Key Insights

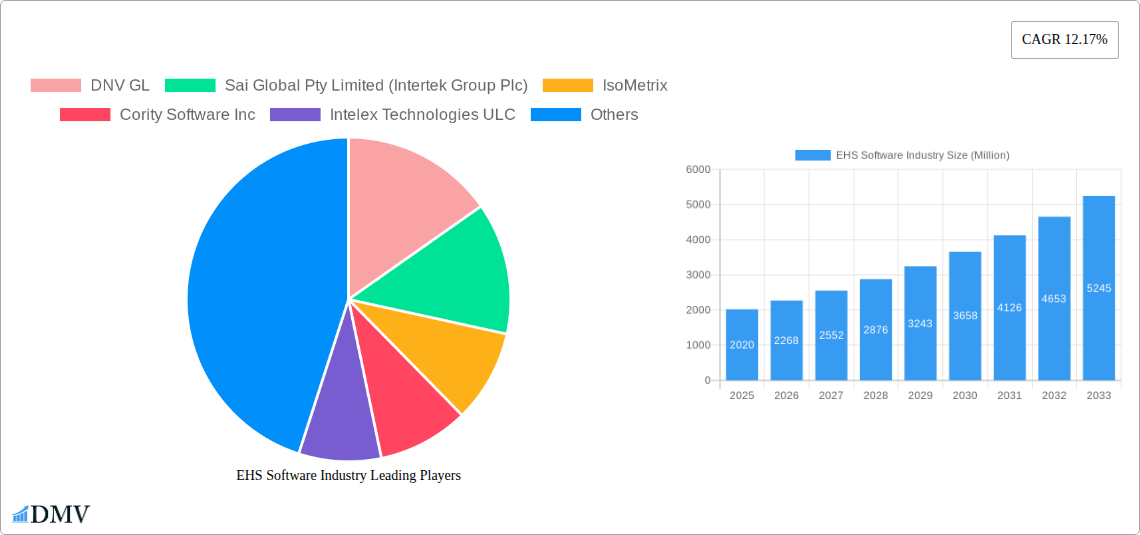

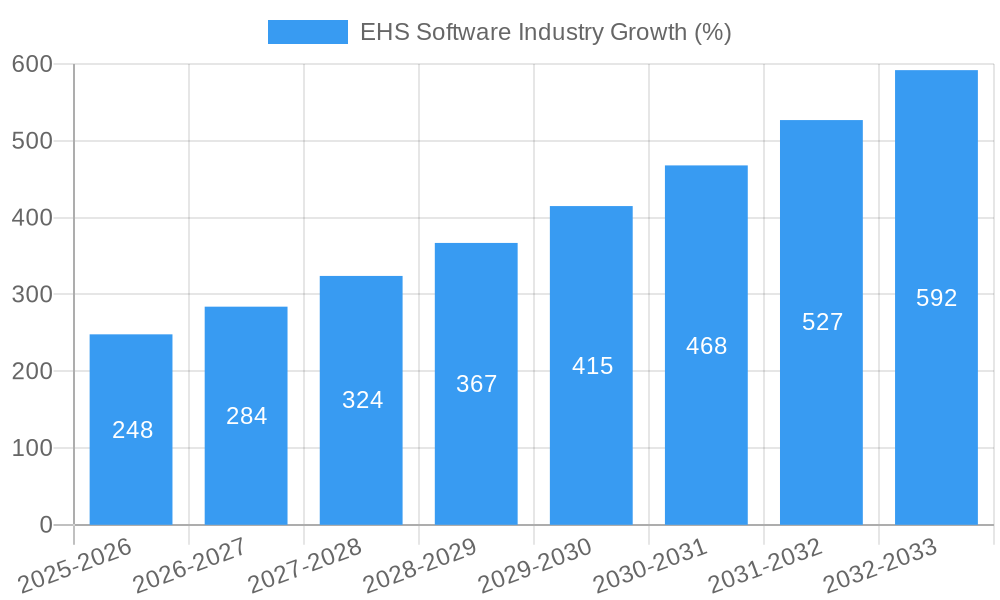

The EHS (Environmental, Health, and Safety) software market is experiencing robust growth, projected to reach \$2.02 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 12.17% from 2025 to 2033. This expansion is driven by several key factors. Increasing regulatory scrutiny across various industries, particularly in sectors like oil and gas, energy and utilities, and manufacturing, necessitates robust EHS management systems. Furthermore, the growing awareness of environmental sustainability and corporate social responsibility (CSR) initiatives are pushing organizations to adopt sophisticated EHS software solutions to minimize environmental impact and improve workplace safety. The shift toward cloud-based deployment models offers scalability and cost-effectiveness, fueling market adoption. Advanced analytics capabilities within these platforms allow for better risk assessment, improved compliance, and enhanced operational efficiency, making them an attractive investment for businesses of all sizes. Competition within the market is fierce, with established players like DNV GL, Intertek, and Sphera Solutions alongside emerging innovative companies driving innovation and pushing technological advancements.

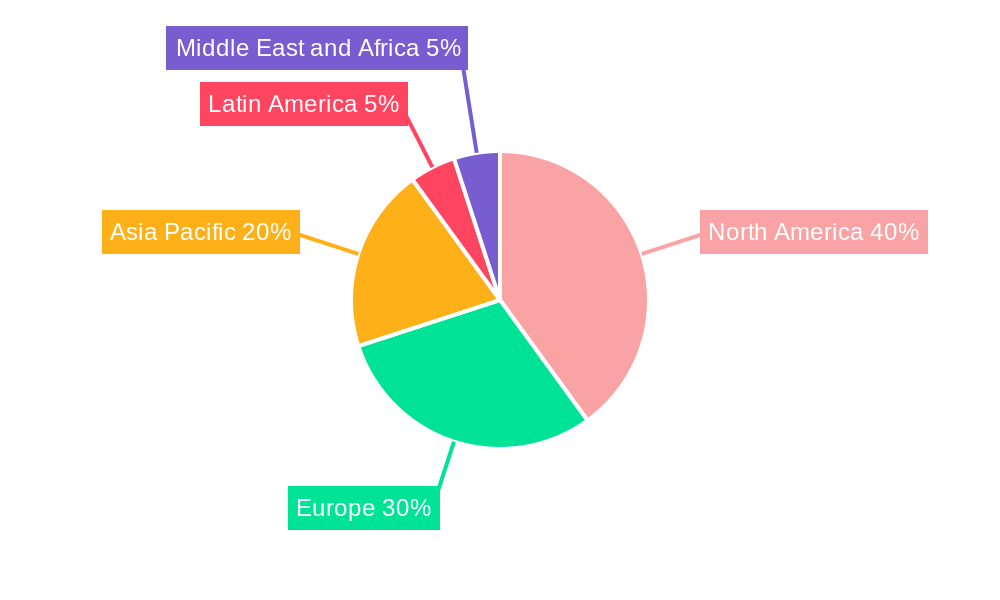

The market segmentation highlights the significant contribution of various end-user verticals. While oil and gas, energy and utilities, and manufacturing currently dominate, growth is expected across all sectors. The cloud deployment segment is anticipated to witness faster growth compared to on-premise solutions, reflecting a broader industry trend towards digital transformation. Geographic distribution sees North America and Europe as mature markets, while the Asia-Pacific region presents significant growth potential due to increasing industrialization and stricter environmental regulations. The forecast period (2025-2033) promises continued expansion, shaped by ongoing technological innovation, increasing regulatory pressures, and a greater focus on sustainable business practices. While economic fluctuations could present challenges, the long-term outlook for the EHS software market remains positive.

EHS Software Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the EHS (Environmental, Health, and Safety) software market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report examines market trends, leading players, and future growth potential. The market is projected to reach xx Million by 2033, showcasing significant expansion opportunities.

EHS Software Industry Market Composition & Trends

This section analyzes the competitive landscape, innovation drivers, regulatory influences, and market dynamics within the EHS software industry. The market exhibits moderate concentration, with several key players holding significant shares, but also featuring numerous niche players. Innovation is driven by increasing regulatory pressures, evolving technological capabilities, and the growing demand for integrated ESG (Environmental, Social, and Governance) solutions.

- Market Share Distribution (2024 Estimate): DNV GL (xx%), Sai Global (xx%), Sphera Solutions (xx%), Intelex Technologies (xx%), VelocityEHS (xx%), Others (xx%). These figures are estimates based on available market data and private company filings; precise percentages are not publicly available for all listed players.

- M&A Activity: The industry has witnessed significant M&A activity, with deals totaling an estimated xx Million in value during the historical period (2019-2024). Key drivers include portfolio expansion, accessing new customer bases, and accelerating growth. Examples include the VelocityEHS acquisitions and investment rounds detailed later in the report.

- Regulatory Landscape: Stringent EHS regulations globally are a key catalyst for market growth, driving demand for robust and compliant software solutions. Compliance requirements vary significantly by region and industry, creating diverse opportunities for specialized software vendors.

- Substitute Products: While dedicated EHS software provides comprehensive functionality, some companies may use alternative solutions, such as general-purpose business management software, for basic EHS tasks. However, the complexity and regulatory pressures inherent in EHS management typically favor dedicated solutions.

- End-User Profiles: The industry serves a broad spectrum of end-users across various sectors, including Oil and Gas, Energy and Utilities, Healthcare and Life Sciences, Construction and Manufacturing, Chemicals, Mining and Metals, Food and Beverages, and other verticals.

EHS Software Industry Evolution

The EHS software market has experienced robust growth over the past five years, fueled by technological advancements and evolving customer demands. The transition from on-premise to cloud-based solutions is a major trend, offering improved scalability, accessibility, and cost-effectiveness. Demand for integrated solutions that combine EHS and ESG functionality is also rapidly expanding, reflecting the growing importance of corporate sustainability. The market is witnessing increased adoption of AI and machine learning for predictive risk analysis and incident prevention.

Over the forecast period (2025-2033), the market is expected to maintain a compound annual growth rate (CAGR) of xx%, driven by sustained demand for compliance and increased focus on risk mitigation across industries. The adoption rate of cloud-based solutions is anticipated to surpass xx% by 2033.

Leading Regions, Countries, or Segments in EHS Software Industry

The North American market currently dominates the EHS software landscape, driven by stringent regulations, high technological adoption, and a substantial number of large enterprises. Europe follows closely, exhibiting significant growth potential particularly in the Chemicals and Manufacturing sectors.

- By End-user Vertical: The Oil and Gas, Energy and Utilities, and Chemicals sectors represent the largest market segments currently, due to stringent regulatory requirements and a high concentration of large-scale operations. However, growth is anticipated in the Healthcare and Life Sciences segment, driven by rising safety and compliance concerns.

- By Deployment Mode: The Cloud deployment model is experiencing rapid growth, surpassing the adoption rates of On-Premise deployments. The ease of accessibility and cost-effectiveness benefits contribute to this rise. Key drivers for this dominance include cost savings, enhanced scalability, and accessibility.

EHS Software Industry Product Innovations

Recent innovations within the EHS software industry include enhanced reporting and analytics capabilities, AI-powered risk assessment tools, improved mobile accessibility, and integrated ESG functionality. These features provide businesses with more comprehensive data insights, enabling proactive risk management and improved compliance efforts. Unique selling propositions frequently revolve around ease of use, regulatory compliance, data integration, and advanced analytics.

Propelling Factors for EHS Software Industry Growth

Several factors are driving the growth of the EHS software market. The increasing stringency of environmental, health, and safety regulations across the globe necessitates robust software solutions. Furthermore, technological advancements in areas such as AI and machine learning are providing enhanced capabilities for risk management and compliance. Finally, the growing emphasis on ESG (Environmental, Social, and Governance) reporting is fostering demand for integrated solutions.

Obstacles in the EHS Software Industry Market

Despite its considerable growth potential, the EHS software market faces various challenges. High implementation costs for large-scale enterprises can be a barrier to entry. Moreover, the integration of disparate EHS systems, legacy infrastructure and regulatory updates require considerable investments. Competition amongst established players and emerging solutions is intense, resulting in continuous pressure on pricing and innovation.

Future Opportunities in EHS Software Industry

Emerging opportunities lie in the expansion into developing economies, where regulatory frameworks are developing rapidly, and the integration of IoT devices and wearables for real-time data acquisition and incident reporting. Furthermore, advancements in AI and machine learning are poised to revolutionize predictive risk assessment, preventive maintenance, and overall operational efficiency.

Major Players in the EHS Software Industry Ecosystem

- DNV GL

- Sai Global Pty Limited (Intertek Group Plc)

- IsoMetrix

- Cority Software Inc

- Intelex Technologies ULC

- Sphera Solutions Inc

- iPoint-systems GmbH

- Benchmark Digital Partners LLC

- Enablon (Wolters Kluwer N V)

- ProcessMAP Corporation

- Dakota Software Corporation

- Quintec GmbH

- Evotix (SHE Software)

- VelocityEHS Holdings Inc

- SAP SE

Key Developments in EHS Software Industry Industry

- August 2022: Partners Group acquires a substantial minority stake in VelocityEHS from CVC Growth Funds, strengthening VelocityEHS's market position.

- April 2022: Quentic expands its partnership in hazardous chemicals management and occupational safety.

- March 2022: VelocityEHS acquires two software solutions from MyAbilities, enhancing its portfolio and capabilities.

- January 2022: ProcessMap Corporation secures significant investment from HgCapital LLC to accelerate growth.

Strategic EHS Software Industry Market Forecast

The EHS software market is poised for continued growth, driven by factors such as increasing regulatory scrutiny, the expanding adoption of cloud-based solutions, and the growing significance of ESG considerations. The market's expansion is further supported by ongoing technological advancements that enhance efficiency, compliance, and proactive risk management. The focus on sustainability and environmental responsibility across various sectors further strengthens the market's long-term outlook, promising significant growth and opportunity for innovative players.

EHS Software Industry Segmentation

-

1. Deployment Mode

- 1.1. Cloud

- 1.2. On-premise

-

2. End-user Vertical

- 2.1. Oil and Gas

- 2.2. Energy and Utilities

- 2.3. Healthcare and Life Sciences

- 2.4. Construction and Manufacturing

- 2.5. Chemicals

- 2.6. Mining and Metals

- 2.7. Food and Beverages

- 2.8. Other End-user Verticals

EHS Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

EHS Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.17% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Stringent Government Regulations and Technology Advancements has Spurred Adoption; Increasing Data Management and Reporting Requirements may Drive the Market Growth

- 3.3. Market Restrains

- 3.3.1 Implementation

- 3.3.2 Budgetary Concerns

- 3.3.3 and Lack of Analytics; Data Security and Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Increasing Data Management and Reporting Requirements may Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 5.1.1. Cloud

- 5.1.2. On-premise

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Oil and Gas

- 5.2.2. Energy and Utilities

- 5.2.3. Healthcare and Life Sciences

- 5.2.4. Construction and Manufacturing

- 5.2.5. Chemicals

- 5.2.6. Mining and Metals

- 5.2.7. Food and Beverages

- 5.2.8. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6. North America EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 6.1.1. Cloud

- 6.1.2. On-premise

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Oil and Gas

- 6.2.2. Energy and Utilities

- 6.2.3. Healthcare and Life Sciences

- 6.2.4. Construction and Manufacturing

- 6.2.5. Chemicals

- 6.2.6. Mining and Metals

- 6.2.7. Food and Beverages

- 6.2.8. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7. Europe EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 7.1.1. Cloud

- 7.1.2. On-premise

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Oil and Gas

- 7.2.2. Energy and Utilities

- 7.2.3. Healthcare and Life Sciences

- 7.2.4. Construction and Manufacturing

- 7.2.5. Chemicals

- 7.2.6. Mining and Metals

- 7.2.7. Food and Beverages

- 7.2.8. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8. Asia EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 8.1.1. Cloud

- 8.1.2. On-premise

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Oil and Gas

- 8.2.2. Energy and Utilities

- 8.2.3. Healthcare and Life Sciences

- 8.2.4. Construction and Manufacturing

- 8.2.5. Chemicals

- 8.2.6. Mining and Metals

- 8.2.7. Food and Beverages

- 8.2.8. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9. Australia and New Zealand EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 9.1.1. Cloud

- 9.1.2. On-premise

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Oil and Gas

- 9.2.2. Energy and Utilities

- 9.2.3. Healthcare and Life Sciences

- 9.2.4. Construction and Manufacturing

- 9.2.5. Chemicals

- 9.2.6. Mining and Metals

- 9.2.7. Food and Beverages

- 9.2.8. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10. Latin America EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 10.1.1. Cloud

- 10.1.2. On-premise

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Oil and Gas

- 10.2.2. Energy and Utilities

- 10.2.3. Healthcare and Life Sciences

- 10.2.4. Construction and Manufacturing

- 10.2.5. Chemicals

- 10.2.6. Mining and Metals

- 10.2.7. Food and Beverages

- 10.2.8. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11. Middle East and Africa EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 11.1.1. Cloud

- 11.1.2. On-premise

- 11.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 11.2.1. Oil and Gas

- 11.2.2. Energy and Utilities

- 11.2.3. Healthcare and Life Sciences

- 11.2.4. Construction and Manufacturing

- 11.2.5. Chemicals

- 11.2.6. Mining and Metals

- 11.2.7. Food and Beverages

- 11.2.8. Other End-user Verticals

- 11.1. Market Analysis, Insights and Forecast - by Deployment Mode

- 12. North America EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Europe EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Asia Pacific EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Middle East and Africa EHS Software Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1.

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 DNV GL

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Sai Global Pty Limited (Intertek Group Plc)

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 IsoMetrix

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Cority Software Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Intelex Technologies ULC

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Sphera Solutions Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 iPoint-systems GmbH

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Benchmark Digital Partners LLC

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Enablon (Wolters Kluwer N V )

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 ProcessMAP Corporation

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Dakota Software Corporation

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Quintec GmbH

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Evotix (SHE Software)

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 VelocityEHS Holdings Inc

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.15 SAP SE

- 17.2.15.1. Overview

- 17.2.15.2. Products

- 17.2.15.3. SWOT Analysis

- 17.2.15.4. Recent Developments

- 17.2.15.5. Financials (Based on Availability)

- 17.2.1 DNV GL

List of Figures

- Figure 1: EHS Software Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: EHS Software Industry Share (%) by Company 2024

List of Tables

- Table 1: EHS Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 3: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: EHS Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: EHS Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: EHS Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: EHS Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: EHS Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: EHS Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 16: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 19: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 22: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 25: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 28: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: EHS Software Industry Revenue Million Forecast, by Deployment Mode 2019 & 2032

- Table 31: EHS Software Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 32: EHS Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the EHS Software Industry?

The projected CAGR is approximately 12.17%.

2. Which companies are prominent players in the EHS Software Industry?

Key companies in the market include DNV GL, Sai Global Pty Limited (Intertek Group Plc), IsoMetrix, Cority Software Inc, Intelex Technologies ULC, Sphera Solutions Inc, iPoint-systems GmbH, Benchmark Digital Partners LLC, Enablon (Wolters Kluwer N V ), ProcessMAP Corporation, Dakota Software Corporation, Quintec GmbH, Evotix (SHE Software), VelocityEHS Holdings Inc, SAP SE.

3. What are the main segments of the EHS Software Industry?

The market segments include Deployment Mode, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Stringent Government Regulations and Technology Advancements has Spurred Adoption; Increasing Data Management and Reporting Requirements may Drive the Market Growth.

6. What are the notable trends driving market growth?

Increasing Data Management and Reporting Requirements may Drive the Market Growth.

7. Are there any restraints impacting market growth?

Implementation. Budgetary Concerns. and Lack of Analytics; Data Security and Privacy Concerns.

8. Can you provide examples of recent developments in the market?

August 2022: A substantial minority share in VelocityEHS from CVC Growth Funds was announced to be purchased by Partners Group, a prominent worldwide private markets business, on behalf of its customers. As a result of the deal, Partners Group would join CVC Growth on the company board. After the investment, Partners Group and CVC Growth will cooperate with the Company's management team to continue driving VelocityEHS' growth and solidify its position in the EHS and ESG software market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "EHS Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the EHS Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the EHS Software Industry?

To stay informed about further developments, trends, and reports in the EHS Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence