Key Insights

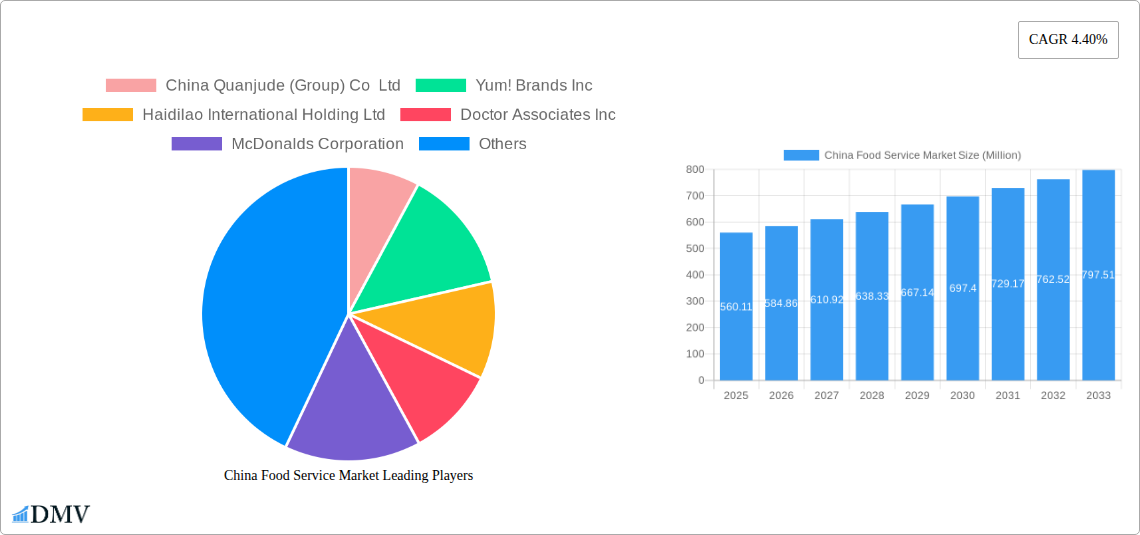

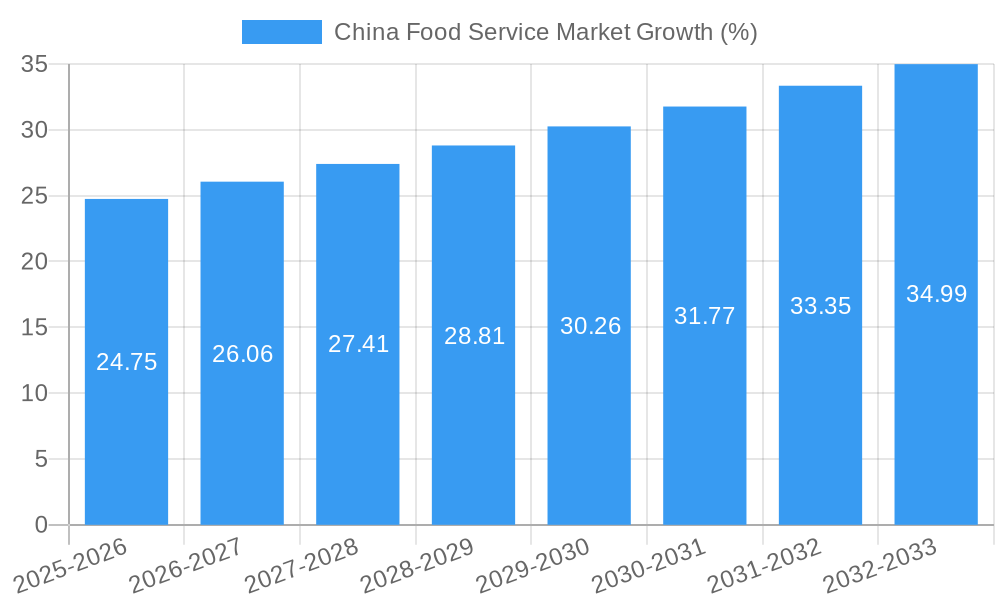

The China food service market, valued at $560.11 million in 2025, is poised for robust growth, projected to expand at a compound annual growth rate (CAGR) of 4.40% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes among China's burgeoning middle class fuel increased spending on dining out, with preferences shifting towards diverse cuisines and convenient options. The increasing urbanization and a young, tech-savvy population further stimulate demand, particularly for quick-service restaurants (QSRs) and online food delivery services. The expansion of e-commerce platforms and sophisticated delivery networks significantly contribute to the market's growth trajectory. Furthermore, a rising trend of casual dining experiences, including cafes and specialty coffee shops, cater to evolving consumer preferences. However, the market faces challenges such as stringent food safety regulations, intense competition, and fluctuating raw material prices which can impact profitability. Growth within specific segments, such as full-service restaurants and cloud kitchens, will be influenced by these factors, requiring agile adaptation to changing consumer needs and economic conditions.

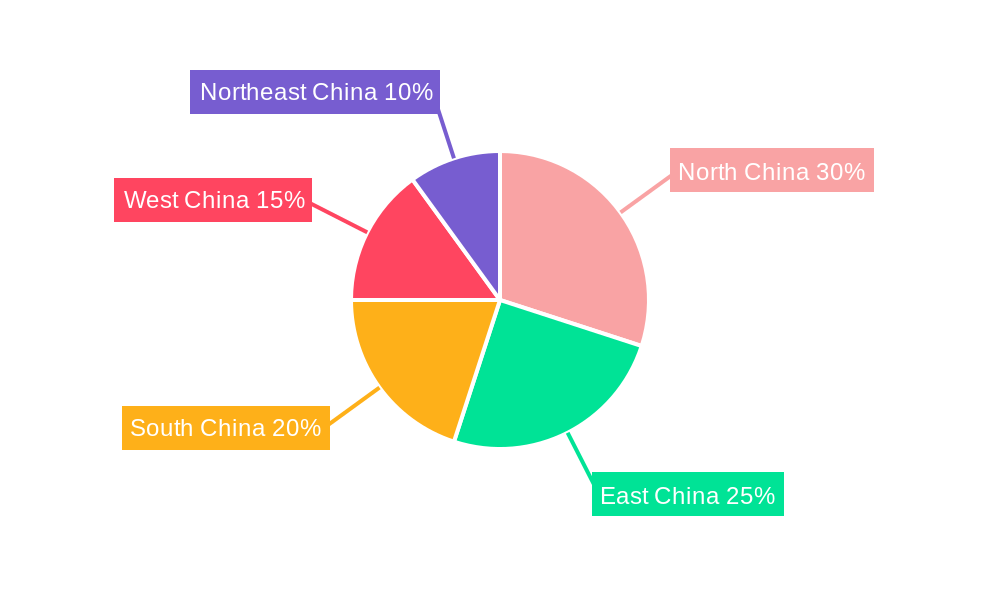

The market segmentation reveals a dynamic landscape. While full-service restaurants represent a significant portion, the quick-service segment shows exceptional growth potential, fueled by busy lifestyles and the convenience of fast and affordable meals. The increasing popularity of cafes and bars, along with the rapid expansion of cloud kitchens, highlight the evolving consumer preferences for diverse dining options and innovative business models. Geographical distribution likely reflects higher concentration in major metropolitan areas, but penetration into smaller cities and rural areas is anticipated to increase as infrastructure improves and consumer spending patterns evolve across regions. Established players like Yum! Brands, Haidilao, and McDonald's maintain a strong market presence, but smaller domestic chains and independent outlets continue to capture significant market share through innovative offerings and localized preferences. The future success of market participants hinges on adapting to consumer preferences, embracing technological advancements, and maintaining high standards of food quality and safety.

China Food Service Market: A Comprehensive Report (2019-2033)

This insightful report delivers a comprehensive analysis of the dynamic China food service market, projecting robust growth from 2025 to 2033. We delve into market segmentation, competitive landscapes, technological advancements, and key growth drivers, providing stakeholders with actionable intelligence for strategic decision-making. The report covers the period from 2019 to 2033, with a base year of 2025 and an estimated year of 2025. Expect detailed market sizing, in Millions, across various segments, backed by robust data and forecasting methodologies.

China Food Service Market Composition & Trends

This section offers a deep dive into the competitive dynamics of the China food service market, analyzing market concentration, innovation, regulation, substitution, end-user behavior, and mergers and acquisitions (M&A) activity. The report utilizes a detailed quantitative analysis to dissect the market share distribution and M&A deal values. The thriving market is shaped by continuous innovation and evolving consumer preferences, leading to a complex interplay of established players and emerging entrants.

- Market Concentration: The market exhibits a mix of large multinational chains and smaller independent operators, with a notable concentration in key urban areas. The exact market share distribution will be detailed within the report, presenting a breakdown of the leading players.

- Innovation Catalysts: Technological advancements such as online ordering, delivery platforms, and AI-powered kitchen management systems are significant drivers of innovation. The increasing adoption of cloud kitchens further revolutionizes the industry's efficiency.

- Regulatory Landscape: Government regulations regarding food safety, hygiene, and labor practices have a significant impact on market operations. The report will detail the key regulations and their influence on the market.

- Substitute Products: The rise of meal kit delivery services and home-cooking trends represent emerging substitute products to traditional restaurant dining. The competitive pressures and market share impact of these alternatives will be explored.

- End-User Profiles: The report segments end-users based on demographics, lifestyle, and dining preferences. This analysis will help stakeholders tailor their offerings and marketing strategies.

- M&A Activity: Significant M&A activity, involving both domestic and international players, reshapes market dynamics. The report will quantify deal values and analyze their strategic implications for the industry, covering examples like Yum! Brands' acquisition of Dragontail Systems. The projected M&A activity for the forecast period will also be included.

China Food Service Market Industry Evolution

This section traces the evolution of the China food service market, charting its growth trajectory, technological advancements, and the shifting consumer landscape from 2019 to 2033. We analyze the growth rate (xx%) across different segments, highlighting the role of technology in enhancing operational efficiency and consumer experience. The impact of evolving consumer demands for convenience, healthier options, and personalized experiences will be extensively examined. For example, we will analyze the impact of McDonald's McPlant launch in 2021 on market trends and consumer preferences. The detailed quantitative analysis within the report will deliver a nuanced understanding of the market's evolution.

Leading Regions, Countries, or Segments in China Food Service Market

This section identifies the dominant regions, countries, and market segments within the China food service industry. The analysis will include a detailed breakdown based on Structure (Independent Outlet vs. Chained Outlet), Location (Standalone, Leisure, Retail, Lodging, Travel), Cuisine Type (Full-Service Restaurants, Other Full-Service Restaurant Cuisine, Quick Service Cuisine, Other Quick Service Cuisine, Cafes and Bars, Specialty Coffee and Tea), and Type (Full-Service Restaurants, Quick Service Restaurants, Cafes and Bars, Cloud Kitchen). The report will quantify the market size for each segment and identify the leading factors driving their dominance.

- Key Drivers (Examples): Investment trends in specific regions, government incentives for certain cuisine types, and consumer preferences for particular dining formats will be presented via bullet points.

- Dominance Factors: In-depth analysis explaining factors contributing to the leading position of specific segments will be thoroughly elaborated in paragraph form. This might include factors such as high population density, strong tourism, or unique cultural preferences. The exact dominant segments and their respective market sizes will be presented.

China Food Service Market Product Innovations

This section showcases recent product innovations, emphasizing unique selling propositions (USPs) and technological advancements. The report will focus on new menu items, service delivery models, and technological integrations, including examples of AI-powered solutions and sustainable practices.

Propelling Factors for China Food Service Market Growth

Several key factors fuel the growth of China's food service market. These include increasing urbanization and disposable incomes, changing consumer lifestyles and preferences (e.g., demand for convenience and healthier options), government initiatives to support the sector, and rapid technological advancements like the rise of online ordering and delivery apps. The expansion of e-commerce and the growing popularity of cloud kitchens also contribute significantly.

Obstacles in the China Food Service Market

The market faces certain challenges, including intense competition, rising operating costs (especially labor costs and raw materials), stringent food safety regulations, and supply chain vulnerabilities. Economic fluctuations and shifts in consumer spending patterns also pose risks. The report will quantitatively assess the impact of these obstacles on market growth.

Future Opportunities in China Food Service Market

The China food service market presents exciting opportunities. Expanding into smaller cities and underserved regions, leveraging technological innovations such as personalized recommendations and loyalty programs, catering to evolving consumer demands for health and sustainability, and exploring niche markets like gourmet food and experiential dining offer significant potential for growth. The rise of new technologies such as AR/VR and the metaverse might provide additional opportunities in the long term.

Major Players in the China Food Service Market Ecosystem

- China Quanjude (Group) Co Ltd

- Yum! Brands Inc

- Haidilao International Holding Ltd

- Doctor Associates Inc

- McDonalds Corporation

- Domino's Pizza Inc

- Inner Mongolia Xiao Wei Yang Chained Food Service Co Ltd

- Starbucks Corporation

- Papa John's International Inc

- Restaurant Brands International Inc

Key Developments in China Food Service Market Industry

- September 2022: McDonald's China opened a LEED-certified zero-carbon drive-through restaurant in Beijing, showcasing the industry's commitment to sustainability.

- December 2021: Restaurants Brands International partnered with Ant Group to enhance its digital transformation efforts in Asia-Pacific.

- October 2021: McDonald's tested its plant-based McPlant burger, indicating the growing demand for plant-based options.

- September 2021: Yum! Brands acquired Dragontail Systems, an AI-based technology provider, accelerating its technological advancement.

Strategic China Food Service Market Forecast

The China food service market is poised for continued growth, driven by factors such as rising disposable incomes, urbanization, and the increasing adoption of technology. The market is expected to witness significant expansion in the forecast period (2025-2033), with opportunities emerging across various segments. The specific growth projections will be detailed with quantitative data within the full report.

China Food Service Market Segmentation

-

1. Structure

- 1.1. Independent Outlet

- 1.2. Chained Outlet

-

2. Location

- 2.1. Standalone

- 2.2. Leisure

- 2.3. Retail

- 2.4. Lodging

- 2.5. Travel

-

3. Cuisine Type

- 3.1. Full Service Restaurants

- 3.2. Quick Service Cuisine

- 3.3. Cafes and Bars

- 3.4. Specialty Coffee and Tea

China Food Service Market Segmentation By Geography

- 1. China

China Food Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Ready Meals

- 3.4. Market Trends

- 3.4.1. Augmented Demand for Vegan Food in Restaurants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Food Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Structure

- 5.1.1. Independent Outlet

- 5.1.2. Chained Outlet

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Standalone

- 5.2.2. Leisure

- 5.2.3. Retail

- 5.2.4. Lodging

- 5.2.5. Travel

- 5.3. Market Analysis, Insights and Forecast - by Cuisine Type

- 5.3.1. Full Service Restaurants

- 5.3.2. Quick Service Cuisine

- 5.3.3. Cafes and Bars

- 5.3.4. Specialty Coffee and Tea

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.1. Market Analysis, Insights and Forecast - by Structure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Quanjude (Group) Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yum! Brands Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haidilao International Holding Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Doctor Associates Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 McDonalds Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Domino's Pizza Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Inner Mongolia Xiao Wei Yang Chained Food Service Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Starbucks Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Papa John's International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Restaurant Brands International Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Quanjude (Group) Co Ltd

List of Figures

- Figure 1: China Food Service Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Food Service Market Share (%) by Company 2024

List of Tables

- Table 1: China Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Food Service Market Revenue Million Forecast, by Structure 2019 & 2032

- Table 3: China Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 4: China Food Service Market Revenue Million Forecast, by Cuisine Type 2019 & 2032

- Table 5: China Food Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: China Food Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Food Service Market Revenue Million Forecast, by Structure 2019 & 2032

- Table 8: China Food Service Market Revenue Million Forecast, by Location 2019 & 2032

- Table 9: China Food Service Market Revenue Million Forecast, by Cuisine Type 2019 & 2032

- Table 10: China Food Service Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Food Service Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the China Food Service Market?

Key companies in the market include China Quanjude (Group) Co Ltd, Yum! Brands Inc, Haidilao International Holding Ltd, Doctor Associates Inc, McDonalds Corporation, Domino's Pizza Inc, Inner Mongolia Xiao Wei Yang Chained Food Service Co Ltd, Starbucks Corporation, Papa John's International Inc, Restaurant Brands International Inc.

3. What are the main segments of the China Food Service Market?

The market segments include Structure, Location, Cuisine Type .

4. Can you provide details about the market size?

The market size is estimated to be USD 560.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Demand for Vegan Food in Restaurants; Growing Preference for Out-The-Home Consumption.

6. What are the notable trends driving market growth?

Augmented Demand for Vegan Food in Restaurants.

7. Are there any restraints impacting market growth?

Increasing Demand for Ready Meals.

8. Can you provide examples of recent developments in the market?

In September 2022, McDonald's China opened a drive-through restaurant McDonald's Shougang Park in Beijing spanning nearly 650 sqm. As per the company's claim, it is the first leed-certified zero-carbon restaurant in the country that is designed and constructed per the Leed net-zero carbon and net-zero energy certification standards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Food Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Food Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Food Service Market?

To stay informed about further developments, trends, and reports in the China Food Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence