Key Insights

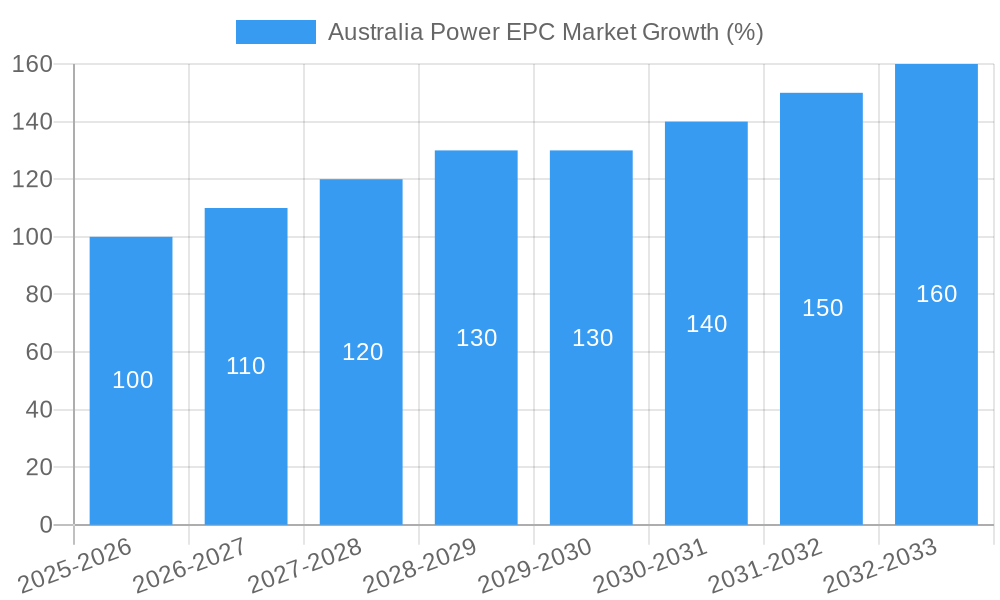

The Australian power engineering, procurement, and construction (EPC) market is experiencing robust growth, driven by increasing energy demand and a significant push towards renewable energy sources. The market, valued at approximately $X million in 2025 (estimated based on provided CAGR and market size data), is projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 6.56% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, Australia's aging thermal power infrastructure requires substantial upgrades and replacements, creating opportunities for EPC contractors. Secondly, the nation's commitment to decarbonization is accelerating the adoption of renewable energy technologies like solar, wind, and potentially geothermal, driving demand for EPC services in these sectors. Furthermore, government initiatives aimed at promoting energy efficiency and grid modernization are contributing positively to market growth. Major players like InterGen Services Inc, Stanwell Corporation Limited, and Origin Energy Ltd are actively involved, shaping market competition and innovation. However, challenges remain, including potential fluctuations in commodity prices, regulatory complexities, and skilled labor shortages that could impact project timelines and costs.

Despite these restraints, the long-term outlook for the Australian power EPC market remains positive. The sustained growth in renewable energy adoption, coupled with the need for grid infrastructure upgrades and modernization, ensures a consistent demand for EPC services over the forecast period. The increasing focus on sustainable and resilient energy solutions positions Australia's power EPC sector for continued expansion, attracting further investment and technological advancements. The market's segmentation into thermal, renewables, and other power generation further underscores the diversification of projects and opportunities for specialized EPC providers within the Australian landscape.

Australia Power EPC Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Australian Power EPC market, offering a comprehensive overview of its current state, future trajectory, and key players. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report is an essential resource for stakeholders seeking to understand and navigate this dynamic market. The total market value is predicted to reach xx Million by 2033.

Australia Power EPC Market Market Composition & Trends

This section delves into the intricate composition of the Australian Power EPC market, analyzing market concentration, driving forces behind innovation, the regulatory framework, substitute products, end-user profiles, and the landscape of mergers and acquisitions (M&A) activity.

Market Concentration and Share Distribution: The Australian Power EPC market exhibits a moderately concentrated structure, with a few dominant players commanding significant market share. Precise market share data for each key player is unavailable, but based on industry reports and project wins, it's estimated that the top five players account for approximately 60% of the market in 2025. The remaining market share is distributed among numerous smaller, regional players. This section will provide detailed analysis of market share distribution across segments.

Innovation Catalysts and Regulatory Landscape: The increasing adoption of renewable energy sources, stringent environmental regulations, and government initiatives promoting sustainable energy solutions are significant drivers of innovation within the market. The Australian government's commitment to renewable energy targets necessitates investment in renewable energy infrastructure. This section analyses the impact of evolving regulations and its influence on technology adoption.

Substitute Products and End-User Profiles: While traditional thermal power generation remains a significant segment, the market is witnessing a rapid shift towards renewable energy solutions. The primary end-users comprise electricity generators, energy companies, and independent power producers. This detailed analysis identifies and assesses emerging technologies and alternative solutions that potentially disrupt the status quo.

M&A Activities: The Australian Power EPC market has seen a significant number of M&A activities in recent years. Though precise deal values for all transactions are unavailable, major deals have involved transactions worth hundreds of Millions. This section will review key M&A activities in the period from 2019-2024, highlighting deal values where available and providing insights into the motives driving these strategic maneuvers.

Australia Power EPC Market Industry Evolution

This section provides a comprehensive analysis of the evolution of the Australian Power EPC market, exploring growth trajectories, technological advancements, and the evolving demands of consumers.

The market has experienced consistent growth during the historical period (2019-2024), with an average annual growth rate (AAGR) estimated at xx%. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace. Factors such as increasing energy demand, government support for renewable energy, and technological advancements in energy efficiency are key drivers of this growth. The transition from fossil fuel-based power generation to renewable energy sources is a significant trend shaping the market. Adoption rates for renewable energy EPC projects are accelerating, exceeding previous predictions. This analysis delves into the interplay of these technological and market factors, highlighting the specific adoption rates of renewable energy EPC projects within this evolving landscape. Further, it will cover the impacts of consumer preferences for greener energy solutions and their subsequent effects on the industry.

Leading Regions, Countries, or Segments in Australia Power EPC Market

This section identifies the dominant region, country, or segment within the Australian Power EPC market, focusing on Power Generation (Thermal, Renewables, Others).

Renewables: This segment is experiencing the most rapid growth, driven by government policies favoring renewable energy and the decreasing cost of renewable energy technologies.

- Key Drivers: Significant government investment in renewable energy projects. Strong public support for sustainability initiatives. Decreasing costs of solar, wind, and other renewable energy technologies.

- Dominance Factors: Large-scale renewable energy projects are demanding extensive EPC services, fueling substantial growth in this segment. Competitive tendering processes foster innovation and price competitiveness.

Thermal: While facing pressure from renewable energy sources, the thermal power generation segment continues to play a role, primarily for baseload power generation.

- Key Drivers: Continued demand for reliable baseload power. Life extension projects of existing thermal power plants.

- Dominance Factors: Existing infrastructure base supports continued involvement in thermal power plant maintenance and upgrades.

Others: This segment includes various other power generation technologies like hydro, biomass, and geothermal. This segment’s growth will be analyzed and compared against other segments.

- Key Drivers: Geographic suitability for certain technologies like hydro. Technological advancements in biomass and geothermal energy.

- Dominance Factors: Specific geographical factors and technological breakthroughs will influence the growth of this segment.

Detailed analysis of market share, investment trends, and regulatory support for each segment is included.

Australia Power EPC Market Product Innovations

Recent innovations focus on optimizing the efficiency and cost-effectiveness of EPC projects. Modular designs, digital twin technologies for enhanced project management, and advanced analytics for predictive maintenance are becoming increasingly prevalent. These innovations shorten project timelines, minimize operational disruptions, and reduce overall project costs. Companies are developing unique selling propositions around these technological advancements, focusing on speed, reliability, and optimized project execution.

Propelling Factors for Australia Power EPC Market Growth

Several factors contribute to the growth of Australia's Power EPC market. Government incentives and policies supporting renewable energy deployment, a steady increase in energy demand driven by population growth and economic activity, and technological advancements resulting in more efficient and cost-effective renewable energy solutions are major drivers. Furthermore, the increasing awareness of climate change and the need for sustainable energy sources are also bolstering market growth.

Obstacles in the Australia Power EPC Market Market

The Australian Power EPC market faces challenges. Supply chain disruptions can cause delays and cost overruns in projects. The competitive landscape, characterized by several large and small companies vying for projects, poses a challenge. Moreover, securing necessary permits and approvals in a regulated environment is often time-consuming and complex. These factors can delay project implementation and impact overall market growth.

Future Opportunities in Australia Power EPC Market

The Australian Power EPC market presents exciting future opportunities. The increasing adoption of smart grid technologies, along with integration of energy storage solutions, creates new avenues for EPC services. Further government investment in renewable energy infrastructure, driven by carbon reduction targets, presents significant growth potential. New technologies like green hydrogen and advanced energy storage systems are also expected to create demand for specialized EPC services.

Major Players in the Australia Power EPC Market Ecosystem

- InterGen Services Inc

- Stanwell Corporation Limited

- Rio Tinto Limited

- EnergyAustralia Holdings Ltd

- Origin Energy Ltd

- Sumitomo Corporation

- NRG Energy Inc

- AGL Energy Limited

Key Developments in Australia Power EPC Market Industry

January 2022: UGL (CIMIC Group Ltd) secures three contracts worth over AUD 296 Million for renewable energy and transmission projects in Queensland and South Australia, significantly boosting the renewable energy segment. One notable project includes the EPC of an 87-MW solar farm and substation upgrade at Tailem Bend, South Australia.

June 2021: Elecnor, through a joint venture with Clough, wins a EUR 917 Million contract for the Energy Connect project, involving 700 kilometers of high-voltage lines and four substations – a considerable boost to the transmission infrastructure sector.

Strategic Australia Power EPC Market Market Forecast

The Australian Power EPC market is poised for continued growth, driven by government policies, increasing energy demand, and technological advancements. The shift towards renewable energy sources will remain a key trend, creating substantial opportunities for companies offering EPC services in solar, wind, and other renewable energy technologies. The market is expected to witness ongoing innovation, consolidation, and increased competition. The projected growth trajectory is influenced by factors such as government regulations, technology adoption, and economic conditions. The potential for significant expansion across different segments remains high.

Australia Power EPC Market Segmentation

-

1. Power Generation

- 1.1. Thermal

- 1.2. Renewables

- 1.3. Others

- 2. Power Transmission and Distribution (T&D)

Australia Power EPC Market Segmentation By Geography

- 1. Australia

Australia Power EPC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Cost as Compared to Rooftop PV Systems

- 3.4. Market Trends

- 3.4.1. Increasing Renewable Energy Installations are Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Power EPC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 5.1.1. Thermal

- 5.1.2. Renewables

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Power Transmission and Distribution (T&D)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Power Generation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 InterGen Services Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Stanwell Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rio Tinto Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 EnergyAustralia Holdings Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Origin Energy Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sumitomo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NRG Energy Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGL Energy Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 InterGen Services Inc

List of Figures

- Figure 1: Australia Power EPC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Power EPC Market Share (%) by Company 2024

List of Tables

- Table 1: Australia Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 3: Australia Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 4: Australia Power EPC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Australia Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Australia Power EPC Market Revenue Million Forecast, by Power Generation 2019 & 2032

- Table 7: Australia Power EPC Market Revenue Million Forecast, by Power Transmission and Distribution (T&D) 2019 & 2032

- Table 8: Australia Power EPC Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Power EPC Market?

The projected CAGR is approximately > 6.56%.

2. Which companies are prominent players in the Australia Power EPC Market?

Key companies in the market include InterGen Services Inc, Stanwell Corporation Limited, Rio Tinto Limited, EnergyAustralia Holdings Ltd, Origin Energy Ltd, Sumitomo Corporation, NRG Energy Inc, AGL Energy Limited.

3. What are the main segments of the Australia Power EPC Market?

The market segments include Power Generation, Power Transmission and Distribution (T&D).

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Reduction in Energy Bills Due to Self-Power Consumption4.; Increasing Installation of Solar PV Modules in Residential Segment.

6. What are the notable trends driving market growth?

Increasing Renewable Energy Installations are Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Cost as Compared to Rooftop PV Systems.

8. Can you provide examples of recent developments in the market?

In January 2022, Australia's UGL, part of CIMIC Group Ltd, secured three contracts worth over AUD 296 million for renewable energy and transmission projects in Queensland and South Australia. One of the orders is Vena Energy to cover the engineering, procurement, and construction (EPC) of an 87-MW solar farm and substation upgrade at Tailem Bend in South Australia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Power EPC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Power EPC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Power EPC Market?

To stay informed about further developments, trends, and reports in the Australia Power EPC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence