Key Insights

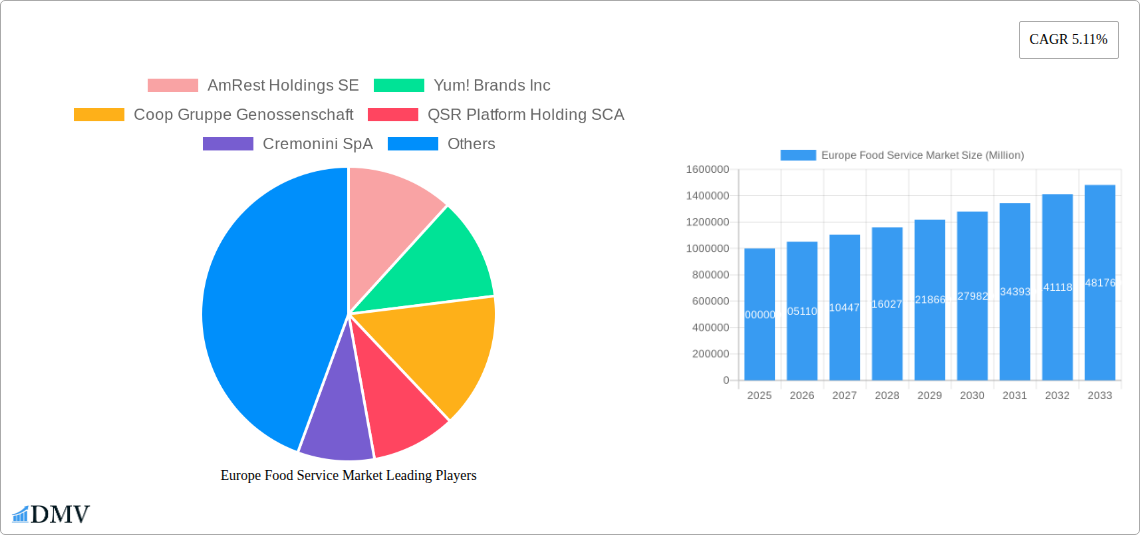

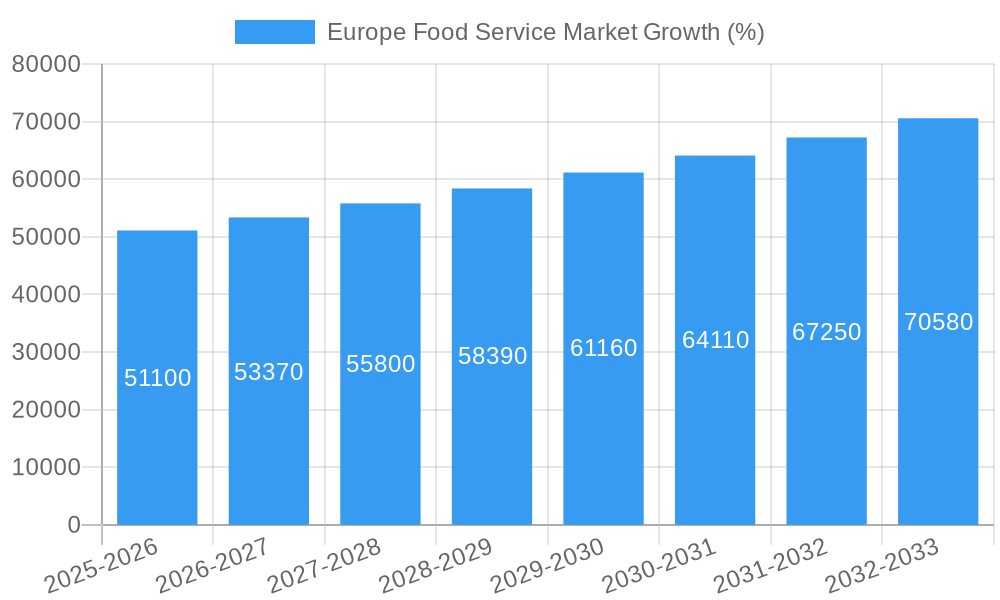

The European food service market, valued at approximately €[Estimate based on market size XX and value unit Million. A logical estimate considering similar markets could be €1 trillion in 2025] in 2025, is projected to experience robust growth, fueled by a compound annual growth rate (CAGR) of 5.11% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising disposable incomes and changing lifestyles across major European economies like Germany, the UK, and France are leading to increased spending on eating out. Secondly, the burgeoning tourism sector, especially in popular destinations across Europe, significantly contributes to the demand for food service offerings in leisure, lodging, and travel segments. Thirdly, the innovative culinary landscape, featuring the rise of diverse QSR cuisines and the continued popularity of cafes and bars, is diversifying the market and attracting a wider customer base.

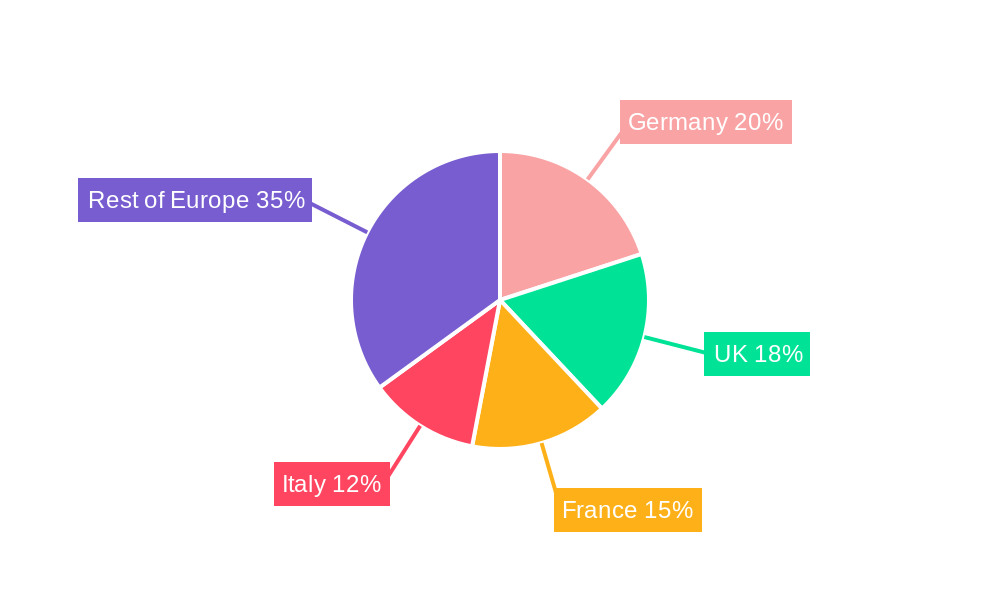

However, the market faces certain challenges. Increasing operational costs, including labor and raw material prices, pose a significant threat to profitability. Furthermore, heightened competition amongst established players and the emergence of new entrants requires continuous innovation and efficient management strategies. The segmentation analysis reveals that chained outlets dominate the market, reflecting the prevalence of large, established brands. Nevertheless, independent outlets retain a significant presence, suggesting substantial opportunities for smaller, specialized businesses. Geopolitically, countries like Germany and the UK are expected to lead the market due to their strong economies and established food service infrastructure, while emerging markets in Eastern Europe present opportunities for expansion. The forecast period reveals consistent growth potential, however, careful navigation of economic volatility and consumer trends will be crucial for sustained success.

Europe Food Service Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Europe Food Service Market, offering a comprehensive overview of its current state and future trajectory. Spanning the period from 2019 to 2033, with a focus on 2025, this study delves into market dynamics, competitive landscapes, and emerging trends, equipping stakeholders with the knowledge necessary to navigate this dynamic sector. The market is projected to reach xx Million by 2033, presenting significant opportunities for growth and investment.

Europe Food Service Market Composition & Trends

This section analyzes the competitive intensity, driving forces of innovation, regulatory frameworks, substitute offerings, consumer profiles, and merger & acquisition (M&A) activities within the European food service market. We examine market share distribution among key players, revealing a moderately concentrated market with several dominant players. M&A activity is analyzed, with data on deal values and their impact on market structure. The report includes a detailed assessment of the regulatory landscape, its impact on market growth, and the role of substitute products in shaping consumer choices. End-user preferences and evolving consumer demographics are also considered.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Innovation Catalysts: Growing demand for healthier options, technological advancements in food preparation and delivery.

- Regulatory Landscape: Varied across European countries, impacting operational costs and food safety standards.

- Substitute Products: Home-cooked meals, meal delivery services, and grocery stores pose competition.

- End-User Profiles: Diverse demographics, with varying preferences based on age, income, and lifestyle.

- M&A Activity: Significant activity observed in recent years, with total deal values exceeding xx Million in 2024. Examples include [mention specific deals if data is available].

Europe Food Service Market Industry Evolution

This section provides a detailed analysis of the market's growth trajectory, technological advancements, and the evolving demands of consumers in the European food service industry. The report traces the market's historical performance from 2019 to 2024, offering a comprehensive understanding of its evolution. We identify key trends shaping the market, including the rise of technology-driven solutions, changing consumer preferences for convenience and healthy options, and the expanding presence of quick-service restaurants (QSRs). Specific data points regarding growth rates and technology adoption are presented. The impact of macroeconomic factors on market dynamics is also explored. The report considers the influence of factors such as disposable income, tourism patterns, and sociocultural changes.

Leading Regions, Countries, or Segments in Europe Food Service Market

This section identifies the leading regions, countries, and segments within the European food service market. We analyze the factors driving their dominance, including investment trends, regulatory support, and consumer preferences.

Key Drivers:

- United Kingdom: High disposable income, strong tourism sector, and favorable regulatory environment.

- Germany: Large population, robust economy, and growing demand for convenience foods.

- France: Significant tourism, sophisticated culinary culture, and high density of restaurants.

- Chained Outlets: Economies of scale, brand recognition, and established supply chains.

- Leisure Locations: High foot traffic, convenience, and strong tourism pull.

Dominance Factors:

The United Kingdom consistently shows strong performance due to a combination of high consumer spending and the presence of major international chains. Germany benefits from its large population and strong economy. France's culinary reputation drives significant revenue in the fine dining segment. Chained outlets benefit from economies of scale and established supply chains, while leisure locations attract significant customer traffic. A deeper analysis of each segment’s growth drivers is included in the full report.

Europe Food Service Market Product Innovations

The European food service market is witnessing a surge in product innovation, driven by the demand for healthier, more convenient, and personalized options. Technological advancements like AI-powered ordering systems and automated kitchens are streamlining operations and enhancing customer experience. Unique selling propositions (USPs) focus on ethically sourced ingredients, customized meal options, and sustainable packaging. These innovations are improving efficiency and addressing evolving consumer preferences. The full report details specific examples and performance metrics.

Propelling Factors for Europe Food Service Market Growth

Several factors are driving the growth of the European food service market. Technological advancements in food preparation, delivery, and ordering systems enhance efficiency and convenience. Rising disposable incomes in several European countries fuel increased spending on food away from home. Favorable regulatory environments in certain regions support market expansion. Examples include the growth of mobile ordering apps and the expansion of delivery services in urban centers.

Obstacles in the Europe Food Service Market

Challenges hindering market growth include regulatory hurdles concerning food safety and labor laws that vary across different European countries. Supply chain disruptions due to geopolitical events and rising input costs impact profitability. Intense competition among established players and new entrants poses a challenge. These factors can lead to price increases and reduced profit margins. The full report quantifies the impact of these challenges.

Future Opportunities in Europe Food Service Market

Future growth is expected from expanding into underserved markets, particularly in Eastern Europe. Technological advancements such as personalized menu options via AI and the utilization of sustainable packaging will open new avenues for growth. Changing consumer preferences, including rising interest in healthier and more sustainable options, present further opportunities.

Major Players in the Europe Food Service Market Ecosystem

- AmRest Holdings SE

- Yum! Brands Inc

- Coop Gruppe Genossenschaft

- QSR Platform Holding SCA

- Cremonini SpA

- The Restaurant Group PLC

- Groupe Bertrand

- PizzaExpress (Restaurants) Limited

- Autogrill SpA

- Groupe Le Duff

- Domino's Pizza Enterprises Ltd

- Restalia Grupo de Eurorestauracion SL

- Costa Coffee

- Starbucks Corporation

- Mitchells & Butlers PLC

- Restaurant Brands International Inc

- McDonald's Corporation

- LSG Group

- Gategroup

- Whitbread PLC

- Greggs PLC

Key Developments in Europe Food Service Market Industry

- August 2023: Starbucks announces a USD 32.78 Million investment to open 100 new UK outlets, reflecting continued growth.

- April 2023: QSR Platform Holding SCA partners with Foodtastic to expand the Pita Pit brand in France and Western Europe, while Foodtastic expands O’Tacos in Canada.

- March 2023: McDonald's France temporarily replaces its potatoes with vegetable fries, showcasing a response to consumer trends.

Strategic Europe Food Service Market Forecast

The Europe Food Service Market is poised for significant growth in the coming years, driven by increasing disposable incomes, evolving consumer preferences, and technological advancements. The market is expected to see continued expansion in key segments, particularly chained outlets and leisure locations. The rise of innovative technologies and sustainable practices will further propel growth, creating lucrative opportunities for established players and new entrants alike. The full report provides detailed forecasts for each segment and region.

Europe Food Service Market Segmentation

-

1. Foodservice Type

-

1.1. Cafes & Bars

-

1.1.1. By Cuisine

- 1.1.1.1. Bars & Pubs

- 1.1.1.2. Juice/Smoothie/Desserts Bars

- 1.1.1.3. Specialist Coffee & Tea Shops

-

1.1.1. By Cuisine

- 1.2. Cloud Kitchen

-

1.3. Full Service Restaurants

- 1.3.1. Asian

- 1.3.2. European

- 1.3.3. Latin American

- 1.3.4. Middle Eastern

- 1.3.5. North American

- 1.3.6. Other FSR Cuisines

-

1.4. Quick Service Restaurants

- 1.4.1. Bakeries

- 1.4.2. Burger

- 1.4.3. Ice Cream

- 1.4.4. Meat-based Cuisines

- 1.4.5. Pizza

- 1.4.6. Other QSR Cuisines

-

1.1. Cafes & Bars

-

2. Outlet

- 2.1. Chained Outlets

- 2.2. Independent Outlets

-

3. Location

- 3.1. Leisure

- 3.2. Lodging

- 3.3. Retail

- 3.4. Standalone

- 3.5. Travel

Europe Food Service Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.11% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products

- 3.3. Market Restrains

- 3.3.1. Presence of Preservatives in Ready Meals may Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 5.1.1. Cafes & Bars

- 5.1.1.1. By Cuisine

- 5.1.1.1.1. Bars & Pubs

- 5.1.1.1.2. Juice/Smoothie/Desserts Bars

- 5.1.1.1.3. Specialist Coffee & Tea Shops

- 5.1.1.1. By Cuisine

- 5.1.2. Cloud Kitchen

- 5.1.3. Full Service Restaurants

- 5.1.3.1. Asian

- 5.1.3.2. European

- 5.1.3.3. Latin American

- 5.1.3.4. Middle Eastern

- 5.1.3.5. North American

- 5.1.3.6. Other FSR Cuisines

- 5.1.4. Quick Service Restaurants

- 5.1.4.1. Bakeries

- 5.1.4.2. Burger

- 5.1.4.3. Ice Cream

- 5.1.4.4. Meat-based Cuisines

- 5.1.4.5. Pizza

- 5.1.4.6. Other QSR Cuisines

- 5.1.1. Cafes & Bars

- 5.2. Market Analysis, Insights and Forecast - by Outlet

- 5.2.1. Chained Outlets

- 5.2.2. Independent Outlets

- 5.3. Market Analysis, Insights and Forecast - by Location

- 5.3.1. Leisure

- 5.3.2. Lodging

- 5.3.3. Retail

- 5.3.4. Standalone

- 5.3.5. Travel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Foodservice Type

- 6. Germany Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Food Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 AmRest Holdings SE

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yum! Brands Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Coop Gruppe Genossenschaft

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 QSR Platform Holding SCA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Cremonini SpA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Restaurant Group PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Groupe Bertrand

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 PizzaExpress (Restaurants) Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Autogrill SpA

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Groupe Le Duff

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Domino's Pizza Enterprises Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Restalia Grupo de Eurorestauracion SL

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Costa Coffee

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Starbucks Corporation

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Mitchells & Butlers PLC

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Restaurant Brands International Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 McDonald's Corporation

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 LSG Group

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Gategroup

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Whitbread PLC

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Greggs PLC

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.1 AmRest Holdings SE

List of Figures

- Figure 1: Europe Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 3: Europe Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 4: Europe Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 5: Europe Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Food Service Market Revenue Million Forecast, by Foodservice Type 2019 & 2032

- Table 15: Europe Food Service Market Revenue Million Forecast, by Outlet 2019 & 2032

- Table 16: Europe Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 17: Europe Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Food Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Food Service Market?

The projected CAGR is approximately 5.11%.

2. Which companies are prominent players in the Europe Food Service Market?

Key companies in the market include AmRest Holdings SE, Yum! Brands Inc, Coop Gruppe Genossenschaft, QSR Platform Holding SCA, Cremonini SpA, The Restaurant Group PLC, Groupe Bertrand, PizzaExpress (Restaurants) Limited, Autogrill SpA, Groupe Le Duff, Domino's Pizza Enterprises Ltd, Restalia Grupo de Eurorestauracion SL, Costa Coffee, Starbucks Corporation, Mitchells & Butlers PLC, Restaurant Brands International Inc, McDonald's Corporation, LSG Group, Gategroup, Whitbread PLC, Greggs PLC.

3. What are the main segments of the Europe Food Service Market?

The market segments include Foodservice Type, Outlet, Location.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Clean Label Food & Beverage Products; Rising Demand for Dairy Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Presence of Preservatives in Ready Meals may Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

August 2023: Coffee shop chain Starbucks announced plans to invest USD 32.78 million toward opening 100 new outlets across the United Kingdom in 2023, as it expects its growth momentum to continue.April 2023: QSR Platform Holding SCA announced that it would be partnering with Foodtastic to bring the Pita Pit brand to France and Western Europe by opening 50 Pita Pits. In return, Foodtastic will expand O'Tacos in Canada by opening at least 50 locations in 2023.March 2023: McDonald's France replaced its potatoes with french fries and offered vegetable fries for a limited time. During this period, beets, carrots, and parsnips replaced the famous potato fries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Food Service Market?

To stay informed about further developments, trends, and reports in the Europe Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence