Key Insights

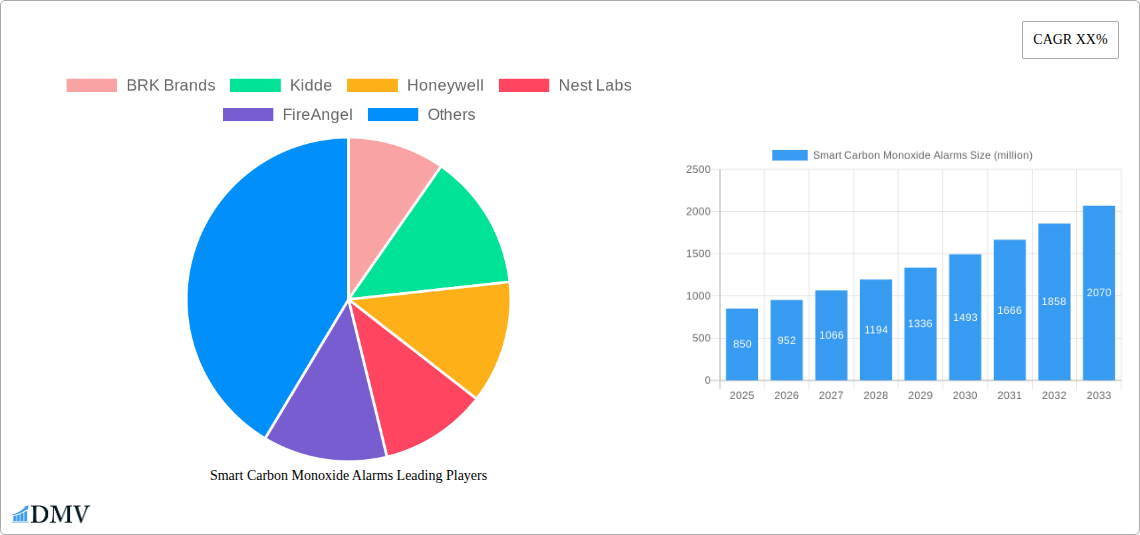

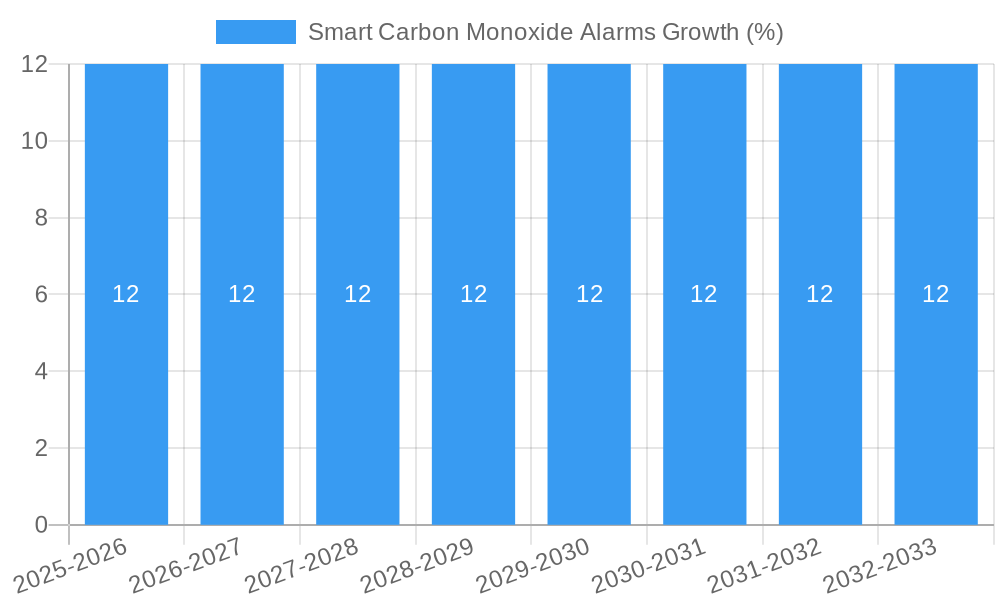

The global Smart Carbon Monoxide Alarms market is poised for significant expansion, with an estimated market size of USD 850 million in 2025, projected to ascend at a Compound Annual Growth Rate (CAGR) of 12% through 2033. This robust growth is primarily fueled by increasing consumer awareness regarding the silent dangers of carbon monoxide poisoning, coupled with stringent government regulations mandating the installation of advanced safety devices in residential and commercial spaces. The escalating adoption of smart home technology, integrating CO alarms with broader home automation systems, is a pivotal driver, offering enhanced convenience, remote monitoring capabilities, and real-time alerts directly to users' smartphones. Furthermore, advancements in sensor technology, leading to more accurate and reliable detection, along with the development of interconnected alarm systems, contribute to market momentum. The "Home Use" segment is expected to dominate, driven by a growing number of homeowners prioritizing safety and the availability of user-friendly, Wi-Fi-enabled devices.

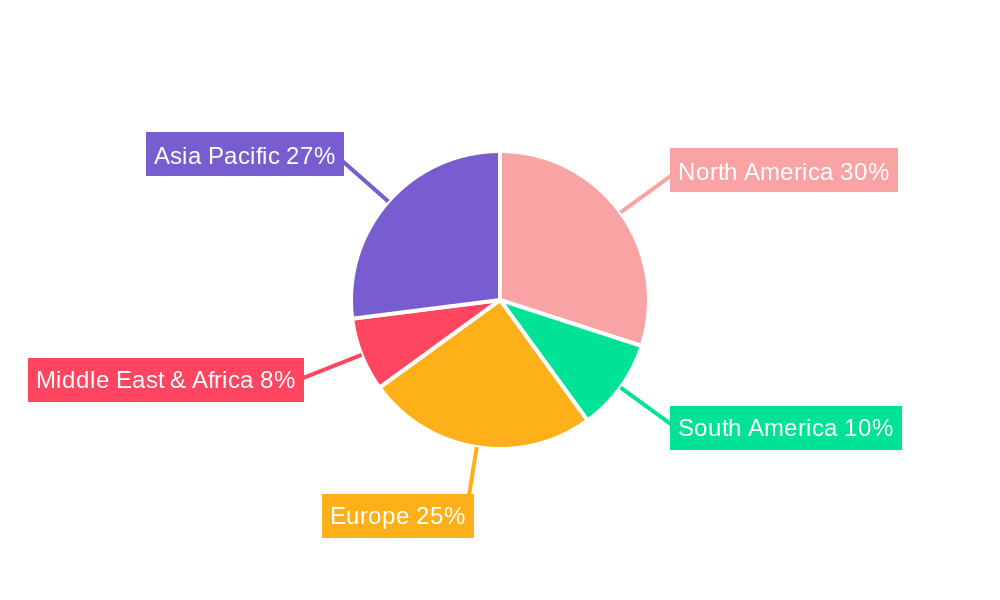

The market is characterized by a dynamic competitive landscape, with key players like Kidde, Honeywell, and Nest Labs investing heavily in research and development to introduce innovative products that offer enhanced features such as voice alerts, integration with emergency services, and long-lasting battery life. While the market presents substantial opportunities, certain restraints such as the initial cost of smart devices compared to traditional alarms and potential concerns around data privacy and cybersecurity associated with connected devices may temper the growth rate in specific segments. However, the clear imperative for enhanced safety and the continuous evolution of smart home ecosystems are expected to outweigh these challenges. Emerging economies, particularly in the Asia Pacific region, are anticipated to witness substantial growth due to increasing disposable incomes, rapid urbanization, and a growing emphasis on home safety standards, presenting new avenues for market penetration and expansion.

Smart Carbon Monoxide Alarms Market Composition & Trends

The global smart carbon monoxide (CO) alarms market is experiencing robust growth, driven by increasing awareness of indoor air quality and the proliferation of connected home technologies. Market concentration is moderate, with key players like BRK Brands, Kidde, and Nest Labs holding significant market share, estimated to be approximately XX million dollars in revenue for 2025. Innovation remains a crucial catalyst, with manufacturers continuously introducing advanced features such as remote monitoring, self-testing capabilities, and integration with smart home ecosystems. Regulatory landscapes are also evolving, with stricter mandates for CO detection in residential and commercial spaces, further fueling market expansion. The threat of substitute products, such as standalone CO detectors, is diminishing as the benefits of smart connectivity and advanced safety features become more apparent. End-user profiles are diverse, encompassing homeowners seeking enhanced safety and convenience, and industrial facilities requiring robust monitoring solutions for employee protection. Mergers and acquisitions (M&A) are contributing to market consolidation, with recent deal values estimated in the range of several hundred million dollars, indicating strategic moves by larger entities to expand their product portfolios and market reach.

- Market Share Distribution (2025):

- BRK Brands: XX%

- Kidde: XX%

- Nest Labs (Google): XX%

- Honeywell: XX%

- FireAngel: XX%

- Ei Electronics: XX%

- Gentex: XX%

- Universal Security Instruments: XX%

- Empaer: XX%

- New-Force: XX%

- Weinuo Electronics: XX%

- Heiman: XX%

- Others: XX%

- M&A Deal Value (Historical 2019-2024): Approximately XXX million dollars.

- Innovation Catalysts: Enhanced connectivity, AI-powered detection, voice assistant integration, predictive maintenance alerts.

- Regulatory Landscape: Evolving building codes and safety standards driving mandatory adoption.

Smart Carbon Monoxide Alarms Industry Evolution

The smart carbon monoxide alarms industry has witnessed a dramatic evolution over the historical period of 2019–2024, propelled by a convergence of technological advancements and growing consumer demand for sophisticated safety solutions. This trajectory is projected to continue its upward climb through the forecast period of 2025–2033, with the market expected to reach a substantial valuation of several billion dollars by the end of the study period. Early iterations focused on basic CO detection, but the integration of IoT (Internet of Things) capabilities has fundamentally transformed the market. Smart CO alarms now offer remote monitoring via smartphone applications, allowing users to receive real-time alerts and system status updates from virtually anywhere. This has significantly enhanced peace of mind for homeowners and facility managers alike.

Technological advancements have been a consistent driver of this evolution. The development of more sensitive and accurate electrochemical sensors has improved the reliability of detection, minimizing false alarms while ensuring prompt notification of hazardous CO levels. Furthermore, the increasing adoption of wireless communication protocols, such as Wi-Fi and Bluetooth, has facilitated seamless integration with other smart home devices, including smart thermostats, security systems, and voice assistants like Amazon Alexa and Google Assistant. This interoperability creates a comprehensive safety ecosystem within a dwelling.

Shifting consumer demands have mirrored these technological leaps. Consumers are no longer satisfied with standalone safety devices; they expect intelligent, connected solutions that offer convenience and proactive protection. The desire for remote access, automated safety responses, and data insights into indoor air quality are key factors influencing purchasing decisions. The market has responded by offering a wider range of features, from battery-powered portable units for enhanced flexibility to sophisticated wall-mounted systems with advanced diagnostics and self-testing capabilities. The estimated market growth rate is projected to be in the range of XX% annually during the forecast period. Adoption metrics for smart CO alarms in new constructions are steadily increasing, with an estimated XX% of new homes being equipped with smart safety features in 2025. The industrial segment is also seeing growing adoption due to stringent safety regulations and the need to protect a large workforce.

- Market Growth Trajectories (2019-2033): Steady upward trend, projected to exceed XX billion dollars by 2033.

- Technological Advancements: IoT integration, advanced electrochemical sensors, wireless connectivity (Wi-Fi, Bluetooth), AI-powered anomaly detection, cloud-based analytics.

- Shifting Consumer Demands: Remote monitoring, mobile alerts, integration with smart home ecosystems, proactive safety features, indoor air quality insights.

- Projected Annual Growth Rate (CAGR): XX% (2025-2033).

- Smart CO Alarm Adoption in New Homes (2025): XX%.

Leading Regions, Countries, or Segments in Smart Carbon Monoxide Alarms

The smart carbon monoxide alarms market is experiencing significant traction across various geographical regions and application segments, with North America currently leading the charge. This dominance can be attributed to a confluence of factors, including high disposable incomes, a strong emphasis on home safety, and a well-established infrastructure for smart home technology adoption. The United States, in particular, stands out as a key market driver, characterized by stringent building codes and a consumer base that readily embraces advanced safety solutions. The Home Use application segment within North America is exceptionally strong, driven by widespread homeownership and a growing awareness of the dangers of carbon monoxide poisoning. The increasing prevalence of smart home installations, where CO alarms are an integral part of a connected security and safety ecosystem, further solidifies this segment's leadership.

In terms of product types, the Wall/Fixed Carbon Monoxide Alarm segment is expected to continue its dominance, particularly in residential and industrial settings where permanent installation ensures continuous monitoring. These units often come with advanced features like hardwired connectivity, battery backup, and integration with whole-house alarm systems. However, the Portable Carbon Monoxide Alarm segment is experiencing substantial growth, driven by the need for flexible safety solutions in RVs, boats, rental properties, and during temporary renovations. This segment's growth is also fueled by increasing awareness among renters and individuals in older, non-smart-enabled homes.

Beyond North America, Europe presents a significant and rapidly growing market, propelled by similar trends in safety consciousness and the adoption of smart home technologies. Countries like the United Kingdom, Germany, and France are witnessing increased demand due to evolving safety regulations and government initiatives promoting safer living environments. The Industrial Use segment, while smaller than home use, is poised for robust expansion globally, driven by the need for compliance with occupational health and safety standards and the protection of workers in environments where CO exposure is a risk.

Key drivers for regional and segment dominance include:

- Investment Trends: Significant R&D investments by leading companies in developing next-generation smart CO alarms.

- Regulatory Support: Government mandates and incentives promoting the installation of advanced safety devices.

- Consumer Awareness Campaigns: Increased public education on the risks of CO and the benefits of smart detection.

- Smart Home Penetration: The growing adoption of smart home hubs and devices, which naturally integrate with smart CO alarms.

- Technological Infrastructure: Availability of reliable internet connectivity essential for the functioning of smart alarms.

The market is dynamic, with emerging economies in Asia-Pacific also showing promising growth as safety awareness and disposable incomes rise, leading to increased adoption of both home and industrial smart CO alarm solutions.

- Dominant Region: North America (particularly the United States).

- Leading Application Segment: Home Use.

- Leading Product Type: Wall/Fixed Carbon Monoxide Alarm.

- Key Growth Drivers in North America: High disposable income, strict building codes, strong smart home ecosystem.

- Emerging Markets: Europe, Asia-Pacific.

- Industrial Use Segment Growth: Driven by occupational safety regulations and workforce protection needs.

Smart Carbon Monoxide Alarms Product Innovations

Product innovations in the smart carbon monoxide alarms market are rapidly transforming the safety landscape. Manufacturers are focusing on enhancing user experience and providing proactive protection. Innovations include advanced electrochemical sensors for faster and more precise CO detection, minimizing false alarms while ensuring rapid notification of hazardous levels. Many new models offer integrated Wi-Fi connectivity, allowing for remote monitoring and instant alerts via smartphone applications, providing users with real-time updates on their home's air quality from anywhere. Features like self-testing capabilities, long-lasting rechargeable batteries, and seamless integration with popular smart home ecosystems (e.g., Google Home, Amazon Alexa) are becoming standard. Some cutting-edge devices also incorporate environmental sensors to detect other household hazards like smoke and volatile organic compounds (VOCs), offering a comprehensive safety solution within a single unit. The performance metrics are continuously improving, with detection times reduced to mere seconds and battery life extended to several years.

Propelling Factors for Smart Carbon Monoxide Alarms Growth

The growth of the smart carbon monoxide alarms market is fueled by several interconnected factors. Firstly, increasing consumer awareness regarding the silent and deadly nature of carbon monoxide poisoning is a primary driver. Secondly, the burgeoning smart home industry provides a fertile ground for the adoption of connected safety devices, with consumers seeking integrated solutions for enhanced security and convenience. Regulatory mandates and evolving building codes that increasingly require or recommend the installation of advanced CO detection systems also play a crucial role. Furthermore, technological advancements in sensor technology and IoT connectivity have led to more reliable, user-friendly, and feature-rich smart CO alarms, making them an attractive investment for both homeowners and businesses. The estimated market value in 2025 is XX million dollars, with significant growth expected.

- Technological Advancements: Enhanced sensor accuracy, IoT integration, mobile app control.

- Economic Influences: Growing disposable incomes, increasing adoption of smart home technology.

- Regulatory Push: Stricter safety standards and building codes mandating CO detection.

- Consumer Demand: Higher awareness of indoor air quality and a desire for connected safety solutions.

Obstacles in the Smart Carbon Monoxide Alarms Market

Despite the promising growth trajectory, the smart carbon monoxide alarms market faces certain obstacles. High initial purchase costs compared to traditional standalone CO detectors can deter some budget-conscious consumers. The need for a stable internet connection for remote monitoring and smart features can be a barrier in areas with unreliable connectivity. Moreover, concerns about data privacy and cybersecurity associated with connected devices can create hesitancy among potential buyers. Supply chain disruptions, particularly for electronic components, can also impact product availability and lead to price fluctuations. Educational gaps regarding the specific benefits of smart versus traditional CO alarms may also exist, requiring ongoing marketing and awareness efforts.

- High Initial Cost: Premium pricing compared to non-smart alternatives.

- Connectivity Dependence: Requirement for stable internet for full functionality.

- Data Privacy Concerns: User apprehension regarding the security of connected device data.

- Supply Chain Vulnerabilities: Potential for component shortages and price volatility.

Future Opportunities in Smart Carbon Monoxide Alarms

The smart carbon monoxide alarms market is ripe with future opportunities. The expansion into emerging economies with rapidly growing middle classes and increasing safety consciousness presents a significant untapped market. Continued innovation in AI and machine learning can lead to predictive maintenance alerts and even the ability to detect subtle anomalies in air quality that might precede a dangerous situation. Integration with a wider array of smart home devices and platforms will enhance interoperability and user convenience. The development of more affordable yet feature-rich models can broaden market penetration. Furthermore, the increasing demand for integrated safety solutions that combine CO detection with smoke, fire, and even air quality monitoring offers a pathway for comprehensive product development and market expansion.

- Emerging Markets: Expansion into developing economies with rising safety awareness.

- AI Integration: Predictive maintenance, anomaly detection for proactive safety.

- Expanded Ecosystem Integration: Seamless connectivity with a broader range of smart home devices.

- Affordable Innovation: Developing cost-effective models to increase accessibility.

Major Players in the Smart Carbon Monoxide Alarms Ecosystem

- BRK Brands

- Kidde

- Honeywell

- Nest Labs

- FireAngel

- Ei Electronics

- Gentex

- Universal Security Instruments

- Empaer

- New-Force

- Weinuo Electronics

- Heiman

Key Developments in Smart Carbon Monoxide Alarms Industry

- 2023/07: Nest Labs (Google) launches enhanced firmware for its Nest Protect, improving voice alerts and integration with other Google Home devices.

- 2022/11: Kidde introduces a new line of smart CO alarms featuring long-lasting rechargeable batteries and advanced connectivity options.

- 2022/04: FireAngel announces strategic partnerships with smart home installation companies to expand its market reach in the UK.

- 2021/09: Honeywell expands its smart home safety portfolio with a new CO alarm featuring sophisticated environmental sensing capabilities.

- 2020/05: BRK Brands acquires a smaller player in the smart sensor market, strengthening its R&D capabilities.

- 2019/12: Ei Electronics receives new certifications for its smart CO alarms, meeting updated European safety standards.

Strategic Smart Carbon Monoxide Alarms Market Forecast

The strategic outlook for the smart carbon monoxide alarms market remains exceptionally positive, driven by an unyielding focus on occupant safety and the pervasive integration of smart technologies into daily life. The market is poised for continued robust growth through 2033, with opportunities arising from ongoing technological advancements and increasing regulatory mandates globally. The shift towards connected living, coupled with a greater consumer understanding of indoor air quality risks, will propel demand for these intelligent safety devices. Strategic market forecasts highlight significant potential in both the residential and industrial sectors, as manufacturers continue to innovate, offering more sophisticated, user-friendly, and interconnected solutions that provide peace of mind and proactive protection against the dangers of carbon monoxide.

Smart Carbon Monoxide Alarms Segmentation

-

1. Application

- 1.1. Home Use

- 1.2. Industrial Use

-

2. Types

- 2.1. Wall/Fixed Carbon Monoxide Alarm

- 2.2. Portable Carbon Monoxide Alarm

Smart Carbon Monoxide Alarms Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Smart Carbon Monoxide Alarms REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Home Use

- 5.1.2. Industrial Use

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Wall/Fixed Carbon Monoxide Alarm

- 5.2.2. Portable Carbon Monoxide Alarm

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Home Use

- 6.1.2. Industrial Use

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Wall/Fixed Carbon Monoxide Alarm

- 6.2.2. Portable Carbon Monoxide Alarm

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Home Use

- 7.1.2. Industrial Use

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Wall/Fixed Carbon Monoxide Alarm

- 7.2.2. Portable Carbon Monoxide Alarm

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Home Use

- 8.1.2. Industrial Use

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Wall/Fixed Carbon Monoxide Alarm

- 8.2.2. Portable Carbon Monoxide Alarm

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Home Use

- 9.1.2. Industrial Use

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Wall/Fixed Carbon Monoxide Alarm

- 9.2.2. Portable Carbon Monoxide Alarm

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Smart Carbon Monoxide Alarms Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Home Use

- 10.1.2. Industrial Use

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Wall/Fixed Carbon Monoxide Alarm

- 10.2.2. Portable Carbon Monoxide Alarm

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BRK Brands

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kidde

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nest Labs

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FireAngel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ei Electronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gentex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Universal Security Instruments

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Empaer

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 New-Force

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Weinuo Electronics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Heiman

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BRK Brands

List of Figures

- Figure 1: Global Smart Carbon Monoxide Alarms Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Smart Carbon Monoxide Alarms Revenue (million), by Application 2024 & 2032

- Figure 3: North America Smart Carbon Monoxide Alarms Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Smart Carbon Monoxide Alarms Revenue (million), by Types 2024 & 2032

- Figure 5: North America Smart Carbon Monoxide Alarms Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Smart Carbon Monoxide Alarms Revenue (million), by Country 2024 & 2032

- Figure 7: North America Smart Carbon Monoxide Alarms Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Smart Carbon Monoxide Alarms Revenue (million), by Application 2024 & 2032

- Figure 9: South America Smart Carbon Monoxide Alarms Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Smart Carbon Monoxide Alarms Revenue (million), by Types 2024 & 2032

- Figure 11: South America Smart Carbon Monoxide Alarms Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Smart Carbon Monoxide Alarms Revenue (million), by Country 2024 & 2032

- Figure 13: South America Smart Carbon Monoxide Alarms Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Smart Carbon Monoxide Alarms Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Smart Carbon Monoxide Alarms Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Smart Carbon Monoxide Alarms Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Smart Carbon Monoxide Alarms Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Smart Carbon Monoxide Alarms Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Smart Carbon Monoxide Alarms Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Smart Carbon Monoxide Alarms Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Smart Carbon Monoxide Alarms Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Smart Carbon Monoxide Alarms Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Smart Carbon Monoxide Alarms Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Smart Carbon Monoxide Alarms Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Smart Carbon Monoxide Alarms Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Smart Carbon Monoxide Alarms Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Smart Carbon Monoxide Alarms Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Smart Carbon Monoxide Alarms Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Smart Carbon Monoxide Alarms Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Smart Carbon Monoxide Alarms Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Smart Carbon Monoxide Alarms Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Smart Carbon Monoxide Alarms Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Smart Carbon Monoxide Alarms Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Carbon Monoxide Alarms?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Smart Carbon Monoxide Alarms?

Key companies in the market include BRK Brands, Kidde, Honeywell, Nest Labs, FireAngel, Ei Electronics, Gentex, Universal Security Instruments, Empaer, New-Force, Weinuo Electronics, Heiman.

3. What are the main segments of the Smart Carbon Monoxide Alarms?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Carbon Monoxide Alarms," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Carbon Monoxide Alarms report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Carbon Monoxide Alarms?

To stay informed about further developments, trends, and reports in the Smart Carbon Monoxide Alarms, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence