Key Insights

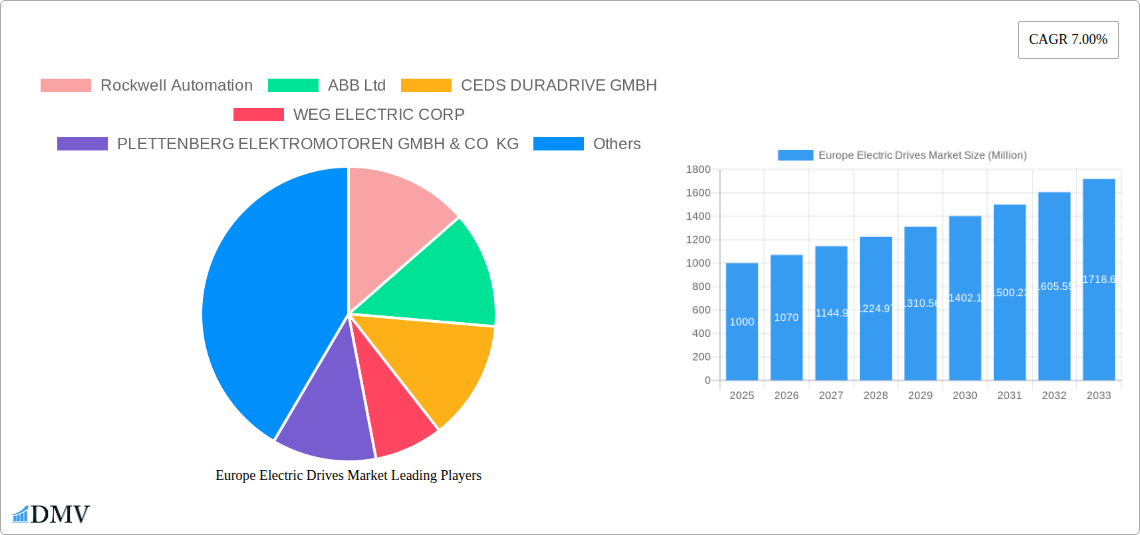

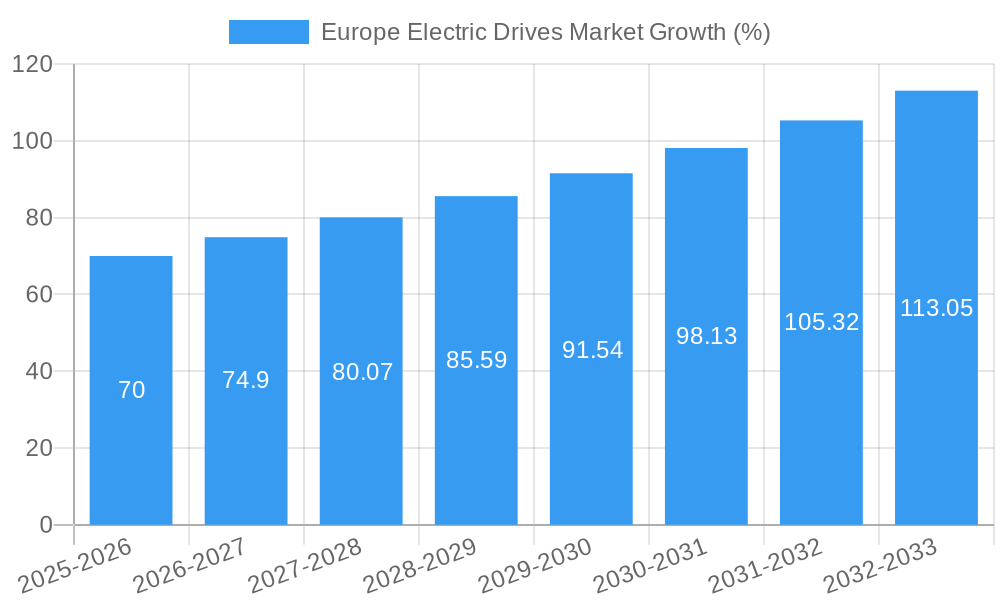

The European electric drives market, valued at approximately €[Estimate based on provided market size XX and value unit Million – Let's assume XX = 1000 for this example. Therefore, the 2025 market size is €1000 million.] million in 2025, is projected to experience robust growth, driven by a compound annual growth rate (CAGR) of 7.00% from 2025 to 2033. This expansion is fueled by several key factors. The increasing automation across diverse industrial sectors, including oil & gas, chemical processing, and manufacturing, necessitates the widespread adoption of efficient and reliable electric drive systems. Furthermore, stringent environmental regulations promoting energy efficiency and reduced carbon emissions are significantly impacting market dynamics, driving demand for energy-saving electric drive technologies such as AC drives and servo drives. Growth is also spurred by advancements in drive technology, leading to improved performance, enhanced control capabilities, and reduced maintenance needs. Specific segments like servo drives are experiencing particularly strong growth due to their precision and responsiveness, making them crucial in automated processes. Germany, the UK, France, and Italy are the major contributors to the overall market size within Europe, with Germany holding a significant market share due to its robust industrial base and technological advancements.

The market's growth, however, is not without challenges. High initial investment costs associated with implementing electric drive systems can act as a restraint, particularly for small and medium-sized enterprises (SMEs). Furthermore, the technological complexity of some drive systems necessitates skilled labor for installation, maintenance, and operation, potentially impacting adoption in regions with limited skilled workforce. Competition among established players like ABB, Rockwell Automation, and WEG, alongside emerging regional players, is intense, putting pressure on pricing and margins. Nevertheless, ongoing technological innovations, coupled with supportive government policies focused on industrial automation and sustainability, are expected to mitigate these restraints and ensure continued, albeit potentially moderated, growth throughout the forecast period. The diverse range of end-user industries and the varying technological demands across these sectors present significant opportunities for market players to specialize and cater to specific needs.

Europe Electric Drives Market: A Comprehensive Market Report (2019-2033)

This insightful report provides a comprehensive analysis of the Europe Electric Drives Market, offering a detailed outlook for stakeholders and investors. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. The report delves into market size, segmentation, key players, technological advancements, and future growth opportunities, providing actionable intelligence for informed decision-making. The market is projected to reach xx Million by 2033, presenting significant investment potential.

Europe Electric Drives Market Market Composition & Trends

This section offers a deep dive into the competitive landscape, innovation dynamics, and regulatory factors shaping the European electric drives market. We analyze market concentration, identifying leading players and their respective market share. The report further examines the impact of mergers and acquisitions (M&A) activity, including deal values and their influence on market structure. Innovation catalysts, such as technological advancements and government initiatives, are thoroughly assessed, alongside an examination of substitute products and their competitive impact. Finally, detailed end-user profiles reveal industry-specific demands and preferences, providing a holistic understanding of the market’s intricacies.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 5 players holding approximately xx% of the market share in 2024.

- M&A Activity: The past five years have witnessed xx M&A deals valued at approximately xx Million, predominantly driven by strategic expansion and technological integration.

- Innovation Catalysts: Stringent environmental regulations and the rising demand for energy-efficient solutions are driving innovation in electric drive technologies.

- Substitute Products: The emergence of alternative technologies, such as hydraulic and pneumatic systems, poses a moderate competitive threat.

- End-User Profiles: The automotive, industrial automation, and renewable energy sectors are key end-user segments, exhibiting diverse requirements in terms of drive specifications.

Europe Electric Drives Market Industry Evolution

This section traces the evolution of the European electric drives market, charting its growth trajectory from 2019 to 2033. We analyze the interplay of technological advancements, shifting consumer demands, and market growth rates, providing a detailed understanding of the market's dynamic nature. Specific data points, such as compound annual growth rates (CAGR) and adoption rates of new technologies, are included to support our analysis. The report also explores the impact of macroeconomic factors, such as economic cycles and government policies, on market growth.

Leading Regions, Countries, or Segments in Europe Electric Drives Market

This section identifies the leading regions, countries, and segments within the European electric drives market. We analyze the factors driving the dominance of specific segments, providing a detailed understanding of regional variations and key market drivers. This includes analyzing investment trends, regulatory support, and technological advancements.

By Type: AC Drives remain the dominant segment, accounting for approximately xx% of the market in 2024, driven by their cost-effectiveness and versatility. Servo drives are experiencing robust growth, fueled by increasing automation in various industries.

By Voltage: The Medium voltage segment is expected to dominate due to the increasing demand for high-power applications across various industries.

By End-user Industry: The industrial automation sector is the leading end-user, driven by the increasing adoption of electric drives in manufacturing processes. Other significant segments include Oil & Gas, Chemical & Petrochemical, and Renewable Energy.

By Country: Germany and the United Kingdom are the leading markets, benefiting from robust industrial activity and supportive government policies.

Key Drivers: Strong industrial growth, government incentives for energy efficiency, and increasing automation across various sectors are key drivers.

Europe Electric Drives Market Product Innovations

Recent years have witnessed significant advancements in electric drive technology, encompassing improvements in efficiency, power density, and control capabilities. New product features include advanced control algorithms, integrated safety systems, and enhanced communication interfaces. These innovations are enhancing performance metrics, leading to improved energy efficiency and reduced operational costs. Key players are focusing on developing customized solutions to cater to specific industry needs. The market is seeing a rise in smart drives with integrated connectivity and data analytics capabilities.

Propelling Factors for Europe Electric Drives Market Growth

The Europe Electric Drives Market's growth is propelled by several key factors: Firstly, increasing automation across industries drives the demand for advanced electric drive systems. Secondly, stringent environmental regulations promoting energy efficiency fuel innovation and adoption of energy-efficient electric drives. Finally, government initiatives supporting renewable energy further stimulate market expansion.

Obstacles in the Europe Electric Drives Market Market

Several obstacles hinder market growth. Supply chain disruptions caused by geopolitical events and the COVID-19 pandemic affect component availability and lead times. Intense competition among established players and emerging entrants puts downward pressure on prices. Furthermore, the high upfront investment required for advanced electric drive systems might limit adoption among smaller companies.

Future Opportunities in Europe Electric Drives Market

Emerging opportunities exist in specialized applications, such as electric vehicles, robotics, and renewable energy integration. Advancements in power electronics and control technologies will further enhance the capabilities of electric drives. The growing focus on Industry 4.0 and smart manufacturing opens new avenues for connected and data-driven electric drive systems. Expansion into developing markets within Europe presents substantial growth potential.

Major Players in the Europe Electric Drives Market Ecosystem

- Rockwell Automation

- ABB Ltd

- CEDS DURADRIVE GMBH

- WEG ELECTRIC CORP

- PLETTENBERG ELEKTROMOTOREN GMBH & CO KG

- GROSCHOPP AG DRIVES & MORE

- Fuji Electric

- IAI Industrieroboter GmbH

- DUNKERMOTOREN GMBH

- Robert Bosch GmbH

- Yaskawa Europe GmbH

- TECO Electric Europe Ltd

- FISCHER PANDA GMBH

Key Developments in Europe Electric Drives Market Industry

- March 2021: Yaskawa launches AC Servo Drive Σ-X Series, featuring a speed response frequency of 3.5 kHz and a maximum servomotor speed of 7000 rotations per minute. This launch enhances motion control performance and expands Yaskawa's market share.

- March 2021: Rockwell Automation enhances the PowerFlex 755T AC Drive with improved security, performance, and commissioning features, including an embedded dual ethernet port capable of gigabit speeds. This upgrade strengthens Rockwell's position in the high-performance AC drive segment.

Strategic Europe Electric Drives Market Market Forecast

The Europe Electric Drives Market is poised for robust growth over the forecast period (2025-2033). Continued industrial automation, the rise of renewable energy, and ongoing technological advancements will drive market expansion. The increasing adoption of energy-efficient and smart drives will further fuel this growth, creating significant opportunities for established players and new entrants alike. The market is expected to exhibit a healthy CAGR of xx% during the forecast period.

Europe Electric Drives Market Segmentation

-

1. Type

- 1.1. AC Drives

- 1.2. DC Drives

- 1.3. Servo Drives

-

2. Voltage

- 2.1. Low

- 2.2. Medium

-

3. End-user Industry

- 3.1. Oil & Gas

- 3.2. Chemical & Petrochemical

- 3.3. Food & Beverage

- 3.4. Water & Wastewater

- 3.5. Power Generation

- 3.6. Metal & Mining

- 3.7. Pulp & Paper

- 3.8. HVAC

- 3.9. Discrete Industries

- 3.10. Other End-user Industries

Europe Electric Drives Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Electric Drives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 High adoption of industrial internet of things; Using smart electric drive technology

- 3.2.2 EV operating costs can be reduced.

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Electric Vehicles to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. AC Drives

- 5.1.2. DC Drives

- 5.1.3. Servo Drives

- 5.2. Market Analysis, Insights and Forecast - by Voltage

- 5.2.1. Low

- 5.2.2. Medium

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil & Gas

- 5.3.2. Chemical & Petrochemical

- 5.3.3. Food & Beverage

- 5.3.4. Water & Wastewater

- 5.3.5. Power Generation

- 5.3.6. Metal & Mining

- 5.3.7. Pulp & Paper

- 5.3.8. HVAC

- 5.3.9. Discrete Industries

- 5.3.10. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Electric Drives Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Rockwell Automation

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 CEDS DURADRIVE GMBH

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 WEG ELECTRIC CORP

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 PLETTENBERG ELEKTROMOTOREN GMBH & CO KG

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GROSCHOPP AG DRIVES & MORE

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fuji Electric*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 IAI Industrieroboter GmbH

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DUNKERMOTOREN GMBH

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Robert Bosch GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Yaskawa Europe GmbH

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 TECO Electric Europe Ltd

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 FISCHER PANDA GMBH

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.1 Rockwell Automation

List of Figures

- Figure 1: Europe Electric Drives Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Electric Drives Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Electric Drives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Electric Drives Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Electric Drives Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 4: Europe Electric Drives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe Electric Drives Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe Electric Drives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe Electric Drives Market Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Europe Electric Drives Market Revenue Million Forecast, by Voltage 2019 & 2032

- Table 16: Europe Electric Drives Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe Electric Drives Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe Electric Drives Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Electric Drives Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Europe Electric Drives Market?

Key companies in the market include Rockwell Automation, ABB Ltd, CEDS DURADRIVE GMBH, WEG ELECTRIC CORP, PLETTENBERG ELEKTROMOTOREN GMBH & CO KG, GROSCHOPP AG DRIVES & MORE, Fuji Electric*List Not Exhaustive, IAI Industrieroboter GmbH, DUNKERMOTOREN GMBH, Robert Bosch GmbH, Yaskawa Europe GmbH, TECO Electric Europe Ltd, FISCHER PANDA GMBH.

3. What are the main segments of the Europe Electric Drives Market?

The market segments include Type, Voltage, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High adoption of industrial internet of things; Using smart electric drive technology. EV operating costs can be reduced..

6. What are the notable trends driving market growth?

Increasing Demand for Electric Vehicles to Drive the Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs.

8. Can you provide examples of recent developments in the market?

March 2021 - Yaskawa launches AC Servo Drive Σ-X Series. The company designs the product to help the customers get the best motion performance. According to the company, during the trials, the speed response frequency of the device reached 3.5 kHz, while the maximum speed of the servomotor reached 7000 rotations per minute.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Electric Drives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Electric Drives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Electric Drives Market?

To stay informed about further developments, trends, and reports in the Europe Electric Drives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence