Key Insights

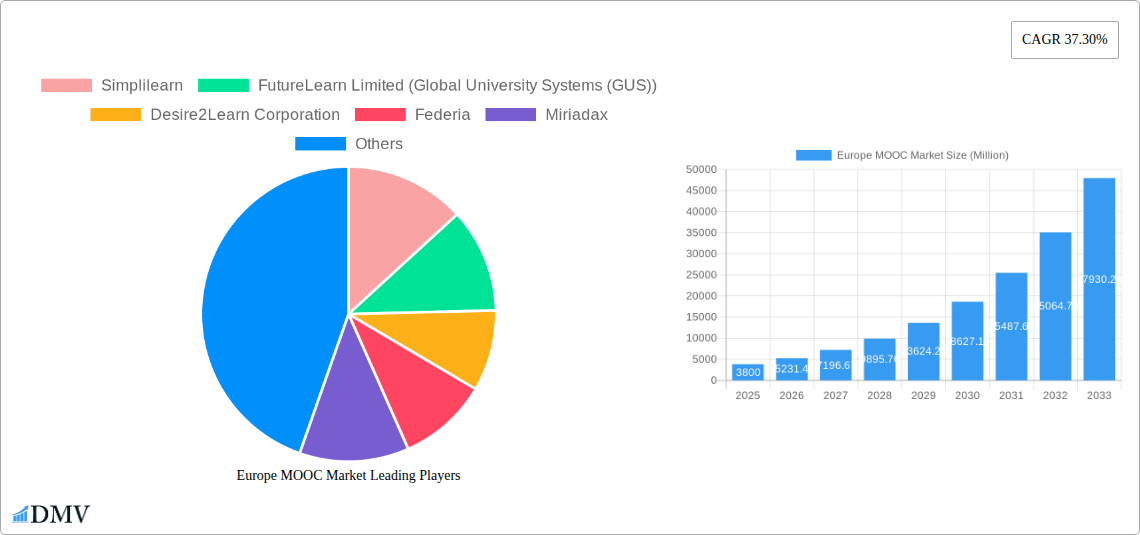

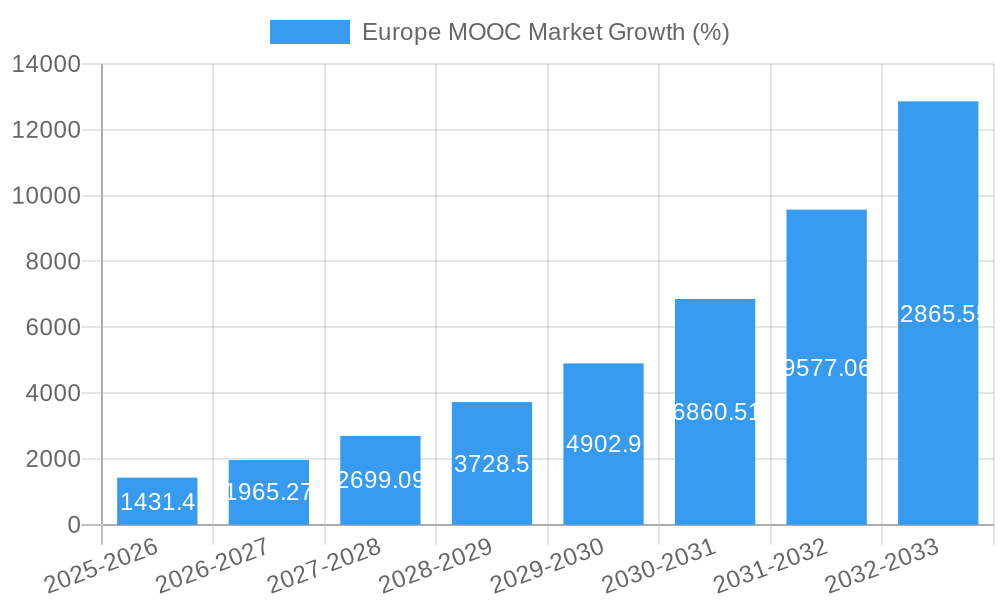

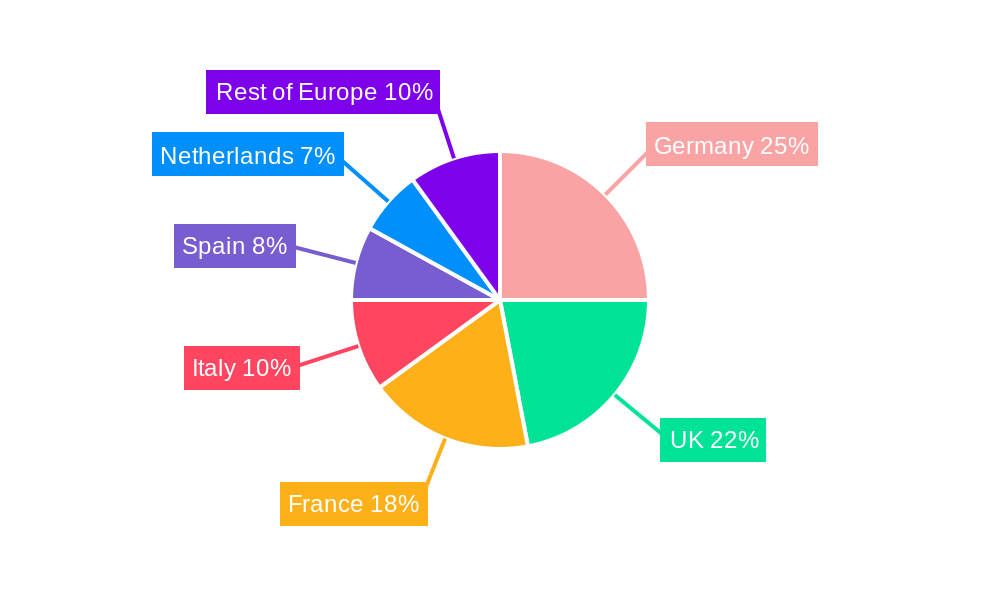

The European Massive Open Online Course (MOOC) market is experiencing robust growth, projected to reach €3.80 billion in 2025 and exhibiting a remarkable Compound Annual Growth Rate (CAGR) of 37.3% from 2025 to 2033. This expansion is fueled by several key factors. Increased accessibility to high-quality education, particularly for professionals seeking upskilling and reskilling opportunities, is a major driver. The growing adoption of blended learning models, integrating online and in-person instruction, further contributes to market growth. Furthermore, the increasing affordability of online courses compared to traditional education and the rising demand for specialized skills in burgeoning technological sectors are significant catalysts. The market is segmented by subject matter (Technology, Business, Science, and Other Subjects) and geographically (United Kingdom, France, Germany, Italy, Spain, Netherlands, and Rest of Europe). Germany, France, and the UK are expected to be the dominant markets within Europe, driven by their robust economies and high digital literacy rates. However, other countries such as Spain and the Netherlands are also demonstrating significant growth potential due to increasing government investments in digital education infrastructure and initiatives promoting lifelong learning. Competitive intensity is high, with key players like Coursera, Udemy, FutureLearn, and Simplilearn vying for market share through innovative course offerings, strategic partnerships, and robust marketing campaigns. The ongoing development of advanced learning technologies such as AI-powered personalized learning platforms is set to further reshape the landscape in the coming years.

The significant growth trajectory of the European MOOC market reflects a broader shift towards digital learning and the increasing importance of lifelong learning in a rapidly evolving job market. While challenges such as ensuring equitable access to technology and addressing concerns about the quality and credibility of online certifications remain, the overall market outlook remains exceptionally positive. The projected CAGR suggests substantial expansion, with substantial opportunities for both established players and emerging entrants. Future growth will likely be shaped by advancements in learning technologies, government policies supporting online education, and the evolving needs of learners in an increasingly digital world. The continued expansion of high-quality, affordable, and accessible MOOCs will be critical in shaping the future of education and workforce development across Europe.

Europe MOOC Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe MOOC market, offering valuable insights for stakeholders seeking to understand its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a focus on 2025, this report leverages extensive data and expert analysis to provide a clear and actionable understanding of this dynamic market.

Europe MOOC Market Composition & Trends

The European MOOC market, valued at xx Million in 2025, exhibits a complex interplay of factors influencing its growth and evolution. Market concentration is moderate, with several key players holding significant shares but not dominating the landscape entirely. Innovation is driven by advancements in learning technologies, personalized learning platforms, and gamification techniques. Regulatory frameworks, though varying across European nations, are generally supportive of online education initiatives, creating a conducive environment for market expansion. Substitute products, such as traditional classroom learning and corporate training programs, continue to compete, but the convenience and accessibility of MOOCs provide a compelling alternative. End-user profiles are diverse, ranging from individual learners seeking upskilling or reskilling opportunities to corporations utilizing MOOCs for employee training. M&A activity has been notable in recent years, with deals primarily focused on consolidating market share and expanding product portfolios.

- Market Share Distribution (2025): Coursera Inc (xx%), Udemy Inc (xx%), FutureLearn Limited (xx%), Simplilearn (xx%), Others (xx%).

- Significant M&A Activity (2019-2024): xx Million in total deal value, with notable transactions involving [insert specific examples if available, otherwise indicate “data unavailable”].

Europe MOOC Market Industry Evolution

The European MOOC market has experienced significant growth from 2019 to 2024, with a Compound Annual Growth Rate (CAGR) of xx%. This expansion is fueled by several key factors. Technological advancements, including the rise of artificial intelligence (AI) in personalized learning, improved user interfaces, and enhanced mobile accessibility, have broadened the reach and appeal of MOOCs. Simultaneously, shifting consumer demands, particularly the growing need for flexible and affordable education options, have fueled the market's expansion. Furthermore, increased corporate adoption of MOOCs for employee training programs has contributed significantly to market growth. Looking ahead, the market is projected to maintain a steady growth trajectory, with a forecasted CAGR of xx% from 2025 to 2033, reaching an estimated value of xx Million by 2033. Adoption metrics indicate a continuous increase in the number of users engaging with MOOCs across various subject areas and countries within Europe. Specific growth rates vary by country, with the UK, Germany, and France showing consistent strong performance. The integration of MOOCs into formal education systems is expected to further accelerate market growth.

Leading Regions, Countries, or Segments in Europe MOOC Market

The United Kingdom consistently ranks as a leading market within Europe, driven by strong government support for online education and a high density of technology-oriented institutions and businesses. Germany and France also demonstrate significant market potential, characterized by large and tech-savvy populations and a rising emphasis on lifelong learning.

- Key Drivers:

- United Kingdom: High broadband penetration, strong digital literacy, supportive government policies.

- Germany: Robust economy, focus on upskilling workforce, strong presence of tech companies.

- France: Growing adoption of online learning, government investments in digital education.

- Technology Subject Segment: High demand driven by rapidly evolving tech landscape and career opportunities.

- Dominance Factors: The UK's established digital infrastructure, combined with significant investment in online learning initiatives, has positioned it as a leading market. Germany's focus on industrial competitiveness and France's commitment to digital transformation are also driving substantial MOOC adoption in these countries. The Technology subject segment consistently leads due to the high demand for skill development in this ever-changing field.

Europe MOOC Market Product Innovations

Recent innovations in the European MOOC market include the integration of AI-powered personalized learning platforms that adapt to individual learner needs and provide customized learning paths. Gamification techniques are increasingly being incorporated to enhance engagement and motivation, resulting in improved learning outcomes. Furthermore, advancements in virtual reality (VR) and augmented reality (AR) technologies are paving the way for more immersive and interactive learning experiences within MOOC platforms. These innovations are aimed at enhancing the overall user experience and increasing the effectiveness of MOOCs as a learning tool. Unique selling propositions often include personalized learning paths, gamified elements, and integration with other learning management systems (LMS).

Propelling Factors for Europe MOOC Market Growth

Several factors are driving the growth of the European MOOC market. Technological advancements, such as AI-powered learning platforms and mobile accessibility, enhance learning experiences and broaden reach. The economic benefits of upskilling and reskilling, especially crucial in a changing job market, are also significant drivers. Supportive government policies and funding initiatives across many European countries further propel market growth, creating a favorable environment for MOOC providers. Examples include government-funded programs promoting digital literacy and initiatives to support the integration of MOOCs into higher education institutions.

Obstacles in the Europe MOOC Market

Despite the promising growth trajectory, several challenges hinder the European MOOC market. Regulatory inconsistencies across different European countries can create complexities for providers aiming for pan-European reach. Supply chain disruptions affecting technology infrastructure can affect platform accessibility and functionality. Furthermore, intense competition among numerous MOOC providers and traditional educational institutions creates pressure on pricing and profitability. Data regarding the quantifiable impact of these challenges is currently limited, requiring further investigation.

Future Opportunities in Europe MOOC Market

The future of the European MOOC market holds several exciting opportunities. Expansion into underserved regions and demographics, particularly among older learners or those with limited digital literacy, presents significant potential. The integration of cutting-edge technologies, such as blockchain for secure credentialing and AI for personalized learning, will continue to enhance MOOCs' effectiveness. Emerging trends like micro-learning and blended learning models, combining online and offline learning, will further shape the market's future growth.

Major Players in the Europe MOOC Market Ecosystem

- Simplilearn

- FutureLearn Limited (Global University Systems (GUS))

- Desire2Learn Corporation

- Federia

- Miriadax

- Coursera Inc

- Kandenze com

- OpenupEd

- Udemy Inc

- Pluralsight Inc

Key Developments in Europe MOOC Market Industry

July 2022: Launch of the MOOC "Mental Boundaries, Physical Borders and the Development of Modern European Identity and Citizenship" by Arqus, a collaborative effort of six European universities. This highlights the growing collaboration and cross-border initiatives within the MOOC space.

February 2023: EUNICE's free MOOC, "Introduction to Global Studies," underscores the increasing use of MOOCs for access to higher education and addressing crucial global issues. This initiative potentially expands the MOOC market's reach and further increases its visibility.

Strategic Europe MOOC Market Forecast

The European MOOC market is poised for continued growth, driven by technological innovation, increased demand for flexible learning solutions, and supportive government policies. The market's future potential is substantial, with further expansion expected across various subject areas and demographics. Emerging technologies like AI and VR will play a crucial role in shaping the future of the MOOC landscape, resulting in a more engaging and effective learning experience. The overall market outlook remains positive, anticipating significant market expansion in the coming years.

Europe MOOC Market Segmentation

-

1. Subject

- 1.1. Technology

- 1.2. Business

- 1.3. Science

- 1.4. Other Subjects

Europe MOOC Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe MOOC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 37.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for scalable learning platform; Availability of wider varieties of courses across streams

- 3.3. Market Restrains

- 3.3.1. Low Completion Rates in the Region; Operational issues

- 3.4. Market Trends

- 3.4.1. Increasing demand for scalable learning platform

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Subject

- 5.1.1. Technology

- 5.1.2. Business

- 5.1.3. Science

- 5.1.4. Other Subjects

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Subject

- 6. Germany Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe MOOC Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Simplilearn

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 FutureLearn Limited (Global University Systems (GUS))

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Desire2Learn Corporation

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Federia

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Miriadax

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Coursera Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kandenze com

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 OpenupEd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Udemy Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Pluralsight Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Simplilearn

List of Figures

- Figure 1: Europe MOOC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe MOOC Market Share (%) by Company 2024

List of Tables

- Table 1: Europe MOOC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe MOOC Market Revenue Million Forecast, by Subject 2019 & 2032

- Table 3: Europe MOOC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe MOOC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe MOOC Market Revenue Million Forecast, by Subject 2019 & 2032

- Table 13: Europe MOOC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United Kingdom Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Germany Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: France Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Italy Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Spain Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherlands Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Belgium Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Sweden Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Norway Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Poland Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Denmark Europe MOOC Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe MOOC Market?

The projected CAGR is approximately 37.30%.

2. Which companies are prominent players in the Europe MOOC Market?

Key companies in the market include Simplilearn, FutureLearn Limited (Global University Systems (GUS)), Desire2Learn Corporation, Federia, Miriadax, Coursera Inc, Kandenze com, OpenupEd, Udemy Inc, Pluralsight Inc .

3. What are the main segments of the Europe MOOC Market?

The market segments include Subject.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for scalable learning platform; Availability of wider varieties of courses across streams.

6. What are the notable trends driving market growth?

Increasing demand for scalable learning platform.

7. Are there any restraints impacting market growth?

Low Completion Rates in the Region; Operational issues.

8. Can you provide examples of recent developments in the market?

February 2023: EUNICE, the European University for Customized Education, announced the provision of a free Massive Open Online Course (MOOC) entitled Introduction to Global Studies to those interested. The course will be offered through May, designed as an introduction to global studies. It will address global issues, including economics, society, culture, health, and sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe MOOC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe MOOC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe MOOC Market?

To stay informed about further developments, trends, and reports in the Europe MOOC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence