Key Insights

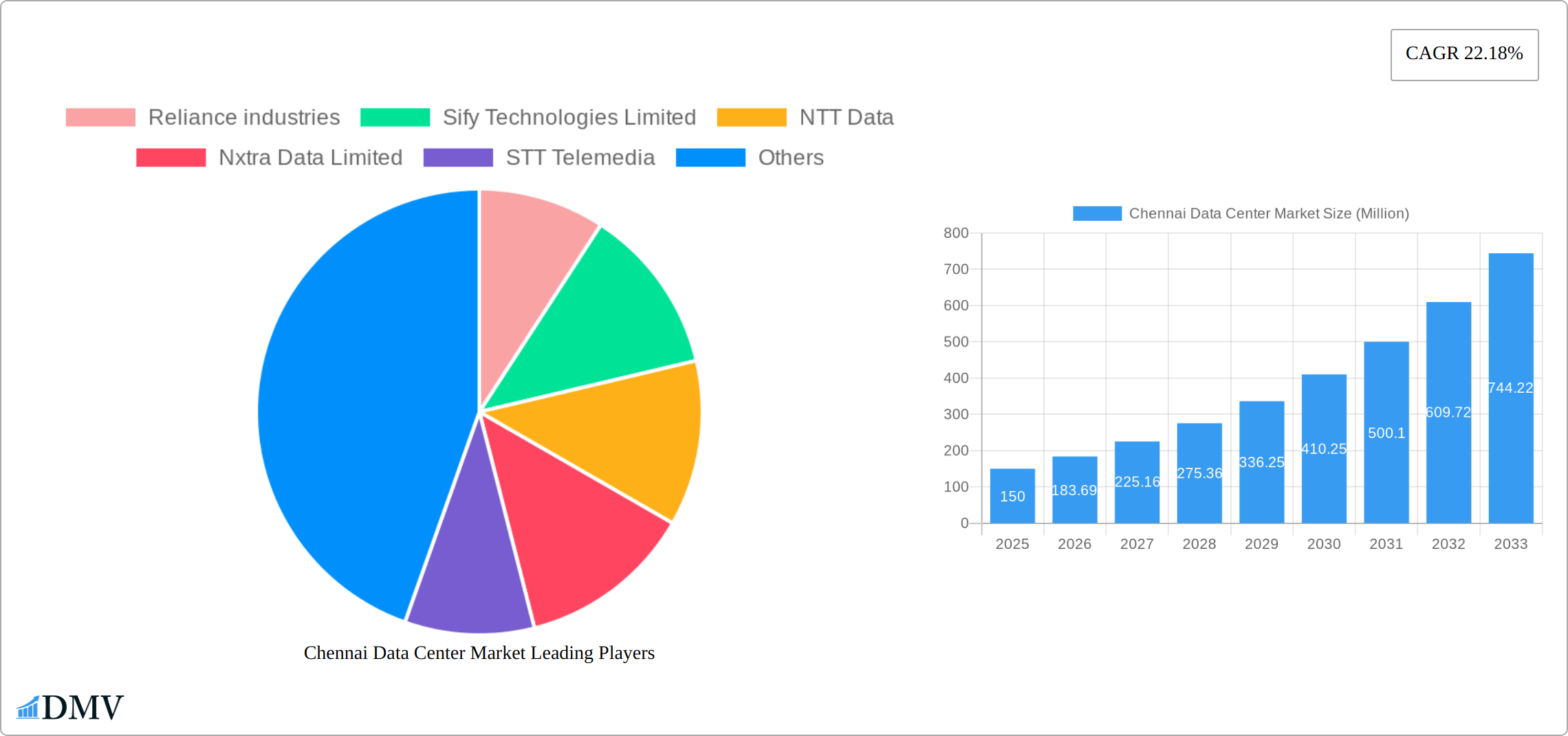

The Chennai data center market is experiencing robust growth, fueled by a burgeoning IT sector, increasing digitalization across industries, and government initiatives promoting digital infrastructure. With a projected CAGR of 22.18% from 2025 to 2033, the market is poised for significant expansion. The market is segmented by end-user (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-commerce, and Others), data center size (Small, Medium, Large, Massive, Mega), tier type (Tier 1, Tier 2, Tier 3, Tier 4), absorption (Utilized, Non-Utilized), and colocation type (Retail, Wholesale, Hyperscale). The substantial growth is driven by the increasing demand for cloud services, the expansion of 5G networks, and the growing adoption of digital technologies across various sectors in Chennai. Key players like Reliance Industries, Sify Technologies Limited, NTT Data, Nxtra Data Limited, STT Telemedia, and Adani are actively contributing to the market's expansion through investments in new facilities and infrastructure upgrades. The large concentration of IT/ITeS companies in Chennai coupled with a relatively lower cost of operations compared to other metropolitan areas further strengthens the market's attractiveness. The market's future growth will hinge on factors such as sustained government support for digital infrastructure, improving power reliability, and the ongoing expansion of the IT and related industries in the region. While challenges like land availability and regulatory hurdles might pose some restraints, the overall outlook for the Chennai data center market remains overwhelmingly positive.

The strong growth trajectory is anticipated to continue throughout the forecast period (2025-2033), driven by the sustained demand for robust digital infrastructure. While precise market sizing for 2025 is unavailable, leveraging the provided CAGR and assuming a reasonable base year value (e.g., based on publicly available information about major players' capacities), a projection can be made for the forecast period. Further segmentation analysis can reveal which specific segments (e.g., hyperscale colocation, large data centers) are exhibiting the most significant growth. Understanding the regional distribution of data centers within Chennai and identifying areas with optimal connectivity and power infrastructure will be crucial for strategic investment decisions. Competitive analysis focusing on market share and the strategies employed by key players will provide valuable insights into the dynamics of this expanding market.

Chennai Data Center Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Chennai data center market, covering market size, growth projections, key players, and future trends. With a focus on the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is essential for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The report leverages extensive research to offer a precise and up-to-date view of the Chennai data center landscape.

Chennai Data Center Market Composition & Trends

The Chennai data center market exhibits a dynamic interplay of factors influencing its composition and trajectory. Market concentration is moderate, with several major players competing alongside smaller, specialized providers. Innovation is driven by the need for greater efficiency, scalability, and sustainability, leading to investments in advanced cooling technologies and renewable energy sources. The regulatory landscape, while generally supportive of data center growth, presents challenges related to land acquisition, power supply, and environmental compliance. Substitute products, such as cloud services, exert competitive pressure but also complement data center deployments. Mergers and acquisitions (M&A) activity is significant, reflecting consolidation within the market and expansion by larger players. The report analyzes these factors in depth, offering:

- Market Share Distribution (MW): Reliance Industries: xx Million MW; Sify Technologies Limited: xx Million MW; NTT Data: xx Million MW; Nxtra Data Limited: xx Million MW; STT Telemedia: xx Million MW; Adani: xx Million MW; Others: xx Million MW.

- M&A Deal Values (2019-2024): Total deal value approximated at xx Million USD. Specific deal breakdowns are provided within the full report.

- End-User Profile: A detailed breakdown of end-user segments (Cloud & IT, Telecom, Media & Entertainment, Government, BFSI, Manufacturing, E-Commerce, Other End-User, Non-Utilized) and their respective market shares is included.

Chennai Data Center Market Industry Evolution

The Chennai data center market has experienced robust growth over the historical period (2019-2024), driven by increasing digitalization, government initiatives promoting IT infrastructure development, and the establishment of Chennai as a major IT hub. Technological advancements, such as the adoption of hyperscale data centers and the rise of edge computing, are reshaping market dynamics. Shifting consumer demands, including a preference for greater resilience, security, and sustainability, are further shaping the market. The report examines these trends in detail, providing specific data points, including compound annual growth rates (CAGR) and adoption metrics for key technologies. For instance, the adoption rate of Tier III and Tier IV data centers has increased by xx% from 2019 to 2024, reflecting a growing focus on higher levels of redundancy and reliability. Furthermore, the report explores the impact of the global economic climate on market expansion, incorporating analysis of economic indicators to provide a comprehensive view.

Leading Regions, Countries, or Segments in Chennai Data Center Market

The Chennai data center market is geographically concentrated, with certain areas benefitting from superior infrastructure, connectivity, and regulatory support. The report identifies the dominant regions within Chennai itself, highlighting factors driving their prominence. Analysis across segments (By End-User, DC Size, Tier Type, Absorption, Colocation Type) reveals the leading segments and the underlying drivers for their success.

Key Drivers:

- Investment Trends: Significant investments in infrastructure development and technology upgrades are fueling growth in specific segments.

- Regulatory Support: Government policies and incentives promoting data center development are creating favorable conditions.

Dominance Factors: The Cloud & IT sector is the leading end-user segment, fueled by the rising demand for cloud services and data storage. Large and Mega data centers dominate in terms of capacity, reflecting the economies of scale involved in these deployments. Similarly, Tier III and Tier IV data centers are gaining traction due to their enhanced reliability and resilience. The high absorption rate within the utilized segment points to strong demand and limited excess capacity. Retail colocation continues to be the most prevalent type, but a growing segment for hyperscale colocation reflects the expansion of cloud providers.

Chennai Data Center Market Product Innovations

Continuous innovation is a hallmark of the Chennai data center market. Recent product innovations include advanced cooling technologies, such as liquid cooling systems, aiming to enhance energy efficiency and reduce operating costs. Furthermore, advancements in security technologies and the integration of renewable energy sources are prominent trends. These innovations contribute to improved operational performance metrics, including reduced power consumption and increased uptime. The emergence of modular data center designs facilitates faster deployments and greater scalability, contributing to the market's dynamism.

Propelling Factors for Chennai Data Center Market Growth

Several factors contribute to the robust growth trajectory of the Chennai data center market. Technological advancements, particularly in areas like AI and IoT, are driving the demand for data storage and processing capacity. The favorable economic climate in India, with robust growth in the IT sector, is another major driver. Supportive government policies and initiatives, aimed at boosting digital infrastructure, further stimulate market expansion. Specific examples include tax incentives and streamlined regulatory processes facilitating data center construction.

Obstacles in the Chennai Data Center Market

Despite the significant growth potential, the Chennai data center market faces certain challenges. Regulatory hurdles, such as obtaining necessary permits and approvals, can delay projects and increase costs. Supply chain disruptions, particularly in procuring specialized equipment, can also impede growth. Intense competition among existing players and the entry of new entrants add pressure on pricing and margins. These factors are quantified within the report to offer a comprehensive picture of market restraints.

Future Opportunities in Chennai Data Center Market

The Chennai data center market presents numerous future opportunities. The expansion of 5G networks will drive demand for edge data centers, enabling faster data processing and lower latency. The increasing adoption of cloud computing and the growth of the digital economy will create further demand for data center capacity. Furthermore, investments in renewable energy sources and sustainable technologies will present new avenues for market players.

Major Players in the Chennai Data Center Market Ecosystem

- Reliance Industries

- Sify Technologies Limited (Sify Technologies)

- NTT Data (NTT Data)

- Nxtra Data Limited (Nxtra Data)

- STT Telemedia

- Adani

Key Developments in Chennai Data Center Market Industry

- December 2022: CapitaLand announced plans to construct a 55 MW data center in Chennai, with completion of Phase 1 expected by the end of 2025. This represents a significant investment in the market and will add substantial capacity.

- February 2023: Cyfuture initiated the construction of a new data center in Tambaran, Chennai, with an initial capacity of 500 racks. This reflects the continued expansion of data center infrastructure within the region.

Strategic Chennai Data Center Market Forecast

The Chennai data center market is poised for continued strong growth over the forecast period (2025-2033). Driven by technological innovation, favorable government policies, and the expanding digital economy, the market is expected to witness significant capacity additions and an increase in the number of players. The report details these projections, providing quantitative data and qualitative insights into the factors shaping the market's future. The focus on sustainability and enhanced connectivity will be key elements in driving growth.

Chennai Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. By Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. By End-User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End-User

-

3.1.1. By Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Chennai Data Center Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chennai Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 22.18% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 3.3. Market Restrains

- 3.3.1. Risk of Thermal Effect

- 3.4. Market Trends

- 3.4.1. Government policies would advance the Investment of Data Centre

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. By Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. By End-User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End-User

- 5.3.1.1. By Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 6.1.1. Small

- 6.1.2. Medium

- 6.1.3. Large

- 6.1.4. Massive

- 6.1.5. Mega

- 6.2. Market Analysis, Insights and Forecast - by Tier Type

- 6.2.1. Tier 1 & 2

- 6.2.2. Tier 3

- 6.2.3. Tier 4

- 6.3. Market Analysis, Insights and Forecast - by Absorption

- 6.3.1. Utilized

- 6.3.1.1. By Colocation Type

- 6.3.1.1.1. Retail

- 6.3.1.1.2. Wholesale

- 6.3.1.1.3. Hyperscale

- 6.3.1.2. By End-User

- 6.3.1.2.1. Cloud & IT

- 6.3.1.2.2. Telecom

- 6.3.1.2.3. Media & Entertainment

- 6.3.1.2.4. Government

- 6.3.1.2.5. BFSI

- 6.3.1.2.6. Manufacturing

- 6.3.1.2.7. E-Commerce

- 6.3.1.2.8. Other End-User

- 6.3.1.1. By Colocation Type

- 6.3.2. Non-Utilized

- 6.3.1. Utilized

- 6.1. Market Analysis, Insights and Forecast - by DC Size

- 7. South America Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 7.1.1. Small

- 7.1.2. Medium

- 7.1.3. Large

- 7.1.4. Massive

- 7.1.5. Mega

- 7.2. Market Analysis, Insights and Forecast - by Tier Type

- 7.2.1. Tier 1 & 2

- 7.2.2. Tier 3

- 7.2.3. Tier 4

- 7.3. Market Analysis, Insights and Forecast - by Absorption

- 7.3.1. Utilized

- 7.3.1.1. By Colocation Type

- 7.3.1.1.1. Retail

- 7.3.1.1.2. Wholesale

- 7.3.1.1.3. Hyperscale

- 7.3.1.2. By End-User

- 7.3.1.2.1. Cloud & IT

- 7.3.1.2.2. Telecom

- 7.3.1.2.3. Media & Entertainment

- 7.3.1.2.4. Government

- 7.3.1.2.5. BFSI

- 7.3.1.2.6. Manufacturing

- 7.3.1.2.7. E-Commerce

- 7.3.1.2.8. Other End-User

- 7.3.1.1. By Colocation Type

- 7.3.2. Non-Utilized

- 7.3.1. Utilized

- 7.1. Market Analysis, Insights and Forecast - by DC Size

- 8. Europe Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 8.1.1. Small

- 8.1.2. Medium

- 8.1.3. Large

- 8.1.4. Massive

- 8.1.5. Mega

- 8.2. Market Analysis, Insights and Forecast - by Tier Type

- 8.2.1. Tier 1 & 2

- 8.2.2. Tier 3

- 8.2.3. Tier 4

- 8.3. Market Analysis, Insights and Forecast - by Absorption

- 8.3.1. Utilized

- 8.3.1.1. By Colocation Type

- 8.3.1.1.1. Retail

- 8.3.1.1.2. Wholesale

- 8.3.1.1.3. Hyperscale

- 8.3.1.2. By End-User

- 8.3.1.2.1. Cloud & IT

- 8.3.1.2.2. Telecom

- 8.3.1.2.3. Media & Entertainment

- 8.3.1.2.4. Government

- 8.3.1.2.5. BFSI

- 8.3.1.2.6. Manufacturing

- 8.3.1.2.7. E-Commerce

- 8.3.1.2.8. Other End-User

- 8.3.1.1. By Colocation Type

- 8.3.2. Non-Utilized

- 8.3.1. Utilized

- 8.1. Market Analysis, Insights and Forecast - by DC Size

- 9. Middle East & Africa Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 9.1.1. Small

- 9.1.2. Medium

- 9.1.3. Large

- 9.1.4. Massive

- 9.1.5. Mega

- 9.2. Market Analysis, Insights and Forecast - by Tier Type

- 9.2.1. Tier 1 & 2

- 9.2.2. Tier 3

- 9.2.3. Tier 4

- 9.3. Market Analysis, Insights and Forecast - by Absorption

- 9.3.1. Utilized

- 9.3.1.1. By Colocation Type

- 9.3.1.1.1. Retail

- 9.3.1.1.2. Wholesale

- 9.3.1.1.3. Hyperscale

- 9.3.1.2. By End-User

- 9.3.1.2.1. Cloud & IT

- 9.3.1.2.2. Telecom

- 9.3.1.2.3. Media & Entertainment

- 9.3.1.2.4. Government

- 9.3.1.2.5. BFSI

- 9.3.1.2.6. Manufacturing

- 9.3.1.2.7. E-Commerce

- 9.3.1.2.8. Other End-User

- 9.3.1.1. By Colocation Type

- 9.3.2. Non-Utilized

- 9.3.1. Utilized

- 9.1. Market Analysis, Insights and Forecast - by DC Size

- 10. Asia Pacific Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 10.1.1. Small

- 10.1.2. Medium

- 10.1.3. Large

- 10.1.4. Massive

- 10.1.5. Mega

- 10.2. Market Analysis, Insights and Forecast - by Tier Type

- 10.2.1. Tier 1 & 2

- 10.2.2. Tier 3

- 10.2.3. Tier 4

- 10.3. Market Analysis, Insights and Forecast - by Absorption

- 10.3.1. Utilized

- 10.3.1.1. By Colocation Type

- 10.3.1.1.1. Retail

- 10.3.1.1.2. Wholesale

- 10.3.1.1.3. Hyperscale

- 10.3.1.2. By End-User

- 10.3.1.2.1. Cloud & IT

- 10.3.1.2.2. Telecom

- 10.3.1.2.3. Media & Entertainment

- 10.3.1.2.4. Government

- 10.3.1.2.5. BFSI

- 10.3.1.2.6. Manufacturing

- 10.3.1.2.7. E-Commerce

- 10.3.1.2.8. Other End-User

- 10.3.1.1. By Colocation Type

- 10.3.2. Non-Utilized

- 10.3.1. Utilized

- 10.1. Market Analysis, Insights and Forecast - by DC Size

- 11. North America Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World Chennai Data Center Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Reliance industries

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Sify Technologies Limited

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 NTT Data

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Nxtra Data Limited

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 STT Telemedia

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Adani7 2 Market share analysis (In terms of MW)7 3 List of Companie

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.1 Reliance industries

List of Figures

- Figure 1: Global Chennai Data Center Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Chennai Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 11: North America Chennai Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 12: North America Chennai Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 13: North America Chennai Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 14: North America Chennai Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 15: North America Chennai Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 16: North America Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Chennai Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 19: South America Chennai Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 20: South America Chennai Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 21: South America Chennai Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 22: South America Chennai Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 23: South America Chennai Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 24: South America Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 25: South America Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Europe Chennai Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 27: Europe Chennai Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 28: Europe Chennai Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 29: Europe Chennai Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 30: Europe Chennai Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 31: Europe Chennai Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 32: Europe Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Europe Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East & Africa Chennai Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 35: Middle East & Africa Chennai Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 36: Middle East & Africa Chennai Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 37: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 38: Middle East & Africa Chennai Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 39: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 40: Middle East & Africa Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East & Africa Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Asia Pacific Chennai Data Center Market Revenue (Million), by DC Size 2024 & 2032

- Figure 43: Asia Pacific Chennai Data Center Market Revenue Share (%), by DC Size 2024 & 2032

- Figure 44: Asia Pacific Chennai Data Center Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 45: Asia Pacific Chennai Data Center Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 46: Asia Pacific Chennai Data Center Market Revenue (Million), by Absorption 2024 & 2032

- Figure 47: Asia Pacific Chennai Data Center Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 48: Asia Pacific Chennai Data Center Market Revenue (Million), by Country 2024 & 2032

- Figure 49: Asia Pacific Chennai Data Center Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Chennai Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Global Chennai Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 15: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 16: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 17: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Canada Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 22: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 23: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 24: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Brazil Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Rest of South America Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 29: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 30: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 31: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United Kingdom Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Germany Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Italy Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Spain Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Russia Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Benelux Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Nordics Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 42: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 43: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 44: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: Turkey Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Israel Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: GCC Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: North Africa Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Africa Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Middle East & Africa Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Chennai Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 52: Global Chennai Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 53: Global Chennai Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 54: Global Chennai Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: China Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: India Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Japan Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: South Korea Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: ASEAN Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Oceania Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Rest of Asia Pacific Chennai Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chennai Data Center Market?

The projected CAGR is approximately 22.18%.

2. Which companies are prominent players in the Chennai Data Center Market?

Key companies in the market include Reliance industries, Sify Technologies Limited, NTT Data, Nxtra Data Limited, STT Telemedia, Adani7 2 Market share analysis (In terms of MW)7 3 List of Companie.

3. What are the main segments of the Chennai Data Center Market?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers; Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers.

6. What are the notable trends driving market growth?

Government policies would advance the Investment of Data Centre.

7. Are there any restraints impacting market growth?

Risk of Thermal Effect.

8. Can you provide examples of recent developments in the market?

December 2022: CapitaLand acquired land in Chennai, India, to construct a 55 MW data center. The disputed property is a 4.01-acre freehold plot in Chennai, India's Ambattur neighborhood. The 55 MW greenfield facility will be built by CapitaLand India Trust (CLINT) through its subsidiary, Minerva Veritas Data Centre Private Limited. The data center complex will be finished when it can accommodate 4,900 racks over seven stories and 420,000 square feet. Phase 1 of CLINT's project was expected to be completed by the end of 2025. The organization added that the facility would serve clients like cloud service providers, major corporations, and international technology firms.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chennai Data Center Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chennai Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chennai Data Center Market?

To stay informed about further developments, trends, and reports in the Chennai Data Center Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence