Key Insights

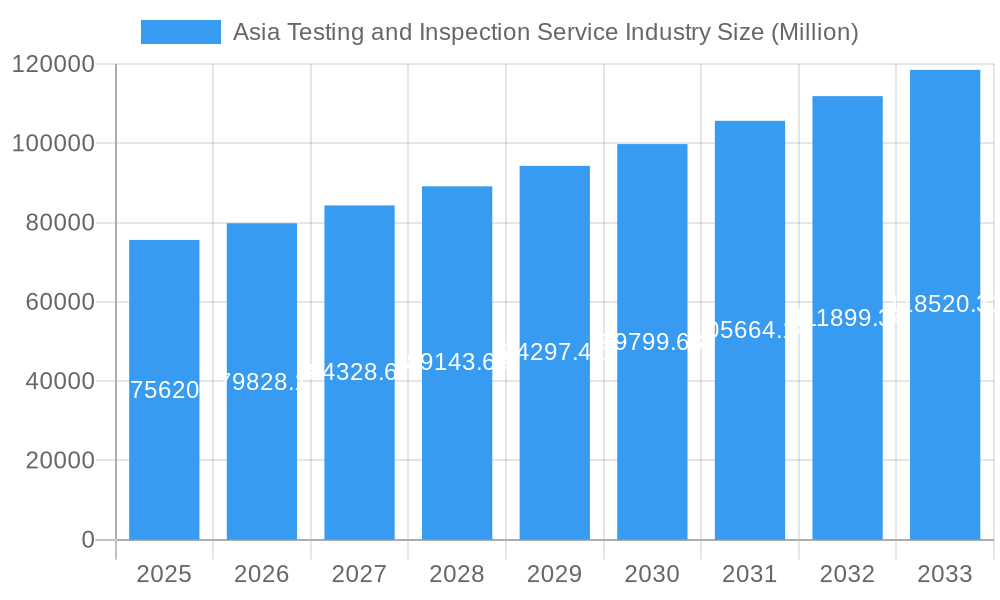

The Asia-Pacific Testing and Inspection (T&I) services market, valued at $75.62 billion in 2025, is projected to experience robust growth, driven by factors such as increasing industrialization, stringent regulatory compliance requirements, and rising consumer demand for quality and safety. The region's diverse economic landscape, encompassing rapidly developing nations like China and India alongside established economies like Japan and South Korea, fuels this demand across various sectors. Significant growth drivers include the burgeoning automotive and transportation industries, the expansion of infrastructure projects, the increasing focus on food safety and quality control within the agriculture sector, and the rising need for robust quality assurance in manufacturing. The outsourcing trend within the T&I sector is also contributing to market expansion, allowing companies to focus on core competencies while leveraging the expertise of specialized testing and inspection providers. The market is segmented by service type (testing & inspection, certification), end-user (industrial manufacturing, automotive, oil & gas, etc.), and country, allowing for a nuanced understanding of market dynamics and potential investment opportunities within specific niches. While potential restraints include economic fluctuations and geopolitical uncertainties, the overall market outlook remains positive due to the fundamental need for T&I services across various sectors.

Asia Testing and Inspection Service Industry Market Size (In Billion)

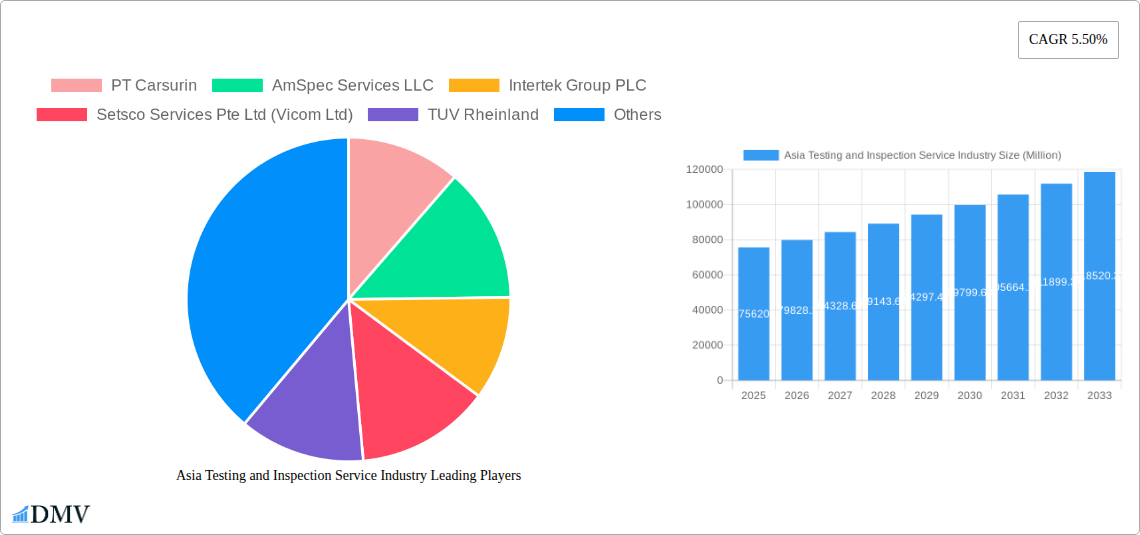

The competitive landscape is characterized by a mix of multinational corporations and regional players. Key players such as Intertek, SGS, Bureau Veritas, and TÜV Rheinland hold significant market share, leveraging their global networks and expertise. However, local players are also thriving, capitalizing on regional knowledge and adapting services to specific market requirements. Future growth will be fueled by technological advancements, such as automation and AI in testing procedures, as well as increasing focus on sustainability and environmental compliance. The demand for specialized services, particularly in emerging technologies like electric vehicles and renewable energy, will further shape the market's trajectory throughout the forecast period (2025-2033). A projected CAGR of 5.50% suggests a significant expansion in market value over the coming years.

Asia Testing and Inspection Service Industry Company Market Share

Asia Testing and Inspection Service Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia Testing and Inspection Service industry, projecting a robust growth trajectory for the forecast period (2025-2033). The study covers key market segments, leading players, and emerging trends, offering valuable insights for stakeholders seeking to navigate this dynamic market. With a detailed analysis of the historical period (2019-2024) and a base year of 2025, this report is your essential guide to understanding the current landscape and future opportunities within the Asia Testing and Inspection Services sector. The total market size is estimated at XXX Million in 2025, and expected to reach XXX Million by 2033.

Asia Testing and Inspection Service Industry Market Composition & Trends

The Asia Testing and Inspection service market is characterized by a moderately fragmented landscape, with several major players vying for market share. Key players such as SGS Group, Bureau Veritas Group, Intertek Group PLC, and TUV Rheinland hold significant positions, yet numerous smaller, regional players also contribute to the market’s vibrancy. Market share distribution fluctuates based on specialization, geographic reach, and the ever-evolving regulatory environment. The market concentration ratio (CR4) is estimated at xx%, indicating a moderately consolidated structure.

Innovation is driven by technological advancements in testing methodologies, automation, and data analytics, creating more efficient and precise services. Regulatory landscapes vary across Asian countries, influencing both market access and service standardization. Substitutes exist, but their limitations often favor the more comprehensive and accredited services provided by established testing and inspection firms.

M&A activity is significant in this sector, with notable deals exceeding xx Million in value in recent years. These activities contribute to market consolidation, technological expansion, and enhanced service portfolios.

- Key Market Trends:

- Increasing demand for quality and safety assurance across various industries.

- Stringent government regulations and standards driving testing needs.

- Adoption of advanced technologies like AI and automation for increased efficiency.

- Rise of outsourcing to specialized testing and inspection providers.

- Growing emphasis on sustainability and environmental compliance.

Asia Testing and Inspection Service Industry Industry Evolution

The Asia Testing and Inspection service market has witnessed robust growth over the past five years, fueled by several key factors. Rapid industrialization across many Asian nations, coupled with rising consumer awareness of product safety and quality, has spurred demand for testing and inspection services. This growth trajectory is expected to continue, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of AI and big data analytics, are streamlining operations, improving accuracy, and reducing turnaround times. These advancements are also driving the adoption of remote testing and inspection technologies, expanding service accessibility. Simultaneously, shifting consumer demands toward higher-quality and ethically sourced products influence this sector's growth. The increased emphasis on sustainability and environmental compliance also necessitates more rigorous testing and certification processes. The market's evolution is not without its challenges. Fluctuations in economic growth and regional political landscapes can impact demand and operational efficiency. The need for skilled professionals and the complexity of navigating diverse regulatory frameworks across various countries pose additional hurdles. Nevertheless, the ongoing trend towards globalization and rising demand for quality assurance underpin the positive outlook for the market's continued growth. The market value experienced a CAGR of xx% from 2019 to 2024, exceeding xx Million.

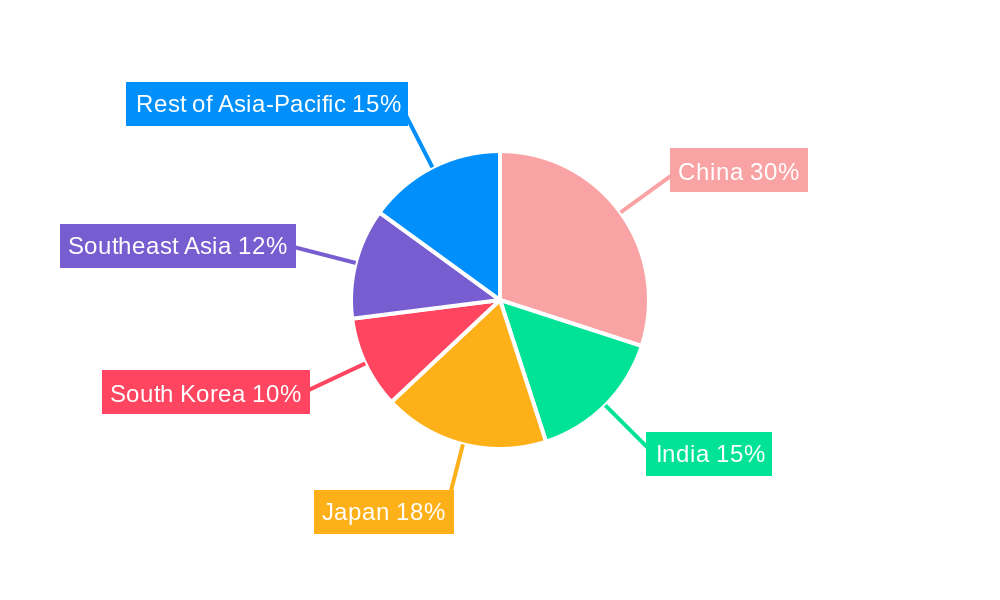

Leading Regions, Countries, or Segments in Asia Testing and Inspection Service Industry

The Asia Testing and Inspection service market exhibits diverse growth patterns across its segments. China, India, and Japan remain dominant markets, driven by significant industrial activity and regulatory frameworks emphasizing quality assurance. Within service types, Testing and Inspection commands the largest market share, followed by Certification services. The key drivers vary across segments:

By Country:

- China: Massive industrial base, stringent regulatory environment, and robust government investment in infrastructure development.

- India: Rapid industrial growth, increasing foreign investment, and a focus on improving manufacturing standards.

- Japan: Advanced technology infrastructure, high quality standards, and strong focus on product safety.

By Service Type:

- Testing and Inspection: High demand across various industries due to quality control needs.

- Certification: Growing adoption driven by consumer trust and international trade requirements.

By End User:

- Industrial Manufacturing: Largest segment driven by the prevalence of manufacturing across Asia.

- Automotive and Transportation: Stringent safety and emissions regulations fuel market growth.

By Type:

- Outsourced: Dominant model due to specialization and efficiency advantages of specialized firms.

Asia Testing and Inspection Service Industry Product Innovations

Recent innovations in the Asia Testing and Inspection services industry include advanced analytical techniques, such as spectroscopic methods for material analysis, and the implementation of AI-powered image recognition for automated defect detection. These innovations contribute to faster, more accurate, and cost-effective testing and inspection services. The development of portable testing devices and remote monitoring technologies expands accessibility and improves real-time data analysis. Companies are focusing on developing integrated solutions that combine testing, inspection, and certification under one umbrella, enhancing efficiency and providing clients with comprehensive services. Unique selling propositions frequently highlight speed, accuracy, accreditation, and advanced technology integration.

Propelling Factors for Asia Testing and Inspection Service Industry Growth

Several factors fuel the growth of the Asia Testing and Inspection service industry. Firstly, the rising demand for quality and safety assurance across numerous sectors, driven by stricter regulations and increased consumer awareness, is a major catalyst. Secondly, technological advancements, such as automation and AI-powered analysis, are improving efficiency and accuracy. Thirdly, increasing investments in infrastructure projects and industrial expansion throughout Asia significantly contribute to this growth. Finally, robust governmental support and favorable regulatory frameworks are fostering a thriving market environment.

Obstacles in the Asia Testing and Inspection Service Industry Market

Several challenges hinder the Asia Testing and Inspection service industry's growth. These include the diverse and sometimes complex regulatory landscapes across various Asian countries, which require firms to navigate different standards and compliance requirements. Supply chain disruptions and resource scarcity affect operational efficiency and costs. Intense competition among numerous established players and new entrants can pressure pricing and profitability.

Future Opportunities in Asia Testing and Inspection Service Industry

Future opportunities reside in several areas: the expansion of testing services into emerging sectors like renewable energy and biotechnology, the adoption of cutting-edge technologies such as blockchain for traceability and transparency, and the growth of e-commerce, which drives the need for robust supply chain quality control. Furthermore, providing comprehensive, integrated services, including consultation and risk management, offers significant potential. The growing focus on sustainability and environmental regulations presents a lucrative opportunity for firms specializing in environmental testing and compliance.

Major Players in the Asia Testing and Inspection Service Industry Ecosystem

- PT Carsurin

- AmSpec Services LLC

- Intertek Group PLC

- Setsco Services Pte Ltd (Vicom Ltd)

- TUV Rheinland

- Apave Japan Co Limited

- Singapore Test Lab Pte Ltd

- SGS Group

- Bureau Veritas Group

- ALS Malaysia (ALS Limited)

- HQTS Group Ltd

- Seoul Inspection & Testing Co Limited

- Cotecna Inspection SA

- PT SUCOFINDO Perseo

- SIRIM QAS International Sdn Bhd

- UL LLC

- ABS Group

- TUV SUD

Key Developments in Asia Testing and Inspection Service Industry Industry

December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai, focusing on cosmetic and personal care product testing. This expansion showcases the company’s commitment to providing advanced testing capabilities and highlights the growing demand for high-quality testing services in the region.

October 2022: Intertek Group PLC launched the "As Advertised" Program, designed to enhance trust and quality assurance in online marketplaces. This initiative demonstrates the increasing importance of establishing trust and transparency in e-commerce, driving demand for robust quality assurance services.

Strategic Asia Testing and Inspection Service Industry Market Forecast

The Asia Testing and Inspection service market is poised for sustained growth, driven by increasing industrialization, stringent regulations, and technological advancements. The market is expected to benefit from expanding e-commerce activity and a growing emphasis on sustainability. The opportunities presented by emerging sectors, coupled with the ongoing adoption of innovative testing technologies, promise a highly promising future for the industry. The forecast predicts continued market expansion, with significant growth potential particularly in rapidly developing Asian economies.

Asia Testing and Inspection Service Industry Segmentation

-

1. Type

- 1.1. In-house

- 1.2. Outsourced

-

2. Service Type

- 2.1. Testing and Inspection

- 2.2. Certification

-

3. End User

- 3.1. Industrial Manufacturing

- 3.2. Automotive and Transportation

- 3.3. Oil and Gas

- 3.4. Mining and Downstream Applications

- 3.5. Food and Agriculture

- 3.6. Building and Infrastructure

- 3.7. Consumer Goods and Retail

- 3.8. Other End Users

Asia Testing and Inspection Service Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asia Testing and Inspection Service Industry Regional Market Share

Geographic Coverage of Asia Testing and Inspection Service Industry

Asia Testing and Inspection Service Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 3.3. Market Restrains

- 3.3.1. Low Awareness about the Facility Management Services

- 3.4. Market Trends

- 3.4.1. Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Testing and Inspection Service Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-house

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Testing and Inspection

- 5.2.2. Certification

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Industrial Manufacturing

- 5.3.2. Automotive and Transportation

- 5.3.3. Oil and Gas

- 5.3.4. Mining and Downstream Applications

- 5.3.5. Food and Agriculture

- 5.3.6. Building and Infrastructure

- 5.3.7. Consumer Goods and Retail

- 5.3.8. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PT Carsurin

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AmSpec Services LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Intertek Group PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Setsco Services Pte Ltd (Vicom Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TUV Rheinland

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Apave Japan Co Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Singapore Test Lab Pte Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SGS Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bureau Veritas Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ALS Malaysia (ALS Limited)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HQTS Group Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Seoul Inspection & Testing Co Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Cotecna Inspection SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 PT SUCOFINDO Perseo*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 SIRIM QAS International Sdn Bhd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 UL LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 ABS Group

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 TUV SUD

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 PT Carsurin

List of Figures

- Figure 1: Asia Testing and Inspection Service Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Testing and Inspection Service Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Asia Testing and Inspection Service Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Asia Testing and Inspection Service Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: China Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: India Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Bangladesh Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Pakistan Asia Testing and Inspection Service Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Testing and Inspection Service Industry?

The projected CAGR is approximately 5.50%.

2. Which companies are prominent players in the Asia Testing and Inspection Service Industry?

Key companies in the market include PT Carsurin, AmSpec Services LLC, Intertek Group PLC, Setsco Services Pte Ltd (Vicom Ltd), TUV Rheinland, Apave Japan Co Limited, Singapore Test Lab Pte Ltd, SGS Group, Bureau Veritas Group, ALS Malaysia (ALS Limited), HQTS Group Ltd, Seoul Inspection & Testing Co Limited, Cotecna Inspection SA, PT SUCOFINDO Perseo*List Not Exhaustive, SIRIM QAS International Sdn Bhd, UL LLC, ABS Group, TUV SUD.

3. What are the main segments of the Asia Testing and Inspection Service Industry?

The market segments include Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 75.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Emphasis on Adopting Export-friendly Practices by Mitigating Product Recalls and Scope for Counterfeiting and Piracy; Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

6. What are the notable trends driving market growth?

Emergence of APAC as a Major Manufacturing Hub to Aid Market Demand for TIC Services.

7. Are there any restraints impacting market growth?

Low Awareness about the Facility Management Services.

8. Can you provide examples of recent developments in the market?

December 2022: SGS inaugurated a new multidisciplinary 1,300 m2 Center of Excellence Testing Facility in Dubai. The laboratory will concentrate on analytical testing - physical, chemical, and microbial contamination - for cosmetic and personal care products. It is ISO/IEC 17025 accredited and has a Class 10,000 cleanroom certification.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Testing and Inspection Service Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Testing and Inspection Service Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Testing and Inspection Service Industry?

To stay informed about further developments, trends, and reports in the Asia Testing and Inspection Service Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence