Key Insights

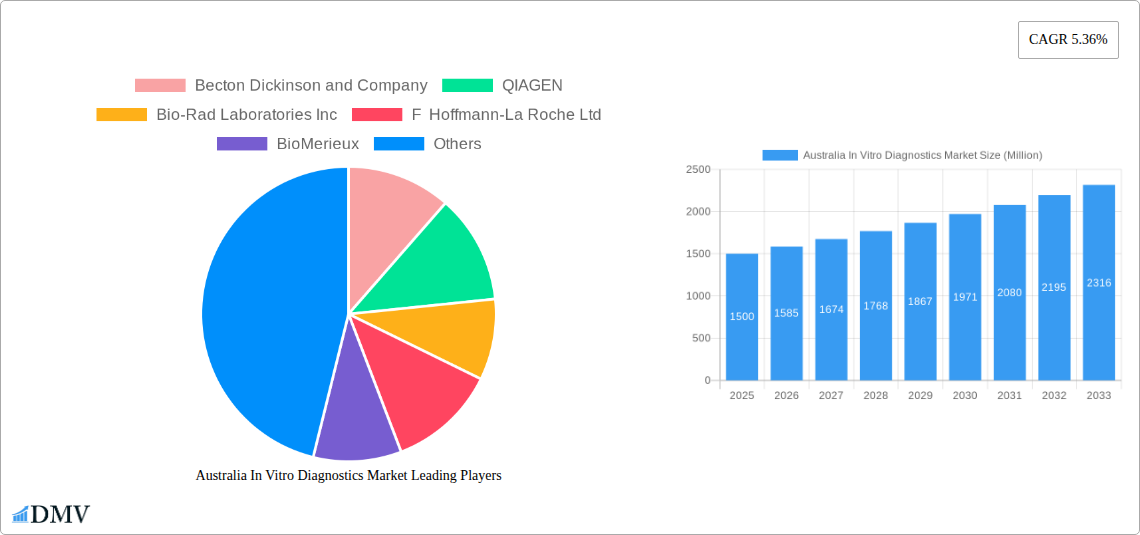

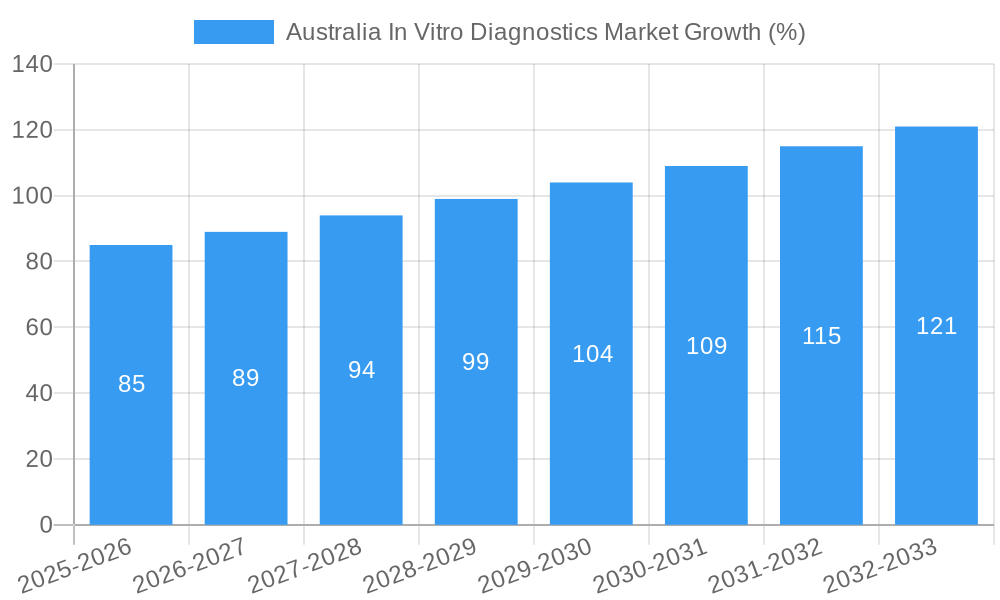

The Australian In Vitro Diagnostics (IVD) market, valued at approximately $X million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.36% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising prevalence of chronic diseases like diabetes, cancer, and cardiovascular ailments fuels the demand for diagnostic testing. Secondly, technological advancements in molecular diagnostics and immunoassays are leading to more accurate, rapid, and efficient testing methods. Furthermore, increasing government initiatives focused on improving healthcare infrastructure and promoting preventive healthcare contribute to market growth. The market's segmentation reveals that clinical chemistry, molecular diagnostics, and immunoassays represent significant portions of the test type segment, while instruments and reagents dominate the product type segment. Hospitals and diagnostic laboratories remain the primary end-users. Leading players such as Becton Dickinson, QIAGEN, Bio-Rad, Roche, BioMerieux, Siemens, Abbott, and Thermo Fisher Scientific are actively shaping the market landscape through innovations and strategic partnerships.

However, certain restraints impede the market's full potential. High costs associated with advanced diagnostic technologies can limit accessibility, particularly in rural areas. Moreover, stringent regulatory approvals and reimbursement policies can pose challenges for market entry and expansion. Despite these limitations, the overall outlook remains positive. The growing geriatric population, increasing awareness of early disease detection, and the continuous development of sophisticated IVD technologies are expected to sustain market growth throughout the forecast period. The Australian IVD market offers significant opportunities for established players and new entrants alike, particularly those focusing on innovative technologies and cost-effective solutions tailored to the needs of the Australian healthcare system. We project the market to reach approximately $Y million by 2033 (assuming a consistent CAGR and no major disruptions). Note that the exact values of X and Y require further data on the 2025 market size to calculate precisely.

Australia In Vitro Diagnostics Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Australian In Vitro Diagnostics (IVD) market, offering a comprehensive overview of its current state, future trajectory, and key players. Spanning the period from 2019 to 2033, with 2025 as the base year, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

Australia In Vitro Diagnostics Market Composition & Trends

This section delves into the competitive landscape, innovation drivers, and regulatory influences shaping the Australian IVD market. We analyze market concentration, revealing the market share distribution among key players such as Becton Dickinson and Company, QIAGEN, Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, BioMerieux, Siemens AG, Abbott, and Thermo Fisher Scientific. The report further examines the impact of mergers and acquisitions (M&A) activities, quantifying deal values where possible and assessing their influence on market dynamics. We also explore the role of technological innovation, regulatory approvals (like the ARTG), and the presence of substitute products in influencing market trends. The analysis incorporates an in-depth look at end-user profiles – Diagnostic Laboratories, Hospitals and Clinics, and Other End Users – highlighting their varying needs and preferences. Specific metrics included are market share percentages for leading companies and a breakdown of M&A deal values by year. The report also examines the impact of changing reimbursement policies on market growth.

Australia In Vitro Diagnostics Market Industry Evolution

This section provides a granular analysis of the Australian IVD market's evolution, charting its growth trajectory from 2019 to 2024 and projecting its expansion until 2033. We examine technological advancements, such as the integration of AI and automation in diagnostic testing, and their impact on market growth. The report details the adoption rates of new technologies, highlighting the shift towards personalized medicine and point-of-care diagnostics. Shifting consumer demands, influenced by factors like an aging population and increased awareness of preventative healthcare, are also carefully considered. The analysis incorporates detailed growth rate data (CAGR) for different segments and provides quantitative evidence of technological adoption within the market. Specific data points illustrating market growth rates for each segment (by test type, product type, application, and end-user) from 2019 to 2024, as well as projected growth to 2033, will be provided.

Leading Regions, Countries, or Segments in Australia In Vitro Diagnostics Market

This section pinpoints the leading segments within the Australian IVD market. We analyze market dominance across various categories:

By Test Type:

- Clinical Chemistry: This segment's dominance is fueled by factors such as [insert factors driving Clinical Chemistry market dominance, e.g., increasing prevalence of chronic diseases].

- Molecular Diagnostics: This segment's growth is driven by [insert factors driving Molecular Diagnostics market dominance, e.g., technological advancements and rising demand for early disease detection].

- Immuno Diagnostics: This segment is experiencing growth due to [insert factors driving Immuno Diagnostics market dominance, e.g., rising prevalence of autoimmune diseases].

- Haematology: This segment's growth is influenced by [insert factors driving Haematology market dominance, e.g., increasing incidence of blood-related disorders].

- Other Test Types: This segment encompasses [list types included] and is characterized by [mention key trends].

By Type of Product:

- Instruments: High capital expenditure associated with advanced instruments and the preference for automated systems influence this segment.

- Reagents: The consistent demand for reagents associated with various diagnostic tests drives the growth of this segment.

- Other Types of Product: This segment includes [list types included].

By Application:

- Infectious Disease: Growth is driven by [mention specific factors like outbreaks or government initiatives].

- Cancer/Oncology: This segment benefits from [mention advancements in cancer diagnostics and treatment].

- Diabetes: Increasing prevalence of diabetes fuels this segment's growth.

- Cardiology: Advancements in cardiology diagnostics are impacting this segment.

- Autoimmune Disease: The rise in autoimmune diseases is directly impacting this segment.

- Other Applications: This segment comprises [list applications included]

By End User:

- Diagnostic Laboratories: Large-scale testing and advanced infrastructure drive this segment.

- Hospitals and Clinics: A wide range of diagnostic needs is pushing this segment's growth.

- Other End Users: This segment involves [mention specific end users].

Detailed analysis supporting each bullet point will be included in the report, focusing on investment trends, regulatory support, and other factors influencing segment leadership.

Australia In Vitro Diagnostics Market Product Innovations

The Australian IVD market is witnessing significant innovation, particularly in point-of-care diagnostics, rapid diagnostic tests, and automated systems. These innovations offer improved speed, accuracy, and ease of use, enhancing diagnostic capabilities and streamlining workflows. Key features include miniaturization, enhanced sensitivity, and connectivity with electronic health records (EHR). Companies are focusing on developing unique selling propositions (USPs), such as faster turnaround times and integrated data analysis features.

Propelling Factors for Australia In Vitro Diagnostics Market Growth

Several factors are driving the expansion of the Australian IVD market. Technological advancements, leading to more accurate and efficient diagnostic tools, are a primary driver. Economic factors, such as increased healthcare expenditure and government initiatives promoting preventative healthcare, are also significant. Furthermore, supportive regulatory frameworks, including streamlined approval processes for new diagnostic tests, foster market growth.

Obstacles in the Australia In Vitro Diagnostics Market

The Australian IVD market faces challenges such as stringent regulatory hurdles, potentially leading to delays in product launches. Supply chain disruptions, particularly those caused by global events, can impact the availability and pricing of diagnostic products. Furthermore, intense competition among established and emerging players poses a constant challenge. The report quantifies the impact of these obstacles where possible, for example, by estimating the financial consequences of supply chain disruptions.

Future Opportunities in Australia In Vitro Diagnostics Market

Future opportunities lie in the expanding application of molecular diagnostics, particularly for personalized medicine. The increasing prevalence of chronic diseases presents a significant growth opportunity. Moreover, technological advancements, such as AI-powered diagnostics and telehealth integration, are likely to open up new avenues for growth. Exploration of new market segments, particularly in remote areas with limited access to healthcare, also presents opportunities.

Major Players in the Australia In Vitro Diagnostics Market Ecosystem

- Becton Dickinson and Company

- QIAGEN

- Bio-Rad Laboratories Inc

- F Hoffmann-La Roche Ltd

- BioMerieux

- Siemens AG

- Abbott

- Thermo Fisher Scientific

Key Developments in Australia In Vitro Diagnostics Market Industry

- July 2022: Abbott's COVID-19 test kits were included in the Australian Register of Therapeutic Goods (ARTG), facilitating their legal supply within Australia. This development significantly impacted market share within the COVID-19 diagnostic testing segment.

- June 2022: CerTest Biotec and BD announced a collaboration to develop a molecular diagnostic test for the monkeypox virus. This collaboration reflects the industry's response to emerging infectious diseases and its potential to generate new revenue streams.

Strategic Australia In Vitro Diagnostics Market Forecast

The Australian IVD market is poised for continued growth, driven by technological advancements, increasing healthcare expenditure, and a supportive regulatory environment. The rising prevalence of chronic diseases and the increasing adoption of personalized medicine will further fuel market expansion. Opportunities in point-of-care diagnostics and telehealth integration offer significant potential for future growth. The market's robust growth trajectory is expected to continue, with specific growth catalysts detailed in the complete report.

Australia In Vitro Diagnostics Market Segmentation

-

1. Test Type

- 1.1. Clinical Chemistry

- 1.2. Molecular Diagnostics

- 1.3. Immuno Diagnostics

- 1.4. Haematology

- 1.5. Other Test Types

-

2. Type of Product

- 2.1. Instruments

- 2.2. Reagents

- 2.3. Other Types of Product

-

3. Application

- 3.1. Infectious Disease

- 3.2. Diabetes

- 3.3. Cancer/Oncology

- 3.4. Cardiology

- 3.5. Autoimmune Disease

- 3.6. Other Applications

-

4. End User

- 4.1. Diagnostic Laboratories

- 4.2. Hospitals and Clinics

- 4.3. Other End Users

Australia In Vitro Diagnostics Market Segmentation By Geography

- 1. Australia

Australia In Vitro Diagnostics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies

- 3.3. Market Restrains

- 3.3.1. Stringent Regulations

- 3.4. Market Trends

- 3.4.1. The Molecular Diagnostics Segment is Expected to Hold a Major Market Share in the Australia In-vitro Diagnostics Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia In Vitro Diagnostics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 5.1.1. Clinical Chemistry

- 5.1.2. Molecular Diagnostics

- 5.1.3. Immuno Diagnostics

- 5.1.4. Haematology

- 5.1.5. Other Test Types

- 5.2. Market Analysis, Insights and Forecast - by Type of Product

- 5.2.1. Instruments

- 5.2.2. Reagents

- 5.2.3. Other Types of Product

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Infectious Disease

- 5.3.2. Diabetes

- 5.3.3. Cancer/Oncology

- 5.3.4. Cardiology

- 5.3.5. Autoimmune Disease

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Diagnostic Laboratories

- 5.4.2. Hospitals and Clinics

- 5.4.3. Other End Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Test Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Becton Dickinson and Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 QIAGEN

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bio-Rad Laboratories Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 F Hoffmann-La Roche Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 BioMerieux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Siemens AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thermo Fisher Scientific

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Australia In Vitro Diagnostics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia In Vitro Diagnostics Market Share (%) by Company 2024

List of Tables

- Table 1: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 4: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 5: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 6: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Type of Product 2019 & 2032

- Table 7: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Australia In Vitro Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 10: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 11: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Test Type 2019 & 2032

- Table 16: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Test Type 2019 & 2032

- Table 17: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Type of Product 2019 & 2032

- Table 18: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Type of Product 2019 & 2032

- Table 19: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 21: Australia In Vitro Diagnostics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 22: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 23: Australia In Vitro Diagnostics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Australia In Vitro Diagnostics Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia In Vitro Diagnostics Market?

The projected CAGR is approximately 5.36%.

2. Which companies are prominent players in the Australia In Vitro Diagnostics Market?

Key companies in the market include Becton Dickinson and Company, QIAGEN, Bio-Rad Laboratories Inc, F Hoffmann-La Roche Ltd, BioMerieux, Siemens AG, Abbott, Thermo Fisher Scientific.

3. What are the main segments of the Australia In Vitro Diagnostics Market?

The market segments include Test Type, Type of Product, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

High Prevalence of Chronic Diseases; Increasing Use of Point-of-care (POC) Diagnostics; Advanced Technologies.

6. What are the notable trends driving market growth?

The Molecular Diagnostics Segment is Expected to Hold a Major Market Share in the Australia In-vitro Diagnostics Market.

7. Are there any restraints impacting market growth?

Stringent Regulations.

8. Can you provide examples of recent developments in the market?

July 2022: COVID-19 test kits were included in the Australian Register of Therapeutic Goods (ARTG) for legal supply in Australia by Abbott.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia In Vitro Diagnostics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia In Vitro Diagnostics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia In Vitro Diagnostics Market?

To stay informed about further developments, trends, and reports in the Australia In Vitro Diagnostics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence