Key Insights

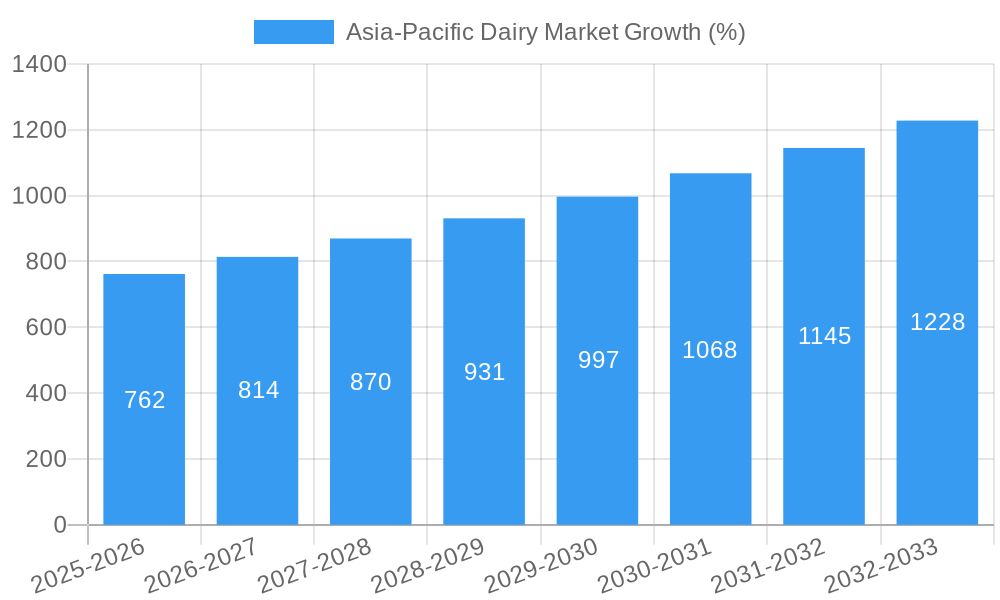

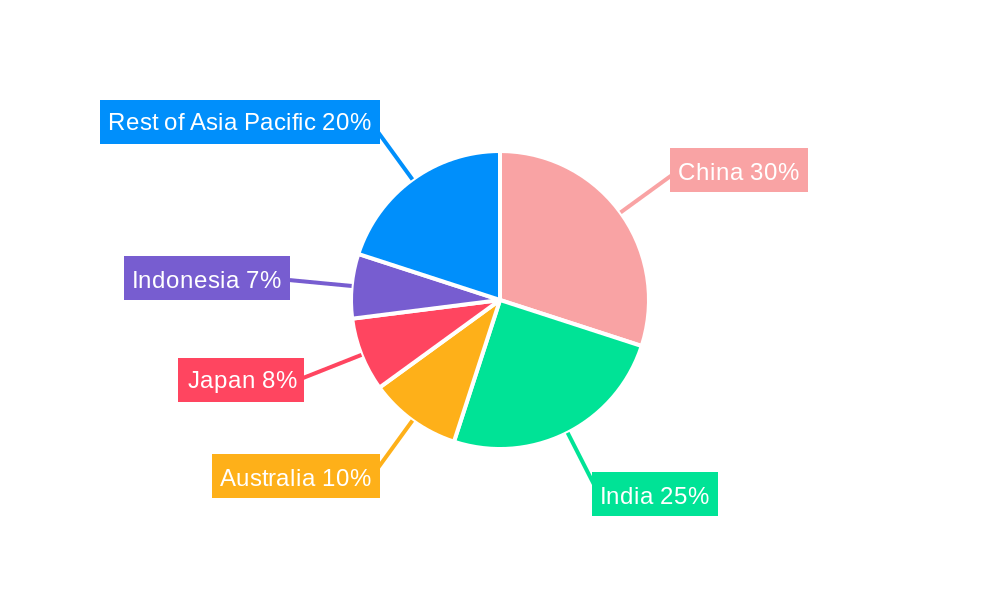

The Asia-Pacific dairy market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.62% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across the region, particularly in rapidly developing economies like India and Indonesia, are driving increased consumption of dairy products. A growing preference for convenient and nutritious food options is also boosting demand for dairy-based products like yogurt, cheese, and flavored milk. Furthermore, the increasing awareness of the health benefits associated with dairy consumption, including calcium and protein intake, is contributing to market growth. Government initiatives promoting dairy farming and improved infrastructure for milk processing and distribution further enhance market prospects. However, challenges remain, including fluctuating milk prices, concerns about the environmental impact of dairy farming, and the prevalence of counterfeit products in some markets. Competition among established players and the emergence of new entrants also shape market dynamics. Segmentation analysis reveals significant variations in consumption patterns across countries, with China and India leading in overall volume, while Australia and New Zealand contribute significantly to higher-value dairy exports. The on-trade sector, encompassing food service and restaurants, represents a significant segment, alongside a continuously expanding off-trade sector fueled by retail sales. The market's future trajectory will likely be influenced by consumer preferences shifting towards organic and plant-based alternatives, prompting the dairy industry to innovate and adapt its product offerings.

The market's diverse product portfolio, encompassing butter, other dairy products, and varying distribution channels, offers numerous opportunities for growth. Key players like Inner Mongolia Yili Industrial Group Co Ltd, Nestlé SA, and Fonterra Co-operative Group Limited are strategically investing in capacity expansion, new product development, and market penetration strategies to consolidate their positions. The increasing integration of technology in dairy farming and processing, focusing on efficiency and sustainability, is further shaping the landscape. Regional disparities in consumption patterns and infrastructural developments across the Asia-Pacific region will continue to present both opportunities and challenges. Understanding these regional nuances is crucial for businesses aiming to effectively participate and succeed in this dynamic market. Future growth projections suggest continued expansion, driven by the aforementioned factors, although potential economic downturns or unforeseen events could impact the projected CAGR.

Asia-Pacific Dairy Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific dairy market, offering a comprehensive overview of its current state and future trajectory. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this study is an invaluable resource for stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report values are presented in Millions.

Asia-Pacific Dairy Market Composition & Trends

This section delves into the competitive landscape of the Asia-Pacific dairy market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user profiles, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of multinational giants and regional players, resulting in a complex competitive dynamic. Key players such as Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, and Fonterra Co-operative Group Limited contribute significantly to the overall market value, while regional players like Hatsun Agro Product Ltd and Dodla Dairy Ltd hold substantial market share within their respective regions. Market share distribution varies significantly across countries and product categories, with China and India dominating in terms of volume, but other countries exhibiting strong growth. M&A activities, exemplified by China Mengniu's USD 1 billion acquisition of Bellamy's Australia in September 2023, showcase the strategic consolidation taking place within the industry. The report details significant M&A deals with estimated values, offering valuable insights into market dynamics. The regulatory landscape varies across the region, impacting production standards, labeling, and distribution, further shaping market dynamics.

- Market Concentration: xx% dominated by top 5 players in 2024, expected to increase to xx% by 2033.

- Innovation Catalysts: Growing consumer demand for specialized dairy products (e.g., organic, lactose-free).

- Regulatory Landscape: Varying regulations across countries regarding food safety and labeling.

- Substitute Products: Plant-based milk alternatives presenting increasing competitive pressure.

- End-User Profiles: Shifting consumer preferences towards convenience and health-conscious products.

- M&A Activity: Significant M&A activity driven by market consolidation and expansion strategies. Total M&A deal value estimated at xx Billion USD between 2019 and 2024.

Asia-Pacific Dairy Market Industry Evolution

The Asia-Pacific dairy market has witnessed significant transformation over the historical period (2019-2024), characterized by fluctuating growth trajectories influenced by economic conditions, consumer preferences, and technological advancements. The market exhibited a Compound Annual Growth Rate (CAGR) of xx% during 2019-2024, with growth expected to decelerate slightly to xx% during 2025-2033. Technological advancements, including automation in production and improved packaging solutions, have enhanced efficiency and shelf life. Shifting consumer demands, driven by rising health consciousness and disposable incomes, are leading to a surge in demand for specialized dairy products like organic milk, lactose-free options, and value-added products. The adoption of these specialized products is increasing at a rate of xx% annually. Furthermore, increasing urbanization and changing lifestyles have influenced the distribution channel preferences, leading to a greater emphasis on convenience formats and online sales. The impact of climate change on milk production is also a key factor affecting industry stability, creating uncertainty within the forecasting of future growth.

Leading Regions, Countries, or Segments in Asia-Pacific Dairy Market

China and India are currently the dominant markets within the Asia-Pacific dairy sector, driven by large populations and rising disposable incomes. However, other countries like Australia, New Zealand, and Japan contribute substantially to specific segments of the market. Within product categories, butter maintains a strong position, although other dairy products such as cheese and yogurt are rapidly gaining traction. The off-trade channel (retail sales) is dominant, yet the on-trade (foodservice) channel displays a notable growth rate.

Key Drivers for China and India:

- Large and growing populations.

- Rising disposable incomes and changing dietary habits.

- Increasing urbanization and evolving distribution networks.

- Government support for dairy farming and processing.

Key Drivers for Australia and New Zealand:

- High-quality dairy production standards.

- Export-oriented economies.

- Established brands and strong international presence.

Dominant Segments:

- Off-Trade Channel: Convenience, affordability and wider availability contribute to its dominance.

- Butter Category: Sustained demand and established consumer preferences drive its market share.

Asia-Pacific Dairy Market Product Innovations

Recent innovations within the Asia-Pacific dairy market include the development of functional dairy products with added health benefits, such as probiotics and vitamins. Companies are also focusing on creating more sustainable and ethically sourced dairy products, catering to the increasing consumer awareness of environmental and animal welfare issues. Technological advancements in packaging have improved shelf life and convenience, while product diversification expands customer options. The introduction of novel flavors and formats caters to diverse consumer preferences and increases market penetration. The unique selling propositions for many new products focus on health, convenience, and sustainability.

Propelling Factors for Asia-Pacific Dairy Market Growth

Several factors fuel the growth of the Asia-Pacific dairy market. Rising disposable incomes in many countries are driving increased spending on dairy products. Urbanization and changing lifestyles are boosting demand for convenient and processed dairy options. Technological advancements are improving efficiency in production and expanding product ranges. Government initiatives and policies aimed at supporting the dairy industry also contribute to market growth. For example, government subsidies in India have encouraged dairy farming. Furthermore, the growing popularity of Western-style diets across the region has increased the consumption of dairy products.

Obstacles in the Asia-Pacific Dairy Market

The Asia-Pacific dairy market faces challenges, including fluctuating milk production due to climate change impacting supply and increasing production costs. Stringent regulatory standards vary across countries, impacting production and distribution. The increasing competition from plant-based milk alternatives poses a significant challenge to conventional dairy products. Supply chain disruptions and logistical challenges can increase prices and reduce availability. Furthermore, the price volatility of raw materials can influence production costs and profit margins.

Future Opportunities in Asia-Pacific Dairy Market

Future opportunities exist in exploring new product categories, particularly functional and fortified dairy products targeting health-conscious consumers. Expanding distribution networks into underserved areas and leveraging e-commerce present significant potential. Developing sustainable and ethical dairy farming practices will attract environmentally aware consumers. Innovation in packaging and product formats to better suit local preferences and lifestyles will further increase market reach.

Major Players in the Asia-Pacific Dairy Market Ecosystem

- Inner Mongolia Yili Industrial Group Co Ltd

- Yakult Honsha Co Lt

- Nestlé SA

- Karnataka Cooperative Milk Producers Federation Ltd

- Hatsun Agro Product Ltd

- Fonterra Co-operative Group Limited

- Meiji Dairies Corporation

- Gujarat Co-operative Milk Marketing Federation Ltd

- Dodla Dairy Ltd

- China Mengniu Dairy Company Ltd

Key Developments in Asia-Pacific Dairy Market Industry

- September 2023: China Mengniu acquired organic infant formula producer Bellamy's Australia for USD 1 billion, significantly expanding its presence in the infant nutrition sector and highlighting the increasing consolidation in the market.

- July 2022: Nestlé launched Nescafe Gold Cappuccino ice cream in Malaysia, demonstrating innovation in product diversification and expanding into the ice cream market.

- July 2022: Yili opened a new dairy hub in North China to produce fresh milk, infant formula, and cheese, expanding its production capacity and broadening its product portfolio.

Strategic Asia-Pacific Dairy Market Forecast

The Asia-Pacific dairy market is poised for continued growth, driven by rising disposable incomes, urbanization, and evolving consumer preferences. Opportunities lie in specializing products, expanding distribution channels, and promoting sustainable practices. While challenges exist regarding production costs and competition from plant-based alternatives, the overall market outlook remains positive, with significant potential for expansion and innovation in the coming years. The market is projected to reach xx Billion USD by 2033, representing a robust growth trajectory.

Asia-Pacific Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Asia-Pacific Dairy Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players

- 3.3. Market Restrains

- 3.3.1. Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. China Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Dairy Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Yakult Honsha Co Lt

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Nestlé SA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Karnataka Cooperative Milk Producers Federation Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hatsun Agro Product Ltd

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Fonterra Co-operative Group Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Meiji Dairies Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Gujarat Co-operative Milk Marketing Federation Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dodla Dairy Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 China Mengniu Dairy Company Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Inner Mongolia Yili Industrial Group Co Ltd

List of Figures

- Figure 1: Asia-Pacific Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Asia-Pacific Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 14: Asia-Pacific Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia-Pacific Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Dairy Market?

The projected CAGR is approximately 7.62%.

2. Which companies are prominent players in the Asia-Pacific Dairy Market?

Key companies in the market include Inner Mongolia Yili Industrial Group Co Ltd, Yakult Honsha Co Lt, Nestlé SA, Karnataka Cooperative Milk Producers Federation Ltd, Hatsun Agro Product Ltd, Fonterra Co-operative Group Limited, Meiji Dairies Corporation, Gujarat Co-operative Milk Marketing Federation Ltd, Dodla Dairy Ltd, China Mengniu Dairy Company Ltd.

3. What are the main segments of the Asia-Pacific Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Application and Benefits of Collagen Across End-User Industry; Implementation of Business Strategies by Market Players.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Intolerance of Vegetarian/Vegan Population Towards Animal Sourced Protein.

8. Can you provide examples of recent developments in the market?

September 2023: China Mengniu acquired organic infant formula producer Bellamy's Australia for USD 1 billion.July 2022: Nestle launched Nescafe Gold Cappuccino ice cream in Malaysia.July 2022: In order to produce fresh milk, infant formula, and cheese, Yili opened a dairy hub in the area where the business is based, in North China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Dairy Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence