Key Insights

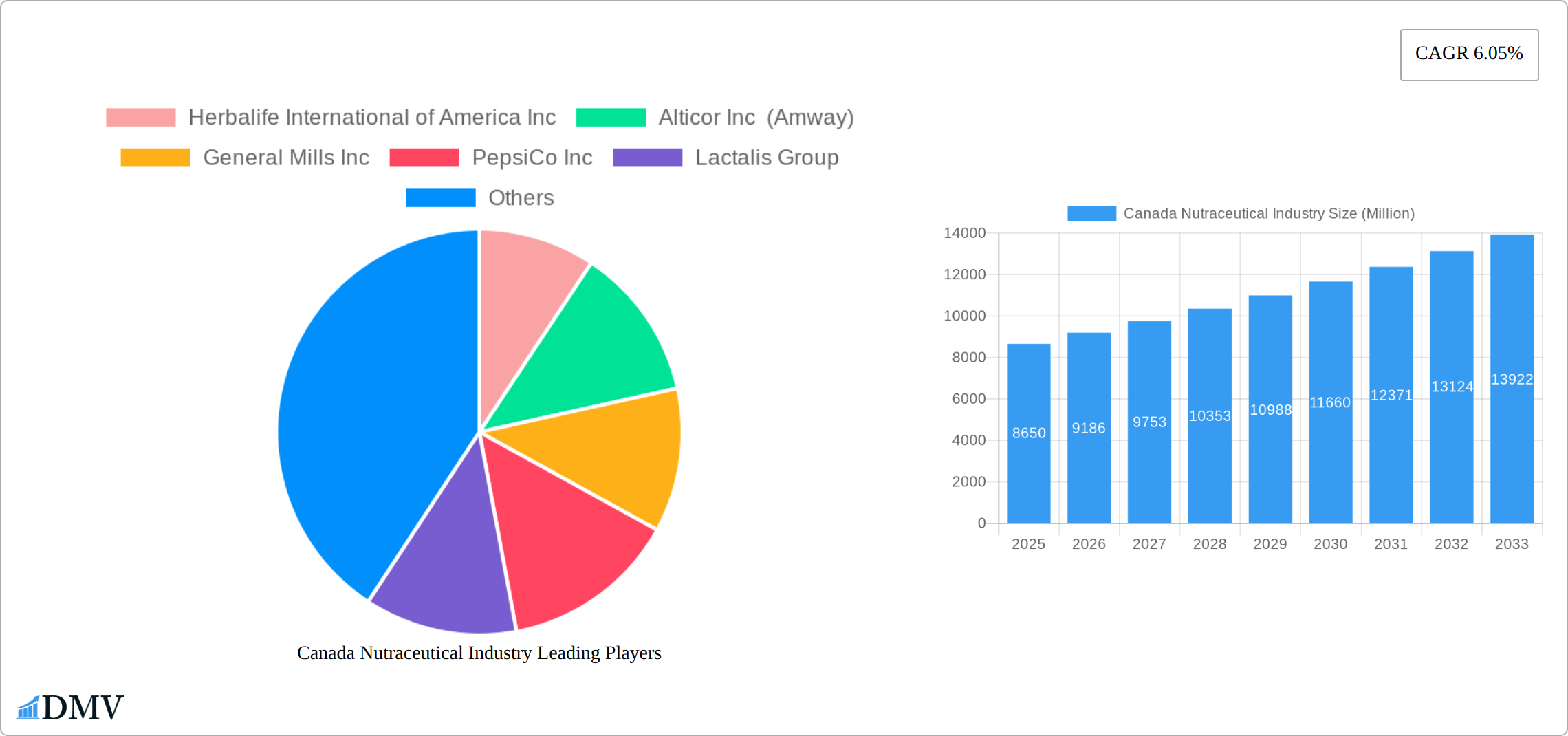

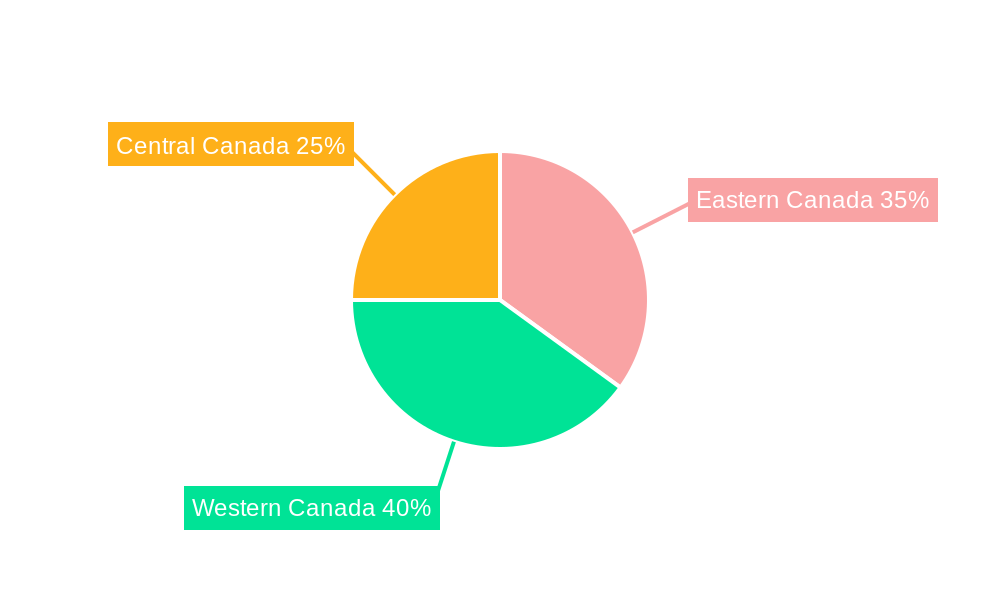

The Canadian nutraceutical market, valued at $8.65 billion in 2025, is projected to experience robust growth, driven by a rising health-conscious population, increasing prevalence of chronic diseases, and growing demand for functional foods and beverages. The 6.05% CAGR from 2025 to 2033 indicates a significant expansion, with the market expected to surpass $13 billion by 2033. Key growth drivers include the increasing adoption of preventative healthcare measures, rising disposable incomes, and a surge in the popularity of personalized nutrition plans. The market is segmented by distribution channel (specialty stores, supermarkets/hypermarkets, convenience stores, drug stores/pharmacies, online retail stores, and others) and product type (functional foods and functional beverages, including dietary supplements). The dominance of specific distribution channels will likely shift as online retail continues to grow and gain consumer preference for convenience and broader product selection. Competition is fierce, with major players like Herbalife, Amway, General Mills, PepsiCo, and Nestlé vying for market share alongside smaller, specialized nutraceutical companies. Regional variations in market penetration exist across Eastern, Western, and Central Canada, influenced by factors like demographics, health awareness levels, and distribution infrastructure. The market faces challenges including stringent regulatory approvals for new products, rising input costs and increasing consumer awareness for ingredient sourcing and product authenticity. Successful companies will need to leverage innovation, build strong brand trust and invest in marketing to reach targeted demographic segments.

The Canadian nutraceutical sector's growth trajectory is directly linked to shifting consumer behaviour towards proactive health management. The increasing prevalence of conditions like diabetes and heart disease fuels demand for preventative solutions offered by nutraceuticals. Furthermore, a growing awareness of the role of nutrition in overall well-being is prompting consumers to incorporate functional foods and dietary supplements into their daily routines. This trend is further amplified by increased access to health information online and a rise in personalized wellness strategies. However, maintaining sustainable growth requires addressing consumer concerns regarding product safety and efficacy, ensuring transparent labeling practices, and adapting to evolving regulatory landscapes. The integration of technology in personalized nutrition recommendations and targeted advertising will play a vital role in the continued expansion of this promising market. The competitive landscape necessitates strategic investments in research and development to introduce innovative products and maintain market competitiveness.

Canada Nutraceutical Industry Market Composition & Trends

The Canadian nutraceutical industry is a dynamic market shaped by a complex interplay of factors: market concentration, innovation, stringent regulations, and evolving consumer preferences. While moderate market concentration exists, with major multinational players like Herbalife International of America Inc, Alticor Inc (Amway), and General Mills Inc holding significant shares (approximately 30% collectively in 2025), the majority of the market remains fragmented among numerous smaller companies. Innovation is fueled by a growing health-conscious consumer base and continuous advancements in food science and technology. Health Canada's rigorous regulatory oversight significantly impacts product claims, safety standards, and market entry, creating a challenging yet crucial landscape for responsible growth.

- Market Share Distribution (2025): Top three companies hold approximately 30%, with the remaining market share distributed amongst smaller players.

- Innovation Catalysts: Increased consumer health awareness, technological advancements in food science (e.g., personalized nutrition, AI-driven product development), and the rise of plant-based and sustainable products.

- Regulatory Landscape: Stringent regulations enforced by Health Canada govern product claims, safety, and market access, fostering a focus on compliance and product integrity.

- Substitute Products: Traditional pharmaceuticals represent a competitive landscape, however, nutraceuticals are gaining traction due to their perceived natural appeal and holistic health approach.

- End-User Profiles: An aging population and health-conscious millennials are key drivers of demand, particularly for functional foods and targeted supplements.

- Mergers & Acquisitions (M&A) Activity: Significant M&A activity in 2024 (estimated value: [Insert Specific Value if Available] Million) indicates ongoing consolidation and expansion within the industry.

Canada Nutraceutical Industry Industry Evolution

The Canada Nutraceutical Industry has experienced robust growth over the study period of 2019-2033, with a forecasted CAGR of 7.5% from 2025 to 2033. Technological advancements have significantly propelled this sector, particularly in the development of functional foods and beverages. For instance, the integration of probiotics and prebiotics into everyday products has seen a surge, with adoption rates increasing by 12% annually since 2020. Consumer demands have shifted towards clean-label products, free from artificial additives, further fueling the market. The rise of e-commerce has also played a pivotal role, with online retail channels growing by 15% year-over-year. The industry has seen a transition from traditional supplement forms to innovative delivery systems like gummies and powders, catering to diverse consumer preferences. This evolution reflects a broader trend towards personalized nutrition, driven by increased awareness and accessibility to health information.

Leading Regions, Countries, or Segments in Canada Nutraceutical Industry

Within the Canadian nutraceutical market, distinct segments and distribution channels demonstrate significant dominance. Specialty stores currently hold a leading market share, capitalizing on consumer demand for personalized service and expert advice within a health-focused retail environment.

- Specialty Stores: Market leadership driven by investment in health-focused retail spaces, consumer education programs, and a curated selection of high-quality products.

- Supermarkets/Hypermarkets: Broad product accessibility and convenient purchasing locations contribute to substantial sales volumes.

- Online Retail Stores: E-commerce is experiencing rapid growth, fueled by increased convenience, extensive product selection, and ease of comparison shopping.

- Functional Foods: This segment experiences high demand due to their seamless integration into daily diets and associated health benefits.

- Dietary Supplements: Growing consumer awareness of preventative health and targeted health solutions drives continued expansion within this sector.

Specialty stores' success stems from their ability to provide expert guidance and carefully selected products, appealing to health-conscious consumers. Supermarkets and hypermarkets benefit from their wide reach and the convenience of offering nutraceuticals alongside everyday groceries. The online retail sector's surge is a direct result of ease of access, comprehensive product information, and the ability to compare options. Functional foods' popularity reflects the desire for convenient and effective ways to improve health, while dietary supplements address specific health needs and preventative health measures.

Canada Nutraceutical Industry Product Innovations

Recent product innovations in the Canada Nutraceutical Industry include the development of functional beverages with added health benefits such as probiotics and antioxidants. The introduction of plant-based protein supplements has also gained traction, appealing to the growing vegan and vegetarian consumer base. These innovations focus on enhancing taste and nutritional value, utilizing advanced technologies like microencapsulation to ensure the stability and efficacy of active ingredients. Unique selling propositions include clean-label formulations and personalized nutrition options, catering to individual health needs.

Propelling Factors for Canada Nutraceutical Industry Growth

The Canada Nutraceutical Industry is propelled by several key factors. Technologically, advancements in food processing and ingredient formulation have enabled the creation of more effective and palatable products. Economically, rising disposable incomes and a growing middle class have increased consumer spending on health and wellness. Regulatory influences include Health Canada's supportive policies towards natural health products, which encourage market growth. Examples include the adoption of probiotics in functional foods and the rise of clean-label products.

Obstacles in the Canada Nutraceutical Industry Market

The Canada Nutraceutical Industry faces several obstacles that could impede growth. Regulatory challenges, such as stringent labeling requirements and product approval processes, can delay market entry and increase costs. Supply chain disruptions, particularly during global events like pandemics, have led to shortages and price volatility. Competitive pressures from traditional pharmaceutical companies and other nutraceutical brands create a crowded marketplace, with companies spending approximately xx Million annually on marketing to maintain market share.

Future Opportunities in Canada Nutraceutical Industry

Significant future opportunities for growth within the Canadian nutraceutical industry include expansion into personalized nutrition, leveraging genetic and lifestyle data to offer tailored products. Technological advancements, including AI-driven product development and blockchain technologies for enhanced supply chain transparency and traceability, will play a pivotal role. Furthermore, the increasing consumer preference for plant-based and sustainable products presents a prime opportunity for innovation and the development of new, ethically sourced nutraceuticals.

Major Players in the Canada Nutraceutical Industry Ecosystem

- Herbalife International of America Inc

- Alticor Inc (Amway)

- General Mills Inc

- PepsiCo Inc

- Lactalis Group

- Magnum Nutraceuticals *List Not Exhaustive

- Red Bull GmbH

- Danone S A

- Natural Factors Nutritional Products Ltd

- Kellogg Company

- Pfizer Inc

- Nestlé S A

Key Developments in Canada Nutraceutical Industry Industry

- October 2022: Nestlé and Natures Bounty launched VitaBeans, a vegetarian, gluten-free, and gelatin-free product line, impacting the vitamins and supplements market with a focus on natural ingredients.

- June 2022: Kellogg Company announced a split into three companies, with a "Global Snacking Co" focusing on snacks and cereals, a "North American Cereal Company" on cereals, and a "Plant Company" on plant-based foods, reshaping market dynamics.

- September 2021: Lactalis Canada introduced Astro PROTEIN & FIBRE Yogurt in four flavors, enhancing the functional food segment with protein and fiber-rich options.

Strategic Canada Nutraceutical Industry Market Forecast

The strategic forecast for the Canada Nutraceutical Industry indicates robust growth driven by increasing consumer health awareness, technological innovations, and supportive regulatory environments. The market is poised to capitalize on emerging trends such as personalized nutrition and sustainable products. With a forecasted CAGR of 7.5% from 2025 to 2033, the industry presents significant opportunities for companies to expand their product portfolios and explore new market segments, leveraging the growing demand for health and wellness solutions.

Canada Nutraceutical Industry Segmentation

-

1. Type

-

1.1. Functional Food

- 1.1.1. Functional Cereal

- 1.1.2. Functional Bakery & Confectionary

- 1.1.3. Functional Dairy

- 1.1.4. Functional Snacks

- 1.1.5. Other Functional Foods

-

1.2. Functional Beverage

- 1.2.1. Energy Drink

- 1.2.2. Sports Drink

- 1.2.3. Fortified Juice

- 1.2.4. Dairy and Dairy Alternative Beverage

- 1.2.5. Other Functional Beverages

-

1.3. Dietary Supplement

- 1.3.1. Vitamin

- 1.3.2. Mineral

- 1.3.3. Botanical

- 1.3.4. Enzyme

- 1.3.5. Fatty Acid

- 1.3.6. Protein

- 1.3.7. Other Dietary Supplements

-

1.1. Functional Food

-

2. Distribution Channel

- 2.1. Specialty Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Convenience Stores

- 2.4. Drug Stores/Pharmacies

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

Canada Nutraceutical Industry Segmentation By Geography

- 1. Canada

Canada Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.05% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Expenditure on Health and Wellness

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Nutraceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Functional Food

- 5.1.1.1. Functional Cereal

- 5.1.1.2. Functional Bakery & Confectionary

- 5.1.1.3. Functional Dairy

- 5.1.1.4. Functional Snacks

- 5.1.1.5. Other Functional Foods

- 5.1.2. Functional Beverage

- 5.1.2.1. Energy Drink

- 5.1.2.2. Sports Drink

- 5.1.2.3. Fortified Juice

- 5.1.2.4. Dairy and Dairy Alternative Beverage

- 5.1.2.5. Other Functional Beverages

- 5.1.3. Dietary Supplement

- 5.1.3.1. Vitamin

- 5.1.3.2. Mineral

- 5.1.3.3. Botanical

- 5.1.3.4. Enzyme

- 5.1.3.5. Fatty Acid

- 5.1.3.6. Protein

- 5.1.3.7. Other Dietary Supplements

- 5.1.1. Functional Food

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Convenience Stores

- 5.2.4. Drug Stores/Pharmacies

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Eastern Canada Canada Nutraceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Nutraceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Nutraceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Herbalife International of America Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Alticor Inc (Amway)

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 General Mills Inc

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 PepsiCo Inc

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Lactalis Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Magnum Nutraceuticals*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Red Bull GmbH

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Danone S A

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Natural Factors Nutritional Products Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Kellogg Company

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Pfizer Inc

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Nestlé S A

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.1 Herbalife International of America Inc

List of Figures

- Figure 1: Canada Nutraceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Nutraceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Canada Nutraceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Nutraceutical Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Canada Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Canada Nutraceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Canada Nutraceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Eastern Canada Canada Nutraceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Western Canada Canada Nutraceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Central Canada Canada Nutraceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Nutraceutical Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Canada Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Canada Nutraceutical Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Nutraceutical Industry?

The projected CAGR is approximately 6.05%.

2. Which companies are prominent players in the Canada Nutraceutical Industry?

Key companies in the market include Herbalife International of America Inc, Alticor Inc (Amway), General Mills Inc, PepsiCo Inc, Lactalis Group, Magnum Nutraceuticals*List Not Exhaustive, Red Bull GmbH, Danone S A, Natural Factors Nutritional Products Ltd, Kellogg Company, Pfizer Inc, Nestlé S A.

3. What are the main segments of the Canada Nutraceutical Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars.

6. What are the notable trends driving market growth?

Increasing Expenditure on Health and Wellness.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In October 2022, with the launch of the VitaBeans product line, Nestlé and Natures Bounty entered the Canadian vitamins and supplements market. Besides being vegetarian, the beans also contain no gluten or gelatin and no artificial colors or flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Canada Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence