Key Insights

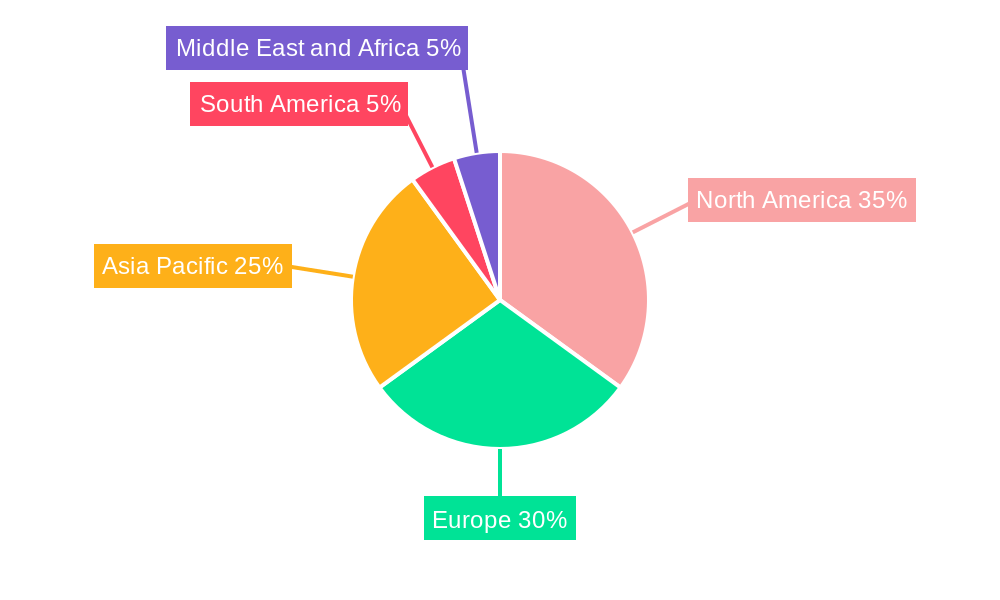

The global fermented drinks market, valued at $2.27 billion in 2025, is projected to experience robust growth, driven by increasing consumer awareness of the health benefits associated with probiotics and fermented foods. The market's Compound Annual Growth Rate (CAGR) of 6.20% from 2019 to 2024 indicates a consistent upward trajectory, fueled by rising demand for functional beverages and a shift towards healthier lifestyle choices. Key drivers include the growing popularity of kombucha, kefir, and other fermented beverages, particularly amongst health-conscious millennials and Gen Z consumers. The increasing availability of these drinks in various distribution channels, including both on-trade (restaurants, bars) and off-trade (retail stores, supermarkets), further contributes to market expansion. While the precise segmentation data is unavailable, it's reasonable to assume that the alcoholic segment (e.g., beer, certain wines) holds a significant market share, alongside the rapidly expanding non-alcoholic sector (e.g., kombucha, kefir). Regional growth is expected to be diverse, with North America and Europe likely maintaining strong positions due to established markets and high consumer purchasing power, while Asia-Pacific shows significant potential for future expansion, driven by rising disposable incomes and changing consumer preferences. The market faces challenges such as fluctuating raw material costs and stringent regulations surrounding labeling and product claims. However, ongoing innovation in flavors, product formats (e.g., ready-to-drink), and marketing strategies is expected to mitigate these challenges and drive future growth.

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized players. Major players like Nestle, Danone, and Anheuser-Busch InBev leverage their extensive distribution networks and brand recognition to maintain market dominance. Meanwhile, smaller companies focusing on niche segments (e.g., organic or specialized fermented drinks) are capitalizing on consumer demand for unique and high-quality products. Future growth will likely be shaped by consumer demand for sustainability, transparency in sourcing ingredients, and personalized nutrition. Companies are increasingly investing in research and development to meet these evolving consumer expectations. The continued innovation of fermented beverages and expansion into new geographic markets and product categories will remain crucial factors shaping the long-term success of the fermented drinks market.

Fermented Drinks Market Market Composition & Trends

The Fermented Drinks Market is characterized by a dynamic interplay of innovation and competition. Market concentration is moderate, with leading companies like Nestle SA, Danone SA, and Anheuser-Busch InBev SA/NV holding significant shares. As of 2025, the top five players are estimated to control approximately 40% of the market, highlighting a balanced yet competitive landscape. Innovation catalysts include the rising demand for health-centric beverages, which has led to the development of new products such as kombucha and kefir. Regulatory landscapes vary by region, with stricter standards in Europe and North America influencing product formulations and marketing strategies. Substitute products like carbonated soft drinks pose a challenge, yet fermented drinks appeal to health-conscious consumers seeking probiotics and natural fermentation benefits.

- End-user Profiles: Health-conscious consumers and millennials are the primary demographics driving the market, valuing the health benefits of fermented drinks.

- M&A Activities: Over the past five years, the market has seen M&A deals totaling around USD 2 Billion, with a focus on expanding product portfolios and geographical reach.

Fermented Drinks Market Industry Evolution

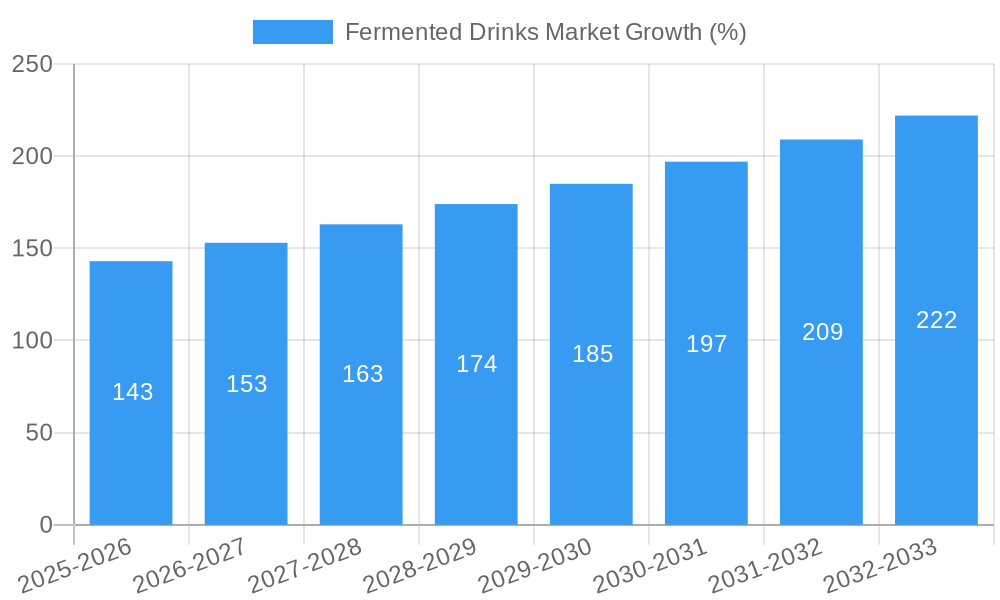

The Fermented Drinks Market has experienced significant evolution over the study period from 2019 to 2033, with the base year set at 2025. Growth trajectories show a steady increase, with the market size projected to grow at a CAGR of 6.5% during the forecast period of 2025-2033. This growth is driven by a heightened awareness of health and wellness, leading to a surge in demand for non-alcoholic fermented beverages like kombucha and kefir. Technological advancements have played a pivotal role, with improved fermentation processes enhancing product quality and shelf life. For instance, the adoption of precision fermentation techniques has risen by 20% since 2019, allowing for more consistent product quality.

Shifting consumer demands have also influenced market dynamics, with a growing preference for organic and sugar-free options. This trend is evident in the increased sales of organic kombucha, which saw a 15% rise in 2024 compared to the previous year. The market's evolution is further underscored by the entry of major beverage companies into the fermented drinks sector, leveraging their distribution networks to capture market share. This strategic move is expected to intensify competition and spur further innovation in the coming years.

Leading Regions, Countries, or Segments in Fermented Drinks Market

The Fermented Drinks Market is segmented by type into Alcoholic Beverages and Non-alcoholic Beverages, and by distribution channel into On-trade and Off-trade. Among these, the Non-alcoholic Beverages segment is leading the market, driven by the global trend towards healthier drink options.

- Key Drivers for Non-alcoholic Beverages:

- Investment in R&D for developing new health-focused products.

- Regulatory support for promoting low-sugar and probiotic-rich drinks.

- Consumer demand for functional beverages that offer health benefits.

The dominance of the Non-alcoholic Beverages segment can be attributed to several factors. Firstly, there is a growing awareness of the health benefits associated with probiotics and natural fermentation processes, which are key components of non-alcoholic fermented drinks. Secondly, the segment benefits from robust marketing efforts that position these beverages as a healthier alternative to traditional soft drinks. Additionally, the off-trade distribution channel, encompassing supermarkets, hypermarkets, and convenience stores, has seen increased sales due to its convenience and wide product availability. This channel's growth is supported by consumer preferences for purchasing beverages for home consumption, especially in the wake of the global health crisis.

Fermented Drinks Market Product Innovations

Product innovations in the Fermented Drinks Market are centered around enhancing health benefits and flavor profiles. Recent developments include the introduction of sugar-free kombucha by Remedy, featuring live active cultures and antioxidants. These innovations cater to the growing demand for functional beverages that support gut health and overall wellness. Technological advancements, such as precision fermentation, have enabled companies to produce high-quality, consistent products that meet consumer expectations for taste and health benefits.

Propelling Factors for Fermented Drinks Market Growth

Several factors are propelling the growth of the Fermented Drinks Market. Technological advancements in fermentation processes have improved product quality and scalability. Economically, the rising disposable incomes in emerging markets have increased consumer spending on premium beverages. Regulatory influences, such as favorable policies for health-focused products, also play a significant role. For example, the FDA's approval of health claims for probiotics has boosted the market for fermented drinks.

Obstacles in the Fermented Drinks Market Market

The Fermented Drinks Market faces several obstacles that could hinder its growth. Regulatory challenges vary by region, with stringent labeling and health claim requirements impacting product launches. Supply chain disruptions, exacerbated by global events, have led to increased costs and delays. Competitive pressures are intense, with large beverage companies entering the market and driving down prices. These factors have collectively reduced profit margins by an estimated 5% in the past year.

Future Opportunities in Fermented Drinks Market

Emerging opportunities in the Fermented Drinks Market include the expansion into new markets such as Asia-Pacific, where there is a growing interest in health and wellness. Technological advancements, like the use of AI in fermentation processes, offer potential for increased efficiency and product innovation. Consumer trends towards personalized nutrition and functional beverages also present opportunities for tailored fermented drink offerings.

Major Players in the Fermented Drinks Market Ecosystem

- Nestle SA

- Paine Schwartz Partners (Suja Life LLC)

- Yakult Honsha Co Ltd

- Schreiber Foods Inc

- Bio-tiful Dairy Ltd*List Not Exhaustive

- Danone SA

- The Boston Beer Company

- Anheuser-Busch InBev SA/NV

- Bright Food (Group) Co Limited

- GTs Living Food

Key Developments in Fermented Drinks Market Industry

- March 2022: Nestlé USA announced a USD 675 Million investment in a new beverage factory in Glendale, Arizona, enhancing its market position and production capacity.

- August 2021: The Boston Beer Company and PepsiCo planned to collaborate on HARD MTN DEW, combining expertise in alcoholic and iconic non-alcoholic beverages.

- July 2021: Beam Suntory and The Boston Beer Company formed a strategic partnership to expand into fast-growing beverage alcohol segments.

- July 2021: Remedy launched its sugar-free, live-cultured beverages in the US, offering flavors like Ginger Lemon Kombucha and Peach Kombucha.

Strategic Fermented Drinks Market Market Forecast

The Fermented Drinks Market is poised for robust growth, driven by increasing consumer interest in health and wellness. Future opportunities include the expansion into emerging markets and the development of personalized, functional beverages. The market's potential is further enhanced by ongoing technological advancements in fermentation processes, which are expected to improve product quality and efficiency. With a forecasted CAGR of 6.5% from 2025 to 2033, the market offers significant growth prospects for stakeholders.

Fermented Drinks Market Segmentation

-

1. Type

- 1.1. Alcoholic Beverages

-

1.2. Non-alcoholic Beverages

- 1.2.1. Kombucha

- 1.2.2. Kefir

- 1.2.3. Other Types

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores/Grocery Stores

- 2.2.3. Specialty Stores

- 2.2.4. Online Retail Stores

- 2.2.5. Other Distribution Channels

Fermented Drinks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Italy

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Fermented Drinks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Synthetic Food Colorant

- 3.4. Market Trends

- 3.4.1. Rising Demand for Probiotic and Prebiotic Food and Beverages

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Alcoholic Beverages

- 5.1.2. Non-alcoholic Beverages

- 5.1.2.1. Kombucha

- 5.1.2.2. Kefir

- 5.1.2.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores/Grocery Stores

- 5.2.2.3. Specialty Stores

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Alcoholic Beverages

- 6.1.2. Non-alcoholic Beverages

- 6.1.2.1. Kombucha

- 6.1.2.2. Kefir

- 6.1.2.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-trade

- 6.2.2. Off-trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores/Grocery Stores

- 6.2.2.3. Specialty Stores

- 6.2.2.4. Online Retail Stores

- 6.2.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Alcoholic Beverages

- 7.1.2. Non-alcoholic Beverages

- 7.1.2.1. Kombucha

- 7.1.2.2. Kefir

- 7.1.2.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-trade

- 7.2.2. Off-trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores/Grocery Stores

- 7.2.2.3. Specialty Stores

- 7.2.2.4. Online Retail Stores

- 7.2.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Alcoholic Beverages

- 8.1.2. Non-alcoholic Beverages

- 8.1.2.1. Kombucha

- 8.1.2.2. Kefir

- 8.1.2.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-trade

- 8.2.2. Off-trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores/Grocery Stores

- 8.2.2.3. Specialty Stores

- 8.2.2.4. Online Retail Stores

- 8.2.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Alcoholic Beverages

- 9.1.2. Non-alcoholic Beverages

- 9.1.2.1. Kombucha

- 9.1.2.2. Kefir

- 9.1.2.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-trade

- 9.2.2. Off-trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores/Grocery Stores

- 9.2.2.3. Specialty Stores

- 9.2.2.4. Online Retail Stores

- 9.2.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Alcoholic Beverages

- 10.1.2. Non-alcoholic Beverages

- 10.1.2.1. Kombucha

- 10.1.2.2. Kefir

- 10.1.2.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-trade

- 10.2.2. Off-trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores/Grocery Stores

- 10.2.2.3. Specialty Stores

- 10.2.2.4. Online Retail Stores

- 10.2.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Rest of Europe

- 13. Asia Pacific Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Fermented Drinks Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Nestle SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Paine Schwartz Partners (Suja Life LLC)

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Yakult Honsha Co Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Schreiber Foods Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Bio-tiful Dairy Ltd*List Not Exhaustive

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Danone SA

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 The Boston Beer Company

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Anheuser-Busch InBev SA/NV

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Bright Food (Group) Co Limited

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 GTs Living Food

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Nestle SA

List of Figures

- Figure 1: Global Fermented Drinks Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Fermented Drinks Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Fermented Drinks Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Fermented Drinks Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 15: North America Fermented Drinks Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 16: North America Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Fermented Drinks Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Fermented Drinks Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Fermented Drinks Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Europe Fermented Drinks Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Europe Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Fermented Drinks Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Fermented Drinks Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Fermented Drinks Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 27: Asia Pacific Fermented Drinks Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 28: Asia Pacific Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: South America Fermented Drinks Market Revenue (Million), by Type 2024 & 2032

- Figure 31: South America Fermented Drinks Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: South America Fermented Drinks Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 33: South America Fermented Drinks Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 34: South America Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 35: South America Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Fermented Drinks Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Fermented Drinks Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Fermented Drinks Market Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 39: Middle East and Africa Fermented Drinks Market Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 40: Middle East and Africa Fermented Drinks Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Fermented Drinks Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Fermented Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Global Fermented Drinks Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Russia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Italy Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: South Africa Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Saudi Arabia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Middle East and Africa Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 34: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Mexico Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of North America Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 41: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Germany Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: United Kingdom Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: France Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Italy Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Spain Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 51: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 52: India Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: China Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Japan Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Australia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 59: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Argentina Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of South America Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Global Fermented Drinks Market Revenue Million Forecast, by Type 2019 & 2032

- Table 64: Global Fermented Drinks Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 65: Global Fermented Drinks Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: South Africa Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: Saudi Arabia Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Rest of Middle East and Africa Fermented Drinks Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Fermented Drinks Market?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Fermented Drinks Market?

Key companies in the market include Nestle SA, Paine Schwartz Partners (Suja Life LLC), Yakult Honsha Co Ltd, Schreiber Foods Inc, Bio-tiful Dairy Ltd*List Not Exhaustive, Danone SA, The Boston Beer Company, Anheuser-Busch InBev SA/NV, Bright Food (Group) Co Limited, GTs Living Food.

3. What are the main segments of the Fermented Drinks Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumer Awareness Regarding Natural Products; Growing Demand for Anthocyanin in Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Rising Demand for Probiotic and Prebiotic Food and Beverages.

7. Are there any restraints impacting market growth?

Easy Availability of Synthetic Food Colorant.

8. Can you provide examples of recent developments in the market?

In March 2022, Nestlé USA stated that it would invest USD 675 million in the construction of a new beverage factory in Glendale, Arizona. Nestlé's investment increases its market position and improves its manufacturing capacity to satisfy rising customer demand for its goods as one of the top producers in the creamer and flavored milk categories.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Fermented Drinks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Fermented Drinks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Fermented Drinks Market?

To stay informed about further developments, trends, and reports in the Fermented Drinks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence