Key Insights

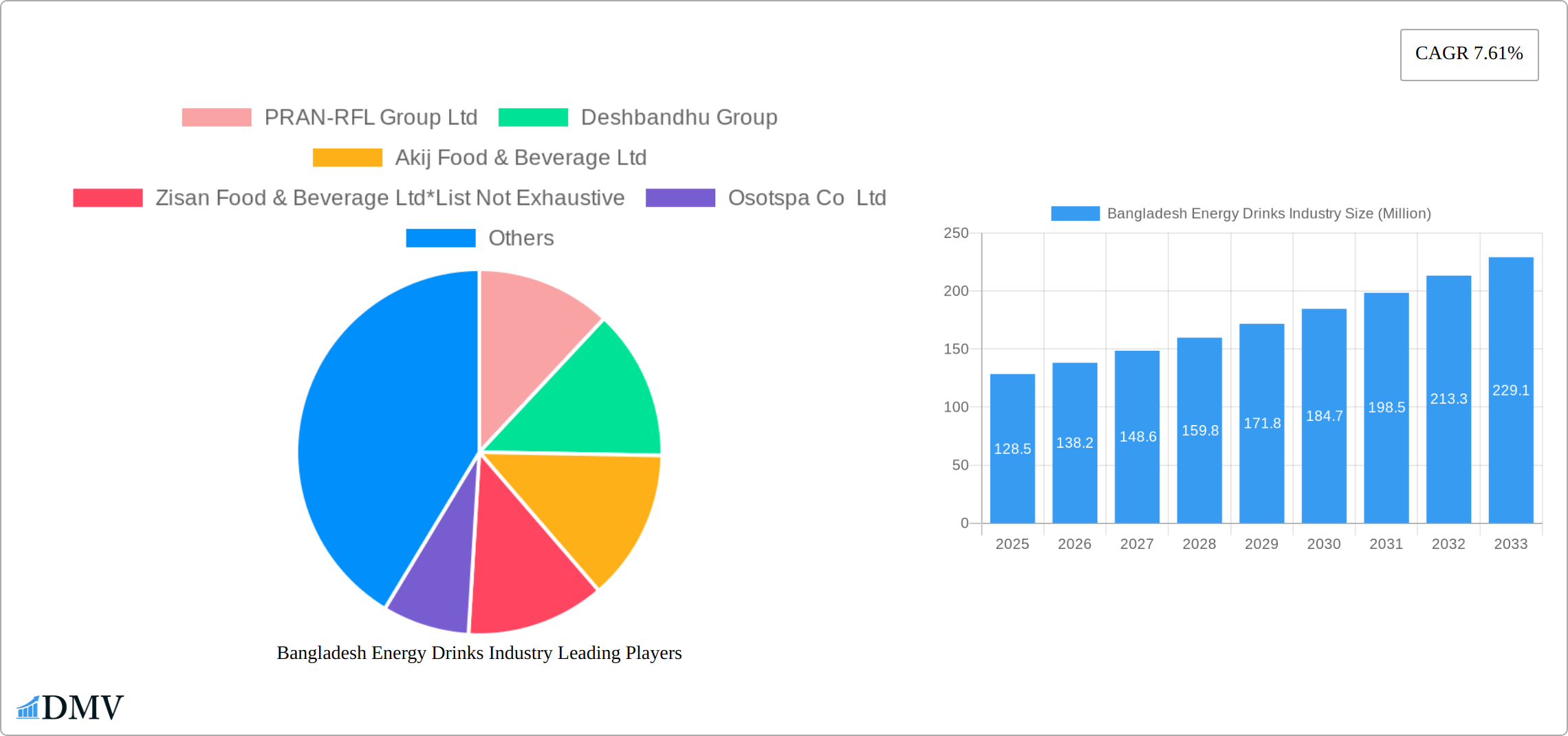

The Bangladesh energy drink market, valued at $128.5 million in 2025, is projected to experience robust growth, driven by a burgeoning young population, rising disposable incomes, and increasing health consciousness leading to demand for functional beverages. Key growth drivers include the increasing adoption of active lifestyles, a surge in urbanization, and the expanding presence of international and domestic brands within the country. The market is segmented by packaging type (cans and PET bottles), with cans likely holding a larger share due to their association with portability and convenience for on-the-go consumption. Distribution channels encompass supermarkets/hypermarkets, convenience/grocery stores, and a rapidly expanding online retail sector reflecting evolving consumer behavior. Major players like PRAN-RFL Group Ltd, Deshbandhu Group, and Akij Food & Beverage Ltd, alongside international brands like Red Bull, compete intensely, influencing pricing strategies and product innovation. While the market faces challenges such as potential health concerns associated with high sugar content and the fluctuating prices of raw materials, the overall trajectory suggests considerable future growth potential.

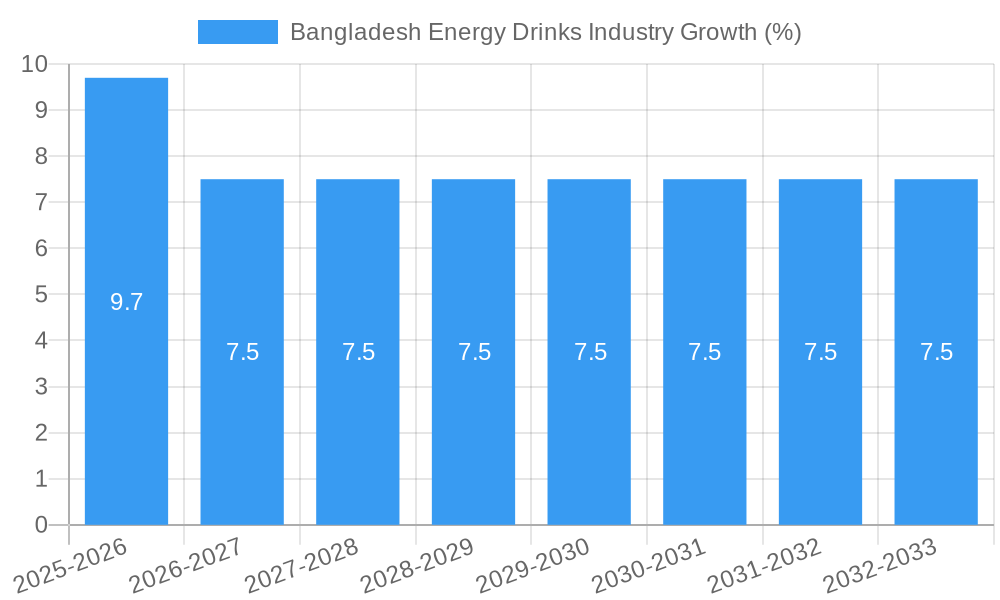

The projected Compound Annual Growth Rate (CAGR) of 7.61% from 2025 to 2033 indicates a steady expansion of the market. This growth is expected to be fueled by sustained economic development in Bangladesh, further boosting consumer spending on premium and functional beverages. Market segmentation by distribution channel highlights the importance of strategic partnerships with retailers to reach a wider consumer base. The increasing popularity of online shopping presents a significant opportunity for energy drink manufacturers to tap into a younger, digitally savvy consumer demographic. Competitive pressure will likely spur innovation in product formulations, flavors, and marketing strategies, ensuring the market remains dynamic and responsive to evolving consumer preferences.

Bangladesh Energy Drinks Industry: A Comprehensive Market Report (2019-2033)

This insightful report provides a detailed analysis of the Bangladesh energy drinks industry, covering market trends, competitive landscape, and future growth projections from 2019 to 2033. The study includes a thorough examination of key players, product innovations, and market dynamics, offering valuable insights for stakeholders across the value chain. With a base year of 2025 and an estimated year of 2025, this report projects market size and trends up to 2033, offering a comprehensive understanding of this dynamic sector. The report's forecast period spans from 2025 to 2033, while the historical period analyzed is 2019-2024. The total market value is projected to reach xx Million by 2033.

Bangladesh Energy Drinks Industry Market Composition & Trends

This section delves into the intricate structure of the Bangladesh energy drink market, evaluating market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The report meticulously analyzes market share distribution among key players like PRAN-RFL Group Ltd, Deshbandhu Group, Akij Food & Beverage Ltd, Zisan Food & Beverage Ltd, Osotspa Co Ltd, Globe Soft Drinks & AST Beverage Ltd, and Red Bull GMBH, providing a clear picture of the competitive landscape. We explore the impact of regulatory changes and the prevalence of substitute beverages on market dynamics. Furthermore, the report examines the end-user demographics consuming energy drinks in Bangladesh, providing a segmentation based on age, gender, lifestyle, and purchasing habits. Finally, it assesses significant M&A activities within the industry, quantifying deal values and their impact on market consolidation. Analysis includes:

- Market Concentration: Detailed analysis of market share held by top players, identifying any dominant firms and assessing the level of competition.

- Innovation Catalysts: Identification of key factors driving innovation, including technological advancements, changing consumer preferences, and competitive pressures. Example: the introduction of functional energy drinks with added vitamins or herbal ingredients.

- Regulatory Landscape: Review of existing regulations affecting the energy drink industry in Bangladesh and their impact on market growth and operations.

- Substitute Products: Assessment of substitute products, such as sports drinks, coffee, and tea, and their influence on the energy drink market share.

- End-User Profiles: Detailed segmentation of consumer demographics and their consumption patterns.

- M&A Activities: Analysis of past M&A activity, including deal values and the effect on market structure. For example, the impact of Deshbandhu Group's BDT 8.0 Billion investment in 2021.

Bangladesh Energy Drinks Industry Industry Evolution

This section provides a comprehensive overview of the Bangladesh energy drink market's evolution, detailing market growth trajectories, technological advancements, and evolving consumer preferences. We analyze historical data from 2019-2024 to identify growth patterns and forecast future trends until 2033. The analysis includes a deep dive into technological advancements, such as innovative packaging designs and the use of functional ingredients, and how they influence market growth and consumer adoption. Furthermore, we investigate shifting consumer demands, including health consciousness and preference for natural ingredients, and their implications for the industry. Specific data points, such as compound annual growth rates (CAGRs) and adoption rates of new technologies, are included to illustrate the market's progression.

This detailed analysis provides crucial insights into the driving forces shaping the industry's past and future trajectory, encompassing factors such as changing consumer preferences for healthier options, the growing middle class, and advancements in manufacturing and distribution networks. Specific data on consumption patterns, market size, and growth rates are examined to give a holistic view of industry development.

Leading Regions, Countries, or Segments in Bangladesh Energy Drinks Industry

This segment analyzes the leading regions, countries, and market segments within Bangladesh's dynamic energy drinks industry. We examine market share based on crucial factors like packaging (cans, PET bottles) and distribution channels (supermarkets/hypermarkets, convenience/grocery stores, online retailers, and other channels). The analysis will pinpoint the dominant segment, exploring the key drivers behind its success. This includes a detailed examination of regional investment patterns, the impact of government regulations on specific segments, and other significant factors influencing market leadership. We will also consider the influence of consumer preferences and purchasing habits on market segmentation.

- Key Drivers (By Packaging Type & Distribution Channel):

- Cans: The enduring popularity of cans stems from their convenience, recyclability, and established consumer preference, particularly amongst younger demographics.

- PET Bottles: PET bottles offer cost-effectiveness, ease of handling, and the potential for larger volume packaging, appealing to both consumers and businesses.

- Supermarkets/Hypermarkets: These channels benefit from established distribution networks, wide consumer reach, and opportunities for bulk purchases, often leading to price discounts.

- Convenience/Grocery Stores: Their high accessibility and strategic placement within local communities drive impulse purchases and contribute to significant market penetration.

- Online Stores: The rapid growth of e-commerce in Bangladesh provides a convenient and increasingly popular platform for energy drink sales, enabling targeted marketing and wider reach.

- Traditional Trade: The role of smaller, independent retailers and street vendors should not be overlooked; their capillary reach in densely populated areas continues to be a significant distribution channel.

Bangladesh Energy Drinks Industry Product Innovations

This section details recent product innovations within the Bangladeshi energy drink market. We analyze new product launches, focusing on their unique selling propositions (USPs), the technological advancements behind them, and their impact on market dynamics. The analysis includes case studies of successful launches, examining market share gains, consumer reception, and contribution to overall industry growth. We will delve into specific examples, such as the impact of Osotspa's reformulated M-150 and Red Bull's strategic introduction of new flavors, analyzing their success in terms of sales figures and market positioning. The analysis will also assess the role of functional ingredients and health-conscious formulations.

Propelling Factors for Bangladesh Energy Drinks Industry Growth

Several factors contribute to the growth of the Bangladesh energy drinks industry. These include technological advancements in production and packaging, economic growth leading to increased disposable incomes and spending power, and supportive regulatory frameworks. The rising prevalence of busy lifestyles and the growing young population also drive demand for convenient energy boosts. Furthermore, effective marketing campaigns and strategic partnerships play a crucial role in enhancing brand visibility and market penetration. Specific examples of each factor are explored to demonstrate their impact.

Obstacles in the Bangladesh Energy Drinks Industry Market

Despite the considerable growth potential, the Bangladesh energy drinks market faces significant challenges. These include navigating stringent regulatory frameworks for food and beverage products, managing potential supply chain disruptions affecting raw material availability and distribution, and competing effectively with both established domestic and international players. We quantify the impact of these obstacles on market growth and explore strategies to mitigate these risks, including diversification of supply chains and proactive engagement with regulatory bodies.

Future Opportunities in Bangladesh Energy Drinks Industry

The Bangladesh energy drinks market presents several lucrative opportunities. The increasing adoption of e-commerce platforms offers new distribution channels, and there is potential for growth in niche segments such as functional energy drinks with health benefits. Furthermore, strategic collaborations with local businesses and expanding into rural markets could yield substantial returns. These untapped potential areas present promising prospects for market expansion and diversification.

Major Players in the Bangladesh Energy Drinks Industry Ecosystem

- PRAN-RFL Group Ltd

- Deshbandhu Group

- Akij Food & Beverage Ltd

- Zisan Food & Beverage Ltd

- Osotspa Co Ltd

- Globe Soft Drinks & AST Beverage Ltd

- Red Bull GMBH

- Other emerging local brands

Key Developments in Bangladesh Energy Drinks Industry Industry

- October 2021: Deshbandhu Group's substantial BDT 8.0 Billion investment in business expansion, with a significant portion allocated to its food and beverage division, signals strong confidence in the industry's long-term prospects.

- February 2022: Red Bull's launch of a watermelon-flavored can demonstrates a commitment to product diversification and catering to evolving consumer preferences within the Bangladeshi market.

- March 2022: Osotspa's reformulated M-150 energy drink, enhanced with double the Vitamin B12, highlights the growing trend towards functional energy drinks that appeal to health-conscious consumers.

- [Add other recent key developments with dates and brief descriptions. Include mergers, acquisitions, new factory openings, marketing campaigns etc.]

Strategic Bangladesh Energy Drinks Industry Market Forecast

The Bangladesh energy drinks industry is poised for substantial growth in the coming years, driven by several key factors including rising disposable incomes, a growing young population, and a preference for convenient energy sources. The increasing availability of innovative products, coupled with strategic investments by key players and the expansion of distribution networks, will further fuel market expansion. The demand for functional energy drinks, incorporating health benefits and natural ingredients, is also expected to experience considerable growth, creating new opportunities for industry players. The market is predicted to maintain a healthy growth trajectory throughout the forecast period (2025-2033), reaching a projected value of xx Million by 2033.

Bangladesh Energy Drinks Industry Segmentation

-

1. Packaging Type

- 1.1. Cans

- 1.2. PET Bottles

-

2. Distribution Channel

- 2.1. Supermarket/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Stores

- 2.4. Others

Bangladesh Energy Drinks Industry Segmentation By Geography

- 1. Bangladesh

Bangladesh Energy Drinks Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.61% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits

- 3.3. Market Restrains

- 3.3.1. Affordability of the Product is Restraining the Market's Growth

- 3.4. Market Trends

- 3.4.1. Strong Demand From Fitness-oriented Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bangladesh Energy Drinks Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Cans

- 5.1.2. PET Bottles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarket/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Bangladesh

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 PRAN-RFL Group Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Deshbandhu Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Akij Food & Beverage Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zisan Food & Beverage Ltd*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Osotspa Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Globe Soft Drinks & AST Beverage Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Red Bull GMBH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 PRAN-RFL Group Ltd

List of Figures

- Figure 1: Bangladesh Energy Drinks Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bangladesh Energy Drinks Industry Share (%) by Company 2024

List of Tables

- Table 1: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 3: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Packaging Type 2019 & 2032

- Table 7: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Bangladesh Energy Drinks Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bangladesh Energy Drinks Industry?

The projected CAGR is approximately 7.61%.

2. Which companies are prominent players in the Bangladesh Energy Drinks Industry?

Key companies in the market include PRAN-RFL Group Ltd, Deshbandhu Group, Akij Food & Beverage Ltd, Zisan Food & Beverage Ltd*List Not Exhaustive, Osotspa Co Ltd, Globe Soft Drinks & AST Beverage Ltd, Red Bull GMBH.

3. What are the main segments of the Bangladesh Energy Drinks Industry?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 128.5 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of Consuming Cocktails; Rising Demand for Premium Spirits.

6. What are the notable trends driving market growth?

Strong Demand From Fitness-oriented Consumers.

7. Are there any restraints impacting market growth?

Affordability of the Product is Restraining the Market's Growth.

8. Can you provide examples of recent developments in the market?

In March 2022, The Osotspa Public Company Limited released a newly formulated M-150 energy drink containing a double dose of Vitamin B12 to enhance energy and focus levels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bangladesh Energy Drinks Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bangladesh Energy Drinks Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bangladesh Energy Drinks Industry?

To stay informed about further developments, trends, and reports in the Bangladesh Energy Drinks Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence