Key Insights

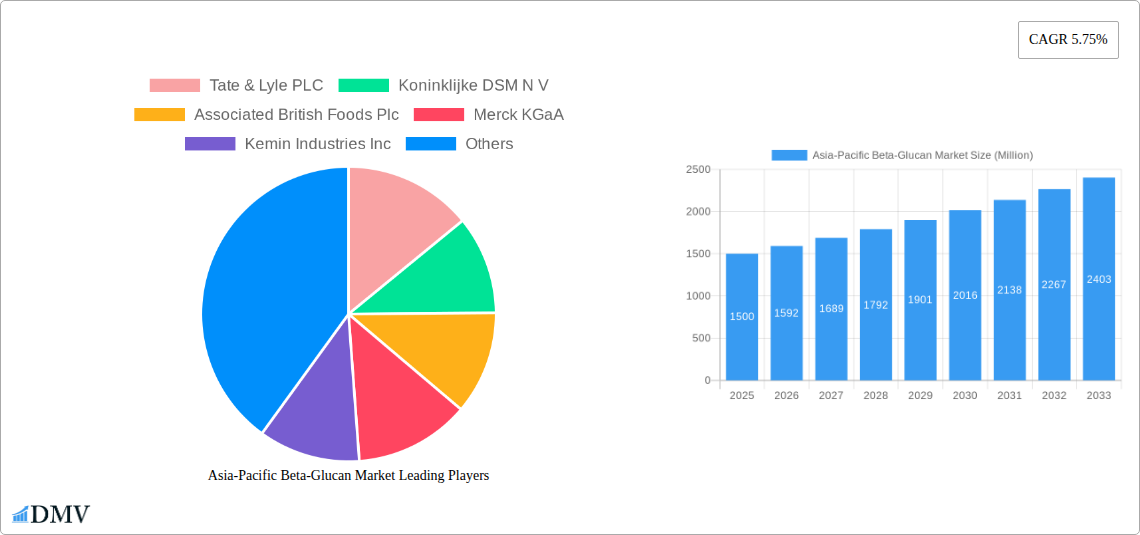

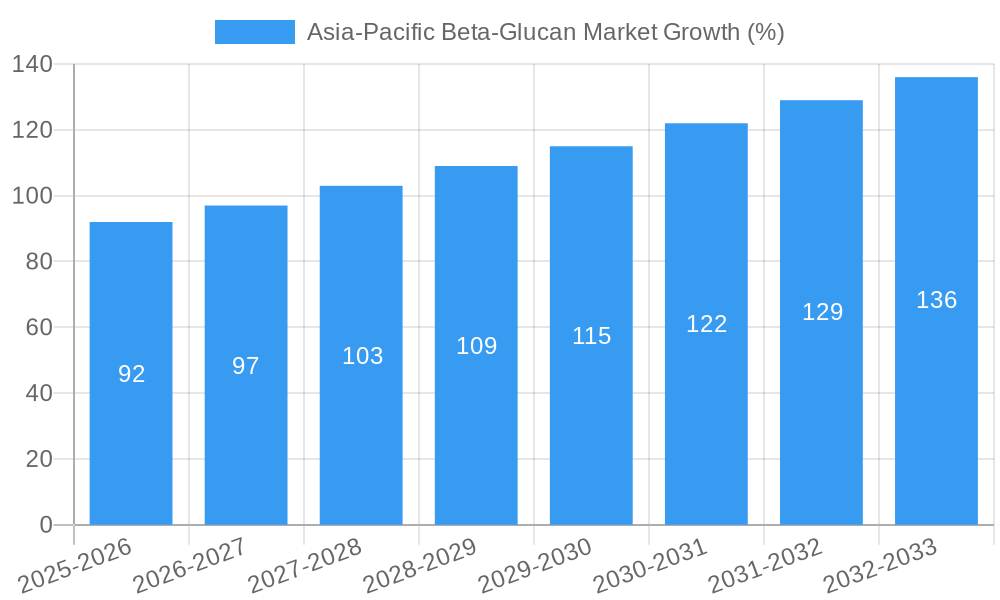

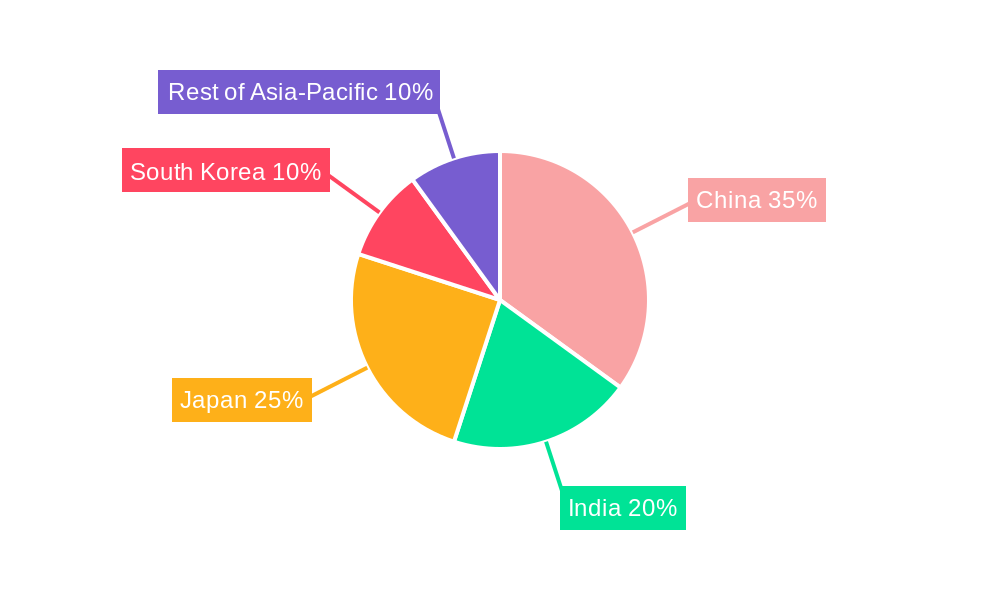

The Asia-Pacific beta-glucan market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.75% from 2025 to 2033. This expansion is fueled by several key drivers. Rising consumer awareness of the health benefits associated with beta-glucan, particularly its role in boosting immunity and improving gut health, is a significant factor. The increasing prevalence of chronic diseases like diabetes and cardiovascular ailments is further driving demand for functional foods and dietary supplements containing beta-glucan. Furthermore, the burgeoning food and beverage industry in the region, with a growing preference for natural and functional ingredients, presents significant opportunities for beta-glucan manufacturers. Innovation in beta-glucan extraction methods, leading to higher purity and cost-effectiveness, is another contributing factor. Key market segments include soluble and insoluble beta-glucan, with applications spanning food and beverages, healthcare and dietary supplements, and other sectors. China, Japan, India, and South Korea are expected to be the major contributors to market growth within the Asia-Pacific region, driven by their large populations, expanding middle classes, and increasing health consciousness. While regulatory hurdles and potential fluctuations in raw material prices could pose challenges, the overall market outlook remains positive, with significant potential for expansion throughout the forecast period. The competitive landscape is characterized by a mix of established multinational corporations and regional players, fostering innovation and competition.

The market segmentation reveals the dominant role of food and beverage applications, followed by the healthcare and dietary supplements sector. Soluble beta-glucan, due to its better solubility and easier incorporation into products, is expected to hold a larger market share compared to insoluble beta-glucan. Cereal-based beta-glucan currently dominates the source segment, but yeast and mushroom-derived beta-glucan are experiencing growth due to their higher purity and functional properties. Geographic variations exist within the Asia-Pacific region, with China and India potentially exhibiting the highest growth rates due to their expansive populations and rapidly evolving consumer preferences. The forecast period will likely witness increased investment in research and development, leading to new product formulations and applications for beta-glucan, further enhancing its market appeal and driving future growth.

Asia-Pacific Beta-Glucan Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Asia-Pacific beta-glucan market, offering a comprehensive overview of market size, growth drivers, challenges, and future opportunities. With a focus on the period 2019-2033, including a base year of 2025 and an estimated year of 2025, this report is an invaluable resource for stakeholders seeking to understand and capitalize on the potential of this dynamic market. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR. This in-depth analysis covers key segments including soluble and insoluble beta-glucans, across applications such as food & beverages, healthcare & dietary supplements, and other applications, sourced from cereal, yeast, mushroom, and other sources. Leading players like Tate & Lyle PLC, Koninklijke DSM N.V., and Associated British Foods Plc are profiled, providing valuable competitive intelligence.

Asia-Pacific Beta-Glucan Market Composition & Trends

The Asia-Pacific beta-glucan market exhibits a moderately fragmented landscape, with several key players holding significant market share but no single dominant entity. The market concentration ratio (CR5) is estimated at xx%, reflecting a relatively competitive environment. Innovation is a key driver, with companies constantly developing new beta-glucan products with enhanced functionalities and improved efficacy. Regulatory landscapes vary across the region, influencing product approvals and market access. Substitute products, such as other dietary fibers, pose a competitive threat, but the unique health benefits of beta-glucan are driving its adoption. End-users span food and beverage manufacturers, healthcare companies, and dietary supplement producers. M&A activities have been moderate, with deal values averaging xx Million in recent years.

- Market Share Distribution (2024): Tate & Lyle PLC (xx%), Koninklijke DSM N.V. (xx%), Associated British Foods Plc (xx%), Others (xx%).

- Average M&A Deal Value (2019-2024): xx Million

- Key Innovation Catalysts: Improved extraction techniques, functionalization of beta-glucans for specific applications, development of novel delivery systems.

Asia-Pacific Beta-Glucan Market Industry Evolution

The Asia-Pacific beta-glucan market has witnessed significant growth over the historical period (2019-2024), driven primarily by increasing consumer awareness of health and wellness, coupled with the rising prevalence of chronic diseases. The market exhibited a CAGR of xx% during this period, and is expected to maintain a strong growth trajectory during the forecast period (2025-2033). Technological advancements in extraction and purification techniques have improved the quality and affordability of beta-glucans, accelerating market penetration. A notable shift in consumer demand towards functional foods and dietary supplements further fuels this market's expansion. The adoption of beta-glucan in various applications, particularly in food and beverages, has steadily increased, demonstrating its versatility and market acceptance. The increasing demand for convenient and easily digestible forms of beta-glucan is driving innovation in product formats. This trend is further bolstered by growing investments in research and development, which are fueling the creation of newer, higher quality beta-glucan products with superior efficacy.

Leading Regions, Countries, or Segments in Asia-Pacific Beta-Glucan Market

China and Japan are currently the leading markets for beta-glucan in the Asia-Pacific region. This dominance is driven by several factors:

- China: High population, rising disposable incomes, increasing health consciousness, and substantial investments in the food and beverage sector. Regulatory support for functional foods is also a key driver.

- Japan: High consumer awareness of health benefits, coupled with a strong market for functional foods and dietary supplements.

- Dominant Segments: Soluble beta-glucan holds a larger market share compared to insoluble beta-glucan due to its better solubility and easier incorporation into various products. The food and beverage application segment is the largest, driven by strong demand for functional foods. Yeast is the primary source of beta-glucan, due to its cost-effectiveness and large-scale production.

Key Drivers:

- Significant investments in research and development to enhance beta-glucan functionality.

- Favorable regulatory environments that support the inclusion of beta-glucan in food and beverage products.

- Rising consumer demand for health-conscious food options with demonstrable health benefits.

Asia-Pacific Beta-Glucan Market Product Innovations

Recent innovations focus on enhancing the solubility, stability, and bioavailability of beta-glucans. New product forms like encapsulated beta-glucans and beta-glucan-based blends are emerging. These innovations cater to specific consumer needs, including improved taste and texture. Technological advancements, such as microencapsulation and nanotechnology, are enhancing the efficacy and shelf life of beta-glucan products. Unique selling propositions include improved immune support, cholesterol-lowering properties, and prebiotic effects.

Propelling Factors for Asia-Pacific Beta-Glucan Market Growth

Several factors contribute to the growth of the Asia-Pacific beta-glucan market:

- Growing health consciousness: Consumers are increasingly adopting healthier lifestyles and seeking out foods and supplements with health benefits.

- Rising prevalence of chronic diseases: The increasing incidence of diabetes, cardiovascular diseases, and other chronic illnesses is driving demand for functional ingredients like beta-glucan.

- Favorable government regulations: Governments in many Asia-Pacific countries are supporting the development and use of functional foods and dietary supplements.

Obstacles in the Asia-Pacific Beta-Glucan Market

Challenges include:

- Fluctuations in raw material prices: Variations in the cost of raw materials can impact the profitability of beta-glucan production.

- Stringent regulatory approvals: The process of obtaining regulatory approvals for new products can be time-consuming and expensive.

- Intense competition: The market is becoming increasingly competitive, with both established and new players vying for market share.

Future Opportunities in Asia-Pacific Beta-Glucan Market

Future opportunities include:

- Expansion into new applications: Beta-glucan is finding applications in areas beyond food and beverages, such as cosmetics and animal feed.

- Development of novel product formulations: Innovation in product delivery systems can enhance the appeal and efficacy of beta-glucan products.

- Growing demand from emerging economies: The rising middle class in many Asia-Pacific countries is driving demand for higher-quality food and health products.

Major Players in the Asia-Pacific Beta-Glucan Market Ecosystem

- Tate & Lyle PLC

- Koninklijke DSM N.V.

- Associated British Foods Plc

- Merck KGaA

- Kemin Industries Inc

- Angel Yeast Co Ltd

- Kerry Group plc

Key Developments in Asia-Pacific Beta-Glucan Market Industry

- 2024 Q4: Koninklijke DSM N.V. launched a new line of soluble beta-glucan ingredients for the food and beverage industry.

- 2023 Q3: Tate & Lyle PLC announced a strategic partnership to expand its beta-glucan production capacity in the Asia-Pacific region.

- 2022 Q1: A major merger between two beta-glucan producers led to increased market consolidation. (Further details on the merger would be included in the full report).

Strategic Asia-Pacific Beta-Glucan Market Forecast

The Asia-Pacific beta-glucan market is poised for significant growth in the coming years, driven by increasing consumer awareness of health benefits, growing demand for functional foods and dietary supplements, and technological advancements in beta-glucan production. The market is expected to benefit from increased investments in research and development, leading to the development of innovative products with improved functionalities and wider applications. The expansion into new markets and consumer segments will further fuel market growth, making the Asia-Pacific region a significant hub for the beta-glucan industry.

Asia-Pacific Beta-Glucan Market Segmentation

-

1. Category

- 1.1. Soluble

- 1.2. Insoluble

-

2. Application

- 2.1. Food and Beverages

- 2.2. Healthcare and Dietary Supplements

- 2.3. Other Applications

-

3. Source

- 3.1. Cereal

- 3.2. Yeast

- 3.3. Mushroom

- 3.4. Other Sources

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Asia-Pacific Beta-Glucan Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Beta-Glucan Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Application in Dietary Supplements

- 3.3. Market Restrains

- 3.3.1. High Production Costs for Beta-Glucan

- 3.4. Market Trends

- 3.4.1. Increased Demand for Algae derived Beta Glucan in Dietary Supplements

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Soluble

- 5.1.2. Insoluble

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Food and Beverages

- 5.2.2. Healthcare and Dietary Supplements

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Source

- 5.3.1. Cereal

- 5.3.2. Yeast

- 5.3.3. Mushroom

- 5.3.4. Other Sources

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. China Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. Soluble

- 6.1.2. Insoluble

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Food and Beverages

- 6.2.2. Healthcare and Dietary Supplements

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Source

- 6.3.1. Cereal

- 6.3.2. Yeast

- 6.3.3. Mushroom

- 6.3.4. Other Sources

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. Japan Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. Soluble

- 7.1.2. Insoluble

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Food and Beverages

- 7.2.2. Healthcare and Dietary Supplements

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Source

- 7.3.1. Cereal

- 7.3.2. Yeast

- 7.3.3. Mushroom

- 7.3.4. Other Sources

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. India Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. Soluble

- 8.1.2. Insoluble

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Food and Beverages

- 8.2.2. Healthcare and Dietary Supplements

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Source

- 8.3.1. Cereal

- 8.3.2. Yeast

- 8.3.3. Mushroom

- 8.3.4. Other Sources

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. Australia Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. Soluble

- 9.1.2. Insoluble

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Food and Beverages

- 9.2.2. Healthcare and Dietary Supplements

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Source

- 9.3.1. Cereal

- 9.3.2. Yeast

- 9.3.3. Mushroom

- 9.3.4. Other Sources

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Rest of Asia Pacific Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. Soluble

- 10.1.2. Insoluble

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Food and Beverages

- 10.2.2. Healthcare and Dietary Supplements

- 10.2.3. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Source

- 10.3.1. Cereal

- 10.3.2. Yeast

- 10.3.3. Mushroom

- 10.3.4. Other Sources

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. China Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific Beta-Glucan Market Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 Tate & Lyle PLC

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Koninklijke DSM N V

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Associated British Foods Plc

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 Merck KGaA

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 Kemin Industries Inc

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 Angel Yeast Co Ltd

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 Kerry Group plc

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.1 Tate & Lyle PLC

List of Figures

- Figure 1: Asia-Pacific Beta-Glucan Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Beta-Glucan Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 3: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 5: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: China Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Japan Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: South Korea Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Taiwan Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Australia Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia-Pacific Asia-Pacific Beta-Glucan Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 16: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 18: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 19: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 21: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 23: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 26: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 28: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 29: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 31: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 33: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 34: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Category 2019 & 2032

- Table 36: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Application 2019 & 2032

- Table 37: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Source 2019 & 2032

- Table 38: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 39: Asia-Pacific Beta-Glucan Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Beta-Glucan Market?

The projected CAGR is approximately 5.75%.

2. Which companies are prominent players in the Asia-Pacific Beta-Glucan Market?

Key companies in the market include Tate & Lyle PLC, Koninklijke DSM N V, Associated British Foods Plc, Merck KGaA, Kemin Industries Inc, Angel Yeast Co Ltd, Kerry Group plc.

3. What are the main segments of the Asia-Pacific Beta-Glucan Market?

The market segments include Category, Application, Source, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Application in Dietary Supplements.

6. What are the notable trends driving market growth?

Increased Demand for Algae derived Beta Glucan in Dietary Supplements.

7. Are there any restraints impacting market growth?

High Production Costs for Beta-Glucan.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Beta-Glucan Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Beta-Glucan Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Beta-Glucan Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Beta-Glucan Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence