Key Insights

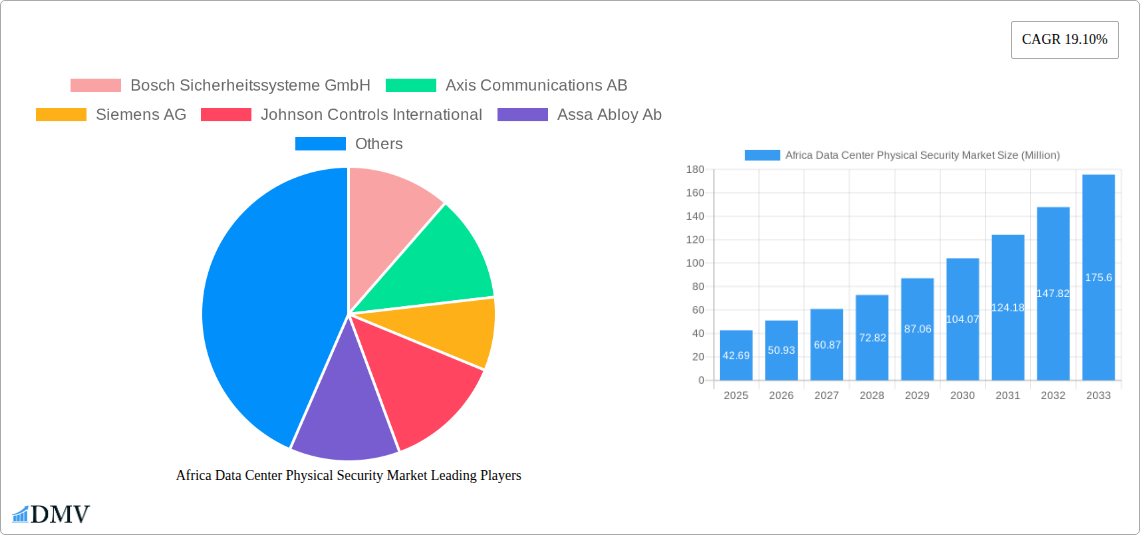

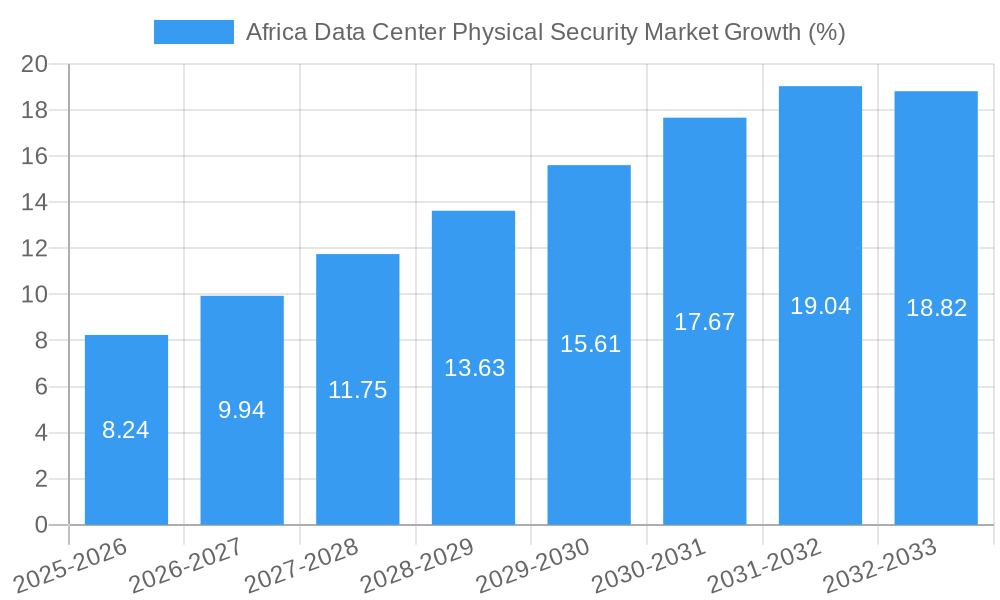

The Africa Data Center Physical Security Market is experiencing robust growth, projected to reach \$42.69 million in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 19.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning digital economy across Africa is driving increased investment in data centers, necessitating robust security measures to protect sensitive data and infrastructure. Secondly, growing awareness of cybersecurity threats and data breaches is pushing organizations to adopt advanced physical security solutions, including access control systems, video surveillance, intrusion detection, and perimeter security. The increasing adoption of cloud computing and the rising demand for colocation services further contribute to this market's growth trajectory. Key players like Bosch, Axis Communications, Siemens, and Johnson Controls are actively participating in this expanding market, offering a diverse range of solutions tailored to the specific needs of African data centers. However, challenges remain, including infrastructural limitations in some regions, inconsistent regulatory frameworks, and the need for skilled cybersecurity professionals. Despite these restraints, the long-term outlook for the Africa Data Center Physical Security Market remains positive, driven by sustained economic growth and the increasing digitization of African economies.

The market segmentation is likely diverse, reflecting variations in security needs based on data center size, location, and client requirements. Smaller data centers might prioritize cost-effective solutions, while larger facilities with more sensitive data might invest in more sophisticated, integrated systems. Regional disparities within Africa are also expected, with more developed economies exhibiting higher adoption rates than less developed ones. The forecast period (2025-2033) will witness a significant expansion of the market, potentially influenced by government initiatives promoting digital infrastructure development and increased private sector investments in data center security. The historical period (2019-2024) likely saw a slower growth rate compared to the forecast period, reflecting the earlier stages of market development and slower adoption of advanced security technologies. Future growth will hinge on overcoming existing challenges and continued investment in both technological advancement and skilled workforce development.

Africa Data Center Physical Security Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa Data Center Physical Security Market, offering a comprehensive overview of market dynamics, growth drivers, challenges, and future opportunities. Spanning the period from 2019 to 2033, with a focus on 2025, this report is essential for stakeholders seeking to navigate this rapidly evolving landscape. The market is projected to reach xx Million by 2033, presenting significant investment and growth potential.

Africa Data Center Physical Security Market Composition & Trends

This section delves into the intricate composition of the Africa Data Center Physical Security Market, analyzing its structure, trends, and key players. We examine market concentration, revealing the market share distribution amongst leading players like Bosch Sicherheitssysteme GmbH, Axis Communications AB, Siemens AG, Johnson Controls International, Assa Abloy Ab, Schneider Electric SE, ABB Ltd, Suprema Inc, and Brivo Systems LLC (list not exhaustive). We quantify M&A activity with an estimated xx Million in deal values during the historical period (2019-2024). The report further explores innovation catalysts, regulatory landscapes (including evolving data privacy regulations impacting security solutions), the prevalence of substitute products, detailed end-user profiles (including hyperscalers, colocation providers, and enterprises), and the overall competitive intensity.

- Market Concentration: Analysis of market share held by top 5 players, illustrating the level of competition. We estimate the top 5 players collectively hold xx% of the market share in 2025.

- Innovation Catalysts: Examination of technological advancements driving market growth, including AI-powered surveillance, biometric authentication, and advanced access control systems.

- Regulatory Landscape: A detailed overview of relevant regulations and their impact on market growth.

- Substitute Products: Assessment of alternative security solutions and their potential impact on market penetration.

- End-User Profiles: Detailed segmentation of end-users based on their specific security requirements and budgetary constraints.

- M&A Activity: Analysis of significant mergers and acquisitions, including deal values and their impact on market dynamics.

Africa Data Center Physical Security Market Industry Evolution

This section meticulously traces the evolutionary trajectory of the Africa Data Center Physical Security Market from 2019 to 2033. We examine market growth trajectories, revealing a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including the increasing adoption of cloud computing, the rise of data centers across the continent, and growing concerns about data security and cyber threats. The analysis further encompasses technological advancements, such as the integration of IoT devices and AI-powered security systems, and the shifting consumer demands towards more sophisticated and integrated security solutions. The report also details the adoption rates of various security technologies within the data center sector in Africa, highlighting the growing preference for advanced solutions.

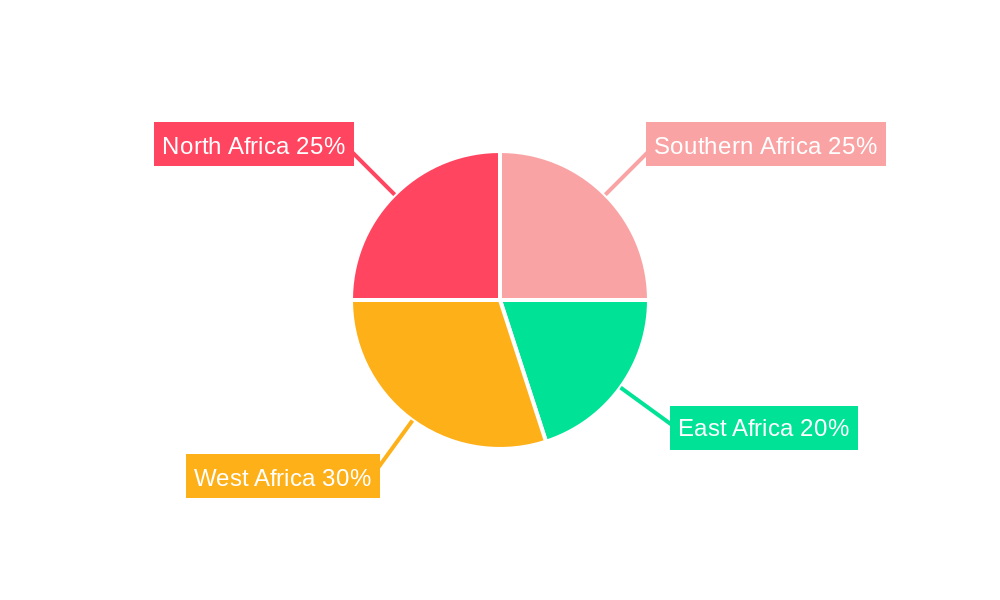

Leading Regions, Countries, or Segments in Africa Data Center Physical Security Market

This section identifies the dominant regions and countries within the Africa Data Center Physical Security Market. The report will highlight the leading region/country (e.g., South Africa, Nigeria, Kenya) and provide a detailed analysis of factors contributing to its dominance.

- Key Drivers:

- Investment Trends: Analysis of investments in data center infrastructure and security solutions within the dominant region/country.

- Regulatory Support: Assessment of government policies and initiatives promoting data center development and security.

- Economic Growth: Correlation between economic growth and the expansion of the data center physical security market.

- Dominance Factors: In-depth discussion of factors propelling the market's growth in the leading region/country, including market size, technological adoption rates, and competitive landscape.

Africa Data Center Physical Security Market Product Innovations

Recent innovations have significantly enhanced the capabilities of physical security systems within African data centers. This includes the integration of AI and machine learning for advanced threat detection, biometric authentication systems offering enhanced security and convenience, and advanced access control systems providing granular control over access privileges. These innovative solutions boast improved performance metrics, such as reduced false positives and quicker response times to threats, leading to enhanced security and operational efficiency. The unique selling propositions of these innovations often center on ease of integration with existing systems, improved scalability to accommodate growth, and enhanced reporting capabilities for better security management.

Propelling Factors for Africa Data Center Physical Security Market Growth

The growth of the Africa Data Center Physical Security Market is propelled by a confluence of technological, economic, and regulatory factors. The rapid expansion of the data center infrastructure across Africa, driven by increasing cloud adoption and digital transformation initiatives, fuels demand for robust security solutions. Furthermore, the rising awareness of cybersecurity threats and data breaches encourages organizations to invest heavily in advanced security technologies. Supporting government policies and regulatory frameworks focused on data protection and cybersecurity further enhance market growth.

Obstacles in the Africa Data Center Physical Security Market

Despite the significant growth potential, several factors hinder the market's expansion. Regulatory inconsistencies across different African nations create complexities for deploying and managing security systems. Supply chain disruptions can lead to delays and increased costs for procuring security equipment. Furthermore, intense competition among established and emerging players may put downward pressure on pricing and profit margins. These combined challenges require strategic planning and adaptability to effectively navigate the market.

Future Opportunities in Africa Data Center Physical Security Market

The Africa Data Center Physical Security Market presents numerous untapped opportunities. The growth of edge computing and IoT deployments will drive the demand for integrated security solutions. The increasing adoption of cloud-based security services provides scalable and cost-effective solutions. Furthermore, the focus on developing robust cybersecurity frameworks and compliance regulations will encourage further investments in sophisticated security technologies.

Major Players in the Africa Data Center Physical Security Market Ecosystem

- Bosch Sicherheitssysteme GmbH

- Axis Communications AB

- Siemens AG

- Johnson Controls International

- Assa Abloy Ab

- Schneider Electric SE

- ABB Ltd

- Suprema Inc

- Brivo Systems LLC

- List Not Exhaustive

Key Developments in Africa Data Center Physical Security Market Industry

- October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group, introducing the Zwipe Access fingerprint-scanning smart card integrated with Schneider Electric’s Continuum and Security Expert platforms, expanding reach into airports, transportation, healthcare, and data centers. This partnership signifies a significant advancement in biometric security within the data center sector.

- April 2023: Schneider Electric launched EcoCare for Modular Data Centers, a service plan offering 24/7 proactive remote monitoring and condition-based maintenance, enhancing modular data center uptime and reliability. This service demonstrates a proactive approach to data center security and maintenance, strengthening market resilience.

Strategic Africa Data Center Physical Security Market Forecast

The Africa Data Center Physical Security Market is poised for sustained growth, driven by the expanding data center infrastructure, increasing adoption of cloud technologies, and heightened awareness of cybersecurity risks. The strategic integration of advanced technologies, like AI and IoT, will further enhance security capabilities and propel market expansion. The predicted CAGR of xx% over the forecast period (2025-2033) underscores the substantial market potential and the lucrative opportunities for businesses in this dynamic sector.

Africa Data Center Physical Security Market Segmentation

-

1. Solution Type

- 1.1. Video Surveillance

- 1.2. Access Control Solutions

- 1.3. Other So

-

2. Service Type

- 2.1. Consulting Services

- 2.2. Professional Services

- 2.3. Other Service Types (System Integration Services)

-

3. End User

- 3.1. IT & Telecommunication

- 3.2. BFSI

- 3.3. Government

- 3.4. Healthcare

- 3.5. Other End Users

Africa Data Center Physical Security Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Data Center Physical Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems

- 3.4. Market Trends

- 3.4.1. The IT and Telecom Segment to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Data Center Physical Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 5.1.1. Video Surveillance

- 5.1.2. Access Control Solutions

- 5.1.3. Other So

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Consulting Services

- 5.2.2. Professional Services

- 5.2.3. Other Service Types (System Integration Services)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. IT & Telecommunication

- 5.3.2. BFSI

- 5.3.3. Government

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bosch Sicherheitssysteme GmbH

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axis Communications AB

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Johnson Controls International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Assa Abloy Ab

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schneider Electric SE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ABB Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Suprema Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Brivo Systems LLC*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Bosch Sicherheitssysteme GmbH

List of Figures

- Figure 1: Africa Data Center Physical Security Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Data Center Physical Security Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Data Center Physical Security Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Africa Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 4: Africa Data Center Physical Security Market Volume Million Forecast, by Solution Type 2019 & 2032

- Table 5: Africa Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 6: Africa Data Center Physical Security Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 7: Africa Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Africa Data Center Physical Security Market Volume Million Forecast, by End User 2019 & 2032

- Table 9: Africa Data Center Physical Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Africa Data Center Physical Security Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Africa Data Center Physical Security Market Revenue Million Forecast, by Solution Type 2019 & 2032

- Table 12: Africa Data Center Physical Security Market Volume Million Forecast, by Solution Type 2019 & 2032

- Table 13: Africa Data Center Physical Security Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 14: Africa Data Center Physical Security Market Volume Million Forecast, by Service Type 2019 & 2032

- Table 15: Africa Data Center Physical Security Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Africa Data Center Physical Security Market Volume Million Forecast, by End User 2019 & 2032

- Table 17: Africa Data Center Physical Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Africa Data Center Physical Security Market Volume Million Forecast, by Country 2019 & 2032

- Table 19: Nigeria Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Nigeria Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 21: South Africa Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Africa Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: Egypt Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Egypt Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 25: Kenya Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Kenya Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: Ethiopia Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Ethiopia Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 29: Morocco Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Morocco Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 31: Ghana Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Ghana Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 33: Algeria Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Algeria Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 35: Tanzania Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Tanzania Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 37: Ivory Coast Africa Data Center Physical Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ivory Coast Africa Data Center Physical Security Market Volume (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Data Center Physical Security Market?

The projected CAGR is approximately 19.10%.

2. Which companies are prominent players in the Africa Data Center Physical Security Market?

Key companies in the market include Bosch Sicherheitssysteme GmbH, Axis Communications AB, Siemens AG, Johnson Controls International, Assa Abloy Ab, Schneider Electric SE, ABB Ltd, Suprema Inc, Brivo Systems LLC*List Not Exhaustive.

3. What are the main segments of the Africa Data Center Physical Security Market?

The market segments include Solution Type, Service Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 42.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems.

6. What are the notable trends driving market growth?

The IT and Telecom Segment to Hold Significant Share.

7. Are there any restraints impacting market growth?

Growing Adoption of Access Control Systems Owing to Rising Crime Rates and Threats; Advancements in Video Surveillance Systems Connected to Cloud Systems.

8. Can you provide examples of recent developments in the market?

October 2023: Zwipe partnered with Schneider Electric’s Security Solutions Group. Schneider Electric will introduce its clientele to the Zwipe Access fingerprint-scanning smart card. This card will be integrated with Schneider Electric’s Continuum and Security Expert platforms, serving a client base from sectors, including airports, transportation, healthcare, and data centers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Data Center Physical Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Data Center Physical Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Data Center Physical Security Market?

To stay informed about further developments, trends, and reports in the Africa Data Center Physical Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence