Key Insights

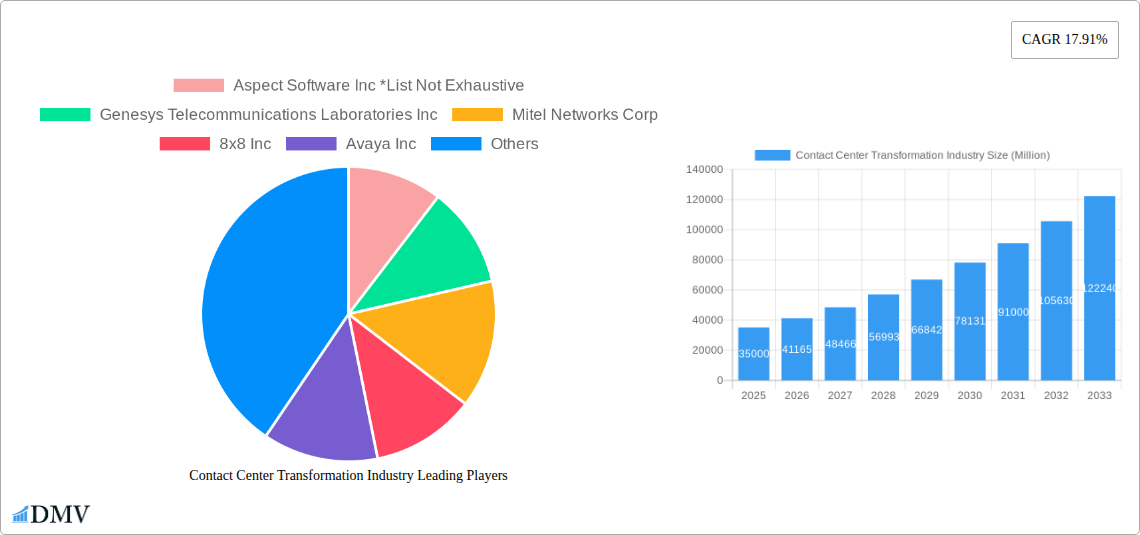

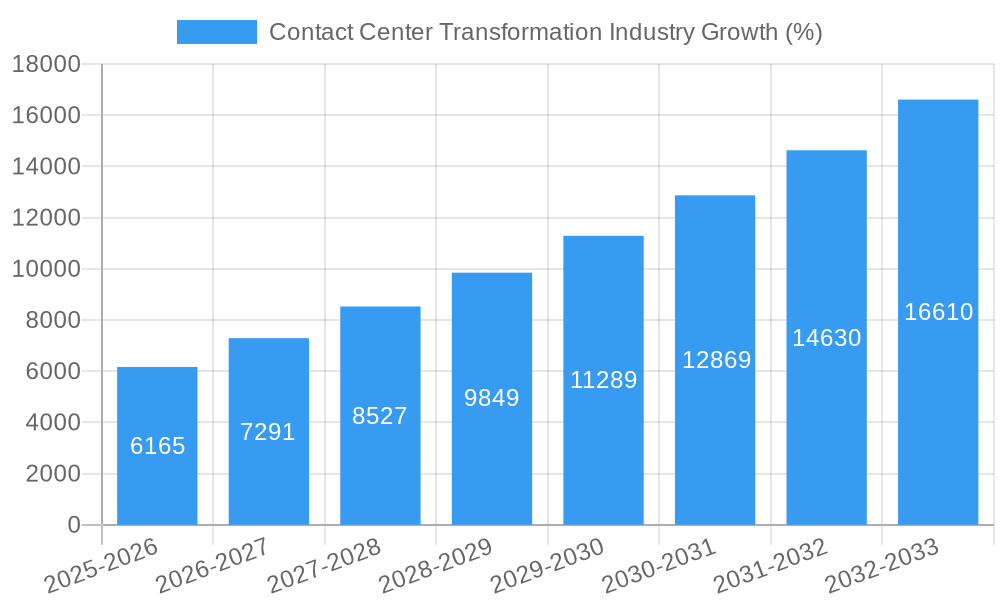

The Contact Center Transformation market is experiencing robust growth, projected to reach a significant size driven by the increasing adoption of cloud-based solutions, the need for improved customer experience (CX), and the rise of omnichannel communication strategies. The market's Compound Annual Growth Rate (CAGR) of 17.91% from 2019 to 2024 indicates strong investor interest and significant market expansion. Key drivers include the need for businesses to enhance operational efficiency, reduce costs, and improve customer satisfaction. The shift towards AI-powered solutions such as intelligent call routing and workforce performance optimization is streamlining operations and creating more personalized customer interactions. Furthermore, the growing demand for robust analytics and reporting capabilities enables businesses to gain valuable insights into customer behavior and optimize their strategies accordingly. While on-premise deployments still hold a segment of the market, the trend is clearly towards hosted and cloud-based solutions due to their scalability, flexibility, and cost-effectiveness. Large enterprises are leading the adoption, but the SME segment is also showing promising growth, driven by the accessibility of affordable and feature-rich cloud solutions. The BFSI, IT & Telecom, and Retail sectors are key end-user industries spearheading this transformation.

The future of the Contact Center Transformation market appears promising, with continued growth expected throughout the forecast period (2025-2033). Technological advancements in areas such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) will continue to fuel innovation, leading to more sophisticated and personalized customer interactions. The increasing adoption of omnichannel strategies, integrating various communication channels, is expected to further propel market growth. However, challenges remain, such as the need for skilled personnel to manage and maintain these complex systems and concerns regarding data security and privacy in the cloud. Despite these challenges, the ongoing drive for enhanced CX and operational efficiency ensures that the Contact Center Transformation market will maintain its significant upward trajectory in the coming years. We estimate the market size in 2025 to be approximately $35 Billion, extrapolating from the provided CAGR and considering industry growth trends.

Contact Center Transformation Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Contact Center Transformation industry, projecting a market value of $xx Million by 2033. It offers a comprehensive overview of market dynamics, key players, technological advancements, and future growth opportunities, covering the period from 2019 to 2033. The report is crucial for stakeholders seeking to understand the evolving landscape and make strategic decisions within this rapidly transforming sector.

Contact Center Transformation Industry Market Composition & Trends

The Contact Center Transformation market is experiencing dynamic shifts driven by technological innovation and evolving customer expectations. Market concentration is moderate, with several key players holding significant shares, but a fragmented landscape also exists amongst smaller niche players. The market is characterized by robust M&A activity, with deal values exceeding $xx Million in recent years. This reflects the desire for consolidation and expansion within the sector.

- Market Share Distribution (2024): Genesys holds approximately xx% market share, followed by Avaya with xx%, and other players such as 8x8 Inc., NICE Systems Inc., and RingCentral Inc. each holding significant shares.

- Innovation Catalysts: AI-powered solutions, cloud-based deployments, and omnichannel integration are major innovation drivers.

- Regulatory Landscape: Data privacy regulations (GDPR, CCPA) and compliance standards significantly influence market operations and vendor strategies.

- Substitute Products: While limited, self-service options like chatbots and FAQs can sometimes replace basic contact center interactions.

- End-User Profiles: The industry caters to a wide range of end-users across diverse sectors, including BFSI, IT & Telecom, Retail, and Healthcare, each with unique needs and priorities.

- M&A Activities: Significant M&A activity exceeding $xx Million annually reflects consolidation trends and the quest for technological expansion within the market.

Contact Center Transformation Industry Industry Evolution

The Contact Center Transformation industry is experiencing exponential growth, fueled by the convergence of several factors. The market witnessed a Compound Annual Growth Rate (CAGR) of xx% from 2019 to 2024 and is projected to maintain a CAGR of xx% between 2025 and 2033, reaching an estimated value of $xx Million by 2033. This growth is being driven primarily by the increasing adoption of cloud-based solutions, the integration of AI-powered technologies (e.g., chatbots, sentiment analysis), and a growing demand for enhanced customer experience (CX). The shift towards omnichannel engagement is another key driver, as businesses strive to deliver seamless interactions across multiple touchpoints. Furthermore, the increasing focus on workforce optimization and performance management is leading to higher adoption of analytics and reporting tools, contributing to the overall market expansion. The demand for flexible and scalable solutions, along with the decreasing cost of cloud services, are additional factors accelerating this market evolution. Adoption of AI-powered solutions, particularly for tasks such as sentiment analysis and automated routing, is increasing, improving efficiency and customer satisfaction.

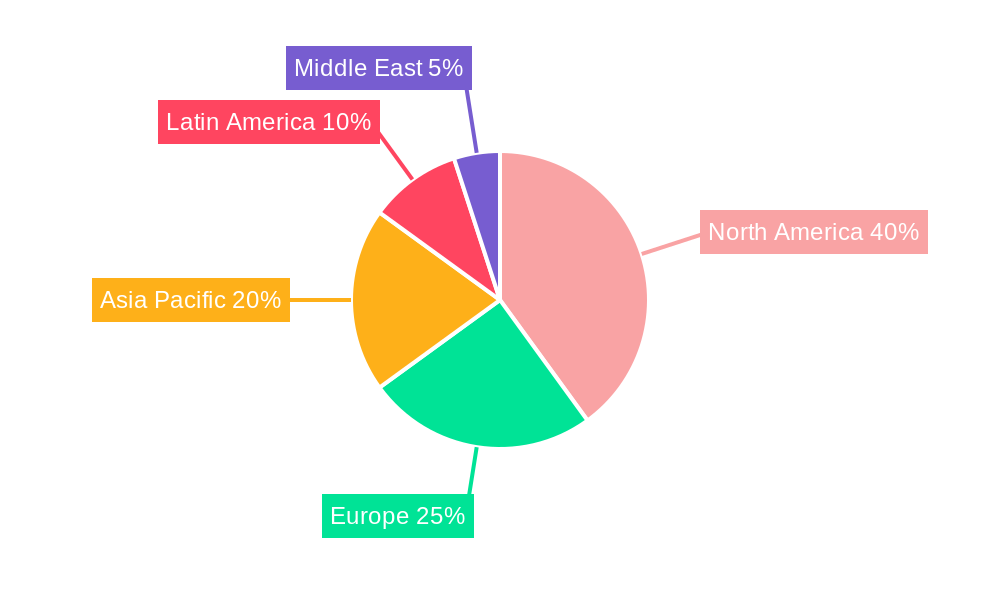

Leading Regions, Countries, or Segments in Contact Center Transformation Industry

Dominant Region: North America is currently the leading region, holding a xx% market share in 2024, driven by high technological adoption, robust digital infrastructure, and substantial investments in CX improvement initiatives. Europe follows closely, with a xx% market share.

Dominant Segments (By Type): Intelligent Call Routing and Workforce Performance Optimization are the leading segments by type, each accounting for approximately xx% of the total market in 2024. This is due to the significant value these technologies bring in terms of increased efficiency and reduced operational costs. The demand for advanced analytics and reporting solutions is also significant.

Dominant Segments (By Deployment): Hosted solutions are the fastest-growing segment, reflecting the advantages of scalability, flexibility, and reduced IT infrastructure costs. However, on-premise deployments continue to hold a significant share, especially among larger enterprises.

Dominant Segments (By Organization Size): Large enterprises are currently the leading consumers due to their larger budgets and sophisticated requirements. However, the SME segment is demonstrating strong growth potential, driven by the availability of cost-effective cloud-based solutions.

Dominant Segments (By End-user Industry): The BFSI sector is a significant driver, followed by IT & Telecom. The Retail and Healthcare sectors are also expected to demonstrate substantial growth in the coming years. Investment in customer experience improvements across these sectors is a key driver. Regulatory pressures in industries like BFSI are also propelling demand.

Contact Center Transformation Industry Product Innovations

Recent innovations focus on AI-driven automation, predictive analytics, and seamless omnichannel integration. Advanced routing algorithms, intelligent chatbots, and real-time performance dashboards are enhancing efficiency and customer satisfaction. The emergence of cloud-native contact centers is reducing the burden on IT infrastructure while ensuring scalability and enhanced security. These innovations contribute to improved agent productivity, increased customer satisfaction, and ultimately a better return on investment for businesses.

Propelling Factors for Contact Center Transformation Industry Growth

Technological advancements, particularly in AI and cloud computing, are the primary growth drivers. The rising demand for improved customer experience (CX) and the need for greater operational efficiency are also contributing factors. Furthermore, favorable regulatory environments in some regions are encouraging the adoption of advanced contact center technologies. The increasing adoption of cloud-based solutions allows for flexibility and scalability, making it appealing to businesses of all sizes.

Obstacles in the Contact Center Transformation Industry Market

High initial investment costs for some advanced solutions can be a barrier to entry for smaller businesses. Integration complexities with existing legacy systems can also hinder adoption. Data security concerns and the need for compliance with evolving data privacy regulations are major challenges for vendors and end-users alike. Furthermore, the intense competition among various vendors can make selecting the right solution a complex process.

Future Opportunities in Contact Center Transformation Industry

The integration of emerging technologies such as advanced analytics, machine learning, and robotic process automation (RPA) presents significant growth opportunities. Expansion into new markets, particularly in developing economies with growing digital adoption rates, offers substantial potential. Specialized solutions catering to specific industry verticals (e.g., healthcare, financial services) will experience growth. The potential for improved self-service options and proactive customer support can unlock additional market growth.

Major Players in the Contact Center Transformation Industry Ecosystem

- Aspect Software Inc

- Genesys Telecommunications Laboratories Inc

- Mitel Networks Corp

- 8x8 Inc

- Avaya Inc

- NICE Systems Inc

- RingCentral Inc

- Vocalcom SA

- Enghouse Interactive Inc

- Five9 Inc

- Altitude Software

Key Developments in Contact Center Transformation Industry Industry

June 2022: 8x8, Inc. launched the 8x8 Elevate Microsoft Partner (MP) Program and the 8x8 XT edition, enhancing Microsoft Teams integration for improved communication and productivity. This significantly impacted market dynamics by strengthening 8x8's position in the cloud contact center market and boosting Microsoft Teams adoption for business communication.

May 2022: Sprinklr's partnership with Twilio enabled the integration of Twilio's voice and SMS technologies with Sprinklr Modern Care, allowing clients to build next-generation contact centers with enhanced omnichannel capabilities. This development expanded the capabilities of both platforms, pushing the market towards more sophisticated omnichannel solutions.

Strategic Contact Center Transformation Industry Market Forecast

The Contact Center Transformation industry is poised for continued robust growth, driven by technological advancements, increasing demand for improved customer experience, and favorable regulatory environments. The shift towards cloud-based solutions, AI-powered tools, and omnichannel strategies will shape the market landscape in the coming years. New markets and industry-specific solutions are anticipated to drive growth, creating new opportunities for both established and emerging players. The market's future depends on continuous innovation, addressing evolving customer demands, and navigating the challenges of data security and regulatory compliance.

Contact Center Transformation Industry Segmentation

-

1. Type

- 1.1. Intelligent Call Routing

- 1.2. Workforce Performance Optimization

- 1.3. Dialers

- 1.4. Interactive Voice Response

- 1.5. Computer Telephony Integration

- 1.6. Analytics and Reporting

- 1.7. Services (Consulting and Managed Services)

-

2. Deployment

- 2.1. On-Premise

- 2.2. Hosted

-

3. Organization Size

- 3.1. Small and Medium Enterprises

- 3.2. Large

-

4. End-user Industry

- 4.1. Banking, Financial Services, and Insurance (BFSI)

- 4.2. IT and Telecom

- 4.3. Media and Entertainment

- 4.4. Retail and Consumer

- 4.5. Healthcare

- 4.6. Other End-user Industries

Contact Center Transformation Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Contact Center Transformation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 17.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need For Reduction in Overall Cost of Contact Center Management; Flexible Cloud-based Contact Center Solutions

- 3.3. Market Restrains

- 3.3.1. Integration Existing System To Cloud Due To Limited To Store Infrastructures

- 3.4. Market Trends

- 3.4.1. Intelligent Call Routing is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Intelligent Call Routing

- 5.1.2. Workforce Performance Optimization

- 5.1.3. Dialers

- 5.1.4. Interactive Voice Response

- 5.1.5. Computer Telephony Integration

- 5.1.6. Analytics and Reporting

- 5.1.7. Services (Consulting and Managed Services)

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. On-Premise

- 5.2.2. Hosted

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium Enterprises

- 5.3.2. Large

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Banking, Financial Services, and Insurance (BFSI)

- 5.4.2. IT and Telecom

- 5.4.3. Media and Entertainment

- 5.4.4. Retail and Consumer

- 5.4.5. Healthcare

- 5.4.6. Other End-user Industries

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Intelligent Call Routing

- 6.1.2. Workforce Performance Optimization

- 6.1.3. Dialers

- 6.1.4. Interactive Voice Response

- 6.1.5. Computer Telephony Integration

- 6.1.6. Analytics and Reporting

- 6.1.7. Services (Consulting and Managed Services)

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. On-Premise

- 6.2.2. Hosted

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium Enterprises

- 6.3.2. Large

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Banking, Financial Services, and Insurance (BFSI)

- 6.4.2. IT and Telecom

- 6.4.3. Media and Entertainment

- 6.4.4. Retail and Consumer

- 6.4.5. Healthcare

- 6.4.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Intelligent Call Routing

- 7.1.2. Workforce Performance Optimization

- 7.1.3. Dialers

- 7.1.4. Interactive Voice Response

- 7.1.5. Computer Telephony Integration

- 7.1.6. Analytics and Reporting

- 7.1.7. Services (Consulting and Managed Services)

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. On-Premise

- 7.2.2. Hosted

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium Enterprises

- 7.3.2. Large

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Banking, Financial Services, and Insurance (BFSI)

- 7.4.2. IT and Telecom

- 7.4.3. Media and Entertainment

- 7.4.4. Retail and Consumer

- 7.4.5. Healthcare

- 7.4.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Intelligent Call Routing

- 8.1.2. Workforce Performance Optimization

- 8.1.3. Dialers

- 8.1.4. Interactive Voice Response

- 8.1.5. Computer Telephony Integration

- 8.1.6. Analytics and Reporting

- 8.1.7. Services (Consulting and Managed Services)

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. On-Premise

- 8.2.2. Hosted

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium Enterprises

- 8.3.2. Large

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Banking, Financial Services, and Insurance (BFSI)

- 8.4.2. IT and Telecom

- 8.4.3. Media and Entertainment

- 8.4.4. Retail and Consumer

- 8.4.5. Healthcare

- 8.4.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Intelligent Call Routing

- 9.1.2. Workforce Performance Optimization

- 9.1.3. Dialers

- 9.1.4. Interactive Voice Response

- 9.1.5. Computer Telephony Integration

- 9.1.6. Analytics and Reporting

- 9.1.7. Services (Consulting and Managed Services)

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. On-Premise

- 9.2.2. Hosted

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium Enterprises

- 9.3.2. Large

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Banking, Financial Services, and Insurance (BFSI)

- 9.4.2. IT and Telecom

- 9.4.3. Media and Entertainment

- 9.4.4. Retail and Consumer

- 9.4.5. Healthcare

- 9.4.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Intelligent Call Routing

- 10.1.2. Workforce Performance Optimization

- 10.1.3. Dialers

- 10.1.4. Interactive Voice Response

- 10.1.5. Computer Telephony Integration

- 10.1.6. Analytics and Reporting

- 10.1.7. Services (Consulting and Managed Services)

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. On-Premise

- 10.2.2. Hosted

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium Enterprises

- 10.3.2. Large

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Banking, Financial Services, and Insurance (BFSI)

- 10.4.2. IT and Telecom

- 10.4.3. Media and Entertainment

- 10.4.4. Retail and Consumer

- 10.4.5. Healthcare

- 10.4.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Contact Center Transformation Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Aspect Software Inc *List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Genesys Telecommunications Laboratories Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Mitel Networks Corp

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 8x8 Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Avaya Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 NICE Systems Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 RingCentral Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Vocalcom SA

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Enghouse Interactive Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Five9 Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Altitude Software

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Aspect Software Inc *List Not Exhaustive

List of Figures

- Figure 1: Global Contact Center Transformation Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Contact Center Transformation Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Contact Center Transformation Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Contact Center Transformation Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Contact Center Transformation Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Contact Center Transformation Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 17: North America Contact Center Transformation Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 18: North America Contact Center Transformation Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 19: North America Contact Center Transformation Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 20: North America Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Contact Center Transformation Industry Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Contact Center Transformation Industry Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Contact Center Transformation Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 25: Europe Contact Center Transformation Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 26: Europe Contact Center Transformation Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 27: Europe Contact Center Transformation Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 28: Europe Contact Center Transformation Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 29: Europe Contact Center Transformation Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 30: Europe Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Contact Center Transformation Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Contact Center Transformation Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 35: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 36: Asia Pacific Contact Center Transformation Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 37: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 38: Asia Pacific Contact Center Transformation Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Asia Pacific Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Contact Center Transformation Industry Revenue (Million), by Type 2024 & 2032

- Figure 43: Latin America Contact Center Transformation Industry Revenue Share (%), by Type 2024 & 2032

- Figure 44: Latin America Contact Center Transformation Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 45: Latin America Contact Center Transformation Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 46: Latin America Contact Center Transformation Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 47: Latin America Contact Center Transformation Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 48: Latin America Contact Center Transformation Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 49: Latin America Contact Center Transformation Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 50: Latin America Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East Contact Center Transformation Industry Revenue (Million), by Type 2024 & 2032

- Figure 53: Middle East Contact Center Transformation Industry Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East Contact Center Transformation Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 55: Middle East Contact Center Transformation Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 56: Middle East Contact Center Transformation Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 57: Middle East Contact Center Transformation Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 58: Middle East Contact Center Transformation Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 59: Middle East Contact Center Transformation Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 60: Middle East Contact Center Transformation Industry Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East Contact Center Transformation Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Contact Center Transformation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 5: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Global Contact Center Transformation Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Contact Center Transformation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Contact Center Transformation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Contact Center Transformation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Contact Center Transformation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Contact Center Transformation Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 19: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 20: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 21: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 24: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 25: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 29: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 30: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 31: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 33: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 34: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 35: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 36: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Global Contact Center Transformation Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Global Contact Center Transformation Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 39: Global Contact Center Transformation Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 40: Global Contact Center Transformation Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 41: Global Contact Center Transformation Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contact Center Transformation Industry?

The projected CAGR is approximately 17.91%.

2. Which companies are prominent players in the Contact Center Transformation Industry?

Key companies in the market include Aspect Software Inc *List Not Exhaustive, Genesys Telecommunications Laboratories Inc, Mitel Networks Corp, 8x8 Inc, Avaya Inc, NICE Systems Inc, RingCentral Inc, Vocalcom SA, Enghouse Interactive Inc, Five9 Inc, Altitude Software.

3. What are the main segments of the Contact Center Transformation Industry?

The market segments include Type, Deployment, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Need For Reduction in Overall Cost of Contact Center Management; Flexible Cloud-based Contact Center Solutions.

6. What are the notable trends driving market growth?

Intelligent Call Routing is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Integration Existing System To Cloud Due To Limited To Store Infrastructures.

8. Can you provide examples of recent developments in the market?

June 2022 - 8x8, Inc., an integrated cloud communications platform, announced the 8x8 Elevate Microsoft Partner (MP) Program and the exclusive 8x8 XT edition, enabling enterprises to adopt Microsoft Teams to reduce communication costs and improve employee productivity through a highly resilient global telephony solution. 8x8 Voice for Microsoft Teams is a core component of 8x8 XCaaS (eXperience Communications as a Service), a single-vendor solution that offers fully integrated, cloud-native contact center, voice, team chat, video meetings, and CPaaS embeddable APIs capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contact Center Transformation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contact Center Transformation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contact Center Transformation Industry?

To stay informed about further developments, trends, and reports in the Contact Center Transformation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence