Key Insights

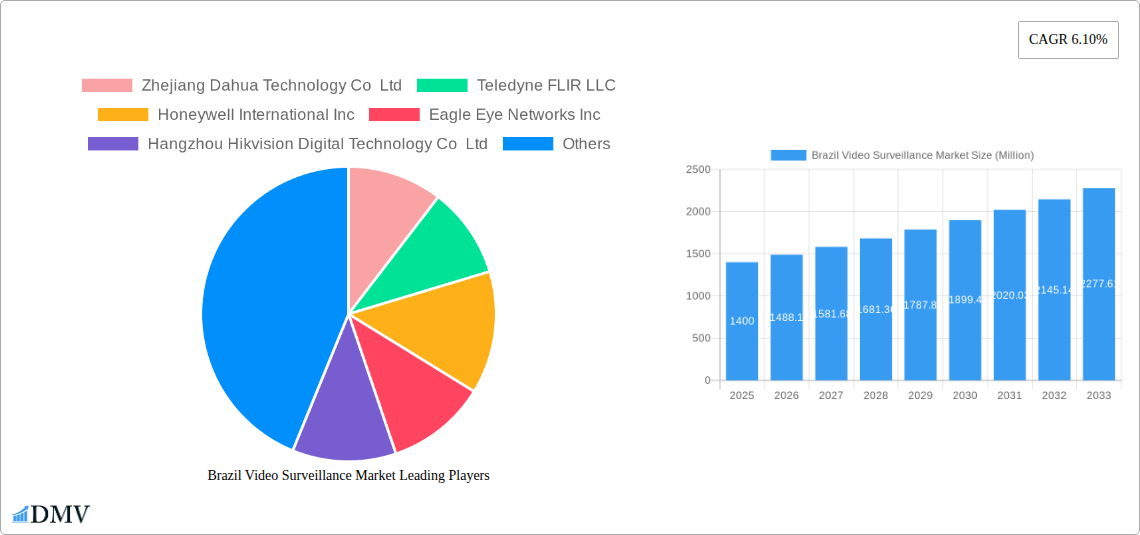

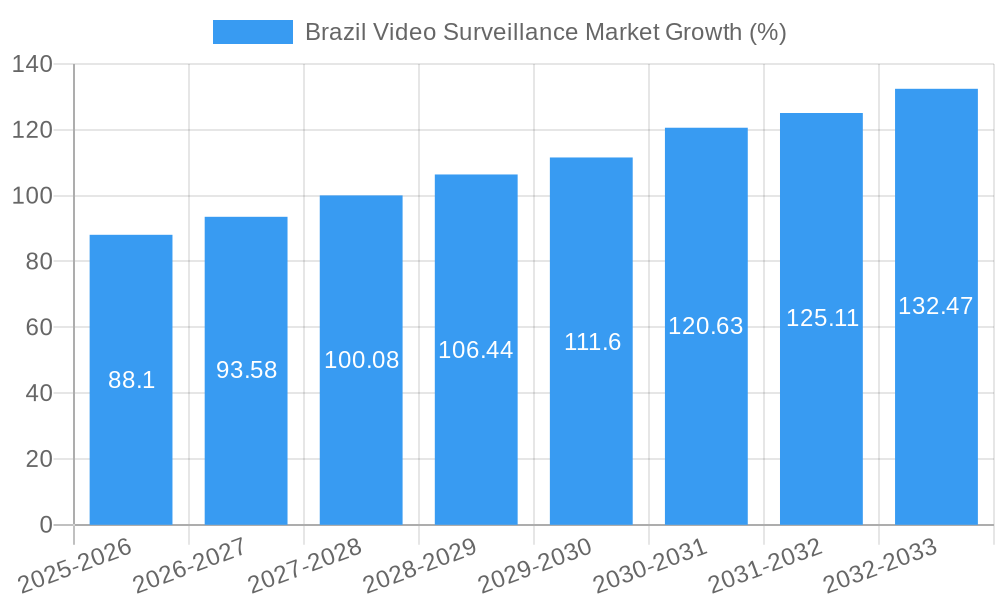

The Brazil video surveillance market, valued at $1.40 billion in 2025, is projected to experience robust growth, driven by increasing concerns about public safety, rising crime rates, and the expanding adoption of smart city initiatives. The market's Compound Annual Growth Rate (CAGR) of 6.10% from 2019 to 2024 suggests a continued upward trajectory. This growth is fueled by several key factors, including the increasing affordability of advanced surveillance technologies like IP cameras and video analytics, government investments in infrastructure development, and the growing need for enhanced security in both public and private sectors. The rising adoption of cloud-based video surveillance solutions, offering scalability and cost-effectiveness, is also contributing significantly to market expansion. Furthermore, the burgeoning e-commerce sector and the need to protect logistics and supply chains are driving demand for sophisticated video surveillance systems. Competitive pressures from a range of established players like Zhejiang Dahua Technology, Hikvision, and Honeywell, alongside emerging technology providers, foster innovation and keep prices competitive, further stimulating market growth.

However, challenges remain. Economic volatility and fluctuating currency exchange rates can influence investment decisions. Furthermore, data privacy concerns and regulatory hurdles surrounding data storage and usage might impede the market's full potential. Despite these challenges, the overall outlook for the Brazil video surveillance market remains positive, with significant growth opportunities anticipated in the coming years, particularly in sectors like retail, transportation, and critical infrastructure. The market segmentation, while not explicitly provided, is likely diverse, encompassing various camera types (IP, analog, thermal), storage solutions, and service offerings (installation, maintenance, and monitoring). The continued expansion of 4G and 5G networks will likely facilitate the broader adoption of connected surveillance solutions, driving future market expansion in the forecast period (2025-2033).

Brazil Video Surveillance Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Brazil video surveillance market, offering a comprehensive overview of its current state, future trajectory, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The market is estimated to be worth xx Million in 2025.

Brazil Video Surveillance Market Composition & Trends

The Brazilian video surveillance market exhibits a moderately concentrated landscape, with key players such as Zhejiang Dahua Technology Co Ltd, Teledyne FLIR LLC, Honeywell International Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB, Bosch Security Systems Incorporated, Samsung Group, Verkada Inc, Motorola Solutions Inc, Infinova Group, and Johnson Controls competing for market share. Market share distribution is currently estimated at xx%, with Dahua and Hikvision holding significant portions. Innovation is driven by the increasing demand for higher resolution cameras, advanced analytics, and cloud-based solutions. The regulatory landscape, while evolving, is generally supportive of security infrastructure development. Substitute products, such as traditional security personnel, are gradually being replaced due to cost-effectiveness and enhanced capabilities. End-users span various sectors, including government, commercial, residential, and critical infrastructure. M&A activity in the past five years has been moderate, with deal values averaging approximately xx Million per transaction.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Innovation Catalysts: Demand for high-resolution, AI-powered, and cloud-based solutions.

- Regulatory Landscape: Supportive of security infrastructure development.

- Substitute Products: Traditional security methods are being gradually replaced.

- End-User Profiles: Government, commercial, residential, and critical infrastructure.

- M&A Activity: Moderate, with average deal values around xx Million.

Brazil Video Surveillance Market Industry Evolution

The Brazilian video surveillance market has witnessed significant growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is attributable to several factors, including rising crime rates, increasing government spending on security infrastructure, and the growing adoption of smart city initiatives. Technological advancements, such as the introduction of Artificial Intelligence (AI)-powered video analytics, high-definition cameras, and cloud-based video management systems (VMS), have further fueled market expansion. Shifting consumer demands towards improved security and convenience have also played a crucial role. The forecast period (2025-2033) is projected to see continued growth, driven by factors such as increasing adoption of IP-based systems, the expansion of 5G networks, and the growing demand for cybersecurity solutions. Adoption rates of AI-powered analytics are expected to increase significantly, reaching approximately xx% by 2033. Market growth is expected to maintain a CAGR of xx% throughout the forecast period.

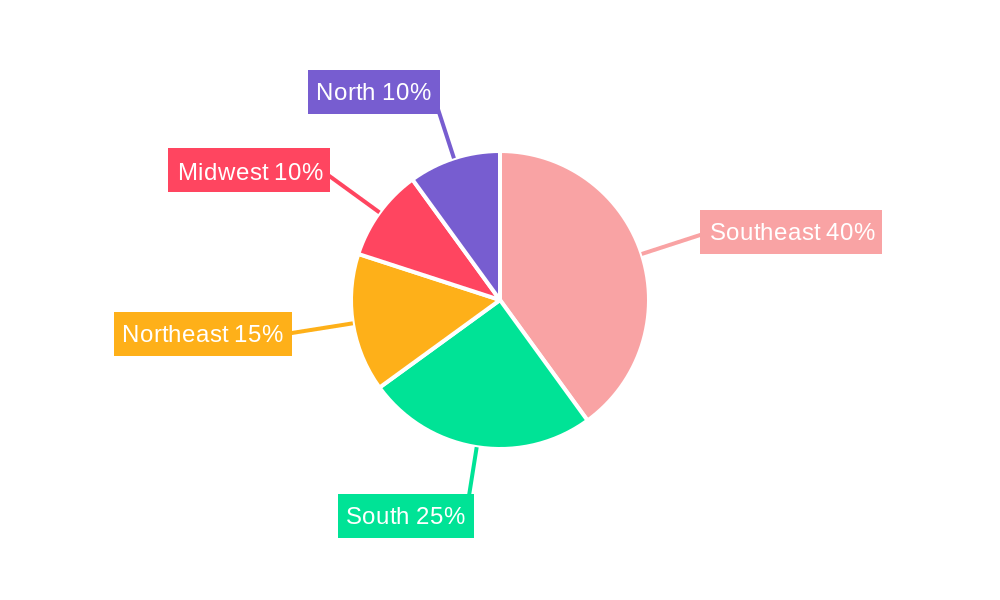

Leading Regions, Countries, or Segments in Brazil Video Surveillance Market

The Southeast region of Brazil currently dominates the video surveillance market, driven by factors such as higher population density, increased economic activity, and significant investments in infrastructure projects. São Paulo, in particular, stands out as a major market hub.

- Key Drivers for Southeast Region Dominance:

- High population density and economic activity.

- Significant investments in infrastructure projects.

- Strong government support for security initiatives.

- Presence of major market players and distributors.

The growth of the commercial segment, particularly in retail and banking, further contributes to the market's dominance. The increasing adoption of advanced security systems in these sectors is a key factor driving the overall market expansion. Furthermore, stringent government regulations concerning security standards across various industries are boosting the adoption rate of sophisticated video surveillance systems. The residential segment is also showing notable growth, driven by rising concerns about personal safety and home security.

Brazil Video Surveillance Market Product Innovations

Recent innovations include the rise of AI-powered video analytics, which offer enhanced threat detection and response capabilities. High-resolution cameras with improved image quality and long-range capabilities are also gaining traction. Cloud-based video management systems (VMS) are becoming increasingly popular due to their scalability, accessibility, and cost-effectiveness. These advancements provide enhanced security and operational efficiency, resulting in a notable increase in customer adoption rates. The unique selling propositions often include advanced analytics, ease of integration, and remote accessibility.

Propelling Factors for Brazil Video Surveillance Market Growth

Several factors contribute to the growth of the Brazilian video surveillance market. The increasing crime rates in urban areas are a primary driver, leading to a higher demand for security solutions. Government initiatives aimed at improving public safety and supporting smart city projects also fuel market growth. Furthermore, technological advancements, such as the development of sophisticated AI-powered video analytics and cost-effective cloud-based solutions, are further propelling market expansion. Economic growth and rising disposable incomes are enhancing investment capacity across various sectors.

Obstacles in the Brazil Video Surveillance Market

Despite the positive growth outlook, the Brazilian video surveillance market faces challenges. High initial investment costs for advanced systems can act as a barrier, particularly for small and medium-sized businesses. Supply chain disruptions can impact availability and pricing. Intense competition among established and emerging players adds to the complexity. Additionally, regulatory hurdles and fluctuating exchange rates can affect market dynamics.

Future Opportunities in Brazil Video Surveillance Market

Future opportunities lie in the growing adoption of AI-powered analytics, improved cybersecurity solutions, and the integration of video surveillance systems with other IoT devices. The expanding adoption of cloud-based VMS and the growth of the smart city initiatives present significant potential. Moreover, exploring new markets, such as the logistics and transportation sectors, will further drive the market's growth.

Major Players in the Brazil Video Surveillance Market Ecosystem

- Zhejiang Dahua Technology Co Ltd

- Teledyne FLIR LLC

- Honeywell International Inc

- Eagle Eye Networks Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- Axis Communications AB

- Bosch Security Systems Incorporated

- Samsung Group

- Verkada Inc

- Motorola Solutions Inc

- Infinova Group

- Johnson Controls

Key Developments in Brazil Video Surveillance Market Industry

- July 2024: Axis Communications launched the AXIS Q1809-LE Bullet Camera, an all-in-one outdoor solution with a custom telephoto lens for long-distance surveillance.

- June 2024: Hikvision enhanced its Heatpro bi-spectrum thermal cameras with VCA 3.0, improving performance and detection capabilities.

Strategic Brazil Video Surveillance Market Forecast

The Brazilian video surveillance market is poised for continued growth, driven by technological advancements, increasing security concerns, and supportive government policies. The focus on AI-powered analytics, cloud-based solutions, and the integration of video surveillance into broader smart city initiatives will shape the market's future. The market's potential is significant, with projections indicating substantial growth over the forecast period.

Brazil Video Surveillance Market Segmentation

-

1. Type

-

1.1. Hardware

-

1.1.1. Camera

- 1.1.1.1. Analog

- 1.1.1.2. IP Cameras

-

1.1.1. Camera

-

1.2. Software

- 1.2.1. Video Analytics

- 1.2.2. Video Management

- 1.3. Services (VSAAS)

-

1.1. Hardware

-

2. End-user Vertical

- 2.1. Commercial

- 2.2. Infrastructure

- 2.3. Institutional

- 2.4. Defense

- 2.5. Residential

Brazil Video Surveillance Market Segmentation By Geography

- 1. Brazil

Brazil Video Surveillance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Concern About Security and Safety; Advances in Technology

- 3.2.2 Such as IoT

- 3.2.3 Artificial Intelligence

- 3.2.4 and Voice Controlled Assistants

- 3.3. Market Restrains

- 3.3.1 Rising Concern About Security and Safety; Advances in Technology

- 3.3.2 Such as IoT

- 3.3.3 Artificial Intelligence

- 3.3.4 and Voice Controlled Assistants

- 3.4. Market Trends

- 3.4.1. IP Cameras Significantly Gaining Popularity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Video Surveillance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.1.1. Camera

- 5.1.1.1.1. Analog

- 5.1.1.1.2. IP Cameras

- 5.1.1.1. Camera

- 5.1.2. Software

- 5.1.2.1. Video Analytics

- 5.1.2.2. Video Management

- 5.1.3. Services (VSAAS)

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Commercial

- 5.2.2. Infrastructure

- 5.2.3. Institutional

- 5.2.4. Defense

- 5.2.5. Residential

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Zhejiang Dahua Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Teledyne FLIR LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Honeywell International Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eagle Eye Networks Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Axis Communications AB

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch Security Systems Incorporated

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Samsung Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Verkada Ince

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Motorola Solutions Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Infinova Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johnson Controls*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Zhejiang Dahua Technology Co Ltd

List of Figures

- Figure 1: Brazil Video Surveillance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Video Surveillance Market Share (%) by Company 2024

List of Tables

- Table 1: Brazil Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Brazil Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Brazil Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Brazil Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 6: Brazil Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 7: Brazil Video Surveillance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Brazil Video Surveillance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Brazil Video Surveillance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Brazil Video Surveillance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Brazil Video Surveillance Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: Brazil Video Surveillance Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 13: Brazil Video Surveillance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Brazil Video Surveillance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Video Surveillance Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Brazil Video Surveillance Market?

Key companies in the market include Zhejiang Dahua Technology Co Ltd, Teledyne FLIR LLC, Honeywell International Inc, Eagle Eye Networks Inc, Hangzhou Hikvision Digital Technology Co Ltd, Axis Communications AB, Bosch Security Systems Incorporated, Samsung Group, Verkada Ince, Motorola Solutions Inc, Infinova Group, Johnson Controls*List Not Exhaustive.

3. What are the main segments of the Brazil Video Surveillance Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Concern About Security and Safety; Advances in Technology. Such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

6. What are the notable trends driving market growth?

IP Cameras Significantly Gaining Popularity.

7. Are there any restraints impacting market growth?

Rising Concern About Security and Safety; Advances in Technology. Such as IoT. Artificial Intelligence. and Voice Controlled Assistants.

8. Can you provide examples of recent developments in the market?

July 2024: Axis Communications unveiled its latest offering, the AXIS Q1809-LE Bullet Camera. This all-in-one outdoor solution boasts a custom telephoto lens designed for optimal long-distance surveillance, ensuring superior image quality and enhanced forensic capabilities. Axis touts the versatility of the AXIS Q1809-LE, asserting its suitability across diverse applications, ranging from smart cities and airports to stadiums and transportation hubs. Notably, the camera is designed for immediate deployment straight out of the box.June 2024: Hikvision, a leading player in the security solutions sector, rolled out a major enhancement to its Heatpro bi-spectrum thermal cameras by incorporating VCA 3.0. This upgrade is not merely cosmetic; it is a strategic move to boost performance, detection capabilities, and accuracy. By integrating VCA 3.0, Hikvision underscores its dedication to cutting-edge security solutions. The latest algorithms in VCA 3.0 mark a leap in processing power and efficiency, heightening the cameras' ability to pinpoint and analyze potential security threats.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Video Surveillance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Video Surveillance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Video Surveillance Market?

To stay informed about further developments, trends, and reports in the Brazil Video Surveillance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence