Key Insights

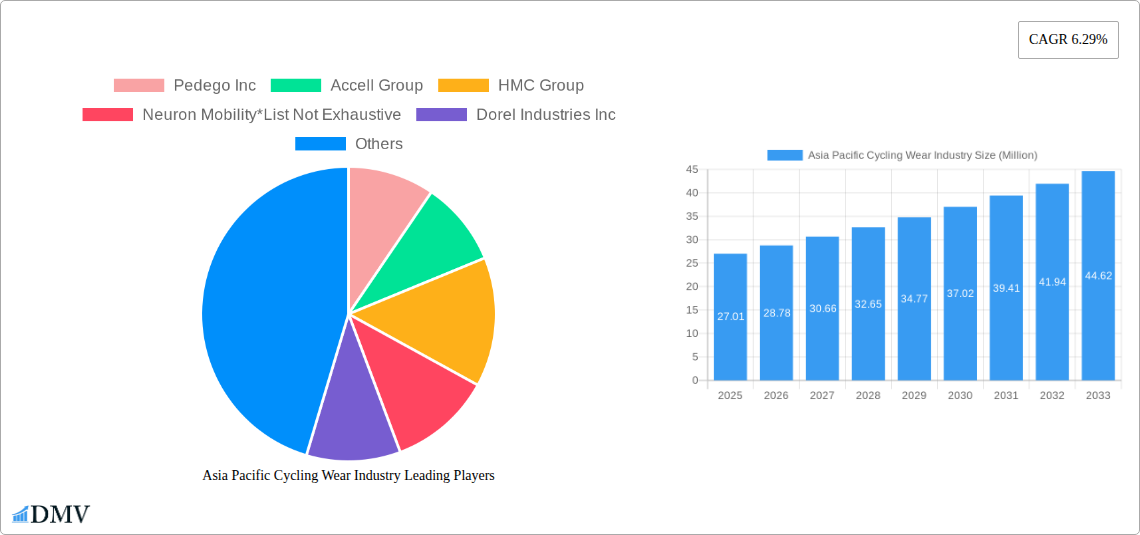

The Asia-Pacific cycling wear market, valued at $27.01 million in 2025, is projected to experience robust growth, driven by increasing participation in cycling activities across various segments, including road cycling, hybrid cycling, and e-cycling. This growth is fueled by rising health consciousness, a preference for eco-friendly transportation, and government initiatives promoting cycling infrastructure in major economies like China, Japan, and India. The increasing popularity of cycling tourism and competitive cycling events further contributes to the market's expansion. The market's segmentation reveals a strong preference for road bicycles and e-bicycles, indicating a growing demand for high-performance and technologically advanced cycling products. The offline retail segment currently dominates distribution, although online retail channels are gaining traction, driven by improved e-commerce infrastructure and consumer familiarity with online shopping. Key players such as Pedego Inc., Accell Group, and Giant Bicycles are leveraging innovation and brand recognition to maintain their market share, while emerging brands are capitalizing on niche market segments.

Asia Pacific Cycling Wear Industry Market Size (In Million)

The projected Compound Annual Growth Rate (CAGR) of 6.29% for the period 2025-2033 suggests continuous market expansion. However, potential restraints include fluctuating raw material prices, economic downturns impacting discretionary spending, and competition from lower-cost manufacturers. Market players are addressing these challenges through strategic partnerships, vertical integration, and cost optimization strategies. Significant regional variations exist within the Asia-Pacific region. China, India, and Japan are expected to be the key growth drivers, owing to their large populations, rising disposable incomes, and expanding cycling infrastructure. The market is witnessing a shift towards sustainable and technologically advanced cycling wear, incorporating features like moisture-wicking fabrics, enhanced safety features, and smart cycling apparel integration. This trend is expected to drive innovation and product differentiation within the market.

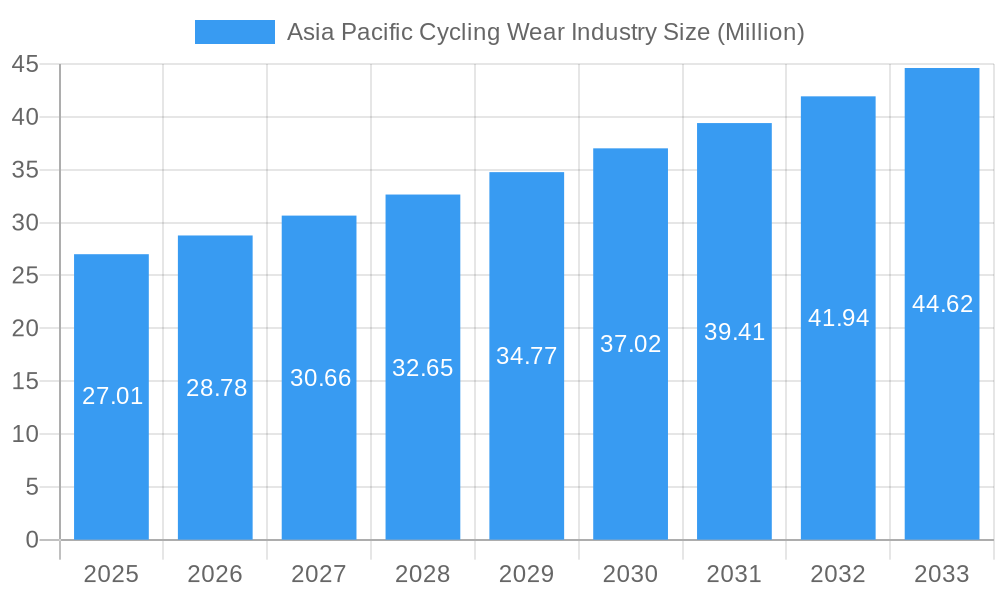

Asia Pacific Cycling Wear Industry Company Market Share

Asia Pacific Cycling Wear Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Asia Pacific cycling wear industry, offering invaluable insights for stakeholders seeking to navigate this dynamic market. From market sizing and segmentation to future growth projections and key player analysis, this report equips you with the knowledge needed to make informed strategic decisions. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report utilizes data from the historical period of 2019-2024, presenting a holistic view of past performance and future potential. The total market value in 2025 is estimated at $XX Million.

Asia Pacific Cycling Wear Industry Market Composition & Trends

This section evaluates the competitive landscape, innovation drivers, regulatory environment, substitute products, and end-user preferences within the Asia Pacific cycling wear market. The market exhibits a moderately concentrated structure, with key players such as Giant Bicycles, Merida Bikes, and Avon Cycles Ltd holding significant market share. However, the emergence of smaller, specialized brands is increasing competition. Innovation is driven by advancements in materials, design, and e-bike technology. Government regulations regarding safety standards and environmental impact also shape market trends. Substitute products, like other forms of activewear and personal transportation, pose a competitive challenge. The primary end-users are recreational cyclists, professional athletes, and commuters. M&A activity has been moderate, with deal values averaging around $XX Million in recent years.

- Market Share Distribution (2024): Giant Bicycles (XX%), Merida Bikes (XX%), Avon Cycles Ltd (XX%), Others (XX%).

- Average M&A Deal Value (2019-2024): $XX Million

- Key Innovation Catalysts: Lightweight materials, aerodynamic designs, integrated technology (GPS, fitness tracking).

- Regulatory Landscape: Focus on safety standards and environmental sustainability.

Asia Pacific Cycling Wear Industry Industry Evolution

The Asia Pacific cycling wear industry has witnessed substantial growth between 2019 and 2024, driven by increasing health consciousness, government initiatives promoting cycling infrastructure, and the rising popularity of e-bikes. Technological advancements, such as improved battery technology for e-bikes and the integration of smart features in cycling apparel, have further boosted market expansion. Consumer preferences are shifting towards high-performance, sustainable, and technologically advanced cycling wear. The market is expected to maintain a strong growth trajectory, with a Compound Annual Growth Rate (CAGR) of XX% projected from 2025 to 2033. This growth is fueled by the increasing adoption of cycling as a mode of transportation and recreation across various demographics. The market value is predicted to reach $XX Million by 2033.

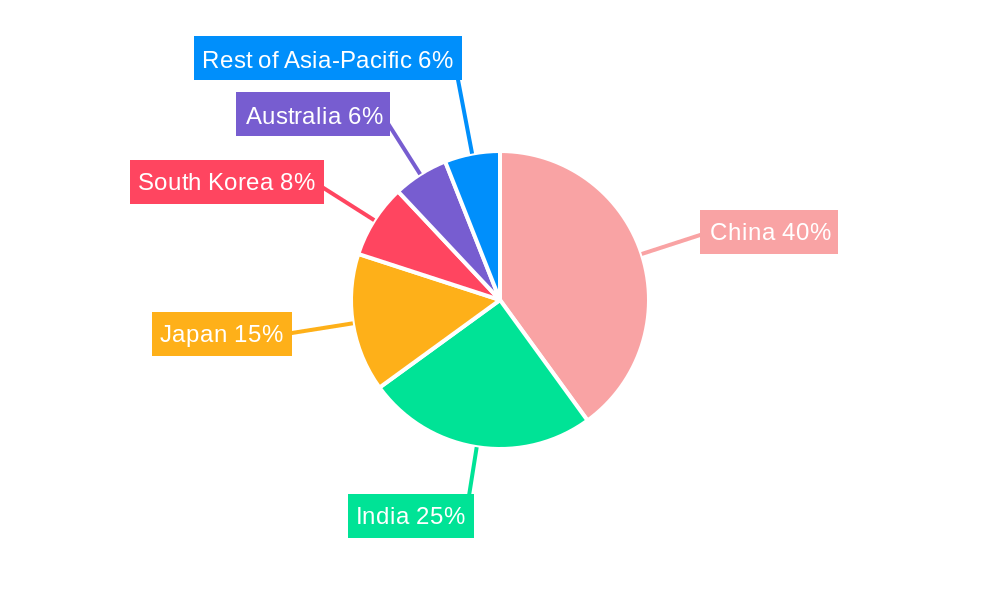

Leading Regions, Countries, or Segments in Asia Pacific Cycling Wear Industry

The Asia Pacific cycling wear market is geographically diverse, with significant variations in growth rates and consumer preferences across regions and countries. China and Japan represent major markets due to established cycling culture, strong economic growth, and supportive government policies. Australia and other developed economies showcase high per capita spending on premium cycling apparel and equipment. Among segment types, E-Bicycles are experiencing the fastest growth, driven by technological advancements and increasing consumer demand for efficient and sustainable transportation. Offline retail stores still dominate distribution, but online channels are rapidly gaining traction, particularly among younger consumers.

- Key Drivers in China: Government initiatives promoting cycling infrastructure, rising disposable incomes.

- Key Drivers in Japan: Established cycling culture, high demand for premium products.

- Fastest Growing Segment: E-Bicycles (CAGR of XX% from 2025 to 2033).

- Dominant Distribution Channel: Offline retail stores, but online channels are rapidly expanding.

Asia Pacific Cycling Wear Industry Product Innovations

Recent innovations in cycling wear include the integration of smart fabrics with embedded sensors for performance tracking, the use of lightweight and breathable materials enhancing comfort and performance, and improved aerodynamic designs to reduce wind resistance. These advancements cater to the growing demand for specialized, performance-oriented products among both recreational and professional cyclists. Companies are focusing on creating unique selling propositions by incorporating sustainable materials and offering personalized fitting options.

Propelling Factors for Asia Pacific Cycling Wear Industry Growth

Several factors are propelling the growth of the Asia Pacific cycling wear industry. Firstly, rising health consciousness and a focus on fitness activities contribute to increased demand for cycling apparel and equipment. Secondly, government initiatives to promote cycling infrastructure and sustainable transportation are encouraging cycling adoption. Thirdly, technological advancements are continuously improving the performance and functionality of cycling products, further boosting market growth. Finally, the increasing affordability of e-bikes is making them accessible to a wider range of consumers.

Obstacles in the Asia Pacific Cycling Wear Industry Market

The Asia Pacific cycling wear market faces challenges including supply chain disruptions, which can lead to production delays and increased costs. Furthermore, intense competition among established brands and new entrants necessitates continuous innovation and marketing efforts. Stricter regulatory frameworks concerning product safety and environmental standards also present hurdles for manufacturers. These factors can impact profitability and market expansion.

Future Opportunities in Asia Pacific Cycling Wear Industry

Emerging opportunities in the Asia Pacific cycling wear industry include the growing demand for sustainable and ethically sourced materials, the development of personalized and customized cycling wear, and expanding market penetration in developing economies with rising middle classes. The integration of advanced technologies like augmented reality and virtual reality in cycling training and experiences also presents promising avenues for future growth.

Major Players in the Asia Pacific Cycling Wear Industry Ecosystem

- Pedego Inc

- Accell Group

- HMC Group

- Neuron Mobility

- Dorel Industries Inc

- Nixeycles

- Merida Bikes

- Giant Bicycles

- Benno Bikes LLC

- Avon Cycles Ltd

- Bridgestone Corporation

Key Developments in Asia Pacific Cycling Wear Industry Industry

- June 2022: Ninety One Cycles launched the Black Arrow 700C bike, featuring a 7-speed EZ fire rear shifter, hybrid fork, Shimano 7-speed gear set, 160mm disk brakes, and high-traction nylon tires. This launch broadened the selection of affordable yet well-equipped bikes.

- April 2022: Neuron Mobility deployed 250 safety-first e-bikes in Sydney, Australia, equipped with Google Maps integration for enhanced rider convenience. This reflects the increasing trend towards e-bike sharing services in urban areas.

- October 2021: Hero MotorCorp (HMC) and Yamaha formed a joint venture to produce electric motors for e-bikes, indicating collaborative efforts to capitalize on the e-bike market’s growth. This partnership significantly strengthens the supply chain within the e-bike sector.

Strategic Asia Pacific Cycling Wear Industry Market Forecast

The Asia Pacific cycling wear industry is poised for sustained growth, driven by several factors. The increasing popularity of cycling as a recreational activity and a mode of sustainable transport, coupled with technological advancements in e-bikes and cycling apparel, are key catalysts. Furthermore, government initiatives promoting cycling infrastructure and supportive policies are fostering market expansion. The market is expected to witness substantial growth over the next decade, offering significant opportunities for businesses to invest and capitalize on emerging trends.

Asia Pacific Cycling Wear Industry Segmentation

-

1. Type

- 1.1. Road Bicycles

- 1.2. Hybrid Bicycles

- 1.3. All-trrain Bicycles

- 1.4. E-bicycles

- 1.5. Other Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Asia Pacific Cycling Wear Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Cycling Wear Industry Regional Market Share

Geographic Coverage of Asia Pacific Cycling Wear Industry

Asia Pacific Cycling Wear Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Continuation of Increasing Demand for Bicycles in India

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Cycling Wear Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Road Bicycles

- 5.1.2. Hybrid Bicycles

- 5.1.3. All-trrain Bicycles

- 5.1.4. E-bicycles

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pedego Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Accell Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HMC Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Neuron Mobility*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dorel Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nixeycles

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Merida Bikes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Giant Bicycles

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Benno Bikes LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avon Cycles Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bridgestone Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Pedego Inc

List of Figures

- Figure 1: Asia Pacific Cycling Wear Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Cycling Wear Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia Pacific Cycling Wear Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Cycling Wear Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Cycling Wear Industry?

The projected CAGR is approximately 6.29%.

2. Which companies are prominent players in the Asia Pacific Cycling Wear Industry?

Key companies in the market include Pedego Inc, Accell Group, HMC Group, Neuron Mobility*List Not Exhaustive, Dorel Industries Inc, Nixeycles, Merida Bikes, Giant Bicycles, Benno Bikes LLC, Avon Cycles Ltd, Bridgestone Corporation.

3. What are the main segments of the Asia Pacific Cycling Wear Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Continuation of Increasing Demand for Bicycles in India.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

In June 2022, Ninety One Cycles launched a new Black Arrow 700C bike. The features of the bike include a 7-speed EZ fire rear shifter, a hybrid fork for jerk absorption, and a Shimano 7-speed gear set. The cycle comes with 160mm disk brakes and high-traction nylon tires.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Cycling Wear Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Cycling Wear Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Cycling Wear Industry?

To stay informed about further developments, trends, and reports in the Asia Pacific Cycling Wear Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence