Key Insights

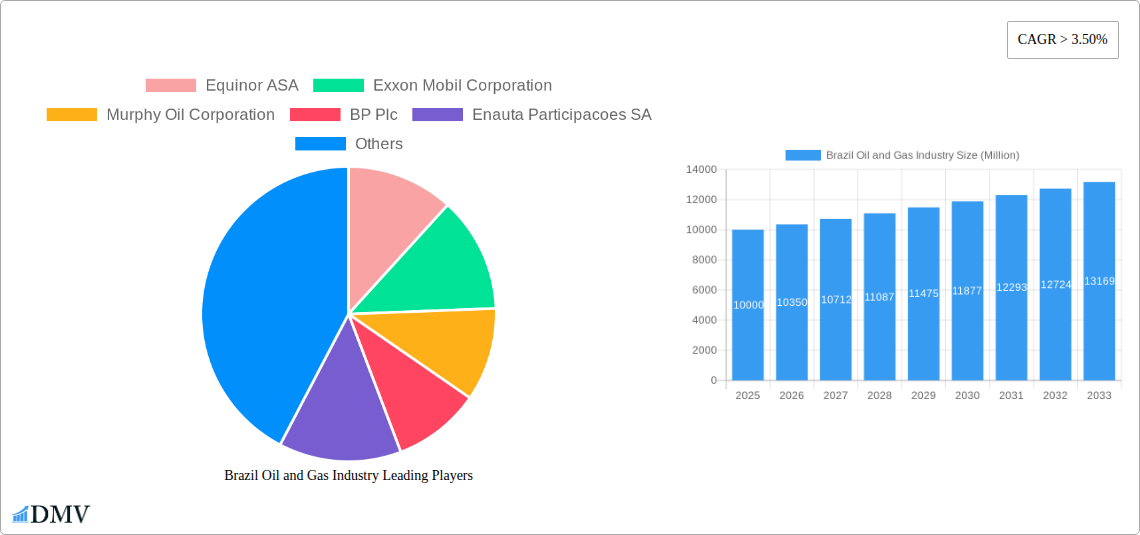

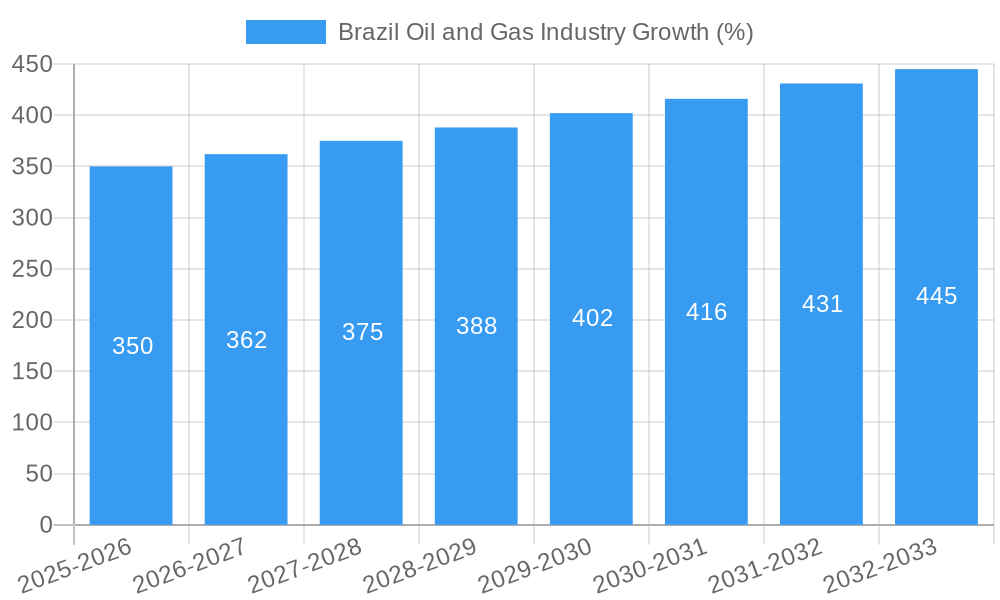

The Brazil oil and gas industry, valued at approximately $XX million in 2025, is projected to experience robust growth, exceeding a compound annual growth rate (CAGR) of 3.5% through 2033. This expansion is fueled by several key drivers. Firstly, Brazil possesses significant untapped reserves of both crude oil and natural gas, particularly in deepwater offshore regions, presenting considerable opportunities for exploration and production. Secondly, increasing domestic energy demand, driven by a growing population and industrialization, creates a strong domestic market for oil and gas products. Thirdly, government initiatives aimed at boosting energy independence and attracting foreign investment are further stimulating industry growth. However, challenges persist. Environmental concerns surrounding offshore drilling and the need for sustainable practices present significant restraints. Furthermore, fluctuations in global oil prices can impact investment decisions and overall profitability. The industry is segmented across upstream, midstream, and downstream operations, with crude oil, natural gas, and refined products being the primary product types catering to the power, transportation, and industrial sectors. Key players such as Petrobras, alongside international giants like ExxonMobil and Shell, are heavily invested in the Brazilian market, contributing to its dynamic landscape. The forecast period (2025-2033) will witness a gradual shift towards cleaner energy sources, however, the continued demand for oil and gas, coupled with ongoing exploration and production activities, will ensure significant growth in the coming years. The market's success will hinge on successfully balancing economic development with environmental sustainability and regulatory compliance.

The competitive landscape is characterized by a blend of state-owned companies and multinational corporations. Petrobras, as the national oil company, holds a significant market share, however, international companies continue to play a critical role in exploration, production, and refining. The industry faces ongoing regulatory scrutiny related to environmental protection and social responsibility, impacting operational costs and investment strategies. Further diversification across product lines and the exploration of alternative energy sources will be crucial for sustained long-term growth and resilience to global market volatility. The midstream sector, particularly pipeline infrastructure and transportation, is expected to experience significant investment to support growing production and meet the rising demand for energy. The downstream segment will be driven by investments in refining capacity and the development of petrochemical industries.

Brazil Oil & Gas Industry: A Comprehensive Market Report (2019-2033)

This insightful report delivers a comprehensive analysis of the Brazilian oil and gas industry, providing crucial data and forecasts for stakeholders from 2019 to 2033. With a focus on market trends, leading players, and future opportunities, this report is an essential resource for investors, industry professionals, and policymakers seeking a deep understanding of this dynamic market. The report utilizes a base year of 2025 and an estimated year of 2025, with a forecast period spanning 2025-2033 and a historical period covering 2019-2024. The market size is expected to reach xx Million by 2033.

Brazil Oil and Gas Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory framework, substitute products, end-user dynamics, and merger & acquisition (M&A) activity within the Brazilian oil and gas sector. The market exhibits a moderate level of concentration, with Petrobras holding a significant share, but facing increasing competition from international players like Equinor ASA, Exxon Mobil Corporation, and BP Plc. Innovation is driven by technological advancements in exploration and extraction, as well as a push towards cleaner energy sources.

- Market Share Distribution (2024): Petrobras (xx%), Equinor ASA (xx%), ExxonMobil (xx%), Others (xx%).

- M&A Activity (2019-2024): Total deal value estimated at xx Million, with a focus on upstream assets.

- Regulatory Landscape: Characterized by a mix of government support for exploration and production, coupled with increasing emphasis on environmental regulations and local content requirements.

- Substitute Products: Growing interest in renewable energy sources (solar, wind) presents a potential challenge to the long-term growth of the oil and gas industry.

- End-User Profiles: Significant demand from the power generation (xx Million barrels of oil equivalent), transportation (xx Million barrels of oil equivalent) and industrial (xx Million barrels of oil equivalent) sectors.

Brazil Oil and Gas Industry Industry Evolution

This section analyzes the evolution of the Brazilian oil and gas industry, focusing on growth trajectories, technological advancements, and shifting consumer demands. The industry has experienced significant growth in recent years, fueled by discoveries in pre-salt regions and increasing domestic demand. Technological innovations, such as improved drilling techniques and enhanced oil recovery methods, have played a crucial role in boosting production. However, the industry is facing increasing pressure to reduce its carbon footprint and adopt more sustainable practices.

- Growth Rate (2019-2024): Average annual growth rate of xx%.

- Technological Advancements: Adoption of digital technologies, such as AI and machine learning, for improved efficiency and safety.

- Shifting Consumer Demands: Increased focus on environmental sustainability and the transition towards cleaner energy.

- Pre-salt Production Growth: Significant increase in pre-salt oil and gas production, contributing significantly to the overall growth of the sector.

Leading Regions, Countries, or Segments in Brazil Oil and Gas Industry

The Brazilian oil and gas industry is dominated by the upstream sector, particularly in the pre-salt regions off the coast of Rio de Janeiro and Santos. This dominance is driven by significant discoveries of oil and gas reserves and substantial investments in exploration and production activities.

- Upstream Sector: Key drivers include substantial reserves in pre-salt areas, significant government investment in infrastructure development, and favorable fiscal policies.

- Crude Oil: Remains the dominant product, with significant demand from domestic refineries and exports.

- Pre-salt Regions: The pre-salt basins of Santos and Campos account for a significant portion of Brazil’s oil and gas production. This is due to substantial investments in deepwater exploration and production technologies.

Further, the Transportation end-user segment represents a significant portion of the overall demand. This stems from the increasing number of vehicles and a growing middle class.

Brazil Oil and Gas Industry Product Innovations

Recent innovations focus on enhancing recovery rates from pre-salt reservoirs and improving the efficiency of refining processes. This includes advancements in drilling technologies, enhanced oil recovery (EOR) techniques, and the development of cleaner fuels. These innovations are aimed at increasing production, reducing costs, and minimizing environmental impact. Companies are also focusing on developing biofuels and exploring opportunities in carbon capture and storage (CCS).

Propelling Factors for Brazil Oil and Gas Industry Growth

Several factors are driving the growth of the Brazilian oil and gas industry, including:

- Abundant Reserves: Vast reserves, particularly in the pre-salt region, provide a strong foundation for long-term growth.

- Government Support: Government policies aimed at attracting foreign investment and promoting domestic exploration have significantly boosted the sector.

- Technological Advancements: Continuous innovation in exploration, extraction, and refining technologies improves efficiency and reduces costs.

Obstacles in the Brazil Oil and Gas Industry Market

The Brazilian oil and gas industry faces several challenges, including:

- Regulatory Uncertainty: Changes in government policies and regulations can create uncertainty for investors.

- Infrastructure Limitations: The need for significant investments in infrastructure to support growing production and transportation.

- Environmental Concerns: Increasing pressure to reduce environmental impact and mitigate greenhouse gas emissions.

Future Opportunities in Brazil Oil and Gas Industry

The Brazilian oil and gas industry presents significant opportunities for growth, including:

- Deepwater Exploration: Further exploration in deepwater areas holds the potential for significant discoveries.

- Natural Gas Expansion: Growth in the natural gas sector is expected, driven by increasing demand for electricity generation.

- Biofuels Development: Brazil has the potential to become a major player in the biofuels market, leveraging its agricultural resources.

Major Players in the Brazil Oil and Gas Industry Ecosystem

- Equinor ASA

- Exxon Mobil Corporation

- Murphy Oil Corporation

- BP Plc

- Enauta Participacoes SA

- Royal Dutch Shell Plc

- Chevron Corporation

- Gas TransBoliviano SA

- Petroleo Brasileiro S A (Petrobras)

- Total S A

Key Developments in Brazil Oil and Gas Industry Industry

- 2022-Q4: Petrobras announces a major investment in offshore wind energy.

- 2023-Q1: New deepwater oil discovery announced by ExxonMobil.

- 2023-Q2: Government approves new regulations aimed at boosting local content. (Further developments to be added as available)

Strategic Brazil Oil and Gas Industry Market Forecast

The Brazilian oil and gas industry is poised for continued growth, driven by exploration successes, domestic demand, and strategic investments in infrastructure. The pre-salt region will remain a key driver of production, while the expanding natural gas sector and the potential for biofuels will offer diversification opportunities. The industry will need to navigate environmental challenges and regulatory changes to maintain its long-term growth trajectory.

Brazil Oil and Gas Industry Segmentation

-

1. Sector

- 1.1. Upstream

- 1.2. Midstream

- 1.3. Downstream

Brazil Oil and Gas Industry Segmentation By Geography

- 1. Brazil

Brazil Oil and Gas Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Upstream Sector as a Significant Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Oil and Gas Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Upstream

- 5.1.2. Midstream

- 5.1.3. Downstream

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Equinor ASA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Murphy Oil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BP Plc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Enauta Participacoes SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Royal Dutch Shell Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Chevron Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gas TransBoliviano SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Petroleo Brasileiro S A (Petrobras)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Total S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Equinor ASA

List of Figures

- Figure 1: Brazil Oil and Gas Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Brazil Oil and Gas Industry Share (%) by Company 2024

List of Tables

- Table 1: Brazil Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Region 2019 & 2032

- Table 3: Brazil Oil and Gas Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 4: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Sector 2019 & 2032

- Table 5: Brazil Oil and Gas Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Region 2019 & 2032

- Table 7: Brazil Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Country 2019 & 2032

- Table 9: Brazil Oil and Gas Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 10: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Sector 2019 & 2032

- Table 11: Brazil Oil and Gas Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Brazil Oil and Gas Industry Volume Metric tonnes Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Oil and Gas Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Brazil Oil and Gas Industry?

Key companies in the market include Equinor ASA, Exxon Mobil Corporation, Murphy Oil Corporation, BP Plc, Enauta Participacoes SA, Royal Dutch Shell Plc, Chevron Corporation, Gas TransBoliviano SA, Petroleo Brasileiro S A (Petrobras), Total S A.

3. What are the main segments of the Brazil Oil and Gas Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Upstream Sector as a Significant Market.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Metric tonnes.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Oil and Gas Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Oil and Gas Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Oil and Gas Industry?

To stay informed about further developments, trends, and reports in the Brazil Oil and Gas Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence