Key Insights

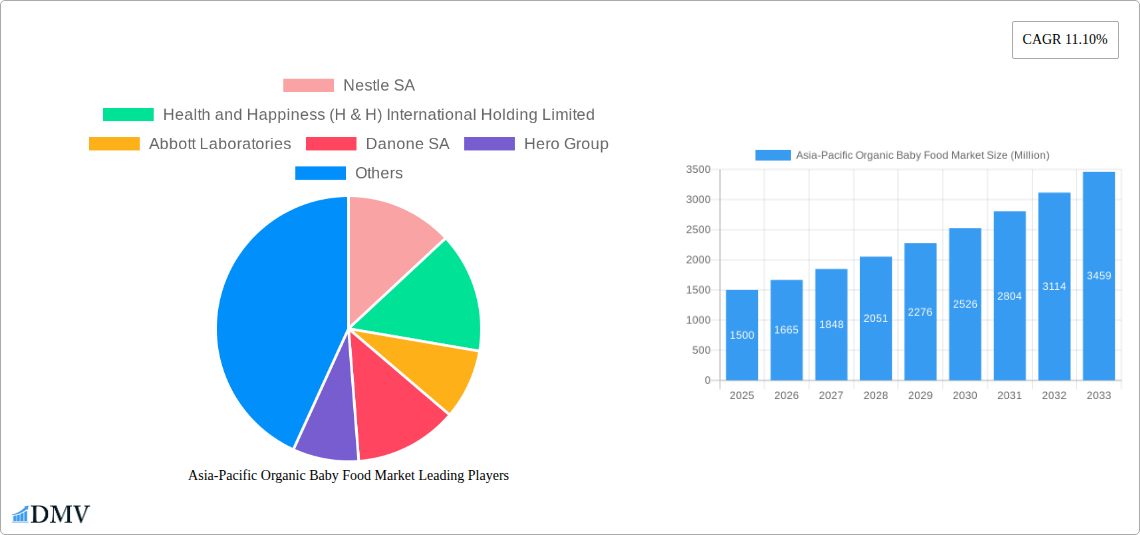

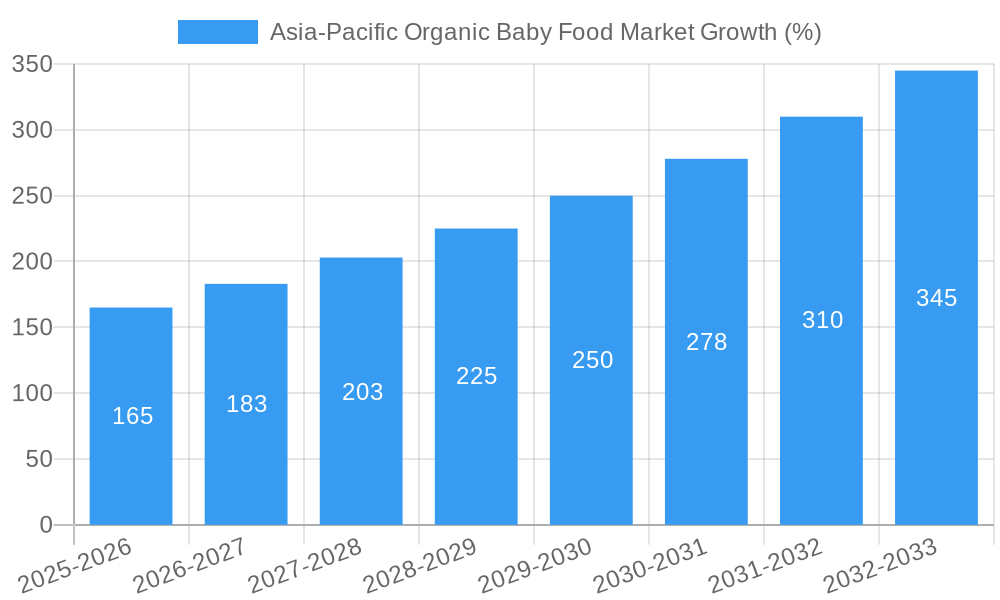

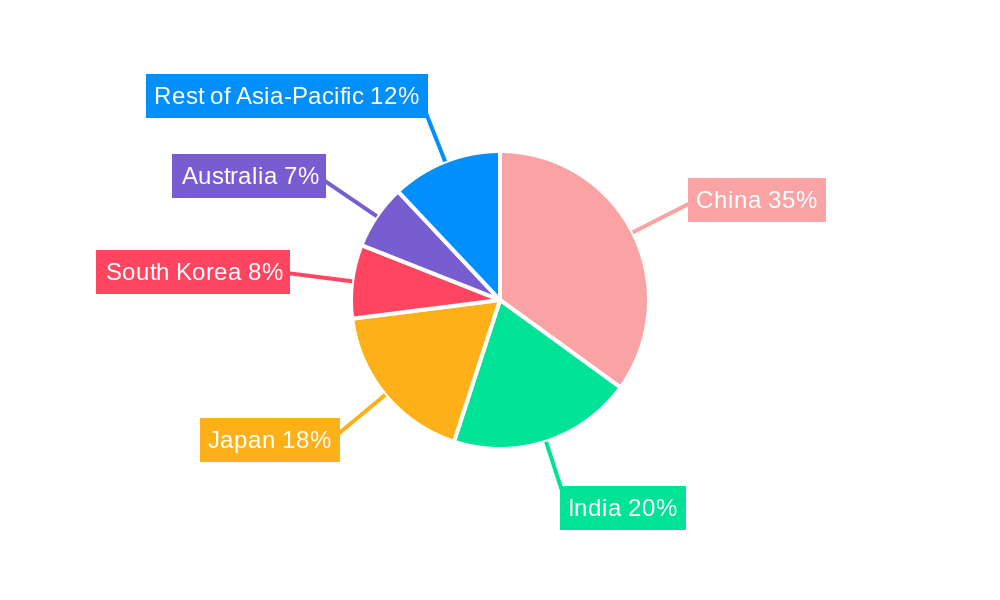

The Asia-Pacific organic baby food market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.10% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across the region, particularly in emerging economies like India and China, are enabling parents to prioritize premium, health-conscious products like organic baby food. Increasing awareness of the health benefits associated with organic food, including reduced exposure to pesticides and improved nutritional value, is further bolstering demand. The growing preference for convenient and ready-to-eat options, along with the increasing penetration of online retail channels, also contributes significantly to market growth. However, the market faces challenges such as fluctuating raw material prices and stringent regulatory requirements for organic certification which may impact market expansion. Segmentation reveals significant opportunities across distribution channels (supermarkets/hypermarkets, convenience stores, and increasingly, online) and product types (milk formula, prepared baby food, and dried baby food are key). The presence of established multinational corporations like Nestlé and Abbott, alongside regional players, creates a dynamic and competitive landscape. China, Japan, and India are expected to remain dominant markets within the Asia-Pacific region, driven by their large populations and rapidly evolving consumer preferences.

The market's future trajectory hinges on successfully navigating several factors. Maintaining a consistent supply chain to ensure product availability and affordability remains crucial. Effective marketing campaigns that highlight the health benefits of organic baby food to a wider consumer base are necessary. Moreover, companies must adapt to evolving consumer preferences and technological advancements within the online retail space. Innovation in product formulations, packaging, and distribution strategies will be key to capturing market share. Increased government support for organic farming and certification processes would further strengthen the market's growth potential. The strategic expansion of distribution networks to reach diverse consumer segments will also be important to unlock the market's full growth potential. Continuous monitoring of consumer trends and adaptation to new preferences will ensure that manufacturers stay ahead of the curve in this dynamic market.

Asia-Pacific Organic Baby Food Market: A Comprehensive Report (2019-2033)

This insightful report provides a comprehensive analysis of the Asia-Pacific organic baby food market, offering valuable insights for stakeholders seeking to understand market dynamics, growth opportunities, and competitive landscapes. The study covers the period 2019-2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology to forecast market trends from 2025 to 2033, based on historical data from 2019 to 2024. Key players analyzed include Nestle SA, Health and Happiness (H & H) International Holding Limited, Abbott Laboratories, Danone SA, Hero Group, Hipp Gmbh & Co, Bellamy's Australia Limited, Campbell Soup Company (Plum Organics), Amara Organic Foods, and Nascens Enterprises Private Limited (Happa Foods), among others. The market is segmented by distribution channel (supermarkets/hypermarkets, convenience stores, online, other) and product type (milk formula, prepared baby food, dried baby food, other). The total market size is projected to reach xx Million by 2033.

Asia-Pacific Organic Baby Food Market Composition & Trends

This section delves into the intricate composition of the Asia-Pacific organic baby food market, examining factors influencing its evolution. We analyze market concentration, revealing the market share distribution among key players. Nestle SA and Abbott Laboratories are expected to hold significant market shares, while regional players like Bellamy's Australia Limited and Hero Group demonstrate strong local presence. The report details the impact of innovation catalysts, such as the rising demand for convenient, healthy options and the development of novel organic ingredients and processing technologies. Furthermore, we explore the regulatory landscape, including labeling standards and safety regulations, which influence market access and product development. The role of substitute products, such as homemade baby food or conventional baby food, is assessed, alongside end-user profiles and their evolving preferences. Finally, M&A activities within the industry are scrutinized, including deal values (xx Million in total M&A value between 2019-2024) and their implications for market consolidation.

- Market Concentration: High concentration among multinational players, with a growing presence of regional brands.

- Innovation Catalysts: Focus on convenient packaging, novel organic ingredients, and sustainable sourcing.

- Regulatory Landscape: Stringent safety standards and labeling requirements driving product quality.

- Substitute Products: Competition from homemade options and conventional baby food influences market growth.

- End-User Profiles: Growing awareness of health benefits drives demand among health-conscious parents.

- M&A Activity: Consolidation through mergers and acquisitions to enhance market share and product portfolio.

Asia-Pacific Organic Baby Food Market Industry Evolution

This section meticulously analyzes the dynamic evolution of the Asia-Pacific organic baby food market. We trace the market's growth trajectory, identifying periods of rapid expansion and any periods of slowdown observed between 2019 and 2024. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) is estimated at xx%, driven primarily by increasing disposable incomes and heightened awareness of health and wellness amongst consumers. Technological advancements in food processing and packaging significantly influence product quality, shelf life, and consumer convenience, fostering market expansion. The report examines how shifting consumer demands, particularly for organic and sustainably sourced products, have reshaped the market landscape. A specific example is the rising preference for products without artificial ingredients or preservatives. We also analyze the increasing adoption of online channels for purchasing organic baby food. The projected CAGR from 2025 to 2033 is xx%, indicating continued strong market growth.

Leading Regions, Countries, or Segments in Asia-Pacific Organic Baby Food Market

This section pinpoints the dominant regions, countries, and segments within the Asia-Pacific organic baby food market. Analysis is provided by distribution channel and product type.

By Distribution Channel:

- Supermarkets/Hypermarkets: This channel dominates due to wide reach and established distribution networks. Growth is driven by increasing investment in organic food sections and promotional campaigns.

- Online: The online channel showcases robust growth driven by increasing internet and e-commerce penetration, convenient delivery, and targeted advertising.

- Convenience Stores: This segment displays moderate growth potential, constrained by limited shelf space and higher prices.

By Product Type:

- Prepared Baby Food: This segment leads the market, fueled by convenience and variety. Innovations in packaging and flavor profiles further boost growth.

- Milk Formula: A substantial segment driven by the preference for organic and fortified options. Technological advancements in formula composition contribute significantly.

- Dried Baby Food: This segment is expected to show steady growth, driven by its convenient and long shelf life.

Key Drivers: Increased government support for organic agriculture, growing consumer preference for health-conscious products, and rising disposable income levels in developing economies contribute to the dominance of specific regions and segments.

Asia-Pacific Organic Baby Food Market Product Innovations

The Asia-Pacific organic baby food market witnesses continuous product innovation, encompassing novel formulations, packaging advancements, and improved production methods. Companies are launching products tailored to specific age groups and dietary needs, highlighting functionalities like enhanced nutrient profiles and allergen-free options. For example, we have seen a growing trend of single-ingredient purees to cater to specific dietary preferences and reduce the risk of allergic reactions. Innovative packaging materials, such as eco-friendly options, further contribute to consumer appeal and brand sustainability.

Propelling Factors for Asia-Pacific Organic Baby Food Market Growth

The Asia-Pacific organic baby food market expansion is fueled by several factors. Rising disposable incomes in developing economies, coupled with an increasing awareness of the importance of nutrition in early childhood development, drives demand. Technological advancements in processing and packaging technologies ensure longer shelf life and enhanced product quality. Favorable regulatory frameworks and government initiatives promoting organic farming and food safety also boost market growth.

Obstacles in the Asia-Pacific Organic Baby Food Market

Several factors hinder the growth of the Asia-Pacific organic baby food market. Stringent regulations related to organic certification and labeling can increase production costs and restrict market entry. Supply chain disruptions, especially during periods of uncertainty, can affect product availability and increase costs. Intense competition from both established players and emerging brands presents significant challenges. These factors combined impact profit margins and overall market growth.

Future Opportunities in Asia-Pacific Organic Baby Food Market

Future opportunities for growth include tapping into underserved markets, particularly in rapidly developing economies with a burgeoning middle class. The growing trend towards personalization and customization in nutrition represents another opportunity. Technological advancements in food processing and preservation, enabling the creation of innovative and shelf-stable products, provide exciting prospects. Addressing emerging health and dietary needs through customized product offerings allows for further expansion in this market.

Major Players in the Asia-Pacific Organic Baby Food Market Ecosystem

- Nestle SA

- Health and Happiness (H & H) International Holding Limited

- Abbott Laboratories

- Danone SA

- Hero Group

- Hipp Gmbh & Co

- Bellamy's Australia Limited

- Campbell Soup Company (Plum Organics)

- Amara Organic Foods

- Nascens Enterprises Private Limited (Happa Foods)

- List Not Exhaustive

Key Developments in Asia-Pacific Organic Baby Food Market Industry

- January 2023: Nestle SA launched a new range of organic baby food pouches with improved packaging.

- June 2022: Abbott Laboratories invested xx Million in expanding its organic baby food production facility in [Location].

- October 2021: A significant merger between two smaller organic baby food companies led to market consolidation. (Further developments to be added based on actual data)

Strategic Asia-Pacific Organic Baby Food Market Forecast

The Asia-Pacific organic baby food market is poised for continued robust growth, driven by a confluence of factors. Increasing health consciousness among parents, coupled with rising disposable incomes and the expansion of e-commerce channels, will significantly contribute to market expansion. Innovation in product offerings, focusing on convenience, nutrition, and sustainability, will further enhance market appeal. The market's projected CAGR of xx% from 2025 to 2033 reflects the tremendous growth potential and presents significant opportunities for both established and emerging players.

Asia-Pacific Organic Baby Food Market Segmentation

-

1. Product Type

- 1.1. Milk Formula

- 1.2. Prepared Baby Food

- 1.3. Dried Baby Food

- 1.4. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia-Pacific Organic Baby Food Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Resistance toward Conventional Baby Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Milk Formula

- 5.1.2. Prepared Baby Food

- 5.1.3. Dried Baby Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Milk Formula

- 6.1.2. Prepared Baby Food

- 6.1.3. Dried Baby Food

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Milk Formula

- 7.1.2. Prepared Baby Food

- 7.1.3. Dried Baby Food

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Milk Formula

- 8.1.2. Prepared Baby Food

- 8.1.3. Dried Baby Food

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Milk Formula

- 9.1.2. Prepared Baby Food

- 9.1.3. Dried Baby Food

- 9.1.4. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Milk Formula

- 10.1.2. Prepared Baby Food

- 10.1.3. Dried Baby Food

- 10.1.4. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. China Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Organic Baby Food Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Nestle SA

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Health and Happiness (H & H) International Holding Limited

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Abbott Laboratories

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Danone SA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Hero Group

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Hipp Gmbh & Co

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Bellamy's Australia Limited

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Campbell Soup Company (Plum Organics)

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 Amara Organic Foods

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 Nascens Enterprises Private Limited (Happa Foods)*List Not Exhaustive

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 Nestle SA

List of Figures

- Figure 1: Asia-Pacific Organic Baby Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Organic Baby Food Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: China Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Japan Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: India Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Korea Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Taiwan Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Australia Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Asia-Pacific Asia-Pacific Organic Baby Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 15: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 17: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 19: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 23: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 25: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 31: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 33: Asia-Pacific Organic Baby Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Organic Baby Food Market?

The projected CAGR is approximately 11.10%.

2. Which companies are prominent players in the Asia-Pacific Organic Baby Food Market?

Key companies in the market include Nestle SA, Health and Happiness (H & H) International Holding Limited, Abbott Laboratories, Danone SA, Hero Group, Hipp Gmbh & Co, Bellamy's Australia Limited, Campbell Soup Company (Plum Organics), Amara Organic Foods, Nascens Enterprises Private Limited (Happa Foods)*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Organic Baby Food Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Resistance toward Conventional Baby Foods.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence