Key Insights

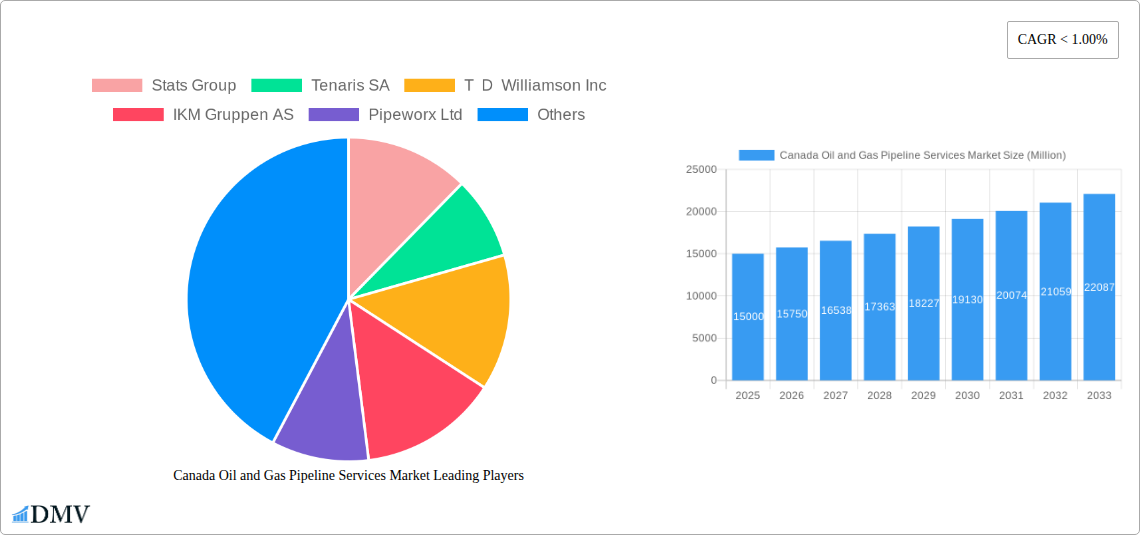

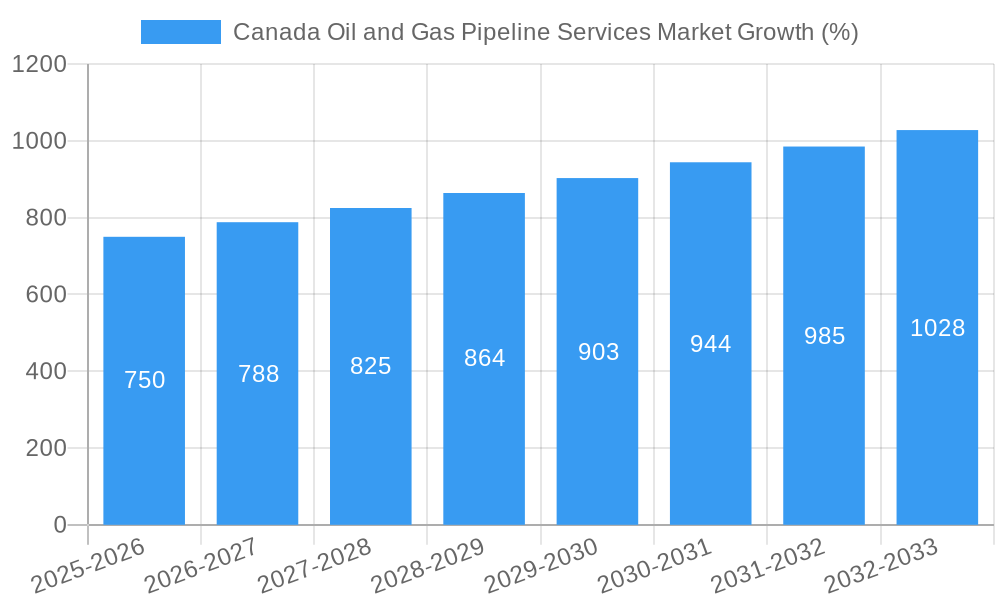

The Canadian oil and gas pipeline services market is experiencing robust growth, driven by increasing demand for energy transportation and the nation's significant oil sands reserves. The period between 2019 and 2024 witnessed considerable expansion, laying a strong foundation for continued growth through 2033. While precise market size figures for past years are unavailable, industry reports and analysis suggest a substantial market value in 2025, estimated at $15 billion CAD, reflecting a healthy compound annual growth rate (CAGR). This growth is fueled by several factors: ongoing investment in pipeline infrastructure modernization and expansion to accommodate growing production, particularly from Alberta's oil sands; stringent government regulations pushing for safer and more efficient pipeline operations leading to increased demand for specialized services; and the increasing focus on environmental concerns stimulating investment in pipeline leak detection and repair technologies. Furthermore, the anticipated rise in cross-border energy trade with the United States further bolsters market prospects.

Looking ahead to the forecast period (2025-2033), the market is poised for sustained growth, projected to reach approximately $25 billion CAD by 2033, based on a conservative CAGR estimation. This projection accounts for potential fluctuations in global energy prices and economic conditions, but anticipates continued investment in pipeline infrastructure and consistent demand for specialized services like maintenance, repair, and integrity management. Challenges such as environmental concerns and regulatory hurdles remain, but the overall market outlook for Canadian oil and gas pipeline services remains positive, presenting significant opportunities for industry players.

Canada Oil and Gas Pipeline Services Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Canada Oil and Gas Pipeline Services market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period spanning 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on the opportunities within this dynamic sector. The market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Canada Oil and Gas Pipeline Services Market Market Composition & Trends

This section delves into the intricate composition of the Canadian oil and gas pipeline services market. We analyze market concentration, revealing the market share distribution among key players, including but not limited to Stats Group, Tenaris SA, T D Williamson Inc, IKM Gruppen AS, Pipeworx Ltd, Mistras Group Inc, Trican Well Service Ltd, Ledcor Group of Companies, Baker Hughes a GE Co, and Tetra Tech Inc. The report also examines the innovative catalysts driving market growth, such as advancements in pipeline inspection technologies and the increasing adoption of sustainable practices. Furthermore, we explore the regulatory landscape, its impact on market dynamics, and the role of substitute products. A detailed analysis of end-user profiles across the upstream, midstream, and downstream sectors is included, along with an assessment of mergers and acquisitions (M&A) activities, including estimated deal values in Millions. The competitive landscape is further analyzed, highlighting key strategic alliances and partnerships impacting market share.

- Market Concentration: The market exhibits a [Describe Concentration - e.g., moderately concentrated] structure with the top five players holding an estimated xx% market share in 2025.

- M&A Activity: Analysis of significant M&A deals completed between 2019 and 2024, including estimated transaction values (in Millions). For example, [mention a specific deal if available, otherwise state "Specific deal values are confidential and not publicly available"].

- Regulatory Landscape: Detailed examination of key regulations influencing market operations, including environmental regulations and pipeline safety standards.

- Substitute Products & Technologies: Discussion on alternative technologies and services impacting market growth.

Canada Oil and Gas Pipeline Services Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Canada oil and gas pipeline services market. We examine historical market growth trajectories (2019-2024) and project future growth rates (2025-2033), considering factors such as fluctuating oil and gas prices, government policies, and technological advancements. Key technological advancements such as the implementation of advanced inspection technologies (e.g., smart pigs, robotic inspection systems) and data analytics for predictive maintenance are discussed, along with their impact on market growth and efficiency. The analysis will also incorporate an examination of shifting consumer demands, such as increased emphasis on environmental sustainability and safety. The adoption rates of new technologies and their influence on service offerings will be quantified wherever possible. Specific data points, such as year-on-year growth rates and market penetration rates of new technologies, will be provided.

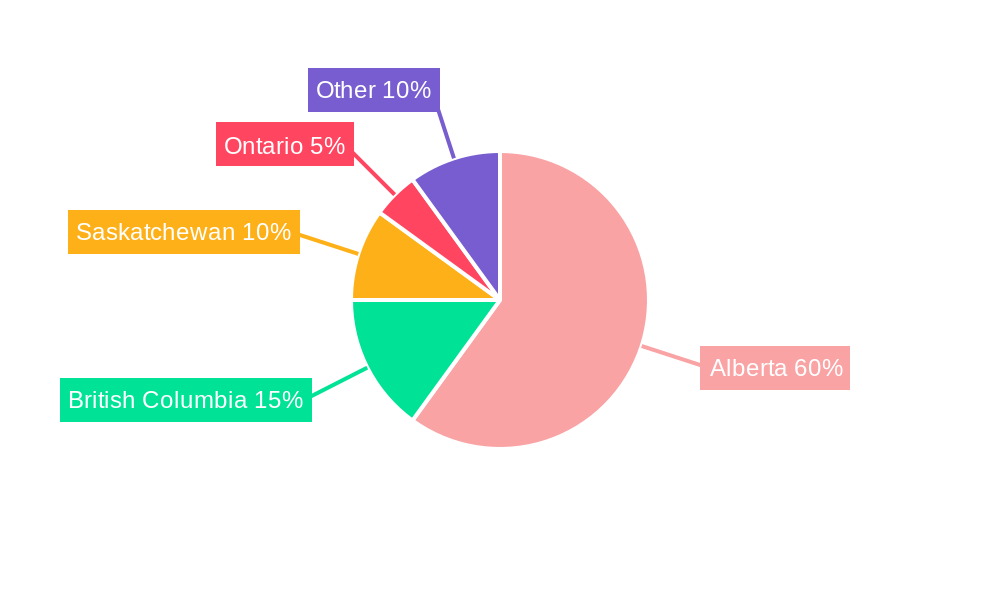

Leading Regions, Countries, or Segments in Canada Oil and Gas Pipeline Services Market

This section identifies the dominant regions, countries, and segments within the Canadian oil and gas pipeline services market. We analyze performance across various segments:

- Sector: Upstream, Midstream, and Downstream – detailing the market share and growth potential of each.

- Service Type: Pre-commissioning and Commissioning Services, Pigging and Cleaning Services, Mechanical Cleaning: Inspection Services (Excluding Pigging), Other Inspection Services: Flushing and Chemical Cleaning Services, Other Flushing and Chemical Cleaning Services: Drying Services – highlighting the leading service type and its key drivers.

- Repair Services: Vacuum Drying and Other Repair Services (including Decommissioning Services) - identifying the fastest-growing segment and its market size.

Key Drivers (using bullet points for each dominant segment):

- Upstream: [e.g., High levels of oil and gas exploration and production activity in Alberta and British Columbia.]

- Midstream: [e.g., Significant investments in pipeline infrastructure expansion and modernization.]

- Downstream: [e.g., Growing demand for refined petroleum products driving the need for efficient pipeline operations.]

- Pigging and Cleaning Services: [e.g., Stringent regulatory requirements for pipeline integrity and safety]

- Inspection Services: [e.g., Increasing adoption of advanced inspection technologies to enhance pipeline safety and reduce maintenance costs.]

- Decommissioning Services: [e.g., Rising number of aging pipelines requiring decommissioning]

The analysis will pinpoint the dominant regions or provinces within Canada and provide a detailed explanation for their leading position.

Canada Oil and Gas Pipeline Services Market Product Innovations

This section showcases recent product innovations in the Canadian oil and gas pipeline services market. This includes advancements in inspection technologies, such as smart pigging systems with enhanced data analytics capabilities, robotic inspection systems for improved access to challenging pipeline sections, and the development of more efficient and environmentally friendly cleaning and drying methods. These innovations offer unique selling propositions including enhanced pipeline safety, reduced downtime, and minimized environmental impact. We discuss the performance metrics of these innovative products, highlighting their superior capabilities and the overall impact on market efficiency.

Propelling Factors for Canada Oil and Gas Pipeline Services Market Growth

Several factors contribute to the growth of the Canadian oil and gas pipeline services market. Technological advancements in pipeline inspection and maintenance, such as the use of drones and robotics for inspections, are significantly improving efficiency and reducing costs. Furthermore, government regulations promoting pipeline safety and environmental protection drive demand for specialized services. Strong economic growth, particularly in the energy sector, and increasing investments in pipeline infrastructure expansion and modernization further fuel market expansion.

Obstacles in the Canada Oil and Gas Pipeline Services Market Market

Despite its growth potential, the Canadian oil and gas pipeline services market faces certain challenges. Stringent environmental regulations and the associated compliance costs can pose a significant hurdle for market players. Fluctuations in oil and gas prices directly impact investment decisions and project timelines, while geopolitical uncertainty can also create instability. Furthermore, supply chain disruptions, especially regarding specialized equipment and materials, can lead to project delays and increased costs. Finally, intense competition among service providers puts downward pressure on pricing, potentially impacting profit margins.

Future Opportunities in Canada Oil and Gas Pipeline Services Market

The Canadian oil and gas pipeline services market presents several promising opportunities. The increasing focus on pipeline integrity management and the adoption of predictive maintenance strategies create a demand for advanced technologies and specialized services. The expansion of existing pipeline networks and the development of new projects, particularly in areas with abundant oil and gas resources, will generate substantial growth. Furthermore, opportunities exist in the decommissioning of aging pipelines, creating a need for specialized expertise and equipment. Growing demand for environmentally sustainable solutions in pipeline operations also presents a considerable opportunity for companies offering innovative and eco-friendly services.

Major Players in the Canada Oil and Gas Pipeline Services Market Ecosystem

- Stats Group

- Tenaris SA

- T D Williamson Inc

- IKM Gruppen AS

- Pipeworx Ltd

- Mistras Group Inc

- Trican Well Service Ltd

- Ledcor Group of Companies

- Baker Hughes a GE Co

- Tetra Tech Inc

Key Developments in Canada Oil and Gas Pipeline Services Market Industry

- [Date]: [Development description and impact on market dynamics - e.g., "XYZ Company launched a new smart pigging system, increasing market competitiveness."]

- [Date]: [Development description and impact on market dynamics - e.g., "New environmental regulations were implemented, driving demand for eco-friendly pipeline services."]

- [Date]: [Development description and impact on market dynamics - e.g., "A major merger occurred between two key players, significantly altering market share."]

- [Date]: [Development description and impact on market dynamics - e.g., "A new pipeline project was announced, boosting demand for pipeline construction and maintenance services."]

Strategic Canada Oil and Gas Pipeline Services Market Market Forecast

The Canadian oil and gas pipeline services market is poised for sustained growth over the forecast period (2025-2033). Continued investment in pipeline infrastructure, driven by both domestic and international demand for oil and gas, will fuel market expansion. The adoption of advanced technologies, promoting efficiency and safety, will remain a key growth driver. Furthermore, evolving regulatory landscapes emphasizing environmental sustainability and pipeline integrity will create opportunities for specialized services and innovative solutions. The market's potential is considerable, driven by the substantial pipeline network and the ongoing need for effective maintenance and modernization.

Canada Oil and Gas Pipeline Services Market Segmentation

-

1. Service Type

- 1.1. Pre-commissioning and Commissioning Services

-

1.2. Pigging and Cleaning Services

- 1.2.1. Intelligent Pigging

- 1.2.2. Caliper Pigging

- 1.2.3. Mechanical Cleaning

-

1.3. Inspection Services (Excluding Pigging)

- 1.3.1. Hydro Testing

- 1.3.2. Other Inspection Services

-

1.4. Flushing and Chemical Cleaning Services

- 1.4.1. Chemical Inhibitors

- 1.4.2. Other Flushing and Chemical Cleaning Services

-

1.5. Drying Services

- 1.5.1. Air Drying

- 1.5.2. Nitrogen

- 1.5.3. Vacuum Drying

-

1.6. Repair Services

- 1.6.1. Hot Tapping

- 1.6.2. Other Repair Services

- 1.7. Decommissioning Services

-

2. Sector

- 2.1. Upstream

- 2.2. Midstream

- 2.3. Downstream

-

3. Geography

- 3.1. Western Canada

- 3.2. Eastern Canada

Canada Oil and Gas Pipeline Services Market Segmentation By Geography

- 1. Western Canada

- 2. Eastern Canada

Canada Oil and Gas Pipeline Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 1.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Share of Renewable Energy

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Repair Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Pre-commissioning and Commissioning Services

- 5.1.2. Pigging and Cleaning Services

- 5.1.2.1. Intelligent Pigging

- 5.1.2.2. Caliper Pigging

- 5.1.2.3. Mechanical Cleaning

- 5.1.3. Inspection Services (Excluding Pigging)

- 5.1.3.1. Hydro Testing

- 5.1.3.2. Other Inspection Services

- 5.1.4. Flushing and Chemical Cleaning Services

- 5.1.4.1. Chemical Inhibitors

- 5.1.4.2. Other Flushing and Chemical Cleaning Services

- 5.1.5. Drying Services

- 5.1.5.1. Air Drying

- 5.1.5.2. Nitrogen

- 5.1.5.3. Vacuum Drying

- 5.1.6. Repair Services

- 5.1.6.1. Hot Tapping

- 5.1.6.2. Other Repair Services

- 5.1.7. Decommissioning Services

- 5.2. Market Analysis, Insights and Forecast - by Sector

- 5.2.1. Upstream

- 5.2.2. Midstream

- 5.2.3. Downstream

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Western Canada

- 5.3.2. Eastern Canada

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Western Canada

- 5.4.2. Eastern Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Western Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Pre-commissioning and Commissioning Services

- 6.1.2. Pigging and Cleaning Services

- 6.1.2.1. Intelligent Pigging

- 6.1.2.2. Caliper Pigging

- 6.1.2.3. Mechanical Cleaning

- 6.1.3. Inspection Services (Excluding Pigging)

- 6.1.3.1. Hydro Testing

- 6.1.3.2. Other Inspection Services

- 6.1.4. Flushing and Chemical Cleaning Services

- 6.1.4.1. Chemical Inhibitors

- 6.1.4.2. Other Flushing and Chemical Cleaning Services

- 6.1.5. Drying Services

- 6.1.5.1. Air Drying

- 6.1.5.2. Nitrogen

- 6.1.5.3. Vacuum Drying

- 6.1.6. Repair Services

- 6.1.6.1. Hot Tapping

- 6.1.6.2. Other Repair Services

- 6.1.7. Decommissioning Services

- 6.2. Market Analysis, Insights and Forecast - by Sector

- 6.2.1. Upstream

- 6.2.2. Midstream

- 6.2.3. Downstream

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Western Canada

- 6.3.2. Eastern Canada

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Eastern Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Pre-commissioning and Commissioning Services

- 7.1.2. Pigging and Cleaning Services

- 7.1.2.1. Intelligent Pigging

- 7.1.2.2. Caliper Pigging

- 7.1.2.3. Mechanical Cleaning

- 7.1.3. Inspection Services (Excluding Pigging)

- 7.1.3.1. Hydro Testing

- 7.1.3.2. Other Inspection Services

- 7.1.4. Flushing and Chemical Cleaning Services

- 7.1.4.1. Chemical Inhibitors

- 7.1.4.2. Other Flushing and Chemical Cleaning Services

- 7.1.5. Drying Services

- 7.1.5.1. Air Drying

- 7.1.5.2. Nitrogen

- 7.1.5.3. Vacuum Drying

- 7.1.6. Repair Services

- 7.1.6.1. Hot Tapping

- 7.1.6.2. Other Repair Services

- 7.1.7. Decommissioning Services

- 7.2. Market Analysis, Insights and Forecast - by Sector

- 7.2.1. Upstream

- 7.2.2. Midstream

- 7.2.3. Downstream

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Western Canada

- 7.3.2. Eastern Canada

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Eastern Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Western Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Central Canada Canada Oil and Gas Pipeline Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Stats Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tenaris SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 T D Williamson Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IKM Gruppen AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pipeworx Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mistras Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Trican Well Service Ltd*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ledcor Group of Companies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baker Hughes a GE Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tetra Tech Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Stats Group

List of Figures

- Figure 1: Canada Oil and Gas Pipeline Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Oil and Gas Pipeline Services Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 3: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Eastern Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Western Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Central Canada Canada Oil and Gas Pipeline Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 11: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 12: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 13: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 15: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 16: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Canada Oil and Gas Pipeline Services Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Oil and Gas Pipeline Services Market?

The projected CAGR is approximately < 1.00%.

2. Which companies are prominent players in the Canada Oil and Gas Pipeline Services Market?

Key companies in the market include Stats Group, Tenaris SA, T D Williamson Inc, IKM Gruppen AS, Pipeworx Ltd, Mistras Group Inc, Trican Well Service Ltd*List Not Exhaustive, Ledcor Group of Companies, Baker Hughes a GE Co, Tetra Tech Inc.

3. What are the main segments of the Canada Oil and Gas Pipeline Services Market?

The market segments include Service Type, Sector, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; The Rise in Oil and Gas Drilling Activities4.; Increased Shale Gas Exploration.

6. What are the notable trends driving market growth?

Increasing Demand for Repair Services.

7. Are there any restraints impacting market growth?

4.; Increasing Share of Renewable Energy.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Oil and Gas Pipeline Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Oil and Gas Pipeline Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Oil and Gas Pipeline Services Market?

To stay informed about further developments, trends, and reports in the Canada Oil and Gas Pipeline Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence