Key Insights

The global Tax Planning Software market is poised for substantial growth, projected to reach approximately $2,500 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of around 15% anticipated through 2033. This robust expansion is fueled by an increasing demand for sophisticated tools that simplify complex tax regulations, enhance financial efficiency, and minimize tax liabilities for individuals and businesses alike. Key drivers include the growing emphasis on proactive tax strategizing, driven by evolving tax laws and the pursuit of optimized financial outcomes. The digital transformation across industries further propels adoption, as organizations seek integrated solutions for seamless tax management. Furthermore, the rising prevalence of freelance and gig economy work necessitates personalized tax planning, contributing to market momentum. The market is also benefiting from advancements in cloud-based solutions, offering scalability, accessibility, and cost-effectiveness, thereby appealing to a broader user base.

The market segmentation reveals a strong preference for cloud-based solutions, owing to their inherent flexibility and reduced infrastructure overhead. While on-premises solutions continue to cater to specific enterprise needs, the agility of cloud offerings is a dominant trend. The application landscape highlights significant adoption by individual taxpayers and enterprise clients, reflecting a dual demand for personal financial management and corporate tax optimization. Government agencies also represent a noteworthy segment, leveraging these tools for compliance and revenue management. Prominent players like Intuit, Wolters Kluwer, and Thomson Reuters are actively innovating, introducing advanced features such as AI-driven analytics, automated compliance checks, and enhanced forecasting capabilities. Emerging trends include the integration of tax planning with broader financial planning and wealth management platforms, creating a holistic approach to financial well-being. However, challenges such as data security concerns and the initial cost of implementation for advanced features may present some restraints to accelerated growth in certain segments.

Tax Planning Software Market Composition & Trends

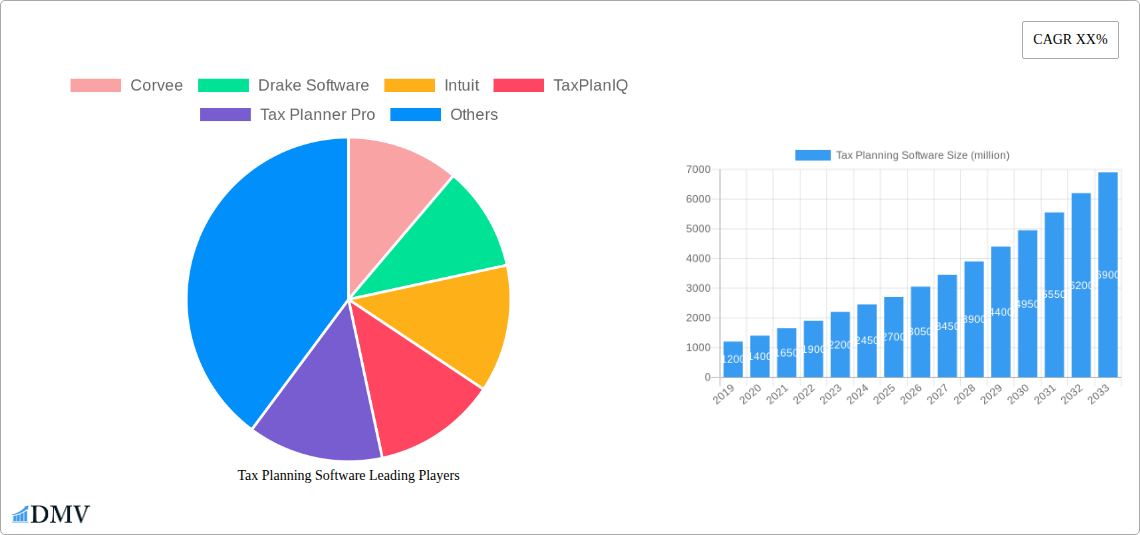

The global Tax Planning Software market is a dynamic landscape characterized by a moderate level of concentration, with key players like Intuit, Wolters Kluwer, Thomson Reuters, and SAP holding significant sway. Innovation is a primary catalyst, driven by the continuous pursuit of enhanced automation, AI integration for predictive analysis, and user-friendly interfaces. Regulatory landscapes, such as evolving tax codes and compliance mandates, also profoundly influence market dynamics, spurring demand for adaptable software solutions. Substitute products, primarily manual tax preparation methods and basic spreadsheet tools, are gradually losing ground to sophisticated software offerings. End-user profiles are diverse, encompassing individual taxpayers, small and medium-sized enterprises (SMEs), large enterprises, and government agencies, each with distinct needs for tax compliance and strategic planning. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and market expansion, with estimated deal values in the range of several hundred million to over a billion dollars, reinforcing the positions of established vendors and fostering niche player integration. Market share distribution sees Intuit and Thomson Reuters dominating with estimated combined market share of over 40%, followed by Wolters Kluwer at approximately 15%. M&A deal values are projected to average around $750 million annually throughout the forecast period.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Catalysts: AI, automation, user experience improvements, regulatory compliance.

- Regulatory Landscapes: Evolving tax laws, compliance requirements.

- Substitute Products: Manual methods, spreadsheets.

- End-User Profiles: Individual, Government Agency, Enterprise, Others.

- M&A Activities: Strategic consolidation, market expansion.

- Estimated M&A Deal Value: $750 million annually.

Tax Planning Software Industry Evolution

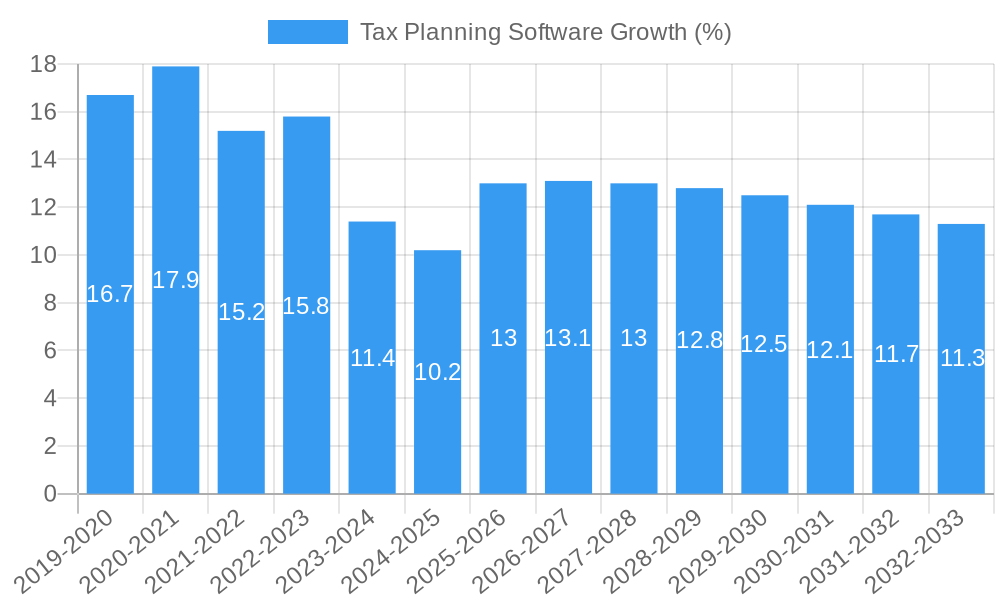

The Tax Planning Software industry has undergone a significant transformation over the historical period (2019-2024) and is poised for accelerated growth through 2033. This evolution is marked by a consistent upward trajectory in market growth, driven by an increasing awareness of tax optimization strategies among individuals and businesses, coupled with the growing complexity of tax regulations globally. Technological advancements have been the cornerstone of this evolution, with a decisive shift from on-premises solutions to highly scalable and accessible cloud-based platforms. This transition, observed from 2019 onwards, has democratized access to sophisticated tax planning tools, enabling a broader user base to benefit from their capabilities. Adoption metrics highlight a substantial increase in cloud-based software usage, projected to capture over 80% of the market share by 2033, a significant jump from approximately 40% in 2019. Shifting consumer demands have also played a crucial role. Users now expect intuitive interfaces, real-time data integration, advanced analytics, and mobile accessibility, pushing vendors to continuously innovate and enhance their product offerings. The market has seen a compound annual growth rate (CAGR) of approximately 12% during the historical period, with projections indicating a sustained CAGR of 14% for the forecast period (2025-2033). This robust growth is attributed to the increasing need for proactive tax management, driven by economic uncertainties and the pursuit of greater financial efficiency. The base year of 2025 is expected to see a market size of over $5.5 billion, with an estimated $12 billion by 2033.

Leading Regions, Countries, or Segments in Tax Planning Software

The Enterprise segment, particularly within the Cloud-based type, is emerging as the dominant force in the global Tax Planning Software market. This dominance is fueled by a confluence of factors, including the inherent complexity of tax structures for large organizations, the need for robust compliance solutions, and the strategic advantages offered by cloud deployment. Enterprises require sophisticated tools to manage intricate tax liabilities across multiple jurisdictions, optimize deductions, and ensure adherence to ever-changing tax laws. Cloud-based solutions provide the scalability, accessibility, and real-time data synchronization essential for managing these complexities effectively. Investment trends within the Enterprise segment are substantial, with companies allocating significant budgets towards software that promises enhanced efficiency, reduced risk, and improved financial forecasting. Regulatory support, while not segment-specific, indirectly bolsters this dominance by increasing the compliance burden on larger entities, thus driving demand for advanced tax planning software.

Dominant Segment: Enterprise (Application)

- Key Drivers: Complex tax structures, stringent compliance requirements, need for advanced analytics and forecasting, significant budget allocation for financial software.

- Investment Trends: High capital expenditure on enterprise-grade tax solutions, focus on ROI and risk mitigation.

- Regulatory Support Impact: Increased compliance needs drive adoption of sophisticated software.

Dominant Type: Cloud-based (Types)

- Key Drivers: Scalability, accessibility, real-time updates, cost-effectiveness for dynamic business environments, rapid deployment capabilities.

- Adoption Metrics: Projected to account for over 80% of the market by 2033, with a significant increase in adoption among SMEs and large enterprises.

- Technological Advancements: Facilitates seamless integration with other business software, enabling holistic financial management.

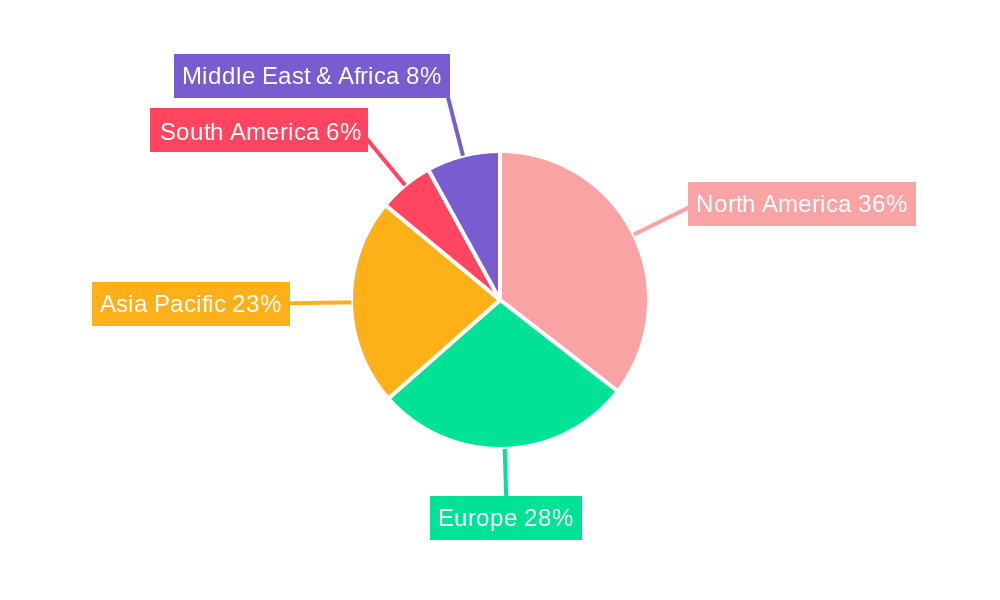

The North American region, particularly the United States, stands out as a leading geographical market, driven by a mature regulatory environment and a high concentration of businesses and individuals actively seeking tax optimization. The widespread adoption of cloud technologies and a strong emphasis on financial planning within the US business ecosystem further solidify its leadership.

Tax Planning Software Product Innovations

Product innovations in Tax Planning Software are rapidly transforming how individuals and businesses manage their financial obligations. Key advancements include the integration of artificial intelligence (AI) and machine learning (ML) for predictive tax forecasting, anomaly detection, and personalized tax advice, moving beyond mere compliance. Applications are expanding to offer seamless integration with accounting, payroll, and financial planning tools, creating a unified financial ecosystem for users. Performance metrics demonstrate significant improvements in time savings, estimated at 30-50% reduction in tax preparation time, and accuracy enhancements, minimizing the risk of penalties by over 90%. Unique selling propositions revolve around intuitive user interfaces, real-time data analytics, and sophisticated scenario planning capabilities, empowering users to make informed strategic financial decisions.

Propelling Factors for Tax Planning Software Growth

Several key factors are propelling the growth of the Tax Planning Software market. The increasing complexity of tax legislation worldwide, coupled with a growing global awareness of tax optimization strategies among individuals and businesses, is a primary driver. Technological advancements, particularly the widespread adoption of cloud computing and the integration of AI and machine learning, are enabling more sophisticated and accessible solutions. Furthermore, economic volatility and the constant pursuit of financial efficiency by corporations and individuals necessitate proactive tax planning. Government initiatives and regulatory reforms that encourage greater transparency and compliance also indirectly fuel demand for advanced tax planning tools.

- Increasing Tax Complexity: Evolving global tax laws necessitate robust planning software.

- Technological Advancements: Cloud adoption, AI, and ML enhance functionality and accessibility.

- Economic Volatility: Drives the need for proactive financial management and tax optimization.

- Regulatory Landscape: Reforms and compliance mandates spur demand for advanced solutions.

Obstacles in the Tax Planning Software Market

Despite its robust growth, the Tax Planning Software market faces several obstacles. Regulatory challenges, including the constant flux of tax laws across different jurisdictions, can make it difficult for software providers to maintain up-to-date and universally compliant solutions. Supply chain disruptions, though less direct, can impact the availability of necessary hardware and software components for on-premises solutions, a segment still holding a considerable market share in certain regions. Fierce competitive pressures among established players and emerging startups lead to pricing challenges and necessitate continuous heavy investment in R&D, potentially impacting profitability margins. Data security concerns and the perceived complexity of adopting new software also pose barriers for some segments of the market.

- Regulatory Volatility: Frequent changes in tax laws create compliance challenges.

- Data Security Concerns: User apprehension about protecting sensitive financial information.

- Adoption Inertia: Resistance to change and perceived complexity of new software.

- Intense Competition: Drives pricing pressures and high R&D costs.

Future Opportunities in Tax Planning Software

The future of Tax Planning Software presents a wealth of opportunities. The untapped potential in emerging markets, particularly in developing economies experiencing rapid economic growth and increasing regulatory sophistication, offers significant expansion avenues. The continued evolution of AI and ML promises personalized tax advice, automated tax filing for complex scenarios, and proactive risk assessment, creating new service offerings. The growing demand for integrated financial management solutions, where tax planning is a seamless component of broader financial operations, opens doors for cross-platform integration and bundled service packages. Furthermore, the increasing focus on Environmental, Social, and Governance (ESG) reporting also presents an opportunity for tax planning software to incorporate tax implications related to sustainability initiatives.

- Emerging Markets: Untapped potential in developing economies.

- AI & ML Advancements: Personalized advice, automated filing, risk assessment.

- Integrated Financial Management: Bundled solutions and cross-platform synergy.

- ESG Reporting: Tax implications of sustainability initiatives.

Major Players in the Tax Planning Software Ecosystem

- Corvee

- Drake Software

- Intuit

- TaxPlanIQ

- Tax Planner Pro

- Wolters Kluwer

- Holistiplan

- CFS Tax Software

- Bonsai Technologies

- Thomson Reuters

- Bloomberg Tax

- InvestCloud

- Execplan

- TaxFitness

- TaxStrategis

- ChangeGPS

- ESPlanner

- Forte International Tax

- Covisum

- SAP

- Sovos Compliance

- InfoSpace

- Sailotech

- TaxSlayer

Key Developments in Tax Planning Software Industry

- 2023 (Ongoing): Widespread adoption of AI-powered predictive analytics for tax forecasting and scenario planning by Wolters Kluwer and Thomson Reuters.

- 2023 (Q3): Intuit's acquisition of smaller fintech firms to enhance its small business tax planning suite, contributing to market consolidation valued at over $XXX million.

- 2023 (Q4): Drake Software launches a new cloud-based module for international tax planning, addressing growing global business needs.

- 2024 (Q1): SAP introduces enhanced integration capabilities for its tax planning solutions with enterprise resource planning (ERP) systems, streamlining financial operations.

- 2024 (Q2): Sovos Compliance expands its suite with advanced compliance solutions for evolving digital tax regulations across Europe, estimated to drive revenue growth of 15%.

- 2024 (Q3): TaxPlanIQ releases a new mobile application, offering on-the-go tax planning and advisory services to individual users.

- 2024 (Q4): Bloomberg Tax announces significant updates to its research platform, incorporating real-time legislative changes and their tax implications.

Strategic Tax Planning Software Market Forecast

The strategic Tax Planning Software market is projected to experience robust growth, driven by an increasing demand for proactive financial management and compliance solutions. The confluence of technological advancements, particularly in AI and cloud computing, will continue to fuel innovation, leading to more sophisticated and user-friendly tools. Emerging economies present significant untapped potential, while established markets will see deeper penetration of advanced features. Strategic partnerships and consolidations are expected to shape the competitive landscape, with market leaders focusing on expanding their service offerings and geographical reach. The market is poised for substantial expansion, with strong revenue growth predicted throughout the forecast period, driven by evolving regulatory environments and the persistent need for tax optimization.

Tax Planning Software Segmentation

-

1. Application

- 1.1. Individual

- 1.2. Government Agency

- 1.3. Enterprise

- 1.4. Others

-

2. Types

- 2.1. Cloud-based

- 2.2. On-premises

Tax Planning Software Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Tax Planning Software REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Individual

- 5.1.2. Government Agency

- 5.1.3. Enterprise

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Cloud-based

- 5.2.2. On-premises

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Individual

- 6.1.2. Government Agency

- 6.1.3. Enterprise

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Cloud-based

- 6.2.2. On-premises

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Individual

- 7.1.2. Government Agency

- 7.1.3. Enterprise

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Cloud-based

- 7.2.2. On-premises

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Individual

- 8.1.2. Government Agency

- 8.1.3. Enterprise

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Cloud-based

- 8.2.2. On-premises

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Individual

- 9.1.2. Government Agency

- 9.1.3. Enterprise

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Cloud-based

- 9.2.2. On-premises

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Tax Planning Software Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Individual

- 10.1.2. Government Agency

- 10.1.3. Enterprise

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Cloud-based

- 10.2.2. On-premises

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Corvee

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Drake Software

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Intuit

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TaxPlanIQ

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Tax Planner Pro

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Wolters Kluwer

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Holistiplan

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CFS Tax Software

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bonsai Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Thomson Reuters

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bloomberg Tax

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 InvestCloud

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Execplan

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TaxFitness

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 TaxStrategis

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 ChangeGPS

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 ESPlanner

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Forte International Tax

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Covisum

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 SAP

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Sovos Compliance

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 InfoSpace

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Sailotech

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 TaxSlayer

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.1 Corvee

List of Figures

- Figure 1: Global Tax Planning Software Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Tax Planning Software Revenue (million), by Application 2024 & 2032

- Figure 3: North America Tax Planning Software Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Tax Planning Software Revenue (million), by Types 2024 & 2032

- Figure 5: North America Tax Planning Software Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Tax Planning Software Revenue (million), by Country 2024 & 2032

- Figure 7: North America Tax Planning Software Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Tax Planning Software Revenue (million), by Application 2024 & 2032

- Figure 9: South America Tax Planning Software Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Tax Planning Software Revenue (million), by Types 2024 & 2032

- Figure 11: South America Tax Planning Software Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Tax Planning Software Revenue (million), by Country 2024 & 2032

- Figure 13: South America Tax Planning Software Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Tax Planning Software Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Tax Planning Software Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Tax Planning Software Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Tax Planning Software Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Tax Planning Software Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Tax Planning Software Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Tax Planning Software Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Tax Planning Software Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Tax Planning Software Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Tax Planning Software Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Tax Planning Software Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Tax Planning Software Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Tax Planning Software Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Tax Planning Software Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Tax Planning Software Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Tax Planning Software Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Tax Planning Software Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Tax Planning Software Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tax Planning Software Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Tax Planning Software Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Tax Planning Software Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Tax Planning Software Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Tax Planning Software Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Tax Planning Software Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Tax Planning Software Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Tax Planning Software Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Tax Planning Software Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Tax Planning Software Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tax Planning Software?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Tax Planning Software?

Key companies in the market include Corvee, Drake Software, Intuit, TaxPlanIQ, Tax Planner Pro, Wolters Kluwer, Holistiplan, CFS Tax Software, Bonsai Technologies, Thomson Reuters, Bloomberg Tax, InvestCloud, Execplan, TaxFitness, TaxStrategis, ChangeGPS, ESPlanner, Forte International Tax, Covisum, SAP, Sovos Compliance, InfoSpace, Sailotech, TaxSlayer.

3. What are the main segments of the Tax Planning Software?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tax Planning Software," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tax Planning Software report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tax Planning Software?

To stay informed about further developments, trends, and reports in the Tax Planning Software, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence