Key Insights

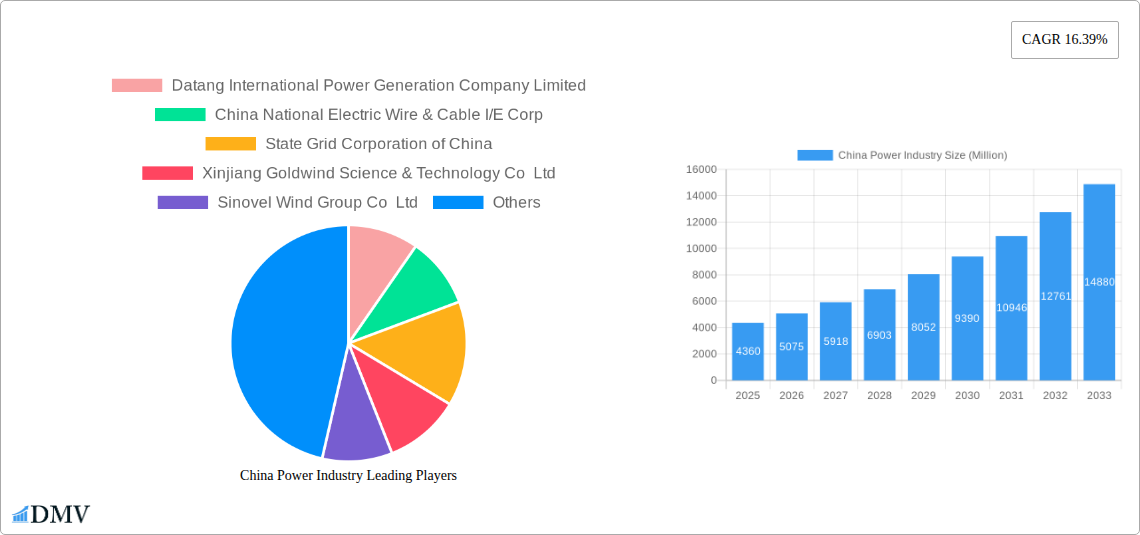

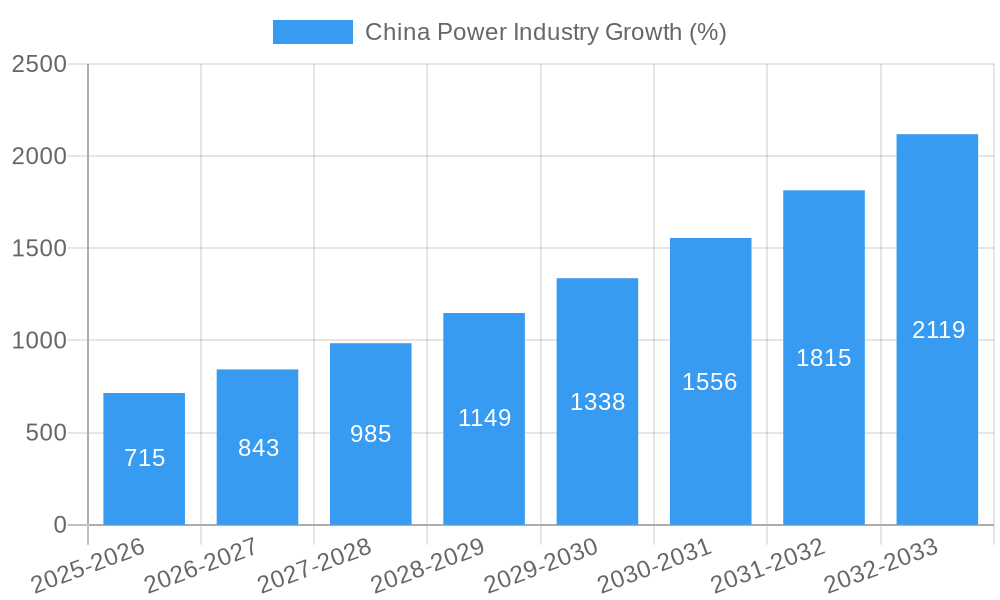

The China power industry, valued at $4.36 billion in 2025, is projected to experience robust growth, driven by increasing energy demand fueled by rapid economic expansion and urbanization. A Compound Annual Growth Rate (CAGR) of 16.39% from 2025 to 2033 forecasts a substantial market expansion. Key growth drivers include the government's significant investments in renewable energy sources like solar and wind power to meet carbon emission reduction targets and enhance energy security. This transition is evident in the expanding market share of renewable energy segments within the power generation source category (Thermal, Hydroelectric, Nuclear, Renewable, Other). Furthermore, the rising adoption of smart grids and advanced energy storage technologies are further propelling market growth. However, challenges remain, including the need for substantial infrastructure upgrades to accommodate the influx of renewable energy and the ongoing management of existing thermal power plants. The industry's competitive landscape is dominated by major players such as Datang International Power Generation Company Limited, State Grid Corporation of China, and Xinjiang Goldwind Science & Technology Co Ltd, among others, who are actively investing in research and development and strategic acquisitions to maintain a competitive edge.

The forecast period (2025-2033) anticipates a significant increase in the overall market size, driven by continued government support for renewable energy initiatives and the expansion of the power transmission and distribution infrastructure. This growth will likely be uneven across different power generation sources, with renewable energy sources experiencing the most significant expansion. The continued dominance of large state-owned enterprises in the sector will likely persist, though the increased participation of private sector players in renewable energy development is anticipated to increase competition and drive innovation. Regional variations in growth will be influenced by factors such as population density, economic development levels, and the availability of renewable resources. Addressing the challenges of grid integration, ensuring energy security, and navigating the complexities of regulatory frameworks will be crucial for sustained growth and success within the Chinese power industry.

China Power Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the China power industry, encompassing market trends, technological advancements, leading players, and future growth projections from 2019 to 2033. With a focus on key segments – Thermal, Hydroelectric, Nuclear, Renewable, and Other Power Generation Sources – this report is essential for stakeholders seeking to navigate this dynamic and rapidly evolving market. The base year for this analysis is 2025, with estimations and forecasts extending to 2033.

China Power Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the Chinese power industry. We analyze market share distribution among key players, highlighting M&A activities and their impact on market concentration. The report delves into evolving end-user profiles and the emergence of substitute products, shaping future industry trajectories. We estimate the total market size to be XXX Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033.

- Market Concentration: Dominated by State-owned Enterprises (SOEs) with a combined market share exceeding xx%, resulting in a moderately concentrated market.

- Innovation Catalysts: Government incentives for renewable energy, technological advancements in smart grids, and increasing energy efficiency standards drive innovation.

- Regulatory Landscape: Stringent environmental regulations and policies promoting energy security shape industry strategies.

- Substitute Products: Growth of renewable energy sources poses a challenge to traditional thermal power generation.

- End-User Profiles: A diverse range of end-users exists, including industrial, commercial, and residential consumers, each with unique energy demands.

- M&A Activities: Over the past five years, M&A deal values in the power sector totaled approximately xx Million, with a focus on consolidation and expansion into renewable energy.

China Power Industry Industry Evolution

This section analyzes the historical (2019-2024) and projected (2025-2033) growth trajectories of the China power industry. We examine technological advancements, such as the integration of smart grids and the deployment of advanced energy storage systems. The impact of shifting consumer preferences towards cleaner energy sources and government policies promoting energy transition is also discussed. The market exhibited a CAGR of xx% during the historical period, driven primarily by increasing energy demand and investments in infrastructure. We predict a CAGR of xx% during the forecast period due to continued industrial growth and the expanding renewable energy sector. Specific growth rates and adoption metrics are presented for each power generation source segment.

Leading Regions, Countries, or Segments in China Power Industry

This section identifies the dominant regions and power generation sources within China's energy landscape. We analyze the factors driving their dominance, including investment trends, policy support, and resource availability.

- Renewable Energy: Rapid growth is observed in the renewable energy segment (solar, wind, hydro) due to government incentives and falling costs.

- Thermal Power: Despite a decreasing share, thermal power (coal, natural gas) remains a significant contributor, providing baseload power.

- Hydroelectric Power: China's abundant hydropower resources continue to support significant hydroelectric power generation.

- Nuclear Power: Nuclear power is steadily expanding to meet the increasing energy demand and reduce reliance on fossil fuels.

- Key Drivers:

- Government Policies: Significant investments in renewable energy infrastructure and supportive policies.

- Technological Advancements: Cost reductions in solar and wind technologies, improved efficiency in hydroelectric and thermal plants.

- Resource Availability: China's abundant renewable resources and vast hydroelectric potential.

The dominance of specific regions is largely dictated by resource availability and government investment in infrastructure development. For example, provinces with abundant wind resources have seen significant growth in wind power capacity.

China Power Industry Product Innovations

Recent years have witnessed significant product innovations in China's power industry, driven by the need for increased efficiency and sustainability. Advancements in smart grid technologies enable real-time monitoring and control, optimizing energy distribution and minimizing losses. New materials and designs in renewable energy technologies have resulted in improved performance metrics and lower costs. These innovations, coupled with unique selling propositions like enhanced reliability and reduced environmental impact, are shaping the future of the industry.

Propelling Factors for China Power Industry Growth

Several key factors contribute to the continued growth of the China power industry. Strong economic growth fuels increased energy demand across all sectors. Government policies promoting renewable energy and energy efficiency initiatives provide crucial support. Furthermore, technological advancements in renewable energy sources, energy storage, and grid management enhance overall efficiency and capacity.

Obstacles in the China Power Industry Market

Despite strong growth potential, the China power industry faces significant challenges. Integrating large-scale renewable energy sources into the existing grid poses technical and logistical obstacles. Supply chain disruptions, particularly related to critical components for renewable energy technologies, can impact project timelines and costs. Furthermore, intense competition among players, coupled with fluctuating energy prices, presents risks.

Future Opportunities in China Power Industry

The China power industry presents several compelling opportunities. The continued expansion of renewable energy sources and the development of smart grid technologies offer significant potential for growth. New market segments, such as electric vehicle charging infrastructure and energy storage systems, are emerging. Technological innovations will lead to further cost reductions and efficiency improvements in renewable energy generation.

Major Players in the China Power Industry Ecosystem

- Datang International Power Generation Company Limited

- China National Electric Wire & Cable I/E Corp

- State Grid Corporation of China

- Xinjiang Goldwind Science & Technology Co Ltd

- Sinovel Wind Group Co Ltd

- China National Electric Engineering Co Ltd

- China Yangtze Power Co Ltd

- Wuxi Suntech Power Co Ltd

- Sinohydro Corporation

- Shandong energy group co Ltd

- List Not Exhaustive

Key Developments in China Power Industry Industry

- February 2023: Commencement of the world's largest ultra-high-voltage energy transmission project, boosting power transmission capacity and grid stability. This significantly improves energy distribution from the Southwest to Central China.

- January 2023: China Three Gorges' (CTG) announcement of a massive 16 GW renewable and coal project signals a continued focus on energy diversification. This initiative contributes to the nation's clean energy transition while maintaining baseload power.

- March 2022: Shenzhen Energy Group's order for GE gas turbines highlights the ongoing shift towards cleaner fossil fuel-based power generation, replacing older coal-fired plants. This transition addresses environmental concerns while ensuring reliable energy supply.

Strategic China Power Industry Market Forecast

The China power industry is poised for sustained growth, fueled by robust economic expansion, government support for clean energy, and ongoing technological advancements. The increasing adoption of renewable energy sources and the development of smart grid technologies will drive market expansion. This report's projections indicate a significant increase in market size and capacity over the forecast period, highlighting significant opportunities for industry players.

China Power Industry Segmentation

-

1. Power Generation Source

- 1.1. Thermal

- 1.2. Hydroelectric

- 1.3. Nuclear

- 1.4. Renewable

- 1.5. Other Power Generation Sources

- 2. Power Transmission and Distribution (T&D)

China Power Industry Segmentation By Geography

- 1. China

China Power Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Upcoming Investments in Renewable Energy Sector4.; Growing Manufacturing Sector Increases Demand For Power

- 3.3. Market Restrains

- 3.3.1. Rising Phase Out of Coal-based Power Plants

- 3.4. Market Trends

- 3.4.1. The Renewable Energy Segment Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Power Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 5.1.1. Thermal

- 5.1.2. Hydroelectric

- 5.1.3. Nuclear

- 5.1.4. Renewable

- 5.1.5. Other Power Generation Sources

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Power Generation Source

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Datang International Power Generation Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China National Electric Wire & Cable I/E Corp

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 State Grid Corporation of China

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xinjiang Goldwind Science & Technology Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sinovel Wind Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 China National Electric Engineering Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Yangtze Power Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wuxi Suntech Power Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sinohydro Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Shandong energy group co Ltd *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Datang International Power Generation Company Limited

List of Figures

- Figure 1: China Power Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Power Industry Share (%) by Company 2024

List of Tables

- Table 1: China Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Power Industry Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 3: China Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 4: China Power Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Power Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Power Industry Revenue Million Forecast, by Power Generation Source 2019 & 2032

- Table 7: China Power Industry Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 8: China Power Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Power Industry?

The projected CAGR is approximately 16.39%.

2. Which companies are prominent players in the China Power Industry?

Key companies in the market include Datang International Power Generation Company Limited, China National Electric Wire & Cable I/E Corp, State Grid Corporation of China, Xinjiang Goldwind Science & Technology Co Ltd, Sinovel Wind Group Co Ltd, China National Electric Engineering Co Ltd, China Yangtze Power Co Ltd, Wuxi Suntech Power Co Ltd, Sinohydro Corporation, Shandong energy group co Ltd *List Not Exhaustive.

3. What are the main segments of the China Power Industry?

The market segments include Power Generation Source, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD 4.36 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Upcoming Investments in Renewable Energy Sector4.; Growing Manufacturing Sector Increases Demand For Power.

6. What are the notable trends driving market growth?

The Renewable Energy Segment Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Rising Phase Out of Coal-based Power Plants.

8. Can you provide examples of recent developments in the market?

February 2023: China announced that it had started work on the world's biggest ultrahigh-voltage energy transmission project, which will connect Southwest China's Sichuan Province and the Xizang Autonomous Region to Central China's Hubei Province. The transmission project will carry around 40 billion KW hours of electricity, including hydroelectricity from the Jinsha River's upper stream, comparable to one-sixth of Hubei Province's annual power demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Power Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Power Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Power Industry?

To stay informed about further developments, trends, and reports in the China Power Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence