Key Insights

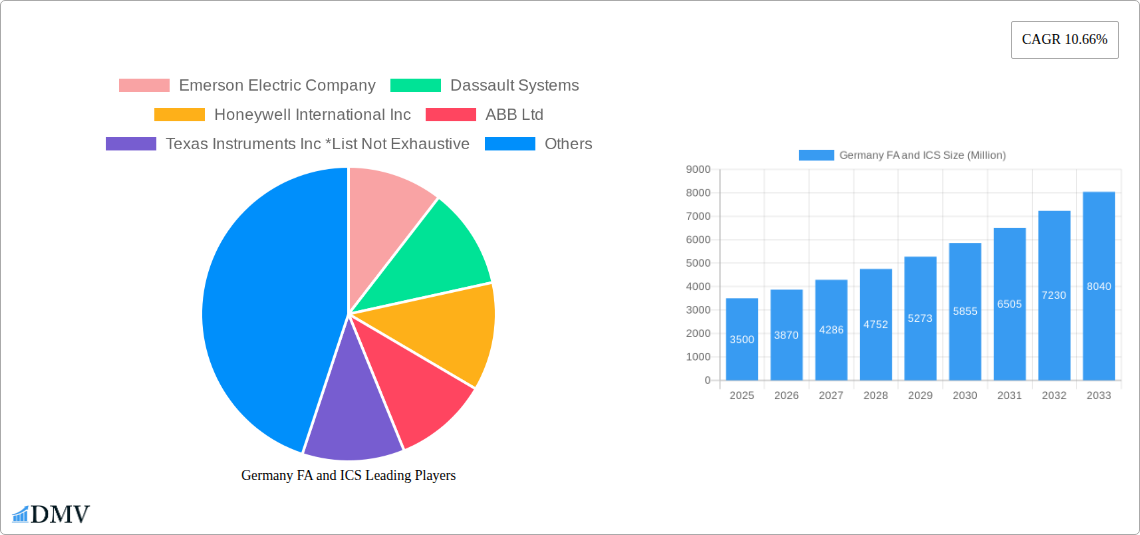

The German Factory Automation (FA) and Industrial Control Systems (ICS) market is experiencing robust growth, driven by increasing automation across various sectors, particularly in the automotive, chemical, and energy industries. The market's considerable size, estimated at several billion Euros in 2025 (precise figure unavailable but extrapolated from global market data and the given CAGR of 10.66%), reflects a strong commitment to enhancing efficiency and productivity. Key drivers include the rising adoption of Industry 4.0 technologies, such as Industrial Internet of Things (IIoT), cloud computing, and advanced analytics. These technologies enable real-time monitoring, predictive maintenance, and improved operational efficiency, leading to significant cost savings and competitive advantages for German manufacturers. Furthermore, government initiatives promoting digitalization and sustainability are accelerating the adoption of FA and ICS solutions. While data on specific market segment sizes within Germany is not provided, the strong presence of major global players like Siemens, Bosch, and ABB in Germany highlights the region's significance within the global FA and ICS landscape. The specific contribution of field devices within the broader ICS segment is substantial given their critical role in industrial automation, and segments like oil and gas, chemicals, and power utilities are likely to represent a significant portion of the overall market value.

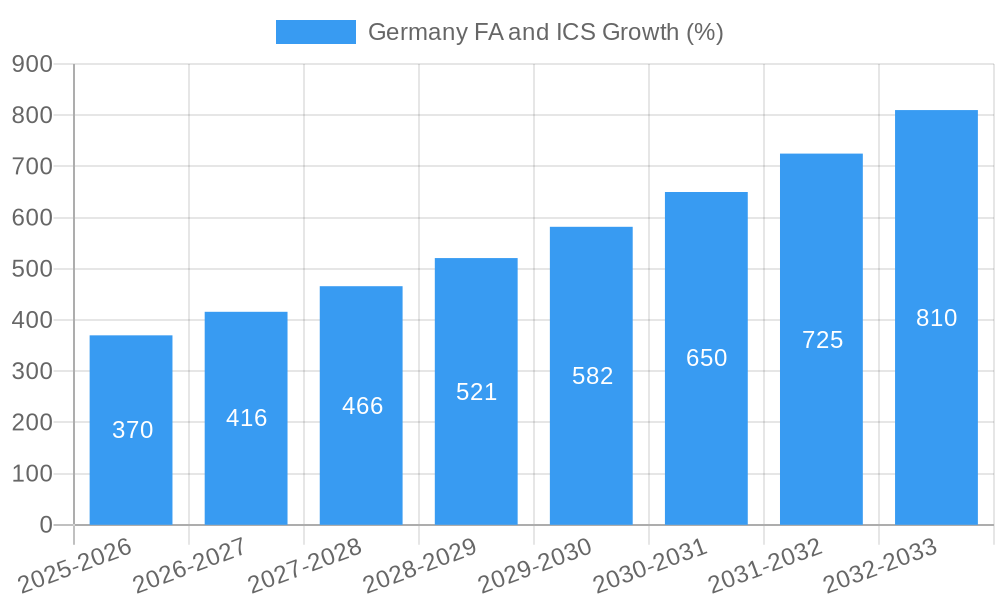

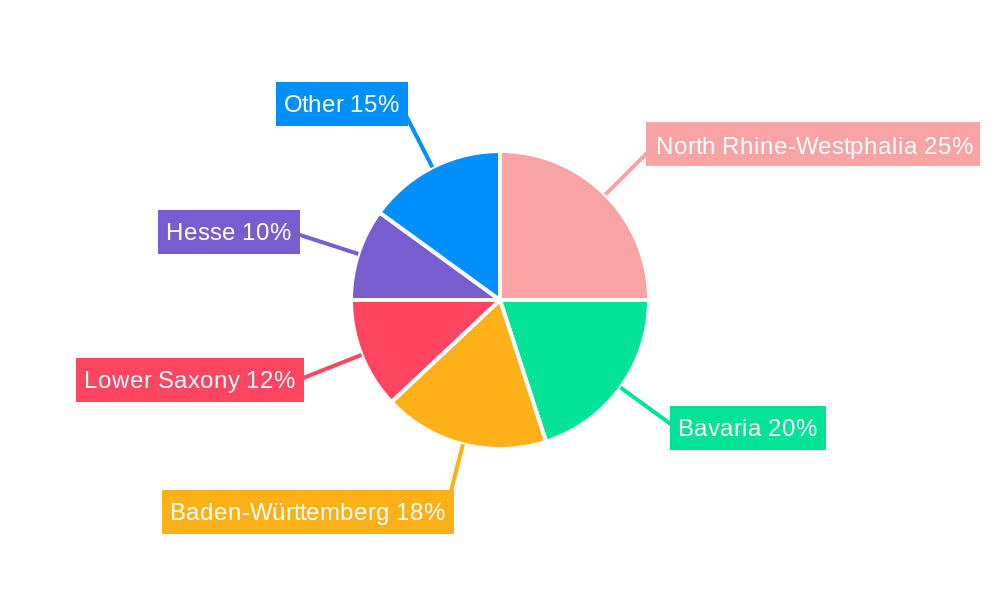

The projected Compound Annual Growth Rate (CAGR) of 10.66% indicates sustained growth throughout the forecast period (2025-2033). However, market growth may be influenced by factors such as the global economic climate, supply chain disruptions, and the availability of skilled labor to implement and maintain advanced automation systems. Despite these potential restraints, the long-term outlook for the German FA and ICS market remains positive, fueled by continuous technological advancements and the ongoing digital transformation across industries. The concentration of key players in regions like North Rhine-Westphalia, Bavaria, and Baden-Württemberg underscores the geographical distribution of this dynamic market. Regional differences in industrial activity and government policies might contribute to variations in growth rates across these regions. Further research is needed to fully quantify the impact of each segment and region on the overall market size and growth.

Germany FA and ICS Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany Factory Automation (FA) and Industrial Control Systems (ICS) market, offering a comprehensive overview of market dynamics, technological advancements, and future growth potential. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report incorporates data from the historical period of 2019-2024 and provides estimated values for 2025. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting substantial growth.

Germany FA and ICS Market Composition & Trends

This section delves into the competitive landscape of the German FA and ICS market, examining market concentration, innovation drivers, regulatory frameworks, and the impact of mergers and acquisitions (M&A) activities. We analyze the market share distribution among key players, including Emerson Electric Company, Dassault Systèmes, Honeywell International Inc, ABB Ltd, Texas Instruments Inc, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Autodesk Inc, Robert Bosch GmbH, and Rockwell Automation Inc (list not exhaustive). The report also explores the influence of substitute products and evolving end-user profiles across diverse sectors.

- Market Concentration: The German FA and ICS market exhibits a moderately concentrated structure, with a few dominant players holding significant market share. The top five companies account for approximately xx% of the total market.

- Innovation Catalysts: The industry is driven by advancements in artificial intelligence (AI), Internet of Things (IoT), and cloud computing, fostering the development of smart factories and automated systems.

- Regulatory Landscape: Stringent regulations concerning data security and industrial safety significantly influence market developments and adoption rates.

- M&A Activity: The past five years have witnessed xx Million in M&A deals within the German FA and ICS sector, reflecting consolidation trends and strategic expansion efforts by major players.

Germany FA and ICS Industry Evolution

This section analyzes the evolution of the German FA and ICS industry, focusing on market growth trajectories, technological innovation, and shifting consumer demands from 2019 to 2033. We examine the factors driving market growth, including increasing automation needs across various industries, the adoption of Industry 4.0 technologies, and government initiatives promoting digitalization. The report quantifies these trends, providing specific data points like compound annual growth rates (CAGR) and adoption rates for key technologies. The German market’s unique characteristics, including its strong manufacturing base and commitment to technological advancement, are highlighted. The forecast for 2025-2033 shows a projected CAGR of xx%, driven by increased adoption of advanced automation solutions and a rising demand for enhanced operational efficiency across industries like automotive, chemicals, and energy.

Leading Regions, Countries, or Segments in Germany FA and ICS

This section identifies the leading regions, countries, or segments within the German FA and ICS market. Analysis focuses on key drivers for dominance across various categories, including:

- By Type: Industrial Control Systems consistently holds the largest market share due to its essential role in industrial processes. Other Industrial Control Systems, particularly field devices, are experiencing robust growth, driven by increasing demand for enhanced monitoring and control capabilities.

- By End-user Industry: The Chemical and Petrochemical sector is a key driver of market growth, followed closely by the Automotive and Transportation industry and the Power and Utilities sector. These industries exhibit significant investments in automation and digitalization to enhance productivity and efficiency.

- Key Drivers:

- Significant Investments: Large-scale investments in automation and digital transformation initiatives by end-user industries.

- Government Support: Government policies and initiatives aimed at promoting industrial modernization and digitalization in Germany.

- Technological Advancements: Continuous innovation in Industrial Control Systems and related technologies.

Germany FA and ICS Product Innovations

Recent years have witnessed significant innovation in the German FA and ICS market. New products featuring advanced functionalities, such as predictive maintenance capabilities, enhanced cybersecurity features, and improved human-machine interfaces, are gaining traction. This is driven by the increased need for robust, secure, and efficient industrial control systems, reflecting the broader Industry 4.0 trend. The integration of AI and machine learning algorithms enables real-time data analysis, optimizing performance and predictive maintenance.

Propelling Factors for Germany FA and ICS Growth

Several factors contribute to the growth of the German FA and ICS market. Technological advancements like AI, IoT, and cloud computing are pivotal. Government initiatives promoting Industry 4.0 and digitalization further stimulate growth. Robust economic conditions in Germany create a favorable environment for investments in automation. Finally, the growing emphasis on operational efficiency and productivity across various industries fuels demand.

Obstacles in the Germany FA and ICS Market

Despite significant growth potential, certain obstacles hinder market expansion. These include regulatory complexities related to data security and industrial safety compliance, which can increase implementation costs and timelines. Supply chain disruptions, particularly concerning crucial components, can impact production and delivery schedules. Intense competition among established players and emerging entrants adds another layer of complexity.

Future Opportunities in Germany FA and ICS

Future growth opportunities in Germany's FA and ICS market include expanding into new application areas within various industries, leveraging emerging technologies like edge computing and blockchain for enhanced security and data management, and capitalizing on rising demand for sustainable and energy-efficient automation solutions. The growing adoption of collaborative robots (cobots) and digital twins also presents significant potential.

Major Players in the Germany FA and ICS Ecosystem

- Emerson Electric Company

- Dassault Systèmes

- Honeywell International Inc

- ABB Ltd

- Texas Instruments Inc

- Mitsubishi Electric Corporation

- Siemens AG

- Schneider Electric SE

- Autodesk Inc

- Robert Bosch GmbH

- Rockwell Automation Inc

Key Developments in Germany FA and ICS Industry

- July 2020: K+S, an international mining company, implemented an AP Sensing Linear Heat Detection (LHD) solution for enhanced fire safety at a German salt production site, showcasing the adoption of advanced safety technologies.

- March 2021: BP and SABIC's collaboration in Gelsenkirchen, Germany, focuses on increasing the production of certified circular products from recycled plastics, highlighting the growing importance of sustainability within the chemical sector and impacting the demand for efficient and adaptable FA and ICS solutions within the petrochemical industry.

Strategic Germany FA and ICS Market Forecast

The German FA and ICS market is poised for significant growth, driven by ongoing technological advancements, strong government support for digitalization, and increasing demand for automation across various sectors. The market's future potential is substantial, with continued expansion expected across key segments like industrial control systems and specific end-user industries. The forecast indicates substantial growth opportunities for innovative companies offering advanced solutions that address the evolving needs of German manufacturers.

Germany FA and ICS Segmentation

-

1. Type

-

1.1. Industrial Control Systems

- 1.1.1. Distributed Control System (DCS)

- 1.1.2. Programable Logic Controller (PLC)

- 1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 1.1.4. Product Lifecycle Management (PLM)

- 1.1.5. Manufacturing Execution System (MES)

- 1.1.6. Human Machine Interface (HMI)

- 1.1.7. Other Industrial Control Systems

-

1.2. Field Devices

- 1.2.1. Machine Vision

- 1.2.2. Industrial Robotics

- 1.2.3. Electric Motors

- 1.2.4. Safety Systems

- 1.2.5. Sensors & Transmitters

- 1.2.6. Other Field Devices

-

1.1. Industrial Control Systems

-

2. End-user Industry

- 2.1. Oil and Gas

- 2.2. Chemical and Petrochemical

- 2.3. Power and Utilities

- 2.4. Food and Beverage

- 2.5. Automotive and Transportation

- 2.6. Pharmaceutical

- 2.7. Other End-user Industries

Germany FA and ICS Segmentation By Geography

- 1. Germany

Germany FA and ICS REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.66% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement

- 3.3. Market Restrains

- 3.3.1. ; High Initial Investment and Maintenance Costs

- 3.4. Market Trends

- 3.4.1. Electric Motors Segment is Observing Significant Increase

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Control Systems

- 5.1.1.1. Distributed Control System (DCS)

- 5.1.1.2. Programable Logic Controller (PLC)

- 5.1.1.3. Supervisory Control and Data Acquisition (SCADA)

- 5.1.1.4. Product Lifecycle Management (PLM)

- 5.1.1.5. Manufacturing Execution System (MES)

- 5.1.1.6. Human Machine Interface (HMI)

- 5.1.1.7. Other Industrial Control Systems

- 5.1.2. Field Devices

- 5.1.2.1. Machine Vision

- 5.1.2.2. Industrial Robotics

- 5.1.2.3. Electric Motors

- 5.1.2.4. Safety Systems

- 5.1.2.5. Sensors & Transmitters

- 5.1.2.6. Other Field Devices

- 5.1.1. Industrial Control Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and Gas

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Power and Utilities

- 5.2.4. Food and Beverage

- 5.2.5. Automotive and Transportation

- 5.2.6. Pharmaceutical

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North Rhine-Westphalia Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany FA and ICS Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Emerson Electric Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ABB Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texas Instruments Inc *List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mitsubishi Electric Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Autodesk Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Robert Bosch GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rockwell Automation Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Emerson Electric Company

List of Figures

- Figure 1: Germany FA and ICS Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany FA and ICS Share (%) by Company 2024

List of Tables

- Table 1: Germany FA and ICS Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany FA and ICS Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Germany FA and ICS Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Germany FA and ICS Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Germany FA and ICS Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North Rhine-Westphalia Germany FA and ICS Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Bavaria Germany FA and ICS Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Baden-Württemberg Germany FA and ICS Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Lower Saxony Germany FA and ICS Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Hesse Germany FA and ICS Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Germany FA and ICS Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Germany FA and ICS Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 13: Germany FA and ICS Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany FA and ICS?

The projected CAGR is approximately 10.66%.

2. Which companies are prominent players in the Germany FA and ICS?

Key companies in the market include Emerson Electric Company, Dassault Systems, Honeywell International Inc, ABB Ltd, Texas Instruments Inc *List Not Exhaustive, Mitsubishi Electric Corporation, Siemens AG, Schneider Electric SE, Autodesk Inc, Robert Bosch GmbH, Rockwell Automation Inc.

3. What are the main segments of the Germany FA and ICS?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Gaining Prominence for Automation Technologies; Increasing Focus Towards Cost Optimization and Business Process Improvement.

6. What are the notable trends driving market growth?

Electric Motors Segment is Observing Significant Increase.

7. Are there any restraints impacting market growth?

; High Initial Investment and Maintenance Costs.

8. Can you provide examples of recent developments in the market?

March 2021 - BP and SABIC (Saudi Basic Industries Corp.), Riyadh, Saudi Arabia, signed an agreement to jointly work at the Gelsenkirchen, Germany, a chemical complex. The companies say the new collaboration will help to increase the production of certified circular products that take used mixed plastics to make feedstock, reducing the number of fossil resources required in the petrochemical plants at the site.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany FA and ICS," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany FA and ICS report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany FA and ICS?

To stay informed about further developments, trends, and reports in the Germany FA and ICS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence