Key Insights

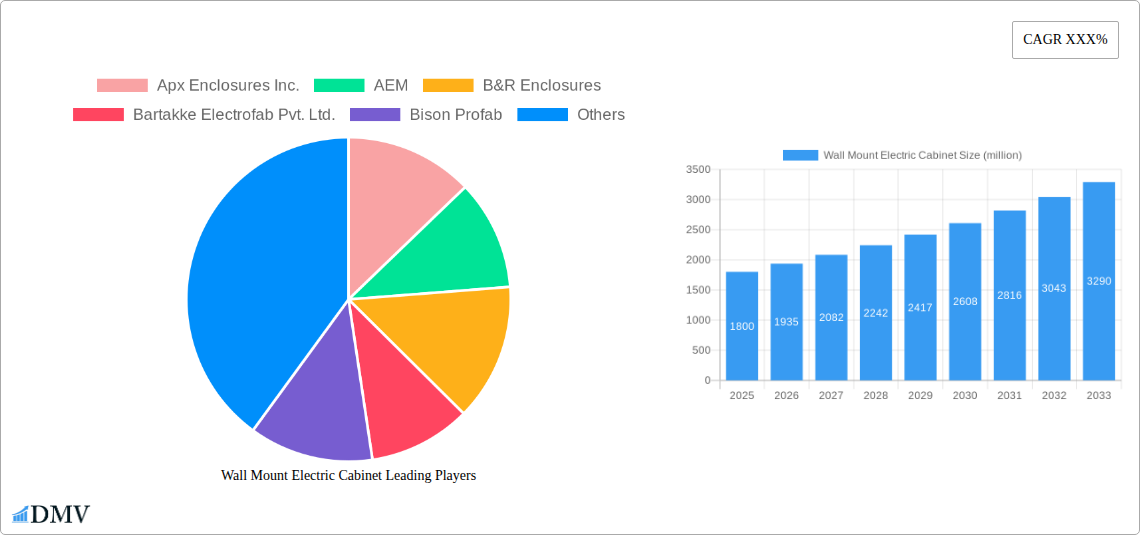

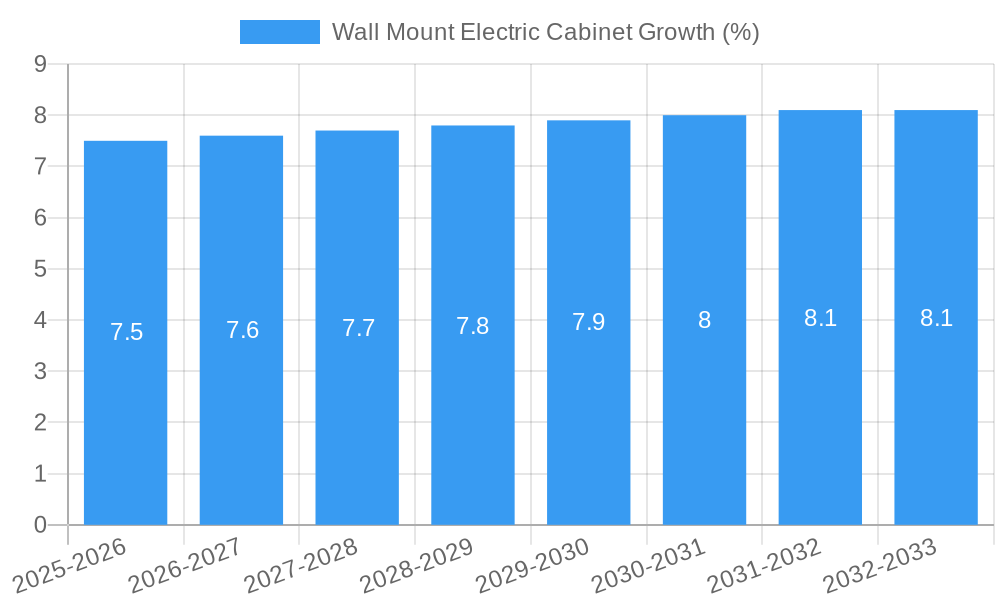

The global Wall Mount Electric Cabinet market is poised for significant expansion, projected to reach an estimated market size of $1,800 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.5% expected through 2033. This growth trajectory is fueled by the increasing demand for industrial automation, the burgeoning smart city initiatives, and the critical need for reliable electrical enclosure solutions in diverse sectors such as telecommunications, manufacturing, and renewable energy. The market's value is denominated in millions, underscoring the substantial economic activity within this segment. Key drivers include the escalating adoption of IoT devices requiring secure and protected electrical infrastructure, stringent safety regulations mandating the use of high-quality enclosures, and the ongoing modernization of existing industrial facilities. Furthermore, the shift towards more compact and aesthetically pleasing cabinet designs, particularly in commercial and public spaces, is shaping product development and consumer preferences.

The market is segmented by application, including areas like industrial automation, telecommunications, IT & data centers, utilities, and transportation, and by type, differentiating between metallic and non-metallic cabinets. Each segment presents unique growth opportunities. For instance, the IT & data center segment is experiencing rapid expansion due to the exponential growth of data and cloud computing, necessitating secure and efficient housing for sensitive electronic equipment. Conversely, the industrial automation segment benefits from the Industry 4.0 revolution, where intelligent manufacturing processes rely heavily on robust electrical control systems housed within specialized cabinets. While the market demonstrates a strong upward trend, certain restraints, such as the high cost of raw materials and the complex regulatory landscape in some regions, could present challenges. However, the relentless pursuit of innovation in terms of material science, modular designs, and enhanced environmental protection capabilities is expected to mitigate these challenges, ensuring sustained market vitality.

Here's the SEO-optimized, insightful report description for the Wall Mount Electric Cabinet market:

Wall Mount Electric Cabinet Market Composition & Trends

This comprehensive market analysis delves into the intricate dynamics of the global Wall Mount Electric Cabinet market. We explore the current market concentration, identifying key players and their respective market share distributions, estimated at over one million for the leading entities. Innovation catalysts, including advancements in materials science and smart enclosure technologies, are meticulously examined. The regulatory landscapes across major economies are scrutinized for their impact on product adoption and manufacturing standards. Substitute products, such as free-standing cabinets and custom-built solutions, are evaluated for their competitive threat. End-user profiles are detailed, highlighting the specific needs and purchasing behaviors of industries ranging from industrial automation to telecommunications. Furthermore, this report quantifies Mergers & Acquisitions (M&A) activities, with estimated deal values exceeding one million, providing crucial insights into market consolidation and strategic partnerships.

- Market Share Distribution: Analysis of key players' estimated market share exceeding one million.

- M&A Deal Values: Quantified impact of strategic acquisitions and collaborations, with values projected over one million.

- Innovation Catalysts: Identification of technological breakthroughs driving market evolution.

- Regulatory Impact: Assessment of government policies and standards influencing market growth.

- End-User Segmentation: Detailed profiles of key customer segments and their specific requirements.

Wall Mount Electric Cabinet Industry Evolution

The global Wall Mount Electric Cabinet industry has witnessed a significant evolutionary trajectory from 2019 to 2033, with a base year of 2025 and a robust forecast period extending to 2033. This report meticulously analyzes the market's growth trajectories, projecting a Compound Annual Growth Rate (CAGR) of XX% through the forecast period. Technological advancements have been a primary driver, with the integration of smart features, advanced materials like corrosion-resistant alloys, and enhanced IP ratings for superior environmental protection. Shifting consumer demands, particularly driven by the increasing adoption of Industry 4.0 principles and the proliferation of IoT devices, have spurred the need for compact, versatile, and secure electrical enclosures. The historical period from 2019 to 2024 saw foundational growth, with the estimated year of 2025 marking a pivotal point for accelerated adoption due to escalating industrial automation and smart infrastructure development. Adoption metrics for specialized wall mount cabinets in critical sectors are projected to surge by XX% over the forecast period. The market's evolution is characterized by a move towards customized solutions, energy-efficient designs, and enhanced data security capabilities, all contributing to a market size expected to reach several million by the end of the forecast period.

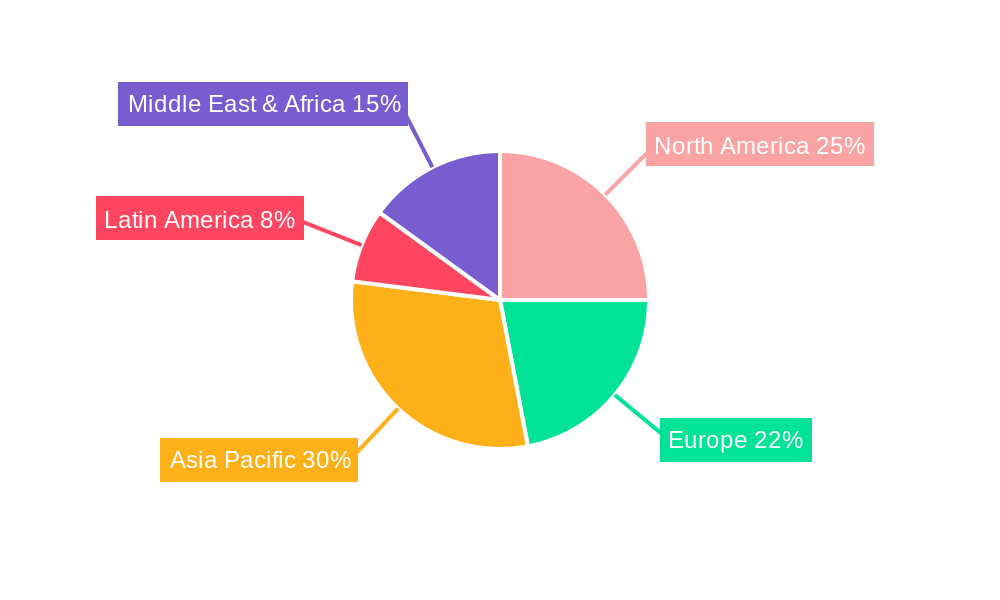

Leading Regions, Countries, or Segments in Wall Mount Electric Cabinet

The Application segment of industrial automation is poised to dominate the Wall Mount Electric Cabinet market, driven by relentless investment trends and supportive regulatory frameworks aimed at enhancing manufacturing efficiency and safety. North America, particularly the United States, stands out as a leading country due to its advanced industrial base and significant investments in smart manufacturing initiatives. The demand for robust and compact wall mount electric cabinets is fueled by the increasing deployment of automated machinery, robotics, and control systems in factories and production facilities. Regulatory support, such as mandates for enhanced electrical safety and data protection in industrial settings, further propels the adoption of high-quality enclosures.

- Dominant Application Segment: Industrial Automation, expected to capture over XX% of the market share by 2033.

- Key Drivers in Industrial Automation:

- Accelerated adoption of Industry 4.0 technologies and IoT in manufacturing.

- Government initiatives promoting smart factories and localized production.

- Increasing demand for process control and data acquisition systems.

- Stringent safety regulations requiring secure electrical enclosures.

- Leading Region Analysis (North America):

- High concentration of advanced manufacturing facilities.

- Significant R&D investments in automation solutions.

- Favorable economic conditions and corporate spending on infrastructure upgrades.

- Leading Type Segment Analysis: The Type segment of Indoor Wall Mount Electric Cabinets will lead due to widespread use in existing infrastructure and new construction projects across various industries. These cabinets offer a cost-effective and efficient solution for housing electrical components in controlled environments, supporting the growth of commercial buildings, data centers, and public utilities. The ease of installation and accessibility for maintenance further solidify their position.

Wall Mount Electric Cabinet Product Innovations

Product innovations in the Wall Mount Electric Cabinet market are revolutionizing functionality and application. Manufacturers are increasingly integrating advanced materials, such as high-strength, lightweight composites, to enhance durability and reduce installation complexities. Smart features, including integrated environmental monitoring sensors, remote access capabilities, and tamper-detection systems, are becoming standard, offering enhanced security and operational efficiency. Performance metrics are seeing significant improvements in terms of thermal management, electromagnetic interference (EMI) shielding, and ingress protection (IP) ratings, ensuring reliable operation in harsh environments. Unique selling propositions now revolve around modular designs for scalability, sustainable manufacturing practices, and cybersecurity features for connected industrial systems.

Propelling Factors for Wall Mount Electric Cabinet Growth

The global Wall Mount Electric Cabinet market is propelled by several key growth drivers. The escalating adoption of Industry 4.0 and the Internet of Things (IoT) across various sectors is a primary catalyst, necessitating secure and compact enclosures for smart devices and control systems. Technological advancements in materials science and manufacturing processes enable the production of more durable, cost-effective, and feature-rich cabinets. Furthermore, increasing investments in infrastructure development, particularly in smart cities and renewable energy projects, are creating substantial demand. Favorable government regulations promoting industrial safety and energy efficiency also play a crucial role in driving market expansion.

- Industry 4.0 & IoT Integration: Demand for smart and connected industrial environments.

- Technological Advancements: Improved materials, manufacturing, and integrated smart features.

- Infrastructure Development: Growth in smart cities, renewable energy, and commercial construction.

- Regulatory Support: Mandates for safety, security, and energy efficiency in electrical installations.

Obstacles in the Wall Mount Electric Cabinet Market

Despite robust growth, the Wall Mount Electric Cabinet market faces several obstacles. Fluctuations in raw material prices, particularly for metals like steel and aluminum, can impact manufacturing costs and profit margins. Supply chain disruptions, as witnessed in recent years, can lead to production delays and increased lead times, affecting customer satisfaction. Intense competition from a multitude of global and regional players, some offering lower-cost alternatives, presents a pricing challenge for premium products. Furthermore, stringent regulatory compliance for specific industries or regions can add complexity and cost to product development and certification processes.

- Raw Material Price Volatility: Impact on production costs and pricing strategies.

- Supply Chain Vulnerabilities: Risk of delays and increased lead times.

- Intense Market Competition: Pressure on pricing and market share.

- Regulatory Compliance Burdens: Added costs and complexities for market entry.

Future Opportunities in Wall Mount Electric Cabinet

Emerging opportunities in the Wall Mount Electric Cabinet market are abundant. The rapid expansion of 5G infrastructure and data centers presents a significant demand for specialized, high-density enclosures. The growing focus on renewable energy sources, such as solar and wind power, requires robust and weather-resistant cabinets for distributed power systems. The trend towards smart homes and buildings is creating a new segment for aesthetically designed and feature-rich cabinets. Furthermore, advancements in additive manufacturing (3D printing) could open doors for highly customized and complex cabinet designs, offering unique solutions for niche applications.

- 5G Infrastructure & Data Centers: High-density, secure enclosure requirements.

- Renewable Energy Sector: Demand for weather-resistant and durable cabinets.

- Smart Homes & Buildings: Market for aesthetically pleasing and integrated solutions.

- Additive Manufacturing: Potential for highly customized and innovative designs.

Major Players in the Wall Mount Electric Cabinet Ecosystem

Apx Enclosures Inc. AEM B&R Enclosures Bartakke Electrofab Pvt. Ltd. Bison Profab Cannon Technologies Delphin Technology AG Ensto Group Hubbell Ltd Hammond Manufacturing IDE ELECTRIC, S.L. KUKA AG Mirsan Ningbo Tianan (Group) CO.,Ltd. Panasonic PLUTON RAVARINI CASTOLDI & C RETEX ROSE Systemtechnik Sobem-Scame Spelsberg TECNOVISION Westech ZPAS Gorup

Key Developments in Wall Mount Electric Cabinet Industry

- 2024 February: Apx Enclosures Inc. launched a new line of IP67 rated wall mount cabinets designed for harsh outdoor environments, featuring enhanced corrosion resistance and extended lifespan.

- 2023 December: KUKA AG announced strategic partnerships to integrate smart sensing capabilities into their enclosure solutions, enhancing predictive maintenance for industrial robots.

- 2023 October: Panasonic introduced advanced modular wall mount cabinets with integrated thermal management systems, optimizing performance for sensitive electronic components.

- 2023 August: Hubbell Ltd acquired a leading manufacturer of industrial electrical enclosures, expanding its product portfolio and market reach in North America.

- 2023 June: ROSE Systemtechnik showcased innovative, sustainable materials used in their wall mount cabinets, emphasizing reduced environmental impact and recyclability.

- 2022 November: Spelsberg introduced a new generation of intelligent wall mount enclosures with built-in cybersecurity features to protect connected industrial systems.

- 2022 September: Cannon Technologies expanded its manufacturing capacity in Europe to meet the growing demand for industrial automation enclosures.

- 2022 July: B&R Enclosures partnered with a leading automation software provider to offer integrated control and enclosure solutions for smart factories.

Strategic Wall Mount Electric Cabinet Market Forecast

The strategic Wall Mount Electric Cabinet market forecast highlights a trajectory of significant growth, fueled by the persistent digital transformation across industries. The increasing integration of smart technologies and IoT devices will continue to drive demand for secure and versatile wall mount solutions. Emerging markets in Asia-Pacific and Latin America are expected to become significant growth hubs as industrialization accelerates. Innovations in materials science and the adoption of sustainable manufacturing practices will shape future product development. The market is poised to benefit from continued investments in smart infrastructure, renewable energy, and automation, creating a robust outlook for the Wall Mount Electric Cabinet sector, projected to reach several million in market value.

Wall Mount Electric Cabinet Segmentation

-

1. Application

- 1.1. undefined

-

2. Type

- 2.1. undefined

Wall Mount Electric Cabinet Segmentation By Geography

- 1. undefined

- 2. undefined

- 3. undefined

- 4. undefined

- 5. undefined

Wall Mount Electric Cabinet REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1.

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1.

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1.

- 5.3.2.

- 5.3.3.

- 5.3.4.

- 5.3.5.

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. undefined Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1.

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1.

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. undefined Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1.

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1.

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. undefined Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1.

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1.

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. undefined Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1.

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1.

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. undefined Wall Mount Electric Cabinet Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1.

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1.

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Apx Enclosures Inc.

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AEM

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 B&R Enclosures

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bartakke Electrofab Pvt. Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bison Profab

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cannon Technologies

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Delphin Technology AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Ensto Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hubbell Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hammond Manufacturing

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IDE ELECTRIC S.L.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 KUKA AG

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mirsan

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ningbo Tianan (Group) CO.Ltd.

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Panasonic

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 PLUTON

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 RAVARINI CASTOLDI & C

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 RETEX

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 ROSE Systemtechnik

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Sobem-Scame

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Spelsberg

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 TECNOVISION

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Westech

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 ZPAS Gorup

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Apx Enclosures Inc.

List of Figures

- Figure 1: Global Wall Mount Electric Cabinet Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: undefined Wall Mount Electric Cabinet Revenue (million), by Application 2024 & 2032

- Figure 3: undefined Wall Mount Electric Cabinet Revenue Share (%), by Application 2024 & 2032

- Figure 4: undefined Wall Mount Electric Cabinet Revenue (million), by Type 2024 & 2032

- Figure 5: undefined Wall Mount Electric Cabinet Revenue Share (%), by Type 2024 & 2032

- Figure 6: undefined Wall Mount Electric Cabinet Revenue (million), by Country 2024 & 2032

- Figure 7: undefined Wall Mount Electric Cabinet Revenue Share (%), by Country 2024 & 2032

- Figure 8: undefined Wall Mount Electric Cabinet Revenue (million), by Application 2024 & 2032

- Figure 9: undefined Wall Mount Electric Cabinet Revenue Share (%), by Application 2024 & 2032

- Figure 10: undefined Wall Mount Electric Cabinet Revenue (million), by Type 2024 & 2032

- Figure 11: undefined Wall Mount Electric Cabinet Revenue Share (%), by Type 2024 & 2032

- Figure 12: undefined Wall Mount Electric Cabinet Revenue (million), by Country 2024 & 2032

- Figure 13: undefined Wall Mount Electric Cabinet Revenue Share (%), by Country 2024 & 2032

- Figure 14: undefined Wall Mount Electric Cabinet Revenue (million), by Application 2024 & 2032

- Figure 15: undefined Wall Mount Electric Cabinet Revenue Share (%), by Application 2024 & 2032

- Figure 16: undefined Wall Mount Electric Cabinet Revenue (million), by Type 2024 & 2032

- Figure 17: undefined Wall Mount Electric Cabinet Revenue Share (%), by Type 2024 & 2032

- Figure 18: undefined Wall Mount Electric Cabinet Revenue (million), by Country 2024 & 2032

- Figure 19: undefined Wall Mount Electric Cabinet Revenue Share (%), by Country 2024 & 2032

- Figure 20: undefined Wall Mount Electric Cabinet Revenue (million), by Application 2024 & 2032

- Figure 21: undefined Wall Mount Electric Cabinet Revenue Share (%), by Application 2024 & 2032

- Figure 22: undefined Wall Mount Electric Cabinet Revenue (million), by Type 2024 & 2032

- Figure 23: undefined Wall Mount Electric Cabinet Revenue Share (%), by Type 2024 & 2032

- Figure 24: undefined Wall Mount Electric Cabinet Revenue (million), by Country 2024 & 2032

- Figure 25: undefined Wall Mount Electric Cabinet Revenue Share (%), by Country 2024 & 2032

- Figure 26: undefined Wall Mount Electric Cabinet Revenue (million), by Application 2024 & 2032

- Figure 27: undefined Wall Mount Electric Cabinet Revenue Share (%), by Application 2024 & 2032

- Figure 28: undefined Wall Mount Electric Cabinet Revenue (million), by Type 2024 & 2032

- Figure 29: undefined Wall Mount Electric Cabinet Revenue Share (%), by Type 2024 & 2032

- Figure 30: undefined Wall Mount Electric Cabinet Revenue (million), by Country 2024 & 2032

- Figure 31: undefined Wall Mount Electric Cabinet Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Wall Mount Electric Cabinet Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Wall Mount Electric Cabinet Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Wall Mount Electric Cabinet Revenue million Forecast, by Country 2019 & 2032

- Table 8: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 9: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 10: Global Wall Mount Electric Cabinet Revenue million Forecast, by Country 2019 & 2032

- Table 11: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Wall Mount Electric Cabinet Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 15: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 16: Global Wall Mount Electric Cabinet Revenue million Forecast, by Country 2019 & 2032

- Table 17: Global Wall Mount Electric Cabinet Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Wall Mount Electric Cabinet Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Wall Mount Electric Cabinet Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wall Mount Electric Cabinet?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Wall Mount Electric Cabinet?

Key companies in the market include Apx Enclosures Inc., AEM, B&R Enclosures, Bartakke Electrofab Pvt. Ltd., Bison Profab, Cannon Technologies, Delphin Technology AG, Ensto Group, Hubbell Ltd, Hammond Manufacturing, IDE ELECTRIC, S.L., KUKA AG, Mirsan, Ningbo Tianan (Group) CO.,Ltd., Panasonic, PLUTON, RAVARINI CASTOLDI & C, RETEX, ROSE Systemtechnik, Sobem-Scame, Spelsberg, TECNOVISION, Westech, ZPAS Gorup.

3. What are the main segments of the Wall Mount Electric Cabinet?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wall Mount Electric Cabinet," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wall Mount Electric Cabinet report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wall Mount Electric Cabinet?

To stay informed about further developments, trends, and reports in the Wall Mount Electric Cabinet, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence