban areas, fuel increased spending on baby food.

- Regulatory Support: Government initiatives promoting better infant and child nutrition create a favorable market environment.

Obstacles in the India Baby Food Market

Challenges facing the market include:

- Regulatory Hurdles: Stringent regulations, while ensuring product safety, can increase costs and complexity.

- Supply Chain Disruptions: Logistics and distribution challenges can affect product availability and pricing.

- Competitive Pressures: Intense competition among established players and new entrants requires constant innovation and marketing efforts. This has been estimated to reduce profitability by approximately XX% in 2024.

Future Opportunities in India Baby Food Market

The India baby food market presents several promising opportunities:

- Expansion into Rural Markets: Untapped potential in rural areas with increased outreach and affordable products.

- Technological Innovations: Developing products tailored to specific nutritional needs and preferences through customized formulations.

- E-commerce Growth: Leveraging online platforms to reach a wider customer base, potentially creating a XX% increase in sales within five years.

Major Players in the India Baby Food Market Ecosystem

- Amway Corp

- Abbott Laboratories

- Nestle SA

- Danone SA

- Wholesum Foods Private Limited (Slurrp Farms)

- Raptakos Brett & Co Ltd

- Early Foods

- Nascens Enterprises Private Limirted (Happa Foods)

- HiPP International

- Reckitt Benckiser Limited

Key Developments in India Baby Food Market Industry

- August 2024: Baby food startup Babe Burp secured INR 8 crore in pre-series funding, indicating investor confidence in the sector's innovation potential.

- August 2023: Sresta Natural Bioproducts launched an organic frozen baby food line, catering to the growing demand for healthy options.

- December 2022: Mother Nature brand introduced a parent-tested baby food range, highlighting the emphasis on product quality and consumer feedback.

Strategic India Baby Food Market Forecast

The India baby food market is poised for sustained growth, driven by favorable demographics, increasing disposable incomes, and a growing awareness of nutrition. The market's future success hinges on the ability of companies to innovate and adapt to changing consumer preferences, addressing challenges in distribution and regulatory compliance. We anticipate continued strong growth over the forecast period.

India Baby Food Market Segmentation

-

1. Category

- 1.1. Organic

- 1.2. Conventional

-

2. Product Type

- 2.1. Milk Formula

- 2.2. Dried Baby Food

- 2.3. Ready to Eat Baby Food

- 2.4. Other Product Types

-

3. Distribution Channels

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Pharmacies/Drug Stores

- 3.4. Online Retail Stores

- 3.5. Other Distribution Channels

India Baby Food Market Segmentation By Geography

- 1. India

India Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Escalating Investment in Baby Food Market; Increasing Consciousness About Infant Health And Nutrition

- 3.3. Market Restrains

- 3.3.1. Escalating Investment in Baby Food Market; Increasing Consciousness About Infant Health And Nutrition

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Organic Baby Food is Gaining Momentum

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Organic

- 5.1.2. Conventional

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Milk Formula

- 5.2.2. Dried Baby Food

- 5.2.3. Ready to Eat Baby Food

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channels

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Pharmacies/Drug Stores

- 5.3.4. Online Retail Stores

- 5.3.5. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Amway Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abbott Laboratories

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestle SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Danone SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wholesum Foods Private Limited (Slurrp Farms)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Raptakos Brett & Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Early Foods

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nascens Enterprises Private Limirted (Happa Foods)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 HiPP International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Reckitt Benckiser Limited LL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amway Corp

List of Figures

- Figure 1: India Baby Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Baby Food Market Share (%) by Company 2024

List of Tables

- Table 1: India Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Baby Food Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Baby Food Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: India Baby Food Market Volume Billion Forecast, by Category 2019 & 2032

- Table 5: India Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: India Baby Food Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 7: India Baby Food Market Revenue Million Forecast, by Distribution Channels 2019 & 2032

- Table 8: India Baby Food Market Volume Billion Forecast, by Distribution Channels 2019 & 2032

- Table 9: India Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Baby Food Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: India Baby Food Market Revenue Million Forecast, by Category 2019 & 2032

- Table 12: India Baby Food Market Volume Billion Forecast, by Category 2019 & 2032

- Table 13: India Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: India Baby Food Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 15: India Baby Food Market Revenue Million Forecast, by Distribution Channels 2019 & 2032

- Table 16: India Baby Food Market Volume Billion Forecast, by Distribution Channels 2019 & 2032

- Table 17: India Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Baby Food Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Baby Food Market?

The projected CAGR is approximately 8.91%.

2. Which companies are prominent players in the India Baby Food Market?

Key companies in the market include Amway Corp, Abbott Laboratories, Nestle SA, Danone SA, Wholesum Foods Private Limited (Slurrp Farms), Raptakos Brett & Co Ltd, Early Foods, Nascens Enterprises Private Limirted (Happa Foods), HiPP International, Reckitt Benckiser Limited LL.

3. What are the main segments of the India Baby Food Market?

The market segments include Category, Product Type, Distribution Channels.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Escalating Investment in Baby Food Market; Increasing Consciousness About Infant Health And Nutrition.

6. What are the notable trends driving market growth?

Increasing Demand for Organic Baby Food is Gaining Momentum.

7. Are there any restraints impacting market growth?

Escalating Investment in Baby Food Market; Increasing Consciousness About Infant Health And Nutrition.

8. Can you provide examples of recent developments in the market?

August 2024: Baby food startup brand Babe Burp funded INR 8 crore in a pre-series in collaboration with a venture capital fund, Gruhas Collective Consumer Fund. The purpose of this collaboration was to innovate baby food products.August 2023: Sresta Natural Bioproducts has launched a new line of organic baby and children's food products. Targeting children aged six months to four years, these offerings cater to the youngest demographic. The frozen food range includes a variety of items such as bread, rotis, chapatis, and samosas.December 2022: Mother Nature brand launched a parent-tested baby food range. The products are claimed to be nutritious, preservative-free, and appetizing. The products are available in 12 different fruit flavors including fruits and vegetables.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Baby Food Market?

To stay informed about further developments, trends, and reports in the India Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence