Key Insights

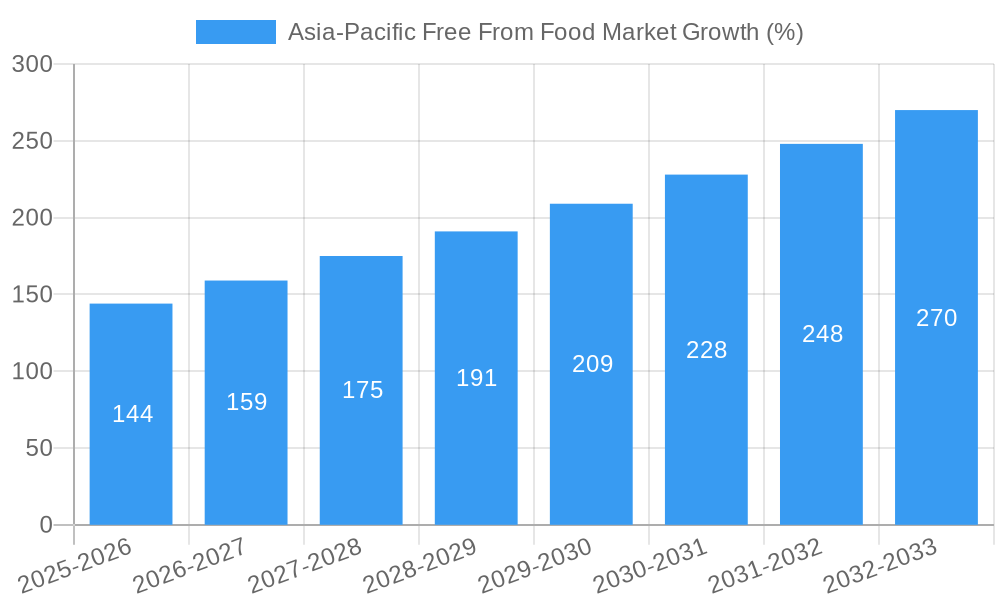

The Asia-Pacific free-from food market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a CAGR of 9.60% from 2025 to 2033. This expansion is fueled by several key factors. Rising prevalence of food allergies and intolerances, particularly in developed economies like Australia, Japan, and South Korea, is a major driver. Increasing consumer awareness of health and wellness, coupled with a growing preference for natural and organic products, further fuels demand. The rising disposable incomes in several Asian countries, enabling consumers to afford premium free-from options, also contributes significantly. Growth is further bolstered by the increasing availability of free-from products across diverse distribution channels, including supermarkets, online retailers, and specialty stores. The market is segmented by type (gluten-free, dairy-free, allergen-free, and others), end product (bakery, dairy-free foods, snacks, beverages), and distribution channel. While the exact market share of each segment is unavailable, it's reasonable to expect that gluten-free and dairy-free products will dominate the market, considering the widespread prevalence of these intolerances. The bakery and confectionery segment is likely to show strong growth due to the increasing demand for substitutes for conventional products. Online retail channels are predicted to experience significant expansion, driven by rising e-commerce adoption and convenience. However, challenges remain, including potential fluctuations in raw material prices and the need for continuous innovation to meet evolving consumer preferences and demands for taste and texture.

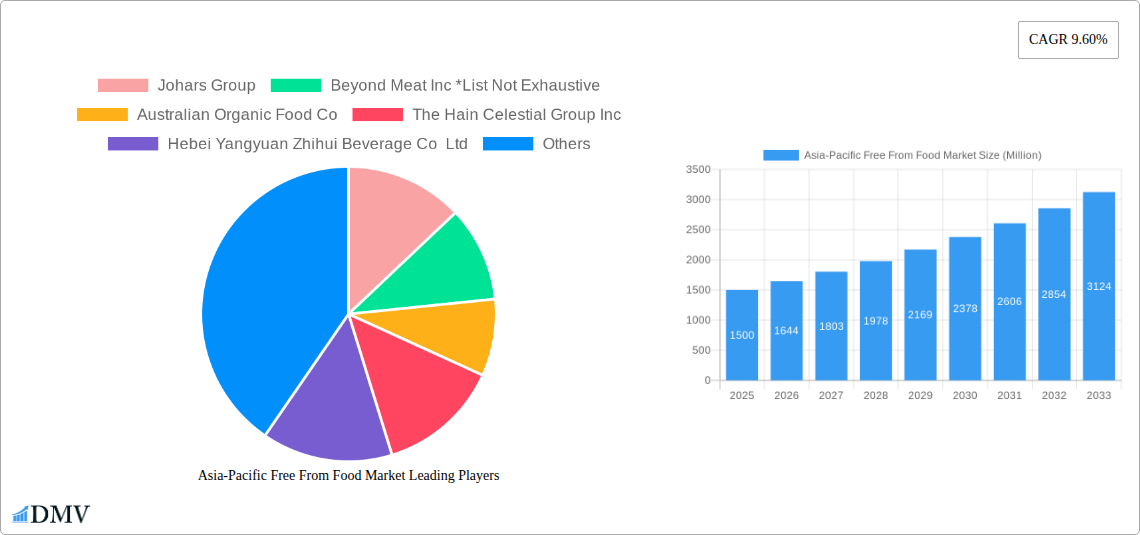

The competitive landscape is dynamic, with both established international players like The Hain Celestial Group and Upfield B.V., and regional players like Johars Group and Rakyan Beverages vying for market share. Companies are focusing on product diversification, strategic partnerships, and new product development to cater to the evolving consumer needs and preferences. The presence of several prominent companies demonstrates the market's potential. Further market expansion will be influenced by government regulations and initiatives related to food safety and labeling, along with successful marketing and promotion strategies that effectively communicate the benefits of free-from foods. The Asia-Pacific region, particularly China and India with their burgeoning middle class and growing health consciousness, is poised to be a significant growth engine for this market.

Asia-Pacific Free From Food Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Asia-Pacific free from food market, offering invaluable insights for stakeholders seeking to navigate this dynamic landscape. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a comprehensive overview of market trends, key players, and future opportunities. The market is projected to reach xx Million by 2033, showcasing significant growth potential.

Asia-Pacific Free From Food Market Market Composition & Trends

This section delves into the competitive landscape of the Asia-Pacific free from food market, examining market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and merger & acquisition (M&A) activities. The market exhibits a moderately fragmented structure, with several key players vying for market share. Innovation is primarily driven by consumer demand for healthier and more inclusive food options, leading to the development of novel product formulations and processing techniques. Stringent regulatory frameworks regarding labeling and food safety standards vary across the region, influencing market dynamics. Substitute products, including conventional foods and those from other specialized food categories, pose a constant competitive challenge. M&A activity within the free-from food sector has been relatively moderate, with deal values ranging from xx Million to xx Million, primarily focused on expanding product portfolios and geographical reach.

- Market Share Distribution: xx% held by top 5 players.

- M&A Deal Values (2019-2024): Averaging xx Million per deal.

- Key Innovation Catalysts: Growing consumer awareness of health & wellness, increasing prevalence of allergies and intolerances.

- Regulatory Landscape: Varying standards across countries impacting labeling and product development.

Asia-Pacific Free From Food Market Industry Evolution

The Asia-Pacific free from food market has witnessed remarkable growth over the past few years, fueled by evolving consumer preferences and technological advancements. The market's trajectory showcases consistent expansion, with an average annual growth rate (AAGR) of xx% during the historical period (2019-2024), expected to reach xx% during the forecast period (2025-2033). This growth is predominantly driven by the escalating prevalence of food allergies and intolerances, coupled with rising health consciousness among consumers. Technological advancements in food processing and formulation have played a pivotal role in enhancing product quality, expanding product variety, and mitigating cost constraints. The increasing adoption of online retail channels further bolsters market growth.

- Growth Rate (2019-2024): xx% AAGR

- Projected Growth Rate (2025-2033): xx% AAGR

- Adoption of Online Retail Channels: xx% growth in online sales from 2020 to 2024.

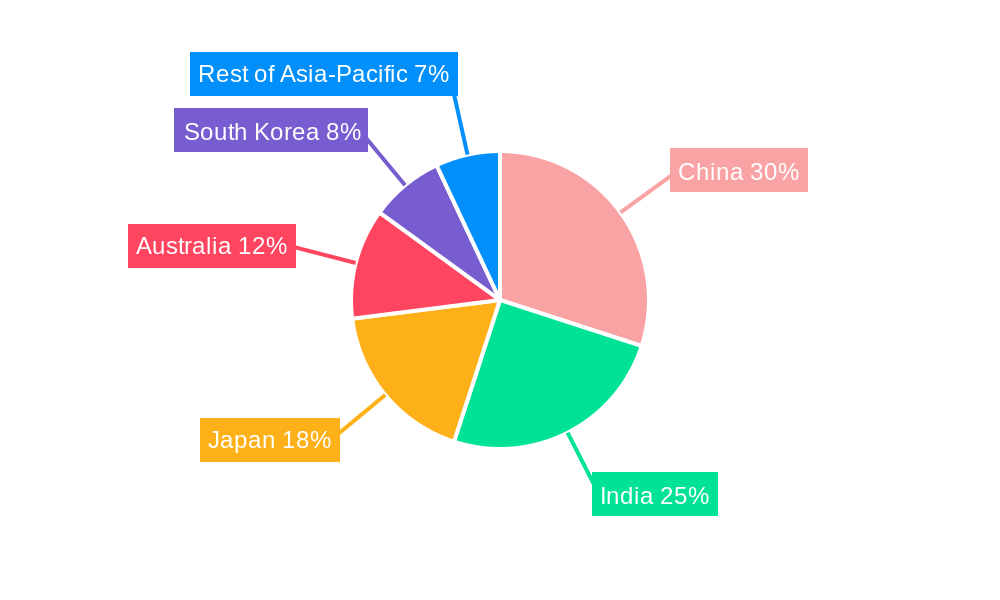

Leading Regions, Countries, or Segments in Asia-Pacific Free From Food Market

The Asia-Pacific free from food market exhibits significant regional variations in growth and dominance. Australia and Japan currently lead in terms of market size and adoption of free-from foods. However, rapidly growing economies like India and China are witnessing a surge in demand, exhibiting promising growth potential. Within market segments, Dairy Free products currently hold the largest market share, followed by Gluten Free and Allergen Free products. Within the end product segment, Dairy Free Foods and Beverages dominate. Supermarkets/Hypermarkets constitute the primary distribution channel.

- Key Drivers (Australia): High consumer awareness of health and wellness, established regulatory framework.

- Key Drivers (India): Rising disposable incomes, increasing prevalence of lactose intolerance.

- Key Drivers (China): Growing middle class, increased access to international brands.

- Dominant Segment (By Type): Dairy Free

- Dominant Segment (By End Product): Dairy Free Foods

- Dominant Segment (By Distribution Channel): Supermarkets/Hypermarkets

Asia-Pacific Free From Food Market Product Innovations

Recent product innovations focus on enhancing taste, texture, and nutritional value. Plant-based alternatives to dairy and meat products, utilizing ingredients like pea protein, soy protein, and almond milk, are gaining traction. Manufacturers are also focusing on developing products with extended shelf life and improved convenience. Technological advancements, such as 3D printing of food and precision fermentation, are paving the way for innovative product development, further refining product functionality and delivering improved value for consumers.

Propelling Factors for Asia-Pacific Free From Food Market Growth

The Asia-Pacific free from food market is propelled by several key factors. The rising prevalence of food allergies and intolerances is a major driver, alongside increasing consumer awareness of health and wellness. Technological advancements in food processing have led to improved product quality and affordability. Favorable regulatory environments in some countries further stimulate market growth.

Obstacles in the Asia-Pacific Free From Food Market Market

The Asia-Pacific free from food market faces several challenges. Varying and sometimes stringent regulatory environments across different countries pose hurdles to market entry and expansion. Supply chain disruptions can impact product availability and pricing. Intense competition from both established and emerging players adds to market pressures. Pricing remains a key barrier for several consumers.

Future Opportunities in Asia-Pacific Free From Food Market

The future of the Asia-Pacific free from food market holds significant opportunities. Untapped markets in rapidly developing economies present substantial growth potential. Technological innovations such as precision fermentation and 3D food printing offer avenues for product diversification and improvement. Catering to the growing demand for sustainable and ethically sourced products presents another significant growth opportunity.

Major Players in the Asia-Pacific Free From Food Market Ecosystem

- Johars Group

- Beyond Meat Inc

- Australian Organic Food Co

- The Hain Celestial Group Inc

- Hebei Yangyuan Zhihui Beverage Co Ltd

- Namaste Foods

- Bob's Red Mill Natural Foods

- Upfield B V

- One Good (Goodmylk)

- Rakyan Beverages

Key Developments in Asia-Pacific Free From Food Market Industry

- November 2022: Beyond Meat launched plant-based chicken products (Beyond Chicken Nuggets and Beyond Popcorn Chicken), available at over 5,000 Kroger and Walmart stores.

- September 2022: Nestlé announced exploration of animal-free dairy products through a partnership with Perfect Day.

- June 2022: Provilac launched lactose-free cow milk in India, expanding its reach to 20,000 households in Pune, Mumbai, and Hyderabad.

Strategic Asia-Pacific Free From Food Market Market Forecast

The Asia-Pacific free from food market is poised for substantial growth, driven by evolving consumer preferences and technological advancements. Untapped markets, coupled with increasing health consciousness and innovation in product development, create a promising outlook for market expansion. The market's continued evolution is expected to be shaped by sustainable practices, personalized nutrition, and technological breakthroughs that cater to diverse dietary needs.

Asia-Pacific Free From Food Market Segmentation

-

1. Type

- 1.1. Gluten Free

- 1.2. Dairy Free

- 1.3. Allergen Free

- 1.4. Other Types

-

2. End Product

- 2.1. Bakery and Confectionery

- 2.2. Dairy Free Foods

- 2.3. Snacks

- 2.4. Beverages

- 2.5. Other End Products

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience/Grocery Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Thailand

- 4.5. Australia

- 4.6. Rest of Asia-Pacific

Asia-Pacific Free From Food Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Thailand

- 5. Australia

- 6. Rest of Asia Pacific

Asia-Pacific Free From Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Vegan and non-GMO Breakfast Cereals; Rising Consumer Inclination Towards Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. Availability of Product Alternatives in the Market

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Lactose Free Products Across the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Gluten Free

- 5.1.2. Dairy Free

- 5.1.3. Allergen Free

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End Product

- 5.2.1. Bakery and Confectionery

- 5.2.2. Dairy Free Foods

- 5.2.3. Snacks

- 5.2.4. Beverages

- 5.2.5. Other End Products

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience/Grocery Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Thailand

- 5.4.5. Australia

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Thailand

- 5.5.5. Australia

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Gluten Free

- 6.1.2. Dairy Free

- 6.1.3. Allergen Free

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End Product

- 6.2.1. Bakery and Confectionery

- 6.2.2. Dairy Free Foods

- 6.2.3. Snacks

- 6.2.4. Beverages

- 6.2.5. Other End Products

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience/Grocery Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Thailand

- 6.4.5. Australia

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Japan Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Gluten Free

- 7.1.2. Dairy Free

- 7.1.3. Allergen Free

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End Product

- 7.2.1. Bakery and Confectionery

- 7.2.2. Dairy Free Foods

- 7.2.3. Snacks

- 7.2.4. Beverages

- 7.2.5. Other End Products

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience/Grocery Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Thailand

- 7.4.5. Australia

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. India Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Gluten Free

- 8.1.2. Dairy Free

- 8.1.3. Allergen Free

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End Product

- 8.2.1. Bakery and Confectionery

- 8.2.2. Dairy Free Foods

- 8.2.3. Snacks

- 8.2.4. Beverages

- 8.2.5. Other End Products

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience/Grocery Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Thailand

- 8.4.5. Australia

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Thailand Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Gluten Free

- 9.1.2. Dairy Free

- 9.1.3. Allergen Free

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End Product

- 9.2.1. Bakery and Confectionery

- 9.2.2. Dairy Free Foods

- 9.2.3. Snacks

- 9.2.4. Beverages

- 9.2.5. Other End Products

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience/Grocery Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Thailand

- 9.4.5. Australia

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Australia Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Gluten Free

- 10.1.2. Dairy Free

- 10.1.3. Allergen Free

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by End Product

- 10.2.1. Bakery and Confectionery

- 10.2.2. Dairy Free Foods

- 10.2.3. Snacks

- 10.2.4. Beverages

- 10.2.5. Other End Products

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Convenience/Grocery Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Thailand

- 10.4.5. Australia

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of Asia Pacific Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Gluten Free

- 11.1.2. Dairy Free

- 11.1.3. Allergen Free

- 11.1.4. Other Types

- 11.2. Market Analysis, Insights and Forecast - by End Product

- 11.2.1. Bakery and Confectionery

- 11.2.2. Dairy Free Foods

- 11.2.3. Snacks

- 11.2.4. Beverages

- 11.2.5. Other End Products

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets/Hypermarkets

- 11.3.2. Convenience/Grocery Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Distribution Channels

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Thailand

- 11.4.5. Australia

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. China Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 13. Japan Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 14. India Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 15. South Korea Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 16. Taiwan Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 17. Australia Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Asia-Pacific Asia-Pacific Free From Food Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Johars Group

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Beyond Meat Inc *List Not Exhaustive

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Australian Organic Food Co

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 The Hain Celestial Group Inc

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Hebei Yangyuan Zhihui Beverage Co Ltd

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Namaste Foods

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Bob's Red Mill Natural Foods

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 Upfield B V

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 One Good (Goodmylk)

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Rakyan Beverages

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Johars Group

List of Figures

- Figure 1: Asia-Pacific Free From Food Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Free From Food Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Free From Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 4: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Free From Food Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia-Pacific Free From Food Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 17: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 18: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 21: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 22: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 23: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 27: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 32: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 33: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 37: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 38: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Asia-Pacific Free From Food Market Revenue Million Forecast, by Type 2019 & 2032

- Table 41: Asia-Pacific Free From Food Market Revenue Million Forecast, by End Product 2019 & 2032

- Table 42: Asia-Pacific Free From Food Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 43: Asia-Pacific Free From Food Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Asia-Pacific Free From Food Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Free From Food Market?

The projected CAGR is approximately 9.60%.

2. Which companies are prominent players in the Asia-Pacific Free From Food Market?

Key companies in the market include Johars Group, Beyond Meat Inc *List Not Exhaustive, Australian Organic Food Co, The Hain Celestial Group Inc, Hebei Yangyuan Zhihui Beverage Co Ltd, Namaste Foods, Bob's Red Mill Natural Foods, Upfield B V, One Good (Goodmylk), Rakyan Beverages.

3. What are the main segments of the Asia-Pacific Free From Food Market?

The market segments include Type, End Product, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Vegan and non-GMO Breakfast Cereals; Rising Consumer Inclination Towards Healthy Lifestyle.

6. What are the notable trends driving market growth?

Increasing Demand for Lactose Free Products Across the Region.

7. Are there any restraints impacting market growth?

Availability of Product Alternatives in the Market.

8. Can you provide examples of recent developments in the market?

In November 2022, Beyond Meats launched plant-based chicken products namely Beyond Chicken Nuggets and Beyond Popcorn Chicken. The company claims that the product contains 14g of plant-based protein derived from a blend of pea and faba beans, 0% cholesterol, 50% less saturated fat, and no added soy, hormones, or antibiotics. The product is available at more than 5,000 Kroger and Walmart stores.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Free From Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Free From Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Free From Food Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Free From Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence