Key Insights

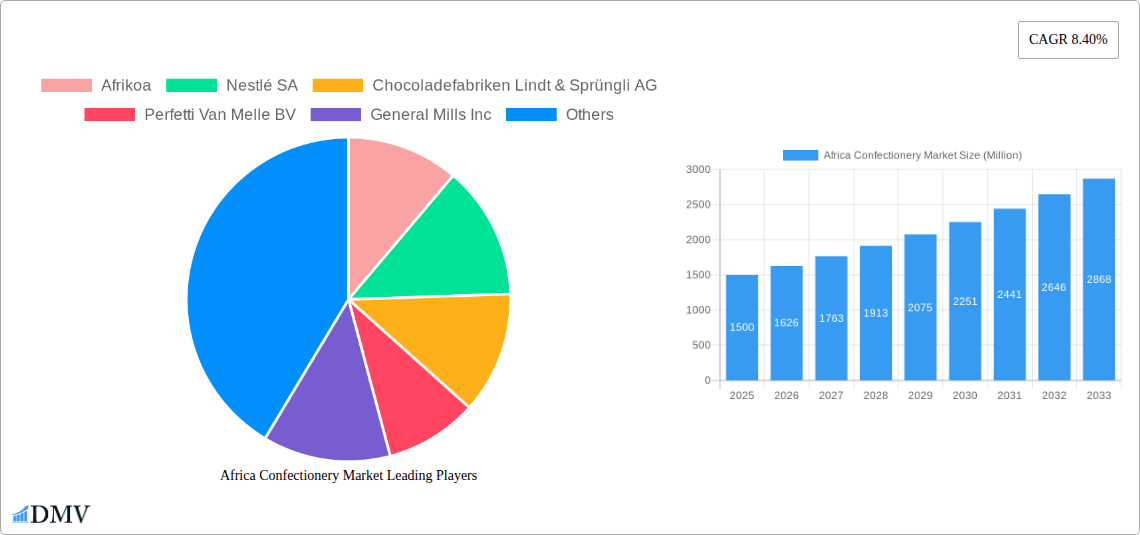

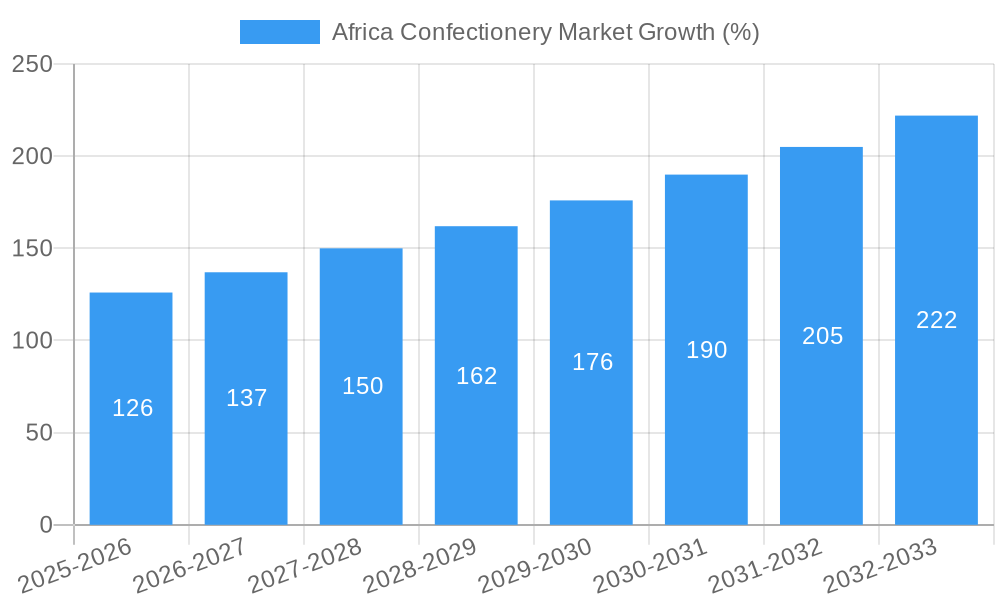

The Africa confectionery market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.40% from 2025 to 2033. This expansion is fueled by several key drivers. Rising disposable incomes across several African nations, particularly in urban centers, are leading to increased spending on discretionary items like confectionery. A burgeoning young population, with a significant portion residing in urban areas, represents a substantial consumer base eager to explore diverse confectionery options. Furthermore, the increasing influence of Western consumer culture and the growing popularity of online retail channels are expanding market access and product variety. The chocolate confectionery segment currently dominates the market, driven by its appeal across different age groups and socio-economic strata. However, the sugar confectionery and "other confectionery" segments are expected to witness significant growth, driven by innovation in flavors and formats, catering to evolving consumer preferences. Significant growth is also projected for online retail channels, indicating a shift towards e-commerce platforms in addition to established channels like supermarkets and convenience stores.

Despite the positive outlook, several restraints could impact market growth. Fluctuations in raw material prices, such as cocoa and sugar, pose a challenge to manufacturers. Economic instability in certain regions could also curb consumer spending. Furthermore, the prevalence of traditional sweets and local confectionery necessitates strategic adaptation by multinational players aiming to penetrate the market effectively. Companies like Nestlé, Mars, and Ferrero are major players, but a growing number of local and regional confectionery brands are also competing effectively, offering products tailored to specific tastes and purchasing power. The market’s future hinges on manufacturers' ability to cater to diverse consumer preferences, manage raw material costs, and effectively navigate the unique challenges presented by the diverse African landscape.

Africa Confectionery Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the burgeoning Africa confectionery market, offering a comprehensive overview of its current state, future trajectory, and key players. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. This report is crucial for stakeholders seeking to understand market dynamics, identify growth opportunities, and make informed business decisions within this rapidly evolving sector. The market is projected to reach xx Million by 2033, presenting significant investment potential.

Africa Confectionery Market Composition & Trends

This section delves into the competitive landscape of the African confectionery market, analyzing market concentration, innovation drivers, regulatory frameworks, substitute products, end-user behavior, and merger & acquisition (M&A) activities. We examine the market share distribution among key players like Nestlé SA, Mondelēz International Inc., and Mars Incorporated, revealing the degree of market concentration. The report also explores the impact of regulatory changes on market access and product development, analyzing the role of substitute products like fruit snacks and healthier alternatives. Finally, we assess the influence of M&A activities, detailing recent deals and their impact on market structure. The total value of M&A deals in the period 2019-2024 is estimated at xx Million.

- Market Concentration: Analysis of market share held by top players (Nestlé SA, Mondelēz International Inc., etc.).

- Innovation Catalysts: Examination of factors driving product innovation, such as changing consumer preferences and technological advancements.

- Regulatory Landscape: Assessment of the impact of regulations on market access and product development.

- Substitute Products: Analysis of the competitive pressure from substitute products and their market share.

- End-User Profiles: Segmentation of consumers based on demographics, preferences, and purchasing behavior.

- M&A Activities: Overview of recent mergers and acquisitions, including deal values and their strategic implications (e.g., xx Million deal between Company A and Company B).

Africa Confectionery Market Industry Evolution

This section provides a thorough analysis of the evolution of the African confectionery market, focusing on growth trajectories, technological advancements, and evolving consumer demands. We present detailed data points, including compound annual growth rates (CAGR) for various segments, and quantify the adoption of new technologies within the industry. The report highlights shifts in consumer preferences, such as the increasing demand for healthier options and premium products, and their effect on market trends. The market experienced a CAGR of xx% during the historical period (2019-2024), driven by factors such as rising disposable incomes and changing lifestyle preferences.

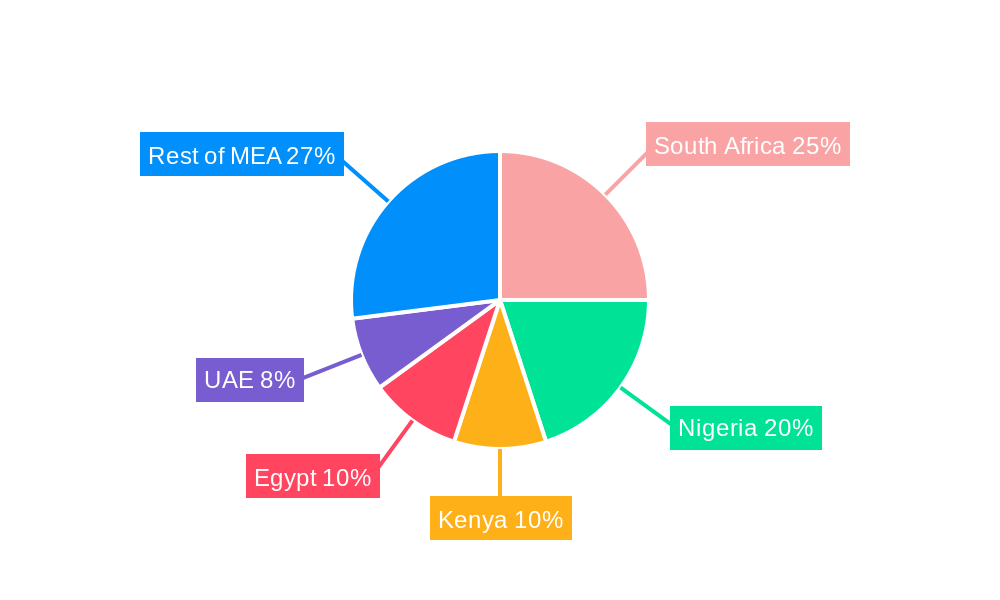

Leading Regions, Countries, or Segments in Africa Confectionery Market

This section identifies the dominant regions, countries, and segments within the African confectionery market based on product type (chocolate confectionery, sugar confectionery, other confectionery), distribution channel (convenience stores, online retail, supermarkets/hypermarkets, others), and confection type (chocolate, others). We examine the key drivers behind this dominance, including investment trends and regulatory support.

Key Drivers (Examples):

- Increased investment in manufacturing facilities in specific regions.

- Favorable government policies supporting domestic confectionery production.

- Strong consumer demand in particular countries due to cultural preferences or high purchasing power.

In-depth Analysis: Detailed examination of market dynamics and competitive landscapes within the dominant regions, countries, and segments, identifying factors that contribute to their leading position.

Africa Confectionery Market Product Innovations

This section details recent product innovations, their applications, and performance metrics. We highlight the unique selling propositions (USPs) of new products and the technological advancements that have enabled their development. The market has witnessed the introduction of innovative products such as vegan chocolates and protein bars, catering to evolving consumer preferences for healthier and more specialized confectionery options. These innovations have improved product quality and shelf life while expanding market reach.

Propelling Factors for Africa Confectionery Market Growth

Several key factors drive the growth of the African confectionery market. Rising disposable incomes across various African countries are leading to increased spending on discretionary items, including confectionery. Rapid urbanization and the growth of a young, increasingly affluent population further fuel this demand. Technological advancements, such as improved manufacturing processes and enhanced packaging, are improving efficiency and product quality. Favorable government policies and infrastructure development are facilitating market growth.

Obstacles in the Africa Confectionery Market

Despite its growth potential, the African confectionery market faces several challenges. Fluctuations in raw material prices and supply chain disruptions can impact production costs and profitability. Intense competition from established multinational players and local manufacturers creates pricing pressures. Regulatory hurdles related to food safety and labeling requirements can pose significant barriers to entry and growth. These factors have contributed to xx Million in losses for the industry during the forecast period.

Future Opportunities in Africa Confectionery Market

The African confectionery market presents significant future opportunities. The expansion of organized retail channels, particularly supermarkets and hypermarkets, offers increased distribution reach for confectionery brands. The growing popularity of online retail provides new sales channels. The increasing adoption of e-commerce platforms and mobile payment systems facilitates online sales and wider market penetration.

Major Players in the Africa Confectionery Market Ecosystem

- Afrikoa

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- General Mills Inc

- PepsiCo Inc

- Tiger Brands

- August Storck KG

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding AŞ

- Arcor S.A.I.C.

- HARIBO Holding GmbH & Co KG

- Mondelēz International Inc

- The Hershey Company

- Kellogg Company

Key Developments in Africa Confectionery Market Industry

- July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa, expanding product offerings and catering to growing consumer demand for plant-based alternatives.

- May 2023: Mondelēz International Inc. launched three new special edition Dairy Milk flavors, enhancing product portfolio and capitalizing on consumer preference for indulgence.

- April 2023: The Hershey Company introduced a Peanut Butter & Jelly flavored protein bar under its ONE brand, tapping into the growing health and wellness market segment.

Strategic Africa Confectionery Market Forecast

The Africa confectionery market is poised for significant growth, driven by factors such as rising disposable incomes, expanding middle class, and increasing urbanization. The market's future is bright, characterized by innovation in product offerings, increased investment in manufacturing, and expansion into new distribution channels. This presents lucrative opportunities for both existing and new market entrants. The forecast period (2025-2033) promises a substantial increase in market size, projected at xx Million.

Africa Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Africa Confectionery Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. UAE Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Afrikoa

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestlé SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Chocoladefabriken Lindt & Sprüngli AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Perfetti Van Melle BV

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 General Mills Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 PepsiCo Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Tiger Brands

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 August Storck KG

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ferrero International SA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Mars Incorporated

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Yıldız Holding A

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Arcor S A I C

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 HARIBO Holding GmbH & Co KG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Mondelēz International Inc

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 The Hershey Company

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 Kellogg Company

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.1 Afrikoa

List of Figures

- Figure 1: Africa Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Africa Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 3: Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 11: Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Nigeria Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: South Africa Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Egypt Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Kenya Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Ethiopia Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Morocco Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Ghana Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Algeria Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Tanzania Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Ivory Coast Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Confectionery Market?

The projected CAGR is approximately 8.40%.

2. Which companies are prominent players in the Africa Confectionery Market?

Key companies in the market include Afrikoa, Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Arcor S A I C, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company, Kellogg Company.

3. What are the main segments of the Africa Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa. The products are available in two vegan flavors – Lindt Vegan Smooth Chocolate (made with oats and almonds to deliver a smooth, creamy texture) and Lindt Vegan Hazelnut Chocolate (made with roasted hazelnuts and premium vegan chocolate for a nutty flavor).May 2023: Under its brand, Mondelēz International Inc. launched three new special edition flavors that deliver indulgence with much-loved flavor combinations. The 150 g slabs include Dairy Milk Fudge Cookie Crumble, Fudge Mint Crisp, and Dream Coconut & Hazelnut Bliss.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Confectionery Market?

To stay informed about further developments, trends, and reports in the Africa Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence