Key Insights

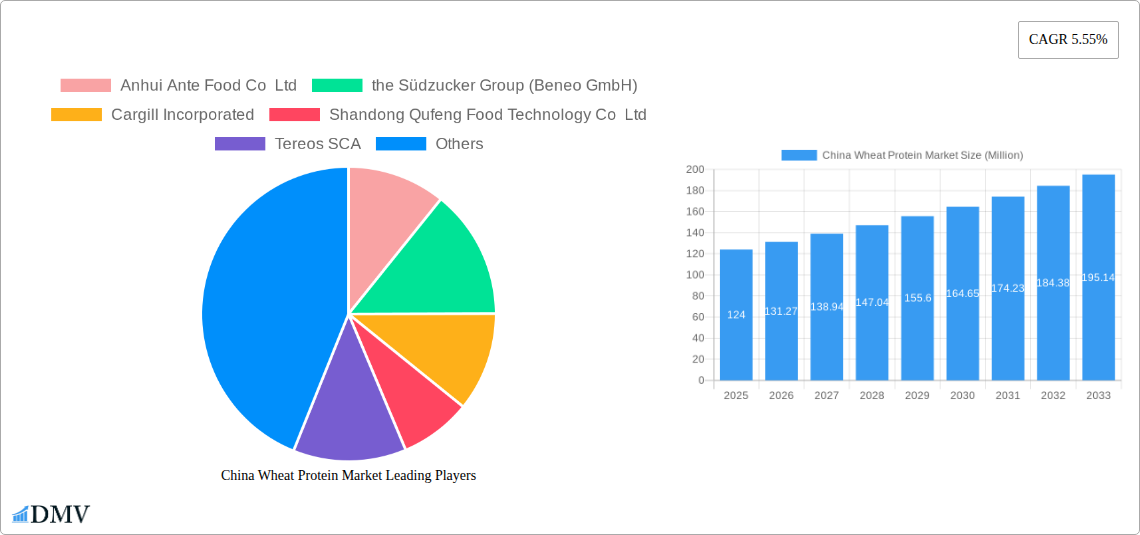

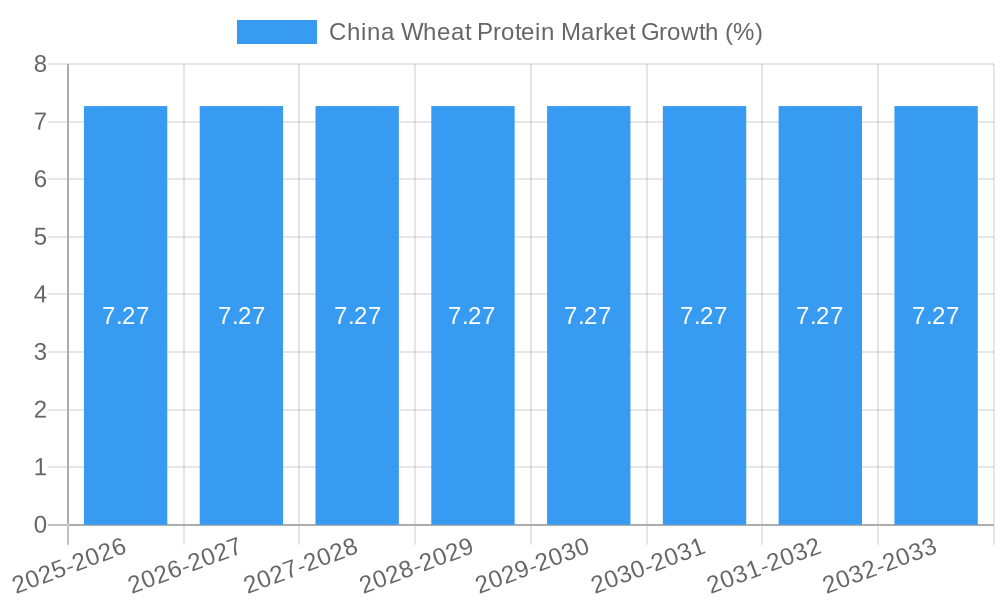

The China wheat protein market, valued at $124 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for plant-based protein sources and the rising popularity of functional foods and beverages. This growth is further fueled by the expanding animal feed industry in China, which increasingly incorporates wheat protein for its nutritional benefits and cost-effectiveness compared to traditional protein sources. The market segmentation reveals a significant share held by wheat protein concentrates, reflecting their widespread use across various applications. While isolates and textured/hydrolyzed forms command a smaller share currently, their specialized functionalities are driving growth in niche segments like personal care and high-value food products. Key players like Anhui Ante Food Co Ltd, Beneo GmbH, and Cargill Incorporated are strategically positioning themselves to capture market share through innovation and expansion, focusing on product diversification and improved processing technologies. The 5.55% CAGR projected through 2033 indicates a substantial market expansion, driven by ongoing consumer preference shifts and government initiatives promoting sustainable and healthy food options. However, challenges remain, including fluctuations in wheat prices and potential supply chain disruptions which could impact the overall market growth trajectory. The market's geographic concentration in China presents both an opportunity and a challenge; further expansion into other regions of the country remains a key strategy for sustained growth.

Government regulations regarding food safety and labeling, as well as increasing consumer awareness of the nutritional and environmental benefits of plant-based proteins, are expected to further stimulate the market's growth. This upward trend is predicted to continue, with substantial growth anticipated across all market segments. However, the market needs to address challenges such as maintaining consistent product quality and developing efficient and sustainable production processes to fully realize its growth potential. Companies are expected to invest in research and development to improve the functionality and nutritional profile of wheat protein, leading to new product innovations and applications. The increasing focus on sustainability and reducing reliance on imported protein sources will also drive the market's expansion, making it an attractive investment sector for both domestic and international players.

China Wheat Protein Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the burgeoning China Wheat Protein Market, offering crucial data and forecasts from 2019 to 2033. The study meticulously examines market dynamics, competitive landscapes, and future growth trajectories, equipping stakeholders with the knowledge needed to navigate this rapidly evolving sector. With a base year of 2025 and an estimated year of 2025, this report offers valuable insights into the market's historical performance (2019-2024) and projects its future performance (2025-2033). The total market size is predicted to reach xx Million by 2033.

China Wheat Protein Market Composition & Trends

This section delves into the intricate structure of the China wheat protein market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user preferences, and mergers and acquisitions (M&A) activities. The market is characterized by a moderately concentrated landscape, with key players such as Anhui Ante Food Co Ltd and Cargill Incorporated holding significant market share. However, smaller, agile companies are also contributing significantly to innovation.

Market Concentration: The top 5 players account for approximately xx% of the market share in 2025, indicating a moderately concentrated landscape with room for both established players and emerging competitors. Market share distribution is expected to shift slightly by 2033, with a predicted xx% increase in market share for smaller companies due to increased innovation.

Innovation Catalysts: Growing demand for plant-based protein alternatives, coupled with technological advancements in wheat protein extraction and processing, is driving innovation. The development of new functionalities and improved nutritional profiles of wheat protein products is a significant catalyst for market growth.

Regulatory Landscape: Government regulations pertaining to food safety and labeling significantly impact the market. Stricter regulations are anticipated to drive product quality and improve transparency within the supply chain.

Substitute Products: Soy protein, pea protein, and other plant-based proteins act as substitutes; however, wheat protein's unique functional properties and relative cost-effectiveness maintain its competitive edge.

End-User Profiles: The primary end-users include the food and beverage, animal feed, and personal care & cosmetics industries. The animal feed segment is expected to dominate the market due to increasing demand for sustainable animal feed solutions, with projections showing xx Million in revenue by 2033.

M&A Activities: Significant M&A activities have been observed, particularly in the past 5 years, with deal values totaling xx Million. These transactions indicate the strategic importance of the market and the consolidation of market share by major players.

China Wheat Protein Market Industry Evolution

This section traces the evolutionary path of the China wheat protein market, analyzing market growth trajectories, technological advancements, and evolving consumer preferences. The market has witnessed significant growth in the past five years, driven by increasing consumer awareness of the nutritional benefits of plant-based proteins and the growing adoption of sustainable and ethical food practices.

Technological advancements in wheat protein extraction and processing have facilitated the production of high-quality, functional wheat protein ingredients, leading to diversified applications across various end-user segments. The market exhibits a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024), with projected CAGR of xx% during the forecast period (2025-2033). This robust growth is largely fueled by rising consumer preference for plant-based diets, alongside advancements in extraction technologies leading to increased efficiency and cost-effectiveness. The rising demand in animal feed segment particularly demonstrates the impact of these trends with an estimated xx% increase in consumption between 2025 and 2033. This trend is mirrored by the growing adoption of wheat protein in the food and beverage sector, driven by the versatility and functionality of the protein. Further innovation in texture and taste profile is enhancing consumer acceptance and creating new market opportunities.

Leading Regions, Countries, or Segments in China Wheat Protein Market

This section identifies the leading regions, countries, and segments within the China wheat protein market. Considering the vastness of China, regional variations in consumption patterns and market dynamics are significant. However, the eastern coastal regions, known for their higher population density and advanced food processing industries, currently dominate the market.

Key Drivers for Dominant Segments:

- Animal Feed: High demand for cost-effective, high-protein animal feed, coupled with government support for sustainable animal agriculture.

- Food and Beverages: Rising consumer preference for plant-based foods and growing demand for clean-label, functional food ingredients.

- Concentrates: Cost-effectiveness and widespread availability compared to isolates and textured/hydrolyzed forms.

Dominance Factors: Factors contributing to the dominance of specific segments include higher demand from specific end-users, economies of scale in production, and ease of integration into existing supply chains. For example, the cost-effectiveness of concentrates makes them particularly attractive for high-volume applications in the animal feed industry.

China Wheat Protein Market Product Innovations

Recent innovations focus on enhancing the functional properties of wheat protein, such as improved solubility, emulsification, and water-holding capacity, to broaden its applications in food and beverage products. The development of wheat protein isolates with enhanced digestibility and nutritional value is also driving market expansion. These innovations cater to consumer demand for clean-label, natural, and functional ingredients, and they are contributing to the growth of wheat protein across various segments and applications.

Propelling Factors for China Wheat Protein Market Growth

Several factors contribute to the growth of the China wheat protein market. Technological advancements in wheat protein extraction and processing have made the ingredient more efficient and cost-effective to produce. Moreover, the rising demand for plant-based protein alternatives is a significant driver of market growth. Increasing consumer awareness of the health and environmental benefits of plant-based diets, coupled with supportive government policies promoting sustainable agriculture, further enhances market expansion. The growing global interest in plant-based proteins creates a lucrative export market for Chinese wheat protein producers.

Obstacles in the China Wheat Protein Market Market

Despite the favorable growth trajectory, the China wheat protein market faces several challenges. Fluctuations in wheat prices and potential supply chain disruptions, particularly considering weather patterns, represent significant risks. Furthermore, intense competition from other plant-based proteins necessitates continuous innovation and improvement in product quality and cost-effectiveness. Stringent food safety regulations increase production costs and compliance burdens for manufacturers. These obstacles present challenges to sustainable growth, requiring companies to adopt robust strategies for supply chain management and regulatory compliance.

Future Opportunities in China Wheat Protein Market

Future opportunities exist in the development of novel wheat protein applications in emerging food categories, such as meat alternatives and plant-based dairy products. Advancements in protein fractionation technologies could unlock higher value-added products with specialized functional characteristics. Expanding into new geographical markets and building stronger partnerships along the value chain will also create growth opportunities. The development of novel applications and new product formats, such as ready-to-mix protein powders, will attract a wider consumer base.

Major Players in the China Wheat Protein Market Ecosystem

- Anhui Ante Food Co Ltd

- the Südzucker Group (Beneo GmbH)

- Cargill Incorporated

- Shandong Qufeng Food Technology Co Ltd

- Tereos SCA

- Ezaki Glico Co Ltd

- Archer Daniels Midland Company

- Wilmar International Ltd

- Roquette Frères

- Lantmännen *List Not Exhaustive

Key Developments in China Wheat Protein Market Industry

June 2023: BENEO launched its new toolbox of non-GMO plant-based proteins, including wheat protein concentrate, for pet food applications, indicating a diversification of applications and expansion into new markets.

May 2023: Lantmännen's new biorefinery in Sweden, with established operations in China, signals increased production capacity and strengthened market presence. This development is set to create a ripple effect within the market, enhancing supply chain efficiency and increasing the availability of high-quality wheat protein.

Strategic China Wheat Protein Market Market Forecast

The China wheat protein market is poised for significant growth, driven by rising demand for plant-based proteins, technological advancements, and favorable government policies. The increasing focus on sustainable and ethical food production further strengthens market prospects. Continued innovation in product development, expansion into new applications, and strategic partnerships will be crucial for capturing the market's significant growth potential. The market is projected to experience substantial growth in the coming years, offering numerous opportunities for both established players and new entrants.

China Wheat Protein Market Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End-user

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.5. RTE/RTC Food Products

- 2.3.6. Snacks

China Wheat Protein Market Segmentation By Geography

- 1. China

China Wheat Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Product Innovation in Meat Alternatives Drive the Wheat Protein Market; Increasing Demand for Plant Protein in Food and Beverages Segment

- 3.3. Market Restrains

- 3.3.1. Increasing Gluten Intolerance Population

- 3.4. Market Trends

- 3.4.1 Animal Feed

- 3.4.2 Food and Beverages Industry holds the Largest Segment by End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Wheat Protein Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.5. RTE/RTC Food Products

- 5.2.3.6. Snacks

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Anhui Ante Food Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 the Südzucker Group (Beneo GmbH)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Incorporated

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Shandong Qufeng Food Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tereos SCA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ezaki Glico Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wilmar International Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roquette Frères

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lantmännen*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Anhui Ante Food Co Ltd

List of Figures

- Figure 1: China Wheat Protein Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Wheat Protein Market Share (%) by Company 2024

List of Tables

- Table 1: China Wheat Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Wheat Protein Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 3: China Wheat Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 4: China Wheat Protein Market Volume k Tons Forecast, by Form 2019 & 2032

- Table 5: China Wheat Protein Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 6: China Wheat Protein Market Volume k Tons Forecast, by End-user 2019 & 2032

- Table 7: China Wheat Protein Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: China Wheat Protein Market Volume k Tons Forecast, by Region 2019 & 2032

- Table 9: China Wheat Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Wheat Protein Market Volume k Tons Forecast, by Country 2019 & 2032

- Table 11: China Wheat Protein Market Revenue Million Forecast, by Form 2019 & 2032

- Table 12: China Wheat Protein Market Volume k Tons Forecast, by Form 2019 & 2032

- Table 13: China Wheat Protein Market Revenue Million Forecast, by End-user 2019 & 2032

- Table 14: China Wheat Protein Market Volume k Tons Forecast, by End-user 2019 & 2032

- Table 15: China Wheat Protein Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Wheat Protein Market Volume k Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Wheat Protein Market?

The projected CAGR is approximately 5.55%.

2. Which companies are prominent players in the China Wheat Protein Market?

Key companies in the market include Anhui Ante Food Co Ltd, the Südzucker Group (Beneo GmbH), Cargill Incorporated, Shandong Qufeng Food Technology Co Ltd, Tereos SCA, Ezaki Glico Co Ltd, Archer Daniels Midland Company, Wilmar International Ltd, Roquette Frères, Lantmännen*List Not Exhaustive.

3. What are the main segments of the China Wheat Protein Market?

The market segments include Form, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 124.0 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Product Innovation in Meat Alternatives Drive the Wheat Protein Market; Increasing Demand for Plant Protein in Food and Beverages Segment.

6. What are the notable trends driving market growth?

Animal Feed. Food and Beverages Industry holds the Largest Segment by End User.

7. Are there any restraints impacting market growth?

Increasing Gluten Intolerance Population.

8. Can you provide examples of recent developments in the market?

June 2023: BENEO, a leading ingredient manufacturer, unveiled its innovative toolbox comprising high-quality, non-GMO plant-based proteins specially formulated for incorporation into pet food and treat recipes. This diverse range of ingredients includes wheat protein concentrate, boasting both nutritional and functional advantages. With a strategic focus on key markets, BENEO aims to cater to regions including the United States, Brazil, the United Kingdom, Germany, and China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in k Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Wheat Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Wheat Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Wheat Protein Market?

To stay informed about further developments, trends, and reports in the China Wheat Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence