Key Insights

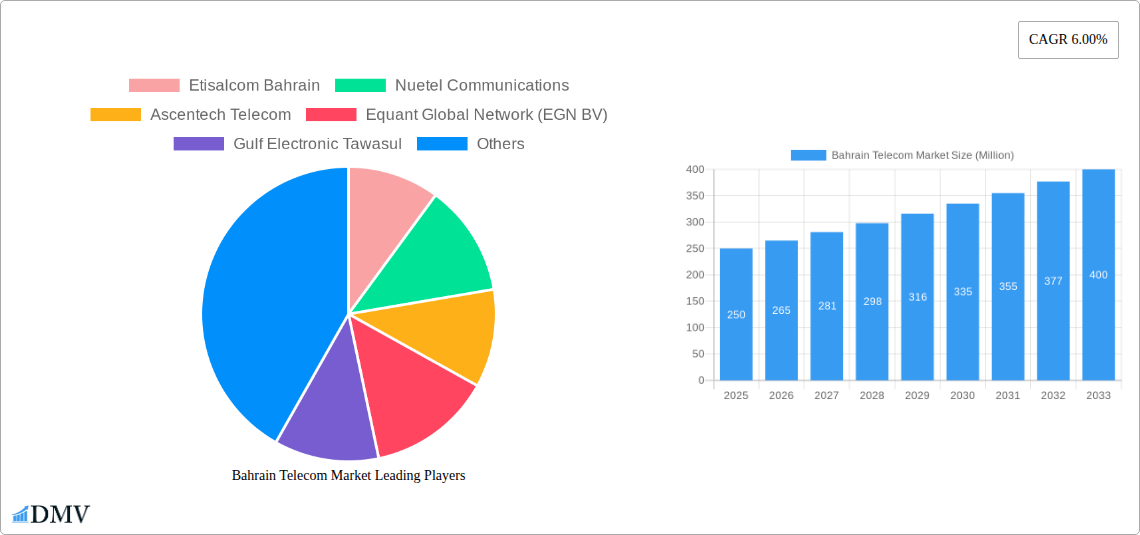

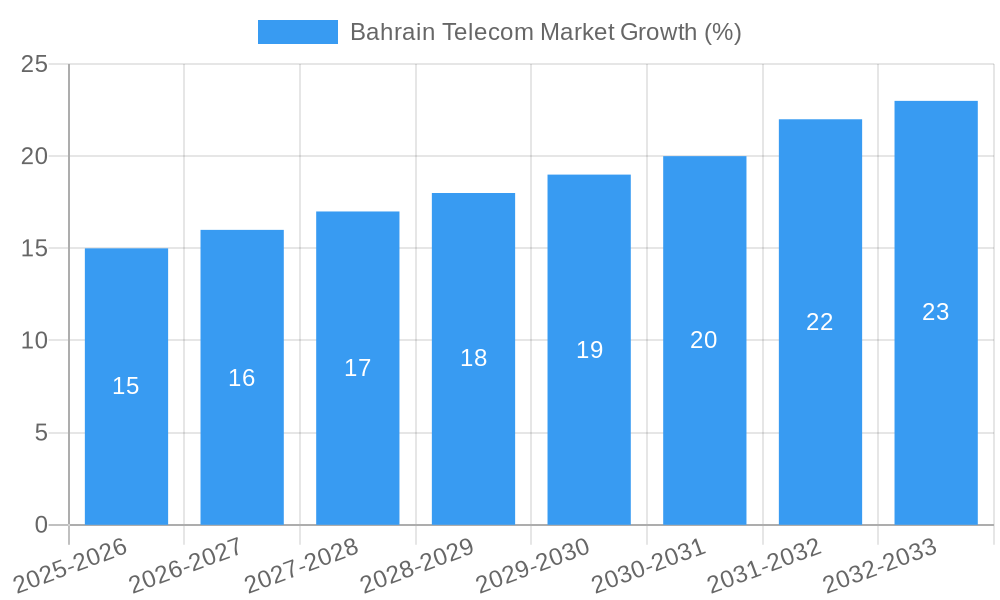

The Bahrain telecom market, valued at approximately $XXX million in 2025 (estimated based on provided CAGR and market trends), is projected to experience steady growth with a Compound Annual Growth Rate (CAGR) of 6.00% from 2025 to 2033. This growth is fueled by several key drivers. Increasing smartphone penetration and data consumption are significantly boosting demand for mobile and broadband services. The government's ongoing investments in digital infrastructure, aimed at fostering a knowledge-based economy, are further stimulating market expansion. Furthermore, the rising adoption of cloud computing and IoT (Internet of Things) applications are creating new opportunities for telecom providers. The market is segmented into mobile, fixed-line, and broadband services, with the mobile segment currently dominating due to its affordability and widespread accessibility. Competitive pressures from established players like Batelco and Zain Bahrain, alongside newer entrants like Kalaam Telecom and STC Bahrain, are driving innovation and service improvements, ultimately benefiting consumers.

However, certain restraints are hindering accelerated growth. Price competition, particularly in the mobile segment, is squeezing profit margins. The regulatory landscape, while supportive of growth, presents certain challenges for operators. Furthermore, the relatively small size of the Bahrain market limits the potential for significant expansion compared to larger regional players. The forecast period (2025-2033) anticipates continued growth, driven primarily by the expansion of 5G networks, the increasing demand for high-speed internet, and the burgeoning digitalization initiatives within the country. This positive outlook suggests promising investment opportunities for telecom companies operating in Bahrain. The market's evolving dynamics will necessitate strategic adaptations by existing players to maintain competitiveness and capitalize on emerging opportunities.

Bahrain Telecom Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Bahrain Telecom market, encompassing market size, segmentation, competitive landscape, technological advancements, and future growth prospects. Covering the period from 2019 to 2033, with a focus on 2025, this research offers invaluable insights for stakeholders including telecom operators, investors, and regulatory bodies. The study meticulously examines the market's evolution, pinpointing key drivers and challenges influencing its trajectory. With a comprehensive analysis of the Mobile, Fixed-line, and Broadband segments, this report is an indispensable resource for navigating the dynamic Bahrain telecom landscape. The total market value in 2025 is estimated at XX Million.

Bahrain Telecom Market Market Composition & Trends

This section delves into the intricate structure of the Bahrain telecom market, analyzing its concentration, innovation drivers, regulatory environment, and competitive dynamics. We dissect the market share distribution amongst key players, including Batelco (Bahrain Telecommunication Company BSC), Zain Bahrain, and others, providing a clear picture of the competitive landscape. The report also examines the impact of M&A activities, quantifying deal values (in Millions) where data is available, and explores their influence on market consolidation and innovation. The regulatory landscape's influence on market access and competition is also meticulously analyzed, along with an assessment of substitute products and their potential impact on market share. Finally, the report profiles end-users across various sectors, highlighting their specific telecom needs and preferences.

- Market Concentration: Batelco holds a significant market share, with Zain Bahrain and other players vying for market dominance. Detailed market share data for 2025 is provided within the full report.

- Innovation Catalysts: Government initiatives promoting digital transformation and 5G rollout are driving innovation.

- Regulatory Landscape: The Telecommunications Regulatory Authority (TRA) plays a crucial role in shaping market dynamics.

- Substitute Products: VoIP services and OTT platforms present some competition, but their market share remains limited.

- End-User Profiles: The report categorizes end-users by sector (e.g., residential, enterprise, government) analyzing their specific needs.

- M&A Activities: The report details significant M&A deals in the historical period (2019-2024) and projects potential activity for the forecast period (2025-2033), including estimated deal values (in Millions) where available.

Bahrain Telecom Market Industry Evolution

This section charts the dynamic evolution of the Bahrain telecom market from 2019 to 2033, examining growth trajectories, technological advancements, and evolving consumer preferences. We analyze the shift in consumer demand towards higher bandwidth services (e.g., 4G/5G mobile and fiber broadband), highlighting the adoption rates and their impact on market segments. Technological innovations like the widespread deployment of 5G, IoT, and cloud computing are examined for their influence on market growth and future opportunities. Detailed growth rate projections for each segment (Mobile, Fixed-line, Broadband) are provided, illustrating the market's expansion over the forecast period (2025-2033). Specific data points include compound annual growth rates (CAGR) for various segments and technological adoption rates. The year-on-year growth rate in the overall telecom market is estimated to be XX% in 2025.

Leading Regions, Countries, or Segments in Bahrain Telecom Market

This section identifies the dominant segments within the Bahrain telecom market: Mobile, Fixed-line, and Broadband. The analysis emphasizes the key factors contributing to the dominance of each segment, using both qualitative and quantitative data. Specific metrics include market size (in Millions), growth rates, and penetration rates.

- Mobile: The mobile segment is expected to remain the largest segment in 2025 due to high smartphone penetration and increasing data consumption. Key drivers include increased investment in network infrastructure and competitive pricing plans.

- Fixed-line: The fixed-line segment is experiencing slower growth compared to mobile, primarily due to the rise in mobile broadband penetration.

- Broadband: High-speed broadband subscriptions are experiencing strong growth, driven by increasing demand for higher bandwidth applications and government initiatives.

Bahrain Telecom Market Product Innovations

This section showcases recent product innovations and technological advancements within the Bahrain telecom market. It highlights the unique selling propositions (USPs) of new products and services, along with their performance metrics (e.g., speed, latency, reliability). For example, the launch of advanced 5G networks and the increasing availability of fiber-optic broadband services are discussed along with their impact on customer experience and market competition. The adoption rate of these new technologies is also quantified.

Propelling Factors for Bahrain Telecom Market Growth

The growth of the Bahrain telecom market is propelled by several interconnected factors. The government's sustained investment in digital infrastructure, including the expansion of 5G networks, plays a vital role. The increasing adoption of smartphones and the rising demand for high-speed internet access among both individuals and businesses contribute significantly to market expansion. Furthermore, favorable regulatory policies and the growing penetration of digital services further fuel market growth.

Obstacles in the Bahrain Telecom Market Market

Despite the promising growth outlook, the Bahrain telecom market faces certain challenges. Intense competition among established and emerging players can create pricing pressure and limit profitability. Regulatory hurdles and the high cost of infrastructure development can pose significant obstacles. Furthermore, fluctuations in the global economy could influence investment decisions and overall market growth.

Future Opportunities in Bahrain Telecom Market

The Bahrain telecom market presents several promising opportunities for future growth. The increasing demand for IoT applications, coupled with the expansion of 5G technology, creates a fertile ground for new service offerings. The development of smart city initiatives and the growing adoption of cloud-based services also offer significant potential for expansion. Furthermore, exploring new market segments, such as the growing enterprise sector's digital transformation needs, will open new avenues for revenue generation.

Major Players in the Bahrain Telecom Market Ecosystem

- Batelco (Bahrain Telecommunication Company BSC)

- Zain Bahrain

- Kalaam Telecom Bahrain

- Rapid Telecom

- STC Bahrain

- BT Solutions Ltd

- Viacloud Telecom

- Vodafone Enterprise Bahrain WLL

- Etisalcom Bahrain

- Nuetel Communications

- Ascentech Telecom

- Equant Global Network (EGN BV)

- Gulf Electronic Tawasul

- Infonas WLL

Key Developments in Bahrain Telecom Market Industry

- 2022-Q3: Batelco launched its 5G network across the country.

- 2023-Q1: Zain Bahrain announced a new partnership with a technology provider to expand its IoT services.

- 2024-Q2: A significant M&A deal involved the acquisition of a smaller telecom provider by a larger player (details in the full report). (Further key developments are detailed within the complete report).

Strategic Bahrain Telecom Market Market Forecast

The Bahrain telecom market is poised for sustained growth over the forecast period (2025-2033), driven by technological advancements, rising digital adoption, and government support. The increasing demand for high-bandwidth services, coupled with the expansion of 5G networks and the adoption of cloud technologies, will create substantial growth opportunities. This positive outlook underscores the significant market potential and investment prospects within the Bahrain telecom sector. The total market value is projected to reach XX Million by 2033.

Bahrain Telecom Market Segmentation

-

1. Type

- 1.1. Mobile

- 1.2. Fixed-line

- 1.3. Broadband

Bahrain Telecom Market Segmentation By Geography

- 1. Bahrain

Bahrain Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Digital Transformation Trends within the Telecom Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Telecom Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile

- 5.1.2. Fixed-line

- 5.1.3. Broadband

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Etisalcom Bahrain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nuetel Communications

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascentech Telecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equant Global Network (EGN BV)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Electronic Tawasul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Infonas WLL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Batelco (Bahrain Telecommunication Company BSC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zain Bahrain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kalaam Telecom Bahrain

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rapid Telecom

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 STC Bahrain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BT Solutions Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Viacloud Telecom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Vodafone Enterprise Bahrain WLL

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Etisalcom Bahrain

List of Figures

- Figure 1: Bahrain Telecom Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Bahrain Telecom Market Share (%) by Company 2024

List of Tables

- Table 1: Bahrain Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Bahrain Telecom Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Bahrain Telecom Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Bahrain Telecom Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Bahrain Telecom Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Bahrain Telecom Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: Bahrain Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Bahrain Telecom Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: Bahrain Telecom Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Bahrain Telecom Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: Bahrain Telecom Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Bahrain Telecom Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Telecom Market?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the Bahrain Telecom Market?

Key companies in the market include Etisalcom Bahrain, Nuetel Communications, Ascentech Telecom, Equant Global Network (EGN BV), Gulf Electronic Tawasul, Infonas WLL, Batelco (Bahrain Telecommunication Company BSC), Zain Bahrain, Kalaam Telecom Bahrain, Rapid Telecom, STC Bahrain, BT Solutions Ltd, Viacloud Telecom, Vodafone Enterprise Bahrain WLL.

3. What are the main segments of the Bahrain Telecom Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

Digital Transformation Trends within the Telecom Sector.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Telecom Market?

To stay informed about further developments, trends, and reports in the Bahrain Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence