Key Insights

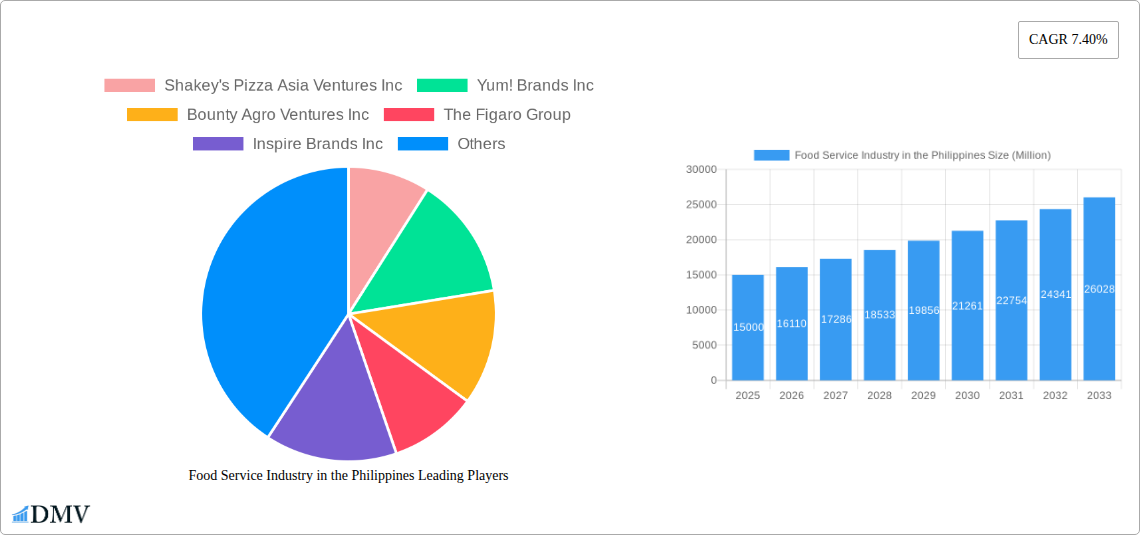

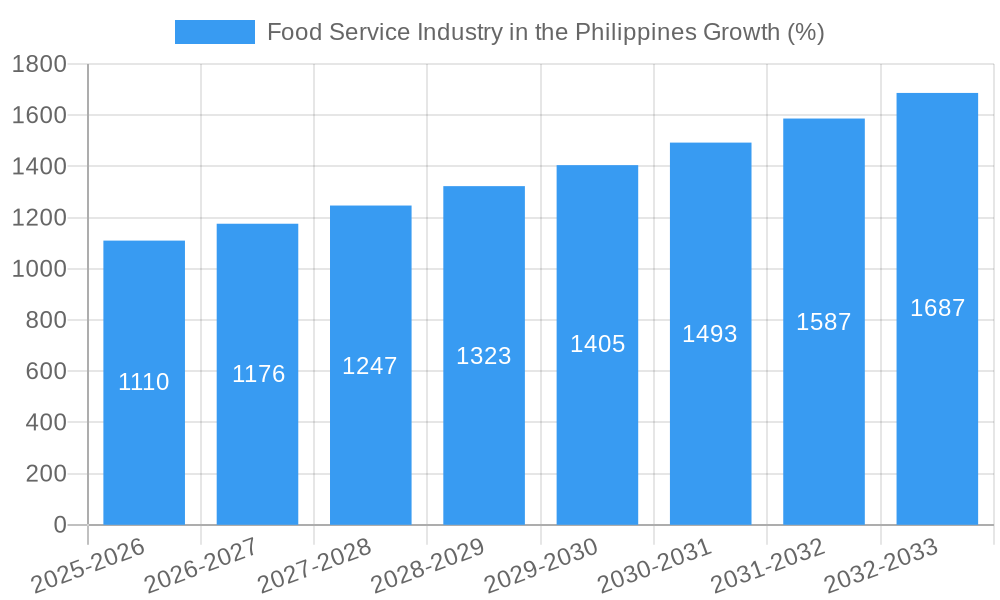

The Philippine food service industry, valued at approximately \$XX million in 2025, exhibits robust growth potential, projected to expand at a 7.40% CAGR from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes and a burgeoning young population with increasing spending power are driving demand for diverse dining experiences. Tourism, a significant contributor to the economy, further boosts the industry, with both domestic and international travelers contributing to restaurant revenue. The shift towards convenience and the growing popularity of quick-service restaurants (QSRs) and cafes are also shaping market dynamics. While the industry faces challenges such as rising food costs and labor shortages, these are largely offset by the strong underlying growth drivers. Segmentation reveals a diverse landscape: the chained outlet segment is expected to continue its dominance, but independent outlets are also experiencing growth, driven by entrepreneurial spirit and the rise of unique culinary offerings. Further market segmentation into leisure, lodging, retail, standalone, and travel segments reveals varied growth trajectories. For instance, the travel segment's growth is closely tied to tourism trends. Within foodservice types, cafes and bars, along with other QSR cuisines, demonstrate strong performance, adapting to evolving consumer preferences. The key players, including Jollibee Foods Corporation, Golden Arches Development Corporation, and Starbucks Corporation, are strategically positioning themselves to capitalize on these trends.

The competitive landscape is characterized by both established international and homegrown brands vying for market share. While established players benefit from brand recognition and economies of scale, the emergence of innovative independent outlets and niche cuisine offerings adds dynamism to the market. To sustain growth, industry players are increasingly focusing on technological advancements, such as online ordering and delivery platforms, to enhance customer experience and expand reach. Furthermore, adapting to evolving consumer preferences for healthier and sustainable options is becoming crucial for success. The sustained growth outlook for the Philippines food service sector presents substantial opportunities for both established players and new entrants, provided they can successfully navigate the evolving dynamics of this competitive market.

Food Service Industry in the Philippines: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the dynamic Philippine food service industry, encompassing market size, segmentation, competitive landscape, and future projections. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into the key players, innovative trends, and growth drivers shaping this lucrative sector, offering valuable insights for stakeholders including investors, operators, and industry professionals. The report projects a market valuation exceeding xx Million by 2033.

Food Service Industry in the Philippines Market Composition & Trends

The Philippine food service industry exhibits a diverse landscape, characterized by both established giants and burgeoning local players. Market concentration is moderately high, with Jollibee Foods Corporation and Golden Arches Development Corporation (McDonald's) holding significant market share. However, the rise of independent outlets and diverse QSR cuisines indicates a dynamic competitive environment. Innovation is driven by evolving consumer preferences for healthier options, unique flavors, and convenient delivery services. The regulatory landscape, while generally supportive, faces ongoing challenges in maintaining food safety standards and streamlining licensing procedures. Substitute products, such as home-cooked meals and ready-to-eat packaged foods, pose a degree of competition, especially in the lower-income segments. End-user profiles range from budget-conscious consumers to affluent individuals seeking premium dining experiences. M&A activities have been significant, with deal values exceeding xx Million in recent years, reflecting consolidation and expansion strategies within the sector.

- Market Share Distribution (2024 Estimate): Jollibee Foods Corporation (xx%), Golden Arches Development Corporation (xx%), other players (xx%).

- M&A Deal Value (2019-2024): Over xx Million.

- Key Innovation Catalysts: Growing demand for healthy and convenient food, technological advancements in ordering and delivery.

Food Service Industry in the Philippines Industry Evolution

The Philippine food service industry has witnessed remarkable growth over the past five years (2019-2024), driven by a burgeoning middle class, rising disposable incomes, and increasing urbanization. The sector has experienced a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024), and is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033). Technological advancements, particularly in online ordering and delivery platforms, have significantly reshaped the industry, boosting accessibility and convenience for consumers. Consumer preferences are shifting towards healthier choices, personalized experiences, and diverse culinary offerings, driving innovation in menu development and service models. The industry is witnessing a growing trend of food delivery services with significant penetration from platforms like Grab Food and Foodpanda. Adoption of digital payment methods continues to grow.

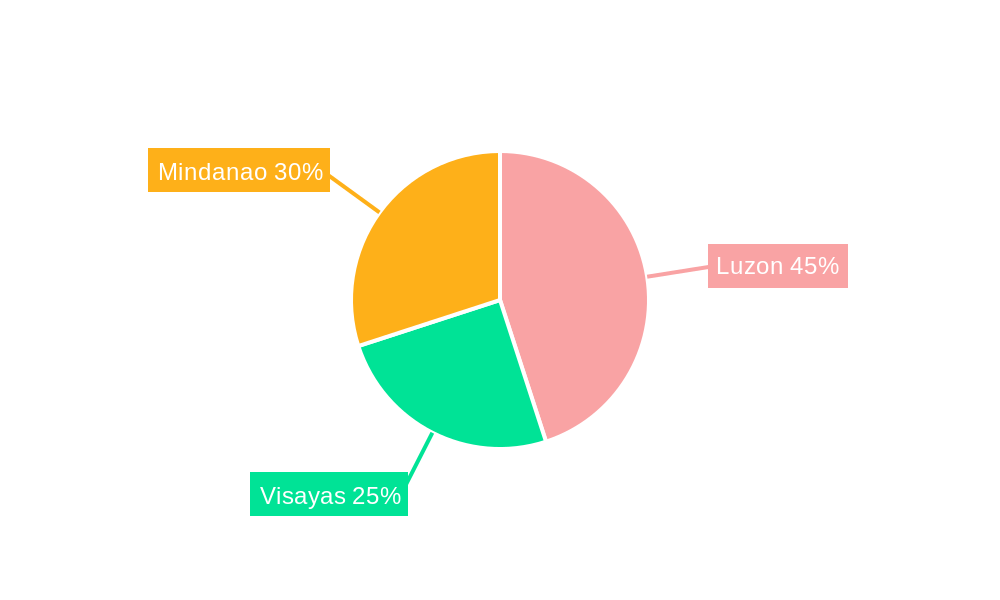

Leading Regions, Countries, or Segments in Food Service Industry in the Philippines

The National Capital Region (NCR) and other major urban centers dominate the Philippine food service market. This dominance is fueled by higher population density, increased purchasing power, and high tourist footfall.

Key Drivers:

- High Population Density & Purchasing Power: NCR and major cities have a higher concentration of people with disposable income, leading to a greater demand for food services.

- Tourism: The influx of tourists significantly boosts the demand, particularly within the leisure and lodging segments.

- Investment Trends: Significant investments in new restaurant concepts and infrastructure further contribute to the concentration in urban areas.

Dominance Factors:

The concentration of chained outlets in major urban areas highlights the preference for established brands and consistent service quality. The prevalence of Cafes & Bars and Other QSR Cuisines within these chained outlets points towards consumer demand for diverse and convenient food options. The Retail segment within the urban landscape also demonstrates the significant importance of accessible food service options for consumers who are shopping.

Food Service Industry in the Philippines Product Innovations

Recent innovations include the expansion of plant-based menu options, personalized meal customization through mobile apps, and the integration of technology to streamline operations, such as automated ordering kiosks and robotic food preparation. These innovations aim to enhance customer experience, improve operational efficiency and appeal to evolving consumer preferences. Unique selling propositions center around convenience, health consciousness, and unique culinary experiences.

Propelling Factors for Food Service Industry in the Philippines Growth

Several factors drive the growth of the Philippine food service industry. Technological advancements such as online ordering and delivery platforms have significantly increased accessibility and convenience. Economic growth, rising disposable incomes, and a burgeoning middle class fuel demand for diverse and high-quality food experiences. Supportive government policies and regulatory frameworks also contribute to industry expansion.

Obstacles in the Food Service Industry in the Philippines Market

The industry faces challenges such as rising food costs and fluctuating supply chain dynamics impacting profitability. Intense competition amongst established players and new entrants creates price pressures. Regulatory compliance and obtaining licenses can prove demanding for businesses, especially smaller ones. These factors can limit industry growth if not addressed strategically.

Future Opportunities in Food Service Industry in the Philippines

Emerging opportunities lie in the expansion of cloud kitchens, the rise of personalized meal plans, and increased adoption of sustainable practices. The growing demand for healthier food options presents opportunities for brands that cater to wellness-conscious consumers. Expansion into less-served regions of the country also holds substantial growth potential.

Major Players in the Food Service Industry in the Philippines Ecosystem

- Jollibee Foods Corporation

- Golden Arches Development Corporation

- Shakey's Pizza Asia Ventures Inc

- Yum! Brands Inc

- Bounty Agro Ventures Inc

- The Figaro Group

- Inspire Brands Inc

- Seven & I Holdings Co Ltd

- Mary Grace Foods Inc

- Maxs Group Inc

- Udenna Group

- Domino's Pizza Inc

- Berjaya Corporation Bhd

- Starbucks Corporation

- Restaurant Brands International Inc

Key Developments in Food Service Industry in the Philippines Industry

- October 2023: Starbucks launched two new ice cream-based drinks in the Philippines, boosting sales and attracting new customers.

- May 2023: Inspire Brands, Inc. expanded its Butternut product line with six new butter variants, increasing product diversification and appealing to various taste preferences.

- April 2023: The Figaro Coffee Group launched Cafe Portofino, a new café brand, expanding its market reach and broadening its portfolio.

Strategic Food Service Industry in the Philippines Market Forecast

The Philippine food service industry is poised for continued growth, driven by increasing consumer spending, technological advancements, and evolving dietary preferences. The sector is expected to witness significant expansion across various segments, including quick-service restaurants, cafes, and fine dining establishments. Continued innovation and strategic investments will be key to capturing market share in this dynamic and competitive environment.

Food Service Industry in the Philippines Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Food Service Industry in the Philippines Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Food Service Industry in the Philippines REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. Quick service restaurants held a dominating share in the market owing expansion of franchise outlets and menu innovations

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. North America Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6.1.1. Cafes & Bars

- 6.1.1.1. By Cuisine

- 6.1.1.1.1. Bars & Pubs

- 6.1.1.1.2. Juice/Smoothie/Desserts Bars

- 6.1.1.1.3. Specialist Coffee & Tea Shops

- 6.1.1.1. By Cuisine

- 6.1.2. Cloud Kitchen

- 6.1.3. Full Service Restaurants

- 6.1.3.1. Asian

- 6.1.3.2. European

- 6.1.3.3. Latin American

- 6.1.3.4. Middle Eastern

- 6.1.3.5. North American

- 6.1.3.6. Other FSR Cuisines

- 6.1.4. Quick Service Restaurants

- 6.1.4.1. Bakeries

- 6.1.4.2. Burger

- 6.1.4.3. Ice Cream

- 6.1.4.4. Meat-based Cuisines

- 6.1.4.5. Pizza

- 6.1.4.6. Other QSR Cuisines

- 6.1.1. Cafes & Bars

- 6.2. Market Analysis, Insights and Forecast - by Outlet

- 6.2.1. Chained Outlets

- 6.2.2. Independent Outlets

- 6.3. Market Analysis, Insights and Forecast - by Location

- 6.3.1. Leisure

- 6.3.2. Lodging

- 6.3.3. Retail

- 6.3.4. Standalone

- 6.3.5. Travel

- 6.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7. South America Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 7.1.1. Cafes & Bars

- 7.1.1.1. By Cuisine

- 7.1.1.1.1. Bars & Pubs

- 7.1.1.1.2. Juice/Smoothie/Desserts Bars

- 7.1.1.1.3. Specialist Coffee & Tea Shops

- 7.1.1.1. By Cuisine

- 7.1.2. Cloud Kitchen

- 7.1.3. Full Service Restaurants

- 7.1.3.1. Asian

- 7.1.3.2. European

- 7.1.3.3. Latin American

- 7.1.3.4. Middle Eastern

- 7.1.3.5. North American

- 7.1.3.6. Other FSR Cuisines

- 7.1.4. Quick Service Restaurants

- 7.1.4.1. Bakeries

- 7.1.4.2. Burger

- 7.1.4.3. Ice Cream

- 7.1.4.4. Meat-based Cuisines

- 7.1.4.5. Pizza

- 7.1.4.6. Other QSR Cuisines

- 7.1.1. Cafes & Bars

- 7.2. Market Analysis, Insights and Forecast - by Outlet

- 7.2.1. Chained Outlets

- 7.2.2. Independent Outlets

- 7.3. Market Analysis, Insights and Forecast - by Location

- 7.3.1. Leisure

- 7.3.2. Lodging

- 7.3.3. Retail

- 7.3.4. Standalone

- 7.3.5. Travel

- 7.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8. Europe Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 8.1.1. Cafes & Bars

- 8.1.1.1. By Cuisine

- 8.1.1.1.1. Bars & Pubs

- 8.1.1.1.2. Juice/Smoothie/Desserts Bars

- 8.1.1.1.3. Specialist Coffee & Tea Shops

- 8.1.1.1. By Cuisine

- 8.1.2. Cloud Kitchen

- 8.1.3. Full Service Restaurants

- 8.1.3.1. Asian

- 8.1.3.2. European

- 8.1.3.3. Latin American

- 8.1.3.4. Middle Eastern

- 8.1.3.5. North American

- 8.1.3.6. Other FSR Cuisines

- 8.1.4. Quick Service Restaurants

- 8.1.4.1. Bakeries

- 8.1.4.2. Burger

- 8.1.4.3. Ice Cream

- 8.1.4.4. Meat-based Cuisines

- 8.1.4.5. Pizza

- 8.1.4.6. Other QSR Cuisines

- 8.1.1. Cafes & Bars

- 8.2. Market Analysis, Insights and Forecast - by Outlet

- 8.2.1. Chained Outlets

- 8.2.2. Independent Outlets

- 8.3. Market Analysis, Insights and Forecast - by Location

- 8.3.1. Leisure

- 8.3.2. Lodging

- 8.3.3. Retail

- 8.3.4. Standalone

- 8.3.5. Travel

- 8.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9. Middle East & Africa Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 9.1.1. Cafes & Bars

- 9.1.1.1. By Cuisine

- 9.1.1.1.1. Bars & Pubs

- 9.1.1.1.2. Juice/Smoothie/Desserts Bars

- 9.1.1.1.3. Specialist Coffee & Tea Shops

- 9.1.1.1. By Cuisine

- 9.1.2. Cloud Kitchen

- 9.1.3. Full Service Restaurants

- 9.1.3.1. Asian

- 9.1.3.2. European

- 9.1.3.3. Latin American

- 9.1.3.4. Middle Eastern

- 9.1.3.5. North American

- 9.1.3.6. Other FSR Cuisines

- 9.1.4. Quick Service Restaurants

- 9.1.4.1. Bakeries

- 9.1.4.2. Burger

- 9.1.4.3. Ice Cream

- 9.1.4.4. Meat-based Cuisines

- 9.1.4.5. Pizza

- 9.1.4.6. Other QSR Cuisines

- 9.1.1. Cafes & Bars

- 9.2. Market Analysis, Insights and Forecast - by Outlet

- 9.2.1. Chained Outlets

- 9.2.2. Independent Outlets

- 9.3. Market Analysis, Insights and Forecast - by Location

- 9.3.1. Leisure

- 9.3.2. Lodging

- 9.3.3. Retail

- 9.3.4. Standalone

- 9.3.5. Travel

- 9.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10. Asia Pacific Food Service Industry in the Philippines Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 10.1.1. Cafes & Bars

- 10.1.1.1. By Cuisine

- 10.1.1.1.1. Bars & Pubs

- 10.1.1.1.2. Juice/Smoothie/Desserts Bars

- 10.1.1.1.3. Specialist Coffee & Tea Shops

- 10.1.1.1. By Cuisine

- 10.1.2. Cloud Kitchen

- 10.1.3. Full Service Restaurants

- 10.1.3.1. Asian

- 10.1.3.2. European

- 10.1.3.3. Latin American

- 10.1.3.4. Middle Eastern

- 10.1.3.5. North American

- 10.1.3.6. Other FSR Cuisines

- 10.1.4. Quick Service Restaurants

- 10.1.4.1. Bakeries

- 10.1.4.2. Burger

- 10.1.4.3. Ice Cream

- 10.1.4.4. Meat-based Cuisines

- 10.1.4.5. Pizza

- 10.1.4.6. Other QSR Cuisines

- 10.1.1. Cafes & Bars

- 10.2. Market Analysis, Insights and Forecast - by Outlet

- 10.2.1. Chained Outlets

- 10.2.2. Independent Outlets

- 10.3. Market Analysis, Insights and Forecast - by Location

- 10.3.1. Leisure

- 10.3.2. Lodging

- 10.3.3. Retail

- 10.3.4. Standalone

- 10.3.5. Travel

- 10.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Shakey's Pizza Asia Ventures Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Yum! Brands Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bounty Agro Ventures Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Figaro Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Inspire Brands Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Seven & I Holdings Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mary Grace Foods Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Jollibee Foods Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maxs Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Udenna Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Golden Arches Development Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Domino's Pizza Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Berjaya Corporation Bhd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Starbucks Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Restaurant Brands International Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Shakey's Pizza Asia Ventures Inc

List of Figures

- Figure 1: Global Food Service Industry in the Philippines Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Philippines Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 3: Philippines Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 5: North America Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 6: North America Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 7: North America Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 8: North America Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 9: North America Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 10: North America Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 13: South America Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 14: South America Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 15: South America Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 16: South America Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 17: South America Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 18: South America Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 21: Europe Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 22: Europe Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 23: Europe Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 24: Europe Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 25: Europe Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 26: Europe Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 29: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 30: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 31: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 32: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 33: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 34: Middle East & Africa Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Foodservice Type 2024 & 2032

- Figure 37: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Foodservice Type 2024 & 2032

- Figure 38: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Outlet 2024 & 2032

- Figure 39: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Outlet 2024 & 2032

- Figure 40: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Location 2024 & 2032

- Figure 41: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Location 2024 & 2032

- Figure 42: Asia Pacific Food Service Industry in the Philippines Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Food Service Industry in the Philippines Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Food Service Industry in the Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Global Food Service Industry in the Philippines Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 8: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 9: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 10: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 22: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 23: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 24: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 35: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 36: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 37: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Food Service Industry in the Philippines Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 45: Global Food Service Industry in the Philippines Revenue Million Forecast, by Outlet 2019 & 2032

- Table 46: Global Food Service Industry in the Philippines Revenue Million Forecast, by Location 2019 & 2032

- Table 47: Global Food Service Industry in the Philippines Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Food Service Industry in the Philippines Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Food Service Industry in the Philippines?

The projected CAGR is approximately 7.40%.

2. Which companies are prominent players in the Food Service Industry in the Philippines?

Key companies in the market include Shakey's Pizza Asia Ventures Inc, Yum! Brands Inc, Bounty Agro Ventures Inc, The Figaro Group, Inspire Brands Inc, Seven & I Holdings Co Ltd, Mary Grace Foods Inc, Jollibee Foods Corporation, Maxs Group Inc, Udenna Group, Golden Arches Development Corporation, Domino's Pizza Inc, Berjaya Corporation Bhd, Starbucks Corporation, Restaurant Brands International Inc.

3. What are the main segments of the Food Service Industry in the Philippines?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

Quick service restaurants held a dominating share in the market owing expansion of franchise outlets and menu innovations.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

October 2023: Starbucks launched two new drinks with the addition of ice cream in the Philippines.May 2023: Inspire Brands, Inc. launched new butter variants to its Butternut portfolio. These variants include the Plain Butternut, Choco Almond Butternut, Ube Cheese Butternut, Strawberry Butternut, Cheesy Butternut, and Choco Butternut.April 2023: The Figaro Coffee Group increased its brand portfolio and launched a new café concept brand called Cafe Portofino.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Food Service Industry in the Philippines," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Food Service Industry in the Philippines report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Food Service Industry in the Philippines?

To stay informed about further developments, trends, and reports in the Food Service Industry in the Philippines, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence