Key Insights

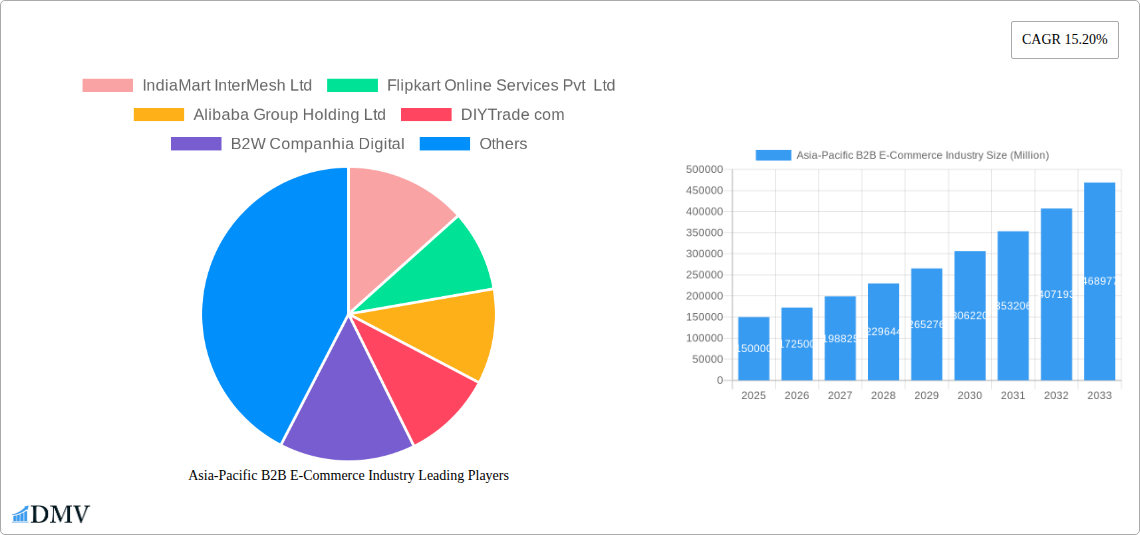

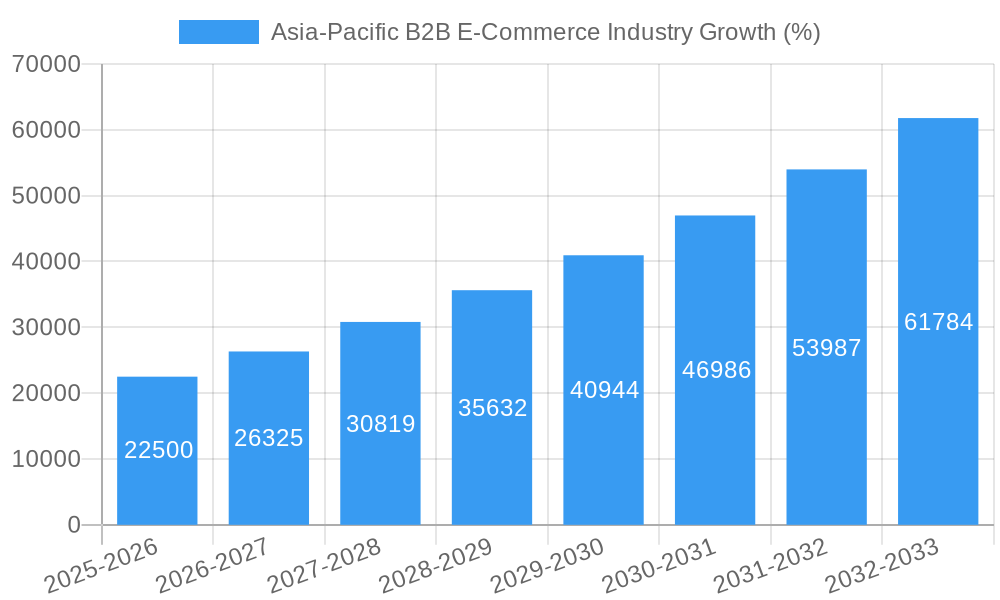

The Asia-Pacific B2B e-commerce market is experiencing robust growth, driven by the region's expanding digital infrastructure, increasing internet and smartphone penetration, and a burgeoning small and medium-sized enterprise (SME) sector eager to embrace digitalization for enhanced efficiency and market reach. The market's Compound Annual Growth Rate (CAGR) of 15.20% from 2019 to 2024 indicates a significant upward trajectory. Key drivers include government initiatives promoting digital adoption, the rising preference for online procurement among businesses, and the emergence of specialized B2B e-commerce platforms catering to diverse industry needs. Growth is particularly strong in countries like China, India, and Japan, fueled by their large and rapidly developing economies. While the direct sales channel remains significant, marketplace sales are gaining traction, offering businesses access to wider customer bases and streamlined logistics. Challenges include the need for robust cybersecurity measures, concerns around data privacy, and the digital literacy gap in certain segments of the population, particularly in smaller businesses and rural areas. However, ongoing investments in technological infrastructure and digital literacy programs are gradually mitigating these concerns. The competitive landscape is dynamic, with both established international players and regional companies vying for market share. The forecast period (2025-2033) anticipates continued strong growth, exceeding the previously observed CAGR and likely surpassing $X billion (estimated based on the 2019-2024 CAGR and current market trends) by 2033, as the market continues to mature and broaden its reach across various industries and regions within the Asia-Pacific.

The future of the Asia-Pacific B2B e-commerce market hinges on overcoming existing infrastructural limitations and enhancing digital literacy. Continued investment in logistics and payment infrastructure, along with focused training initiatives, will be crucial for unlocking the full potential of this dynamic market segment. Furthermore, the adoption of innovative technologies, such as artificial intelligence and blockchain, is poised to streamline processes, enhance security, and foster greater transparency within B2B e-commerce transactions. The increasing sophistication of B2B e-commerce platforms and the growing integration of various business processes onto a single platform are also expected to fuel market growth. The expansion into underserved segments and the adoption of cross-border e-commerce strategies will also drive the market forward.

Asia-Pacific B2B E-Commerce Industry: Market Analysis & Forecast (2019-2033)

This comprehensive report provides an in-depth analysis of the burgeoning Asia-Pacific B2B e-commerce market, projecting robust growth from 2025 to 2033. We delve into market dynamics, competitive landscapes, technological advancements, and key regional trends, offering invaluable insights for stakeholders across the industry. The report utilizes data from the historical period (2019-2024), with the base year set at 2025 and forecasts extending to 2033. The total market value is expected to reach xx Million by 2033.

Asia-Pacific B2B E-Commerce Industry Market Composition & Trends

This section examines the competitive intensity, innovative drivers, regulatory frameworks, substitute products, and end-user profiles shaping the Asia-Pacific B2B e-commerce landscape. We analyze mergers and acquisitions (M&A) activity, providing a clear picture of market share distribution and deal values.

Market Concentration: The Asia-Pacific B2B e-commerce market exhibits a moderately concentrated structure, with several dominant players commanding significant market share. IndiaMart, Alibaba, and Amazon hold a combined xx% market share (estimated 2025). However, a significant number of smaller, niche players contribute to the overall market vibrancy.

Innovation Catalysts: Technological advancements, particularly in areas such as Artificial Intelligence (AI), big data analytics, and mobile commerce, are driving innovation. The increasing adoption of cloud-based solutions and improved logistics infrastructure further fuels market growth.

Regulatory Landscape: Varying regulatory landscapes across different Asia-Pacific countries impact market dynamics. Evolving data privacy regulations and cross-border trade policies are key considerations for businesses operating in the region.

Substitute Products: Traditional B2B sales channels, such as physical trade shows and direct sales representatives, continue to compete with online platforms. However, the convenience and efficiency offered by e-commerce are increasingly driving market share gains.

End-User Profiles: The Asia-Pacific B2B e-commerce market serves a diverse range of industries and business sizes, from small and medium-sized enterprises (SMEs) to large multinational corporations. Industries like manufacturing, retail, and healthcare are significant contributors to market revenue.

M&A Activities: The Asia-Pacific B2B e-commerce sector has witnessed significant M&A activity in recent years, with deal values totaling xx Million in 2024 (estimated). These transactions aim to expand market reach, enhance technology capabilities, and improve supply chain efficiency.

Asia-Pacific B2B E-Commerce Industry Industry Evolution

This section details the evolution of the Asia-Pacific B2B e-commerce industry, focusing on market growth trajectories, technological innovations, and changing customer expectations.

The Asia-Pacific B2B e-commerce market has witnessed phenomenal growth over the past few years, driven by factors such as increasing internet penetration, rising smartphone usage, and the growing preference for online transactions among businesses. From 2019 to 2024, the market experienced a Compound Annual Growth Rate (CAGR) of xx%, reaching a value of xx Million in 2024. This strong growth trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, resulting in a market size of xx Million by 2033.

Technological advancements have been instrumental in shaping the industry’s evolution. The adoption of mobile-first e-commerce platforms, the increasing use of AI-powered tools for customer relationship management (CRM) and inventory management, and the rise of blockchain technology for secure transactions have significantly transformed the industry landscape. Furthermore, the increasing sophistication of logistics and supply chain management has addressed previous bottlenecks in e-commerce operations. Changing customer demands for personalized experiences, seamless omnichannel integration, and secure payment gateways have further propelled market growth and spurred platform innovation.

Leading Regions, Countries, or Segments in Asia-Pacific B2B E-Commerce Industry

This section identifies the dominant regions, countries, and segments within the Asia-Pacific B2B e-commerce market, focusing on By Channel: Direct Sales and Marketplace Sales.

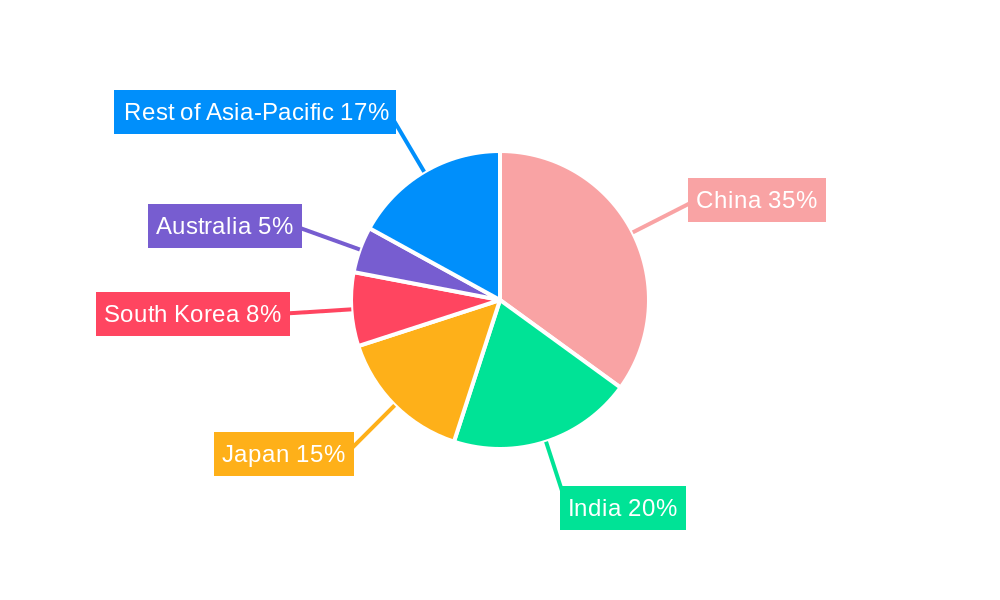

Dominant Region/Country: China and India currently lead the Asia-Pacific B2B e-commerce market, driven by a combination of factors, including large business populations, high internet penetration, and supportive government policies.

Segment Analysis:

Marketplace Sales: This segment dominates the market share, leveraging extensive networks of suppliers and buyers. The ease of access and large product selection attracts a wide range of businesses, contributing significantly to the overall market value.

Direct Sales: While smaller than Marketplace Sales, Direct Sales is growing steadily, particularly among established businesses preferring direct relationships with suppliers. The focus on customized solutions and improved control over the customer experience is driving the growth.

Key Drivers:

- Investment Trends: Significant venture capital and private equity investments fuel platform development and expansion.

- Regulatory Support: Supportive government policies promoting digitalization and e-commerce in several Asia-Pacific nations boost market development.

- Technological Advancements: Innovations in logistics, payment gateways, and supply chain solutions significantly improve the efficiency and reliability of B2B e-commerce platforms.

Asia-Pacific B2B E-Commerce Industry Product Innovations

Recent product innovations in the Asia-Pacific B2B e-commerce sector focus on improving the overall customer experience. Platforms are incorporating AI-powered tools for personalized product recommendations, chatbots for enhanced customer support, and advanced analytics for sales forecasting and inventory management. The integration of blockchain technology enhances security and transparency in transactions. These innovations provide unique selling propositions, improving platform efficiency and customer loyalty.

Propelling Factors for Asia-Pacific B2B E-Commerce Industry Growth

Several factors fuel the growth of the Asia-Pacific B2B e-commerce market. Firstly, increasing internet and smartphone penetration across the region expands the potential customer base. Secondly, supportive government policies promoting digitalization facilitate online business expansion. Thirdly, the rise of fintech solutions provides secure and convenient online payment options. Finally, technological advancements in logistics, such as improved delivery infrastructure and efficient inventory management systems, significantly contribute to improved platform efficiency and adoption.

Obstacles in the Asia-Pacific B2B E-Commerce Industry Market

Despite its significant potential, the Asia-Pacific B2B e-commerce market faces several challenges. Varying levels of digital literacy across different regions create an adoption barrier for some businesses. Furthermore, concerns surrounding data security and privacy remain a significant obstacle. Supply chain disruptions, particularly evident during the recent global pandemic, continue to impact businesses reliant on online transactions. Finally, intense competition among various platforms necessitates continuous innovation and adaptation to stay ahead.

Future Opportunities in Asia-Pacific B2B E-Commerce Industry

The Asia-Pacific B2B e-commerce market holds tremendous future potential. The expansion of e-commerce into previously underserved markets creates significant growth opportunities. The integration of emerging technologies, such as AI, IoT, and 5G, will further improve platform efficiency and customer experience. Finally, a growing focus on sustainability and ethical sourcing provides opportunities for platforms promoting eco-friendly business practices.

Major Players in the Asia-Pacific B2B E-Commerce Industry Ecosystem

- IndiaMart InterMesh Ltd

- Flipkart Online Services Pvt Ltd

- Alibaba Group Holding Ltd

- DIYTrade com

- B2W Companhia Digital

- KOMPASS

- ChinaAseanTrade com

- Amazon com Inc

- EWORLDTRADE Inc

- eBay Inc

Key Developments in Asia-Pacific B2B E-Commerce Industry Industry

- June 2022: Vertiv launched its official store on Tokopedia, expanding its Southeast Asian e-commerce presence. This highlights the growing importance of online channels for reaching B2B customers in the region.

- June 2022: Ramagya Mart added home appliance categories to its B2B platform, significantly increasing product selection and attracting 900 new manufacturers. This demonstrates the ongoing expansion and diversification within the B2B e-commerce sector.

Strategic Asia-Pacific B2B E-Commerce Industry Market Forecast

The Asia-Pacific B2B e-commerce market is poised for continued expansion, fueled by increasing digital adoption, supportive government initiatives, and technological advancements. The focus on enhancing customer experience through innovative solutions will be crucial for future success. Untapped market potential in smaller cities and rural areas offers further opportunities for growth. The integration of emerging technologies such as AI and blockchain will continue to shape the market's future and drive greater efficiency and transparency. The market is projected to witness robust growth, maintaining a strong CAGR throughout the forecast period (2025-2033).

Asia-Pacific B2B E-Commerce Industry Segmentation

-

1. Channel

- 1.1. Direct Sales

- 1.2. Marketplace Sales

-

2. Geography

- 2.1. China

- 2.2. Japan

- 2.3. India

- 2.4. South Korea

- 2.5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. South Korea

- 5. Rest of APAC

Asia-Pacific B2B E-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support

- 3.3. Market Restrains

- 3.3.1. Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution

- 3.4. Market Trends

- 3.4.1. Advancement in Technologies Plays a Significant Role in Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Direct Sales

- 5.1.2. Marketplace Sales

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. China

- 5.2.2. Japan

- 5.2.3. India

- 5.2.4. South Korea

- 5.2.5. Rest of APAC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. South Korea

- 5.3.5. Rest of APAC

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Direct Sales

- 6.1.2. Marketplace Sales

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. China

- 6.2.2. Japan

- 6.2.3. India

- 6.2.4. South Korea

- 6.2.5. Rest of APAC

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Direct Sales

- 7.1.2. Marketplace Sales

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. China

- 7.2.2. Japan

- 7.2.3. India

- 7.2.4. South Korea

- 7.2.5. Rest of APAC

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Direct Sales

- 8.1.2. Marketplace Sales

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. China

- 8.2.2. Japan

- 8.2.3. India

- 8.2.4. South Korea

- 8.2.5. Rest of APAC

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Direct Sales

- 9.1.2. Marketplace Sales

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. China

- 9.2.2. Japan

- 9.2.3. India

- 9.2.4. South Korea

- 9.2.5. Rest of APAC

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Rest of APAC Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Direct Sales

- 10.1.2. Marketplace Sales

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. China

- 10.2.2. Japan

- 10.2.3. India

- 10.2.4. South Korea

- 10.2.5. Rest of APAC

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. China Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Japan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 13. India Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 14. South Korea Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 15. Taiwan Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 16. Australia Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 17. Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 18. Competitive Analysis

- 18.1. Market Share Analysis 2024

- 18.2. Company Profiles

- 18.2.1 IndiaMart InterMesh Ltd

- 18.2.1.1. Overview

- 18.2.1.2. Products

- 18.2.1.3. SWOT Analysis

- 18.2.1.4. Recent Developments

- 18.2.1.5. Financials (Based on Availability)

- 18.2.2 Flipkart Online Services Pvt Ltd

- 18.2.2.1. Overview

- 18.2.2.2. Products

- 18.2.2.3. SWOT Analysis

- 18.2.2.4. Recent Developments

- 18.2.2.5. Financials (Based on Availability)

- 18.2.3 Alibaba Group Holding Ltd

- 18.2.3.1. Overview

- 18.2.3.2. Products

- 18.2.3.3. SWOT Analysis

- 18.2.3.4. Recent Developments

- 18.2.3.5. Financials (Based on Availability)

- 18.2.4 DIYTrade com

- 18.2.4.1. Overview

- 18.2.4.2. Products

- 18.2.4.3. SWOT Analysis

- 18.2.4.4. Recent Developments

- 18.2.4.5. Financials (Based on Availability)

- 18.2.5 B2W Companhia Digital

- 18.2.5.1. Overview

- 18.2.5.2. Products

- 18.2.5.3. SWOT Analysis

- 18.2.5.4. Recent Developments

- 18.2.5.5. Financials (Based on Availability)

- 18.2.6 KOMPASS

- 18.2.6.1. Overview

- 18.2.6.2. Products

- 18.2.6.3. SWOT Analysis

- 18.2.6.4. Recent Developments

- 18.2.6.5. Financials (Based on Availability)

- 18.2.7 ChinaAseanTrade com

- 18.2.7.1. Overview

- 18.2.7.2. Products

- 18.2.7.3. SWOT Analysis

- 18.2.7.4. Recent Developments

- 18.2.7.5. Financials (Based on Availability)

- 18.2.8 Amazon com Inc

- 18.2.8.1. Overview

- 18.2.8.2. Products

- 18.2.8.3. SWOT Analysis

- 18.2.8.4. Recent Developments

- 18.2.8.5. Financials (Based on Availability)

- 18.2.9 EWORLDTRADE Inc

- 18.2.9.1. Overview

- 18.2.9.2. Products

- 18.2.9.3. SWOT Analysis

- 18.2.9.4. Recent Developments

- 18.2.9.5. Financials (Based on Availability)

- 18.2.10 eBay Inc

- 18.2.10.1. Overview

- 18.2.10.2. Products

- 18.2.10.3. SWOT Analysis

- 18.2.10.4. Recent Developments

- 18.2.10.5. Financials (Based on Availability)

- 18.2.1 IndiaMart InterMesh Ltd

List of Figures

- Figure 1: Asia-Pacific B2B E-Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific B2B E-Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 3: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific B2B E-Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 14: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 17: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 20: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 23: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Channel 2019 & 2032

- Table 26: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 27: Asia-Pacific B2B E-Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific B2B E-Commerce Industry?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Asia-Pacific B2B E-Commerce Industry?

Key companies in the market include IndiaMart InterMesh Ltd, Flipkart Online Services Pvt Ltd, Alibaba Group Holding Ltd, DIYTrade com, B2W Companhia Digital, KOMPASS, ChinaAseanTrade com, Amazon com Inc, EWORLDTRADE Inc, eBay Inc.

3. What are the main segments of the Asia-Pacific B2B E-Commerce Industry?

The market segments include Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in Technologies; Increasing Business Interest towards Convenient Shopping solutions; Regulatory and Government Support.

6. What are the notable trends driving market growth?

Advancement in Technologies Plays a Significant Role in Market Growth.

7. Are there any restraints impacting market growth?

Risk of Data Breach in Storing and Processing Large Data in Next-gen Computing; High operational challenges in Implementing the Solution.

8. Can you provide examples of recent developments in the market?

June 2022 - Vertiv, a provider of critical digital infrastructure and continuity solutions, announced opening its official store in Tokopedia, Indonesia's e-commerce platform. This is part of Vertiv's continuous expansion into the e-commerce space in Southeast Asia, reaching more customers looking to buy small to medium-sized uninterruptible power supply (UPS) solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific B2B E-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific B2B E-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific B2B E-Commerce Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific B2B E-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence